Served by Jesse of Le Café Américain

There are three basic inputs to the market price of a product or service:

1. Level of Aggregate Supply

2. Level of Aggregate Demand

3. Relative Value (purchasing power) of the Medium of Exchange

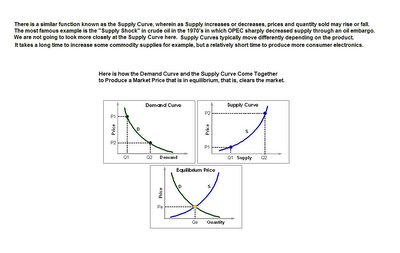

Let’s consider supply and demand first, since they are the most intuitively obvious.

The market presents an overall demand, and within that demand for individual products in particular.

Supply is the second key component to price. We are not going to go into more detail on it since what we are facing now is a decrease in Aggregate Demand.

It can seem a little confusing perhaps. Just keep in mind that if the aggregate demand decreases for goods and services for whatever reasons, such as severe unemployment, and supply remains available then prices will drop overall, with some variance across products because of their differing elasticity to price changes.

This is known as the Law of Supply and Demand.

How we do know when aggregate Demand is decreasing?

Gross Domestic Product = Consumption + Investment + Government spending + (exports − imports),

or the famous economic equation GDP = C + I + G + (X − M).

Consumption, or Aggregate Demand, is a measurable and key component of our GDP figures.

Given the huge slump in GDP, it should be obvious that we are in a demand driven price deflation on many goods and services. People are saving more and consuming less.

Now, that covers supply and demand as components of price, but what about money?

Money

Notice in the above examples we talk about Price as a value without a label.

Money is a medium of exchange. It is the label which we apply to give a meaning to our economic transactions.

If you are in England, or France, or Argentina, or China, the value label you apply to Price is going to be different according to local laws and customs.

Money is the predominant medium of exchange that a group of people have agreed to use when engaging in economic transactions that are not based on pure trading of goods, known as barter.

The source and store of wealth are the ‘credits’ within the system which one uses to exchange for products. The money is the medium of exchange.

If you work for a living, you are exchanging your time and your talent, which is your source of wealth, for products. The way in which this is labeled and facilitated in the United States is through the US dollar. I n Russia and China is it something else completely.

The Value of Money

How do we know what some unit of money is worth? Try not to think about your domestic currency. Since we use it so often every day, we tend to think of it with a set of assumptions and biases. Most Americans have little practical exposure to foreign exchange, and tend to think of themselves as living in a dollar-centric world.

Let’s use the Chinese yuan. What is the yuan worth? What if I offered you a roll of yuan in exchange for a day’s work? How would you know if it was a ‘fair trade?”

Since there is no fixed standard for money in our world, you would most likely inquire in the markets what you could obtain for those yuan I offered to you in an accessible market.

But what sets the rate at which yuan are exchanged for a given product?

In a free market system, it is a very dynamic system of barter. When you offer something for money, I know how much of my source or store of wealth I must exchange for the yuan to provide for the product offered.

Money is just a placeholder. We hold it because we expect to be able to trade it for something else which we really desire. You don’t eat or wear money; you exchange it for things which you wish to eat or wear.

If the value of money changes, the price of all the things to which you have been applying that label changes. This is why it is important to distinguish between price changes because of changes in demand, and changes because of money supply. They are different, and require very different responses.

Money supply

In a very real sense, there is a relationship between how many goods and services are available, and how much money exists.

Let’s say we are in China. I give you 100 yuan. Tomorrow the Chinese government triples the amount of yuan in the economy by giving each of its citizens ten thousand yuan for essentially doing nothing, for not producing anything more or less.

Do you think the 100 yuan will be worth as much as they were the day before? No, obviously not.

In real economies these changes tend to happen with a time lag, or gradually, between the action and the reaction. This is necessary because people can only adjust their daily habits, their economic transactions, gradually. Otherwise it becomes too stressful, since our daily routines and decisions are based so heavily on habits and assumptions of value and consequences.

