Dave here. Big apologies, apparently I cross-posted the wrong post. This is going to get me thrown out of guest-posting school!

By Steve Keen, professor of economics & finance at the University of Western Sydney and author of Debunking Economics and the blog Debtwatch. Professor Keen has invented a simple way to build monetary models of the economy, and he’s raising funds via Kickstarter to pay programmers to develop he software, which he’s calling Minsky. He’s raised over $50,000 already, but as much as $1 million is needed to pay for 10,000 hours of programming time to fully develop the program. Please pledge support now at Minsky campaign: http://kck.st/XhKtdX.

This article is the second half of a two-part series. To see the first half, click here. Cross-posted from Business Spectator.

Krugman’s explanation of our crisis today is straight from the pages of John Hicks’s 1937 explanation of the Great Depression (though curiously, Hicks himself didn’t mention the actual state of the global economy at all in his 1937 paper, which attempted to explain the relationship between interest rates, and real output in goods and services and money markets.

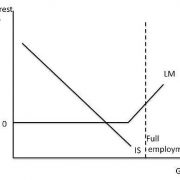

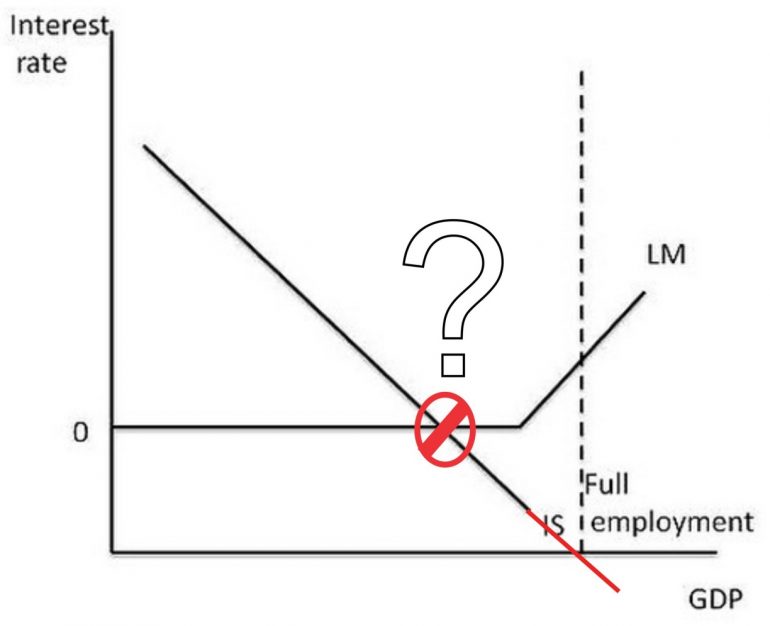

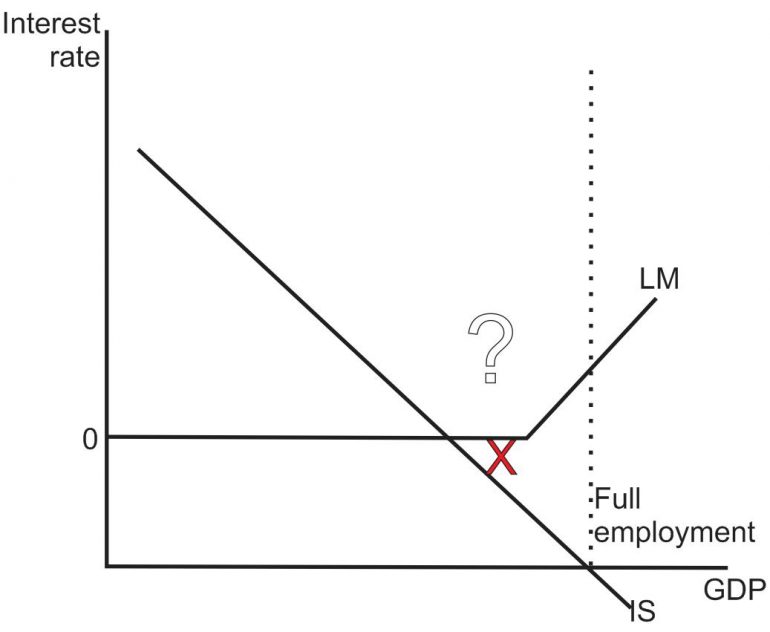

Firstly, the LM curve, (representing Liquidity Preference – Money Supply) is horizontal at the “zero lower bound”, since when nominal rate of interest reaches zero, there’s no point in buying bonds – it’s wiser to keep your money in cash. And secondly, during a Depression, private demand can fall so much that the intersection of IS (representing Investment – Saving) and LM occurs at a level of GDP well below the full employment level. The economy is in an equilibrium with involuntary unemployment (see figure 7).

