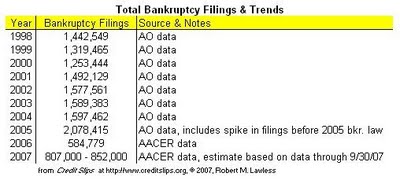

Credit Slips tells us that bankruptcy filings are increasing, but the new bankruptcy law has succeeded in keeping them below the 2005 level (the law became effective late October 2005). They dispute the idea that this represents progress.

From Credit Slips:

According to the folks at Automated Access to Court Electronic Records (AACER), preliminary figures show total U.S. bankruptcy filings in September at 67,286. That represents an increase from the 76,959 filings in August. Huh? Well, the September filings were spread over only 19 business days, but the August filings were over 23 business days. Thus, on the basis of filings per day, September filings were 3,541 as compared to 3,346. That’s a 5.8% increase in September over August. One cannot read a lot into monthly variations, but that is the highest daily filing rate since the enactment of the 2005 bankruptcy law….

None of this should surprise us. The architects of the 2005 bankruptcy law set out to make bankruptcy more expensive and more time-consuming and less effective for people once they got there. The point was to drive away people from the bankruptcy courts. It looks like they got what they wanted. Of course, it’s hardly a success to claim that bankruptcy filings are down. Consumers are hurting just the same, maybe more. Claiming victory by keeping people out of the bankruptcy system is like claiming victory over illness by closing the hospital.