As Wolf points out, despite stock touts’ talk of “escape velocity” and other confidence-fairy boosterism, the Fed has been quietly making more and more negative assessments of the economic outlook.

By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street.

Wall Street’s and the media’s attention was riveted single-mindedly on whether or not the Fed would include in its statement the two words, “considerable time,” the two vaguest, stretchable latex words available that describe absolutely nothing and leave the door wide open for wishful thinkers of every stripe. That’s what the Fed’s gyrations since the financial crisis have so successfully accomplished; they have reduced the market, a place of price discovery, to a crummy joke.

The Fed delivered those two words, but during the press conference, Fed Chair Janet Yellen doused them with so many qualifiers that they’ve become even more meaningless, if that were even possible.

Wishful thinkers still see Yellen as a pure dove, while others worry that she has turned into a closet hawk who is afraid of letting this tsunami of free liquidity inflate asset bubbles and build up risks so immense that even a minor hiccup would bring down the entire financial system once again. And this time, under her watch.

Clearly, FOMC members, and particularly Yellen, would try hard to dodge blame. But after having printed $3 trillion, and after having forced short-term rates to near zero – and below the rate of inflation – for what likely will be more than six years, and after having messed with the markets throughout, they too can imagine that blame for the fiascos these policies might end up causing will be hard to dodge.

But beyond its crummy joke, the Fed has done something else: it has removed “Escape Velocity” – the economic surge in the US that has been falsely promised for five years in a row to rationalize soaring stock prices – from its vision of the future.

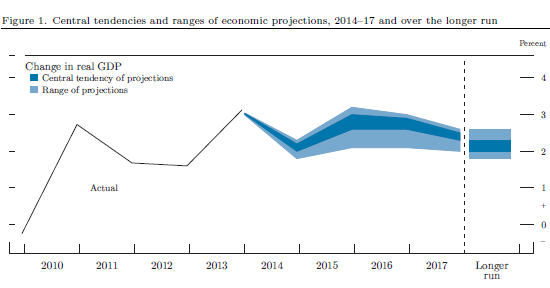

The Economic Projections of Federal Reserve Board members and Federal Reserve Bank Presidents, as the report is called, cut GDP projections for all years to come, as far as the Fed’s eye can see:

For 2014, policymakers cut their “central tendency” of GDP growth to 2.0% to 2.2%. That’s down from their June projection of 2.1% to 2.3%. The “range” of GDP growth dropped unceremoniously to 1.8% to 2.3%.

While they were at it, they cut the GDP growth projections for 2015 to a central tendency of 2.6% to 3.0%. For 2016, they nudged it down to 2.6% to 2.9%. For 2017, they figured it would languish at 2.3% to 2.5%. And in the “longer run,” GDP growth would even be below that. Here is what the slow-growth economic future of the US, as seen by Fed policymakers, looks like, after $3 trillion in QE and so many years of ZIRP that investors can’t even imagine what life might be like once the cost of capital is actually a decision-making factor again:

The light blue areas represent the “range” of the projections of policymakers. The darker blue areas represent the “central tendency,” which excludes the three highest and the three lowest projections in each year.

Next year, the economy might touch 3%. It would be the fastest growth for years to come. It would be peak growth. And Escape Velocity, that big economic acceleration that has been promised for years? Gone from the future.

That doesn’t mean that Wall Street stock-hype mongers might not trot it out again as a prediction of what will happen next spring, as they have done every, but the Fed isn’t seeing it.

Alas, as in the past, the Fed’s GDP projections for years out will be cut further as reality approaches. And the possibility of a recession or worse does not – and will never – figure into the Fed’s projections. Policymakers know only how to figure positive growth, at least in public, though they’re gradually learning how to project the pathetically slow growth that has resulted from their very own policies.

While the Fed is getting less optimistic, CEOs get “gloomier,” a word that inconveniently shows up to describe their outlook. Read… CEOs Darken Outlook, Slash Hiring and Cap-Ex Plans – Hope Now Focused on Share Buybacks (which just Plunged)

This is what peak oil looks like. And let’s face it, those GDP estimates are themselves “fudged” upwards. In fact growth will be negative from here on out, decades, except for the odd outburst of “animal spirits”.

Mature economies, therefore more complex economies, will struggle to maintain order. Mature economies do not have huge profits to be made except in privatization of public assets which is ongoing.

Developing economies with higher EROI’s will get investment but, if the PTB have their way, only through bankster channels and with the politically correct corporations otherwise there will be trouble for them.

The entire modus operandi of the privately owned and operated Federal Reserve is more of the same … enrich the already wealthy individuals and corporations. Their scheme is working famously …

Resource costs, which most economists still don’t recognize. have been a significant drag since roughly doubling in the 2000s.

