By Delusional Economics, who is determined to cleanse the daily flow of vested interests propaganda to produce a balanced counterpoint. Cross posted from MacroBusiness.

Eurozone Flash PMI for January came out overnight and the news was relatively good overall, although it must be noted that contraction continues across the zone.

The January flash PMI data suggest that the Eurozone economic downturn has eased at the start of 2013. While official data are likely to confirm that the region contracted at a stronger rate in the final quarter of last year, the outlook has since brightened with January seeing the smallest drop in business activity since last March.

“Forward-looking indicators – such as business confidence and the new orders-to-inventory ratio – also suggest that the rate of decline will continue to slow in the coming months, and a return to growth looks to be on the cards during the first half of 2013.

“Worrying signs of weakness persist, however, with companies cutting staff at a faster rate, reflecting the need to keep costs as low as possible in the face of ongoing uncertainty about the economic outlook.

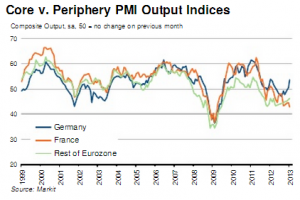

“Trends also remained worryingly divergent within the single currency area, creating tensions for policymakers. While Germany is reporting a strengthening upturn, France is seeing the steepest downturn since early-2009.

So Germany up led by services, but France continues to slide down as austerity bites and everywhere else still deep in the mire but slightly less so:

January’s Flash PMI data signal a very disappointing start to 2013 and add to concerns that the French economy is sliding towards recession. Sickly performances from both the manufacturing and service sectors resulted in the steepest drop in overall output for almost four years, while the pace of job losses gathered pace.

Although it’s hard to find many positives in this gloomy set of figures, there were a couple of glimmers of hope from the service sector, where the decline in new business eased and firms signalled a modest improvement in expectations regarding activity.

However, persistent strong competitive pressures resulted in another fall in overall output prices which, combined with a further rise in input costs, maintained the squeeze on company margins.

I’ve argued previously that France is far more of a periphery nation than one of the ‘core’ one in terms of economic structure, so this continued slowdown isn’t a surprise. It is now doing worse than some “periphery” nations. France, however, wasn’t the only one with poor news. Spanish unemployment has reached yet another record:

Spain’s unemployment rate has hit another high, with almost six million people out of work in the southern European nation. While the figures are gloomy enough, the situation looks set to deteriorate.

At the end of the last quarter in 2012, Spain’s unemployment rate reached 26 percent, the national statistics body INE reported on Thursday. It climbed from a rate of 25 percent in the previous three months.

This is very much in line with Spanish GDP data that came out this week:

Spain’s central bank said a recession in the euro zone’s fourth-largest economy deepened in the last quarter of 2012 after Prime Minister Mariano Rajoy’s government in late September approved its fifth austerity package in a year to head off tougher conditions demanded as part of a potential European bailout.

In the first estimate of fourth-quarter economic performance, the Bank of Spain said the economy contracted 1.7 percent compared with the same period a year ago and likely contracted 0.6 percent from the previous quarter.

And similar news from Italy:

Italy’s recession will be worse than previously expected, the country’s central bank said today as it cut its 2013 estimate for gross domestic product on weakness in the global economy and disappointing internal demand.

Italian GDP will probably contract 1 percent this year, the Bank of Italy said today in its economic bulletin. That compares with a July estimate from the central bank for a 0.2 percent reduction.

“In our country, internal demand still hasn’t reached an inflection point,” the Bank of Italy said. The lower GDP forecast was “due to the worsening of the international scenario and the continuation of the weakness in business activity in recent months.”

And to round off the dour news, Dutch consumer spending fell 3.0% YoY.

But Germany is enjoying a sharp resurgence, with services up 3.3 points to 55 and manufacturing up 2.8 points to 48.8 and close to expansion. No doubt on the improving sentiment apparent in the ZEW and perhaps external demand, though it’s not yet apparent in export official data.

From the above chart you can see that the French and Germany PMIs have never diverged from each other for long so it will be interesting to watch which wins the current tug-of-war.

Full Eurozone PMI report below.

Was für eine Überraschung!

Despite Chris Williamson’s happy talk assessment which Delusional Economics includes at the beginning of this post, this is a dreadful report. The big news is that employment in the Eurozone was falling at its fastest pace since November 2009. Even Germany didn’t add any jobs. And its primary uptick was on the services side. That looks soft to me. Manufacturing was up too but still had not broken through the 50 mark which would indicate expansion. I have to wonder how much of this is Germany benefiting from a cheaper euro, that is at the expense of the rest of the eurozone, including France which is in a nosedive:

Flash France Composite Output Index drops to 42.7 (44.6 in December), 46-month low

Flash France Services Activity Index falls to 43.6 (45.2 in December), 46-month low

Flash France Manufacturing PMI slips to 42.9 (44.6 in December), 4-month low

Flash France Manufacturing Output Index drops to 40.8 (43.3 in December), 4-month low

And French unemployment increasing at its fastest rate in 3 months.

