By Philip Pilkington. Journalist, writer, economic anti-moralist and aficionado of political theatre

‘Tis not due yet; I would be loath to pay him before

his day. What need I be so forward with him that

calls not on me? – Falstaff, ‘Henry VII’

The Anxieties of Government and Debt

Apart from debt, there is perhaps one other economic phenomenon that generates exceptionally large amounts of emotive nonsense both on the internet and in real life – and that is government. So it’s quite unsurprising that when government debt is the discussion of the day, passions flare, accusations are hurled and the coming apocalypse is invoked.

It would be interesting to undertake a psychological study of modern man’s aversion to government and to debt. If I were to guess I would say that many people tend to associate government with authority and debt with obligation. Authority and obligation – surely in our era of selfish hedonism no other potential restraints are so terrifying to so many. These phenomena intrude rudely on one of our most cherished contemporary ideological myths: individualism. More specifically, that outlandish individualism conjured up by marketing men to flog their wares and crystallised in novels and narratives written by lonely and isolated individuals like Ayn Rand. It is, of course, a fantasy individualism; one that few truly adhere to in their day-to-day lives – but it is, like the religions of days gone by, an important determinate in the messages people choose to accept and those they choose to reject.

To put the questions of individualism and of liberty aside though, from an economic point-of-view debt is inevitable. It always has been. Even in the most primitive economies debt is absolutely necessary for activity to expand beyond simple barter. In our advanced state-capitalist economies, even the idea that debt could be done away with altogether is beyond absurd.

The only real question that we can ask is: who should hold the debt? Should government hold the debt, or should the private-sector?

Consider the nonsense that has sprung up around the Eurozone crisis. Whenever the Eurocrisis comes up in discussion some smart-alec always chimes in claiming that at its roots are the nefarious public sector workers of the Eurozone periphery; profligate scum who have had access to the teat of government for too long. “Those lousy moochers don’t do anything,” your petit-bourgeois friend will say. “They just slack off, engorging themselves as government debt amasses skyward.”

Such a narrative is quite incredible – an almost perfect sleight of hand. After all, haven’t a number of countries just experienced a massive economic contraction due to private sector debt meltdowns? And aren’t some of these countries in the Eurozone? If this is the case how on earth can public sector workers be to blame for… well… everything?

Sectoral Balances – A Primer

Before we take a closer look at this – for there is an irony embedded in this narrative that is truly fantastic – we need to first understand how debt is incurred by various institutions in society. This is called the ‘Sectoral Financial Balances of Aggregate Demand’ model and I know of no clearer demonstration the article ‘Sectoral Financial Balances of Aggregate Demand – Revised’ by Scott Fullwiler over at New Economics Perspectives.

I must apologise to Scott in advance for the thorough butchery I am about to subject his argument to. I do this only so that it will be easier to follow my argument in what follows.

What I will now present is the most simplified and boiled down version of Mr. Fullwiler’s arguments I can present. I strongly suggest that readers interested in the real mechanics of the argument refer to the original article as linked to above.

The basic argument of the sectoral balances approach is that there are three distinct sectors which make up a modern economy: the government sector; the private sector and the external sector.

First we have the government sector. The government sector is made up of all those institutions that are funded by government spending (e.g. the civil service, social welfare etc.). The government sector is unique insofar as it is the only sector that can issue ‘new money’ on demand. This, of course, is because the government sector has control over what passes for legal currency. In the old days we might have said that the government has control over the printing press – today it would be more apt to say that the government has control over the central bank computer system.

Then we have the external sector. The external sector is made up of all the goods that flow across national borders. The external sector then is made up of imports and exports. The external sector can either be in a deficit or a surplus. If there are more exports flowing out of the country than there are imports flowing in, the external sector is referred to as being in ‘surplus’ (if the opposite is the case, it is referred to as being in ‘deficit’). The aggregate of these flows is referred to as a country’s ‘current account’. We usually hear about ‘trade surpluses’ and ‘trade deficits’ in the media (more often the latter as it makes for a better story). These are the same thing.

Finally we have the private sector. The private sector is made up of all those institutions that are not directly controlled and funded by the government (e.g. businesses, households etc.). This sector relies on the other sectors for new cash inflows as it cannot issue new currency and so must accrue it through transactions with the other two sectors. It can also, as we will see, borrow in order to spend money.

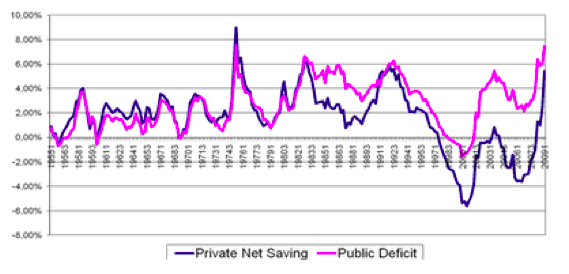

Now the basic premise behind the sectoral balances approach is that surpluses and deficits across the sectors of a single national economy must all net to zero. This is quite nicely illustrated in the following chart from Fullwiler’s piece, which tracks the private and public sectors in the US for around half a century.

Note that up until around 1980 private sector saving – that is, private sector surpluses – were essentially ‘cancelled out’ by government spending – that is, public sector deficits. This began to diverge because the current account – that is, the trade balance – began to fall into deficit in the Reagan era, which generally resulted in higher public sector deficits and larger amounts of private debt.

The key point here is that when the private sector decided to save, all else being equal, the government had to offset this by running deficits. To put this another way – and in keeping with our previous discussion – when the private sector was less interested in taking on debt, the government had to step in and do so instead.

Similarly, when the public sector wished to run a budget surplus – as they did in the Clinton years – the private sector had to take on an awful lot more debt in order for GDP to continue growing.

(As an aside, it should be noted that it’s not just the MMTers that are emphasising the importance of the sectoral balances approach. A blogger over at the Financial Times voted a similar graph the most important of the year in 2010 – scroll down in the comments section and you’ll see Martin Wolf agree. The author however, who otherwise gets it right, doesn’t seem to understand how the US government funds its deficits).

Anyway, back to our presentation. Fullwiler provides an excellent graph showing that the level of debt by each sector was a necessary consequence of the US ‘New Economy’ expansion that took place during the 1990s. I’ve altered the graph significantly and greatly oversimplified the dynamics in order to make my point as clearly as possible. Once again, for those who wish to understand the true dynamics of this, read the original article.

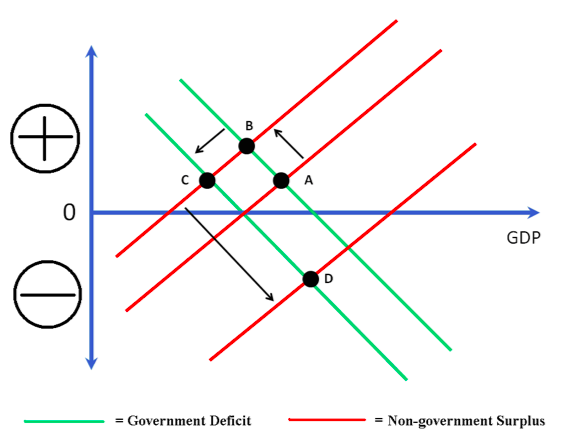

So, rewind back to the mid-90s. Think ‘Friends’, Windows 95 and Britpop. We start at point (A). As we can see from the diagram, there is a government deficit together with a non-government surplus. The non-government sector – that is, the private sector and the external sector – is saving. For this to be possible the government must spend. So in order for the non-government sector to save, the government have to ratchet up their debt-load.

The economy moves to point (B) when the Asian crisis hits in 1997. The weakened Asian economies led to a lowered US trade balance which could have – were nothing else to counteract it – led to a decrease in overall GDP growth. On the graph we see this represented by point (B) being further down the blue ‘GDP arrow’ than point (A).

