Yves here. There has been so much anticipation of the seemingly inevitable next financial markets crash that it’s easy to brush off yet another market call. But given Rajan’s track record, it’s worth at least listening to his reasoning.

It’s noteworthy, however, that post author Llewellyn-Smith sees no crash detonator prior to 2016, which might as well be 2025 as far as most investors are concerned. I have no idea what the timing will be, but the focus on financial/asset markets as the trigger seems unduly narrow. Geopolitics are vastly more fraught than in the runup to the global financial crisis, and we also have more unstable weather, such as the drought in California, which is certain to put pressure on food prices in the US. In other words, it appears that real economy risks, which are often wild cards, are not adequately factored into these “when might the wheels come off” exercises.

By David Llewellyn-Smith, founding publisher and former editor-in-chief of The Diplomat magazine, now the Asia Pacific’s leading geo-politics website. Originally posted at MacroBusiness

The Wall Street Journal is reporting that:

Reserve Bank of India Governor Raghuram Rajan warned Wednesday that the global economy bears an increasing resemblance to its condition in the 1930s, with advanced economies trying to pull out of the Great Recession at each other’s expense.

The difference: competitive monetary policy easing has now taken the place of competitive currency devaluations as the favored tool for playing a zero-sum game that is bound to end in disaster. Now, as then, “demand shifting” has taken the place of “demand creation,” the Indian policymaker said.

As was the case in the 1930s, the lack of coordination between policymakers is producing spillovers that may be difficult to control, and the world’s financial system may soon face fresh turbulence at a time when central banks have yet to repair the damage that the 2008 financial crisis caused to developed economies.

“We are taking a greater chance of having another crash at a time when the world is less capable of bearing the cost,” said Mr. Rajan in an interview with the Central Banking Journal.

Before you write this off as the ramblings of a subaltern crackpot, recall that it was Raghuram Rajan that warned in August 2005 that:

Developments in the financial sector have led to an expansion in its ability to spread risks. The increase in the risk bearing capacity of economies, as well as in actual risk taking, has led to a range of financial transactions that hitherto were not possible, and has created much greater access to finance for firms and households. On net, this has made the world much better off. Concurrently, however, we have also seen the emergence of a whole range of intermediaries, whose size and appetite for risk may expand over the cycle. Not only can these intermediaries accentuate real fluctuations, they can also leave themselves exposed to certain small probability risks that their own collective behavior makes more likely. As a result, under some conditions, economies may be more exposed to financial-sector-induced turmoil than in the past. The paper discusses the implications for monetary policy and prudential supervision. In particular, it suggests market-friendly policies that would reduce the incentive of intermediary managers to take excessive risk.

He issued this warning at the FOMC’s Jackson Hole gathering where he was greeted with genteel jeering and was publicly dressed down by Larry Summers.

Rajan was proven very precisely to be right. Unfortunately he is almost certainly right again this time. The only question is when.

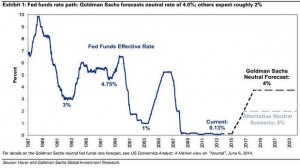

On that I’m on the record arguing that the Chinese property market may trigger the event some time after 2015. But another scenario that is a persuasive alternative is the Jeremy Grantham theory of a 2016 bubble bust for US markets following its Presidential election. On that Goldman today provides a nice trigger:

The S&P 500 will generate an annualised total return of 6 per cent between now and 2018 when Fed funds reach a “neutral” level of 4 per cent…We assume a neutral Fed funds rate will be reached in 2018, and 10-year Treasuries will yield 4.5 per cent. Our baseline scenario implies an annualised total return of 1 per cent on a constant maturity 10-year Treasury note through year-end 2018…Buying a 10-year Treasury note and holding it through 2018 would also generate a nominal annualised return of 1 per cent.

If we ever reach 4% I will very happily eat my hat.

The crisis a result of a dramtic disconnect between capitalist yield bearing assets and a chronic lack of purchasing power.

