Yves here. It’s been frustrating to see orthodox economists continue to invoke the Bernanke “saving glut hypothesis” as a significant driver of the crisis. That view was rebutted in gory detail in a 2010 paper by Claudio Borio and Piti Disyatat of the BIS, “Global imbalances and the financial crisis: Link or no link?” (see Andrew Dittmer’s summary here). Not surprisingly, the orthodoxy has chosen to ignore this paper (which also includes an important discussion about another bit of wrong-headed thinking, the failure to distinguish between the “natural” rate of interest and market rates of interest). The “savings glut” is still routinely mentioned in op-eds and papers by Serious Economists.

A new working paper by Junji Tokunaga and Gerald Epstein, “The Endogenous Finance of Global Dollar-Based Financial Fragility in the 2000s: A Minskian Approach,” builds on the perspective of the Borio/Disyatat paper and they are recapping it in a four-part series. Readers should find this to be a straightforward, persuasive discussion of an important topic.

By Junji Tokunaga, Associate Professor in the Department of Economics and Management, Wako University, Tokyo and Gerald Epstein, Professor in the Department of Economics, University of Massachusetts-Amherst, and Co-Director of the Political Economy Research Institute (PERI)

Global financing patterns have been at the center of debates on the global financial crisis in recent years. The global imbalance view, a prominent hypothesis, attributes the financial crisis to excess saving over investment in emerging market countries which have run current account surplus since the end of the 1990s. The excess saving flowed into advanced countries running current account deficits, particularly the U.S., thus depressing long-term interest rates and fueling a credit boom there in the 2000s.

According to this view, the financial crisis was triggered by an external and exogenous shock that resulted from excess saving in emerging market countries, not the shadow banking system in advanced countries which was the epicenter of the financial crisis. Instead, we argue that a key cause of the global financial crisis was the dynamic expansion of balance sheets at large complex financial institutions (LCFIs) (Borio and Disyatat [2011] and Shin [2012]), driven by the endogenously elastic finance of global dollar funding in the global shadow banking system.

The endogenously elastic finance of the global dollar contributed to the buildup of global financial fragility that led to the global financial crisis. Importantly, the supreme position of U.S. dollar as debt-financing currency, underpinned by the dominant role of the dollar in the development of new financial innovations and instruments, and was a driving force in this endogenously dynamic and ultimately destructive process.

Part 1: Global financing patterns in the 2000s

The Growth of Global Imbalances

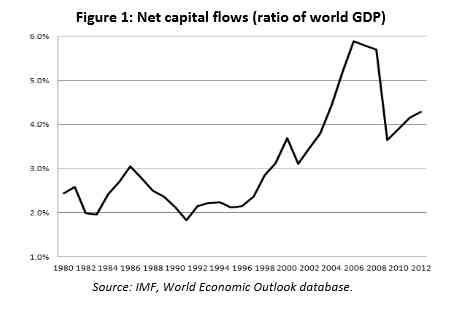

In the wake of the global financial crisis, many economists and policymakers have drawn attention to the role of global capital flows as a key factor contributing to the global financial crisis. A prominent view is the global imbalances hypothesis, which focuses on the growing imbalance in world current account position. Since the end of the 1990s, emerging market countries, predominantly in emerging Asian and oil-exporting countries, had run account surpluses, while some advanced countries, such as the U.S., had expanded current account deficits. A growing imbalance in world current account positions emerged in which emerging market countries were consistent providers of net capital flows, and the U.S. was a primary net consistent recipient. Figure 1 demonstrates the absolute value of net capital flows, which mirrors the imbalances in world current accounts, as a percentage of world GDP since the 1980s. A sustained increase in net flows started in the second half of the 1990s, particularly the 2000s, and peaked to around 6.0 percent in 2006 before the start of the financial crisis.