Figure 1: Krugman’s key graph in IS-LMentary (Krugman 2009)

Krugman concludes that knowing the IS-LM model helps people avoid fallacies that afflicted a range of commentators who expected large government deficits to lead to higher interest rates, rampant inflation, and the crowding out of the private sector.

“IS-LM makes some predictions about what happens in the liquidity trap. Budget deficits shift IS to the right; in the liquidity trap that has no effect on the interest rate. Increases in the money supply do nothing at all,” he said.

“That’s why in early 2009, when the WSJ, the Austrians, and the other usual suspects were screaming about soaring rates and runaway inflation, those who understood IS-LM were predicting that interest rates would stay low and that even a tripling of the monetary base would not be inflationary. Events since then have, as I see it, been a huge vindication for the IS-LM types – despite some headline inflation driven by commodity prices – and a huge failure for the soaring-rates-and-inflation crowd.

“Yes, IS-LM simplifies things a lot, and can’t be taken as the final word. But it has done what good economic models are supposed to do: make sense of what we see, and make highly useful predictions about what would happen in unusual circumstances. Economists who understand IS-LM have done vastly better in tracking our current crisis than people who don’t.”

Sounds plausible? Yes, and there are some ways in which it is – as I often note, I frequently agree with Krugman even though I have a very different approach to economics. But now to show why his understanding and use of IS-LM is flawed.