Look at this article – the Irish neo liberal ESRI thinks that houses are undervalued by 27%.

http://www.irishtimes.com/business/economy/esri-says-house-prices-27-below-real-value-1.1889640

Maybe maybe not.

But we are looking at a system in transition and which may break down because of its own internal and external contradictions.

Recent Irish house price rises is a result of external people backed up by external credit creation buying up these assets,

The resident Irish continue to see a decline in real purchasing power.

The banking system needs to scale up further if these strange inflationary goals are to be acheived.

Then perhaps the irish can be taxed further so as to compel them break up the family unit and take residence in the street or in some other conduit asset.

Yeah, its funny (no, its not) how workers are never, ever “undervalued” and their purchasing power can ONLY be increased by allowing them more credit.

Mr. Dork of Cork, I seem to recall reading recently an analysis by the Irish Central Bank stating that 25% of all mortgages in Ireland were still interest only loans. Sounds pretty catastrophic to me.

But why care about mortgages in the first place ?

Those goods have been produced already.

Why not return wealth to the people by doing the Christian thing and simply giving it away.

However this is simply just too New Testament for the masonic lodges.

Surely the purpose of a economy is to produce goods which can be bought…………or is it ?

Central banks always and everywhere are a pox on humanity.

LOL! Nothing “neutral” about the Fed, and who in the hell do they think is going to buy all of these expensive homes with the mortgage rate implied by a 4% Fed funds rate? I guess they’ll have their sanctuaries prepared on Elysium by then so they can monitor it all from a safe distance.

I dunno about this dude. A “seer”. I mean really. Did any of these dudes even watch TV in 2006? Probly not. They too busy staring at Demonic Sadistic Godless Equations to even tie their shoes. You can look at them and see the drool fall out their mouths like a frozen icicle of spit.

There’s “risk” and then there’s “fraud”. Nobody covered this better than NC and our Editor and Chief Cat Slave. Nobody. We all know that.

So these boneheads talk about risk but they really mean fraud. But they don’t seem to know it or SEE it or reason through it, even now, years later. Why is that, I wonder? Of course Professor R. doesn’t seem as thick of a bonehead as the others, but the bone is still pretty hard there where it counts.

It worked so well for them last time, they would be CRAZY not to do it again.

The definition of Financial acumen is working a fraud, making billions, having the FED say it was like a natural disaster that no one could ever possibly have seen coming, …..and than repeating it making billions, having the FED say it was like a natural disaster that no one could ever possibly have seen coming, …..and than repeating it making billions, having the FED say it was like a natural disaster that no one could ever possibly have seen coming, …..and than repeating it making billions, having the FED say it was like a natural disaster that no one could ever possibly have seen coming, …..and than repeating it………

The floorboards are rotted. There is no “trigger” needed.

Larry Summers is still not in jail?

‘The floorboards are rotted. There is no “trigger” needed.’

Or, any trigger will do.

The real agenda ??????

https://www.youtube.com/watch?v=TbYRRa30a9w&list=UUugsH0a5pKF7q9qck2CxTAQ

Energy extracted from the US and burned in euroland as people work for the machines (capital goods overproduction)

You can easily observe local estate managers working to capture external primary goods so as to restart their demonic scarcity engine.

http://www.irisheconomy.ie/index.php/2014/08/07/16734/#comment-774780

There is no shortage of houses or cars in Ireland………….

This is a fascist cromwellian drive for yield no matter what the true cost.

Wealth is not the English understanding of it …..well being.

It is simple extraction when looked at from a sufficient distance.

As I predicted last year.

Irish new private car consumption almost to the 100,000 + level already.

The highest since 2008………….despite a chronic lack of purchasing power.

http://www.beepbeep.ie/stats?sYear%5B%5D=2014&sYear%5B%5D=2013&sRegType=1&sMonth%5B%5D=1&sMonth%5B%5D=12&x=40&y=11

‘… competitive monetary policy easing has now taken the place of competitive currency devaluations …’

This is a distinction without a difference. Pre-1970, devaluations took place explicitly within a fixed exchange rate framework. Now QE is being used to devalue all currencies in a global race to the bottom.

