Yves here. This post looks at how little has been done in the wake of the global financial crisis is instructive because it takes an international view. The Australian writer, Catherine Cashmore, is particularly anxious about the failure to address the usually lucky country’s ginormous property bubble, and its not alone in having this problem (cue the UK, China, and Canada). It the US, although we’ve had a housing “recovery” and some markets are looking frothy, the bigger issues are the squeeze on renters as former homeowners are now leasing and the stock of rentals is tight in some markets (in part due to destruction of homes that would have been rentable in the foreclosure process due to servicer mismanagement and in some markets, due to properties being held off the market, both by servicers and by landlords who are either in the process of rehabbing them or have otherwise not leased them up). And it focuses on the elephant in the room: lousy worker wage growth.

By Catherine Cashmore, a market analyst, journalist, and policy thinker, with extensive industry experience in all aspects relating to property. Follow Catherine on Twitter or via her blog. Originally published at MacroBusiness

Five years on since the US recession ‘officially’ ended in June 2009, urban land prices are rising, the pattern of history is repeating, and this time, the players on the chessboard have changed.

But our Governments are turning a blind eye.

They have yet to acknowledge why the global financial crisis happened, or put policies in place to prevent it happening again.

Expensive welfare systems, elaborate tax and transfer policies, and the financial ‘cures’ following the previous land induced crash in the early-1990s, did nothing to prevent the swiftest and sharpest synchronised global downturn in human history.

Taxpayers were punished, bankers got a “get out of jail free” card, and the largest real estate investment trusts spent $50 billion purchasing 386,000 foreclosed homes, to rent out to previous owners who believed and acted on the lie that “there is no bubble.”

The IMF, and policy makers are now twisting themselves in economic knots trying to pin down a ‘cure’ for the dangers of excessive house price inflation, which they readily admit lead to most banking crises, with Australia featuring in the top five of each of their highlighted risk assessments:

“……our research indicates that boom-bust patterns in house prices preceded more than two-thirds of the recent 50 systemic banking crises…..” IMF “Era of Benign Neglect of House Price Booms is Over” June 11 2014

The IMF claims the ‘neglect of house price booms is over’, but as the OECD ‘Post Mortem’ of the 2008 crises reveals, these economists can’t see.

They ignore the role that rent (unearned income,) debt and the financial sector play in shaping the economy.

They have a colourful history of recurrent boom-bust land cycles, all replete with rampant speculation and easy credit, spanning in excess of 300 years from which to study … and yet:

“The macroeconomic models available at the time of the crisis typically ignored the banking system…” (OECD Forecasts During And After The Financial Crisis: A Post Mortem – February 2014)

In other words, based on the aesthetic qualities of their equations, the 2006/7 bubble couldn’t exist. A story we hear repeated every year as prices continue to defy gravity and economist try and explain it away with ‘sound fundamentals.’

Neo-liberal policy made matters worst.

Less government interference protecting labour or redistributing wealth through taxing the rich, deregulation of capital markets, lowering trade barriers, reducing state influence though privatization and fiscal austerity – was termed by American scholar Robert Waterman McChesney as “Capitalism with the gloves off.”

It promised to lead to efficient markets and lower unemployment.

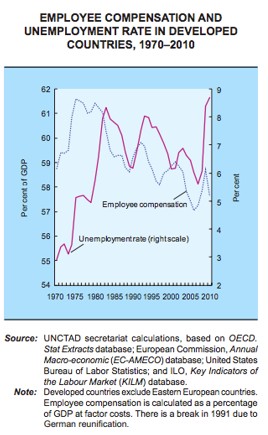

But at the onset of the global financial crisis, unemployment in developed nations rose above any previous recession of the past three decades, whilst wages, as a share of GDP plummeted to their lowest point since the Second World War.

“This should be a wake-up call…” concluded the UN in their annual Trade and Development report that revealed the findings:

“There must be something fundamentally wrong with an economic theory, that justifies the rise of inequality mainly in terms of the need to tackle persistent unemployment.” Annual report by the UN Conference on Trade and Development 2012, Ch 11. Section C (analysing the effects of “labour market flexibility.”)

In the UK, the Bank of England has imposed a 4.5 times loan to income cap on 85% of mortgages, along with various ‘stress tests’ to please the regulators.

But the Council of Mortgage lenders show only 19% of recent London mortgages are at or above this ratio, whilst the national figure is a mere 9%.