But in general, if the supply of money is increasing faster than real per capita GDP over a longer term average the money supply is inflating, that is, losing real purchasing power.

Seems simple? Well its a bit more complicated than that unfortunately since these things relate to free markets, and if there is any other thing you need to remember, we do not have free markets, only free to varying degrees.

The logical question at this point is to ask, “What is the money supply?” That is, what is money and what is not?

We dealt with this at some length, and suggest you look at this Money Supply: A Primer in order to gain more knowledge of what is money and money supply.

We would like to note here though, that there is a difference between money supply and credit, between real money and potential money.

If I have 100 Yuan in my pocket, there is a real difference between that money, and my ability to work at some job tomorrow and be paid 100 yuan, or have you repay 100 yuan to me which I gave to you yesterday, or my hopes that I can borrow 100 yuan from some third party.

If you do not understand this, you will not understand money. It is one of the great charades of our time that risk has been so badly distorted out of our calculations. We cannot help but think that some future generation will look at us as though we had all gone barking mad.

The subject becomes even more complicated these days because we are in what is called a fiat regime. Fiat means ‘let it be done’ as we will it, and we are if anything in a very relativistic age in which we think we can will just about anything.

The major nations of the world get together and attempt to manage the value of their currencies relative to one another, primarily through their finance ministries and central banks.

Countries will interfere in the markets, much more than they will admit, to attempt to maintain certain relationships among currencies of importance to them. Sometimes they are overt about it, as when nations ‘peg’ one currency to another, and at other times they are more subtle and merely influence other currencies through mass purchases of debt and other forms of persuasion and the molding of perception.

I hope this helps. I don’t intend to answer loads of questions on this, particularly from those who immediately start inventing complex examples to try and disprove this. Most of the time the examples betray a bias that person has that defies patience and a stubborn belief that everything is relative. In the longer term it is most assuredly not.

Each will learn at their own pace what is real and what is not. But they will not be able to say that they have not been warned that sometimes appearance is different than reality.

Here are some examples of money supply growth in the US. If you read our Primer you will know that MZM is by far the most important now that M3 is no longer reliably available.

Is money supply growing faster than real per capita GDP? Yes, decidedly so. And unless this trend changes significantly we will face a whopping monetary inflation.

Here is a chart that shows the buying of US debt that other countries have been doing through the NY Fed Custodial Accounts for a variety of motivations. Without this absorption of US money supply the value of the dollar would be greatly diminished relative to several other currencies. This is probably not a sustainable relationship but it has had a good long run because it is supported by the US as the world’s superpower.

Other countries are essentially exchanging their productivity, their per capita GDP, for our excess money supply. This is why a US monetary inflation has remained manageable. Other countries are providing an artificial Demand for US debt at non-market prices.

One of the great errors of our generation has been the gradual and erroneous mispricing of risk through a variety of bad assumptions and convenient fallacies. Without the appropriate allowance for risk, there is no ability to discover valid pricing and allocation of capital.

The consequences of this abuse of reason are going to be enormous.

I do not see this improving quickly because the manipulation of risk for the benefit of the few, and the transfer of that risk to the public and the rest of the world, has tremendous value to the powerful status quo.

But the day of reckoning and settlement of accounts is coming, and as it approaches it will accelerate and come with a vengeance. For after all,

“Life is a school of probability.” Walter Bagehot

School is almost out.

I am not sure that the efficiency of utilization of additional dollars has been taken into account and how it relates to money velocity.

For instance you print money and give each tax payer 10 dollars but if they all save it or use it to pay off debt you have not instigated inflation. I guess you could argue that you are stoking future inflation.

Thank you so much for making it plain. So lucid, so to the point. A breath of fresh air.

The missing ingredient is "inflation expectations".

If you expect a significant, imminent increase in inflation, you would be far more likely to spend those marginal dollars than to save them or use them to pay down debt.

Banana Republic Ben & Co, are frantically trying to raise inflation expectations in order to make that happen.