If the global economy ‘bears an increasing resemblance to its condition in the 1930s,’ India has certainly done its part to make Rajan’s prophecy self-fulfilling, by torpedoing the WTO trade round.

Not seeing how India’s decision regarding the most recent iteration of the WTO trade agreement could be considered a potential catalyst for crashing the global financial system. Ditto the TPP, TTIP and other so called “trade agreements”, which I consider to be an incredibly aggressive expansion of corporate and TBTF bank powers at the expense of sovereign nations.

We’re not talking Smoot-Hawley here, although selective use of economic sanctions against particular nations and the countermeasures being taken by those nations is an interesting related emerging issue.

The economic sanctions against Russia and the retaliatory sanctions against US/European products are reminiscent of Smoot-Hawley.

‘We’re not talking Smoot-Hawley here’

No … but this is the first trade round since GATT kicked off in 1947 to fail.

http://en.wikipedia.org/wiki/General_Agreement_on_Tariffs_and_Trade

Arguably bilateral and regional trade pacts such as the ones you mentioned are undermining WTO’s global process. As Slime Pickens mentioned, the escalating trade war against Russia is quite ugly, sending 10-year German bunds to record-low yields of 1.07 percent.

What’s that spell? One interpretation is ‘depression in Europe.’

Torpedoing the WTC “round” was a favor to us all, from a very unexpected source.

Don’t know why anyone (excepting ignorant press secretaries) could call it unexpected. Everybody knew India would not budge from government managed food stockpiles. Everybody knew the bullies in the room consider public stockpiles treats to their Godgiven profits. The only question was when would the bullies pull the plug.

Technical issue: FWI

I have a Chrome notebook: Recently your site became very slow and when I went to links to froze up but I could tell the something was scanning my computer. I dumped cookies and the problem was solved.

Yves: re: your mention of the drought in CA — I am in SoCal at the moment. Here in the desert, lawns and golf courses retain their brilliant green thanks to daily automatic watering. So yes, this drought will be used to raise food prices, but it does not seem to be out of line with historic conditions and apparently TPTB are not alarmed.

What of the $500 fines for watering your lawn or washing your car?

I was just in SF and made a short trip to Napa. It really looked like when I visited Croatia just when what turned out to be horrific fires were breaking out.

Southern CA is still green and excessive water use carries few actual penalties (conservation is mostly softly encouraged not mandated) Lawns are green (yes more people are choosing drought tolerant landscaping but it’s still a minority and it’s entirely voluntary).

the other day, the Willamette Valley was covered by a high brown haze. We checked – no fires in the area. The smoke was coming all the way from fires in CA.

It’s gonna BURN. The worst part? Doing the right thing and not watering makes your place more vulnerable to wild fires.

Actually, watering one’s personal landscape does little to prevent destruction by wildfire. Creating a clear non-combustible zone is more effective. Building with fire-resistant design and materials, second best. Not living in the urban/wildland interface, a definitive advantage. I live in the California chaparral (fire zone extraordinaire) and wildland fire destruction is rather random.

Yves,

Writing from just south of SF, the “restrictions” are not particularly stringent (up to a $500 fine for) :

* Application of water to outdoor landscapes that causes runoff onto adjacent property, non-irrigated areas, walkways, roadways, parking lots, or structures

* Use of a hose to wash vehicles, except where the hose has a shut-off nozzle

* Application of water to any hard surface (driveways, sidewalks, asphalt)

Emphasis added. Basically, don’t water the sidewalk and turn off the hose when you’re washing your car.

But the drought is getting to be quite serious — it’s one thing if you can’t grow lettuce in the Central Valley due to water restrictions but a completely different issue if you need to start cutting nut and fruit trees (and can’t graze livestock).

SoCal is under different conditions than Central and Northern California (and rest of the states receiving water from the Colorado River.). The drought is very real. The water managers are drilling at the bottom of Lake Mead to drain every last drop. The drain is similar to what we see in our bath tubs.

I think Science Friday had a podcast on this issue.