By volume, London accounts for around a quarter of loans nationally, (Q1) so the 85% cap will do little to nothing, except perhaps eliminate home ownership for low-income groups.

But stemming inflation or deterring speculative activity is not, and never will be, Central Bank policy:

Carney – “These actions should not restrain current market housing activity … these actions will have minimal impact in the future if the housing market evolves in line with the Bank’s central view,” (i.e. up)

Guardian – “Bank of England will not act on house prices yet” 27 June 2014

In the U.S.A just five megabanks and their holding companies control a derivatives market worth hundreds of trillions of dollars. In Australia, the ‘Big Four’ command 80% of the market and 88% of residential mortgages.

‘These are the men who have the most economic power in the world’ wrote British philosopher, mathematician and historian, Bertrand Russell, one of the 20th century’s leading logicians; “..and they derive it from land, minerals, and credit, in combination.”

Russell understood only too well, that all productive gains, every improvement in society and the economy, would be capitalised into rising land values, enriching those who owned the assets but more so, those who created the credit and traded on the debt.

Milton Friedman meanwhile tutored that societies are structured on greed.

But greed means taking something from another, grasping for a larger slice of the pie. (see pareto efficiency.)

Greed is not a natural feature of a well functioning community; rather it’s a feature of a dysfunctional economy that allows a country’s wealth to gravitate into an elite nucleus of financially strong hands.

It remains that the economy is fueled by what is termed the FIRE sector – Finance, Insurance, and Real Estate.

The FIRE Economy is dependent on rising asset prices – on you and me buying houses – so it can extract economic rent.

The three sectors work together – they’re intrinsically linked.

The banking sector pumps a colossal amount of credit into the system by way of a home loan. Real estate businesses sell the products – some trading as REITs – insurance companies underwrite the owners debt, property, and income, and as the interest payments compound – doubling and doubling again – the debt is recycled into more lending, more borrowing, higher house prices – making those who trade on the debt in an obscure concentrated market of derivatives, increasingly wealthy.

See Bubble Economics: Australian Land Speculation 1830 – 2013, by Paul D. Egan and Philip Soos

The Government, many members of which come directly from the industry itself, receive substantial payments from the FIRE sector.

For example, between 1998 and 2008 the banking industry spent $3.4 billion lobbying the US government.

In Australia, the ICAC investigations into illegal donations from developers and “wealthy property tycoons” reveal tens of thousands of dollars have been used to influence decisions by local, state and federal governments.

It should, therefore, be of no surprise that ‘affordable housing policy’ always seems to work in reverse.

Generous subsidies are handed over to investors – all of which are capitalised into land prices.

Restraints on supply are imposed, ‘rich neighbourhoods’ are protected from over development, land on the fringes is no longer dirt cheap, acreages are banked, exempt from State Land Tax until subdivision at the owner’s pleasure.

To survive, the FIRE sector must effectively sell the illusion that the economy can grow on rooftops, that we can all take part in an orgy of economic rent.

“Only the little people pay taxes” (i.e. work for a living) – we can all become wealthy through property investment, dining out and trading on leveraged gains, perhaps donating a little to charity, or taking part in some publicity-generating event to raise funds for homelessness along the way – as our politicians are fond of doing.

Of course, first homebuyers suffering alarm at rapidly escalating costs are necessary oxygen for the system.

So their judgement is manipulated as housing affordability is now reclassified as mortgage serviceability – how far the pay cheque can stretch each month rather than highlighting the upfront cost, while young buyers are encouraged to enter the market as speculators, living off their parents, until they gain a ‘foothold’ from leveraging the equity.

Banks assist with an array of financial products – offset accounts, honeymoon rates, shared equity schemes – mortgages treated like credit card payments, where all that’s required is the interest and should the market collapse with money still outstanding, they’ll collect the house too.

The result is land is now used for greed rather than need, pushing city boundaries outwards, requiring an excessive use of durable capital, which eventually leads to a shortage of loanable funds.

You will never be told the system can fail.

Instead you will hear that house prices can maintain a ‘high plateau’ – stagnate for a while until we all ‘catch up.’

However, the increase in the annual rate of growth is now part of the income that buyers pay for and lenders rely upon.

This is how real estate is sold – investors gravitate to areas that advertise ‘good capital gains,’ calculating the land’s value based on both the rent a tenant will pay plus the projected annual increase (land rent.)