Exactly … The Federal Reserve, BOE, ECB and other central banks have been deliberately slowing economic activity to counter these price increases. Only through demand destruction will prices be maintained at levels that will avoid a crash.

These Central Banks are “regulating” this imminent de-growth in a manner that allows the oligarchy to loot the middle classes and public assets. If they allowed a crash they would then have to eat all that bad debt and admit that growth is over and that Ponzi Fractional Reserve Banking is over …

And this is why we see the world in such a state. Countries are desperate for scapecoats … the US and EU are causing havoc worldwide as well as in their own countries to hide the real reasons for this worldwide growth reversal … peak oil and the rise in commodity prices especially food.

So much gobbledy gook. You hit the hipster economic myth talking point trifecta.

ponzi franctional reserve banking

peak oil

growth is over

Rather than engage in argument you hurl insult. Seeing your other posts your problem is that you can’t acknowledge the relationship between the real world and a financial sector … The Fed understands and is protecting banksters and the wealthy.

ponzi franctional reserve banking ~ The world is now at the tipping point where wealth is being consumed not created … No amount of money or “animal spirits” can create the cheap oil and commodities needed out of thin air …

peak oil ~ Conventional oil production “peaked” in 2005. Fracking and other unconventional production is only possible at higher and higher prices. Non state owned oil companies have multiplied their drilling budgets only to see their reserves fall.

growth is over ~ Overall growth is over. Some countries will grow depending on their resources and economic strength. Most countries will end up in a permanent recession or crash altogether.

I simply replied with all the thoughtfulness that your comment deserved.

There is no such thing as fractional reserve lending in modern, non-convertible, sovereign economies.

People have been going on about peak oil for decades, the inflation adjusted price of oil today is within the same range its been within for 100 years:

http://inflationdata.com/Inflation/Inflation_Rate/Gasoline_Inflation.asp

GDP is nothing but the summation of human transactions measured in a currency unit. As long as populations grow and the fiat money supply grows as well, there will always be GDP growth.

Like I said, all of your points are myths. Spouted by people who dont really understand economics.

“As long as populations grow and the fiat money supply grows as well, there will always be GDP growth.”

So you subscribe to the infinite resources on a finite planet scenario.

Explain why having recently spent many multiples on exploration and development oil companies reserves are declining …

Without the underlying resources it does not matter how much money a sovereign can print. Those resources simply won’t be there.

Once again you ignore the real world …

dollars are not a finite resource

Walking to a concert and spending $10 on a ticket or $20 does not change the energy used, but it does increase GDP (REAL GDP assuming inflation is less)

I dont subscribe to the infinite resources, but you finite planet people dont understand nominal vs real very well. Or the capacity of humans to engineer solutions to energy and pollution problems assuming money and investment are used for that purpose. And money is an infinite resource.

“Explain why having recently spent many multiples on exploration and development oil companies reserves are declining …”

If thats even true, cant take your word for anything as youve demonstrated an impressive litany of ignorant claims, what does that matter? If there were no oil reserves left and we used no oil, then it would be irrelevant. real prices have not gone up, lets talk again when they do.

What resources wont be there? Labor? Digital processing? Time? Food? lumber? concrete? ingenuity?

Carbon based fuels are not the be all and end all of human civilization.

What is your point?

….”money is an infinite resource.” Maybe. But the rich hoard it anyway, and the poor haven’t been told. People are suffering, A.P. I hope you will do something about it post-haste.

Last time I looked at anything “infinite”, there was also another word that described it: “worthless”. For something to remain valuable it must remain relatively scarce, and bank debt money just does not fall into that category, Auburn needs to crack a few more history books. These things take decades to play out, let’s imagine it’s 2020, Fed is announcing QE 21…how much is that piece of paper worth again? 1/20th of a loaf of bread? Goods and services are finite, bank debt money is not, then it’s all down to real versus nominal.

http://ftalphaville.ft.com/files/2013/01/Perfect-Storm-LR.pdf

Auburn Parks says we don’t need oil …

“”What resources wont be there? Labor? Digital processing? Time? Food? lumber? concrete? ingenuity?

Carbon based fuels are not the be all and end all of human civilization.””

I can’t even begin to describe the ignorance of your assertion … Without oil (95% of the worlds transportation fuel) the world comes to a standstill.

Without coal and nat gas 70% of heating and electricity goes away … There are NO alternatives ready to fill this gap for decades … in the meantime economic catastrophe.

Join the real world … You live in a techno fantasy dreamworld my friend …

>>>>

Carbon based fuels are not the be all and end all of human civilization.

