By George Washington of Washington’s Blog.

As Absolute Return Partners wrote in its July newsletter:

The most important investment decision you will have to make this year and possibly for years to come is whether to structure your portfolio for deflation or inflation.

So which is it, inflation or deflation?

This is obviously a hot topic of debate, and experts weigh in on both sides. I’ve analyzed this issue in numerous posts, but every day there are new arguments one way or the other from some very smart people.

Because the arguments for inflation are so obvious and widely-discussed (bailouts, quantitative easing, Fed purchasing treasuries, etc.), I will not discuss them here (other than pointing to an interesting new argument for inflation by Andy Xie).

How Bad Could It Get?

The biggest deflation bears are rather pessimistic:

- David Rosenberg says that deflationary periods can last years before inflation kicks in

- Renowned economist Dr. Lacy Hunt says that we may have 15-20 years of deflation

- PhD economist Steve Keen says that – unless we reduce our debt – we could have a “never-ending depression”

These are the most pessimistic views I have run across. Most deflationists think that a deflationary period would last for a shorter period of time.

The Best Recent Arguments for Deflation

Following are some of the best arguments for deflation.

Unemployment

Wall Street Journal’s Scott Patterson writes that we won’t get inflation until unemployment is down below 5%:

A rule of thumb is that inflation doesn’t become sticky until the unemployment rate dips below 5%…

“I see very little prospect of accelerating inflation” partly because of the employment outlook, said Mark Zandi, chief economist of Moody’s Economy.com. “I don’t think the risk shifts toward inflation until 2011, or even 2012.”

It could take a lot longer for unemployment to go back down to 5% (and for consumers to have more money to spend again).

(Note: hyperinflation is obviously an entirely different animal. For example, there was rampant unemployment in the Weimar Republic during its bout with hyperinflation ).

Debt Overhang and Deleveraging

Steve Keen argues that the government’s attempts to increase lending won’t work, consumers will keep on deleveraging from their debt, and that – unless debt is slashed – the massive debt overhang will keep us in a deflationary environment for a long time.

Mish writes:

An over-leveraged economy is one prone to deflation and stagnant growth. This is evident in the path the Japanese took after their stock and real estate bubbles began to implode in 1989.

Leverage is increasing again, according to an article in Bloomberg:

Banks are increasing lending to buyers of high-yield company loans and mortgage bonds at what may be the fastest pace since the credit-market debacle began in 2007…

“I am surprised by how quickly the market has become receptive to leverage again,” said Bob Franz, the co-head of syndicated loans in New York at Credit Suisse…

Indeed, as I have repeatedly pointed out, Bernanke, Geithner, Summers and the chorus of mainstream economists have all acted as enablers for increasing leverage.

Mish continues:

Creative destruction in conjunction with global wage arbitrage, changing demographics, downsizing boomers fearing retirement, changing social attitudes towards debt in every economic age group, and massive debt leverage is an extremely powerful set of forces.

Bear in mind, that set of forces will not play out over days, weeks, or months. A Schumpeterian Depression will take years, perhaps even decades to play out.

Thus, deflation is an ongoing process, not a point in time event that can be staved off by massive interventions and Orwellian Proclamations “We Saved The World”.

Bernanke and the Fed do not understand these concepts, nor does anyone else chanting that pending hyperinflation or massive inflation is coming right around the corner, nor do those who think new stock market is off to new highs. In other words, almost everyone is oblivious to the true state of affairs.

Pension Crisis

Pension expert Leo Kolivakis writes:

The global pension crisis is highly deflationary and yet very few commentators are discussing this.

Collapse of the Shadow Banking System

Hoisington’s Second Quarter 2009 Outlook states:

One of the more common beliefs about the operation of the U.S. economy is that a massive increase in the Fed’s balance sheet will automatically lead to a quick and substantial rise in inflation. [However] An inflationary surge of this type must work either through the banking system or through non-bank institutions that act like banks which are often called “shadow banks”. The process toward inflation in both cases is a necessary increasing cycle of borrowing and lending. As of today, that private market mechanism has been acting as a brake on the normal functioning of the monetary engine.

For example, total commercial bank loans have declined over the past 1, 3, 6, and 9 month intervals. Also, recent readings on bank credit plus commercial paper have registered record rates of decline. The FDIC has closed a record 52 banks thus far this year, and numerous other banks are on life support. The “shadow banks” are in even worse shape. Over 300 mortgage entities have failed, and Fannie Mae and Freddie Mac are in federal receivership. Foreclosures and delinquencies on mortgages are continuing to rise, indicating that the banks and their non-bank competitors face additional pressures to re-trench, not expand. Thus far in this unusual business cycle, excessive debt and falling asset prices have conspired to render the best efforts of the Fed impotent.