Buyers live in fear of land values collapsing, yet, while prices trend higher, expectations over shoot the mark by no small degree. Landowners treat their unearned increment as income, raising consumption, lowering saving, putting to upward pressure on inflation, which eventually results in interest rates rising.

Never, throughout the course of history, has such a process been economically sustainable.

At some point the productive capacity of the economy can no longer support the boom – and as Australia’s history of land induced financial crises reveal, the end is not always as kind as experienced in 2008 (see Bubble Economics: Australian Land Speculation 1830 – 2013, by Paul D. Egan and Philip Soos).

“House prices don’t always go up” warned the Governor of the RBA, Glenn Stevens at a recent speech in Hobart, just as he did in March – a message he has repeatedly reiterated since appearing on Seven Network’s Sunrise in 2010.

But Australian investors aren’t listening to Glenn – they’re reading the media headlines, covering the latest findings in the BRW Rich 200, which shows property to be the ‘single biggest source of wealth,’ and entrepreneurs “piling into property faster than ever.”

Banks remain disturbingly under-capitalised.

“I’ve had land that has doubled in value in the past 12 months,” said Harry Triguboff … (BRW Rich 200: Fatter profits for property barons – 27th June 2014)

But while Triguboff paid a lot for his land, he did not make his cheque payable to the local school, park, rail network, or the array of public and community services that yield his land a healthy source of locational revenue that grants such windfall gains.

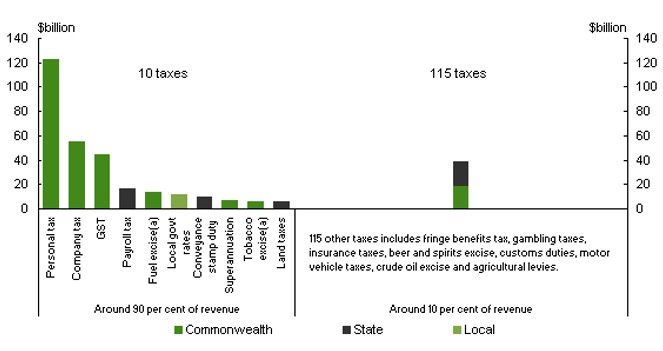

His payment went direct to the previous owner of the land, who pocketed the profit, while the funding needed for maintaining the facilities and attracting workers to the city, come from an elaborate network of taxes, which fall primarily on income and productivity – ‘the little people.’

This is the kind of rent seeking most of us have some experience of, a process that effectively punishes and disheartens the priced-out sectors of the community, whilst encouraging the hoarding of land as the road that leads to riches – thereby ignoring the social and ethical problems that result from the process.

The effect is to turn us into a nation of speculators where moral judgement is subverted by the unearned yields one can receive.

Investigate most societal problems, wages, housing, health, poverty, the loss of jobs to off shore markets, and this will be found at the root.

No one is born into poverty or inequality – these things are not by-products of nature – in a modern society the extremes we experience that lead to protests and riots over cuts in expenditure to welfare (a requirement exacerbated by the process outlined above) are due to policy and political ignorance.

When the Henry Tax Review in 2008 concluded “economic growth would be higher if governments raised more revenue from land and less revenue from other tax bases”, it was onto something important.

Lifting taxes off labour and restructuring our tax and supply policies is a good start, but alone it won’t do. Removing the power embedded in the banking industry to create credit based on their own vested interests is equally important. It would free up the creative capacity of the community and move instead toward a society and culture that is able to provide for all.

However, it remains that every effort in history to effect the changes suggested above have been fought by the establishment. In this respect, change can never come from the top down. It requires a system that can return democracy to the people through a slow process of re-education, and it’s a system we need to advocate if social and economic justice is the goal.

But until such a time, it’s business as usual – and we have a way to go yet, but be well aware, the date for the next global financial crisis has been set.

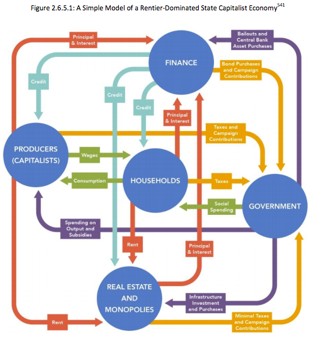

Love that flow chart.