<<<<

Actually, unless we manage to act pretty creatively on a macro level, that is, collectively, deliberately, begin swapping in other more renewable-like forms of fuel, I tend to agree with those who maintain that carbon based fuels are indeed the end/all, be/all for our particular form of civilization.

In any case, to change the subject slightly, I don't think the poster to whom you originally responded made any points that were outlandish enough to warrant your insulting tone. If you disagree very fundamentally with those points, please do explain quite a bit more how so.

150 Years Of “Real” Oil Prices

http://www.zerohedge.com/news/2014-07-14/150-years-real-oil-prices

Beginning of the End? Oil Companies Cut Back on Spending

http://ourfiniteworld.com/2014/02/25/beginning-of-the-end-oil-companies-cut-back-on-spending/

Oil CAPEX soars …. production falls

http://gailtheactuary.files.wordpress.com/2014/02/kopits-40-oil-majors-capex-and-production.png

Not sure I agree that oil price today is not more expensive than 150 years ago.

The inflation adjusted price of oil has risen considerably over the past seven tenths of a century. The link that you provide shows the inflation adjusted price of gasoline, not oil. I’m not sure why the price of gasoline has not risen with the increasing price of oil. Perhaps it’s due to improvements in refining technology. Anyhow, petroleum is a lot more expensive than it was nearly seventy years ago (the gasoline chart starts at 1918, and the petroleum chart starts at 1946):

http://inflationdata.com/Inflation/Inflation_Rate/Historical_Oil_Prices_Chart.asp

Peak oil is a real phenomenon. However, the “peak” is really more of a plateau, and we can expect to be at that plateau for a while.

Julian Simon meets MMT. Light, sweet, and crude.

Energetics, the study of energy. The reason the term is seldom used is because it is too broad: Physics, Chemistry, Biology; the role of energy is central to all these and more; in economics, energy is a side note.

Though we have more than a few Copernicuses, we are still waiting for society to switch to a heliocentric theory of economy.

http://www.theguardian.com/commentisfree/2014/sep/02/limits-to-growth-was-right-new-research-shows-were-nearing-collapse

I remember well how the Club of Rome projections were refuted. Turns out they did them again, and what do you know, the real price of resources IS going up. As I have said many times, in my youth, minimum wage work of one hour could buy you 8 gallons of gasoline. Now it buys you two.

Which shows, I suppose, that the price of human energy has fallen, when measured in the price of petroleum chemical industry. So we should use more human energy, and less petrochemical industry, to produce what is needed. More hand labor. Less automation.

Yet today I can drive and use only 6.5ish liters per 100 Km or conversely 1000 Km on a 66.8 liter tank.

At the end of the day prices are largely administered, due to the dominance key participants have in any sector, as industry BSD sets the standards.

Peak oil is a political problem. The correct set of policies would see an immediate end of US hostility towards a growing number of the largest potential producers (Iraq, Iran, Libya, Sudan, Venezuela, Russia) of oil and enter into urgent, fair, and rational negotiations to develop the various resources required to take us to a global economy beyond fossil fuels, and do so within 20 years at most or miss vital windows for large-scale, catastrophic ecosystem destruction if we maintain global consumption growth even at the current rate.

The US economy is badly damaged due to unbelievably stupid policy-making, domestic and foreign, for a generation, not the increasing cost of oil. The problem is far too much of the economy is owned/controlled by a criminally wealthy elite no longer interested in taking chances and losing, but make certain political change is impossible by capturing Governments even while propagating a decades-long ‘Hate Government’ campaign very richly resourced. So you have the entire neoliberal corporate agenda enabled: free-tade, WTO, off-shoring of production, tax haven wealth centres and playgrounds, financialization of everything, pensions, death insurance and all, taxpayers who cannot see it’s corporations that are screwing them blind via the bogus Government so revolt on taxes which creates a downward spiral of service cuts, public frustration, tax cuts, service cuts, blah, blah. Throw in non-stop GWOT, regime change wars, ‘security’ spending gone insane and a permanent War Machine waste of hundreds of billions every single year and you just don’t need Peak Oil to explain it. A problem? Yes. No hope? No.

Not that oil is infinite. It isn’t. But we have to reduce our consumption across the board and get off fossil fuels even if we did have infinite oil, because there isn’t infinite anything else either, including the capacity of this planet to absorb ever-increasing human activity. We can get to where we need to go if the US just drops the Empire and remembers how to cooperate with other countries as equals looking for mutual benefit.