Ellen Brown argues that the break down in the securitized loan markets (especially CDOs) within the shadow banking system dwarfed other types of lending, and argues that the collapse of the securitized loan market means that deflation will – with certainty – continue to trump inflation unless conditions radically change.

Support for Brown’s argument comes from several sources.

As the Washington Times notes:

“Congress’ demand that banks fill in for collapsed securities markets poses a dilemma for the banks, not only because most do not have the capacity to ramp up to such large-scale lending quickly. The securitized loan markets provided an essential part of the machinery that enabled banks to lend in the first place. By selling most of their portfolios of mortgages, business and consumer loans to investors, banks in the past freed up money to make new loans. . . .“The market for pooled subprime loans, known as collateralized debt obligations (CDOs), collapsed at the end of 2007 and, by most accounts, will never come back. Because of the surging defaults on subprime and other exotic mortgages, investors have shied away from buying the loans, forcing banks and Wall Street firms to hold them on their books and take the losses.”

Senior economic adviser for UBS Investment Bank, George Magnus, confirms:

The restoration of normal credit creation should not be expected, until the economy has adjusted to the disappearance of shadow bank credit, and until banks have created the capacity to resume lending to creditworthy borrowers. This is still about capital adequacy, where better signs of organic capital creation are welcome. More importantly now though, it is about poor asset quality, especially as defaults and loan losses rise into 2010 from already elevated levels.

And McClatchy writes:

The foundation of U.S. credit expansion for the past 20 years is in ruin. Since the 1980s, banks haven’t kept loans on their balance sheets; instead, they sold them into a secondary market, where they were pooled for sale to investors as securities. The process, called securitization, fueled a rapid expansion of credit to consumers and businesses. By passing their loans on to investors, banks were freed to lend more.

Today, securitization is all but dead. Investors have little appetite for risky securities. Few buyers want a security based on pools of mortgages, car loans, student loans and the like.

“The basis of revival of the system along the line of what previously existed doesn’t exist. The foundation that was supposed to be there for the revival (of the economy) . . . got washed away,” [economist James K.] Galbraith said.

Unless and until securitization rebounds, it will be hard for banks to resume robust lending because they’re stuck with loans on their books.

Fed Paying Interest on Reserves

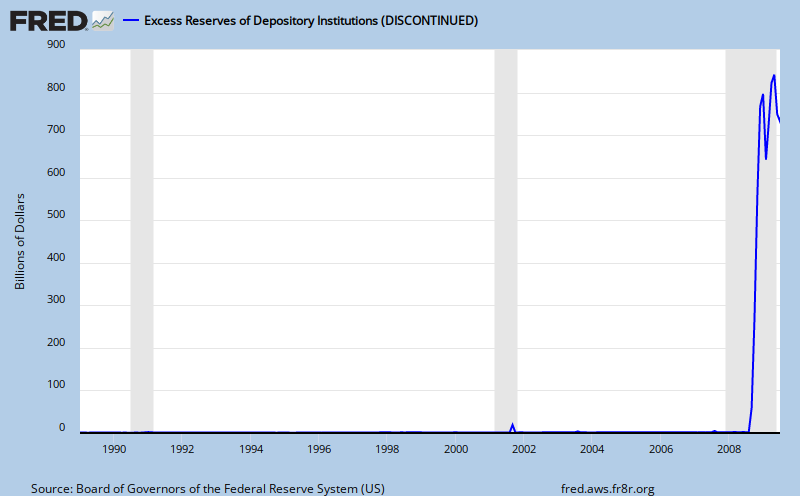

And Naufal Sanaullah writes:

So if all of this printed money is being used by the Fed to purchase toxic assets, where is it going?

Excess reserves, of course. Counting for $833 billion of the Fed’s liabilities, the reserve balance with the fed has skyrocketed almost 9000% YoY. Excess reserves, balances not used to satisfy reserve requirements, total $733 billion, up over 38,000%!

The Fed pays interest on these reserves, and with an interest rate (return on capital) comes opportunity cost. Banks hoard the capital in their reserves, collecting a risk-free rate of return, instead of lending it out into the economy. But what happens as more loan losses occur and consumer spending grinds to a halt? The Fed will lower (or get rid of) this interest on reserves.

