We’ve reported extensively on a story that the Wall Street Journal broke two weeks ago, which is that the private equity kingpin KKR looks to be cheating the limited partners in its funds by not sharing fees charged to portfolio companies by its in-house consulting firm, KKR Capstone. This is a serious charge because if the critics are right, KKR is embezzling. Moreover, this case also shows the degree to which private equity investors, who have negotiated to have the overall fees they pay reduced via rebates against the management fee, are having their intentions vitiated either via grifting or extremely sneaky maneuvers that they can’t readily detect or police.

Here is the overview from our post in late May:

Over the years, one of the few ways that the limited partners in private equity investments have pushed back against the numerous fees that private equity firms charge over and above their management fee and carried interest (the prototypical “2 and 20”) is by winning the concession that a certain percentage of those extra fees, typically 80%, be credited against management fees. The Journal tells us that sort of arrangement was in place for the 2006 fund in question:

Big investors now routinely demand a share of fees private-equity firms charge their portfolio companies—often 80% to 100%—arguing that the charges drain companies bought with their money. Investors generally don’t collect fees directly, but use them to offset a portion of annual management fees they would otherwise owe private-equity firms.

When raising $17.6 billion for its 2006 fund, KKR agreed to share 80% of a range of fees collected by its management company or any “KKR affiliate.”

Now if KKR Capstone is an affiliate, all the consulting fees it charges should be included in the rebates against the management fee. But KKR has not been making those credits, even thought there is considerable evidence that KKR Capstone walks, talks, and quacks enough like an affiliate to be deemed to be an affiliate.

Back to the current post. KKR’s response has been to insist that its consulting arm, called KKR Capstone, is not affiliated with it. KKR makes this ludicrous “the sky is green” claim despite numerous facts to the contrary, which include:

KKR has repeatedly depicted KKR Capstone as an integrated part of its activities from an operational and even a financial perspective in various materials presented to its shareholders.

KKR Capstone’s revenues have been reported in KKR’s SEC filings as KKR revenues

KKR described KKR Capstone as a subsidiary of KKR in its 2011 10-K annual report filed with the SEC

KKR Capstone works exclusively for KKR, meaning it is fully captive. When one firm supplies all of the revenues of another party by virtue of being its sole source of revenues, they are in a position to exert managerial control

KKR Capstone executives participate in the KKR carry pool

KKR Capstone has no independent website; its website is a tab in KKR website. KKR Capstone also shares office space with KKR

We’ve added to this Wall Street Journal’s story by publishing the full text of the KKR 2006 Fund limited partnership agreement. This is the contract with the investors that governs, among other things, which fees KKR may keep for itself versus which it must rebate to the limited partners. Until we unearthed it, none of KKR’s governmental investors, aka public pension funds, would reveal the terms of their deal with KKR. They fell in line with the private equity industry’s demonstrably false claims that these documents contained competitively sensitive information that constituted a “trade secret” and that limited partners were willing and able to police compliance with the agreements.

Now that we can see the KKR limited partnership agreement, a crucial definition on page A-12 calls all of these arguments into question:

Monitoring Fee means any amount payable to the Management Company or any KKR Affiliate pursuant to a general retainer agreement or as a fee for consulting services rendered by the Management Company or any KKR Affiliate

If Capstone is a “KKR Affiliate,” then its revenues are clearly “Monitoring Fees” according to the limited partnership agreement. Then, on page B-2, section 2.1, we see that the investors are supposed to be refunded 80 percent of Monitoring Fees (“For any Fee Period, the Management Fee will be reduced, but not below zero, by 80% of (i) the sum of Break-up Fees, Transaction Fees and Monitoring Fees”).

So the question of whether KKR has scammed its investors out of well in excess of $100 million over the last three years hinges solely on the question of whether KKR Capstone is a “KKR Affiliate”.