It may be the case that we have little to hang our hats on in terms of hope that leaderships will act before facing the prospect of hanging in the morning, but that isn’t a fact until it occurs and is history. Will Peak Oil be a problem for an American, and broader global, culture that fails to do anything to respond intelligently? Yes. But we will have wrecked the place first.

I would be remiss if I did not point out Yellin’s 18 Sep comments: American Families Need To Boost Savings. She tells us in order for Americans to weather recession storms families need to save more. Earth to Yellin: folks have been topped out for years and that is not going to change soon. Inequality is getting worse. As long as her bank friends are taken care of her job is done.

http://bigstory.ap.org/article/336c5b954e1e44c1a167d240f0f553cf/yellen-says-us-families-need-boost-savings

Families do need to boost savings. Glad someone said it from a high place. You can argue for hours whether or not they can, but, they have to, and they aren’t. Everybody’s driving around in new cars and trucks they can’t afford, because they can’t get a ridiculous mortgage that were being handed out like candy eight years ago, but they can walk in to a dealer and drive out the same day with a ridiculous car loan allowing them another illusion of personal luxury. She sees that every day, and it gives her a bit of concern, I’m sure.

To be fair, used car prices have been absurdly high these past few years.

Getting a decent car with a limited budget is much harder than it used to be.

Au contraire. You haven’t shopped for a new or slightly used car from a dealer lately, I see. Trust me, most anyone with a pulse can drive out of a lot these days.

Maybe it is a regional thing.

Prices in my area haven’t fallen much.

I know the trends indicate the people are taking loans hand over fist but it has been my experience that many of those people simply lack the savings to go about it in any other way.

So keep the old car. Cars last a long time these days. You can easily get ten years/150,000 miles out of a good quality Japanese econo car. Instead, I see people of modest means driving around in expensive, new, very inefficient trucks. The savings between the two and savings in gas could be a substantial amount of money in ten years if invested in safe, cheap index funds.

Good advice if you believe that index funds are “cheap” and “safe” when the assets they comprise are at or near all time high prices because the Fed is maintaining ZIRP because the Fed maintain ZIRP indefinitely. Otherwise, not so good.

I used to be the same way, but after 7 years or so, depending on the climate, cars tend to fail and repairs can take days. No employer would put up with more than 2-3 days off at short notice because the car broke, even if people came in the same day, late, by taxi.

I know in my area, prices for used cars in the <$5000 range are down significantly. Probably as a result of the increase in subprime auto lending taking pressure off the market for beaters.

That’s what happened to my wife and me. We saved fairly diligently for a new car. Medical bills happened. They took our savings, then some. Then it was time for a new (that is, used, but new to us) car. Now we have a “note” to pay ALONG with a hefty (for us) medical bill.

Cheap financing doesn’t equal cheap cars. Some people prefer not to go into debt.

Destroying all those used cars with an “economic program” was a travesty.

To take a useful piece of machinery and destroy it to “boost” the economy was in my opinion government criminality, and nobody is going to jail for that.

Probably conceived by the

economistsuseless eaters at the Fed. No doubt these people drive to their shiny offices in their shiny new Krautwagens.Broken window fallacy. No doubt foisted on the O-man and his retinue of rank amateurs by academic “economists” — the very best money can buy. Bastiat must be laughing out loud at these buffoons from deep inside his crypt.

The name Austan Goolsbee comes to mind. Didn’t he head up the CEO at the time when “cash for clunkers” was instituted?

“You can argue for hours whether or not they can [save], but, they have to, and they aren’t.” Well, there’s no point in arguing over a foregone conclusion. And since “everybody’s driving driving around in a new car” then anyone not saving money is clearly derelict and beneath our consideration or contempt. Neatly settled. I’m surprised Janet didn’t stae it more clearly.

Why so snarky? I’m just stating obvious facts. People aren’t saving. And, people have to save. You can whine and moan and find reasons why they can’t or won’t, but, then another day is lost, and everyone is that much closer to a pet food eating old age. I’m not trying look down with contempt, just trying to strip away the BS I hear every day. Yeah, the big bad meany bankers suck. Sure. Yeah, the big bad meany CEOs suck, too. I get that. So, what are you going to do about it? How are you going to survive?

Why so snarky? Because you issue a grand sweeping, and yes contemptuous dismissal of others’ distress with “obvious facts” that are manifest nonsense, all the while minimizing the “big bad [meanie] bankers” as something we all just have to live with and walk off. You indict a lot of good struggling hard-working people who don’t have new cars, many none at all, as if they’re all derelict and responsible for their plight.

It’s typical of right wingers who attack the victim, like those who blamed scheming, deceitful minorities for causing the great global derivative meltdown by tricking innocent Wall Street bankers into giving them mortgages.