And that is when the excess liquidity synthesized by the Fed, the printed money, comes rushing in and inflates goods prices.

Of course, most people who are arguing we will have deflation for a while believe that we might eventually get inflation at some point in the future.

“Dr. Lacy Hunt says that we may have 15-20 years of deflation”

In 15-20 years the price of a barrel of oil will be somewhere north of $300.00.

Stagflation will rule the economy.

Karl Denninger has been a steadfast deflationist – until recently. He is finally starting to acknowledge the inflationary results (stock market and commodities) of what the Fed is doing.

People seeking to gain from inflation are going to be shocked and in many cases will add to the fuel for deflation. The entire trade is inflation, including the barreling back into the stock market. The Fed is doing nothing more than swapping non-interest bearing liabilities for interest bearing assets. Thus the backing of the cash in accounts has moved from direct to indirect backing of the assets the Fed now holds. The actions of the Fed are not creating deposits, that is unencumbered deposits in banks to spend.

If there is new leverage, much of it is due to falling capital in banks. If a bank has $50 billion and $1 trillion in loan assets, its leveage is 20 to 1. If it loses $10 billion, this leverage goes to 25 to 1. Also, if new capital is put into the banks, it is merely a shift of deposits to owners equity, which of course depresses the money supply. This leaves even less money to service the debt and provide liquidity for instruments such as money markets. The true problem here is the massive increase of socalled liquid assets against a more stable amount of socalled sovereign cash. Most of the money assets created by the Fed were already created deposits, but not liquid between banks. The crunch was about liquidity between banks. The deflation has already started and those that fail to see this are going to find out later. Andy Xie, who was cited in this article as one who sees inflation, created the best reason of all for deflation, the ending of the Chinese residential building boom. He makes a case it has a maximum of 5 years before China is totally residentially built out. All countries of economic importance are entering a time of population busts.

As far as the price of oil? In 1980 it was supposed to top $100 and increasing by 1990. Gas was supposed to be $5 a gallon. Here we are 30 years later and it took a speculative panic aided and abetted by Goldman Sachs and company to get it there.

Can we please stop repeating such nonsense like:

“Wall Street Journal’s Scott Patterson writes that we won’t get inflation until unemployment is down below 5%.”

Yes, it’s true we will not get wage-price-spiral kind of inflation unless unemployment is relatively low or the unions have vast powers.

However there are other causes of inflation, or was the Weimar unemployment rate below 5% ??

Which way do you think the charts in Alea’s post from earlier today point?

http://www.aleablog.com/securitization-issuance-by-type-pictures/

I see stocks and commodities as bubbles built up by Fed and Treasury policies. They are not sustainable and everywhere else as far as the eye can see are deflationary pressures. I would add tapped out consumers as another source of deflation. A facilitator of deflation has been the lack of any responsible, effective financial and economic policy out this Administration or the previous one to address the deteriorating fundamentals in the real economy.

I think a sharp leg down in the market could have a strong psychological impact. Companies are grinding along, hoping the green shoots they hear about show up soon.

If companies get the sense that there is not going to be an improvement, they will start digging in for the long haul by cutting costs.

We have avoided cyclical deflation so far, but if there is a sense of having to dig in for a long time, then we may actually witness something we only read horror stories about.

Deflationists keep harping on reduction in private credit as if consumer borrowing is essential to create price inflation. Additional “demand” does not require private credit creation, consider:

(1) Fed buys securities;

(2) New money goes to Treasury, either directly or indirectly;

(3) Treasury spends new money on goods and services.

The new money will filter through the economy. Of course, some recipients will choose to save the new nominal income, but if the Fed is not satisfied with the level of price inflation, it will repeat (1) on a larger scale.

We have a fiat currency managed by “expert” “economists” whose great fear is a deflationary collapse. No matter their role in creating the debt bubble over the last 60 years. The Fed may miscalculate, and they might be restrained by other factors, but they do have power to push up prices. Anyone who doubts that should ask themselves how much quantitative easing, i.e. monetization of government spending, would convince them otherwise. If $1t isn’t enough, how about $2t, $3t, $10t? Still deflationary?

Well, there was a quadrillion dollars in derivatives. Many of those derivatives are worth nothing. So it is possible you may need to keep going.

david, I put a lot more stock in that little caveat about money failing to circulate and multiply than you do. The Fed has already monetized 1/4 of one of the largest markets out there(RMBS), more than doubling the size of its balance sheet. Beyond some perkiness in speculative asset markets, the cash is literally just sitting there, quiescent, on deposit at the Fed.