Now consider that Since 2008, just about every arrow going into the households circle has either been cut off, or severely constrained, and you can pretty much tell why things are breaking down.

Its wrong to start the clock back to 2008.

I almost infers that pre 2008 was normal times.

Certainly the euro inflation and subsequent deflation was one of the same and was anything but normal – it was a deeply structured event.

The objective during both phases was the extraction of purchasing power from the masses and to use this surplus to overbuid capacity elsewhere – see China.

The epic stock at flow crisis remains.

Spanish oil consumption 1965 – 2013 ( 2009 & 2014 BP stat figures)

1965 : 278

1970 : 552 ( consumption doubled within a half a decade!!!!!! – this period was the flaming heart of the so called Spanish Miracle)

1975 :840

1980 :1,070

1985: 927 ( 80s euro structural adjustment depression)

1990 : 1,040

1995 : 1,177

2000 : 1,452

2005 : 1,619 (peak consumption ) in the 2013 BP stat overview this has changed to 1,594 with peak in 2007 at 1,613

2010 : 1,394

2013 : 1,200 ( return to 1995/6 consumption levels)

What has destroyed Spain ?????

Modernism in whatever form takes your fancy

Just to repeat Spain has returned to 1995 levels of oil consumption

yet there was 19~ million cars in its fleet back then.

Now its 30~ million………..

Not even a hint of rational national policy such as a return to a lower stock level of cars in combination with a higher money suppply.

A return to the village where people can at least have purchasing power within the village square.

Instead Spain is locked into a mercantile vice.

Where it must export to afford cars it cannot afford to run.

The state and bank apparatus is preventing people from returning to the village at all costs.

Bielsa central square – one of the last villages in that part of Aragon trying to hold on to basic life .

https://www.youtube.com/watch?v=I9n4OdKNVXI

interesting analysis – coincides with my view that in addition to all the financial skullduggery, the real increases in oil prices is having a wrenching affect.

Here in Canada the top 20% buy overpriced houses from downsizers who with their gains often go to Florida and Arizona to spend 6 months’ worth of CPP cheques. They fill up their homes with China stuff. They buy imported luxury cars. Then, they plan a couple of annual trips outside the country to get away from the cold.

Then they want tax cuts so they can buy more of the above. And they wonder why their house looks so nice but the infra serving it is falling apart.

All this money flowing out of the country yet they are convinced Canada will be rich forever.

Sounds pretty damned American to me.

Die hard neoliberal to me…

I am always amazed by the sheer size of the road network here in Canada. There is such a large amount of paved roads with very little traffic in the countrywide. Meanwhile, there is barely enough money for public transit in the core.

Since 2009, provinces have been spending inordinate amounts of money building highways leading to resort villages… here we are in the middle of a global crisis where the essentials have been underinvested for decades and we are pouring money into non-essentials.

It just goes to show how disconnected from reality the Western world really is about what is going on.

You can always get credit for new projects based on optimistic estimates over the next 15-20 years but it’s hard to pour money into maintaining assets that are viewed as a cost.

DITTO my remark above.

“……our research indicates that boom-bust patterns in house prices preceded more than two-thirds of the recent 50 systemic banking crises…..”

Step back, if you will, to the 1890s. It was an amazing period of groaf and technological innovation. But land and housing prices had been drifting downward for a quarter century.

Speculative real estate was considered a fool’s investment. You bought a house for shelter, but didn’t expect its price to increase, unless it was in the path of urban growth.

This image of a bygone era is what normal life looks like under a stable currency. Whereas under a fiat currency regime, sequential bubbles are the only possible result. One observer suggests this fix; a different expert another. But if the root cause (an ‘elastic currency’) is not addressed, the bubbles boom on.

Abolish the freaking Fed …

Because a depression every fifteen years and a banking crisis every five was like, way better. Yep, America sure needs a good old dose of 19th Century know-how.

Though many of us advocate many different plans of reform its this difference which alienate us from accomplishing our goal of reform. They’re is nothing like the concise statement in the above article posted by Yves that tells us how badly we need to join one another to accomplish what is needed.

“However, it remains that every effort in history to effect the changes suggested above have been fought by the establishment. In this respect, change can never come from the top down. It requires a system that can return democracy to the people through a SLOW PROCESS OF RE-EDUCATION, and it’s a system we need to advocate if social and economic justice is the goal.”

