By Philip Pilkington, a writer and research assistant at Kingston University in London. You can follow him on Twitter @pilkingtonphil. Originally published at Fixing the Economists

Piketty’s Wikipedia page says that he’s a Keynesian. Well, I don’t see it at all. His book contains a section on the public debt in historical perspective and it is desperately misinformed.

A caveat first though: I actually like Piketty’s book in a lot of ways. While not extremely well written, it is highly readable (if you are an historical data sort of person). And it is very nice to see what is effectively a work of economic history get so much play. Because economists should be far more interested in reality than in modelling and this book could spur that interest.

But the history presented in Piketty’s book is selective and, I think, ultimately untrustworthy. Even the way he chooses to present data — both in terms of the averaging of the time periods and aggregates used — is often quite misleading. I don’t want to get too far into this here but I’m pretty concerned that people who are broadly ignorant about economic history are reading this book and coming away, in many ways, misinformed.

Anyway, let’s deal here with one issue; namely, that of how Piketty treats the public debt. He discusses two countries: Britain and France. Both of these countries ran up massive debts in their late-18th century wars (mainly with each other!). France pretty much cleaned its slate during the French Revolution through a combination of partial default and sustained inflation. But Britain carried its debt into the 19th century.

Piketty takes a sort of crude socialist view of the debt as a tax on society. He sees it — as Marx did too, mind you — as a means to redistribute money by taxing goods and services bought by workers in order to pay rich rentiers. He tells us, for example, that in Britain the owners of the debt were obtaining fairly high interest payments. I don’t really see the rates of interest in these years as being particularly high. They basically fluctuated just below the 5% mark.

Frankly, I’m a bit wary of Piketty’s interpretation of the taxation system in this time period. He seems to hold a very narrow view in that he seems to think that the taxation system is merely a means by which redistribution takes place and in this period that redistribution is from poor workers to rich debt holders. While this is one function of the taxation system, it is not the only one. But in this chapter Piketty pretends that it is. This is altogether not very Keynesian.

He also notes that Britain had fiscal surpluses throughout this era.

For an entire century, from 1815 to 1914, the British budget was always in substantial primary surplus: in other words, tax revenues always exceeded expenditures by several percent of GDP—an amount greater, for example, than the total expenditure on education throughout this period. (p200)

Piketty views this from the perspective of rentiers sucking wealth from the population in the form of taxes. In some sense this might be true — although I really doubt that interest payments on government debt were a key component of inequality in 19th century Britain, as any cursory reading of the history of the industrial revolution will confirm. But I suspect it is misleading in terms of the wider picture. In fact, Britain was very likely running a budget surplus in this era because, being the workshop of the world and penetrating colonial markets, it was running large trade surpluses (Piketty notes this elsewhere in the book but fails to make the connection).

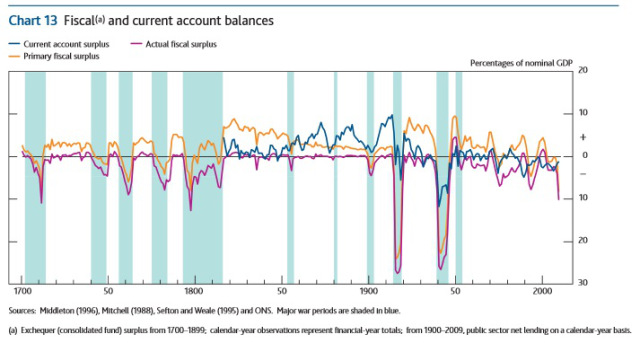

Update: Phillipe has kindly linked to a Bank of England paper in the comments section entitled The UK recession in context — what do three centuries of data tell us?. It provides us with the data on the current account and the public fiscal balance for this period. As can be seen from the graph below the current account was indeed in substantial surplus for the entire 19th century. This was probably the main component of the fiscal surplus, just as simple logical deduction would lead us to assume.

At the same time the Industrial Revolution was roaring and the private sector was probably investing heavily. Thus it is not a big surprise that the government was running a budget surplus for much of the 19th century. After all, that is what the sectoral balances identity would tell us. And since unemployment was very low in this era the combination of a large export surplus and high domestic investment probably required the public sector to run a surplus. Yes, the tax could have been imposed on, say capital gains, rather than on workers, but come on… this was 19th century England!

This sets the stage for the moral tone that Piketty takes with regards to the public debt for the rest of the section. He notes that it is inflation which kept the public debt levels down in the 20th century — even when they spiked after wars. He seems to equate this with the borderline hyperinflation initiated by the Jacobins and thinks of it as a sort of partial default. I think that this is deeply misleading.

In fact, people who hold government debt are used to such levels of inflation — Piketty is, after all, only talking about an average rate of 3% inflation a year in the era spanning from 1913-1950. This leads him to come out sounding like an Austrian warning about the impending doom if some inflation is maintained. I will quote him in the original here:

Second, the inflation mechanism cannot work indefinitely. Once inflation becomes permanent, lenders will demand a higher nominal interest rate, and the higher price will not have the desired effects. Furthermore, high inflation tends to accelerate constantly, and once the process is under way, its consequences can be difficult to master: some social groups saw their incomes rise considerably, while others did not. It was in the late 1970s—a decade marked by a mix of inflation, rising unemployment, and relative economic stagnation (“stagflation”)—that a new consensus formed around the idea of low inflation. (p203)

There’s lots of this sort of unsophisticated stuff in Piketty’s book. And it seems to me likely that this is because, in some ways, the book is a mess owing to a lack of a solid macroeconomic framework. I only take the example of public debt because I know that many of my readers will be all to familiar with this silliness and will be immunised against such thinking.

The more I read Piketty the more I see him as synonymous with the Hollande government in France; proposing taxes at a time when these would ruin the economy while maintaining very mainstream opinions on the role of the public debt in the economy.

Again, I like Piketty’s book overall but I really don’t think his macroeconomic credentials are up-to-scratch. This leads to a lot of silly sections and a lot of misleading interpretations. If you’re not fairly familiar with economic history and don’t have a good grasp of basic macroeconomic principles, I suggest that you handle this book with care. I suppose that warning would apply to the vast majority of working economists too. And for that reason I find it very unlikely that Piketty’s book will have much of a theoretical impact.

Much more likely that various people will cast various contradictory interpretations of the accounting identities that Piketty refers to, rather grandiosely, as ‘laws’. Thus, Piketty’s should be seen as one of those books that will open discussion on a topic without much contributing to it. His accounting identities — like the r > g identity — provide a sort of blank screen upon which commentators will be able to project whatever theory they have concocted with regard to the cause of inequality.

This will likely give rise to an academic industry ruminating on such questions — indeed, such already seems to be taking place and I think that it is the exodus of major figures like Krugman into this new land that has led to the media hype surrounding Piketty’s book (even academics do PR!).

For those of us interested in the study of inequality this is wonderful. Although expect a debate that has been taking place behind the scenes in a very focused manner to quickly become filled with sludge as every crackpot economist puts forward their little model explaining, in one fell swoop, the rise of income inequality while simultaneously handing us the silver bullet to rid us of it.

No questions, your honour.

Errr…. Piketty’s book IS having an theroetical impact. You may regard Piketty’s work as somewhat childish, but it took a child to show others that an emporer has no clothes.

Piketty’s work will have no impact whatsoever. As though the powerful just needed to be convinced by good argument and will now devote themselves to equality, justice and sustainability.

Great sympathy with both these statements. Actual work as a union rep soon makes this clear. I’ve seen Piketty’s work for years and a mass of sociology/psychology/philosophy/history. And all the time we have been going backwards against corporate propaganda.

@Ben Johannson

It’s not an issue of persuading the upper classes that they are wrong. Any socialistic endeavor is to help facilitate the class struggle and combat the inequality that the privileged classes inevitably create.

“When power is robbed of the shining armor of political, moral, and philosophical theories, by which it defends itself, it will fight on without armor; but it will be more vulnerable, and the strength of its enemies is increased.”