If the equilibrium real interest rate is negative, and I strongly suspect it is based both on post-70’s trends and the difficulty generating inflation in China or America post-dot-com, then there’s just no way for 1-2-3 to spark a self-sufficient flame in the economy. It is true that the Fed can continue to add fuel, much as one can keep throwing lit kindling on some wet logs, but while it’s a good palliative it’s a futile exercise. There’s just fundamentally not much out there that is capable of catching fire right now.

We can keep printing money, but we’re discovering that it takes an extremely large amount of kindling to mimic a real campfire, and after it quickly burns, there’s just not much action left.

Loose monetary policy under Greenspan and Bernanke is always to incite asset inflation. They claimed that since CPI was low it gave them sufficient room to reflate. At the end of the day what the top 1% care about is asset inflation. All policies have that focus. So as soon as asset markets deflate we should expect even more helicopter drops. The Greenspan put has become the Bernanke put. So we will see continued volatility as asset markets deflate as the psychology swings from the pessimism of the underlying economic facts to the optimism and then euphoria as central banks and governments unleash the liquidity gusher.

The debate rages on…I just finished telling someone that until one decides which side of the inflation/deflation debate they are on they cannot properly produce an investment thesis.

My expectation is that we will continue to see asset deflation in domestic assets/USD denominated assets (i.e. homes/domestic foods) and inflationary trends in global imports and commodities (oil/gold etc.) thus, pick ample portions of cash/liquidity sources for domestic purchases, GLOBAL commodities, foreign/EM equities (decoupling is/will happen), short dated foreign debt.

@david – I agree in theory repeat step 1 would approach, however at some point the buyer becomes concerns w/ fundamentals of issuer and demands better term (rates) to the point that issuing has diminishing returns and ability to complete issuance. This is where fundamentals of economy must be fixed – and we need to export something other than USD. To the point the Fed becomes sole buyer of Treasuries and continues to monetize, foreign holders will place vote against currency debasement and sell instruments forcing global interest rates up on USD debt.

Stock Market = Valuation Bubble

Commodities = Downdraft of USD/Fundamental Rise to Compensate for debasement

David, even though I still see deflation as the greater risk, at the very least in the near term, I think you’ve put your finger on the crux of the matter. If they were willing to throw all caution to the winds, the Fed (and government) between them do have the capacity to generate inflation, using pretty much exactly the process you describe. This despite the powerful secular deflationary forces that (as this post discusses) are with us and will remain so, probably for a very long time.

I guess the critical question is whether they’ll be persuaded at some point to do such a Thelma and Louise. See, I think the problem is, once the markets felt that such a course of action had been decided on, all hell would break loose. Interest rates would tend to increase sharply (perhaps exponentially) as fixed interest securities were aggressively offered, all of which would powerfully work against the attempt to inflate. To “win” this battle, wouldn’t the Fed in effect have to be willing to “bid for the lot”?

Meantime, the dollar would be sinking and there’d be a frantic scramble to get into almost anything that promised some protection against the looming inflation. Nor, I’m certain, would external creditors be idly sitting by.

How desperate would things have to be before they were willing to take such an irrevocable step? At the very least, it seems to me there’s much ground to cover before they’d even consider it. Markets would have to be in the dumpster again (the green shoots long forgotten) and deflation gathering momentum. More conventional “unconventional” measures would surely have been tried (and failed) before they finally pushed the button on the “nuclear option”.

None of this is to say they mightn’t do so in the end (although I doubt it), but I struggle to see how that day will arrive without plenty of warning lights and sirens first.

My best guess, FWIW, is that for years to come (much as ab initio suggests) we’ll be treated to alternating periods of frenzy and gloom as the PTB floor the accelerator and then tap on the brakes, all against the backdrop of a continuing slow and painful private sector debt deflation.

we have seen time and again that politicians and appointed officials will not let things play out. there will not be a rapid devaluation and treasury selling. circuit breaks will be inacted immediately, exchange controls, commodity caps and the fools will still be holding the trash bags.

In the inflation vs deflation debate I believe many “experts” are not distinguishing clearly between asset inflation and inflation in consumer prices.

During the last reflation (post dotcom bust) we had deflating or low growth rate consumer prices as reflected in CPI growth rate but we had massive asset inflation across many asset classes – although the epicenter of that bubble Nasdaq did not recover anywhere near its highs.

Similarly in this mother of all reflations we should not be surprised to see deflating CPI and even a deflating GDP with asset inflation. Although those asset classes that will inflate this time will be those that already have a inflationary bias. It is highly unlikely that real estate which was at the center of the last reflation will participate in this round.