Actually, the process of re-education is generally pretty fast, and brutal, brought by war. We are so far past “reform,” it’s ridiculous. Forget about it

And give the people more credit. They have a pretty good fix on what’s going on (they’re getting fucked). Oftentimes, they know what to do about it, but because the people are poor and powerless, they are unable to do what is necessary BECAUSE: Homeland Security, Fusion Militarized Local Police, Corporate Personhood, NSA, IMF — need I go on?

I just had the privilege spending the day in Detroit, protesting the shut-off of water to poor people with bills $150 or more in arrears, while the municipal golf course, currently more than $400,000 in arrears, continues to be watered. Also, many private corporations that are way behind in their water bills have not been shut off.

It was inspiring to be there with, we estimated, 1,500-2,000 other people. A very diverse group in terms of age, race, and economic status.

The fascist “emergency management team” in Detroit is going to try to privatize the water system. If we let it happen there, Cleveland will be next. All the rest off you around the country will not be far behind.

In the future, more of us around the Great Lakes (at the edge of 1/5 of the fresh water in the WORLD) need to support our brothers and sisters in Detroit. Whatever happens there, is on its way to you. — Carla

P.S. Some of our favorite signs: “THIRSTY FOR JUSTICE” and “NURSES ARE THE REAL EMERGENCY MANAGERS” (a reference of course to Emergency Manager “Czar” of Detroit, Kevin Orr, an attorney from the Cleveland law firm of Jones Day, BTW).

Many years ago, I read The Robber Barons, by Matthew Josephson, and sizable chucks of the giant book The Rich and the Super Rich, by Ferdinand Lundberg. I would attempt to explain the pernicious effects of extreme wealth to people, but with little success. Few people were prepared to believe; some would argue angrily with me, and some would politely nod their heads, probably hoping I would take the hint and shut up.

One important lesson of the past six years is that people are a little more receptive to the idea that extreme wealth is a dangerous phenomenon. There are still plenty of deniers, but their percentage has dropped. Even some of the deniers have to admit that something is wrong now. I’m not optimistic about the future, but I feel less alone in my awareness of the oligarchy in which we are immersed.

I haven’t read those books, but I’ve owned stock for several decades. I started noticing the concentrations of wealth, which increased, of course, with all tax cuts for the super wealthy beginning with Reagan on down the line. I also witnessed the concentration of certain top dog names on Corporate Boards, clearly highlighting how they were all scratching each others’ backs. CEO & other top Corp job salaries began their swift rise, all while more tax cuts were enacted for them, only.

Wages for the working stiffs, in the meantime, stagnated, while we were all expected to do more, more, more with less, less, less.

I tried explaining this to numerous people, pointing out how the tax cuts were really only being felt by the super wealthy… all to know avail. Got similar responses to what you experienced, and same continues to this day. Doesn’t matter how people vote/identify, either. Most citizens simply do not want to grapple with the issue of wealth/money disparity and the chicanery occurring across the corporations/govt. Why? I don’t know. Laziness, perhaps, and the ability to live in delusion, I guess, plus not giving a damn about those who are truly suffering (v. those who are managing to make it even if just barely).

The Occupy movement definitely helped highlight these issues, and so we can at least talk about the 1s v the 99s, and people “get” what it means (sort of). But most still are lethargic and uninterested in doing anything to push things towards a better place for themselves. I stopped trying to figure it out a long time ago. It’s frustrating, but I have no solutions so far.

Most Americans just aren’t suffering enough yet.

Well, I certainly have changed my views about individualism, incentives, and how the system works. First, a lot of this quest for wealth is irrational. The premise of economists of “rational, utility maximizing” man has been demolished. Keynes once said something to the effect that it is better that a man have dominion over his bank account than his fellow man.

ah, the quote “It is better that a man should tyrannize over his bank balance than over his fellow-citizens.”

http://www.nowandfutures.com/quotes.html

Anyway, it seems to me that the rich are profoundly affecting the laws and very structure of this country – whether Murdoch, Zuckerburg (immigration policy), et al. They have all the money that they can buy anything they want – but they’re wants go far beyond material possessions. I had the view of Keynes – let people be rich, better they lord it over their bank account versus other people – but I was wrong. They DON”T STOP THERE. And there involvement seems to coincide with a real diminishment in the efficiency and effectiveness of the government.