The global imbalances view attributes the global financial crisis to a substantial excess of savings over investment in emerging market countries that mirrors their current account surplus.[2] According to this view, these “excess saving” flowed into advanced countries that ran current account deficits, particularly the U.S., thus depressing long-term interest rates and fuelling the credit boom there. Accordingly, this global imbalances view conjectures that the main macroeconomic cause of the global financial crisis is an external and exogenous shock that resulted from excess savings in emerging market countries, not the shadow banking system in advanced countries that was the epicenter of the financial crisis.

The Expansion of Gross Capital Flows

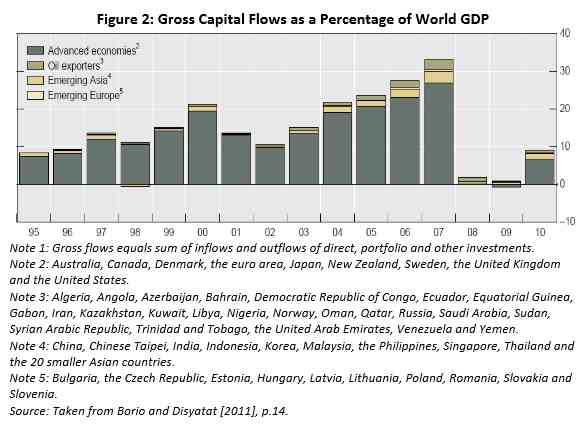

Recently, some mainstream economists and policymakers suggest that net capital flows, which mirrors the global imbalance, are much less important than gross capital flows (inflows and outflows) for understanding global financial instability in the 2000s, as emphasized by Borio and Disyatat [2011], Dorrucci and McKay [2011], Obstd [2012] and Shin [2012]. Figure 2 plots gross capital flows as a percentage of world GDP since the last half of the 1990s. Gross capital flows, most of which consist of flows among advanced economies, rose from about 10 percent in 2002 to over 30 percent in 2007 prior to the financial crisis, and collapsed during the financial crisis, while net capital flows increased from 3.1% in 2001 to 5.9% in 2007, as shown in Figure 1.

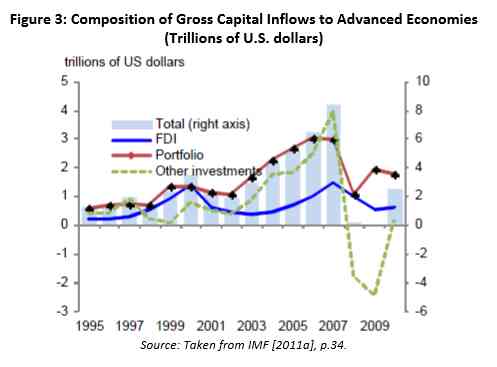

Remarkably, gross debt-financing flows have driven the expansion of gross capital flows. Figure 3 demonstrates the composition of gross capital inflows among advanced countries. Portfolio and other investment flows, which mainly reflect banking flows, were extremely volatile in comparison with foreign direct investment (FDI) and equity investment.[3] Thus, it appears from the observations of global financing patterns presented in this section that gross capital flows, particularly gross debt-financing flows, were likely more important than net capital inflows that the global imbalances view draw attention to understanding the global financial crisis in the 2000s.[4]

The majority of gross capital flows were conducted by a handful of large, complex financial institutions (LCFIs) at the center of the global financial system.[5] The process of financial deregulation and consolidations among financial conglomerates spurred a growing convergence between the activities of the banks and the other financial institutions since the 1990s. The development led to the emergence of LCFIs in the U.S. and Europe, which dominate the global financial markets for debt and equity securities, syndicated loans, securitizations, structured-finance products and OTC derivatives.[6] Our analysis will suggest how gross capital flows had expanded in the 2000s, emphasizing the key role of the US dollar, as LCFIs increased their balance sheet on a global scale before the financial crisis.

Notes

[2] Bernake [2005], the most prominent proponent of this view, refers to this phenomenon of excess savings as the emergence of the “global saving glut”. The global saving glut consists of excess domestic savings over investments in emerging Asian countries, oil-exporting countries and some advanced countries.