Krugman’s IS-LM Errors

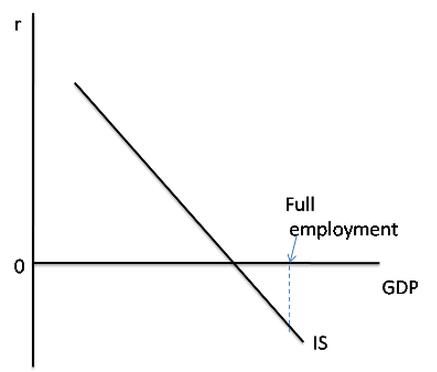

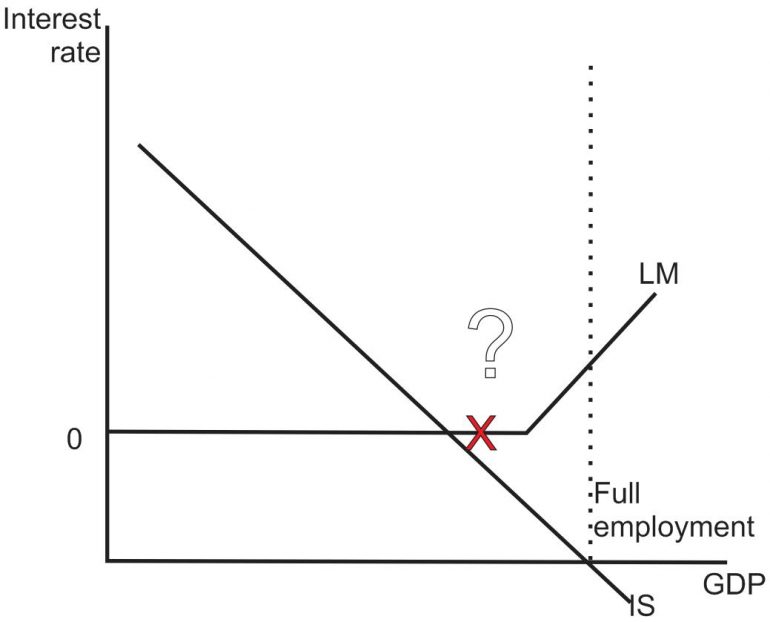

These are most easily seen in his post chiding Niall Ferguson, where he adds a little embellishment to figure 7 by extending his IS curve, effectively until it touches the dotted line representing full employment in Figure 7:

Figure 2: Equilibrium in the IS market occurs with a negative interest rate (Krugman on Ferguson in 2009)

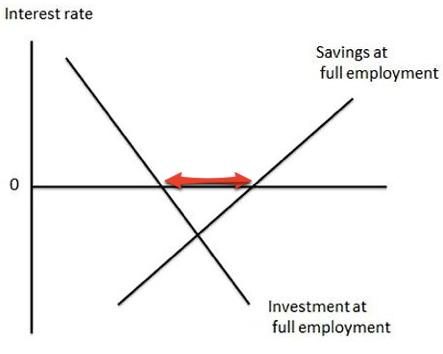

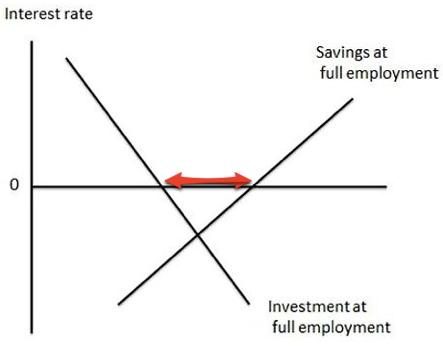

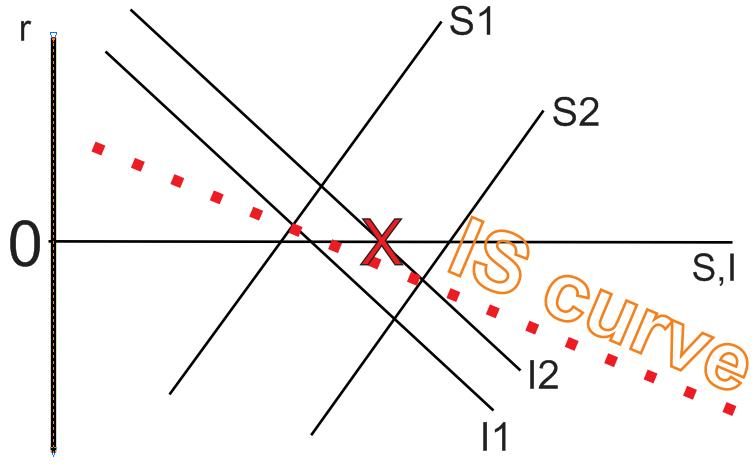

He then spells out what this means in the IS market in his next diagram: the demand for investment funds from firms-borrowers can only equal the supply of savings by households-savers if the interest rate is negative, but since the interest rate is actually zero, there is excess supply in the IS market: the intended supply of savings by households is greater than the actual demand for savings by investing firms.

Figure 3: Disequilibrium in the IS market because of the zero lower bound (Krugman on Ferguson in 2009)

But since the interest rate can’t be negative (the nominal rate – the real rate can be with significant inflation, but of course we don’t have that right now), there is disequilibrium in IS market. Brad Delong emphasized this point by embellishing Krugman’s diagram (see figure 10).

Figure 4: Delong’s embellishment (DeLong 012 in a “Department of Huh? criticizing me)

Now let’s feed that disequilibrium back into Figure 7. Krugman implied in that diagram that the economy was at the point where the IS and LM curves cross. But it can’t be – because at that point, the IS market is in equilibrium.So the economy has to be shown as NOT being on the IS curve.

