By Carmen M Reinhart and Kenneth Rogoff. Reinhart isDennis Weatherstone Senior Fellow, Peterson Institute for International Economics; Rogoff is Thomas D. Cabot Professor of Public Policy and Professor of Economics at Harvard. Originally published at VoxEU.

The strength of the US recovery has become a political issue in the presidential election. The US is doing better than other advanced economies, but famous economists associated with the Romney campaign claim this is not good enough. The US, they argue, is different. Here, the masters of the ‘this time is different’ research genre – Carmen Reinhart and Ken Rogoff – argue that US historical performance is not different when it is properly measured, so the economy’s performance is better than expected.

Five years after the onset of the 2007 subprime financial crisis:

- GDP per capita in the US remains below its initial level;

- Unemployment, although down from its peak, is still hovering near 8%.

Rather than the V-shaped recovery that is typical of most postwar recessions, growth has been slow and halting.

Based on our research (Reinhart and Rogoff, 2009), this disappointing performance should not be surprising. We have presented evidence that recessions that are associated with systemic banking crisis tend to be deep and protracted, and that this pattern is seen in historical and cross-country comparisons. Subsequent academic research using different approaches and samples have found similar results.

Recently, however, a few op-ed writers have argued that in fact, the US is ‘different’. International comparisons are not relevant because of profound institutional differences from other countries. A recent spate of op-ed writers, including Hevin Hassett and Glenn Hubbard, Michael Bordo and John Taylor, have stressed that the US is also ‘different’ in that recoveries from recessions associated with financial crises have been rapid and strong. Their interpretation is at least partly based on a study by Bordo and Haubrich (2012), which examines the issue for the US since 1880.

In this column, we question their ‘interpretation’ of the US historical track record, which is incorporated in Reinhart and Rogoff (2009), where we present results of 224 historical banking crises from around the world, including pre-2007 banking crises in the US.

Confusion in the ‘US is different’ discussion

Perhaps part of the confusion in the recent ‘US is different’ op-eds is a failure to distinguish systemic financial crises from more minor ones and from regular business cycles.

- A systemic financial crisis affects a large share of a country’s financial system;

- They are quite distinct from less severe events that clearly fall short of a full-blown systemic meltdown.

These are referred to in the literature as ‘borderline’ crises.

The distinction between a systemic and a borderline event is well established according to widely accepted criteria and is clear in both our work and that of other scholars. Indeed, in our initial paper on this topic (Reinhart and Rogoff, 2008), we showed that systemic financial crises across advanced economies had far more serious economic consequences than borderline crises.

Our paper – written nine months before the collapse of Lehman in September 2008 – showed that by 2007, US already shared many of the key recurring precursors of a systemic financial crisis: a real estate bubble, high levels of debt, chronically large current account deficits, and signs of slowing economic activity. Today, there can be little doubt that the US has experienced a systemic crisis. This is, in fact, the first systemic financial crisis the US has experienced since the Great Depression. Before that, notable systemic post-civil war US financial crises include those dated in 1873, 1893 and 1907.

Measurement matters

How a recovery is measured is also important as is the way success is defined. The recent op-eds focus on GDP growth immediately following the trough (usually four quarters).

- For a normal recession, the restoration of positive growth is typically a signal event.

- In a V-shaped recovery, the old peak level of GDP is quickly reached, and the economy returns to trend within a year or two.

In Reinhart and Rogoff (2009), we examine both levels and rates of change of per capita GDP; recovery is defined by the time it takes for per capita GDP to ‘recover’ or return to its pre-crisis peak level.

- For post-WWII systemic crises it took about four and a half years to regain lost ground;

- In 14 Great Depression episodes around the world (including the US) it took ten years on average.

A focus on levels is a more robust way to capture the trajectory of an economy where the recovery is more U or nearly L-shaped than V-shaped. It also avoids exaggerating the strength of the recovery when after a deep recession there has been a large cumulative decline in the level GDP.

- An 8% decline followed by an 8% increase does not bring the economy back to its starting point.

Taylor’s chart shows the recovery from the Great Depression as the strongest in the history of the US, even though (as we show in our book) it took about a decade for the US to reach the same level of per capita income as its starting point in 1929.