In the event that they are "successful", a very short-lived and superficial consumption-led boomlet will occur, only to be followed by yet another, even deeper descent into the deflationary abyss. That is the best we can hope for. That is their "Plan". There is no "Plan B".

We are s-oooo screwed.

This analysis is very good – except for one key piece. In today's world, credit IS money – and so when the spigots were turned off, consumer spending ground to a halt. MMULT under 1 is the result of nobody being able to get a loan these days. Although banks have a gadzillion dollars sitting in the vault, no household or business (aside from the occasional statistical anomaly) can take on more debt.

Ultimately, deflation is a monetary phenomenon, and is affected most by the leveraged bets of wall street players. As those bets go south, the dollar destruction is more immense than the growth from businesses and persons taking out loans (due to the inability discussed above) results in a net deflation.

Simple calculation: Go add up all the level 3 assets on the books of the broker dealers. Then imagine the economic destruction if ALL of those assets are forced to their realistic recovery value of 5 cents per dollar at best.

"I am not sure that the efficiency of utilization of additional dollars has been taken into account and how it relates to money velocity.

For instance you print money and give each tax payer 10 dollars but if they all save it or use it to pay off debt you have not instigated inflation. I guess you could argue that you are stoking future inflation."

Precisely, except it depends on WHERE they save it. If they bury it in their back yard it might be benign.

If they save it in a back, it increases reserves and the multiplier.

If they are a foreign entity and they buy Treasury debt, they enable government spending.

Jonathan,

Granted it was a very basic, simple walk through. It was intended to be.

If it is so apparent, why don't so many get it? Why don't people realize that Aggregate Demand is somewhat independent of monetary inflation?

That is what stagflation is all about.

Most people "think" they know things, but then draw conclusions that make it clear that they do not.

It was a primer. Sometimes a review is useful. Stagflation is very counterintuitive and runs against intellectual bias many hold closely.

Last time stagflation came from a supply side shock in oil. This time it may arise from a supply side shock in US dollars.

Don't think its possible? I have given you the basic tools to understand that. Now its all about assessing the probabilities.

J

Firstly, and most importantly, thank you for taking the time to reply to comments. I also want to apologize for the part of my initial comment that referred to "pre-empting". This was unnecessarily snarky.

"If they save it in a bank, it increases reserves and the multiplier."

This is, I believe, simply not true. Banks do not take deposits and then loan them out. In fact, banks make loans first and then those loans become deposits. I believe that the multiplier is a bit of a myth and increased money supply via the banks is constrained only by capital requirements and credit assessments. This is covered very well at http://www.winterspeak.com/2009/01/nytimes-1-chicago-0.html

"Is money supply growing faster than real per capita GDP? Yes, decidedly so.

And unless this trend changes significantly we will face a whopping monetary inflation."

Again, I don't believe it is true that this will necessarily lead to inflation. Inflation is, IMO, a result of the government deficit being larger than the desired amount of public savings. Again, please see the winterspeak post. It is simply excellent.

Regards, Jonathan.

Argh. "public savings" in my previous comment should have been "private savings".

Regards, Jonathan.

Anyone who has the chutzpah to say he was "irritated" by the rudimentary nature of Jesse's post and then goes on to say that "banks do not take deposits and then lend them out" has in my opinion just made a fool of himself (or worse) on multiple levels.

I would echo Brick and Jonathan's claim that increasing the monetary base does not necessarily cause inflation. For that you need consumers spending those extra dollars -i.e. velocity. Accrued Interest http:/accruedint.blogspot.com) has recently written an excellent series of posts on this , which anyone interested in the deflation v. inflation debate should check out.

Still, I think this would have been a good introduction to monetary econ. Definitely a more lucid discussion of money than Mankiw provides in his text.

Yes, Bam_Man, as a banker I would also like Jonathan to clarify that.

Jonathan said:

"If they save it in a bank, it increases reserves and the multiplier."