Figure 5: The IS market is out of equilibrium so the economy can’t be on the IS curve (Krugman 2009, embellished)

So where is it? Working with Krugman’s derivation of the IS curve (see figure 4 in the first instalment of this story), we can at least locate where the IS market is. Using S2 and I2 as the combination at which the market is in equilibrium only at a negative rate of interest – and therefore the market is in disequilibrium with an excess supply of savings because of the “zero lower bound” – the rule in disequilibrium is that “the short side wins”. Given the market price (in this case, zero), the point where the demand curve is at the market price is the amount that actually gets purchased. So it’s “X marks the spot” in figure 6 for the IS market.

Figure 6: IS market volume and price out of equilibrium

But that’s only half the model: where do we show this point on the LM curve? Could we perhaps locate the economy at some point along the LM curve, but not where it intersects the IS curve, as in figure 7?

Figure 7: First try: off the IS curve but on the LM?

No, this won’t work either, because IS-LM is a “general equilibrium” model in Walras’s sense: if the IS market is out of equilibrium, then so must be LM.

Walras’ Law is normally used in an equilibrium manner by neoclassical economists, to argue that if one market in a two-market model is in equilibrium, then the other must be too. But it works in disequilibrium as well: if one market is out of equilibrium, then the other has to be as well. So not only can the economy not be where the two lines cross: it can’t be on either of the two lines at all.

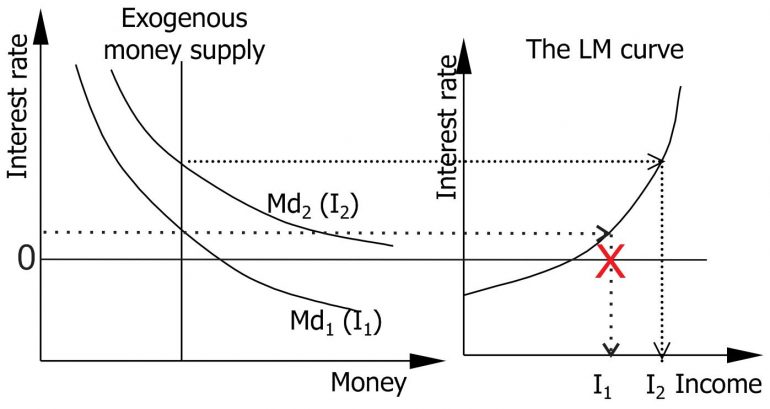

Working with my drawing (figure 5 from the first instalment), since there’s excess supply in the IS market, there has to be excess demand in LM (by Walras’s Law). Since we know the interest rate (zero), I have to draw it somewhere that generates excess demand for money in the model – maybe at a point like X in figure 8.

Figure 8: LM out of equilibrium as well with excess demand

That would then mean that the actual economy was in a location like “X marks the spot” in figure 9 below – but that can’t be right either since we know the interest rate is zero, and X is below the zero mark.

Figure 9: IS-LM in disequilibrium?

So where is the economy, in terms of the IS-LM diagram? It isn’t, as soon as you acknowledge that the economy is in disequilibrium, the IS-LM model can’t be used to represent it.

Doesn’t the fact that there effectively are negative real interest rates in the market negate your point that we have to be in disequilibrium because of the zero bound on the Fed’s nominal rates?

“That would then mean that the actual economy was in a location like “X marks the spot” in figure 9 below – but that can’t be right either since we know the interest rate is zero, and X is below the zero mark.”

Can’t X be the negative real interest rates observed, rather than a reflection of the Fed’s nominal policy rate? And thus the model still holds because we’re in an equilibrium?

It could be, but it doesn’t look like that’s what Krugman is arguing.

I thought that was exactly the argument– it can’t get to equilibrium, because of the zero lower bound, but real interest rates are negative. What am I not getting?

Because Krugman is working in terms of the ZLB he is implicitly arguing in regard to Fed policy being unable to set rates below zero, rather than in terms of real interest rates.

I thought he was arguing both– i.e., interest rates on savings *should* be negative, but can’t be.