This says that Germany doesn’t care if its EMU trade is decreasing, it’s selling now to the UK, China and Eastern Europe.

“The EMU share of German trade has fallen from 46pc to 37pc since the launch of the euro, displaced by Asia, as well as Eastern Europe and the Anglo-sphere.

Fresh data from the Bundesbank show that Anglo-German trade in goods and services soared to €153bn in the first nine months of 2012, with both exports and imports booming at double-digit rates. It is one of the fastest growing trade relationships in the developed world. France lagged behind at €150bn as trade stagnated, with the US at €149bn and China at €115bn.”

http://www.telegraph.co.uk/finance/newsbysector/industry/9816643/Britain-becomes-Germanys-biggest-trade-partner-as-Berlin-London-pact-deepens.html

i wonder if people don’t think, even subconsciously, that we have exhausted a planet and so conservation and making do with less is the new normal – but maybe until they are polluted into sanity asian people still don’t see it (well have a look at beijing if you can)

so it could be that growth is the old paradigm – and our dear economists will have to think up something new to work on – just as well because most failed the old, maybe they’ll model themselves out of the new too…

Well, Herman Daly has been talking about this for years.

So have the “Limits To Growth” book and report people. So is John Michael Greer the Archdruid. So is James Kunstler at his Clusterfuck Nation. So is Dmitri Orlov in his own way. So is Richard Heinberg. So are others.

So there are lots of warnings. People trapped behind the MSBM curtain are prevented from hearing or reading it. But people reading these threads can read/hear as much of it as they wish. They have no one to blame but themselves if they don’t get up to speed on what the “That’s all, Folks!” economists and ecologists are telling them.

You might want to check out CASSE — Center for the Advancement of a Steady State Economy: http://www.steadystate.org

You can even sign a petition there.

France is the most etatist country in Europe. It has over one million more bureaucrats than Germany when corrected for difference in population. The current socialist-communist governement is not going to change that in the least since the functionnaries are the electoral base of Hollande. France has never been able to reform peacefully. It needs to touch bottom and then go through some form of convulsion in order to make changes.

French future looks gloomy.

I don’t worry about France. It has always proved to be very resourceful and it is older than most countries in Europe. Can take the French out of France but can’t take France out the French. They’ll pull through. Always have in the past…

The French could very well do such things as mass job-sharing and other forms of shared co-survivalism . . . if they believe that they can do so. And if their Governators share that vision and help apply it in time.

Not sure what your point is or what you consider “reform” to be. French fiscal policy as with that of the whole Southern Tier is constrained by its use of the euro. The real question is why these countries should stick with a euro which is killing their economies when all they are doing is subsidizing German exports via a cheaper currency than the mark and getting lectures from Germans about how they need to engage in yet more austerity, thereby sinking their economies further and subsidizing German exports even more.

France ( or at least the French elites and intellectuals) probably view the Euro as the ultimate capstone on the European Integration For Peace project which began with the Jean Monet plan and the European Coal and Steel Community and so forth. If I am correct in that guess, the French or at least their elites would have a very hard mental time with the concept that the Euro is a gangrenous limb which can still be amputated in time to save the rest of the body.

Or put another way, the French would probably have a very hard time viewing the Euro as a leg hold trap and viewing France itself as a coyote with its paw caught in the Leg Hold EuroTrap. Is there anything in French cultural folklore like America’s understand of the Coyote/Wolf with its paw in the leghold trap? The Coyote/Wolf would gnaw its own leg off to escape and survive on three legs. Can the French think that way in time?

I have to say, it takes some herculean spinning to turn “a slowing rate of decline” and “companies cutting staff at a faster rate” into any kind of hopeful news.

I imagine a doctor in the emergency room. His/her mutilated and bloody patient lies on a gurney while s/he makes a pronouncement: “the bleeding is slowing, vital signs are stabilizing, I think the worst is almost over.”

But, as it turns out, the patient’s bleeding has almost stopped because the poor schmuck’s already lost it all and his vital signs are indeed stabilizing…at zero.

“Don’t worry,” the doctor assures the patient’s nervous family, “the suffering is almost over.”

It’s Springtime for…

For Dehr Fuhrer Angela Merkel of the 4th Reich? :)

For those interested, here’s the Italian translation of the article above:

http://www.forexinfo.it/Crisi-Eurozona-speranze-per-la