This is, I believe, simply not true. Banks do not take deposits and then loan them out. In fact, banks make loans first and then those loans become deposits. I believe that the multiplier is a bit of a myth and increased money supply via the banks is constrained only by capital requirements and credit assessments. This is covered very well at http://www.winterspeak.com/2009/01/nytimes-1-chicago-0.html"

This is the kind of tautology preferred by some to make things relatively simple more complex.

Deposits are a form a capital for a bank. If they desire to remain in business under a reserve requirement regulatory regime, they will retain some reserves, and deposits are a favored source. To say otherwise is eccentric beyond description.

It does no service to those trying to actually understand what is being said, rather than engage in rhetorical splitting of hairs.

Banks obviously do both seek deposits and make loans. they maintain a BALANCE sheet.

I think I have said more than enough, and learned more than enough about what you know and do not.

Several of you are addressing things that cause the 'lags.'

Obviously just increasing the base does not cause inflation. It must be increased in excess over a period of time.

The Fed and Treasury are busy managing expectations. People may save, and we may import savings through a trade deficit.

This can go on for a long time.

However, like an avalanche, once the mass of built up excess starts moving it could be terrific.

That is the whole point of this. Obviously since it was a primer I did not address all the ins and outs and the educated economist can raise all sorts of objections, all legitimate.

But because I did not include them does not nullify what has been said, it merely builds on what was intended to be a foundation.

I suppose my major points in this post, for those taking the next step are this:

1. Aggregate Demand, Supply and Money Supply are not inexorably linked in lockstep. This is what permits stagflation to occur. We are familiar with Supply stagflation. We are not familiar with Demand and Money Supply Stagflation.

2. Under a fiat regime either inflation or deflation can occur. More importantly neither is necessarily inevitable.

This should be obvious to anyone who understands the workings of our Fed. It is a matter of will and policy decision.

Debtors will rarely choose deflation unless they are compelled or are suicidal.

Paul Volcker gave the odds of inflation versus deflation here at roughly 99.4% and I would tend to agree.

The only question in my mind is how bad the inflation gets, and what sort of international monetary regime replaces the dollar.

I have been on the record for some time that I do not think hyperinflation is a strong probability unless a policy decision is made by BRIC to dump dollars precipitously.

HOwever, a persistent and growing inflation is highly probable UNLESS

we reform our financial system and our economic balance between goods, services and labor among other things.

The financial system is taxing the real economy to a degree that is smothering it.

Oh my God.

Jesse, please tell me you did not mean to say "Deposits are a form of capital for a bank."

Please.

I have tried to submit a follow-up comment, as other readers asked me to elaborate. I do not believe that this has been allowed to be printed.

Regards, Jonathan.

Looks like I was wrong and there is no filter. User error and I apologize for the insinuation.

Please (please!) read a much better explanation of what I am trying to suggest at http://www.winterspeak.com/2009/01/nytimes-1-chicago-0.html

If you are not up for that, here is an extended excerpt:-

Thoughts on human interaction over the next 25 years

Tuesday, January 27, 2009

NYTimes 1, Chicago 0

Paul Krugman is ably taking U Chicago behind the tool shed and thrashing them. I had an email exchange with Prof Cochrane yesterday where I tried to gently point out the error of his ways, but to no avail. Drinking down a tall glass of FAIL may to tolerable if you have tenure, but it still cannot taste that great. I'm sure Fama, Cochrane, and the rest of U Chicago are not enjoying all the egg on their face, so I'll try once again to show them a way out of their conundrum.

The Issue

Essentially, Cochrane and Fama both assert that savings = investment (+ capital account), and so say that any Government stimulus will crowd out private investment. Here's the derivation (by identity) to get you S = I

Y = C + I + G

National savings can be thought of as the amount of remaining money that is not consumed, or spent by government. In a simple model of a closed economy, anything that is not spent is assumed to be invested:

NationalSavings = Y ? C ? G = I

If you think that banks make (investment) loans based on their deposits, then it's reasonable to assume that all money not spent (ie. saved) is invested. But banks do not take deposits and loan them out. In fact, banks make loans first and then those loans become deposits. Remember — loans create deposits, deposits do not "enable" loans.