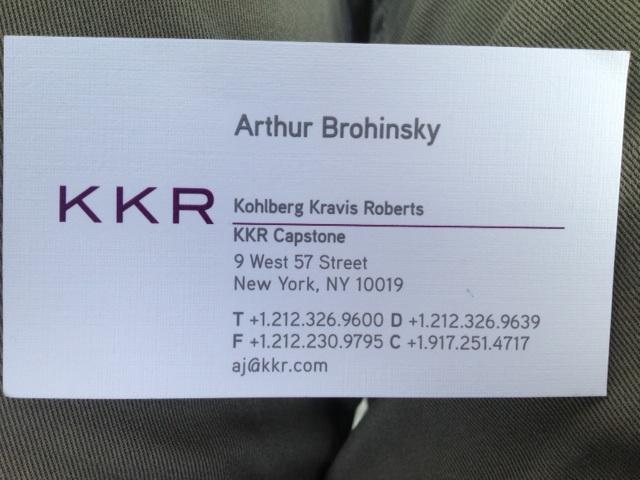

To add another data point, consider this image of a business card for an individual who has been a director at KKR Capstone since 2009:

And in case you think KKR has a technical defense in that it KKR Capstone licenses the name “KKR,” think twice. That “KKR” on the card is a logo. But what is that “Kohlberg Kravis Roberts”? From the definitions section:

KKR means Kohlberg Kravis Roberts & Co. L.P., a Delaware limited partnership, and its successors and assigns

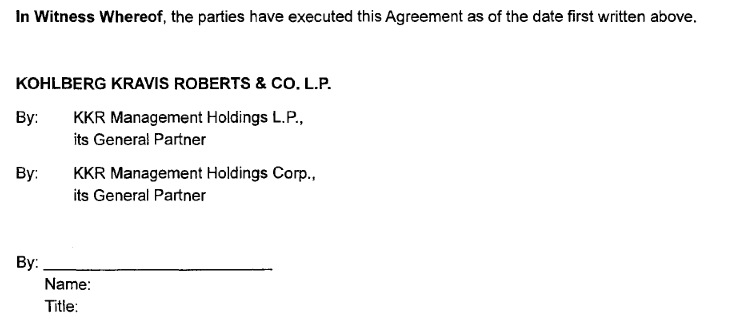

And from the signature page:

It is highly unlikely that Brohinsky’s card has a unique format. That means KKR Capstone employees present themselves as working directly for KKR as well as for KKR Capstone. And per the definitions above, if they are in the employ of KKR, then the fees are unquestionably monitoring fees and hence should be substantially rebated.

Now as we’ll discuss, that is not KKR’s position. KKR contends that its captive KKR Capstone is not an affiliate and hence its arrangement. We’ll debunk that shortly. But consider that card on its face. Can you see why investors are surprised and unhappy about the revelation that KKR was not rebating fees from KKR Capstone? All of KKR’s public presentations, down to KKR Capstone business cards, would lead investors to believe the exact opposite.*

The 2006 KKR Limited Partnership Agreement Shows that KKR Capstone is a “KKR Affiliate”

KKR’s tortured defense to the Wall Street Journal rests on its claim that KKR Capstone is not an affiliate, which by KKR would like the public to believe also means that it is not a “KKR Affiliate”. The Wall Street Journal reporter, Mark Maremont, seemed to have had a “gotcha” in discovering that KKR had reported KKR Capstone as an affiliate in its 2011 SEC filings. KKR has tried to hand-wave that off. From the Wall Street Journal account:

In 2011, KKR began including Capstone’s results in its own financial statements, under accounting rules mandating such consolidation if one company has a “controlling financial interest” in another.

The same year, KKR listed Capstone as a subsidiary in its 2011 annual report, a signal that Capstone had become an affiliate. Under securities laws, a subsidiary is defined as a controlled affiliate. KKR says now the listing was a mistake and that Capstone isn’t a subsidiary but a “variable interest entity.” It never corrected the filing, the KKR official said, because the error was “immaterial.”