Well, bully. My friends would chuckle at the right wing label. Good luck with your anger management issues.

Oh, and my point is that poor people have new cars today, and no savings. It’s a wacky world. OK? Bye.

So you are “left wing” relative to your friends. Quite a band of douchebags that must be.

Wait, what? “Douchebag”?? I haven’t heard that in years. Classy. Are you an adult?

A human adult, aye. Sorry for the douchebag thing, I thought it would be less offensive than psychopath.

Cute. Lord, this place must be filled with angry old bearded virgins typing away furiously in their mom’s basement.

Projection is really not the best way to deal with your problems. If you can’t afford professional help I will gladly chip in towards it.

But, you haven’t answered my question (below). What’s your solution, besides the insults and rage?

Coming from a “get’em down and kick’em while they are down” kinda guy…

The perfect Antionette conundrum:

“But your Exalted Divine Majesty, the people have no money.”

“Well then, let them have savings.”

+100

I’ve been saying this for years.

Look at a 40-year graph of bond yields. Perfect downtrend because every time rates get cut debt levels expand to maximum, the economy slows, rolls over, rates get cut and so on the vicious circle goes.

It’s so simple. We’re seeing it now with just long bonds and mortgage rates rising and house prices stalling.

The Fed put is fast evaporating. One percent 10-years coming in the not too distant future.

trickle-down debt

Ok

Imagine Americans get “richer” next year.

They fly to Dublin for their holidays.

They get a bus or hire a new car to the SW of Ireland

They stop in Sneem for one pint or Ice cream before moving on as their lives are short of time for some funny reason.

What a way to run a planet / distribute tokens.

The FED must be so proud of themselves.

All that energy lost in translation giving the illusion of scarcity.

Never never will they go down the Jesus route (as they are old testament type of people)

Just give the people tokens directly – to be spent in the village at their leisure.

God forbid.

Back in the 60s these American guys would drop a shit load of REAL money in the typical euro village.

Now its diesel fumes and a ice cream.

http://www.youtube.com/watch?v=aKqOMSDNviA

Wall Street’s and the media’s attention was riveted single-mindedly on whether or not the Fed would include in its statement the two words, “considerable time,” . . .

Wall Street and the financial media knows where the butter for it’s bread comes from. What the Fed head says is regurgitated with a beneficial spin to whomever is talking. Why is any attention given to what the Fed says? Fed economists, we have been repeatedly shown by Phil are clueless idiots, and should be fired and handed a broom to sweep the streets. Then they would be doing actual useful work.

Instead, these assholes are the “policymakers”. Not one of them has ever had a real job that has to satisfy a real customer making a decision on how to spend the few remaining dollars left over after paying the parasites.

I will say it again. Fire all the economists at the Fed. They are the useless eaters.

From Wolf’s other article about share buybacks.

. . . these CEOs run companies that have been spending near record amounts, not on productive uses such as capital expenditures or hiring more people to push revenues to the next level, but on buying back their own shares.

From the CEO’s perspective, greed, greed and ever more greed, it is the path to greater riches. They do not care about the company that employs them and there is no long term vision.

When financial engineering is personally profitable, and actual engineering of new products or processes risky and perhaps not profitable, to the company and to yourself, what would you do?

In order for the Banksters and other too-big corporations to “buy back their shares” they have to have a seller. It would be worse if the corporations continued to sell stock and then when our no-growth future became an undeniable reality (soon) they’d have all those shares outstanding and probably would have also invested in capital improvements – even without a hint of improved demand but nevermind that. What is most likely happening is that lots of people want to unload their overpriced stocks. So buybacks are just keeping the company from going bankrupt. And in future maybe they will survive to limp along a little longer. What appears to be happening is a slow-motion run on the stock market – one which is softened by QE and low interest rates. A pre-emptive crash; a pre-disastered economy.

Stock buybacks are about the greedy CEO and may cause the company to go bankrupt.

Wolf makes the point that buybacks happen when stocks are near their peak price. To me, that seems illogical but when you have a “don’t give a shit and greedy” CEO it makes perfect sense to them.

Borrowing huge amounts of money, on the current good name of the corporation to speculate on the shares of your employer, and cause a price rise in those shares makes the executives richer when they personally sell the shares gained by stock options at that higher price.

Other stock market gamblers like this arrangement as their shares are perceived to climb in value.

In the next year the CEO might be gone, comfortable in the knowledge they pulled a fast one, and got out with the loot.

What happens when the stock market swoons, the shares fall in value, and the debt to buy those shares remain? Now there is no money to “compete”, nor to pay off the debt, and potential bankruptcy.

The CEO who’s decisions caused it? On his or her yacht eating caviar.