Negative interest rates would obtain if there were inflation in the economy but there’s not, so no. The problem is that the ISLM model is based on equilibrium points that don’t exist. It seems almost superfluous to add that it has no place for things like the carry trade or a financialized economy of rich rentiers divorced from productivity and employment.

i don’t get it, we have 0 nominal rates, and by some measures of inflation (from the Austrians and people on the right-wing) we’re anywhere from 1-4% (hell, even higher…) annual.

That spells real negative rates.

It’s worth noting that Krugman and others have pointed out this fact, as part of the argument for why it’s silly not to borrow and spend!

So if that equilibrium does hold, then the critique that the situation as described by Krugman must be in disequilibrium is invalid.

Unless there’s a 3rd part to this which expands on the problem, it seems that there’s a case for the model being valid because we are still at an equilibrium point, and thus the IS-LM should still be a valid framework for analysis (it’s worth noting this framework is credited with surviving validity in explaining the financial crisis).

Look at Krugman’s original post:

Which brings us to the current state of affairs. Right now the interest rate that the Fed can choose is essentially zero, but that’s not enough to achieve full employment. As shown above, the interest rate the Fed would like to have is negative. That’s not just what I say, by the way: the FT reports that the Fed’s own economists estimate the desired Fed funds rate at -5 percent.

Krugman himself is implying disequilibrium because the economy cannot reach the desired interest rate or achieve full employment.

But that’s not the condition for equilibrium.

It’s not the desired rate of interest, it just has to be some point X that indicates negative rates to hold, which I would say there is ample evidence to support, even if it falls short of “desired” rates.

Chris,

Disequilibrium only means the quantity supplied cannot meet demand. Employment supplied cannot meet demand by the labor market, interest rates (liquidity, in Krugman’s opinion) cannot meet demand by financial markets because Fed policy cannot push rates into negative territory.

@Hugh

The financialized economy of rich rentiers have built the real economy.

Thats the fucking problem , its real – very real.

The final stage of this event , the post 1980 time period was one of credit hyperinflation rather then the previous mere inflation of assets.

It may not be nice but it has built real stuff.

That real stuff can no longer be serviced.

But the physical world it has built is very real.

The capital (wood or oil today) is gone yet the Easter island heads / burb housing remain.

Its over.

This is what civilizational collapse looks like.

Owning paper is not the same thing as producing anything. Rentiers do not produce. They extract.

The facilitation of production by provision of capital is about as important as the actual production itself, isn’t it?

If so, let’s crowd source it or something. Couldn’t do worse!

This Hicks model is irrelevant. Investment doesn’t depend upon savings. One prominent source of investment is corporate retained earnings, a second is bank lending. Both are largely independent of both savings and income.

Savers don’t have a liquidity preference. They have a risk tolerance. Financial markets offer a bewildering range of alternatives, and the only meaningful variables are return and risk. Savers are ‘return takers’ they cannot influence market rates.

The important investment variable is Fed policy. It can choke off investment by raising interest rates. I believe this last happened in 1981, and before that in 1966. As we have seen since 2008, the Fed cannot increase investment by lowering rates, but it can perform miracles with speculation.

I tried to say this twelve hours ago and had my comment vaporized.

“This is going to get me thrown out of guest-posting school!

Likely not, since the incorrect post wasn’t shaped like a gun.

You make the argument easier to understand. But Keynes was wrong on both points. The liquidity preference curve is a false doctrine in the first place & savings never equal investment either (as CBs loan out new deposits not existing ones).

Bankrupt you Bernanke caused the Great-Recession all by himself (regulatory malfeasance notwithstanding) — by conducting 2 separate contractionary money policies. He first drained legal reserves (RRs) for 29 consecutive months beginning Feb 2006. Then he drained the RR path (proxy for real-output), when the RR trajectory indicated there would be a recession in the 4th qtr of 2008 (forecast in Dec 2007), etc.

Note: Contrary to Friedman (& the Fed’s technical staff), the RR path has been a mathematical constant for the last 100 years.