Nor is your pessimistic attitude about Piketty’s impact entirely valid as there will be people who recognize the presence of injustice in any society and act accordingly.

“There will always be individuals in the more privileged classes who will, by force of rational and moral idealism, identify themselves with the less privileged classes and fight their political battles. But the number of these will probably always remain limited.” -Reinhold Niebuhr, Moral Man and Immoral Society

Piketty was Segolene Royal’s economic adviser when she was Socialist Party candidate for the presidency of France.

It is possible he is trying to mellow the image that he was a hard-core socialist in nature. Which is not necessarily the way he presents himself in France.

He has taught Economics in the US, which needs badly the notion of Social Justice to seep in and install itself. If his book underscores that need, so much the better.

It is certainly a New Dawning for most Americans, who think almost uniquely in terms of Civil Law and its accent on protecting property. The result is, I submit, dangerously exaggerated Income Disparity that makes life in the US more Darwinian than need be.

It was originally written in French. Blame the translation on the translator, if you like.

I wonder if Piketty had to stand up when Her Royal Highness came into the room? http://www.theguardian.com/commentisfree/2014/apr/25/your-boss-rules-office-french-minister

I got this comment from Mark Ames by e-mail when the book was first released:

Curious if Piketty is taken as seriously as a radical thinker in his home country as he is here. I asked a longtime friend of mine in Paris – a well-known writer and translator of American and Russian for a big French publishing house (Mailer, Limonov, etc). He hadn’t heard of Piketty. I told him Piketty is shaking up official economics discourse here in the US. Next day, my friend wrote back savaging Piketty as the worst sort of of co-opted fake French leftist insider, who threatens no one and keeps the Socialist Party scam going under yet another rhetorical guise.

Maybe Piketty’s usefulness here is making Marx palatable to American liberal middlebrows—I think Connor Kilpatrick made that comment recently.

“Piketty is, after all, only talking about an average rate of 3% inflation a year in the era spanning from 1913-1950.”

Only 3%? Why, that’s chicken feed!

“Remember, it’s not how many dollars (or Euros, or whatever) you have — it’s what they buy!

The problem with “inflation” isn’t the one-time hit. It’s that such rates are compounded. Over 30 years a “mere” 2% inflation rate costs you nearly half — 45% approximately — of your purchasing power. […]

Does deflation make it harder to pay debts? It sure does. So what? Debt, in the general sense, is bad. It is only “good” when it permits you to grow output fast enough to pay the service costs and retire the debt at the same time. In all other cases it either simply pulls forward demand (in which case it does nothing) or it allows you to temporarily (but not permanently) live beyond your means, which is manifestly bad because when you stop doing that you must then live below your means to pay it off!

Making debts harder to pay isn’t bad, it’s good for the simple reason that debt in general is negative for society as a whole. It’s very profitable for the people selling you the debt, of course, but that’s not the test; one must look at the impact on everyone, not just the favored few.

Inflation cannot be “weak”, in point of fact, as it should be non-existent over time.

Absent intervention in the economy the natural process of price is mildly deflationary. That is, over time the natural progress of mankind improving process and procedure through technology results in a lower price for a given unit of “stuff.”

That’s demonstrably and provably positive for society as a whole: Having to work 5 hours instead of 10 to pay for your weekly food intake, or 1,000 hours instead of 2,000 to pay for a car is positive for the vast majority of the people in the economy.

It is only the debt merchants that want things the other way around.”

http://market-ticker.org/akcs-www?post=228925

Making debts harder to pay isn’t bad, backwardsevolution

Yes it is! Especially when people are driven into debt via a government-backed/enabled/enforced credit cartel. And making a debt harder to pay after the loan is made is surely immoral if not illegal.

Go on over to mises.org or LewRockwell.com if you’ve become a deflation-loving misery merchant. You’ll only get pelted here and deservedly so!

F. Beard – “Go on over to mises.org or LewRockwell.com if you’ve become a deflation-loving misery merchant. You’ll only get pelted here and deservedly so!”

Never been on their sites, and only once on Krugman’s. Deflation-loving misery merchant? What, versus an inflation-loving, something-for-nothing, abracadabra merchant who wants to rob people who have worked hard? And people are “driven” into debt? Really? Didn’t they fall for the lies and drive themselves there? How silly.

I like what “ewmayer” says at the bottom of the comments section:

“Phil, why did you not immediately follow this with the simple math it implies? Namely, 0.97^37 = .324, i.e. a devaluation of over 2/3. And that assumes the 3% is not being deliberately and persistently understated by the entity(ies) publishing the related data. If the real average rate over that span is in fact a mere 0.5% higher, we have a devaluation of roughly 3/4. A mere 1% higher yields a devaluation of over 80% over 40 years, roughly the working-career span of an average person in a developed country.”

And people are “driven” into debt? Really? Didn’t they fall for the lies and drive themselves there? backwardsevolution

When a government sponsored counterfeiter is lending the choice is borrow or be outbid by those who do borrow, assuming one is creditworthy, which not so long ago included being white.

Yes, theft by inflation occurs but so does theft by deflation. Government-backed credit creation is liked a barbed arrow – pulling it out just makes the wound worse.

Normative hogwash and moral blather, lacking any understanding of money, debt, accounting or anthropology.

It’s immoral blather since deflation is every bit a means to steal as inflation is.

But if you think “Thou shall not steal” ITSELF is blather then there’s a place for you if you don’t repent and it’s very unpleasant and not cool in any positive sense of the word.

Ben, Ben, the bankers’ man!

2% inflation:

“2% inflation is the Fed target, and it’s ok. Really? First, despite the Fed’s “target” the realized inflation rate measured by the government’s intentionally-flawed method (in which they “adjust” for all sorts of things) is closer to 3% than 2%. But even if it wasn’t — over 45 years (the average working life — age 20 to 65) this would mean that a saved dollar when you’re 20 is worth only 41 cents! At the realized rate it’s worth 26 cents. Why isn’t this pointed out? Because there would be a literal revolution by morning if it was; the very precept that the government and Federal Reserve, along with banks, have designed and implemented a policy to steal three quarters of your earnings power over your working life would likely result in literal hangings. This, of course, is why they don’t tell you that.

The very same compounding happens everywhere else too where a percentage rate per year is specified. Whether it’s GDP, price inflation or whatever, that’s the result. The very belief that it’s ok to increase taxes (say, your property tax, for example) by a “mere” 3% a year means that over the 18 years your child lives in that house from birth to graduation your property taxes go up by 70%. That’s nearly a double! Stay until retirement (again, 20 -> 65) and those property taxes rise to a staggering 378% of what they were when you bought the house. Would you put up with that “mere” 3% rate if you understood this? Oh hell no!”

http://market-ticker.org/akcs-www?post=228932

In saying that a dollar earned now is worth only 45 cents, you can only mean a dollar shoved under the mattress. Why on Earth should your dollar earned 45 years ago entitle you to a dollar’s worth of goods now if it wasn’t invested in something productive in the meantime ? And it’s not just inflation that compounds at 3% a year, it’s GDP and productivity too. So understanding that NOMINAL taxes are going to be 378% higher in 45 years but that this says nothing about the REAL burden of those taxes, I do say “hell yeah” to inflation of a mere 3% a year.

Bravo!

Money should not gain value over time but neither should it lose value either.

I absolutely second Ben Johannson.

‘Why on Earth should your dollar earned 45 years ago entitle you to a dollar’s worth of goods now if it wasn’t invested in something productive in the meantime?’

Man, we’ve come a long way from the French peasantry running John Law out of town when he devalued their currency. They promptly saw Law’s actions as theft.

Your question is like crime-inured New Yorkers of the 1970s, asking, ‘Why should I expect my car to be there in the morning when I park it on the street?’

Because you have a right not to be preyed upon by thieves, particularly government-sponsored ones who are supposed to protect us from theft.