Matt Levine at Bloomberg accepted the KKR defense, based on his review of the “variable interest entity” language in KKR’s SEC filings. But in fact, KKR is simply trying to pull yet another fast one on investors and the press. What matters is not how “affiliate” is defined in GAAP, which is the basis for how KKR describes what is and isn’t an affiliate in its SEC filings. What matters is how “KKR Affiliate” is defined in KKR’s 2006 limited partnership agreement, and any other limited partnership agreements that require that consulting and monitoring fees be substantially rebated. Here is the relevant section:

KKR Affiliate means each entity that, directly or indirectly, controls, is controlled by or is under common control with KKR, other than (i) Portfolio Companies or companies in which other KKR-sponsored investment funds invest, (ii) any investment vehicle the formation of which was sponsored by KKR but which is not managed by the Principals, the other members of the general partner of KKR or employees of KKR, and (iii) any investment vehicle the formation of which was sponsored by KKR and which is a Limited Partner in the Partnership.

Notwithstanding clause (iii) of the preceding sentence, KKR PEI will be deemed a “KKR Affiliate” for purposes of Section 6.3.2(g).

So what are the critical tests? First, that an affiliate need to be an entity. Check. Second, that it is “controls, is controlled by or is under common control with KKR.” In fact, as Levine discussed in some detail, and consistent with our earlier analysis, KKR most assuredly controls KKR Capstone:

….KKR consolidates Capstone for accounting purposes, meaning that as a matter of accounting Capstone is part of KKR…So you can see why someone sitting at KKR would say, wait, it is unfair that we’re doing all this operational consulting for our portfolio companies, but we can only get 20 percent of the fees.

Levine acknowledges that both from an operational and financial perspective, KKR Capstone is not independent of KKR. This is from the footnote on variable interest entities in KKR’s latest 10-K which Levine so kindly provided (emphasis ours):

KKR consolidates all VIEs in which it is considered the primary beneficiary. An enterprise is determined to be the primary beneficiary if it has a controlling financial interest under GAAP. A controlling financial interest is defined as (a) the power to direct the activities of a variable interest entity that most significantly impact the entity’s business and (b) the obligation to absorb losses of the entity or the right to receive benefits from the entity that could potentially be significant to the variable interest entity. The consolidation rules which were revised effective January 1, 2010, require an analysis to determine (a) whether an entity in which KKR has a variable interest is a VIE and (b) whether KKR’s involvement, through the holding of equity interests directly or indirectly in the entity or contractually through other variable interests unrelated to the holding of equity interests, would give it a controlling financial interest under GAAP.

This is consistent with what we wrote when the Wall Street Journal story broke. If you control 100% of the revenues of an organization (and remember, KKR Capstone works solely for KKR), you control it in any practical sense of the word. So KKR Capstone meets the second test in the definition of “KKR Affiliate” in the limited partnership agreement. And it appears to get no relief from any of the outs (clauses (i) though (iii)). KKR Capstone is not owned by any of the portfolio companies, nor was it sponsored as an investment vehicle (KKR set it up as an in-house consulting firm in the late 1990s).

If you don’t want to rely solely on Levine’s and my take, it’s not difficult to ascertain that accounting experts agree with this reading. From the CPA Journal (emphasis ours):

Under GAAP, a company must consolidate any entity in which it has a “controlling interest.” This term was long defined as ownership of more than 50% of the entity’s voting interests. FIN 46(R) makes two critical changes: It defines when a company (sponsor or creator of a variable interest entity) should base “controlling financial interest” on factors other than voting rights, and it applies a new “risk and rewards” model in these situations. Consequently, GAAP now prescribes two accounting models for consolidation:

• The voting-interest model, where the investor owning more than 50% of an entity’s voting interests consolidates the investee’s operation; and

• The risk-and-rewards model, where the party that participates in the majority of the entity’s economic impact consolidates such operations. This party could be an equity investor, other capital provider, or a party with contractual arrangements. FASB coined the term “variable interest entity” (VIE) for entities subject to the risk-and-rewards model.Entities deemed VIEs must follow the provisions of FIN 46(R). Entities are deemed VIEs if they meet three requirements. First, they should not be self-supportive, as in the following instances:

• The entity is thinly capitalized (i.e., the equity is insufficient to fund the entity’s activities without additional subordinated financial support); or

• The equity holders as a group possess at least one of the following five characteristics:

• Have insufficient equity investment at risk;

• Have inadequate rights to make significant decisions about the entity’s activities;

• Possess no substantive voting rights;

• Fail to absorb the pro-rated share of the entity’s expected losses; or

• Fail to receive the pro-rated share of the entity’s expected residual returns.Second, the entities must have variable interests in the VIE (e.g., provide it with financial support). The third and final requirement is that the entity must be the VIE’s primary beneficiary (e.g., one absorbing more than half of expected losses or receiving more than half of expected residual returns).

Yves again. Now that was admittedly pretty dense, but you get the point. A VIE is incapable of operating independently. To merit begin consolidated, which is what is occurring with KKR Capstone, the firm providing the financial support must obtain a majority of the financial benefit.

Oh, but what about the Linklaters opinion that KKR brandished as justifying its position? Surely the SEC would never never challenge an opinion by a Reputable Law Firm, even if that firm happened to be the one the blessed Lehman’s Repo 105 ruse.

Wellie, it is not at all clear that the Linklaters’ opinion went beyond accounting issues. Notice the very artful wording in the Wall Street Journal:

KKR said it sought a legal opinion from an outside law firm, concerned that the accounting consolidation of Capstone could have triggered a requirement to share the firm’s fees. The March 31, 2011, opinion by Linklaters LLP concluded Capstone wasn’t an affiliate.

“KKR said it sought”. That creates the strong impression that KKR did not show the actual opinion to the Wall Street Journal. The statement by KKR is tantamount to “accounting consolidation does not mean that KKR Capstone is an affiliate”. And as we see from the long discussion above of accounting issues, yes, for GAAP purposes, if an entity is a variable interest entity, it must be consolidated if the sponsor provides enough support and derives enough financial bennies, and yet not be an affiliate for GAAP purposes.

And if our suspicion is correct, that the Linklaters’ was silent on the matter of whether KKR Capstone is an affiliate under the 2006 limited partnership agreement, this episode demonstrates the lengths to which KKR is willing to go. It realized that the mention of KKR Capstone as an affiliate in SEC filings would lead to unwelcome questions when someone finally connected the dots. So they tried to tidy that up by making sure that verboten word “affiliate” would not appear with “KKR Capstone” in future filings by having KKR Capstone deemed to be a “variable interest entity”, which is such a My Eyes Glaze Over term as to be guaranteed to deter further inquiries.

As we’ve noted, the SEC is on this case, and the SEC can presumably demand to see the full text of the Linklaters’ opinion letter at issue. I hope they give it the careful and skeptical reading that it warrants.

______

*Some media outlets have later stated, citing unnamed private equity investors, that some limited partners thought KKR might not be keeping all of the KKR Capstone consulting fees. Those sort of “nothing to see here” remarks from anonymous sources need to taken with a fistful of salt, particularly since the Financial Times reports today that general partners are “inundated with questions from concerned investors about fees and expenses” after a surprisingly forceful and detailed speech by SEC official Drew Bowden last month that described widespread lawbreaking and control failures at private equity firms.

There are significant categories of private equity investors who have very strong financial incentives to run to the defense of private equity general partners at any whiff of scandal, since a reduction of investor commitments to private equity would hurt them as well. The first type is the Wall Street firms that have private equity funds of their own. What they make in asset management fees pales in comparison to what they make on the investment banking side from working with private equity firms like KKR, Bain, Blackstone, TPG, and their smaller brethren, both in merger and acquisition fees and financing-related income. The second type is fund of funds, which allow wealthy individuals to obtain a diversified exposure to private equity (the logic is that otherwise the amount they can commit to the strategy is too low relative to fund minimum investments to allow them to participate in at most one or two funds). Many of these funds market themselves not simply on their supposed acumen in selecting among private equity general partners, but also via providing access to supposedly difficult-to-get-into private equity funds. This group would be particularly eager to defend the industry, above all the marquee names like KKR.