Yep. Hoarders. Every so often you read stories about people trapped in their homes because they’ve accumulated too many old newspapers, or Kleenex boxes, or whatever. At some point, an intervention is made. I don’t see why the moral calculus for the uber-wealthy is any different from that for the Kleenex box hoarders.

The super rich are worse than the mundane pathological hoarders. The super rich hoard more than just objects; they also hoard influence over people. That influence can be very destructive.

The thing is the richer people get, the more they become detached and scornful… they end up wanting just enough people to lord over and the others to just disappear.

“THEY DON’T STOP THERE.” I learned this in Sunday school at our very wealthy Episcopal Church. We were NOT very wealthy, or even wealthy at all. I wore hand-me-downs to Sunday school and knew perfectly well that every one in my Sunday school class knew it. As I watched and learned and watched and learned, I eventually realized that for the RICH, there is NEVER ENOUGH. They are spiritually impoverished (and I say this as an avowed atheist BTW — thanks very much Episcopal Church — you taught me more than you will ever know.) As spiritually poverty-stricken human beings they can never attain the state of grace of the economically poor. By and large, the rich are entitled narcissists. There are a few exceptions (I have actually met a couple), but very few.

I have been working with the 1% for 20 years and I see the delusions on a daily basis. When I went to lunch with someone, my boss was convinced the person was using me to get to his money… all his relations were based on this thought process. What a miserable life!

Once at lunch I was sitting with the president of our company, worth a bundle, and he kept on saying how much freedom of choice his money gave him. And I was fascinated by how convinced we are of free will. He is free to work at a 10$ per hour job but his brain, the way it was programmed, would never let him to that. It’s called the illusion of choice.

There might be multiple options out there but our brain with it’s computation of available data will only see 1 single option.

I don’t know whether humans have free will. If we do, I don’t understand how it would work. But I do know that if we have free will, it is only a tiny portion of what motivates us. Genetics, exposure to chemicals and nutrients while in the womb, our early childhood experiences, and simple things such as our access to water, food, and shelter all combine to force us to act in certain ways. Any divine spark of free will must be tiny indeed, if it exists at all.

“No one is born into poverty or inequality”. This is bad English, since the statement as it stands and as commonly understood is false. What needs to be meant is that no one is born to be poor or unequal. And while this is certainly true in principle, it does not seem ever to have been true in practice. I have been told that this is because the developmental stage of representative democracy of the kind we now have is so young and, therefore, quite imperfect. I would expect this argument to appeal to a situationalist of a certain stripe. But if you think of the Zimbardo Stanford prison experiment or Milgram’s obedience to authority experiments or Asch’s conformity experiments, you can’t help but wonder whether the situation on its own is such a powerful influence or whether it is working with, rather than against, something deeply embedded in human nature.

I’am in favor of slowing down rent seeking. I know because I own several properties and for some reason the government sees them as passive businesses so I can deduct all sorts of expenses while enjoying the upside on rents from tenants. In fact, I own properties in several countries and MUST claim them all on my tax filings as businesses. This setup for the rich distorts the housing market and hurts the tax base for everyone else. Oh, by the way, when you move the government allows you to deduct the full expense of moving your household goods — even when overseas. Incredible.

Well, if land speculation bubbles go back all the way to mercantilism and colonization it just goes to show that fiat money didn’t cause them. Both greed and deprivation cause speculation. They were first financed by silver and gold coins. Only later did fiat get in the act. Clearly profit dives speculation and Capitalism is synonymous with profit. I’ve always wondered if in 1989 when the USSR “failed” if it wasn’t voluntary because they could see that the US and the “west” were going to implode by their own mismanagement of society. Since we “won” the Cold War things have been awful, haven’t they? That’s because we don’t know what the hell we are doing. And we never did.

Here is a chart of the U.S. price level since 1790. Prices in 1930 were not much higher than in 1790:

http://ct.swaffers.net/net/swaffers/ct/image.axd?picture=2012%2F4%2FCPI-GDP_1790-present2.PNG

But after 1970, when Nixon unplugged the dollar’s last link to gold, inflation took off with a mighty whoosh and never looked back.

This is your currency on drugs (hopium).

I remember it well. But I think that fiat is actually the solution, not the problem. How do you deal with poverty without it? How do you distribute without it? Etc. Fiat is equivocal; it evens itself out. “Gold” is not and it is an unforgiving rule that makes every situation worse. It used to be that we humans had time to grow ourselves out of debt. Not any more. So modern time is the biggest factor. The unforgiven will now become the living dead.