The peasantry of pre-revolutionary France much like the peasantry of today were in no position to accumulate financial assets. It’s not the man who empties his wallet between payday and payday who is hurt by single digit compounding annual inflation. Those who are in the position to accumulate financial assets can reinvest in the economy if they want to maintain the value of those assets. If, on the other hand, they are unwilling to take that risk then its hardly theft when over the long haul those financial claims to real production diminish to nothing.

Take risk or lose it – that sounds like how privatized Social Security will work.

What happened to the guy who hasn’t believed in the economy since the 1970’s because he didn’t like the way the economy was contributing to global warming and thought less consumption was preferred over green technology? His money should be nothing now.

Take risk or lose it – sounds good. A guaranteed return on financial wealth (which is what deflation amounts to) is the purest possible form of rent-seeking. Social security should of course be entirely public – put in 40 years at work, get a guaranteed percentage share of GDP 40 years down the track after you retire, whatever that works out to in nominal and real terms.

I don’t know about the guy who didn’t believe in consumption in 1970. If he went and lived a self-sufficient life on a farm then I don’t see how he accumulated any money. If he worked 9-to-5, 5 days a week, and put most of his wage into green tech then I honestly hope he made a killing and is sitting on millions of dollars worth of stock. If he put most of his wages into the bank, then those reserves likely as not backed a car loan or something equally environmentally unfriendly. Purchasing power transferred and wasteful consumption not decreased.

So what you are saying is that if your money is not making more money it will eventually go away. Also known as “greed is good”.

We have created a monster and instead of doing away with the monster we vilify the monsters victims.

Exactly the opposite. Money that is solely used to make more money (the M->C->M’ of financial capitalism) should go away. Ideally I’d like a post office bank which guaranteed deposits and paid no interest but indexed deposits to inflation. Government deficit spending unlinked to bond issuance. All private financial assets completely un-backstopped.

No need to index deposits to inflation; just eliminate all privileges for the banks, reduce fiat to legal tender for government debts only, and allow genuine private currencies for private debts only.

Then the monetary sovereign ITSELF will have a strong incentive to spend wisely and adequately tax or ELSE watch their government salaries decrease in real value.

It’s about ethics not pragmatism.

It’s pretty much a given that private currencies unguaranteed by government won’t trade at par. The idea of carrying around a spreadsheet and a stock ticker 24/7 to work out how much a hundred Walmart dollars are worth relative to a hundred Citibank dollars and how to make change in 5 or 6 other different flavours of dollar doesn’t appeal.

Then use fiat for all your debts.

The private currencies serve to keep the monetary sovereign honest wrt using inflation to tax by stealth.

Be lazy like me; I rarely shop around for the best price because I know others do so I, personally, would probably stick to fiat myself, knowing that the government had a strong incentive to spend and tax wisely.

Actually, when you think about it, the value of money should decline over time for most goods and services…

You have 2 choices with your money: keep it or spend it. If you bought a car 45 years ago and parked it outside to only retrieve it 45 years later when you needed it, it would not look the same. Same thing with most assets because there is maintenance/depreciation… and if you decide not to spend your money and keep it for future use, you are asking others to pay for the maintenance. It is not logical to expect a better outcome within those 2 choices by choosing the option of no work.

Don’t forget, there are 2X more people than 45 years ago vying for a shrinking pool of resources.

So I guess what you are saying, despite every definition I’ve ever read regarding “money”, is that money is NOT a “store of value”?

It’s one thing to say that money should be a store of value from now until a week next Tuesday. It’s a very different thing to say money should be a store of value decades down the track.

Time creeps into the store of value thing. Anyone familiar with modern book-keeping and inventory management knows what Moneta is saying here. It’s a discounted cash flow thingie. Assets must be sweated, so the parked car (or even one in use) is capital, hypothecated to further investment – one can imagine running a business on a loan based on the car as capital, with the loan actually a set of roll-over repos. Of course, if the business fails they tow away the car. I over-simplify to the extreme. Think from the other end, maybe, with just-in-time accounting You don’t want inventory you have paid for sitting about like Moneta’s car (you bought on credit and are paying interest), you want that inventory in your own sales asap. Of course the guy selling you inventory is happy if you buy it two year’s ahead of time. And once everyone is using JIT it ceases to be a competitive advantage (except it’s a power game).

Inflation is a power game too. We have money all wrong.

We have money all wrong. Gold as money (private joke) retained its value or appreciated in exchange value for other goods for most of history. When people talk about money, thinking about gold as money, inflation feels like coin-clipping (shaving gold off the edges to debase its “value.” Our money has nothing to do with gold as money. In fact, manufactured by the yard out of keyboard key-strokes in central and commercial banks, it has little to do with anything in the real world in many regards, divorced by policy from any such tangible, concrete relationship.

Money, what is money?

It means different things to different people and in fact, can possibly be different things to the same person, depending on the circumstance or the mood.

It’s hard to find something more versatile.

But whatever it is, you don’t find it in free, paleolithic hunter-gatherers.

I am not at all confused about what money is. If you have any $1,000 bills laying around that your not using, send them on and I will.

Mr. I. Wana Loafe

PO box 9

Upper Sofa, Vulgaria

Planet 9

Outer Space

I agree it’s easy with imperial money.

The problem comes when you find $1000 pre-Mao Nationalist Chinese paper money.

The postage to Planet 9 is more expensive than that money.

No it didn’t. Every time someone discovered a new gold mine, the value of the currency dropped. The US panics of the 19th C were rife with that. Just look at the value of gold over the last four years alone. You lost your shirt if you bought gold at $1900/ounce and needed to cash it in.

Just like a house is a store of value… there is depreciation and then there is trust. The store of value is an asymptotic goal, thus not a guarantee.

Economics books all have good and bad insight. The trick is to know how to separate the wheat from the chaff. Not easy!

A haircut 45 years ago is not equal to a haircut today because a hairdresser has to incorporate the vagaries of her material world into the price of her service: rent, scissors, competition…

Putting money away for your children’s education is hardly shoving it under the mattress.

“Why on Earth should your dollar earned 45 years ago entitle you to a dollar’s worth of goods now if it wasn’t invested in something productive in the meantime?”

You must be another banking shill, bought and paid for. Own any assets, an old house, old car, old jewelry, old coins, anything? I’ll tell you what, I’ll buy them from you right now for what you paid for them, nothing more. How dare you think you should get appreciation for YOUR assets! After all, they’re just sitting there doing nothing.

Sold! Provide your address and I’ll be right over to pick them up.

ok, backwards, have I got an old car for you. I bought my 1999 Honda Civic new at the time for $11,000. It now has 125,000 miles on it. It’s very basic, no ac, no stereo, stick shift–but does get 34 city, 44 hiway MPH. I like it for the mileage since i commute 30 miles a day, and plan to keep driving it…unless i can find some fool to pay me $11 grand for a 15 year old car that was as cheap as you could get in 1999.

Send me your address and I’ll send you mine, and then you can send me a check for $11,000 for it. Try thinking about this example carefully, and see if you can realize what’s wrong with your take.

Hint: dollars may be worth less now, but we have a lot more of them…we call it a “wash”… Those who have invested their dollars have received interest or dividends on them, so also a wash. Those who have let them sit under the mattress have the equivalent of my Honda. By all means buy all the old cars you can for their original price–most people with such cars could use the money (unlike me; I have plenty of money, but am just frugal…though I guess that’s one reason I have plenty of money!)

Paul Boisvert – had to rush off to get the kids, so didn’t word things correctly. Of course that’s not what I meant, but I think you know that.

Glad you’ve got lots of money, Paul.

nope, no idea what you meant, other than the completely false idea that you explicitly promulgated. I can certainly sympathize with the notion that in desperate haste, you wrote an insane comment–it’s far less worrisome than the notion that you actually believe what you wrote.

Inflation is not a problem for society in general. It is a problem for certain people in society, because we distribute income to certain people in society in unfair ways. But that’s a political choice (which I oppose)–correct the unfair distribution, and modest, routine, single-digit inflation would not be a problem for anyone. They would have higher prices, but more money with which to pay the prices. Again, we call it a ‘wash’…

Once you have picked up the kids, try writing the correct words, and perhaps it will become clearer (to you and to other readers of the blog) what you “mean”. But don’t get your hopes up–any position claiming that routine inflation is a problem per se is doomed to failure.