As an investor it pays however to not underestimate risk sentiment and the short term effects of government and central bank reflationary policies. At the same time one needs to be watchful as sentiment can swing to pessimism as the deflationary undertow of the economy reasserts itself and causes risk assets to once again take it on the chin. Navigating these swings is not getting easier due to the unprecedented nature of government interventions in markets. Ever since LTCM/Russian debt default the PTB have reflated a bubble and then when that popped launched the next reflation. How long and how far can they take it before asset markets just breakdown??

I share your worldview, and it’s why I find Treasuries so attractive in the medium-term here. Their yield will go down as part of the general releveraging and pumping of asset markets, but when something again goes pop at some point in the distant future, Treasuries will be among the only resilient assets.

I’m not even worried about dollar devaluation. The dollar is also being artificially suppressed by carry trades and the diversification of Chinese assets. As U.S. consumption and current account deficits come in, I’m not really worried about the value of the dollar in the longer run.

All of this is really ugly for the U.S. consumer and taxpayer, and I’m a minnow in both of those pools, but for all the reasons you describe I just can’t see the dynamics working out any other way.

It is not an either/or situation with inflation/deflation. We (Americans) are going to live with both for some time.

We will have inflation because of the trillions that the fed has printed in the past year.

We will have deflation because we are at the end of an inflated consumption period that is (hopefully) not coming back as well as our highly inflated housing assets. Wages and consumption are going to go though a big leveling and America has the most to change with respect to the rest of the world across all industries.

I shudder to think we will use military might to retain our place on top of the heap because we think we are so special. I am already against the next war, for any reason.

I think the biggest problem with the inflation camp is that they fail to recognize what a huge supply of “money” was there to begin with. Net, according to my simple math, it is still being destroyed.

Debt was and is money. 33 trillion dollars is the size of the bond market, according to someone.

11 trillion was the last number for m3.

Putting the size of energy at 2 trillion a year for the US shows how small most of the other markets are.

The credit(debt) markets shrinking by, say 10%, 3.3 trillion dollars, is still bigger than the entirety of the us energy market in a year.

Residential RE mortgages, about 9-12 trillion. I think it was 12, now 9, I could be wrong.

This analysis is simple, and wrong in a lot of ways, but the point I am trying to get across is that this conversation desperately needs numbers, not ideology.

Now, I want to try and pick a fight.

If everyone in the bond market decides to go sell what can they get for 33 trillion dollars worth of bonds? M3, 11 trillion dollars. Using John williams stats M3 is 14-15 trillion. That’s a haircut.

a few points:

– there is no direct link between inflation and employment. a good reference are all banana republics.

– consumer deleveraging has a somewhat direct relationship to inflation: it deflates the prices of all levered assets, but frees up slowly cash for banks to put in equities & commodities markets for example.

– any u.s./japan comparisons are inappropriate: japan has had a trade surplus all the time which leads to currency appreciation, while the u.s. is running trade deficits and thus depreciating its own currency. debasing a currency is de-facto creation of inflation.

– you are underestimating the resolve and ability of appointed officials to create inflation. they undoubtedly will fail in the timing and the scale, but just as undoubtedly, will eventually create inflation with their persistent attempts. expect it to happen in a disorderly fashion.

– you have missed the fact that the fed just monetized 1.25 trillion in home mortgages, out of 3.78 trillion outstanding or 1/3 of the total. most of that money went to foreign governments which put it back into treasury notes & bills. they are now commanding the short end of the yield curve and can easily invert the yield curve or debase the usd further, thus create inflation either way.

– there is no direct link between inflation and employment. a good reference are all banana republics.

Of course there’s a direct link. That’s what the Phillips curve and all its myriad modern derivatives are. There are deviations from the norm, but in mature economies, the empirical evidence that some curve of varying slope and position relating inflation and unemployment does exist.

– consumer deleveraging has a somewhat direct relationship to inflation: it deflates the prices of all levered assets, but frees up slowly cash for banks to put in equities & commodities markets for example.

Banks have an arbitrarily large amount of cash already on deposit with the Fed.

More generally, I don’t think this is the right way to think about consumer deleveraging. Consider cash flow effects instead, where a greater portion of income may be directed toward debt servicing, driving down income and demand. Cumulatively, repaying or defaulting on debt actually destroys money in the system; it frees nothing up. That’s the beauty of fractional reserve in reverse.

But again, there’s as much cash as anyone could want already stuffed in every cranny of the banking system.