At around the same time as the Asian crisis was working itself out, the Clinton administration decided that government spending should be cut. This move brought the economy to point (C) which is even further down the blue ‘GDP arrow’ than point (B). By weakening the total amount of spending within the economy, this should have produced a drag on overall GDP growth.

But instead the non-government moved into deficit – which is what we see at point (D). Point (D), as we can see, is even further up the ‘GDP arrow’ than point (A), where we started. This indicates that GDP was growing at a fairly rapid pace.

Why did this happen? Simple – because the private sector was willing to pile on debt. This was the 90s, after all; the era of private sector leverage. And leverage it did. Of course, we now know the long-term effect of such a move: stock bubble, housing bubble – crash.

So, what’s the point to all this? Well, unless a country is producing significant amounts of exports and importing little (i.e. unless a country is running a large trade surplus), in order for the government to run surpluses, the private sector must go into debt.

If, on the other hand, policymakers want to ensure that the private sector doesn’t leverage itself up to the gills – and create the asset bubbles that generally follow such leveraging – then, all else being equal, the government must run a deficit.

And so we come back to the key point: debt is necessary. It’s simply a case of who is going to hold it.

Commentators then simply can’t have it both ways. Given that a country is not usually running a massive trade surplus, if commentators don’t like private debt and its fallout, they must support government deficits. If, on the other hand, they are strongly averse to government deficits – as so many are at the moment – then they must be implicitly advocating a highly leveraged private sector. If they like neither of these and still continue to comment, then they’re cranks – plain and simple – and should be politely ignored and perhaps, if they continue to wail, given a soother.

Debt Island

Now that we’ve established all of that, let’s turn our attention to Ireland – purr Oyer-land.

So, yeah, as we were saying at the beginning, it’s an internet/dinner table commonplace that the Eurozone’s woes are all caused by vile public sector workers taking on too much nasty debt.

“That,” your angry interlocutor will tell you as he kicks a prole, “is why the government debts are so high in the PIIGS countries.” That is also why the crisis can be solved by kicking as many proles as possible – after all, it’s their fault we’re in this mess and even if a good prole-kicking doesn’t solve the crisis, it’s almost certainly in order.

The problem with this argument is simple: it’s not true – not even remotely. Some of the periphery countries, like Greece, did indeed load up on public debt. But others, like Ireland, did no such thing.

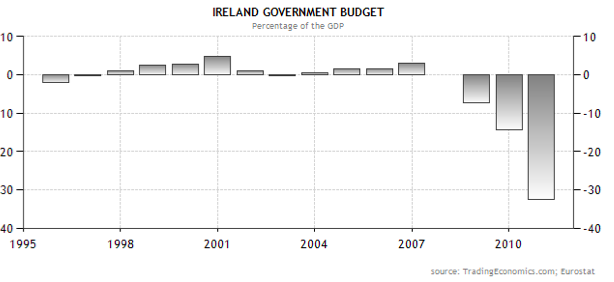

The Irish government actually ran surpluses for most of the ‘good years’ of economic growth, as the following chart shows.

As we can see, it was only around 2008 when the government began running in the red. Why? Well, everyone knows the story – even if they forget it when it’s convenient. The banks melted down due to overextending their leverage and got taken onto the government balance sheets. This was exacerbated by a sharp recession and a rise in unemployment which forced the government to run larger deficits (i.e. to pick up the tab for unemployment claims and the like – ‘automatic stabalisers’ to speak economese).

The key point here is that because the Irish government ran surpluses while the economy grew at a fairly substantial rate, this caused the private sector to become highly leveraged. (We won’t go into the Irish current account, which has been up and down. In recent years it has swayed toward consumption rather than production; deficits rather than surpluses – hence requiring even greater private sector borrowing).

Just like the US in the 90s, keeping the budget balanced meant that the private sector had to take on an inordinate level of debt. We now know that Ireland has the highest level of private sector debt in Europe. So it’s not really hugely surprising that the whole thing melted down.

So, where’s that beautiful irony I spoke of earlier? Right here: Much of the debt ended up on the government balance sheets anyway!

The very attempt to ensure that the government was austere during the boom years led to a private debt load that proved so great that the government eventually had to step in and take it on. The government and the international agencies were so concerned about running budget surpluses that they didn’t think for a moment that the amassing private sector debt would largely fall on the government’s shoulders. But fall it did.

This should raise serious questions about the other Eurozone countries; I mean of course those whose main problem today is government debt pure and simple. If they hadn’t taken on this government debt but had wished to grow at a decent pace would the private sector have simply stepped in to fill the gap? And, more importantly, would much of this private debt have been taken onto the government balance sheet anyway?

The reality is that the Ireland could not have experienced high levels of growth and low rates of unemployment had it not been for the private sector taking on huge amounts of debt. Because the government was unwilling to take on debt at the time, the private sector had to do so. The end result was – from an accounting point-of-view – much the same; the government ended up with a load of debt on its books.

The only alternative to these two models would have been a miraculously large trade surplus. Lacking some sort of wizard who could magic this wonder-economy out of thin air, the only other option would have been a low growth economy; and this would have been inconceivable during the boom years.

Anxieties Overcome

And so, we’re back to where we started: the necessity of debt. Debt is absolutely necessary for a modern economy to grow and function. It’s simply a question of where this debt should come from. Personally, I favour government debt – as long as it’s issued by a central bank and not subject to the whims of the bond vigilantes, as is the case with the Eurozone countries today. Government debt is cheaper, more sustainable (there shouldn’t be a risk of default as long as a central bank is willing to facilitate it indefinitely) and less volatile.

My preferences aside, the key point is that there is simply no avoiding debt accumulation in a modern economy. Those who moan about debt indeterminably – and they are legion – need to be called out on this until the point is driven home to the majority: there is no getting around debt.

If folks complain about government debt they need to be asked if they favour private sector debt – and all the implications that may arise there from; warts, bubbles and all. If they don’t like private debt either they need to be asked if they favour economic stagnation plain and simple.

These are two simple and straightforward questions. But if policymakers were asked them every time they made a statement regarding government spending, what a difference they might make.

How about the author take on some debt and buy this….

http://www.property.ie/property-for-sale/12-Bloomfield-Park-Bloomfield-Avenue-Donnybrook-Dublin-4/596234/

Ha! I drive by them all the time. I’ll tell you what… I’ll give you €50 for one of them. No more, no less.

Isn’t the author making wrong deductions? First explaining, that for the government sector to run a surplus, the private sector must be running a deficit (let’s assume external sector is 0) – and then saying that without additional leverage by the private sector there wouldn’t have been GDP growth? As much as I understand of economics, the GDP growth could be achieved without additional debt – all one needs is productivity and/or work-force growth. US’ GDP would have grown since 80’s anyway – only without additional debt levels, the growth rate would have been closer to productivity-work force growth rate. The same applies to the Ireland example as well – the private sector did not have to become so leveraged as they did for just to keep the gov-private-external sector balanced.

One does not need to increase government debt to decrease private debt – in extreme private debt could be shrunk to 0 through bankruptcies without any impact on government debt level.

The author’s reply to that argument is in the post:

The only alternative to these two models would have been a miraculously large trade surplus. Lacking some sort of wizard who could magic this wonder-economy out of thin air, the only other option would have been a low growth economy; and this would have been inconceivable during the boom years

Debt and leverage are essential to both capitalism, and growth. If you force entrepreneurs to operate on a cash basis you hamstring them. See The Mystery of Capital by Hernando de Soto. He also points out that a private sector system of reliable debt/credit cannot exist without a well maintained cadastre, the chain of ownership of real property. Worth noting that one side effect of driving the aughts growth through hyperleveraging the real property market also entailed damaging the cadastre, through MERS and other mechanisms that circumvented the time and expense of validating deed transfers for securitized mortgages.

Yes he makes a good argument for having some debt in the economy but doesn’t address the reality we (the US) live in at all or at least some of the PIIGS (ie. Greece).