Source: e-mail 11/16/06: “xxxx, this is an interesting idea. Since no one in the Fed tracks reserves…”

Hicks, late in life, repudiated his IS-LM theory. In a letter to Paul Davidson, he admitted that his views now were more consonant with Davidson’s than they were when he was younger. See Davidson’s The Keynes Solution for a short discussion of this. The letter itself Davidson says is in his paper archive.

How convenient.

I’m sure Krugman has the long lost letters of Milton Friedman renouncing the free market as well.

Hicks made abundantly clear he was dissatisfied with ISLM for anything more than perhaps establiahing certain causal relationships; otherwise he referred to the model as a “classroom gadget”.

http://static.ow.ly/docs/4537583_nbe.pdf

The structural alterations promulgated by Milton Friedman’s laissez-faire economics & the practices thereby engendered led to a melange of exscessively destabilizing price changes, especially of those assets, real estate, etc., which serve as loan collateral. The whole brew of ill-advised deregulation & regulatory permissiveness fostered an atmosphere in which greed seemed to triumph, expecially if a little fraud was diluted with a heavy dose of incompetent suepervision by the authorities & their examiners. We necessarily have regulated capitalism.

If we passed the House Democrats budget, we wouldn’t have to worry about the “0 bound” anymore and FED “QE” could be phased out.

The empire participants always believe the empire is all-encompassing, no matter what size it is. Warren Buffet is just an actor acting for other actors. What has changed, but the relative size?

http://www.nytimes.com/2013/03/13/business/john-j-byrne-dies-at-80-saved-geico-from-bankruptcy.html?_r=0

A number of you have already figured out that the assumption of equilibrium is not met in the IS-LM discussion. Hicks discusses this in the paper that Ben Johannson links to above. Good stuff!

Steve Keen does have the next segment (part 3) up at his debtwatch site as of 14March2013:

http://www.debtdeflation.com/blogs/2013/03/14/krugman-doesnt-understand-is-lm-part-3/

However he directs you to “business spectator” which requires registration, but it is free.

This particular part (#3) of the series is by far the most accessible and interesting so far. Can’t wait for the last part — #4 !!

Actually my contention was that the equilibrium does hold because we can observe real negative rates in the market, so it’s not necessarily a zero-bound that we’re held to because of the policy rate. Yes we’re at ZIRP, but there’s also observed inflation at various levels (the Austrians who insist that we’re experiencing huge inflation are one example). It doesn’t have to be “significant” as Keen says, only large enough to trump the nominal rate (not so hard when it’s zero, in order to generate negative real rates.

If there’s a part 4 then I will await a conclusion to the discussion.

First, as a layman, let me say that I do not believe in persistent economic equilibria in general, any more that I think that you can determine an equilibrium in respiration by holding your breath. (At least I hope not!) So I do not have a dog in this fight.

Second, even if Keen is right, and the economy is in disequilibrium, to me that is like saying that glass is a liquid at room temperature. That may be true, but so what? I don’t see the glass flowing. The economy has been acting like it is in a suboptimal equilibrium (or quasi-equilibrium, as I would like to say :)). We could easily have a lost decade or two.

OK, to the argument. After showing a diagram where investment at full employment intersects savings at full employment at a negative interest rate, Keen states: “But since the interest rate can’t be negative (the nominal rate – the real rate can be with significant inflation, but of course we don’t have that right now), there is disequilibrium in IS market.” Sorry, folks, that does not follow. What does follow is that there is not a **full employment** equilibrium in the IS market. Since we are far from full employment, that’s a big DUH, good buddy.

To which the rejoinder may be, a general equilibrium assumes full employment. Well, since powerful forces are arrayed against full employment, even in normal times, then everybody knows that the economy is never in general equilibrium. And since everybody knows that, what is the argument about? Given high unemployment, everybody knows that we are not in an equilibrium, so talk about equilibrium is only approximate, or a manner of speaking. BFD.