GDP growth is misleading when population growth rates change

Another important consideration when working with historical series is the impact of population growth on GDP growth. US population growth has fallen from 2-2.5% per annum in the late 1800s to less than 1% in more recent times To control for this, we stress per capita measures. Put differently, in the early 1900s a year with 2% real GDP growth left the average person’s income unchanged; in the modern context, 2% annual GDP growth means slightly more than one% increase in real income per person. Population growth changes over time are even more pronounced in other countries. The impact of cumulative population growth even within an individual crisis episode is significant, as the recovery process usually spans four to ten years.

Even allowing for all the above issues does not seem to entirely account for differences in our interpretation of the facts from the Hassett-Hubbard, Bordo and Taylor op-eds. The narrative in the Bordo Haubrich paper emphasizes that “the 1907-1908 recession was followed by vigorous recovery.” The Panic of 1907 does indeed fit the standard criteria of a systemic crisis (and one with a global dimension at that). As the charts below show:

- The level real GDP per capita in the US did not return to its pre-crisis peak of 1906 until 1912.

Can one call this a vigorous recovery?

- The US unemployment rate (not examined in the Bordo-Haubrich study) which was 1.7% in 1906 and climbed to 8% in 1908, did not return to the pre-crisis low until 1918.

The aftermath of the systemic banking crisis of 1893 is worse than the 1907 episode; the Depression of the 1930s is worse still. =

According to our (2009) metrics, the aftermath of the US financial crisis has been quite typical of post-war systemic financial crises around the globe. If one really wants to focus just on US systemic financial crises, then the recent recovery looks positively brisk.

Summary of findings from comparison to US historical crises

We first focus on four previous systemic financial crises that the US has experienced since 1870. These include:

- The crisis of 1873 (called the Great Depression until the 1930s),

- The 1893 crisis,

- The panic of 1907, and

- The Great Depression.

Given that all of the earlier crises predate the creation of deposit insurance in 1933, and that three of the four crises predate the establishment of a central bank in the US, one could well quibble about the claim that the relevant institutions are more comparable across centuries in the US than across advanced countries over the last 30 years.

Be that as it may, the comparison across systemic US financial crises suggests:

- That US recoveries from pre-WWII systemic crises were no swifter than the general cross-country pattern;

- That the US has fared no worse this time around than in previous systemic crises.

Standard errors have to be taken with a grain of salt for such small sample. On the whole, however, the conclusion would have to be that in the five years since the onset of the financial crisis the US has performed better in terms of output per capita and unemployment than in the previous crises, even if one excludes the Great Depression.

The reader will note that our comparisons relate to the period dating from the onset of the crisis, and do not delineate between the ‘recession’period and the ‘recovery’ period. Elsewhere we have explained why this distinction is somewhat meaningless in the aftermath of a financial crisis where ‘false dawns’ make it very difficult to detect the start of an ultimate recovery in real time. That is why we have consistently argued that the popular term ‘Great Recession’ is something of a misnomer for the current downturn, which we have argued would be better thought of as ‘The Second Great Contraction’ (after Friedman and Schwartz’s characterisation of the Great Depression as the Great Contraction.)

Summary of findings from comparison of US to other advanced economies

Secondly, we assess how has the US has fared, so far, compared to other advanced economies countries that experienced systemic financial crises in 2007-2008 as well other advanced economies that experienced borderline episodes. Focusing on real per capita GDP, we show that

- The recent crises patterns confirm our earlier result that the countries that recently suffered systemic financial crises have generally fared quite poorly compared to countries where the financial problem was less severe, that is, those with borderline crises; and

- Although tracking worse than the countries that did not have systemic financial crises, the US output performance is, in fact, among the best of those that did.

Charting the US historical episodes

As in our work on the aftermath of financial crisis (Reinhart and Rogoff, 2009), we start our analysis by anchoring the crisis episode at the peak of economic activity, which usually occurs either the year immediately before the crisis or the crisis year. For real per capita GDP we use the Total Economy Database, a multi-country database conceived by Angus Maddison and now updated by the Conference Board: the most recent annual observation is 2011. The US data is available from 1870. For US unemployment, the data is taken from the Historical Statistics of the United States, where the unemployment rate series is available from 1890 (and is consistent with the Bureau of Labour Statistics for the modern era.)