For the millionth time, anyone who uses QE aka the Fed’s fake printing money, as a basis for analysis are seriously confused.

QE adds nothing to the wealth of private sector. Its not printing money, all it does is reduce by hundreds of billions of dollars the interest income of the private sector.

If you have $1M in T-securities accounts at the Fed bank, and the FEd does QE, and gives you $1M in checking accounts at a private bank, why would anyone think this would increase spending and thus incomes?

QE adds no wealth, only deficit spending can do that, and the deficit is extremely low. This is not rocket science

QE lowers the “risk-free” rate on Treasuries, hence the discount rate on all risk assets. This makes asset prices rise.

This isn’t ‘adding wealth’?

“QE lowers the “risk-free” rate on Treasuries, hence the discount rate on all risk assets. This makes asset prices rise.”

First of all ZIRP and QE are not interchangeable. You can have ZIRP without QE and you can have a 5% FFR with QE.

The second order effects of longterm ZIRP on asset prices cannot be considered “printing money” or the Govt adding any financial wealth to the private sector.

Which was of course my point. We have had asset bubbles without ZIRP and QE, and we will continue to do so. The outcome of the “wealth effect” on economic activity is poorly understood. Relying on private credit fueled asset increases has not been a good recipe for the last 40 years, what would possibly make someone believe that this would be an effective policy going forward is beyond me.

Again, which was my original point.

Clearly you don’t understand leverage …

Clearly you dont understand anything, as leverage has nothing to do with we have been talking about.

The cheaper the interest rate and the greater the amount of money means more leverage or cheap money …

It is you that doesn’t understand how leverage is impacted by the Fed’s QE, Zirp and Asset purchase programs …

“The cheaper the interest rate and the greater the amount of money means more leverage or cheap money …”

You are seriously confused.

Leverage is nothing but the ratio of debt to assets.

Interest rates have very little correlation with this ratio, S&L happened in the 80’s with a 10% average FFR

the dotcom bubble happened in the 90’s with a 5%average FFR

and the housing bubble happened in the 00’s with a FFR average below 4%

So whats your point?

And all the bubbles aka large increases in leverage, came without QE,

again, whats your point?

If you are actually claiming QE is unrelated to stock market bubbles, asset price distortions and the rest, then how do you explain the direct correlation between the onset (even the word that there will be an ‘onset’) and duration of bouts of QE and stock market performance? Why do Bernanke, other Fed members, virtually all financial/business press claim that QE boosted those very markets and asset prices? Why does the mere allusion to a ‘taper’ sent shock waves ’round the globe, as when Bernanke supposedly muffed it by his revelation?

What conceivable purpose to QE other than a spectacular gift to Wall Street, corporate insiders, and the wealthy in general? Why QE at all if interest rates alone did the trick?

You dump all over the posters here, but at no point do you provide a rationale that fits or otherwise explains the historical record of QE and other Central Bank interventions over the past 6 years. Or do you, like Krugman, have no inkling whatever what goes on in a thoroughly corrupted US financial system as opposed to theoretical ‘economics’?

I beg to differ that leverage has nothing to do with it. Leverage allows the elites to sell assets to each other at higher and higher prices. No additional assets are created but more money is available to bid up the prices. You are correct that it is all smoke and mirrors because there is no case to be made that just owning some asset over time makes you more wealthy. But leverage is used to exploit our inability to properly account for what wealth is in numbers. Oscar Wilde had it right when he said: “Nowadays people know the price of everything and the value of nothing”.

Excuse me if this is a dumb question, but I’m also reading in this thread that resources are becoming scarcer and thus more expensive. Is this not a case of assets increasing in value?

I know that QE and ZIRP are not interchangeable. ZIRP only operates directly on short-term rates; QE is an attempt to manipulate long-term rates. Since the discount rate on most risk-assets is a function of long-term rates, that is the rationale for the Fed’s employment of it.

The rationale behind QE is irrelevant to the macroeconomic accounting and operations.

Long-term rates are nothing but expectations of short-term rates plus inflation. If the Fed announced that they were going to maintain ZIRP for 20 years regardless of economic conditions, eventually all long-term securities would merge towards the inflation rate.

Again, this has nothing to do with QE. It adds nothing, its not printing money, and so nobody who knows basic accounting and macro should think that it would be very helpful to the economy. And thats not even including the distribution dynamics where the bottom 50% of society own less than 10% of the financial assets and so any asset price increase (ZIRP caused or not) does not benefit them. In fact in probably hurts as home prices etc increase faster than incomes.

Then explain explain why the Fed is using QE …

But it also shows why QE has not and cannot return the economy to full employment. Which was of course my point all along.