Even before any ‘skim’ the 2 and 20 fees in PE look difficult to justify. The rebates of management fees look like a collective agreement to avoid tax among all partners by disguising dividends. The awful complexity can be found in this NYU Law Review article – http://victorfleischer.com/wp-content/uploads/2009/12/Two-and-Twenty.pdf

“The very high fees are paid for the so-called ‘portable alpha’ to beat our old ideas of a diversified portfolio with riskier investments suitably hedged through derivatives. The ability to adjust beta through the use of derivatives is what makes the alpha “portable.” Alpha requires two inputs: the talent of the managers who create it, and the capital of investors to implement the strategy. The two parties share the expected returns;

investors are rationally willing to share large amounts of the abnormal returns with the fund managers who create them.”

Where have we heard all this before? It’s like thieves playing poker and not watching for deals from the bottom of the deck or players slipping each other cards under the table.

Also, LL opinion is that, opinion. Legal opinions spend half of the pages on caveat emptor. Technically, at best, it could provide KKR with a fig leaf to say “we did our best” – but given the other evidence, I doubt it would manage to persuade GPs.

Now, the really important question is – what will GPs do? As we saw with the RMBSes, even very visible violations of contracts led to no action as the investors were afraid (I find it fascinating.. if the people with the money to pay for the product, who want the product, can get frozen out, and the competitors who would provide better service likewise, what does it say about “markets”?).

If no GPs will take action, this is going to be interesting reading, and interesting indicment of the state we’re in, but little else I’m afraid.

Based on the evidence, the limited partners have been fleeced for a very long time. Perhaps, the limited partners knew that someone smarter than them was taking advantage; perhaps they merely suspected that they were being ripped off in some sneaky way; or, perhaps, they were unaware of how naive they were to trust the general partners to comply with a fiduciary duty. The important point about this evidence is twofold: now all of these limited partners know that they are indeed the schmucks, and, now their friends and colleagues know that the limited partners are not as clever as they appeared. Of course, the denouement is whether any of the dupes have the testosterone to do anything about it.

Ha ha. This is what happens when you get too cute by half. One wonders just who is dumb enough to trust any of these banksters. As vlade points out, are any of the general partners going to do anything about this?

D’oh! Limited partner, not general partner.

my do’h, as I suspect you got misled by my wrong terminology.. I of course meant LPs, not GPs.

No honor among thieves.

And in America, no punishment for the rich and powerful.

~

The movie “American Hustle” gives you excellent lessons on how to be a con artist, and for only the price of a movie ticket.

One lesson was on how to be coy to prospective customers. Pretend that you are not sure you want their business for the fabulous product you are offering. Pretty soon they are begging you to take their money. They sure wouldn’t want to offend you by asking probing questions for fear that you might not take their money.

I sense that this is exactly what is going on with KKR.

With gigantic piles of money sloshing around looking for the fabled safe havens, it’s probably easy for KKR to find victims.

The GP – LP relation to these rebated fees is conceived in what most of us would regard as ‘tax crime’. The LPs are beneficiaries and the losers, as usual, us – the tax not paid is serious money. The magic bean is the distribution of work rewards that no one ever gets paid for doing. There must be serious questions of whether such work ever gets done, and if it is done where the pay comes from. Any bill from a non-affiliate should ring the same bells as an invoice from Nigeria.

What is remarkable is today’s America is that fraud at the institutional level has been effectively decriminalized. KKR will probably pay a fine, admit no fault to avoid civil charges, and return to (hopefully less) business as usual. Obama’s DOJ is just as complicit as Bush’s in not prosecuting Wall Street “crime” – or what used to crime. If campaign finance is speech, what it is saying is “Don’t even think about indictments sucker”.

However if you hit a disguised cop who violently grabs your breast from behind, you can go to jail for years.

