Insecticide ‘killing Kenya lions‘ BBC

Saving the planet will be difficult, but do not despair Philip Stephens, Financial Times. Key quote:

Denial is a still a big problem, as demonstrated by the latest survey of global attitudes from the Pew Research Centre. The good news is that majorities in 14 of the 24 countries covered by this annual poll see global warming as a very serious problem. The bad news is that those countries with the smallest concerned majorities are the ones that are also contributing most to the stock of carbon dioxide in the atmosphere.

Less than half – 42 per cent – of people in the US think the rising temperature of the planet is a serious problem. In China, the figure is a mere 24 per cent. That compares with figures of 70 per cent and above in Japan, France, Tanzania and Turkey and 92 per cent in Brazil. That for Germany, surprisingly, is only 61 per cent and for Britain, less surprisingly, 56 per cent.

Oil vs. the Environment: What is the Tradeoff? Dean Baker. Provides some back-of-the-envelope estimates

Do Oil Futures Impact the Cash Price? YES!!! Econompic Data

Conventional wisdom wrong about Arab journalists’ anti-Americanism PhysOrg

Barclays May Get $927 Million From Sumitomo Mitsui, Nikkei Says Bloomberg

It’s Not Nice to Short Bank Stocks Floyd Norris, New York Times

Market power, asset allocation, and oil prices Steve Waldman

Walter Bagehot Was Wrong James Grant, New York Sun (hat tip Barry Ritholtz). Required reading.

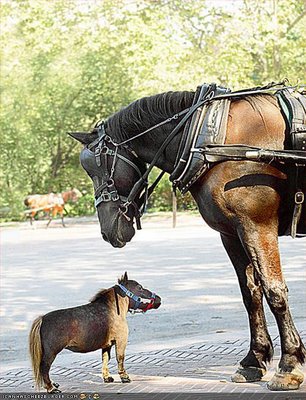

Antidote du jour:

Jim Grant in his article on the degradation of Bagehot’s lender of last resort: “In Boston, before a Mortgage Bankers Association audience on May 6, the chairman of the Federal Housing Finance Board, Ronald Rosenfeld, noted that the Federal Home Loan Banks, which his agency supervises, are closing in on $1 trillion in outstanding loans, or “advances” ($925 billion currently are outstanding, up by $300 billion since last June). “The FHLBs,” Reuters reported of Mr. Rosenfeld’s remarks, “are facing increased risk due to the concentration of loans to big financial institutions that recently ‘decided to become very involved in the FHLB system,’ Mr. Rosenfeld said. Those banks include Countrywide, Washington Mutual Inc. and Wells Fargo & Co., he said. The top borrowers of the FHLB system account for 37% of all advances, he said. ‘That’s an astonishing number, and an astonishing amount of concentration,’ he said.”

Awful. Just absolutely awful concentration. If WaMu goes unquiet into that good night, it just might take the FHLB down with it with those kind of numbers. I realize that we are, yes Virginia, in a banking crisis, but the fundamental gutlessness of the leading minds at the Fed and the Treasury in refusing to do ANY relevant triage _while they still can_ will leave their names in this history books on the ‘Loser’ side of the ledger. Sheesh.