Instead of looking at it in terms of money, let’s look at it in terms of resources and energy…

In Canada a car lasts maybe 10 years… so that would be maybe 10% depreciation. A furnace now lasts maybe 15 years (instead of 25-30 yrs), so depreciation = 6.6%. Let’s say a washer is 7 years = 14% (instead of 25 yrs). A roof maybe 15 yrs (instead of 20-25) = 6.6%. Most clothes last 1 year (instead of a few) = 100%.

Look at the closets in the houses of the 50s… In the 60s, when they were spending on infra which had a life expectancy of 50-100 years, depreciation = 1-2%.

Then they tell us that inflation is 2%. LOL! You know something big will happened over the next decade or two just looking at the choices we are making in terms of depreciation rates.

We will be having trouble maintaining essential stuff that lasted 50-100 years… imagine the stuff that is meant to last less than 10 or 15….

That we need a different way of accounting is clear, unless you want to exclude what is needed in order to do economic argument. It’s a bit like building a fleet of wooden ships to conquer the world, based on finding a bit of British history in a bottle on an as yet untouched island. Mind you, I had a neighbour who built a concrete one (honestly) to escape his wife.

We certainly should NOT be paying interest on the National Debt since for a monetary sovereign to do so is “corporate welfare” according to Professor Bill Mitchell. Welfare should be proportional to one’s need, not proportional to one’s fiat hoard.

“”Piketty takes a sort of crude socialist view of the debt as a tax on society.””

Those Socialists, and that society view.

Any national government that issues certificates of indebtedness rather than issue debt-free fiat money to pay for anything needed for the public good is involved in a societal transfer of wealth (labor-income) in the form of taxation obligations for interest payments to the the holders of the financial assets issued by the borrower-Guv.

It just seems pretty straight-forward as a political-economic reality.

“”……. a means to redistribute money by taxing ………….workers in order to pay rich rentiers.””

And this is wrong, why?

Why is it wrong?! Isn’t it obvious?

> “Again, I like Piketty’s book overall but I really don’t think his macroeconomic credentials are up-to-scratch.”

And your “macroeconomic credentials” are what, exactly?

A cat may look at a king; it’s Piketty’s credentials that matter.

Is Philip really concerned about Piketty’s macroeconomic “credentials”? Surely those are in order: PhD from the London School of Economics, co-founder of the Paris School of Economics, etc. I assume Philip is just concerned about some of Piketty’s macroeconomic views.

Piketty’s career macroeconomic focus has been on distributional issues, which perhaps sets him apart from the usual Anglo-American focus on growth, employment and the business cycle.

The rich have ruined the economy. So naturally if we raised taxes on them, then we would be ruining the economy. /s

Not sure either how raising taxes on the rich would preclude increasing spending on the 99%. The whole allusion to Keynes needs to be fleshed out, or better just dropped in favor of treating the underlying concepts.

Except as metaphors (and curiosities), I do not know what the economies of the 18th and even the 19th centuries contribute to our understanding of current economic conditions.

If you believe, as most economist do, in the lower marginal propensity to spend of the rich, then taxing the rich and resdistributing that wealth to the poor will BOOST the economy, not harm it. The meme that raising taxes always hurts growth is plutocrat propaganda, which is to say, bullshit.

But the real reason to raise taxes on the rich is that they have an immoral, unconscionable, indefensible share of national wealth, and they are putting the social and political stability of nation at ever-increasing risk.

Taxation removes net financial assets from the private sector, it does not transfer anything. You are repeating conservative myths every time you link redistribution with taxation.

Please counter the marginal propensity to spend argument. Tell me how that is WRONG.

Taxation is not related to the marginal propensity to spend because government spending does not derive from its revenues.

Taxation CAN be related to propensity to spend if you take it, via taxation, from those not inclined to spend and give it to those who will spend.

The beauty with this idea is the government doesn’t have to spend any money, except some administrative expenses.

MikeNY…glad to see you here.

Ben stated that there can be no income-strata-transfers with taxation because the Guv doesn’t use taxation to fund its spending.

You just gotta BELIEVE that, and you will be forever happy on these pages.

I feel another round of Beardsley Ruml coming down the line.

Didn’t Phil say that only Socialists believe that paying interest on public debt is a form of social tax?

“”Piketty takes a sort of crude socialist view of the debt as a tax on society.””

“”……. a means to redistribute money by taxing ………….workers in order to pay rich rentiers.””

And this is wrong, why?

More MMT blindness to issues of inequality and failure to understand the connection between the distribution of money and control of resources.

Congatulations, you’ve reached a new level of incoherence. Marginal propensity has nothing to do with resource distribution. They are separate concepts neither of which you understand, it would seem.

You and MRW have resorted to ad hom insults and nastiness rather than counter logical arguments.

You demean this blog by your behaviour.

That’s quite enough for me, I have nothing more to say to you.

Ad homing is an attack in one’s character. Please demonstrate where I have done this.

@MikeNY I have nothing more to say to you.

There’s an art form to dealing with rodent droppings, Mike. It’s not in persuading the rodent but in cleansing the room.

Well said.

By ‘incoherence’, are you suggesting that there is no “ ’connection’ between the distribution of money and control of resources”?

Only via dereliction of duty to Mammom would a concentrated group elites fail to control resources.

Again, I agree with this guy Ben Johannson. MikeNY, your utterances are ludicrous.

And I disagree. Are we keeping a tally? Should I put a +1 comment on everything I agree with or keep with my usual tactic of only commenting when I have something useful to say?

I have seen plenty of ‘+1’s or ‘+100’s.

In fact, I have used ‘+googol’ myself…guilty as charged.

But I have resisted using ‘-1’ or ‘-100.’

Unfortunately there’s no necessary link between increasing taxes on the wealthy and increasing social spending. In fact in a slack economy increasing taxation (particularly as taxing accumulated wealth tends to be completely off the table) , may worsen the governments budgetary position, thus perversely providing political cover for spending cuts rather than funding new spending.

I would say, in defence of Philip’s comment on the not good writing factor of Piketty, NC is easier reading. We might be approaching a singularity in which there is a wide dawning the rich have ripped us off, not only in financial terms and forever, but of the society we might have had and bequeathed.

The ‘theoretical economics’ Philip alludes to is part of the problem. I doubt Piketty has added to that and don’t care. We have had “economics” since before Cyrus the Great. What we need is some honest technology and policing of money, and even the notion that money might fade away. Piketty’s wealth tax is, as he clearly knows, a fiction that questions (or should have us questioning) why we can’t do it – essentially a power-organisation question. We should not, in the first place, give up the structure of our societies to theoretical economics.

“Moneta’s car” is now so hypothecated and derivatised that money is ‘biologically breeding’ in shoe boxes we call shadow banking via Ponzi bubbles. The car rots (maybe this is metaphor for society) as one can currently make more investing its maintenance money in the Ponzis. Hugh’s society (with which I broadly concur) is as fictional as Lambert’s ‘permagarden paradise’ (which I can have too) – this does not make either unreasonable. I would have thought waiting for a fully worked-out economics before we do something much more sensible than the current mess, is the Unreason.

There is some link. There is no purely monetary solution to the problems of the just distribution, democratic control and socially effective use of limited national resources.

Only if we don’t try hard enough; otherwise, we can always take the wealth tax money and spend it on those in need.

OR,

we would rather not know of the link, were there to be one…….

http://habitat.aq.upm.es/boletin/n37/afsod.en.html

Do the research first.

Maybe the real reason to tax the rich is to reduce their ability to buy up governments to make laws that favor their continued looting of the economy? Or to reduce their likelihood of purchasing laws making them and their families permanent nobility (again).

And to make it more difficult for the rich to create an aristocracy of inherited wealth. (Who coulda knowed that this would turn out to be the operational definition of “family values,” but so it proved.)