[3] IMF [2011a], p.32.

[4] The U.S. played a central role in the expansion of gross capital flows. Mainstream economists and policymakers argue that the U.S. has been playing the role of “global financial intermediary” in gross capital flows since the latter 1990s. Gourinchas and Rey [2005] point out that the role of the U.S. changes from a ‘world banker’ to a ‘venture capitalist of the world’ since the 1990s. As Milesi-Ferreti, Strobbe, and Tamirisa [2010] analyze, U.S. gross capital inflows and outflows expanded vis-à-vis the euro area and offshore financial centers (OFCs) such as the U.K. and Caribbean offshore financial centers (pp.15-16).

[5] IMF [2010b], p.8.

[6] Wilmarth [2009], pp.994-95. By 2007, sixteen large complex financial institutions (LCFIs)—including the four largest U.S. banks (Bank of America, Chase, Citigroup and Wachovia), the five largest U.S. securities firms (Bear Stearns, Goldman, Lehman, Merrill and Morgan Stanley), and seven major foreign universal banks (Credit Suisse, Deutsche, Barclays, RBS, HSBC, BNP Paribas and Societe Generale) collectively dominate the global financial system (Wilmarth [2009], p.994). In addition, FSB [2011] identifies an initial group of “Systemically Important Financial Institutions” (SIFIs), namely 29 global systemically important banks (G-SIBs).

The mainstream will always choose the explanation that attributes problems to an unpredictable and unique “shock” rather than explanations that see problems as emerging organically from the fundamental nature of capitalist finance.

And all the better if the “shock” can be traced to some far off “emerging market” and thus blamed on the unenlightened habits of third-world residents, rather than looking in the mirror for the source of our problems. “It’s those damnable Asians and their over-savings!” not our fraud-riddled financial system and our addiction to cheap credit (partially, if not largely, driven by insane amounts of economic inequality right here at home).

Dead right Dan. Read the new Piketty book on the logic of capitalism and inequality. Here’s a review: http://mpra.ub.uni-muenchen.de/52384/1/MPRA_paper_52384.pdf

Savings glut… Imagine that glut if 2/3 of the developed world had actually saved up for retirement! But if everyone had saved up, maybe GDP would have been smaller… but then wait, savings would have not occurred because of lower income… LOL!

Our world leaders are oblivious to their contradictions.

Our debt is not generating GDP. We’ve created a system where everyone’s goal is becoming a rentier and living off other workers.

So how did this imbalance accumulate? “Slowly at first and then suddenly?” Just by financing and leverage for 10 years? The Great Financial Credit Bubble. Could any amount of capital investment by corporations have offset any of this? Why doesn’t capitalism address the danger of geometric expansion when credit goes exponential …

This is fairly readable, speaking as a regular civilian, but I have to admit it’s hard to be sure what exactly is included in the net vs. gross charts. I think I get the gist of the author’s point, just find the charts a little opaque.

the imbalances meme is usually yoked to the “need for safe assets” meme of Caballero and Gary Gorton and the heroic efforts of Wall St to manufacture these desperately needed safe assets via securitization. Gary Gorton really is an awful AIG-paid hack somewhat on the level of Hubbard in the annals of well-paid hackery/quackery and we really need someone to eviscerate his hackery.

Looks like a very insightful series and looking forward to the remainder.

I like the emphasis on the credit backed shadow banking system and seems to resonate well with this analysis..

“”1.2 Summary of the Crisis Response and Consequences: A Review of Findings Presented Last Year

a. Liquidity or Solvency Crisis?

It has been recognized for well over a century that the central bank must intervene as “lender of last resort” in a crisis. Walter Bagehot explained this as a policy of stopping a run on banks by lending without limit, against good collateral, at a penalty interest rate. This would allow the banks to cover withdrawals so the run would stop. Once deposit insurance was added to the assurance of emergency lending, runs on demand deposits virtually stopped.