That reality is that the gov. deficit spent during the supposed good times, and by quite a bit, while the private sector also got in way over its head in debt with the housing and credit bubble that financed it. Then our government (US, but to some extent this is true for the PIIGS as well) doubled down on stupid and bailed out the fraudulent debt the banks had, which privatized profits and socialized losses and surprise surprise the economy still has not recovered here or in the EU. Keynesian economics only works out in a recession if the gov. has some sort “savings”, in the form of excess tax income or high rates to cut, to work with.

There is such a thing as too much debt, even for governments that can issue debt in their own currency, and the consequences can be just as bad as doing nothing at all.

“There is such a thing as too much debt, even for governments that can issue debt in their own currency, and the consequences can be just as bad as doing nothing at all.”

I fail to see those consequences. Could you please tell me what they are?

Dear Sir Pilkington, games have rules, did we misplace the copy?

Skippy…with out rules there is no game, but, advantage unrestricted.

Depends on how far they’re (the US government) willing to go exactly, best case scenario IMO is decade plus stagflation while the nation’s infrastructure and standard of living goes into decline. Think something like the rust belt but extending out all across the country outside of some of the major cities.

If they go full retard and try to print out trillions or tens of trillions plus per year then hyperinflation cannot be ruled out.

Stagflation cannot be caused by government deficits. It’s usually caused by wage-price spirals which are institutional.

Hyperinflation, it is now recognised, cannot be caused by government debt issuance either (as there has to be a demand for funds). There’s extensive work done on this — here’s some of it:

http://bilbo.economicoutlook.net/blog/?p=3773

http://www.agorafinancial.com/richebachersociety/pdfs/RCH_0609.pdf (scroll down to the ‘Hyperinflation’ section)

And here’s a video presentation summing up the two above studies by Marshall Auerback:

http://bit.ly/9ltzpF

And just to be clear here, in the article are you insinuating that you can reap all the benefits of Keynesian economics, without you know, actually doing Keynesian economics? Or are you really going to argue that there is no such thing as too much debt in the real world, even for the US?

Yes we all know that in theory the US can just print up $100 trillion dollars, but this isn’t economics 101 where overly simplistic ivory tower examples are used to demonstrate ideas and concepts, this is the real world where things actually have to work and make sense. So if the US did print up $100 trillion, or $50 trillion, or even a mere $10 trillion dollars tomorrow would you say there would be no consequences or what?

“Stagflation cannot be caused by government deficits. It’s usually caused by wage-price spirals which are institutional.”

You’re really gonna argue that neo-liberal trash that Greenspan and his ilk used to spout?

“Hyperinflation, it is now recognised, cannot be caused by government debt issuance either (as there has to be a demand for funds).”

Hahahahahah sure buddy.

You heard it here folks, governments can do whatever the hell they want with their economies and debt and suffer no consequences.

“So if the US did print up $100 trillion, or $50 trillion, or even a mere $10 trillion dollars tomorrow would you say there would be no consequences or what?”

It all depends how they allocate it. Didn’t they just create money for the QE projects? Nothing really happened there — except MAYBE an increase in stock and commodity prices.

The true Keynesian point is that governments and central banks do not have control over the money-supply. The money-supply is endogenous, not exogenous — if the crisis has shown one thing, it’s shown that.

Think about this carefully. The above article argues that government deficits offset the need for private-sector leverage. The point here is that, since the money-supply is endogenous, even if the government pull back spending, if they want a certain amount of economic growth, the private sector will have to increase the money-supply themselves. If they don’t GDP growth will lag.

So, government debt issuance all depends on circumstances (resource utilisation, infltaion levels etc.).

“You heard it here folks, governments can do whatever the hell they want with their economies and debt and suffer no consequences.”

That’s absolutely not what I said.

And no. Simply creating money cannot cause hyperinflation. It’s doubtful that even government spending on steroids could — although it would cause huge inflation and wreck the economy.

“That’s absolutely not what I said.”

Did you say that word for word? You’re correct, you did not. De facto? You’re wrong, that is the exact out come if what you said is true.

Politician: “We need to finance Medicare part E, F, and G but we can’t raise taxes and no one will buy the bonds, what are we gonna do?!”

Economist: “Print it up silly! ;D”

Politician: “Our various wars in the middle east are going badly AND for far longer than we thought, we need trillions more than we ever said to bribe various foreign officals to stay on our side and to pay for weapons as well! Raising taxes…would go badly right about now and are foreign allies are barely keeping their chin above water, they can’t afford to buy all those bonds! What are we gonna do??!”

Economists: “One sec boss. *presses 1 and mashes the zero button for a minute straight* All done!! ;D”

Politician: “Damn this pesky war on drugs! We spent all those billions and not only did we hardly make a dent its also caused this embarrassing blow back on our southern border. Why its practically a war zone down there!! Beheadings left and right, you think we would’ve trained those Zetas to be more discrete right? Oh well… We need to give those fools down south heaps of cash to bribe their own officials not to defect to the drug dealers and to keep their military from working for the drug lords too. Economist!!”

Economist: “Sir!”

Politician: “Do your duty!”

Economist: *does a single click*

Politician: “What no mashing?”

Economist: “Oh I got one of those programs that automates the whole thing now, its great, here give it a try!! ;D”

Politician: “ooooo”

“And no. Simply creating money cannot cause hyperinflation. It’s doubtful that even government spending on steroids could — although it would cause huge inflation and wreck the economy.”

You know technically hyperinflation could be considered merely “huge inflation” if you wanted to be pedantic about it.

All those are political decisions and they would have consequences. But they would not necessarily cause inflation or wreck the economy — although they might.

You’re pushing my argument to an extreme which is silly — it’s also a sign that you have some emotional investment in discrediting it, but we won’t go into that…

You have to take these one by one and weigh up the consequences. Government deficit spending is no panacea and I never said it was. But used correctly it is a far better way of running an economy than (a) sending the private sector into deficit or (b) allowing economic stagnation and massive unemployment.

“You know technically hyperinflation could be considered merely “huge inflation” if you wanted to be pedantic about it.”

I don’t think that’s an adequate definition. Hyperinflation is inflation measured by the day or by the week rather than by the month. I’d say you’d want % increases by the day in order to truly have hyperinflation.

“All those are political decisions and they would have consequences.”

All the consequences are tied up in the human and economic cost, but money buys anything especially these days, so the human end could be papered over with enough cash. Which has happened before.

“You’re pushing my argument to an extreme which is silly — ”

The “dialog”, such as it, was the only silly part of that and it was mostly spent describing real problems that our government has. Otherwise that “solution” of mashing the 1 with a bunch of zeros after it is pretty much exactly what we are doing right now in the middle east and with our own economy.

“it’s also a sign that you have some emotional investment in discrediting it,”

Anyone with some sense and morals who is paying attention would have more than a little emotional investment in all this, so I’m going to take that as a compliment.

“but we won’t go into that…”

We’re gonna need a rolleyes .gif the size of the early for that quote.

“Government deficit spending is no panacea and I never said it was.”

No you didn’t, but it is the natural outcome if what you were saying were true which is what what you’re saying is so obviously not true.

“But used correctly it is a far better way of running an economy than (a) sending the private sector into deficit or (b) allowing economic stagnation and massive unemployment.”

Current efforts by our government and economists have created an economy where the government is massively in deficit, an teeny tiny percentage of the private sector is doing fantastic who BTW just happen to be the rich, and the vast overwhelming majority of the population is still heavily in debt and poorer than they were 10 years ago. I think its safe to say the economists have really got it wrong.

“I don’t think that’s an adequate definition. Hyperinflation is inflation measured by the day or by the week rather than by the month. I’d say you’d want % increases by the day in order to truly have hyperinflation.”

$100 or $50 trillion would certainly do that job then.

should be earth there where “early” is, mistype

“No you didn’t, but it is the natural outcome if what you were saying were true which is what what you’re saying is so obviously not true.”