Then you don’t understand how the Fed is lining the pockets of the TBTF banks …

You are under the mistaken idea that the Fed is working for the government … it works for the banksters.

The Fed is a Govt agency, just like the CPFB, DOJ, etc, it “works” for the banks in the exact same way as COngress does.

Whats your point?

The Fed is no a department of government, it is owned by the banks who make up the Federal Reserve System.

This rhetorical tick of yours, always ending with the snide “what’s your point” is rude and unenlightening. It also helps if you cite your sources rather than make bald assertions. You may be correct but we are not obliged to take your word for things.

Yes, I agree that ST rates are theoretically the geometric average of the market’s expectations of future ST rates. The point of QE, however, is to *get ahead* of the market’s expectations and suppress LT rates in advance of the market mechanism. That is why it’s “manipulation”, or repression, as others call it.

If QE is entirely ineffective, a nullity, with respect to LT rates and and asset prices, we really do need to wonder why the Fed has does $3 trillion of it, and why they explicitly adduce targeting asset prices as part of the rationale…

But that’s enough out of me, people can think about it for themselves.

Doh! That’s supposed to read “LT rates are theoretically the average of future ST rates…” etc etc

I hope that was obvious.

What you are saying makes perfect sense. It explains the refusal of Congress to do any fiscal stimulation what-so-ever. Can’t juice the fake economy when the Fed is winding it down.

Adding wealth? You own the exact same thing today that you owned yesterday and you are more wealthy. Who says there’s no such thing as alchemy?

“QE adds nothing to the wealth of private sector.”

Wrong. QE has floated the value of housing, the largest and probably only real asset most own these days. No QE, and housing would be down another 20 to maybe 40%.

So what if ZIRP has supported house prices. Home price increases are not necessarily good for the economy when incomes are stagnant.

And btw, you have no evidence that QE has increased home prices. ZIRP on the other hand, is the operative factor. And ZIRP and QE are not interchangable as we can have ZIRP without QE and QE without ZIRP

Have you forgotten the Fed’s asset purchase program?

I think he has.

The Fed, hand in hand with Treasury, immediately went to work trying to float the housing market from disaster by buying up trillions in MBS. It seems to have worked, somewhat. Just go back to ’08 and ’09 when the developed world’s banking system was imploding due to all of the instruments sold during the previous decade based on that bubble market. There was absolutely no private money willing to save the MBS market, and therefore all of the derivatives based on that market, also. Imagine if the housing market was left to fend for itself in that situation. I know the carnage was and is still awful, but imagine if the market took a natural course and overshot below the trend line of pricing over the last fifty years. We would be neck deep in the stuff.

I agree that houses are too expensive. But, they have engineered a soft landing, somewhat, so far. I would not want to be living in the alternative. Long, hard, slow slog for a decade or two to clear this mess. Hopefully. It could be much worse.

I have not forgotten anything. Stopping a full blown debt deflation through MBS purchases is in no way the same as wondering why the Fed’s “money printing” QE has not returned the economy back to “normal”. Which was why I wrote my comment in the first place, in opposition to Richter’s line:

“But after having printed $3 trillion, and after having forced short-term rates to near zero – and below the rate of inflation – for what likely will be more than six years, and after having messed with the markets throughout, they too can imagine that blame for the fiascos these policies might end up causing will be hard to dodge.”

QE is not printing money, and it can not and will not lead to any “fiascos”

Oh, Christ, “debt deflation” again. Yes prices going down would be oh so bad, really, no, really, it’s much better for people to pay MORE for things. After all if prices go DOWN then people would stop buying food, they’d stop paying rent, they’d stop paying to send their kids to school or pay for the doctor or insurance or..

Perhaps falling prices might just reflect increased productivity in agriculture, manufacturing, technology…um, everything? The other name for that is PROGRESS. But heaven forbid the standard of living would be allowed to rise, after all we have three billionaires who don’t want to lose a dime on their bad investments. Insolvency has been outlawed, everybody back to the treadmill to make sure Mr. Buffet receives his Goldman coupon on time….

“QE is not printing money, and it can not and will not lead to any “fiascos””.

Everyone uses ‘printing money’ as an analogy. It accomplishes the same thing. Others prefer ‘currency war’ to describe/explain it. Others still believe if not for the Fed, the market for Treasuries would not support the deficits. It’s not often we get someone so self-assured on this subject commenting, so please, do tell us in detail why the stock market more than doubled off its bottom and stayed in the stratosphere, allowing anyone with the money and inclination to harvest all along the way unheard of gains even if, as you say, ‘savers’ lost hundreds of billions in toto? So what? The Fed takes care of the Fed’s owners first, and the class that supports them second. From mid-middle class on down it could manifestly care less as has been evidenced by the record for a very long time now.