I’ve been in SoCal for a week. Suburban lawns are green and gardens are lush. Sprinkler systems are going morning and evening. Golf courses and public parks are emerald. Car washes are doing their usual phenomenal level of business. There’s some xeriscaping of individual properties, but only here and there. Just relating what I see.

Don’t be fooled by appearances.

I think the water shortage is real. Sure water is still being used right and left. The illusion will be maintained until it can’t be anymore and then it won’t. But even in agriculture, food continues to be grown in CA of course and that makes some sense given the massive population centers (even if some farms have gone under due to lack of water) but this is accomplished by record depletion of aquifiers. Thay are not being replenished. It’s all borrowing against the future. And meanwhile the salmon are trucked to the sea. Southern CA has long gotten water from elsewhere, from the Owens valley (the biggest superfund site in the nation now), from the Colorado river etc..

Historical conditions is a hard one as the last 100 years may have been a historical anomally in being wetter than normal for California. And yes of course there’s AGW.

Thinking things are fine because they seem so now, seems akin to someone pretending smoking a pack a day will have no effect on them as they look the picture of health now. Maintaining illusions seems to be how the whole society rolls.

I don’t think things are fine. California is a desert state, but it doesn’t live like one.

California actually has a Mediterranean climate; Nevada is the desert state (they call it high Prairie). While California has a long dry season interspersed with a “wet season”, droughts are common (and AGW will definitely limit the capacity of the Sierra Nevada mountains to store “wet season” snow in the future).

The climate of California hasn’t changed much in the last 60 years, but the population has grown to over 38 million. That will make for serious repercussions.

The amount of liquid fuel used to build or maintain water facilities in the western world is tiny.

Almost all liquid energy is used to chase scarce money.

If there is a water crisis its a result of scarce money / free credit policies which gives the illusion of scarce capital needed to engage in basic life support.

Earth is not earth – its mainly water.

It even falls from the bloody skies if I recall although rarely in Ireland – you see our propagandists have told us its a bone dry island enaged in a desperate struggle to preserve what little remains.

I am not kidding.

Cork in the year of our lord 2014 – a dry arid place full of strange characters

https://www.youtube.com/watch?v=jg4OCeSTL08

To change the young minds of all the world…………I did not read Dune but I have a friend who read it and thought it was fantastic”

Don’t believe in the shit these people sell , laugh at it.

The problem is it hasn’t been falling from the sky, plus much of California always was a dessert. The amount one would get from a rain barrel with so little rain isn’t much. More capital needed for basic life support? The aqueduct already carries water throughout the state and uses energy to do so, it’s already being transported from the Colorado river, depletion of underground aquifers have already made the ground sink many feet where that has been going on. Unless what is mean is desalinization. Well there is a giant ocean there, the planet is mostly water, but it’s mostly not drinkable without desalinization. And if desalinization is the only thing to make large parts of the country livable … My understanding is desalinization uses crazy amounts of energy though which if it’s fossil fuels is more of the poison that’s killing us. It’s also probably radioactive but oh well, we’ve all been exposed by this point probably :).

People are living in California because that is where the money is………….

Much of the US physical economy is somewhere else.

Same goes for Dublin infact – which is the driest part of Ireland………..

No direct experience of California but I do have of Spain which shares much of its climatic type.

People vacated their version of the lower Sierra Nevada for the hot (and now urban) lowlands because that was where the money tokens were – no other reason really.

http://en.wikipedia.org/wiki/Province_of_Teruel

People with a basic income ( capital allowence) would not leave such places.

A village car could be shared on a communal basis.

Part time agriculture would be engaged in.

Nothing more can be learned in the city other then new methods of extraction from its hinterland.

Produce here in Silicon Valley is still very cheap. But more and more of it is from Mexico. Not good; their constraints on weird plastic “edible” (haha) coatings are even more lax than ours.

Most Americans will readily buy food grown in Mexico and China to save money – I predict. The drought won’t affect our food prices as much as you’d think, because of that. Unfortunately it’ll be toxic crud that they’re eating, not food (even the produce), but that doesn’t seem to bother most people, unfortunately.