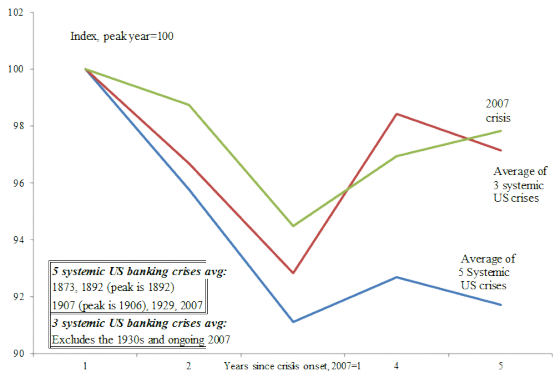

Figure 1 compares the still unfolding (2007) financial crisis to earlier US systemic financial crises of 1873, 1892, 1907 and 1929. As the figure illustrates, the initial contraction in per capita GDP is smaller for the recent crisis than in the earlier crises (even when the Great Depression of the 1930s is excluded). Five years on, the current level of per capita GDP, relative to baseline, is higher than the corresponding five-crisis average that includes the 1930s. The recovery of per capita GDP after 2007 is also slightly stronger than the average for the systemic crises of 1873, 1893 and 1907. Although not as famous as the Great Depression, the depression of the 1890s paints a dismal picture; in 1896 real per capita GDP was still 6% below its pre- crisis level in 1892.

So how many years did it take for per capita GDP to return to its peak at the onset of the crisis? For the 1873 and 1893 (peak is 1892) crises it was five years; for the 1907 (peak is 1906) panic six years and for the Depression 11 years. In output per capita timelines, at least, it difficult to argue that ‘the US is different’. It can hardly be said to have enjoyed vigorous output per capita recoveries from past systemic financial crises.

Figure 1. Real per capita GDP (levels) in the aftermath of systemic banking crises in the US, 1873-2011

Sources: Reinhart and Rogoff (2009), Maddison (2006), GDP per capita from Total Economy Database, Conference Board. Notes: Total GDP per capita in 1990 US dollars (converted at Geary Khamis PPPs).

The ‘US is different’ idea is not supported by the unemployment data

The notion the US exhibits rapid recovery from systemic financial crises does not emerge from the unemployment data either. As we noted, the US unemployment rate data only begins in 1890, which eliminates the 1873 crisis from the pool. The aftermath of remaining four crises are shown in Figure 2.

- The 2007 crisis is associated with significantly lower unemployment rates than both the Depression of the 1930s and the depression of the 1890s.

2007 it is more in line with the unemployment increases observed following the Panic of 1907. As shown in the inset to the figure, the unemployment rate, which was 1.7% in 1906 was near 6% five years later.

- In the 1892 crisis, the unemployment rate started at 3% in 1892, shot up to over 18%, and still remained above 14% in 1896.

In effect, the unemployment never dips back to below 3% until 1906 (on the eve of the next crisis). The pattern during the Great Depression of the 1930s, is off the charts (Eichengreen and O Rourke, 2010 is a must read on this comparison). These historic US episodes are in line with the findings in Reinhart and Reinhart (2010), who examine the decade after post-WWII severe/systemic financial crises in both advanced economies and emerging markets, documenting that in ten of the 15 episodes examined the unemployment rate had not returned to its pre-crisis level in the decade following the crisis.

- For the 1893 and 1929 Depression it was 14 years; for 1907 it was 12 years before the unemployment rate went back to its pre-crisis level.

Figure 2. Average annual unemployment rate in the aftermath of systemic banking crises in the US, 1892-2011

Sources: Bureau of Labor Statistics, Historical Statistics of the US, and Reinhart and Rogoff (2009). Notes: Average annual unemployment rates. The change from the level at the outset is the simple difference; for example the unemployment rate in 2007 was 4.6% so the difference from 2011 (when the unemployment rate is 9%) is 4.4%.