A good epistemologist would interrogate the meaning of the word ‘natural’ in that sentence. They would probably conclude that you didn’t believe in political action and assume that ideas automatically lead to certain consequences.

Consequently they might accuse you of not believing in the existence of politics.

I would say that right now we don’t have politics, we have kabuki theater played with actors who just happen to be US congressmen and the president.

Philip Pilkington: “It all depends how they allocate it.”

Please give an example of how $100T in freshly printed money could be distributed so that it didn’t cause severe inflation or other problems. That sort of hyperbole is exactly what causes people to be dismissive of MMT.

Philip Pilkington: “The above article argues that government deficits offset the need for private-sector leverage.”

No, it argues that net government debt offsets net private savings. Agreed. But it says nothing about gross private debt, which was the cause of our Minsky Moment.

“To put the questions of individualism and of liberty aside though, from an economic point-of-view debt is inevitable. It always has been. Even in the most primitive economies debt is absolutely necessary for activity to expand beyond simple barter. In our advanced state-capitalist economies, even the idea that debt could be done away with altogether is beyond absurd.”

Utter and complete nonsense. To go beyond simple barter all that is needed is a medium of exchange. Can you explain the difference between currency with no bond attached and the demand deposits from debt?

“The basic argument of the sectoral balances approach is that there are three distinct sectors which make up a modern economy: the government sector; the private sector and the external sector.”

Your public sector/private sector is too simplistic and assumes all new medium of exchange should be the demand deposits from debt.

It is more realistic to look at it this way:

savings of the rich = dissavings of the gov’t plus dissavings of the lower and middle class

I believe you can add the foreign sector too.

IMO, it should be savings of the rich plus savings of the lower and middle class = dissavings of the currency printing entity with currency and no bond attached plus the balanced budget(s) of the various level(s) of gov’t. This should give the best chance of distributing productivity gains and other things equally between the major economic entities and distributed evenly in time.

“The very attempt to ensure that the government was austere during the boom years led to a private debt load that proved so great that the government eventually had to step in and take it on. The government and the international agencies were so concerned about running budget surpluses that they didn’t think for a moment that the amassing private sector debt would largely fall on the government’s shoulders. But fall it did.”

That along with the Greece and Ireland bit make a good case for a basically all currency with no bond attached economy.

No debt, no debt defaults, and no spending now and hoping to earn it later with interest.

Also savings isn’t what it used to be. Our (US) government defines paying down debt as savings now, but that sort of change isn’t reflected in his chart nor does he mention that at all in the article above. Comparing savings now vs savings say 20 years ago is an apples to oranges comparison. He is effectively using juked numbers with or without knowing it and you can’t do that and get accurate results.

“Our (US) government defines paying down debt as savings now, but that sort of change isn’t reflected in his chart nor does he mention that at all in the article above.”

Debt is just negative saving. I don’t see any problem with conflating the two. Should make things easier for directing macroeconomic policy.

There is a huge difference, even though they can be spent on the same things debt has interest against it, which is variable and has all sorts of legal stipulations to it that complicate things _vastly_. Also savings _earn_ interest and can be spent far more easily since no agreement has to be worked out prior to getting or spending it.

Interestingly on an individual level people are still advised to save around 10-20% of their yearly income (though almost no one can seem to do this) for retirement or life’s little surprises, but according to today’s economists this is a _bad_ thing, since of course the economy would tank if people did that. Of course they don’t mention word one about what those people will do for retirement. Or for a home payment or to buy a car. Everything is assumed to be paid for with debt.

Yet there was a time when people were able to save up 10-20% for retirement or at least a down payment on a car or home, before they were 30 even. All while having only 1 wage earner in the home… Impossible times I guess right?

“Yet there was a time when people were able to save up 10-20% for retirement or at least a down payment on a car or home, before they were 30 even. All while having only 1 wage earner in the home… Impossible times I guess right?”

To a large extent that is because governments were willing to offset private sector net saving with government deficits. It’s not impossible, it’s just good economic policy.

Yet the deficit/gov. spending was far lower in the 50’s, 60’s and early to mid 70’s than it was in the 80’s and AFAIK onwards.

Its after the 70’s that real wages started to decline and the dual income earner family became The Way Forward. Of course that didn’t work out in the end either did it?

“Yet the deficit/gov. spending was far lower in the 50′s, 60′s and early to mid 70′s than it was in the 80′s and AFAIK onwards.”

This is going to get far too complicated far too quickly, so I’ll make this brief.

(1) Government spending also depends on how you allocate it. Reagan’s policies were idiotic — I won’t deny that.

(2) I think that the ‘Golden Age’ growth had a lot to do with the MASSIVE deficits ran during WWII. These led to substantial savings and gave the economy viable balance for the next two or three decades. I’d advocate something like this now.

(3) We also have to take into account the development of financial instability ala Minsky in the post-war years if we want to understand why increasing deficits were necessary.

(4) Finally, there’s the trade balance.

All this is VERY complicated and far beyond the gambit of the above article. As I said, I’m not offering you the Holy Grail — just a point about sectoral balances that should be learned from the crisis, especially the Eurocrisis.

“This is going to get far too complicated far too quickly, so I’ll make this brief.”

Fair enough this stuff does get pretty complex.

“(2) I think that the ‘Golden Age’ growth had a lot to do with the MASSIVE deficits ran during WWII. These led to substantial savings and gave the economy viable balance for the next two or three decades. I’d advocate something like this now.

(3) We also have to take into account the development of financial instability ala Minsky in the post-war years if we want to understand why increasing deficits were necessary.

(4) Finally, there’s the trade balance.”

Its good that we can agree on Regan and I would agree on points 3 and 4 giving the US a significant economic advantage post WWII, but only up to perhaps to the late 50’s or early 60’s. Europe had largely rebuilt by then AFAIK. I would largely disagree with point 2 though. I would say the domestic savings + Europe getting trashed in the war made it possible for us to get away with the WWII deficits. No one could call in our debts and get away with it and we were the only game in town.

I would also point out that pre WWII it was still common to have one wage earner to pay for a home and family, though there were various social pressures and issues at play there that makes a comparison to modern times difficult at best. You could certainly point out that the economy was far less managed than it was now, especially pre 1900’s in the US, and tended to boom and bust. But then we seem to be going through the same boom bust cycle now, and it started in the late 90’s.

“As much as I understand of economics, the GDP growth could be achieved without additional debt – all one needs is productivity and/or work-force growth.”

The above model is based on demand. Without additional demand the economy cannot grow. To put it crudely: if there’s no-one to buy anything, inventories will simply pile up.

You’re arguing for additions to the supply-side (which, I assume would necessitate investment — which, in turn, would be predicated on adequate aggregate demand). Think about it.

If productivity increases, for example, the company then needs to SELL whatever has been produced. If aggregate demand hasn’t increased how can they sell the product without engaging in cost-cutting?

Okay, realistically they’d sell it to the external sector. As happens in China — since domestic demand cannot soak up all the plastic dolls and the like, the US buys them all. But this adds to the trade surplus — which I dealt with.

So, yes, if you could get increases in productivity, you would get increased GDP. But, all else being equal internally, this would be sold to the external sector and the trade balance would move toward surplus. As jayackroyd pointed out above, this would have been the ‘wonder economy’ that came out of nowhere (my point here is that productivity increases cannot be influenced, to a large extent, by macroeceonomic policy [i.e. government running surpluses or deficits] which is the only real policy tool — in my opinion — available to them).

If there was an overall increase in the workforce GDP would rise. But again: who’s buying the products? It couldn’t just be the new workers themselves at their level of wages — otherwise the investment would be unprofitable. So, domestic workers would have to go into debt; or the government; or the trade surplus would have to rise.