Loans create deposits

Banks, by way of their Federal charter, can expand both sides of their balance sheet at will, subject to capital requirements. This money is created ex-nihilo, but always nets out to zero in the private sector, as each (private) asset that a bank creates must be matched by a (private) liability. Government can create money outside of the system, but banks always need to net out and balance the balance sheet.

People believe that fractional reserve banking, in some weird way, has banks taking deposits, multiplying it (through what seems like a strange and fraudulent process), and then making a larger quantity of loans. In fact, banks make whatever loans they think make sense from a credit perspective, and then borrow the money they need from the interbank market to meet their reserve requirements. If the banking sector as a whole is net short of deposits, it can borrow the extra money it needs from the Fed.

Regards,

Jonathan.

One bank's loan can in turn become another bank's deposit. Some or all of the original borrowed amount may even eventually find its way back to the original lending bank as deposits.

But to say "banks do not take deposits and lend them out" is still an utterly ridiculous statement.

I agree that, in isolation, that statement is ridiculous. Followed up immediately by the sentence "In fact, banks make loans first and then those loans become deposits.", could we agree that this is mainly poor wording and, more importantly, potentially an important point that invalidates the idea of a money multiplier through the banks?

Would love to think that someone headed over to Winterspeak to read his post. Did you have a chance to do that?

Regards, Jonathan.

"Deposits are a form a capital for a bank. If they desire to remain in business under a reserve requirement regulatory regime, they will retain some reserves, and deposits are a favored source. To say otherwise is eccentric beyond description."

Will wait to comment on this until Bam_Man gets a response. At that point, it will be clearer as to what I do and do not know (a lot!), but also what you do and do not know.

Regards, Jonathan.

Jesse – really nice to see you respond this way, so IMO it would be even nicer if you allowed comments and responded to them on your own blog.

Hint: The vast, vast, vast majority of bank deposits are available to the depositor "on demand".

This is about as far away from being "capital" as you can possibly get.

Deposits may bear some resemblance to what in non-banks is referred to as "working capital", but even that is quite a stretch.

Whether a bank is well-capitalized or not has absolutely nothing to do with its level of deposits.

Furthermore, any bank that would attempt to substitute deposits for actual capital would be stopped dead in its tracks, even by our current less-than-stringent regulatory regime.

Couldn't agree more. Are we in agreement, then, that the so-called "money multiplier" of deposits necessarily feeding, via loans, to an increased money supply is not an accurate representation of what actually occurs in banks and that the growth in the money supply is actually a function of capital requirements and credit-worthiness assessments?

If so, can we move on to the more interesting debate around the federal deficit needing to equal the desired level of private savings? ;-)

Regards, Jonathan.

You are correct I did not intend to use the word "capital."

This is what comes of posting while trading. We are testing some key resistance and I have had a nice ride.

Sorry about that. LOL.

Not sure you can write the sentences "Deposits are a form a capital for a bank. If they desire to remain in business under a reserve requirement regulatory regime, they will retain some reserves, and deposits are a favored source" and for it to be a glorified typo, rather than the mistaken belief that deposits are a form of capital.

In case I'm wrong, though, would you care to restate what you dispute about my suggestion that your statement about the existence of a "multiplier", between deposits and money supply, is untrue and that the increase in money supply is constrained only by capital requirements and credit assessments?

As a former trader myself, I suspect you will have downtime to respond at some point.

Regards, Jonathan.

Bam, what I had intended to say was that deposits are a desirable source of the short term borrowings that banks require for their business. BTW not all deposits are on demand, many are in time sensitive certificates.

It has been a long time since I was exposed to bank accounting, roughly 20 years, but I am aware of it. My two friends in B-school were in banking, one an owner and the other worked for the Fed as an examiner.

