Stocks were down today, largely in reaction to the release of the so-called ISM non-manufacturing report, which monitors activity in the service sector (primarily assesses banks, retailers and construction companies). The results showed the sharpest contraction since 2001.

Paul Krugman, who is not the bearish type, said the report indicates a recession is underway:

The ISM non-manufacturing report came in today…. the fact that it has fallen off a cliff should worry us.

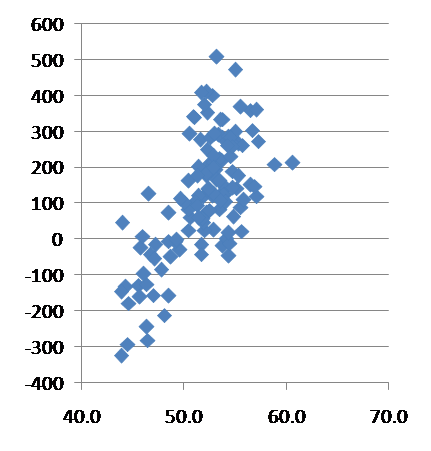

But how bad is it? The latest report has an employment diffusion index of 43.9 (50 means no change, anything less than 50 means job contraction). Here’s the historical relationship between the index (horizontal axis) and the actual monthly change in employment, in thousands (vertical axis), data since July 1997. If this report is at all right, we’re in serious recession territory.

Add: As explained above, the horizontal axis is the ISM employment index, the vertical axis is the change in nonfarm employment over the following month. Fwiw, the best-fit relationship says that this month’s report portends a loss of 137,000 jobs next month. You don’t want to take that too seriously, but it’s appropriate to cry “eek”.

eeeek!

My office is located in Bay Area, CA and I have a nice view of Highway 101. What I’ve noticed this week is that the notorious traffic jam is GONE. I wouldn’t get surprised even I heard that more than 10000 people lost job in this area last week.

Ill go Krugman one better with this link: http://finance.yahoo.com/q/bc?s=%5EHSI&t=1y&l=on&z=m&q=l&c=%5EGSPC

The valuations of stock markets in China and Japan are highly overvalued, by 20% and the S&P 500 for America is still well overvalued by at least 5% in contrast to a 10 year treasury yield! Between the overvaluation in stocks and the global housing market, the only conclusion is to take every chip as far away as from the casino as you can AND THEN HIDE YOUR CASH FOR SEVERAL YEARS!!!!!

Regardless of one’s views of the scenario, the opening comment that Krugman “isn’t bearish” is absurd. He’s forecast recession several times every year since 2001 and should, at this point, have no credibility.

2:02, Don’t agree with you here. Krugman has been pretty middle of the road this time around, and if you believe the Shadow Stats crowd, we had a recession in 2003 if GDP were computed correctly. It’s massively massaged, due particularly to hedonic adjustments.