Plated by Jesse of Le Café Américain

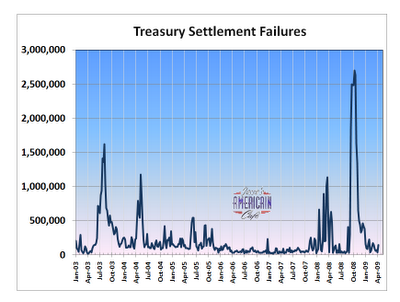

The ‘fails to deliver’ statistics on debt instruments is almost as interesting, and a bit less opaque, than the naked short selling of equity instruments.

A “fail to deliver” occurs when someone sells an asset such as a Treasury note to another party and then does not deliver it within a reasonable period of time.

As you can see from the chart, this had become a pandemic fraud recently as investors flocked to Treasuries as a safe haven and the usual front running and hedges based on shorting the bonds started to fall apart.

Let’s see how this works, and if the ‘financial charge’ is more than a wristslap to the hedge funds and banks who engage in these practices.

Now, if someone could kindly turn some attention to the obvious naked short selling in commodities and equities, other than when their banking friends are in trouble, we might see a return to markets based on some reasonable approximation of the fundamentals and price discovery of value, rather than blatant manipulation of nearly everything as facilitated by the demimondes of Wall Street.

The banks must be restrained, and the financial system reformed, before there can be any sustained recovery in the real economy.

New York Fed Applauds Implementation of the TMPG’s Fails Charge Recommendation

New York Fed Applauds Implementation of the TMPG’s Fails Charge Recommendation

May 1, 2009

The Federal Reserve Bank of New York welcomes today’s implementation of the Treasury Market Practices Group’s (TMPG) recommendation that settlement fails in U.S. Treasury securities transactions be subject to a financial charge when short-term rates are low. The TMPG worked with both buy- and sell-side market participants to address a weakness in market practices that became apparent last fall when short-term market interest rates neared zero.

The New York Fed has adopted this new trading practice in its own market operations and continues to encourage its adoption by all market participants. (The New York Fed was frontrunning Treasuries and selling them naked short? LOL Maybe they were getting tired of the abusive insider trading since they were now in a position to support the bonds. – Jesse)

“We applaud the dedicated efforts of the TMPG in spearheading the development and implementation of this targeted solution to the settlement fails problem,” said New York Fed President William Dudley. “This significant milestone in the evolution of Treasury market practice demonstrates that groups, such as the TMPG, are effective in addressing deficiencies in market functioning and facilitating market best practices.”

The New York Fed acknowledges all of the market participants who joined this effort to develop this new trading practice guidance. In particular, the Securities Industry and Financial Markets Association, the Fixed Income Clearing Corporation, the Securities and Exchange Commission and the U.S. Treasury Department have provided critical support and guidance throughout this process.

It’s exactly this kind of epic gaming of the system that keeps me – for example – from having any confidence that buying physical gold to hold is a good idea. There are these same sets of epic fails everywhere in the system. Would gold be at $2000 without the massive FTDs in the COMEX? Maybe, but I suspect we’ll never know.

As WOPR put it, the only winning move is not to play.

(As I’ve mentioned before, http://www.deepcapture.com is the naked shorting site of choice. They redesigned it recently.)

By “not playing”, and presumably holding US Federal Reserve Notes, or some other currency, or land, or something, you are playing.

Well, I suppose one could be living on a commune in Oregon.

There are no spectators, and there are few if any bystanders.

Naked shorts are only a problem now because they effect treasurys. They have been hurting the little investor for years.

Now the rich are getting some of their own medicine–bring it on.

Pardon me for being a PIG, but this story shall end up here, even though it is somewhat unrelated to the specifics of naked shorting.

Elizabeth Warren: Stress Tests Need To Be Transparent“… In an interview with the Huffington Post, the Harvard Law School Professor laid down four markers for a stable and sufficient recovery, offered support for the prosecution of individuals proven to have committed crimes that contributed to the economic downturn, and criticized bank executives for their rising compensation levels. She also insisted that if Goldman Sachs wanted to pay back the bailout funds it received to get out from under government restrictions, it should have to return all funds, including guarantees and money it receives as a counterparty to AIG.

But it was her broader comments on the Treasury Department’s efforts to resuscitate the banks (delivered from the 5,000-foot high vantage point, as she insists) that stuck out as disconcerting. “The answer is still not clear,” …

Danka!