What would one call the 'working capital' that banks must maintain through borrowings and desposits and other things? I don't recall.

Cash? LOL.

Jonathan, you are so far in the weeds I would need a tow truck to pull you out. Sorry, but that's how I see it.

I would never allow comments on my site unless I were charging a fee for them. 90% of the time is babysitting with little return. I have done it.

Rather, I have an email address and plenty of people find it, and we converse, and I get to know people whom I respect and admire greatly without having to sift through a pile of rubbish.

I don't charge a dime, and accept no adverts. So I allow myself some personal discretion about what I allow on the menu.

I appreciate you responding.

I think the suggested multiplier between deposits and money supply is just untrue and that it is a function of capital requirements (which is why it is important not to see deposits as capital) and credit assessments.

Not sure why that is so far "in the weeds" that it can't be easily refuted, were it to be untrue.

The repeated publication of the multiplier myth does have very important ramifications for today's approach to resolving the economic crisis, so, see it how you see it by all means, but (and sincerely no offense intended here) please don't write about it in such a public forum.

Regards,

Jonathan.

Thanks for the clarification Jesse.

As a devoted fan of your site, I was slightly worried there for a minute.

Monetarization is a stalemate maneuver. How are they going to siphon off the M1 when the credit markets resurrect themselves and the M3 explodes without raising short term interest rates? I don't think Bernake will get Obama will convince Obama to take the unemployment hit.

Bam-Man.

Sorry for that. :)

What would one call it? The short term borrowings? Or do they just flow to wherever they are required? I'd really like a memory jog on that.

As an added thought, one should not overlook the interest payments that the Fed has arranged for banks on their reserves at the Fed which is something new for the US.

This is a tool the Fed is using to soak up 'excess liquidity.' If they zeroed out that interest, banks would be incented to lend.

I thought Bernanke tipped his hand on that one pretty heavily.

Credit is not money. It is potential money, in much the same way that my labor or some physical asset is potential money. Granted some forms of credit are incredibly liquid and available. But much isnot. Also, there is a risk factor is potential money and a friction that makes it 'different.' Like counterparty risk.

We have stopped thinking about risk in this world today. That will change.

The limit of the Fed is the dollar and the bonds.

Watch them carefully.

If we are in a real monetary deflation, then rates will come down on the long end and the dollar will strengthen.

I don't think that will happen.

Please recall that in the Great Depression, under a crushing drop in aggregate demand and destruction of savings and debt/credit, the dollar was devalued, significantly.

AND we were a net creditor/net exporter at that time.

Chew on that.

Jesse,

Total private borrowing has fallen off a cliff. There is far more savings demand than borrowing demand right now. For as long as that continues we are in a deflationary environment. Unless someone can explain how this private sector deleveraing process stops any time soon, I don't see any credible risk of inflation any time soon.

I agree that inflation seems largely inevitable given the Fed's (and other Central Banks') policies. I'm not interested in the quibbling about terminology, please stop, sorry folks.

One point missing from many inflation discussions is the electronic nature of money. This can either drastically increase the velocity of money (inflationary), or decrease the velocity (deflationary). On one hand, the Fed can create a trillion dollars in a microsecond, by simply incrementing a variable in a computer program. That money can ostensibly be used within hours to make millions of purchases. On the other hand, any transaction that occurs for more than about $1000 is done electronically, meaning that 99.999% of spending could be stopped instantaneously by halting electronic transfers. This would be an example of how monetary authorities could stop hyperinflation – people still have money, but they are not allowed to spend it. Of course, banks would need to do this on a temporary basis, since this would cause a panic and a rush to paper currency.

Chances are good that this sort of strategy would be used to stratify the losses from inflation. This strategy could also be employed to slow forex fluctuations. I'll leave the rest to your imagination…

Jesse – it's your site to do with as you wish of course, and as it is I am a daily reader – but with respect, why do you think the readers of your blog are dumber than those with whom you are interacting openly and productively here on NC? After all, if you don't like what they have to say, you don't have to actually communicate with them.