Now, Krugman does seem to be saying that we are at the intersection of the IS and LM lines, which is, and always has been, a high unemployment phenomenon, he seems to be talking about a non-full-employment equilibrium, whatever that may mean.

To me it ought to mean that small deviations from our current state should tend to return to that state. I do not know why that might be, but I would be very disappointed if there were no argument for that. Otherwise, I do not think that anybody would have used the term, equilibrium, to start with. If there is no such argument, pray let us know. Otherwise, Keen should deal with that argument.

Here is another way to show how the economy may be stable with a high unemployment rate without appealing to IS-LM. In a nutshell, excess saving cuts demand and causes the economy to shrink. But the shrinkage eventually ceases because unemployment prevents some people from saving and turns them into involuntary borrowers.

Consider a very simplified model where all profits are distributed so all income flows to individuals. If all individuals follow a policy of saving, say, 5% of their income, then the Paradox of Thrift kicks in and the deficit in demand causes the economy to shrink. This shrinkage causes unemployment as companies lay off the workers that they cannot pay.

Now the unemployed cannot save and, furthermore, must borrow or dis-save to survive. The borrowing can occur either directly, or indirectly, when the government borrows to make unemployment and welfare payments. Therefore as unemployment increases, aggregate borrowing increases, until it is large enough to absorb all of the excess savings. If the unemployed manage to maintain their standard of living, then an equilibrium will be reached with an unemployment rate of 5%, equal to the savings rate of the employed. Somewhat paradoxically, the lower the standard of living of the unemployed, the higher must be the unemployment rate to balance the savings.

At this equilibrium in this simplified model, 95% of people are gainfully employed just as before, but living side by side with the unlucky 5%. As long as the 5% savings policy is followed by the employed, there is no natural force which will tend to reduce the unemployment rate. Obviously it is possible to improve the realism of the model in many respects, but the basic mechanism remains the same.

This model makes it clear that a large measure of control of the situation lies in the hands of those entities with surplus income which they have chosen to save. At the current time, those entities include countries (like China) and companies (like Apple) as well as individuals.

Late again and probably useless, but I sense that MMT, as well as Keynesianism are suffering from false equivalence. That is, what the U.S. has done by propping up banks and asset prices is NOT Keynesian, it is elitism, based on an Aristocratic ideal – the wealthy became so by way of merit (they play the game best, don’t you know) and they are best able to put money and people to work. So, while incurring federal deficits to employ people is Keynesian, incurring public liabilities to protect the rich, is not. I would suggest that the champions of MMT spend at least as much time describing what it is NOT as defining what it IS.

Krugman: “I think it’s important to teach the IS-LM model as a starting point, because done right, it makes it clear that what we’re basically doing is the minimal model that has goods, bonds, and money […] Another point: it is really important, I think, to understand how liquidity preference and loanable funds can both be true at the same time; IS-LM is the way to do that. You also need IS-LM to talk about the hypothetical process by which price flexibility restores full employment, if only to point out how problematic that process is. And I think it’s useful for explaining the liquidity trap too, because it’s a way to make clear why, exactly, there is a zero lower bound on interest rates and what’s going on (or not going on) when you increase the money supply at that zero lower bound.

What Matt Rognlie is complaining about is the representation of monetary and fiscal policy, given the real world fact that central banks target the interest rate rather than the money supply. And there’s also the technical point that some economic issues, like describing the process of disinflation, are more easily described if you put in a central bank reaction function than if you just assume fixed M.

I guess my question is, why can’t we walk and chew gum at the same time? I like to introduce the subject with IS-LM as a representation of three-market economics, then say look, in practice short-run policy involves setting an interest rate target and adjusting M to get there […]. By all means, let’s be more or less realistic about actual monetary policy; but that’s about the nature of the thought experiments you do, not about the underlying model.”

Like, it’s a minimal model. The anti-Krugman obsession on NC is more than a little out of control. I know you guys feel disrespected, but try to rise above.

I have been checking out some of your stories and i can claim pretty nice stuff. I will surely bookmark your website.