You’re looking at all this from a supply-side point-of-view — i.e. a neoclassical point-of-view. I think this is a flawed way of looking at the economy as it misses so much on the demand side (and misses the key point made in the above article about debt levels).

“One does not need to increase government debt to decrease private debt – in extreme private debt could be shrunk to 0 through bankruptcies without any impact on government debt level.”

I missed this. I’m not too good on bankruptcies, but as far as I understand it bankruptcies punch holes in other private sector balance sheets — i.e. those of private sector banks.

If the banks then cannot deal with these, they request a bailout. The alternative, in a modern system, would be financial and economic meltdown. So, the government takes on the debts anyway.

Pretty sure this is what happened in Ireland. NAMA — which is sort of like TARP — holds the bad debts of a load of bankrupt property developers and it’s supported on the government balance sheet.

Philip Pilkington said:

I’m not too good on bankruptcies, but as far as I understand it bankruptcies punch holes in other private sector balance sheets — i.e. those of private sector banks.

If the banks then cannot deal with these, they request a bailout. The alternative, in a modern system, would be financial and economic meltdown. So, the government takes on the debts anyway.

You make it all sound so easy. But where have we heard this argument before?

Oh I remember now!

That same week AIG owed $13 billion to holders of credit default swaps and it didn’t have the money.

On September 17 AIG is taken over by the government and one day later Paulson and Bernanke ask Congress for $700 billion to bail out the banks. They warn that the alternative would be a catastrophic financial collapse.

▬Inside Job, the movie, minute 01:09:45

Of course there’s quite a bit more to the story, as Inside Job goes on to explain:

Henry Paulson: I am playing the hand that was dealt me. A lot of what I’m dealing with, I’m dealing with the consequences of things that were done often many years ago.

Interviewer: He was the senior advocate for prohibiting the regulation of credit default swaps and also lifting the leverage limits on the investment banks. Does he mention those things? I never heard him mention those things.

Moderator: When AIG was bailed out, the owners of its credit default swaps, the most prominent of which was Goldman Sachs, were paid $61 billion the next day. Paulson, Bernanke and Geithner forced AIG to pay 100 cents on the dollar, rather than negotiate lower prices. Eventually the AIG bailout cost taxpayers more than $150 billion.

Interviewer: Isn’t there a problem when the person in charge of dealing with this crisis is the former CEO of Goldman Sachs, who had a major role in creating it?

Philip, give me one good reason why I shouldn’t mark you up in the same column as Paulson, Bernanke and Geithner?

You certainly put forth the same arguments.

“Philip, give me one good reason why I shouldn’t mark you up in the same column as Paulson, Bernanke and Geithner?”

Because I’m not a neo-liberal and I loath neoclassical economics. If I were running things the banking sector would be heavily regulated and few people would be taking on private debt.

There’s a difference between strongly regulating a banking sector and letting it burn to the ground. The latter is inadvisable — unless, of course, you like eating out of bins.

Of course he is making wrong deductions, but not for the reason you stated. This article is the equivalent of a Jedi mind trick. I quote below the three paragraphs where the mind trick is being played:

Here are the hidden untenable assumptions in the above article.

1. That countries with perpetual external deficits are entitled to the same growth in living standards as countries with perpetual external surpluses. Morally, they are not, as their citizens already consume more than they produce.

2. That perpetual debt (either government or private) is somehow a better solution for a country with an external deficit than addressing the causes of the external deficit in the first place. On the contrary, I argue that the “easy solution” of debt stands in the way of the tough structural adjustments necessary to raise exports up to the level of the imports which would then render further debt accummulation unnecessary.

I don’t know anything about the author, but if I were in charge of an astroturf operation tasked to help revive debt-based BAU, and if such an article hadn’t already been written, I would have commissioned its writing without a second thought.

The basic argument of the sectoral balances approach is that there are three distinct sectors which make up a modern economy: the government sector; the private sector and the external sector.

Just want to note that it is hard to make the argument that the money center banks, including, now, Goldman fucking Sachs, are part of the private sector.

Implicitly, that’s what I’m saying in the article — although I use Ireland as an example rather than the US because its more straight forward.

If the banks had to be taken onto the government balance sheet this must have, at a macro-level, been because the government sector was not issuing enough debt and the private sector had to go into debt.

My point is that, in ‘too big to fail’, much of this private sector debt ends up on the government balance sheet anyway. And this so together with a major crash.

This point needs to be raised in the debate going forward. If the US cut their government deficits they’re only going to be encouraging more private sector borrowing.

Is this post supposed to be pandering to the reformists? Because otherwise I don’t understand the exaltation of phony “growth”, government, and debt. Sure, it’s OK to counteract the deficit terrorists, but that doesn’t mean we should affirmatively believe in growth or support the government.

Authority and obligation – surely in our era of selfish hedonism no other potential restraints are so terrifying to so many.

I’d say only brain-dead conformism still recognizes government, banks, and corporations as having any “authority”, and sees the people as having any “obligations” to them.

On the contrary, a true democratic citizen rejects all such notions and seeks the destroy all such fraudulent power.

As for Philip’s lies about the impossibility of doing away with “debt”, all I’ll ask is Why is that allegedly impossible? Remember, you have to give an answer which doesn’t involve the maintenance of capitalism, since that’s circular logic.

(Philip gave me the right to ask these questions by calling himself an “anti-moralist”. We’ll see about that. He seems wretchedly pseudo-moral so far. Moraline, as Nietzsche’s translator Kaufmann rendered it.)

That’s “to destroy”. Gremlins.

“As for Philip’s lies about the impossibility of doing away with “debt”, all I’ll ask is Why is that allegedly impossible? Remember, you have to give an answer which doesn’t involve the maintenance of capitalism, since that’s circular logic.”

Debt systems always accompany a certain level of economic growth. Randy Wray goes through this regarding ancient economies in the third chapter of his book ‘Understanding Modern Money’.

Or consider the following, from ‘Popes and Bankers’ by Jack Cashill:

“The ethics surrounding credit and debt find expression in the oldest written records, those of the Greeks and the Hebrews.” (p. 1)

The Soviet Union also operated on a system of debt. As I said in the above, without debt all you can really have is a barter economy.

“without debt all you can really have is a barter economy.”

Mendācis Extremus…why must we preclude_of our selves_a better opportunity[s], for all living things…in a name of mathematical construct that utilizes leverage of a few, for the few.

Debt systems always accompany a certain level of economic growth.

I said no circular arguments.

And why should people who are willing to work the land have to go into debt? My friends and I are willing to work right now. The only obstacles are contrived political ones, contrived by worthless, parasitic criminals. Why should “debt’ have to exist at all? Why should there be anything beyond nature and the labor we practice upon it?

True anti-moralists will find that an interesting question. Moralinists, not so much.

It’s not a circular argument. It’s a fact. There’s a difference.

“And why should people who are willing to work the land have to go into debt? My friends and I are willing to work right now.”

I suggest you set up a commune and issue your own currency. I wish you luck. My guess is that debts will start being incurred within six months.

P.S. The ‘anti-moralist’ thing was a joke from the last article I ran — the one on the ‘morality play’. Yves ran it again on this one because I forgot to give her a byline. My fault. But don’t take it too seriously.

You’re still circling, Mr. Circular. You’re doing nothing but saying “eat cake” where it comes to the existing power dispensation. You haven’t said word one toward rationally defending the existence of “debt”. You merely suck up to it in good Might Makes Right fashion.

Set up a commune. Prove me wrong. Otherwise stop moaning like a crank.

Haw haw haw, he isn’t arguing for communism so good job insulting him for nothing I guess, but he is right.

Wiping out the debt probably would’ve been the best thing to do. You don’t have to do it all at once, you can put the banks into recievership and slowly make the bondholders eat their losses or at the very least only return their principal and give them no profit.