– you are underestimating the resolve and ability of appointed officials to create inflation. they undoubtedly will fail in the timing and the scale, but just as undoubtedly, will eventually create inflation with their persistent attempts. expect it to happen in a disorderly fashion.

This is the point where I disagree with Harrison, so I regrettably must disagree with you too.

What are the transmission mechanisms? I get how we have inflation in assets, credit markets and things proximal to them. I totally fail to see how this translates into inflation in pricing of goods and services, or wages, in an environment with 68% cap utilization and 16% U-6.

There is absolutely no pricing power for labor or capital, and higher commodity prices with stagnant nominal wages will ceteris paribus suck money from value-added manufacturers and send it to Oz, if you will.

If the HELOC/securitization boom only generated marginal and transient inflation, and $800b of reserves are sitting there doing nada, that says to me that something in the inflationary feedback loops is severely broken.

ndk,

you seem to be thinking strictly in the confines of one theory or another. are you an academic?

the phillips curve is based on his observations of a world with currencies pegged to gold. do we have the same setting today? why would you, or anyone else, expect to see the same outcome from policies when applied in different circumstances? just because the gravity law allows you to walk on the ground, it does not mean you can walk on water as well. do you get my point?

banks have cash that they cannot lend profitably. as bill gross put it, now everyone is more concerned with the return of the capital invested, rather than the return on the capital. they only put money where they can return it, or in the case of stocks, to increase valuations of their own paper assets and thus put some lipstick on their piggish balance sheets and own equity.

when you think in terms in cap utilization, pricing power, unemployment, etc. you tend to ignore the 3rd variable in any supply/demand system: money stock. money used to be a commodity, had use value, not only exchange value. fiat currency does not have use value, but it has exchange value that is determined by the amount in circulation. increase the money supply and sooner or later you will create inflation, regardless of velocity of circulation, because you cannot time perfectly the draining of liquidity. you are totally ignoring the fact that the budget deficit is around 10% of GDP and will be multiples of GDP growth for some time to come. put in other words, money is being injected into the economy at a faster rate than productivity suggests. this is inflationary.

and you seem to hold in high esteem central bankers and their ability to manage the economy. do you remember what bernanke was saying about housing prices in 2006? they reflect the strength of the american economy. is this true even now when they are falling?

economics is not science, it is a complex system driven by the interactions of humans. no politician or appointed official is smart enough to manage it and balance and fully satisfy competing interests.

baychev,

money stock. money used to be a commodity, had use value, not only exchange value. fiat currency does not have use value, but it has exchange value that is determined by the amount in circulation.

I disagree that the amount of money in circulation is particularly relevant at the zero bound. That’s not just because of a declining velocity, but it’s also because money and Treasury debt become equivalent near the lower bound, and that money should just end up as excess reserves, as it has demonstrably done.

Not only can we not even accurately measure the money supply anymore, but we have a few contrary examples in mature economies where those measures of money supply have grown for years due partially to quantitative easing, but inflation and depreciation have not resulted.

That’s exactly what I’d expect from an economy with negative real equilibrium interest rates and deflation, and that’s exactly what I have expected here for a long time. I am still bullish on Treasuries and the dollar.

I’d add that cash money and all T-bills up to a year are basically equivalent zero-coupon securities at this point, yielding nearly the same amount.

and you seem to hold in high esteem central bankers and their ability to manage the economy. do you remember what bernanke was saying about housing prices in 2006? they reflect the strength of the american economy. is this true even now when they are falling?

I don’t see how you get this. One of my major themes has been that the transmission mechanisms were broken and the Fed is powerless. I know what they’d like to do, but I don’t think they’re able to do it.

economics is not science, it is a complex system driven by the interactions of humans. no politician or appointed official is smart enough to manage it and balance and fully satisfy competing interests.

I absolutely agree. Krugman made this point in a terrible, rambling article earlier this month. But rational analysis and informed frameworks are still the best tools we’ve got and we should use them.

and something else you and anyone concerned with deleveraging has to take into account: now lacking private demand is replaced by public demand. it is not people that lever up, but states and in a much more wasteful manner as well.

how do states pay their debts? they either increase taxes, or more easily and politically accetable, create inflation. in fact states never repay debts, they simply roll over and borrow even more.

baychev – ndk is a very bright young guy whose opinions I respect mightily. Nevertheless, I’m with you on this one and agree that seemingly academic arguments can get lost in their apparent but necessarily limited logic. I just can’t get my head around the fact that anyone would want to invest in the $ longer term by buying treasuries at these levels. The argument seems to be that there is nothing the PTB can do to overcome current deflationary forces. This must surely be highly questionable, especially as the American psyche in particular will not tolerate a Japanese-style economy for even a couple of years never mind 20+, and not forgetting that most Japanese had been doing just fine for the last 20 years as the global economy around them prospered – hardly the situation now.

and something else you and anyone concerned with deleveraging has to take into account: now lacking private demand is replaced by public demand. it is not people that lever up, but states and in a much more wasteful manner as well.