With GDP sharing, taxing the rich will be only needed occasionally.

For sure, that would be a huge ancillary benefit.

Wealth is power. It’s as simple as that. The whole idea that we can have a society in which people exercise democratically distributed power over here, while the rich enjoy their highly unequally distributed wealth over there, is an idea that is flawed from the get-go, and has been decisively refuted by current events if it was in any need of further refutation.

Simple and powerful.

I would add that money is also power.

Two things follow.

1. Wealth is power. Power must be shared and distributed equally, more or less. Any concentration is a cause for concern.

2. Money is power. Money creation must be by the people in a DEMOCRATIC monetary sovereign (of the people, for the people, by the people).

Most of the comments above are a purposelessly acrimonious debate between people who might realize they agree. Stimulating the economy with Tax & Spend is the old Keynesian balanced-budget multiplier. There are some old billyblogs on it. Of course it would generally stimulate and is far better than nothing – so one side is right.

The MMT side wants to point out that Tax and Spend are different and unrelated things, true. And they are exercised by Piketty’s wrong-headed focus on taxing the rich over spending on the poor. The “Keynesian” Piketty’s neoclassical/commodity theory imagining that they are directly connected, and confusions concerning interest rates and national debts, as if Keynes and many other economists had never lived. And so they ascribe Piketty’s mistakes to the other side, which doesn’t really make them, is not speaking nonsense, and doesn’t deserve obloquy.

Actually, MMTers have said you can’t tax the wealth now given the state we are in today. Period.

They don’t just say, while these two are not related, they are not exclusive to one another. And they don’t say, “it (tax and spend) would generally stimulate and is far better than nothing.” Instead, we hear, taxing the rich will drain money from the economy and it’s a bad idea now.

Concisely said, Beef.

It is possible to have an *expansionary* tax increase, if that tax redistributes funds to those who are more likely to spend them.

It shouldn’t have been so difficult to make that simple point!

References please. You may have given it in the past and I missed it. If so, please reference again. I certain that Wray, Kelton, or Mitchell never said such a thing and I also doubt Mosler would say such a thing in that particular way. Perhaps something was lost in translation?

I am certain…

@ Nobody (the outcast)

References please.

Yes, it’s utterly false, and Dr. Kelton pulled it from her corncob pipe. Taxation augments USG’s TT&L accounts, and thence the TGA. Enabling government checks to clear rather than bounce for lack of funds. Reserve banks certainly shred unfit currency, but credit the accounts of those who deposit it, including USG.

The MMT argument that taxes don’t fund spending because USG can obtain the funds in other ways — issue a coin, issue a bond, sell off a post office — is distinct from the Kelton argument that USG obtains nothing spendable from taxation. Taxation leaves Reserve Bank liabilities unchanged, but reapportions some of them from the reserve account of the taxpayer’s bank, into USG accounts: either directly to the TGA, or to the reserve account of a TT&L bank.

The end of the transaction. That’s actually what she said.

I don’t see “you can’t tax the wealth now given the state we are in today. Period.” anywhere in there, that’s what I wanted reference to. Calgacus explains what I understand that they mean below. The fact remains there are choices. The government could make any of them work nominally as they do and continue to do. Some might lead to socially good results, some bad. Some might have no effect. What is important is the social results of policy as far as I am concerned. All this obsession with money and who pays for what is why nothing much worthwhile ever gets done about our real social and environmental problems, IMO.

Personally, I think large stocks of money are a pollutant (and large accumulations of financial assets, as well). Money is meant to flow, IMO, when it forms large pools it becomes pollution. I don’t expect anyone to share this view and I certainly don’t have an idea what the full ramifications and effects would be of “cleaning up” the pollution, but I suspect we would have a much more democratic government for better or worse.

@Nobody (the outcast)

I don’t see “you can’t tax the wealth now given the state we are in today. Period.” anywhere in there, that’s what I wanted reference to.

Some of Mosler’s explicit anti-tax arguments are clipped and cited here:

http://www.nakedcapitalism.com/2014/03/j-d-alt-forget-1.html#comment-1901897

Sample:

Beef’s was absolutely a fair characterization.

And see Mosler’s celebration of Treasuries just below at that same link. Treasuries are a form of money that cannot be used in daily transactions, but that can be massively leveraged in the financial sector.

So MMT’s scheme of deficit funding has the effect of leading to a spectacular concentration of wealth in the financial sector, stemming both from the reluctance to tax, and from the issue of Treasuries. Narrow, high-powered money. The power being that of the banking system to leverage and acquire indefinitely with funds the USG gets to spend but once (and then owe back.)

Was our virtual conquest by a financial aristocracy the intention of MMT’s most vocal proponents? I can’t look into their hearts and souls, but that has been the effect of their policies.

MMTers should be beaming with pride at the society we’ve created through deficit spending and tax cuts. Turn that frown upside down, as Stephanie says. Great job, and some truly profound thinking there, guys and gals.

More mischaracterization.

From here:

“I would cease all issuance of Treasury securities. Instead any deficit spending would accumulate as excess reserve balances at the Fed. No public purpose is served by the issuance of Treasury securities with a non convertible currency and floating exchange rate policy. Issuing Treasury securities only serves to support the term structure of interest rates at higher levels than would be the case. And, as longer term rates are the realm of investment, higher term rates only serve to adversely distort the price structure of all goods and services.”

Some celebration of Treasuries that is.

@Nobody More mischaracterization..[snip]..Some celebration of Treasuries that is.

I referred to a particular quote: “And see Mosler’s celebration of Treasuries just below at that same link.” No other cite can refute a characterization of that cite. From a piece written about 18 months after yours:

—

The proposal you cited gives no indication of how to persuade a privately-owned Reserve Bank to accept trillions of dollars of US Government liabilities on its own books without any kind of compensation. Joe Firestone, to his credit, knows this requires a coin or a bond, while Randy Wray suggested other forms of recompense:

And yet Mosler imagined in 2010 that the Reserve Banks, owned by the National Banks in their districts, could be persuaded to accept direct liability for USG expenditures, merely let federal deficits abide as reserve balances on their own books. MMT blue sky thinking at its finest.

But he was celebrating Treasuries in mid-2011, as I’ve shown. Perhaps he learned a bit from his colleagues in the interim.

No they don’t. Reserve banks have nothing to do with that. The 12 District Reserve banks shred the money…period. They do not credit the accounts of those who deposit it, including USG. Does not happen. (Makes sense actually. Dollar bills don’t have ‘EconCCX’ written on them so the Federal Reserve can keep track of depositing your dough.)

As the Federal Reserve spokesman said to me, “Electronic, check & cash IRS payments are irrelevant to us, being functions of the Treasury Department. Our services in the matter are comparable to serving as a conduit, much as the phone companies being privy to telecommunication content, as they serve simply as the transmission medium. […] After [the cash] having been credited to the IRS account, the disposition of the actual bills deposited is not further relevant to any specific account.”

Cash goes to the shredder machines for examination and enlightenment.

There are 133 Geiseke & Deverents BPS3000 currency processing machines in the basements of the 12 Federal Reserve Banks and 21 operational branches nationally. These machines read 56 bills per second to determine suitability on a 1-16 scale. 13/16 is considered optimum, and few bills make the grade. Those that are suitable for recirculation, those that are “blessed” go into storage in ‘receiving’ vaults until disbursed in bank withdrawals, FIFI (first in; first out) supplemented with new-uncirculated-bills as necessary, per volume of demand.]

@MRW The 12 District Reserve banks shred the money…period. They do not credit the accounts of those who deposit it, including USG. Does not happen.

(Makes sense actually. Dollar bills don’t have ‘EconCCX’ written on them so the Federal Reserve can keep track of depositing your dough.)

Yikes. Someday perhaps they will, MRW. Until then, individuals and institutions will generally use deposit slips or equivalent documentation when returning currency to the Reserve Banks for reserve balance or TGA credit, or remitting cash to any bank.

Ahem, darndest things, as JuneTown says. JT, thanks for the Link.☺

Is this the doubting EconXXX ?