Quite a bit of that debt if not most of it was flat out fraudulent, and making the public pay for it just to make rich banker’s richer is amoral. If some rich people lost all their wealth on bad bets then so what? The poor are being made poorer while the middle class is dissappearing right before your eyes through no fault of their own, is it really worth all that to keep some rich people rich or to even make them richer at the vast overwhelming majority’s expense?

Funny. What a suck-ass pig you are. You can keep on making fun of the people who want to liberate us. Meanwhile you’ll get no gratitude or pay from the criminals, who can find flunkeys who are less cowardly and more aggressive than you.

In the end, your type has no future, since “you’re neither hot nor cold, but lukewarm.”

“Wiping out the debt probably would’ve been the best thing to do. You don’t have to do it all at once, you can put the banks into recievership and slowly make the bondholders eat their losses or at the very least only return their principal and give them no profit.”

This article wasn’t about the banking sector. I was only approaching it from the losses taken in a sectoral balances model.

As for the commune jibe, I think it was justified. Our friend wishes to build a Utopia without debt. If he wants to do this, I’m calling his bluff and telling him to try. Him and his buddies can try to do it if they want — they just set up a commune; it’s not hard.

I suspect, however, that — as much as he may crimp and moan — he rather likes living in our economic system (which needs debt to function) and so he won’t open a commune. I also suspect that if he did open a commune it would soon after construct a primitive debtor-creditor system.

he rather likes living in our economic system

Care to provide even one shred of evidence for this?

It’s just like the rest of your unevidenced idiot assertions. But like I said about this post and your previous one, it provides evidence about your own collaborationist psychology.

“This article wasn’t about the banking sector. I was only approaching it from the losses taken in a sectoral balances model.

…

As for the commune jibe, I think it was justified. Our friend wishes to build a Utopia without debt.”

You’re right the article wasn’t about that but I don’t believe he was explicitly saying we should get rid of all debt though he did say this:

–“Sure, it’s OK to counteract the deficit terrorists, but that doesn’t mean we should affirmatively believe in growth or support the government.”

I might very well be reading into this statement but he seems to be fine with some sort of deficit spending, and by default some sort of debt, since he is also fine with “counter acting the deficit terrorists”. I read his statement as being re: fraudulent and/or overly onerous debt, which if so I would agree with and was why I gave that comment you quoted. FWIW if I wasn’t clear before I have no problem with _some_ national debt but I do believe there is such a thing as _too much_ national debt too.

tts, actually I don’t bother advocating Keynesianism, MMT, etc., since this is a terminal kleptocracy which will never spend money on anything other than corporatism.

Instead I join the No Taxes call. Anything taxed from us is merely stolen. Meanwhile anything which erodes the legitimacy of the power structure is a progressive step.

As for the deficit, let ’em run it up. The more the better. It’ll help bring on their collapse.

I suggest you set up a commune and issue your own currency. I wish you luck. My guess is that debts will start being incurred within six months. This is confused. Debts will be incurred (by the currency-issuer) the instant the currency is issued, because currency/money is a form of debt, as you correctly say elsewhere.

Many who read this blog have no doubt read or heard about

the concept of “odious debts”. This was explained to me

in the on-line production Debtocracy, which had

Ecuador ca. 2006 as a case-study of “odious debts” .

As far as I know, things related to “odious debts” are

a gray area in international law. One might try to

frame “odious debts” as a principal-agent question,

with the principal being the electorate of a given

country and the agent being a government or succession

of governments of that country. An immediate

objection coming from the creditors side would be

that absent a finding of wrong-doing by a court of

law, there is no proof of wrong-doing by government

officials (say as regards allegations of bribe-taking).

I’d imagine creditors framing allegations of “odious debts”

as a legal question, whereas the electorate and/or

activists would be more likely to frame “odious debts”

as a moral question, right vs. wrong.

It sure looks like some sort of dilemma.

Philip,

I don’t like your analysis. It’s just all too easy, too loaded with assumptions.

First, there’s the assumption that the only way to achieve acceptable GDP growth is through debt. Then there’s the assumption that perpetual GDP growth , whatever that means, is not only possible, but good. Once these two assumptions are made, the logical conclusion is that perpetual growth of debt is good, even necessary. You sum up these assumptions in this statement:

The reality is that the Ireland could not have experienced high levels of growth and low rates of unemployment had it not been for the private sector taking on huge amounts of debt. Because the government was unwilling to take on debt at the time, the private sector had to do so. The end result was – from an accounting point-of-view – much the same; the government ended up with a load of debt on its books.

The only alternative to these two models would have been a miraculously large trade surplus. Lacking some sort of wizard who could magic this wonder-economy out of thin air, the only other option would have been a low growth economy; and this would have been inconceivable during the boom years.

And once debt becomes an indisputable, uncontestable good, then the only remaining question is whether the debt is to be private or public.

But the analysis begs all sorts of questions:

• Is the only way to achieve acceptable GDP growth through debt?

• Can debt grow to a point where it quashes GDP growth?

• Is perpetual GDP growth sustainable?

• Is perpetual debt growth sustainable?

• Is perpetual GDP growth the quintessential good?

• Is the definition, what we call “GDP” important?

• Is the distribution of GDP amongst the population important?

You state that:

The very attempt to ensure that the government was austere during the boom years led to a private debt load that proved so great that the government eventually had to step in and take it on. The government and the international agencies were so concerned about running budget surpluses that they didn’t think for a moment that the amassing private sector debt would largely fall on the government’s shoulders. But fall it did.

It seems like the prudent thing to have done would have been to regulate the private financial sector during the go-go years so as to prevent the explosion of private debt. But once one makes the assumption that debt is a positive good, that’s not a desirable policy option, is it?

Neoliberalism also encourages the explosion of debt. It cares not a dither whether that debt is public or private, because it knows that through a little neoliberal sleight of hand private debt can be magically transformed into public debt.

The goal of neoliberalism is to create debt slaves. What is your goal?

If you want a low-GDP growth economy, that’s a political question. Even in such an economy, I suspect that some debt would still be necessary. The piece I did on Japan a while ago dealt with some of that.

“The goal of neoliberalism is to create debt slaves. What is your goal?”

To have governments take on debt so the citizens don’t have to. I want citizens to net save, to have a decent public system and access to employment. To do this the government has to take on debt.

The above article was less prescriptive than descriptive, however.

Philip Pilkington said: “To have governments take on debt so the citizens don’t have to.”

Well that certainly sounds like the neoliberal prescription to me. Debt is sacrosanct.

I would suggest that just the opposite take place, that Ireland default on its debt, and that its overly indebted private sector also default on its debt. That way debt is eliminated. Tell the slave drivers to go take a hike.

It’s the triumph of politics over economic theory.

“That way debt is eliminated.”

Together with most of the economic system…

So we’re supposed to eliminate our moral system and our political system so that the economic system can be salvaged at any and all cost?

The economic system, which has morphed into nothing but a theorietical construct, trumps everything, including reality?

Debts are nothing but promises, denominated in money and typically recorded in writing.

But there are promises predicated on moral imperatives.

There are promises predicated on political imperatives.

Some of these are explicit and are recorded in writing. Others are implicit, part of an unwritten but very much agreed upon moral order and social contract.

You seem to have convinced yourself that debt is the end all and be all of human existence, the only thing that matters.

“To have governments take on debt so the citizens don’t have to.”

Yeah. Instead of taking on debts, the citizens get to enjoy austerity measures and see their national treasures sold for next to nothing to the banks who the government went into debt so they could bail out those same banks.

Not all public debt is created equal. Public debt taken on to bail out bad private debts cannot expand the economy.

Pilkington is brave to try to explain simple accounting concepts to this bunch.

@Tao – yes, it makes a difference what the money is spent on. In the 2000’s to keep the economy going in the presence of enormous foreign savings by China, the GOV and private sector had to run huge deficits. In the US’s almost complete absence of public sector spending programs (other than war spending) this had to be taken up by another form of debt: mortgages.