Chart the cross-country real per capita GDP comparisons: 2007-2011

We next turn to comparisons between the US and other countries in the Second Great Contraction. The simplest of cross-country comparisons involves dividing the post-2007 crisis experience into two batches:

- Those countries that experienced systemic banking crises; and

- Those that had milder borderline problems in their financial sector (which does not preclude them from having other serious ‘varieties’ of crises, notably fiscal in this case.)

This applies the same criteria as Reinhart and Rogoff (2008). Figure 3 presents the evolution of per capital GDP normalized to equal 100 in 2007. The inset in the chart indicates which countries are included in the averages for the systemic and borderline episodes.

Figure 3. Real per capita GDP (levels): 2007-2011 systemic and borderline crises in advanced economies

Sources: Laeven and Valencia (June 2012), Reinhart and Rogoff (2009), GDP per capita from Total Economy Database, Conference Board. Notes: Total GDP per capita in 1990 US dollars (converted at Geary Khamis PPPs). For further details on the distinctions between numerous dimensions of the systemic-borderline distinctions since 2007, see Laeven and Valencia (2012). Italy and Portugal post the weakest output performance among the borderline cases, as these countries face additional concerns about their sovereign debt sustainability. For Austria, Germany, The Netherlands and Switzerland peak per capita GDP was 2008. For all others the peak was 2007.

The pattern described in Reinhart and Rogoff (2008) for 1946-2006 crises is replicated in the cross-country performance in the recent (2007-2011) crises: the systemic crises are associated with deeper more protracted recessions than the borderline cases–notwithstanding the fact that some of the borderline banking crises cases (to-date ) involve serious fiscal crises as well, including for example Portugal and Italy where growth and employment performance has been miserable.

Note that the US per capita GDP contraction since 2007 shows a comparable initial decline as that recorded in the other European countries (since 2007) undergoing systemic financial crises but a faster recovery in the subsequent years.

Summary and concluding remarks

While no two crises are identical, there are some robust recurring features of crises that cut across time as well as across national borders. Common patterns as regards the nature of the long boom-bust cycles in debt and their relationship to economic activity emerge as a common thread across very diverse institutional settings. This, in fact, is precisely a key if surprising takeaway from our 2009 book.

The most recent US crisis appears to fit the more general pattern that the recovery process from severe financial crisis is more protracted than from a normal recession or from milder forms of financial distress. There is certainly little evidence to suggest that this time was worse.

Of course this does not mean policy is irrelevant. Quite the contrary, in the heat of the recent financial crisis, there was almost certainly a palpable risk of a Second Great Depression. However, although it clear that the challenges in recovering from a financial crises are daunting, an early recognition of the likely depth and duration of the problem would certainly have been helpful. It would have been helpful in assessing various options and their attendant risks. It is not our intention here to closely analyse policy responses that frankly, may take years of analysis to sort out.

Rather, our aim is to clear the air that somehow the US is different. The latest US financial crisis, yet again, proved it is not.

References

Bordo, M and J Haubrich (2012), “Deep Recessions, Fast Recoveries, and Financial Crises: Evidence from the American Record,” NBER Working Paper 18194.

Caprio, G Jr. and D Klingebiel (1996), “Bank Insolvency: Bad Luck, Bad Policy, or Bad Banking?” in Boris Pleskovic and Joseph Stiglitz (eds.), Annual World Bank Conference on Development Economics, Washington, DC: The World Bank, 79–104.

Claessens, S, M A Kose and M Terrones (2011), “Financial Cycles, What? How? And When?” IMF Working Paper WP/11/76.

Jorda, O, M Schularick and A Taylor (2012), “When Credit Bites Back: Leverage, Business Cycles, and Crises,” mimeograph.

Kaminsky, G and C M Reinhart (1999), “The Twin Crises: The Causes of Banking and Balance of Payments Problems,” American Economic Review 89(3), 473-500.

Laeven, L and F Valencia (2012), “Systemic Banking Crises Database: an Update,” IMF Working Paper WP/12/163.

Papell, D H and R Prudan (2011), “The Statistical Behavior of GDP after Financial Crises and Severe Recessions,” Paper prepared for the Federal Reserve Bank of Boston conference on “Long-Term Effects of the Great Recession,” October 18-19.