— However, banks have increasingly financed their positions in assets by issuing a combination of uninsured deposits plus very short-term non-deposit liabilities. Hence, the GFC actually began as a run on these non-deposit liabilities, which were largely held by other financial institutions. —

Suspicions about insolvency led to refusal to roll over short- term liabilities, which then forced institutions to sell assets. In truth, it was not simply a liquidity crisis but rather a solvency crisis brought on by risky and, in many cases, fraudulent practices.””

and understanding these dynamics for the near future can be very important..

“”These “too big to fail” institutions are seen by some as “systemically dangerous institutions”—often engaged in risky and even fraudulent practices that endanger the entire financial system.””

“”If we are correct in our analysis, because the response last time simply propped up a deeply flawed financial structure and because financial system reform will do little to prevent financial institutions from continuing risky practices, another crisis is inevitable—and indeed will likely occur far sooner than most analysts expect.””

http://www.levyinstitute.org/pubs/rpr_4_13.pdf

“another crisis is inevitable”

Certainly it is. Crisis is a dominant feature of the system. Think of it as a harvesting tool, like an industrial combine for an agricorp wheat field.

Even on lesser scales, sophisticated financial profit-maximizing techniques are predicated on systemic instability, which is therefore cultivated. The famous example of Goldman Squid setting up Greece to fail is only one of many. Instability enables the instigation of wars and other conquests for resource control. It drives risk premiums and price increases, ruins competitors, creates desperate victims, and forces bailouts. It’s really rather common, but that’s just the background noise.

Crisis is what has enabled TPTB to vastly increase their wealth and power over the last forty years until now their control is fairly total. They themselves come out not only unscathed but are hugely paid by their victims for burning them. They can hold whole populations hostage to threat of an engineered collapse so that ‘regulation’ is lame PR and none can touch them. Governments have laid down and become their proxies: the U.S. alone pays them a trillion in tribute per year to delay their next disaster. The results of the 2007 meltdown have been gloriously profitable, and the next promises to be even moreso.

The Law of Diminishing Returns is going to kick in on them at some point – there’s very little left in the way of wealth not already owned by the wealthy. They’re going to to have to financially do in a lot more of their own class this time around in order to realize gains or acquire “cheap” assets. That just might open up a breach within the elite itself if they get too greedy.

our friend (/sarcasm) Adam Davidson pitched this hooey as well, on a very popular This American Life :(

Having never bought into the Chinese glut theory, as evident Wall Street/NYF/Fed/Admin criminality sufficed, I have to wonder how “gluttists” who’ve demanded China “spend” away the “imbalance” on consumption have to say? How about Krugman? Where’s Geithner? Oh, and, please admit for this discussion the odd utility of the word “imbalance” to describe these capital flows, though held suspect elsewhere in the NC converse.

Is there anything meaningful in the relationship between the expansion of gross capital flows (up 200%) vs net capital flows (up 100%)? Is a limit implied with the numbers for gross capital? Could there be a rate of flow beyond which a system failure is certain?

And a final question: has anyone ever attempted to understand economics and its data the way engineers do to understand how their plant operations are working? Visible flows, distinct colour for each data stream, brightness indicates level of activity, at whatever scale, micro to global. Mathematics is not reality. Neither are words. Have we used all of our mind’s tools to look at these problems?

I just found this blog and I am amazed at the amount of accurate and forthright information found here. Not only is ECONNED and Yves a breath of fresh air, but I particularly like the piece by Junji Tokunaga and Gerald Epstein. The “over saving Asians” is true, capitalists are just trying to work out a better way to get them into the credit markets and into debt. We all know WHO the shadow banking systems are run by and YES they try to find anyone else to blame for the global crisis. Like Fukushima’s melt down, it will all be ignored since it is “over there”.

I look forward to the rest of the series, especially the savvy responders and their comments. There may be hope in this world after all………….maybe.