Just think: we had a choice. We could have spent 2T on roads, bridges, water systems, regional rapid transit, airport hubs, etc. Instead we spent it on housing that is now mostly standing empty.

Yves, your website needs some filtering on a Saturday morning. The bozos are working out their hangovers on poor Phil.

Second that. But the effort is a good mind stretcher.

Basically you are saying net debt for the world is zero, but net debt of sectors can be non-zero. I have seen this argument being made on several blogs lately. I agree with it, and I agree with the fact that many of the “powers that be” don’t know this basic accounting fact. However, I think it’s only the start of the story.

I think that net debt is not really the issue. It is gross debt. There is an infinite number of distributions of gross debt that have the same net debt as a result.

Debt needs to serviced. The amount of debt that needs to be serviced is related to gross debt and not to net debt. In case there is a lot of gross debt, the estimated ability of individuals and institutions to service debt depends more and more on their estimates of other people to service debt. This is more art than science, which is why I think that a big problem is gross debt and not net debt.

(Several reasons exist e.g. for the difficulty of estimating debt servicing ability:

1) gross debt is difficult to measure due to various accounting treatment (HTM, AFS, HfT etc)

2) A lot of banks are “hedging” and assuming they are eliminating risk (as are regulators), e.g. fixed rate 10y bonds funded with 1M Libor interbank funds have an interest rate risk. To mitigate this risk, the bank seeks a swap counterparty. This transforms the interest rate risk into a credit risk, because the value of the swap is non-zero when rates move. To mitigate this credit risk, swaps are collateralised. But this creates a liquidity risk, since the collateral will need to be funded. Conclusion: hedging is often transforming risk into some risk that is incorrectly priced, not eliminating risk.

3) debt servicing relies on income, which relies on job security, which relies on debt servicing ability of employers, which relies on….

etc etc)

“Debt needs to serviced. The amount of debt that needs to be serviced is related to gross debt and not to net debt.”

Well, you have to go into detail here:

(1) Is this gross debt private?

If so, I would say that it should be minimised. Servicing private debt is a nuisance — a necessary nuisance, of course, but one that should be minimised. I’d prefer if the government picked up most of the debt tab and allowed the private sector to net save. This leads to…

(2) Is it public?

This instantly leads to…

(3) Is it issued in the domestic currency?

If so, then servicing it is doesn’t really ‘cost’ anything. It’s just a matter of crediting accounts when it falls due — inclusive of interest payments, of course.

Philip Pilkington: “servicing it is doesn’t really ‘cost’ anything. It’s just a matter of crediting accounts when it falls due”

This is the problem I have with MMT (if that’s what you mean by “just crediting accounts”). I’ve no doubt that just printing $X and using it to credit accounts is harmless up to a certain point, but for what value of X is that true? Honest and knowledgeable MMT’ers admit that this is one of the main questions of MMT, but I’ve yet to see it analyzed (rather than merely acknowledged as an issue). Without an intelligent way to estimate X, I can’t have any real faith in this as a practical approach.

“I’ve no doubt that just printing $X and using it to credit accounts is harmless up to a certain point, but for what value of X is that true?”

Look, I’ve said it once and I’ll say it again: I’m not offering a policy solution to fix the world in under 3,000 words.

Anything that resembled that would be bullshit.

These programs would be complicated and would depend on a million variables. But I believe it’s the right approach.

P.S. Currency issuance has never been empirically proven to be tied to exchange-rates. This is important. Issuing currency MAY lead to falling exchange-rates — but it also may not. This is NOT a law and so needs to be examined on an empirical level when determining policy.

“I think that net debt is not really the issue. It is gross debt. … Debt needs to serviced.”

Excellent point. Steve Keen often mentions this, and takes it into consideration in his analyses.

“There is an infinite number of distributions of gross debt that have the same net debt as a result.”

Indeed the Minsky Instability Hypothesis is based on gross rather than net debt. Ignoring gross debt is like the joke that if Bill Gates walks into a bar with nine penniless people then the average net worth of people in that bar is $5B. Similarly, if the economy consists of one creditor who has loaned out $9M and nine debtors, each of who owes $1M, it does not mean the economy is reasonably (or stably) balanced. Note that this situation can occur even with _zero_ net debt.

The sectoral balances approach is _a_ useful point of view for some purposes, but it can’t tell the whole story. Always remember that the choice of sectors to analyze is arbitrary, and you can choose any set you want (entirely legitimate if done for purposes of intelligent analysis). For example, you could argue that the government sector should be divided into federal and state/local, because only the former can print money. I’ll also note that even the standard sectoral balances approach uses _three_ sectors, but the third one (foreign debt) is often given short shrift. That’s a serious omission for a major debtor country like the US.

Lastly while I’m no deficit/debt hawk, and I don’t think the federal deficit/debt is the biggest problem facing the country, if allowed to go to extremes it can can be problematic. At some point, if a certain level of government expenditures is desired, it may make more sense to raise taxes rather than increase government debt. That’s hardly a radical notion given the support (outside of DC) for eliminating at least the high end of the Bush tax cuts. It was also a major reason for ending Prohibition – the government wanted the liquor taxes.

Debt does have to be serviced, so government debt does make a claim on future tax revenues. It will require either higher taxes or lower government spending in the future. Keeping a flat or regressive tax structure while having the government go further into debt means that both principal and interest will have to be paid out of flat or regressive taxes. Guess who benefits? People holding lots of Treasuries.

Raising taxes (federal tax revenues as a percentage of GDP are at their lowest level in 60 years) by making them more progressive, and commensurately reducing the deficit, reduces potential future debt problems. An additional benefit is the political theater of watching wealthy deficit hawks and their cronies in the government come up with reasons why this is a bad idea. Are your minions ready Mr. Peterson?

As for the Keynesian stimulus effects of raising taxes, only tax reductions on the low end of the income scale have a multiplier much greater than unity. Hence more progressive taxes have an economic stimulus effect.

Broken link from the article:

http://neweconomicperspectives.blogspot.com/2009/07/sector-financial-balances-model-of_26.htm

Correct link is provided later in the article:

http://neweconomicperspectives.blogspot.com/2009/07/sector-financial-balances-model-of_26.html

(just needed .html instead of .htm – the legacy of DOS 8.3 file names lives on!)

From the Post: “The key point here is that because the Irish government ran surpluses while the economy grew at a fairly substantial rate, this caused the private sector to become highly leveraged.“

Common sense requires me to call bull sh*t on the “caused”. This statement requires a level of abstraction that is totally unsatisfactory and unnecessary. Debt is a convenience, not a necessity. And the private sector is not interested in growth for growths sake. If there is demand, industry tries to satisfy it and when the demand falls, industry will reduce its production. Companies that operate otherwise will fail. If your theory were correct then growth would become a dirty word.

What amazes me most about the current situation with our economy is the theories offered by economists. Almost universally they assume that we have A REAL ECONOMY GRAFTED ONTO THE FINANCIAL SYSTEMS. Amazing!

In their world the real economy is always subject to control by the financial world or the government. Raise the supply of money, the interest rates or taxes and private industry profits and jobs decrease. Lower the supply of money, the interest rates or taxes and private industry leaps to growth in profits and jobs. Their models show that this is always the case and when it fails, they just add a temporary modifier to the model.

Actually when the economy is stable and operating within certain limits their theories are helpful. Their negative and positive feedback controls effectively do what they claim.

But when the economy has been distorted by REAL externals like unbalanced foreign trade then their machinations are ineffective. Reduce taxes and the increased in private profit and jobs leak into the foreign economies instead of recirculating in our economy, and our economists never seem to notice. Stimulate the economy with government spending and the increases in private profit and jobs leak into the foreign economies.

The basic problem is that they discount “common sense”. Until they recognize the cause of our problems they are very unlikely to find a solution. But they cling to their models as a baby clings to a favorite blanket.

“Debt is a convenience, not a necessity.”