STO — You’re probably the smartest person commenting on NC or at the very least in the top ten, so I offer the following with humility: I suggest that it is not just “Gold” but ANY commodity-based currency (Oil (the dollar), pork bellies, WHATEVER) that “is an unforgiving rule that makes every situation worse” because it can, and will, be immediately hoarded by those with the power and connections to hoard, shutting everybody else out.

However, I admit, I don’t understand how a debt-based fiat currency “evens itself out,” either. Debt-based fiat seems an invitation to speculate with (on) something that is just, uhm, an idea.

I understand that money is only an idea (an agreement, a contract, a law—whatever you want to call it–it’s still just a human construct.)

But so far, I haven’t yet seen how fiat money solves poverty, and although I am probably in way over my head here, I sincerely hope you can and will enlighten me on this point. — Carla

The structure of money is just a reflection of our wants…. money has mostly stemmed from the need to exchange physical goods. It has moved to services but most of new money is based on some sort of physical collateral.

Money will always end up failing after a big surge in credit. I think they understood this thousands of years ago since even in the bible they spoke of debt jubilee every 50th year… interesting how the number coincides with 1 long lifetime or 2 generations. This forced creditors into noblesse oblige.

We need to decide what kind of society we want to live in before determining the structure of the money system. Something we have not done in a long time.

Interesting observation wrt the debt jubilee. I wonder also if they understood the apparent tendency for money and power to accumulate in the pockets of plutocrats, and the debt jubilee was prescribed to avoid social instability.

Post-WWII average inflation has been 3.5%, falling to 2.9% after 1990. Perhaps you should be a bit more up-front and tell people the U.S. had gone through its sixth economic contraction in the 25-30% range between 1790 and 1930. You know, those things you love so much that throw millions out of work and destroy families?

But at least the price level for things no on but the wealthy could afford to buy was stable. Makes the spreadsheet look nice and linear, not so good for actual people.

“Pride of Ownership” is outdated for those who are now renters with massive credit debt. Easy communication is creating a sub-culture that hopefully will ignore the predations of the wealthy few who can live around the world in what they think are gated communities. Loyalty to nation, job and home location mean less every day.

I’ve learned there is no rule of law in America for the criminal elite.

And how much I hate the criminal elite.

RUKidding : “” Most citizens simply do not want to grapple with the issue of wealth/money disparity and the chicanery occurring across the corporations/govt. Why?””

It is like Brzezinski said – the masses are ” woefully ignorant ” and they know they are . They know that even after at least twelve years of expensive public education they understand very little about the technicalities of income distribution and even less about wealth distribution in general . Furthermore , they believe that it is either the exclusive responsibility of government or up to the so-called free markets to make sure they are getting enough of everything they need . They do not know what they do not know and you cannot make them know . The schools should teach distribution theories – the best one will prevail .

Fresno Dan : “” Anyway, it seems to me that the rich are profoundly affecting the laws and very structure of this country “”

It is not too difficult to understand why . Start with the * Universal Law of the Standard Normal Distribution * which is completely mathmaticly defined and scientificly derived based on real world empiricism of the distribution of virtually anything and everything given the proper conditionals or parameters . Look to see how far off rich incomes are from the normal curve where they should be . Then look to see how government is complicit in the discrepancy because the plutocrats ( rich oligarchs ) buy out the government . Then see how the 100+ year old * Iron Law of Oligarchy * explains how nearly all democracies become plutocracies because there is no limitation on taxation whereby all wealth and thus all political power eventually , as taxes increase , accumulates at the top of the hierarchy of rulership via government expenditures to corporations . The natural and logical limitation on taxation ( all taxes ) is 50% of your income . You ain’t gonna beat the rich at the money ( income ) game . You must use political powers that they do not control to get your fair share of the pie – or they will hog it all .

http://crookedtimber.org/2014/07/19/the-unravelling-of-the-global-financial-system/

play ball by NY insider rules.

Susan the other : “” That’s because we don’t know what the hell we are doing. And we never did.””

You may be correct – ” we ” do not know and never did ; but ” they ” do know and always did . We need to pay attention to what ” they ” are doing so that we can figure out a way to keep from being totally enslaved .

great article!