You’re right, though public demand is absolutely puny compared to private demand, and likely consists of very different goods and service requirements than private demand. It’s a very poor substitute.

The really criminal part of this action is that you’re indebting the American public further to the wealthy and foreigners when they’re trying desperately to reduce their borrowing. I’m sickened by this.

how do states pay their debts? they either increase taxes, or more easily and politically accetable, create inflation. in fact states never repay debts, they simply roll over and borrow even more.

I don’t think we can generate inflation, and even if we could, very little of the gains from inflation accrue to the sovereign at this point. Seigniorage is somewhat broken and very small compared to our deficits.

I see the Treasury defaulting outright in some form eventually, along Russia’s lines.

The Fed will lower (or get rid of) this interest on reserves.

And that is when the excess liquidity synthesized by the Fed, the printed money, comes rushing in and inflates goods prices.

I strongly disagree with these statements. The Fed’s paying out a pitifully small amount of interest, and it was necessary to maintain some semblance of sanity in short-term funding markets. With more excess reserves than ever today, it’s more true than ever.

But let’s step back and challenge the second sentence. Any lender will look at risk-adjusted rates of return. Let’s assume my cumulative risk-free return from the Fed on excess deposits over 10 years is 1%.

If I can make 5% per annum with a 4% annual default risk by making loans against those stagnant reserves, I’ll make loans.

If I can make 5% per annum with a 7% annual default risk by making loans against those stagnant reserves, I don’t care how little the Fed is paying. It can offer zero, for all I care, because my risk-adjusted return on lending is negative. That money’s going to sit there, period.

Indeed, I think there’s an interesting case to make that direct Fed intervention in asset markets might depress interest rates more than default risk, making extension of new loans less likely, particularly with the background of widespread inflationary fears deliberately stoked by the Fed.

“And that is when the excess liquidity synthesized by the Fed, the printed money, comes rushing in and inflates goods prices.”

This, of course, assumes that banks can ‘push’ demand for loans. Do you think that is a realistic assumption?

Yoo hoo!

Karl has not changed his mind, because the data hasn’t changed.

All evidence is that we’re in the process of a deflationary credit collapse.

THE MATH IS NEVER WRONG, and Bernanke can’t change the outcome – even though he’s sure as hell trying. All he’s going to do is make it worse.

So, what’s the right trade if we take the view that there will be intermediate term deflation?

short pretty much everything?

Would TIPS succeed as a two-way play? Inflation upside and downside protection, at the cost of the embedded premium?

YooHoo Indeed! Thank you Karl.

Could it be that what we need is a more rapid deflationary/deleveraging event. The housing bubble created price levels and demand that were unsustainable. Our fiat currency engenders a powerful incentive for profligate spending and lending. For forty years plus our social class has been defined by the levels income and education. For forty plus years in order to achieve middle class, two household incomes have been necessary. For forty plus years there has been this consistent erosion of purchasing power.

A nice run of deflation might help us get to point where we can begin to fix the problem. What will happen if and when the deflation process gets us to a point where the dollar can once again be a store of value, what happens then? Can we get there, and the sooner the better?

I think not. I think we have come to the point where our Republic has been lost to the thrall of the musings of idealogues who are enamored of efficient market theories and other delightful canards. It is time to put the corpse on the table and have the autopsy. Once there, I believe that we find that what killed our Republic was a cancer called a fiat currency in concert with fractional reserve banking, fed by idealogue musings that on their face are not demonstrable in the records of our commerce. Moreover, that disease created a sepsis that destroyed class structure, dumbed down our educational system, created a financial kleptocracy and a body of poltroons we call Congress.

What we are in the midst of is the collapse our fiat currency!

Bernanke earned the nickname “Helicopter Ben” because he suggested (non-seriously) that money could be helicopter dropped if necessary to stave off a deflationary spiral.

Surely, if the Federal Reserve posted a $1 million cheque to everyone with a social security number – it would create a massive surge of price inflation (which would probably never leave the system).