That’s just factually incorrect. All money is debt — someone’s debt. That’s not even theory; that’s just accounting.

“If your theory were correct then growth would become a dirty word.”

Only if you consider ‘debt’ to be a dirty word. You do, evidently. I don’t. For me it’s a necessity.

“But when the economy has been distorted by REAL externals like unbalanced foreign trade then their machinations are ineffective.”

You’re living in a world of epistemological mirrors.

What makes unbalanced trade any more ‘real’ than government sector debt? Both are just statements on a central bank computer.

“That’s just factually incorrect. All money is debt — someone’s debt. That’s not even theory; that’s just accounting.”

Accounting is just another way to MODEL the real world. In the real world, money is SOMETHING of value which can be exchanged for goods or services. That SOMETHING may be gold, government currency backed by gold, or paper money backed by the full faith and credit of the government.

“What makes unbalanced trade any more ‘real’ than government sector debt? Both are just statements on a central bank computer.”

Another economics answer to a REAL world issue. Let me restate the obvious, account books, and computer spreadsheets are not the REAL world, they are models or representations of the real world.

THE PURPOSE OF GOVERNMENT IS NOT TO PROVIDE FOR THE MOST EFFICIENT ECONOMY! The preamble to the US Constitution does not mention economic efficiency, it speaks of insuring domestic tranquility, and promoting the General Welfare.

There is just no way to separate a countries economics from it’s politics. When you do, you create inequity, and civil unrest. (Look at Europe and the Euro!) This attempt at a global economy is a recent phenomena and it has caused all sorts of problems for many countries. Specifically it has failed us, and we should return to good old fashioned tariffs.

Economists do what lawyers do, they take commonly used words and apply some special meaning to it. They STEAL words! :^)

“They took our words!!!”

http://www.youtube.com/watch?v=RomPjp3ydek

I prefer the ‘angry mob carrying torches and surrounding Frankenstein’s castle’ scenario! :^)

Dear ‘Lucky’ Jim;

That was quite a howler; “discount ‘common sense.'” As you should know, “common sense” is far from common, and when encountered usually not in the posession of those who make decisions. It’s somewhat like the admittedly Liberal Myth of the “Noble Savage.” Looks good on paper, lots of problems in the implimentation.

As for “leaking into foreign economies,” I would flirt with apostasy and say that the whole earth is now one economy. Labor costs in my field, construction, are slowly approaching Second World levels, due to the conscious importation of Latino workers from “South of the Border.” For the Latino boys and girls, what we would view as ‘slum’ level conditions are actually big improvements. (I’m talking Rurales and Indios here.) They make the perfect neo-feudal proletariat. They work hard, hold to conservative social values, and are already socialized to take massive corruption for granted.

Hola Jim! Bienvenidos al Republica de Platanos!

ambrit said “That was quite a howler; “discount ‘common sense.’”

I see the humor and I wish I could claim that it was intentional, but I am afraid that was just my Yogi Berra side slipping out. :^)

I understand that common sense sometimes fails but discounting it completely is just lunacy. We couldn’t go a day without acting on situations with incomplete information, so we regularly use what I call common sense.

Sometimes common sense fails but how many times was the calendar changed before they got it right? Each time our documented MODEL of time seemed complete and accurate and each time it failed. The current calendar model fails less frequently but it fails.

As to your “the whole earth is now one economy”, you are indeed a lucky apostate, since heresy is no longer punished by burning at the stake. :^)

Buenos dias.

I see a lot of ad hominems from the non MMT crowd here.

I see many criticisms of MMT, but few or no “MMT’ers are idiots, and they don’t bathe regularly” types of comments. “Ad hominem” is not Latin for “criticism”.

I don’t think we’re focusing enough on the purpose or use of the debt. Is the debt for which the debtor is obligated put toward a physical asset that provides the means to pay back the debt over time? Demand is necessary for growth, but it comes about through the new change in economic activity centered around the investment. As long as debt is serviced through income generation, the debtor can apply for more debt for projects in the future thus continuing the cycle. This is how the economy progressively builds itself out. Malinvestment should be avoided because it puts a halt to this cycle, which is applicable in both the private and public space.

“Demand is necessary for growth, but it comes about through the new change in economic activity centered around the investment.”

That’s a common misconception. Investment, by definition, can only come through getting access to new currency to spend on said investment. In order to do this, debt needs to be incurred by some party.

Now, someone will say: “No! It comes from private sector saving.” True — sometimes. But look at the article. Private sector savings are impossible without government debt. So, investment through the use of savings is usually reliant on government debt.

(Or, this may come through the trade-surplus. But that means a deficit for another country — and hence, more debt).

PP: you’re reducing Glassgavin’s point to conceptions that simply cannot be separated from the ends to which debt is applied.

Without discussion of the critical connection between debt incurred and capacity to extinguished it, we find ourselves in monetarist fantasy land where, absent essential, non-linear considerations revolving around the creative capacity of mankind and the positive impact of this, mankind’s natural, elevated state of being, on the productive powers of labor, we have a merely linear discussion of debt dynamics in the framework of interactions within and among sovereign nation states. In other words, what’s missing here is discussion of dynamics making debt “a blessing,” as Alexander Hamilton elaborated it.

Speaking of Hamilton… his argument for forming a national bank will fast become the framework for restoring the soundness of government debt as the Ponzi scheme to which a large part of sovereign obligations presently are tied invariably collapses. This is to suggest that, those who rail against debt intuitively understand that its placement in support of arrangements diminishing the productive power of labor is a doomed state of affairs (such as is the case with today’s imperialist model operating under the banner of “globalization” and “free trade”).

Ref: PP at June 4 at 10:12 AM

“Private sector savings are impossible without government debt. So, investment through the use of savings is usually reliant on government debt.”

I’m late to this thread, Philip, but I’d guess this belief is at the core of your misconceptions. Sector financial balances are calculated post investment expenditure. They’re simply the residual after total expenditure for a given sector, including investment expenditure, is subtracted from total income. Or, put another way, after gross investment is subtracted from gross savings.

So, the private sector isn’t at all reliant on government deficit spending to save and invest. What is true, however, is that should it invest more than it saves in a given period, then it’s reliant on some combination of government deficits and/or foreign lending to make up the difference.

Sectoral financial balances are a useful reminder that 2+2 still equals four, but they don’t tell us much about what’s happening in the economy as a whole. Is it really a revelation that an economy’s total income less total expenditure equals its net relationship with the rest of the world? Hardly. Equally, it ought to be no surprise that if you divide up the economy into sectors, they will (with the exception of the external balance) sum to zero. Government and private sector? Sure. Then again, the division of the private sector into household/non-financial corporate/financial sectors is arguably even more interesting. They’re all just different shorthand ways of looking at the same immensely complex underlying reality.

Unfortunately, sectoral balances enthusiasts seem to often seize upon this simple, useful tool and try to make it do work it’s simply not capable of doing.

This is chicken and egg stuff. It’s really irrelevant.

Governments and institutions run on accounting sheets — not theory.

That’s all I’ll say on this.

People seem to mistake economic and accounting arguments for logical and epistemological arguments. I find that extremely unfortunate.

Glassgavin said: “Malinvestment should be avoided because it puts a halt to this cycle, which is applicable in both the private and public space.”

That’s an excellent point, but we don’t always know beforehand whether an investment is a “malinvestment” or not, not even for those operating in complete good faith (which, needless to say, is not always the case).

That’s why debt (leverage) is always dangerous. It magnifies risk and needs to be kept under control. Derivatives, which are used to obscure leverage and risk taking, are also dangerous. Any entity that can destabilize the economic and financial order should be regulated so as to limit leverage and bar it from trading in derivatives.

To understand private savings one has to understand the commcercial banks and how they borrow. They don’t take depositis and then lend. They lend the money and then borrow from other banks or the federal reserve discount window to meet their reserve requirements.