Reinhart, C M and K S Rogoff (2008), “Is The 2007 US Subprime Crisis So Different? An, International Historical Comparison,” American Economic Review 98(2), 339-344.

Reinhart, C M and K S Rogoff (2009), “The Aftermath of Financial Crises,” American Economic Review 99(2), 466-472.

Reinhart, C M and K S Rogoff (2009), This Time It’s Different: Eight Centuries of Financial Folly, Princeton: Princeton University Press, September.

Reinhart, C M and V R Reinhart (2010), “After the Fall,” in Federal Reserve Bank of Kansas City Economic Policy Symposium, Macroeconomic Challenges: The Decade Ahead at Jackson Hole, Wyoming, on August 26-28.

Seeing as the benefits of any increase in GDP have been going to the 1%, who cares if there has been an increase in per capita GDP? It’s a misleading metric.

The same could be said about unemployment. The unemployment level is understated by about 4.5% because the BLS defines so many workers out of the labor force.

And BTW why do all three of those graphs look the same?

Sir;

I concur. They do look to be the same graph, mistakenly(?) repeated. Is someone trying to assert that all three cases are identical?

“Seeing as the benefits of any increase in GDP have been going to the 1%, who cares if there has been an increase in per capita GDP? It’s a misleading metric.”

Better be careful Hugh. Yer talkin’ like a Bolshevik.

Economists are overly reliant on their GDP figures. Even when they’re accurate it doesn’t paint a realistic picture of what’s happening at the ground level. Since we know they’ve been revised up and downward so much in the past couple of years I take them with a mountain of salt.

The three lines on the graph WILL only look the same if the present recovery stops and there’s another downturn right about…..now. Oh.

And yes GDP or just “economic” growth is/are sacred, as long as the original meaning of ekonos is conveniently ignored. How the “economy” can grow forever on a planet with finite resources and a growing human (but diminishing every-living-thing else) population is a question that no one has a palatable answer for so it must remain taboo.

That’s why most of the debate is IMO of marginal value unless we have some paradigm-shifting activity occur as a result. One wonders whether it will be something aesthetically unthinkable like the extinction of the tiger (inevitable at current rates), or viscerally dumbfounding like the collapse of world fish stocks (80% depleted and counting), that has a chance of sparking some system-rocking change?

“And BTW why do all three of those graphs look the same?”

Because they are the same chart mistakenly posted three times. Vox later replaced Charts 2 and 3 with the correct charts.

I will update. I double checked, triple checked. The file names were different, so….

There is some deep metaphor here, but I don’t know what it is.

I thought the name Glenn “The US is Different” Hubbard looked familiar. Sure enough he’s the sad case at Columbia Business School who got crisped by Charles Ferguson’s documentary “Inside Job” heheh.

http://www.youtube.com/watch?v=zlIoeTObmEk

“Give it your best shot” quite so.

There’s only ONE Glenn, a true “economist’s economist.” AKA, academic theory for hire, especially if you’re well-heeled and willing to pay. Serving the “profession” of economics into the 21st century and beyond – damn the poor and the oceans don’t rise!

Sir;

Reminds me of the story of the ancient English king who was persuaded to exercise his “God Given” ‘supernatural’ powers and stop the tide. The ocean still rose then, it will do so again.

Alas! Times and hegemons change. Truths, whether eternal or epochal, do not. The “mighty” US is about to learn that lesson the hard way. “Unacceptable.” Write that term down. We’re ALL about to learn its TRUE MEANING the hard way. And rest assured, it ain’t ANYTHING we’re gonna like.

Apparently he’s also Rmoney’s economic adviser. He only goes with the best.

Uh, these same people were out of the labor force in 1965. They are always out of the labor force. Mercy, get it please. There is no “understatment”. That is why you have broader measures as well.

You’ve repeatedly come to this site and say things that are widely known to be untrue. This is another example. The definition of unemployment most assuredly has changed over time, via removing certain types of discouraged workers from the labor pool.

Here’s one summary:

Up until the Clinton administration, a discouraged worker was one who was willing, able and ready to work but had given up looking because there were no jobs to be had. The Clinton administration dismissed to the non-reporting netherworld about five million discouraged workers who had been so categorized for more than a year. As of July 2004, the less-than-a-year discouraged workers total 504,000. Adding in the netherworld takes the unemployment rate up to about 12.5%.