So, inflation can be created – it just depends upon how much the helicopter drop should be: $5,000 per head? $25,000? More?

The amount of printed money already leaking into the system (Government disbursements as mentioned above), and not sitting in bank reserves, is steadily increasing – but where is the tipping point?

That is the question and no one seems to know.

In the article and comments, I didn’t see reference to the 2.5 billion consumers, nor the trillions of dollars globally used to purchase raw materials, grains, and energy.

When globalization took prominence, the U.S. became just one more player in a global economy. We may have been one of the largest players but, that is fading rapidly.

I get the email alerts the Bureau of Labor Statistics puts out and here is what is going on with “mass layoffs.”

quote:

The number of mass layoff events in August increased by 533 from the prior month,

and the number of associated initial claims increased by 52,516. Over the year, the number of mass

layoff events increased by 803, and associated initial claims increased by 70,356.

http://www.bls.gov/news.release/pdf/mmls.pdf

============================

This lessens our consumer power in the global economy but, we are just a small portion of the 2.5 billion consumers that control 2/3 of the global economy. It is that 2.5 billion people that will determine prices for us, not what the FED does, or Congress does.

While I don’t think the global recovery is to the point (Baltic Dry Index seems to doubt there is a global recovery) that it is ready to drive price up here, it will as soon as those 2.5 billion regain confidence in the global recovery. It may falter and fall and have to start up again in a few months or a year but, it will be the global economy, not ours that determines what happens here.

The FED and Congress are no longer in control of much of anything. Instead, our lenders and foreign governments, foreign consumers, foreign raw material demand, is the new power that we are losing an economic war to.

Currencies and oil are weapons in this war. A weak dollar here will send oil to $100 for us but, not the nations whose currencies stay strong. China appears to be starting to appreciate the Yuan again, to give their consumers more buying power and thus, their nation more internal consumer growth to replace our consumers.

Inflation here will happen when the dollars used for global purchases start chasing falling production in several commodities. Oil supplies are dropping faster than demand and when the global recovery comes back, oil will be going up and our falling dollar will make it even worse.

If the global recovery is currently an illusion, then all the deflationists will look like geniuses and all they predict will happen. Commodities fall, dollar rally as people sell commodities and equities, higher unemployment, falling tax revenues, etc.

Only when the global recovery is real will the inflationists win the debate. That could be soon or not for a year or so. But, again it will be that global recovery or lack of it that determines most of what happens here. We just don’t have that much economic power anymore. It is the 2.5 billion people and other nation’s governments and what they are doing to leave the dollar that will have to be watched if you want to really know what to expect.

Of course, a dollar collapse and we have hyper-inflation regardless of what is going on. Other nations we import from will stop accepting it.

Siggy

Left out of your thesis is the ivy-league networking system that has proven no particular acumen for business, governance or markets but buoys itself on a cult of superiority over the US body politic and global enterprise to such an extent, so thoroughly, that the zeitgeist thereby created is inescapable –by them.

The glue holding this elite together is the threat of being shunned; the carrot, economic advantage. That carrot and stick creates a mental clogging commonly known as DENIAL -no solutions can come to mind because no discernment is possible -like the ability to discern causes and solutions that are in plain sight. When banks aren’t working for the benefit of the people, small businesses, and full employment they have no legitimate reason for being in business. Their charters need to be revoked. They need to GO OUT OF BUSINESS.

Influencing elites with one ideology or another is taking candy from a baby. The elite just simply subscribe to the status quo, do what they’re told, because they are captive; the baby boomers, having torn down a cooperating suicidal university establishment were never taught to think for themselves. They’ve been getting along very well thank you by just going along firing everyone over 50 as of the 1980s, erasing historical memory and institutions and “the law” and turning the country into a banana republic so elites can pay below minimum wage to take care of their kids and mow their lawns.

Where is the passion for the women and children without health care and trained educated people without jobs? Where is the passion against poverty in this country while elites continue to grab everything possible and ILLEGAL through the finance industry. Instead of government we have Wall Street taxing everything in sight and extracting their vigorish on every keystroke.

Finance income is a zero sum game. Every cent of that $100,000,000 to some Wall Street trader, with BTW no management or production skills, no public service skills, and $700,000,000 to Paulson comes out of your pocket dear American citizen.

If nothing else, this financial crisis has given us additions to two of the oldest truisms/commandments:

1) Do not discuss politics, religion, or inflation vs. deflation in polite company

2) Nothing is certain in life except death, taxes, and daily profits on Goldman’s Prop Desk