Jesse,

I think what you are referring to is a bank's "liquidity position" or "cash position".

This is monitored closely intraday to ensure that there is no "emergency" at end of day settlement that would necessitate a trip to the Fed's Discount Window.

Key difference between the Great Depression and now, quoting Dr. Andre Lara Resende, via Willem Buiter's blog (sorry for the length):-

"There is a major difference between the present conditions and those prevailing at the time Keynes elaborated his theses…In 1932, the economy was still in profound depression, but – as known today – due in a large extent to the errors of monetary policy, the excess of debt of the private sector had been eliminated by the collapse of the financial system. The generalized bankruptcy of banks and firms solved the problem of excessive indebtedness. Banks, enterprises and households were broken, but with no debts. The costs were dramatic, but the excess of debt disappeared. The fact that the mistakes of 1929 have not been repeated, lead to circumstances far different from those of 1932. Financial collapse was avoided and despite the severity of the recession, we are still far from the thorough disorganization of the economy and massive unemployment -close to 30% of the labor force – of the Great Depression. The economy, however, almost two years after the beginning of the crisis, continues to be overwhelmed by unredeemable debts. As long as households and firms continue to bear the brunt of excessive debt, they will try to reduce expenditures and increase savings. Until debt is reduced to levels which are perceived as reasonable, the private sector expenditure will be exceptionally low. After the Great Depression, in the early thirties, there was a lack of demand because there was no economic activity and no income. Today, the lack of demand is the result of the exceptionally high rate of savings required to bring back private debt to reasonable levels. These are very different situations."

I think Jamie's post is exactly correct.

Regards, Jonathan.

"School is almost out."

The analysis and it's underlying assumptions are very flawed.

1. Demand and supply aren't independent variables. They are functions of the prices of goods. Deriving an "equilibrium price" from supply and demand curves is nothing else than circular. The "law of demand and supply" doesn't explain anything.

2. Or even the basic assumption of (neo-classic) mainstream economy that the economic system is somewhere near an "equilibrium" or, at least, its trajectory would trend toward it, if there weren't external shocks that mess it up again and again, is very, very questionable. But, if there isn't any equilibrium what is an "equilibrium price"?

3. Capitalist economy isn't about barter and money isn't just a placeholder to exchange goods in a circulation that looks like G-M-G' (G – good, M – money, G' – another good). The main driving force of capitalist society is making more money, i.e. using money as capital, M-G-M'. Money is the starting and end point of economic activity. The goods in between are the means for the purpose.

4. The money multiplier explanation for credit and inflation is faulty. The money supply doesn't determine the amount of credit in the system. It's mostly the other way around. Steve Keen referred in his post on NC, "The Roving Cavaliers of Credit", to the study that showed how the data disprove the money multiplier model of credit.

http://www.nakedcapitalism.com/2009/02/steve-keen-roving-cavaliers-of-credit.html

Sorry about interrupting class.

rc

rc, Thanks very much for referring back to the Steve Keen article, regarding the multiplier being a myth. It is excellent (if of quite some length. What is interesting is that Jesse himself commented on that article, writing:-

"Allen C said… "sufficient injections of money will ultimately always reverse a deflation. This is absolutely correct!

Allen C is absolutely right.

Anyone who does not understand this does not understand economics.

The value and quantity of the currency is always and everywere a policy decision in a purely fiat monetary regime.

This is so outrageous a concept and the mind of the layman rebels against it, and they create marvelous webs of reasons and rules why 'money' is not arbitrary.

But it is, and obviously so."

Leaving the tone to one side, would you agree with me that this is correct, but the difference is in the definition of "sufficient injections of money"? The Winterspeak/Mosler cats would suggest (I believe) that currently the injection is too small to meet the net demand for private savings, which will cause deflation (i.e. the net private savings will be funded out of aggregate demand and unemployment).

Jesse (I believe) thinks that there has already been a sufficient injection of money to create inflation.

Regards,

Jonathan.