I came across this on that Mosler ‘taxes don’t fund government’ paradox.

http://youtu.be/84qY46vm4pM

Some days, MMTers are like those Linkletter kids….saying the darnedest things.

@JuneTown Is this the doubting EconXXX ?

No, not me. When Joe posted regularly here it was as joebhed. His videos are a bit slow to the point, so I generally pass them by.

Best — EconCCX

No, that is not ‘what they say’.

From the Q&A during this talk at Columbia Univ in Sept 2012, at 1:16:00.

You are misrepresenting what they say, and have said, about using taxes and spending, and when and how to use them depending on the state of the economy (whether running hot or cold). I am giving only one small example above. You may have a grudge against MMTers but you have no right to falsify what they say.

You and Nobody (the outcast) raised a valid point.

Let’s just say I got it wrong and MMTers were not against taxing the rich.

Then, let’s just move forward and agree that today, now, at this moment, we should tax the rich.

Those who are for taxing the 0.01%, unite!

Those against, speak up now.

This MMTer certainly is not. Taxing the rich is often confused with raising revenue (especially by progressives) and so debunking the latter notion might seem like we’re debunking the former. (To pre-empt a war of quotes, for all I know, there are MMTers who don’t want to tax the rich as a matter of policy, but that’s a policy argument, as opposed to bedrock like taxes don’t fund spending, where all agree.)

“…To pre-empt a war of quotes, for all I know, there are MMTers who don’t want to tax the rich as a matter of policy…”

Thank you, Lambert.

Let’s move forward and agree that we want a better society.

If we want a better society, we start with the goal that it should be democratic, with power-sharing, with the understanding that money is power and wealth is power.

Jobs, GDP, GDP growth, government funding, money in circulation…all these are secondary.

First order of business – tax the 0.01%, because wealth inequality is the clear and present danger to that better society.

Here’s my scenario how taxing the rich (which Piketty recommends) will play out:

Let’s focus on concrete material benefits. Taxing the rich, no matter how righteous and fun, doesn’t deliver concrete material benefits.

NOTE * Also, I think “equality of opportunity” is bogus. “Show me the money!”

Your cynicism warms my heart as I watch my rugby team go down drinking coco. You miss the chance to recommend LAMACO (Offshore) services and the value of our incorporation on Dr No Island.

Could not agree more. (For about two minutes I thought you were quoting Piketty, and I thought, Shit, I gotta buy that book now.)

Thank you Calgacus.

Tax the wealthy more to create greater equality which according to The Equality Trust is good for everybody.

Spend in ways that help the bottom end to create greater equality which according to The Equality Trust is good for everybody.

The two are completely different things according to MMT and yes, it is true. There is no reason that we can’t have both, one or the other, or neither. It is a choice. Unfortunately, with the way the power structure is, “neither” will likely be chosen for us.

MyLessThanPrimeBeef – MMT economists do not disagree with the obvious – have said deficit-neutral tax and spend in equal amounts is better than nothing for the reason MikeNY adduced, the balanced budget multiplier. You might find relevant quotes in the old billyblog(s) I mentioned (whose theme however were that the B-B-M is old hat). And I think I recall Wray making such an aside to that effect at NEP. But mentally combining “tax” and “spend” is a road to confusion, and to the idea that the amount taxed restricts the spending, etc,.

Just taxing the rich right now and doing nothing else would be a bad idea, and I agree, MMT economists say this. The rich, the oligarchical oligopolists are like tax farmers of old. If the emperor just says to his tax farmers – I’m taxing you guys more – where do you think the oligarchs are going to get most of the dough? The Clinton surpluses were an example. If his taxation had been accompanied by higher spending for the 99% – e.g. cutting excessive Social Security taxation – we all would have been much better off.

The natural effect of only “just tax the rich” is that the rich continue to oppress the poor and probably oppress them even more. “Spend on the 99%” is much more important – and for the umptrillionth time, only looks “naturally”, “intuitively” automatically inflationary if you have a very wrong theory of money in your mind.

Calgacus,

On the off chance you return to this thread, you have a good grasp of the issues, so let me ask you this question: since Congress controls fiscal policy, and Congress is hardly an “independent” entity like the Fed, do you think it is realistic to believe that Congress would be a responsible monetary steward? In other words, in the real world, do you think Congress would vote to increase taxes to tamp down inflation? How would this play (if it were even understood) in Peoria?

Very good point. Congress as well as the general public needs a better understanding of money.

http://neweconomicperspectives.org/2014/01/diagrams-dollars-modern-money-illustrated-part-1.html

http://neweconomicperspectives.org/2014/01/diagrams-dollars-modern-money-illustrated-part-2.html

http://neweconomicperspectives.org/2014/05/fallacy-composition.html

Thx.

Lambert, I’m interested in your view, too. Do you think this is just a “long-run” problem that can be ignored, as the “short-term” need is to spend on the poor? Or do you believe Congress (and the voting populace) can be educated and persuaded to accept tax increases during a period of inflation, in the interest of monetary stability?

MikeNY: since Congress controls fiscal policy, and Congress is hardly an “independent” entity like the Fed, do you think it is realistic to believe that Congress would be a responsible monetary steward? In other words, in the real world, do you think Congress would vote to increase taxes to tamp down inflation? How would this play (if it were even understood) in Peoria?

The Fed is somewhat independent – mainly on interest rates and not regulating the banks. The first, outside of Volckeresque rate hikes does not do all that much, and often has the opposite effect on inflation from what the received wisdom and the Fed think.. The second has shown the Fed to be a very irresponsible monetary steward.

But because fiscal is the main thing, no matter how many “economists” deny it, Congress, through taxation and spending, always has been the primary monetary steward. Further understanding of its own power can only be a good thing. There really isn’t any ultimate alternative. But yes, Congress should place day-to-day management in other “independent” hands as much as it can – see below on the JG.

The US Congress has passed tax hikes for explicitly Keynesian/MMT anti-inflationary reasons in the past. After the 1964 Kennedy-Johnson tax cut stimulus, Congress passed a tax increase in 1968 explicitly to deal with inflation. It was was not very serious, but it had heated up, due to Great Society & war spending, general world prosperity and the earlier tax reduction (Which had been supported by the old Keynesians, but opposed by Galbraith & Minsky). One of Lester Thurow’s old books (I think Zero-Sum Society) treats the 1968 tax hike. Robert Lekachman’s Age of Keynes is good on the tax cut.

But in an MMT-guided society, the first line of defense against inflation is the JG – which automatically cuts government spending when the economy heats up and people leave the JG for better paying jobs. This solves the problem that even the most enlightened legislature can only pass legislation after a significant lag – so stimulus and restraint may come after they are needed, or even when they are the opposite of the need.

Thanks very much for the lucid reply and the sources.

“There’s lots of this sort of unsophisticated stuff in Piketty’s book. And it seems to me likely that this is because, in some ways, the book is a mess owing to a lack of a solid macroeconomic framework.”

“The more I read Piketty the more I see him as synonymous with the Hollande government in France; ”

No wonder Economics is in such a sad state of affairs! I am no fan of Pikettys’, but I find the arrogance of mainstream economists like the Reviewer amazing! Sophisticated or not, the book provides a lot of data and comments for us to reflect on, to improve our current system, which the 2008 crisis shows that there are shortcomings. Why do mainstream economist just rush to “rubbish” and “label” others who don’t work with DSGE models and write in a way that jive with what the average man/woman can understand? Isn’t economics about helping human resolve problems?

“The more I read Piketty the more I see him as synonymous with the Hollande government in France.” Ouch! I would really like some linky goodness on the French view of Piketty in France (even in French; we might be able to get it translated). Maybe Piketty is their revenge for Jerry Louis?

While Piketty supported Hollande during the election it only took a few months for him to break with Hollande — over the 75% tax on super high incomes. Piketty thought this was a gimmick that would not impact many people (since it was only on income) and wanted Hollande to instead increase taxes on capital (which is the policy Hollande campaigned on).