Jim

Perhaps my last reference to the Occupy Wall Street leader who was setup by the NY police requires clarification. She did receive a short sentence but a long probation (common in these cases) which effectively removes her from active involvement in movement politics.

http://www.theguardian.com/world/2014/may/19/occupy-cecily-mcmillan-sentenced-three-months-prison

Jim

Great post, Yves.

One has to wonder if there are any rules that actually matter at the upper levels of financial institutions anymore.

Are there any large financial institutions that are known to play it straight?

Am I being hopelessly naive? (prolly)

Superbly thorough work and reporting, Yves & co!

One little-discussed problem with this PE vulture culture is the associated collateral damage. A friend who is a production manager in a semiconductor fab unit in Taiwan told me how their parent European company sold them off to KKR, and that then the “new owners” started interfering in production management decisions; for example: insisting that a Japanese machine be replaced with an inferior model from Europe “to save money,” which breaks down many more times often, taking down the whole production line, and thereby destroying their company’s competitiveness with “penny wise-pound foolishness” rewarding the KKR hot-air bottom line bonus business model.

The ripple effects of this pathological PE culture effects whole companies outside of the financial/investor worlds, employees and families, and the entire economy. Invariably associated with American business culture, the noxious odor around KKR contaminates the reputations of all US businesses.

Yves,

Why have managers of large pools of money allowed this to become standard practice? Why? Why not move their riskier, PE type investments in-house, or simply do without these small but sexy income streams? Are they making out too well — despite the skimming — to bother? Are the tax avoidance benefits so great as to make all this obvious self-dealing an “acceptable” cost of doing business?

Even the larger PE companies rely on OPM to thrive. So why on earth do they have this mad leverage? Why would a pension fund allow any of it’s investments to be so blatantly mismanaged? Your documentation is lovely, but it largely confirms what most sensible observers already suspected. The people who manage multi-billion dollar funds are not often stupid, yet the implication of your post is that they’re suffering idiots, rather than complicit in an industry wide scam.

Are any of the money management professionals touched by this idiots, or suffering? It is unlikely. Those fates are reserved for the common man. How then are managers of say, pension funds, benefitting from this status quo? The benefits to the KKRs are obvious, but the benefits to those they do business with control the process.

Thanks for your question.

As I’ll address in a post going up soon, the deeply held belief among investor is that private equity outperforms other investments. That was true in the 1980s when the returns were massive, but that premise remains unquestioned. Even a recent McKinsey report repeats the widespread belief that PE outperforms the S&P 500 by 300 basis points or so. But they do mention that this is based on all of 2 studies. That should give one cause for pause: the fact that the private equity industry has maintained such a data lockdown that there have been only 2 studies that McKinsey deems to be reliable in an investment strategy with an over 30 year history.

As long as investors incorrectly believe that PE provides superior returns, they will not rock the boat. Unlike stocks,, you can’t invest in a PE fund unless the general partner lets you in. So the only people who can make any noise are the very few huge PE investors who are also highly respected (that list starts with CalPERS and has hardly any other names on it). So the alternative is to act together. But the industry association (the ILPA) has a significantly large proportion of PE friendly limited partners as members (see long footnote at end of post for more detail) that it occasionally makes the right noises (like a list of proposed reforms in 2012) but can be counted on not to do very much.

So as much as it is important to get the limited partners to understand that the general partners should not be trusted, nothing much will change until they recognize that the returns are not what they are cracked up to be.

Historical returns should show them different – especially if they (and they should) adjust for liquidity.

Also, it should be telling that the GPs feel the need to suplement their income by stuff like not rebating the fees.

Please see this post. There is no decent historical return data, due among other things to the private equity firms’ insistence that limited partners keep the needed data secret, so there is no industry-wide data set. In addition, the general partners have trained investors to use IRR, an flawed and flattering measurement. That alone is another huge red flag:

http://www.nakedcapitalism.com/2014/06/debunking-myth-private-equitys-superior-returns.html