The Clinton administration also reduced monthly household sampling from 60,000 to about 50,000, eliminating significant surveying in the inner cities. Despite claims of corrective statistical adjustments, reported unemployment among people of color declined sharply, and the piggybacked poverty survey showed a remarkable reversal in decades of worsening poverty trends.

http://www.shadowstats.com/article/employment

Sorry, Yves, the definition of discouraged workers did change, but they were never counted as part of the U-3 rate.

Interesting, thanks. But I wonder to what extent changes in the way that GDP and unemployment are measured (over time and possibly across countries) have been corrected for. Have the bailouts and various exceptional measures artificially boosted GDP and employment?

It also seems that the US is doing better than others (can’t quite tell from the graph: Switzerland is missing…) and better than in previous episodes. Nevertheless, Rogoff earlier claimed the following (The Guardian “Austerity and debt realism”, 1 June 2012):

“In a series of academic papers with Carmen Reinhart – including, most recently, joint work with Vincent Reinhart (“Debt Overhangs: Past and Present”) – we find that very high debt levels of 90% of GDP are a long-term secular drag on economic growth that often lasts for two decades or more. The cumulative costs can be stunning. ”

The US is past 90%. It seems to me we cannot make the austerity/deficit call for another 15 years or so. And then any call has to be assessed on a cumulative basis. Are there any good high resolution long term analyses out there?

I also wonder how long deficit spending can continue before inflation becomes a constraint. For how long should the Government, by implication, support aggregate demand for unproductive nail salons? Or guarantee nail salon jobs?

I find pockets of coherence in economists’ views, but tying them all coherently together appears another matter.

“But I wonder to what extent changes in the way that GDP and unemployment are measured (over time and possibly across countries) have been corrected for.”

Seems impossible to me, but maybe close enough for econ work.

“Have the bailouts and various exceptional measures artificially boosted GDP and employment?”

It’s an accounting identity that USG deficits get added to GDP. So we racked up $5-$6 Trillion in more USG debt. I think GDP is back to where it was pre-crash, but employment – not.

Whether this is better or not, dunno. Hollow victory if it is. Heard Swissies doing relatively well.

“Are there any good high resolution long term analyses out there?”

No. The CBO predicted in 2000 that the National Debt would be paid off this year, I believe. They are supposed to be the good ones. One interesting thing is they make 10 year forecasts, but no 10 year forecast ever includes a recession!

Nail salons don’t scare me that much. Creating nail salon demand thru trickle down economics does, however.

Keynesians tell us we are in a liquidity trap, ie no loan demand, so inflation is not a problem and therefore deficit spending is ok. But then we know that if deficit spending ever fixed the economy, inflation will be a problem, especially since the Fed pushed all the QE money out there (3X normal and counting).

But there are more things to worry about even if we don’t get inflation. Like another financial crisis – since Fed easy money turned wall street into even more of a casino than it was. Interest rates rising because the size of debt gets large enough to finally shock the US bond market out of it’s slumber, or similar problems in currency markets and commodity markets. Any of these things could cause an oil, food, or interest rate shock where some prices go up and then also put a drag on the economy – perhaps to the point of recession – then we have deflation again. The dollar could get dumped as world currency, or more likely the global currency regime morphs into something different. The BRICs are working together to set up trade/currency agreements – so the world may get more regional.

“I find pockets of coherence in economists’ views, but tying them all coherently together appears another matter.”

That’s because economists haven’t done it yet. They just had an epiphany post crash that their fancy math models didn’t include debt and it’s effects.

Really!

OECDStats (http://stats.oecd.org/) I believe tries to harmonize unemployment data across OECD countries. There are always some problems, for example how to count people in training programs, etc.

Most industrial countries use a job seeker model for unemployment more or less consistent with ILO standards. This model significantly understates the number of unemployed because it misses all those who would work if jobs were available to them. And we can get an idea of how big this group is by looking at participation rates in years past.