Piketty writes a column for Libération once a month or so. He is very critical of Hollande; two recent titles were, “François Hollande, that stubborn mule” and “François Hollande, repeated social blunderer”

So Piketty is certainly not sucking up to Hollande in the way for example Krugman does to Obama. In no way is he synonymous with the Hollande shambles.

http://www.liberation.fr/auteur/8031-thomas-piketty

Let me know if any of these interest you and I could try to translate them.

Into Mandarin preferably WCN – they are bloody awful.

I have links to the left critique of Piketty. NC is vaporising them for some reason. No real need to read them to be honest. They claim, as I would, that his work is functionalist and caught up in neo-classicism. The typical angle is that he under-defines capital. He needs a better theory to deal with the richness of data, which I guess he was trying to avoid anyway.

http://spire.sciencespo.fr/hdl:/2441/6d6bmqq2mq9avo75ba1s430vom/resources/wp-25-bonnet-et-al-liepp.pdf

http://www.contretemps.eu/interventions/capital-xxie-si%C3%A8cle-richesse-donn%C3%A9es-pauvret%C3%A9-th%C3%A9orie

http://gesd.free.fr/boyerpik.pdf by Boyer.

;-)))

The reviewer is not a mainstream economist.

‘I don’t really see the rates of interest in these years as being particularly high. They basically fluctuated just below the 5% mark.’

This was in an era of gold-backed currency, when deflation was just as common as inflation.

A 5% real rate of interest (essentially what Spain was paying with 7% gov’t bond yields during the crisis a couple of years ago, when euro-area inflation was under 2%) is considered crushingly high today.

Today’s nominal rates can’t be compared with those of two centuries ago, without taking the inflationary backdrop into account.

Oh dear.

You write: “This was in an era of gold-backed currency, when deflation was just as common as inflation.”

If “inflation was just as common as deflation” then the inflation rate would average around 0%. If nominal interest rates average at about 5% then this would mean that real interest rates would also average at about 5%.

Some basic logic would not go amiss, Jim.

And just for the record real interest rates in the UK seem to be about 3-4% between 1978 and today.

http://greshams-law.com/wp-content/uploads/2011/08/UK-Real-Interest-Rate-Graph.png

What would a “high” rate be? I would imagine maybe, I don’t know, 8-10%?

A high rate is a rate higher than the growth rate of the economy.

The whole point of Piketty is that real interest rate in excess of growth rate is a recipe for increased inequality of capital in a context where the rentiers reinvest their income.

Funny that you take 1978-today as reference for a “normal” level. Thatcher came to power in 1979 and yes, inaugurated an era very favourable to holders of capital and unfavourable to labor. Are you a closet Tory ;-) ?

Piketty is not warning of impending doom in the section Philip cites. He’s just considering the question of whether boosting the rate of inflation unexpectedly – that is to a level that wasn’t already priced in by bondholders when they purchased their government bonds – is a viable substitute for a progressive tax on capital as a mechanism for redistributing wealth. And he concludes it is not because “inflation is a crude and imprecise tool”. The context of his discussion is completely different than the Austrian context, which is fixated on the preservation of private wealth and the minimization of the public role. The entire discussion of public debt in Chapter 16 has to be read in the context of the framing discussion in Part 4 of the book, which is all about the regulation of capital by democratic societies in the 21st century.

But his discussion in chapter 16 is almost entirely focused on contemporary Europe. In Europe, as we know, governments do not issue their own currencies, and so national government debts and debt service have to be viewed in much the same way we would view the debt financing of any other enterprise. Governments cannot finance deficits simply by expanding the money supply, nor do they control the rates of interest on the securities they issue. As a result, debt service results in a redistribution of wealth from taxpayers to bondholders. What Piketty is arguing is that the best approach to the European public debt issue, as it exists in the unique circumstances of the Eurozone where public debt is not much different than private debt since national governments don’t control their own currency, is a massive fiscal redistribution via a pan-European tax. The whole of Part 4 is a pitch, as I read it, for greater European integration and the development of further democratic political and fiscal institutions to match the monetary institutions.

He earlier discusses the role of central banks fairly effectively, I think, recognizing the limits of unconventional asset purchases (QE) since provisions of central bank liquidity can’t “oblige companies to invest or households to consume” and wonders whether other techniques for more dramatic central bank balance sheet expansion might do better. In that regard, he says, “Clearly, the problem is that central banks are not well-suited to such activities, and are not well-suited to try them.” I do think there is some unresolved problems with the section, though. His basic line is that central banks, in the fist instance, redistribute wealth rather than create it, since central banks inject money into the economy by lending it, which doesn’t change net private sector wealth in either nominal or real terms. Whether those actions then contribute to subsequent real growth depends on what the borrowers do with that money – a discussion we have been having for four years now around the impact of unconventional monetary policy. But in discussing the possibility of more dramatic central bank actions, and its actions during emergencies, he seems to be contemplating the possibility of central banks simply exercising seigniorage power and either buying things, or crediting dollars outright to private sector accounts. This is not the same thing as mere balance sheet expansion, since it could push the central bank into negative equity. There really is no economic problem with that, since central bank “equity” is an accounting fiction that doesn’t have the same meaning for the central bank that it would have for a private sector institution that can’t just issue the payment medium for its own financial liabilities. As noted earlier, what Piketty really objects to here are the political implications: central banks are not democratic institutions and should not be assuming greater control over the economy.

‘Central banks exercising seigniorage power … could push the central bank into negative equity. There really is no economic problem with that, since central bank “equity” is an accounting fiction.’

Technically, you are correct that a central bank whose liabilities consist of irredeemable currency can continue functioning with negative equity.

But to conclude that there’s no economic problem with that is terribly cavalier. Currency issued by a negative-equity central bank loses credibility, depreciates, and boosts domestic inflation.

Banks (including central banks) hold an equity cushion for a reason. Dispensing with equity simply because ‘they can’t stop us, nya nya nya’ is a recipe for monetary chaos.

@Jim Haygood Technically, you are correct that a central bank whose liabilities consist of irredeemable currency can continue functioning with negative equity.

But no privately-owned bank can be compelled to do this, and thus Federal Reserve Banks, owned by the national banks in their districts, are insulated from any such pressure. In order to write checks against its accounts there, USG must sell them bonds, coins, or real property, or effect transfers into the TGA from “Treasury Tax & Loan” accounts at commercial banks, where our tax payments are deposited.

All per the Treasury Financial Manual, as I documented here:

nakedcapitalism.com/2014/03/is-russia-trying-to-hurt-dollar-to-defend-ruble.html#comment-1918796

The funds in the TGA aren’t considered Reserves; they’re simultaneously USG assets, Reserve Bank liabilities and demand deposits. When USG writes a check against TGA, reserve balances and commercial bank deposits are restored.

Those who insist that taxation eliminates money from the system will never be able to document it. They will only invoke others who assert it. I urge them to prove me wrong with their best evidence.

As I did at the link cited, to crickets. And again here:

nakedcapitalism.com/2014/04/joe-firestone-using-generational-warfare-divert-attention-oligarchy-corporatism.html#comment-2011573

to responses that either reiterated the assertion without evidence, or graciously rowed it back.

Theories are proven by evidence. Conventions are observed by consensus.

But to conclude that there’s no economic problem with that is terribly cavalier. Currency issued by a negative-equity central bank loses credibility, depreciates, and boosts domestic inflation.

No not necessarily, Jim. There is no easy answer to this question or simple model that can predict the inflation rate on the basis of the state of the central bank’s balance sheet. It all depends how the flow of central bank monetary expansion is interacting with changes in commercial bank balance sheets and the growth of the economy. Also, the state of the balance sheet is a stock, not a flow. A central bank could be in a state of negative equity indefinitely with no net increase or decrease in central bank liabilities.

“Piketty is not warning of impending doom in the section Philip cites. He’s just considering the question of whether boosting the rate of inflation unexpectedly – that is to a level that wasn’t already priced in by bondholders when they purchased their government bonds – is a viable substitute for a progressive tax on capital as a mechanism for redistributing wealth.”