“Chinese imports of U.S. food and agricultural products increased from US$12.1 billion in 2008 to US$25.9 billion in 2012. That represented an increase of 114% and now makes China the largest export market for agricultural products. Despite of differences in business culture and uncertainly about import requirements, U.S. exporters will find that this expanding economy continues to create business opportunities. In 2012, U.S. exports of consumer oriented food products to China increased 20% and totaled a new record high of over US$2.3 billion. China now ranks as the sixth largest market for consumer ready food products from the U.S. Top consumer ready products exported to China in 2012 included red meats, dairy products, processed fruit and vegetables, fresh fruit, tree nuts and poultry meat.

——-

In 2011, China’s food industry continued past rapid growth, but while sales increased, the total number of food operations dropped, signaling both a difficult economy and ongoing consolidation of the industry. By 2012, conditions worsened, with a number of food manufacturers reporting growth rates in the range of 10% as compared to an average rate of 30% over the past ten years. The decline in growth and continued consolidation is the result of a combination of factors, including high rising food ingredients prices, soaring labor costs, rising entry costs for new companies and tightened bank loan requirements for small sized enterprises. At the same time, rising prices generally, and specifically for food, are leading consumers to economize more than in the past. ” https://www.foodexport.org/Resources/CountryProfileDetail.cfm?ItemNumber=1007

looks like China will be supplying Russia and Mexico never could meet demand…present and future droughts will be effectual.

4% ten year = demand boom = S.P. up substantially

“Real economy risks.” Show me a stock market that reflects this and I’ll show you a constant crash.

I think what Rajan realizes is that what began in 2007/2008/2009 has grown into a crisis of globalization itself, or at least the essentially US/Fed Empire version. The Fed as chief regulator was responsible for blowing the global economy apart, and then, acting as if nothing had happened once bailouts and pardons were secured, proceeded with Treasury straight into a very well-signed ‘Box Canyon!’ of policies certain to make the entire problem worse, forcing numerous other important countries and many others less ‘systemically’ so, to do things they really didn’t want to do. Around the world money flowed in and out and up and down sending a rolling wave of instability around the globe at the same time essentially at war from Libya to Pakistan, and now on Russia’s border, as well as on deteriorating terms with China, Germany, Brazil, India..and still others as reflected in recent UN proceedings, oh, with a bit of a wild card in Japan.

What the US is doing vis a vis Ukraine is essentially crazy. It is a wildly disproportionate risk vs ‘gain’ as ‘markets’ that’ve already turned down dozens of good reasons to correct over the last few years are slowly recognizing how fundamentally stupid a policy it is, along with all the other stuff actually happening outside as the product of the dense, roiling haze of corrupted reality centred in Washington and New York.

But even the US and its Bank have limits. Unilateralist globalization has moved too far, too fast as the structures and identities of sovereign peoples and States runs deeper than champions of neoliberalism care to admit. A global slowdown is virtually guaranteed with or without ‘success’ in toppling Putin (as that is the goal) a prospect other large countries view with alarm. The post-9/11 world is a total dead-end, and a lot of eggs are going to be broken finding out the hard way.

10 y tnt will reach 4%(and higher) because of capital-movements, not inflation and/or FED-policy per se. Selling bonds (low interest) by pensions-funds (i.e) for equities(higher yield). Somewhere down the line default-risks in UST will rise but before that happens the dollar will rise(yen, euro, yuan falls) substancially together with the US stockmarket. It is all about over-indebtness and investor-protection = capital-movements = new crises.

The new normal is not a normalization! For now it seems UST will test the bottoms. There is a lot of global capital created the last 15 years that have to be parked somewhere. What if “global” risk-free investments in reserve-bonds bares much higher risks? Which national currency can absorb the need for global capital-safety? Well, the dollar of course. No competion there.

“It’s noteworthy, however, that post author Llewellyn-Smith sees no crash detonator prior to 2016, which might as well be 2025 as far as most investors are concerned. ”

This probably explains the exotically high stock market levels — too much short-termism. Thanks for reminding me of that factor.