Rogoff and Reinhart have been a huge part of the problem in this country since they published their book, and are among a handful of opinions leaders who are centrally responsible for creating the reigning malaise of public debt hysteria, and for turning the nation’s and political class’s attention away from recovery and toward deficit anxiety. We needed bold and can-do government activism, and instead we got stagnation, hand-winging and timid bean-counting, based largely on an analysis that ceased to be applicable with the end of the gold standard. They ought to be ashamed of themselves, and I can’t understand why they are still running around mouthing off in public.

Glad Kervick entered the discussion, good point. As others have pointed out, the debt to GDP ratio they point out is a correlation, not a cause and effect, and it could be the reverse. I see where the European nations haven’t had any success achieveing growth by reducing their deficit, even England, a country that has their own currency. Let’s face it, a good deal needs to be know about govenrment debt and deficits and their relationship to growth or non-growth. R and R do not have the final say, but they sound so convincing.

Right! Let’s blame it all on Reinhart and Rogoff and Reinharff and Rotgut. We can blame it on Krugman and Milton Friedman and goggle-eyed Alan Greenspan … or Charles Hamlin and Charles Manson or John Maynard Keynes … or Andrew Mellon. Everything right now is exactly the same as it was in 1949 … or in 1929 … right?

Blame it on demon rum and loose women and too much crack cocaine! The problem is lazy negroes and/or too many hard-working hispanics. The problem is Moslems/battleships without 18 inch guns and too many battleships with 16 inch guns, the problem is not any battleships at all. Good grief!

Times have changed, the world has burned through a trillion barrels of light, sweet crude. What sort of ‘goods’ have we gotten/earned with this cool trillion? What endures? Where is the capital gained for the capital destroyed? How are things ‘better’ in human terms … in remunerative ways?

(waiting for an answer … … … … …)

We have nothing. The world is filled with a billion pieces of worthless junk and the ‘space’ needed for these things to operate. What makes this and related nonsense function ‘as intended’ is crude that is presently too costly to bring to market … it seems that the worthless junk does not earn enough to pay the increased cost … it does not earn enough to pay for debt SERVICE much less retire any of the debt taken on to make the entire mess function … some way must be found to evade the debt or the consequences of non-payment …

We’re broke! We’ve bankrupted ourselves with our precious toys. None of this is going to be found in the pages of any economist’s book! They all have the same toys and want to keep them. They have a vested interest in keeping the ridiculous scheme going as it has since the industrial revolution began … now it can’t anymore! Proof of the pudding is in the eating … let’s wait five or fifteen more years and things will be worse! There can be no other outcome … this is simple thermodynamics, not economic witch-doctory!

People will be ‘blaming it all’ on some long-dead economist/politician/shaman/environmentalist/philosopher/king. Look at the end of your driveways, folks, that is where the real problem is.

Federal Reserve was formed in 1913, the preceding year Ford Motor Corp. sold 170,211 cars. Can anyone make the connection?

Eh … ?

You are trying to connect two items that are not necessarily related. They make one proposition on the historic aftermath of financial crises. They make a second proposition that high levels of debt can cause financial crisis. The first can be true even if the second is false.

Your personal opinion of Rogoff & Reinhart in no way invalidates anything in their article.

It is quite plausible that the American economy is back in recession. In which case all this talk of recovery is just as relevant as the existence of unicorns. The perception that there is a recovery at all will likely persist until after the election season.

As for the American experience regarding economic crises and their subsequent recoveries, I have major doubts we’ve seen the end of the crisis. Much less the beginning of any recovery. When the yen carry trade unwound in August ’07 all the notional value of assets priced in euros and dollars quickly disappeared in the crisis. The Fed’s actions to replace cheap yen credit with cheap USD to reinflate the debt bubble will not end well if history is any guide. Helicopter Ben can’t beat deflation through money printing. Any more then Benjamin Strong could.

Those that don’t learn from history, something, something.

I know this is peripherally related but bear with me: Could the disappearance of inflation since the 90s be related to the decimation of the Unions? When Unions died the one way for the middle class to get wage raises also died and hence was inflation killed? The White Collar workers also got raises every time the Unions negotiated a raise for their workers, right? So, wage raises all around. Now no more wage raises and hence no more inflation?