And he answers in the negative. He is wrong.

Also, his framing of the uses of taxation is misleading in the extreme (that was the main criticism above).

I doubt we could get the kind of redistribution Piketty is calling for simply by increasing the inflation rate. More importantly, the impact of inflation on different classes in society is varied and unpredictable.

More if you get the chance Dan – your reading has been helping me make sense of the tome.

I’m trying, but it is a long book with a complex main argument that I am still trying to put together

I skim read first and that was disappointing. Then I went to the data to check on what it was. So I’m reading again whilst constructing a spreadsheet for class use. You’ve been a real help – I’ve become so anti-functionalist I was seeing it where it isn’t in Piketty.

Oh man, if you can read the whole thing, all 600 pages, and then post a book report (say 2000 words or less), that would be a public service indeed. Almost as good as the video HuffPo edited together showing all the nude scenes in GOT. Although frankly the guys kind of grossed me out. Can you imagine going to the Louvre and seeing pictures of naked guys laying on a sofa with rippling folds and flowers in a Renaissance light and modern line? It doesn’t do much for me.

Frankly, Professor Picketty is suffering from The Disorder (TM). 600 pages written by a man suffering a mental disorder is not beach reading. This doesn’t mean he can’t be cured, but you can’t count Form with Quantity. People look at quantity and they project Form, whatever Form they imagine, onto the Quantity and that makes their Form come to life in their mind. Then they say “See, this is Reality”. But it isn’t reality. It’s just one way of seeing.

Why should income distribution even matter? What is a Man that we should be mindful of him? Is the Lord a respecter of persons? Are you your brother’s keeper? it may be that is all that’s real. That’s weird. What planet is this anyway? How many planets is it, overlapping like vibrations

I’m trying to put together some PowerPoint slides to outline the argument. I have a three day weekend starting today, so maybe I’ll be able to make some progress.

Austrians beware! NC readers have gotten out the tar and feathers. The only thing one can bank on in economics is that if an Keynesian and an Austrian meet they’ll soon be at each other’s throats.

As a natural saver with no debts I lean towards the later camp because such thinking has worked for me. What economic thinking is working for everyone else? Right now, none! A second reason to lean – is it to the right? – is because those in power are Keynesian, or is it post-Keynesian? and I don’t like them. Economics aside, I’ve good emotional reasons for choosing what I want to believe in and that’s all that matters to me.

When the choice is between Austrians(who are always right, while Keynesians are always wrong) or Keynesians(who are always right, while Austrians are always wrong) or the actual central planners running things – Friedman’s Frankenstein monster – does it matter what we choose. Actually it doesn’t matter because we have no choice. it’s all just a popularity contest with Austrians and Keynesians fighting for cheerleaders. When it comes to an economic illiterate like myself it is so much easier to just tune both sides out and believe whatever silly ideas pop into my own head. Of course with economists unable to agree on anything what’s the point of having economic theory?

Either it all falls apart – really falls apart – and we see what comes from the ashes, or we just muddle along with Keynesian-Austrian bickering continuing and everybody else picking and choosing what suits their beliefs. I will point out that the modern economy is anything but Austrian. If Keynesians rose to power after the Great Depression they may end up as the ones wearing the tar and feathers after this even greater collapse.

Just like you I have opted for no debt. I am in my 40s and have no faith in the future value of money so my focus is on the basics… resources and energy.

My strategy is to focus on how much energy and resources I will need to live to 80. A lot of my thought process has gone into minimizing the impact of depreciation. So I look at my house and ask myself:

-Can I live here for 40 years?

-What needs to be done to this house to make sure I can without running out of resources?

-If all those around me don’t plan properly and I end up the only one on the street, what happens then?

-The list of questions goes on…

It really gets one to question EVERYTHING one takes for granted in our way of life.

I’m there too, though it took my brain longer to get round to this. In my 40s, about 15 years back, I got the chance to spend 6 weeks in a Moldovan village (I had to give up a day a week to lecture for the World Bank). More or less nothing was money there. You pitched in and lived on communal resources at a more or less free table. Made me realise we’ve been stiffed. The hard work hurt, but was also bliss. I fixed some tractors (I’m good with spanners), but the spare parts had to be bought with the WB fees. I don’t suppose it would have dawned on any of the theoretical economists that sending me as a mechanic rather than propagandist was the sensible option. The rich are a massive burden on our backs.

It hit me in my 20s when I visited the cathedrals and museums in Europe… I noticed from the paintings that life was really hard until not so long ago and that these cathedrals must have really seemed majestic to the commoners… no wonder they had faith in the Church.

Then I listened to my 80 year-old grandmother tell us how she used to have to unstitch her sisters’ worn-out hand-me-down dresses and sew them back up inside out… I realized that times were hard right until not so long ago.

Then I asked myself what changed this and the answer was oil.

Had those feelings too, though it’s wider than oil. Its not single-track though, or perhaps wouldn’t be if we were less blinkered. I was appalled as a young scientist to ‘discover’ we used oil as a fuel (even coal) as these were resources to make things with and there were other, obvious and renewable sources. Of course, that young mind believed hot fusion was round the corner (1970), which it still is. It was a while before it dawned on me economics organises this picking of the easy fruit.

Agreed. It’s more than oil but I don’t have the energy to write an essay! Oil/energy/resources were a big enough reason to change my worldview.

What happened was the Socialists and Communists started winning and showed people that there were enough basics to go around and people back then knew better than to believe crap lies that if wages are raised than the economy will crash unlike today’s people believe.

Austrians unite!

They are united: United in their love of deflation and united in their hypocrisy in desiring government privilege for their favorite shiny metals.

Also, united in ignorance when it comes to how banking works.

All this argument should convince people that money creation is a problem in ETHICS but will it? I suppose that depends on how far away The End is and vice versa.

They give money a life of its own Beard. A false idol and root of all evil kinda thing. Shift to practical recognition from reveal wisdom is tough.

Money is just a function of time and space with an eye to production and production is a claim[s on the future.

Is it not the revenue transfers from the bottom to the top of the (compounded) public debt that are worthy of study? Periods of increasing public debt allow that increase in revenue through compounding; periods of decreasing public debt and even budget surpluses allow that increased through accelerated payments to eliminate the debt. Has any country ever run a negative public debt? For how long would taxpayers allow it?

It seems that in all times and places, lending a government money is a great way of upward transfer from the poor to the rich. And even when the lenders for a period experience a default, that is more than offset over time by the very long periods in which they do not.

That is the issue that empirical data, such as exists, should put to rest. And it relates to debt service flows more than to the absolute level of the public debt.

Wouldn’t a “negative public debt” be the same as a government surplus?

Splain me this then. If time doesn’t exist per the new revelations about entanglement then inflation cannot exist, nor can deflation. How liberating. And doesn’t it follow then that debt does not exist since it is impossible to be indebted and freed from indebtedness simultaneously? This could become the economic model to last a thousand years. The only question left is, How do we account for the things we want to do? Nevermind.

it isn’t groaf or contraxun – it’s just an energy transition

….and/or transformation of matter…and recognizing the limited scalability of “efficiencies” while not contemplating it’s flip-side, “entropy”(externalities???)

Lovely (as I’m told I can now no longer mark student work though feeling this). Energy is subject to a conservation law (though believe me physics is still seeking an explanation of the dozens of such). We all get warm sitting round one fire in an enclosed space plus enough air. With a centralised laundry our clothes get clean without puking perborates into the fish world (because we can ‘permagarden’ the effluent). So in using less and destroying less of the environment – possibly none if we achieve economist fantasy of equilibrium. Wrong and right at the same not quite time. Very quantum.

When we understand meditation is a job under JG, if meditation is a career, and if we realize meditation is a recreation, that is, if we occupy ourselves with meditation, day and night, we will be much better friends with the environment.

Or dead from starvation I guess Beef. Sleeping seems to fit too. I understand French peasants more or less hibernated in winter.

Too bad.