And how would Fed policy not be considered a ‘fiasco’ if it cannot withdraw QE or any other ‘extraordinary measures’ for any length of time without a fantastic crash ensuing? How on earth do you think the share of US wealth owned by those in the 90th percentile and above became so even more wildly skewed since the Great Financial Crisis? Diamond mines in Congo?

. . . they have engineered a soft landing… for the rich.

Do you own a house or carry a mortgage? Odds are 6-4 that you do. That asset would be worth much less if a hard landing was allowed to happen. That’s what I’m talking about.

The Fed’s asset purchase program is QE.

MBS are assets.

And your point?

I have been talking about QE the whole time, which is the Fed’s asset purchase program.

You both said:

“Have you forgotten the Fed’s asset purchase program?”

“I think he has”

But I’ve been talking about QE the whole time, which is the Fed’s asset purchase program.

See the problem?

No. Explain.

This isn’t hard:

And your point?

I have been talking about QE the whole time, which is the Fed’s asset purchase program.

You both said:

“Have you forgotten the Fed’s asset purchase program?”

“I think he has”

But I’ve been talking about QE the whole time, which is the Fed’s asset purchase program.

See the problem?

I haven’t. The “assets” they bought, with funny money was to save the banksters from their own crime wave that was about to devour them.

Capitalism gets a bad name whenever it gets down to the job at hand, which was giving the banks and their “investors” their just desserts.

I agree. Cold hard facts of life there. Saving housing was saving the banks. But, just imagine the world otherwise. Study the thirties, when most banks disappeared or simply wouldn’t lend, and foreclosed on most. Imagine that squared. And, as you imply, the 1% wouldn’t be feeling the pain (even then, they didn’t, unless they lost it in the Wall Street casino). You and I would.

To rescue the banks because of their own criminality, is not a just outcome.

These banks should have gone through bankruptcy, senior management fired and been resolved.

What kind of a criminal enterprise is it, when Goldman Sachs can rush the paperwork through in a few minutes to become a bank holding company, and stave off bankruptcy when $13 billion gets passed through AIG to them, courtesy of a taxpayer bailout? They should be history. Instead these parasites are still there, bleeding everyone they touch dry.

Top levels of government are their co-conspirators.

Exactly right. Saving the banks and the global economy emphatically did not require saving the bank-robbers who looted them. Putting banksters in prison and the banks into receivership and adjudicated bankruptcy was the manifest solution that was studiously avoided. Instead, the felons successfully argued that they and the banks were inseparable, that putting them in prison for outright fraud and stripping them of assets, or even curbing their obscene bonuses, would have destroyed the entire banking system and the economy — self-evident nonsense. The institutions may TBTF, but the banksters are certainly not TBTH (too big to hang).

Are you guys academics? With tenure? Independently wealthy, or at least have a conservatively invested trust fund supporting your lifestyle? Because, otherwise, it’s quite cavalier to just say, yeah, screw ’em all, put them all in jail, let ’em all go bankrupt! Really? Do you work in a private industry that depends on credit and other forms of capital? Because you may very well not be if that all happened. along with hundreds of millions world wide.

Hey, I hate the bastards as much as you, but, take a deep breath and consider what the world would be like today if our banking system was allowed to disintegrate as it would have if it was left to it’s own devices, along with the justice department hauling the many who deserved it to jail. You certainly wouldn’t have the luxury of sitting around and saying such things on the internet right now. You’d be foraging for your next meal in dumpsters and wondering how to survive this quickly approaching winter of ’14 with nothing.

These banks should have gone through bankruptcy, senior management fired and been resolved.

We would still have banks and a chance at not repeating the “financial crime wave” again. The financial criminals were rewarded with gobs of money, and left in place without supervision, so history will repeat.

Why isn’t Bill Black put in charge of cleaning the banking house? He would do too good a job, and then where would corrupt politicians get their campaign bribes and kickbacks from?

You clearly don’t understand how orderly judicial bankruptcies through public receivership work. Bill Black showed how this works thru the S&L resolution process. Many of the institutions survived and functioned seamlessly, while many of the felons were put away, and number of their pocketed politicians lost their seats.

The S&L thing was jack compared to what just happened. We’re talking about every major bank in the western world, not the little corner bank that got greedy forty years ago. C’mon.

The lesson: the bigger the destruction you cause, the less likely you are to be punished and more likely to be rewarded for it.

And maybe another lesson is that, even after hundreds of bankruptcies, and hundreds convicted and jailed, financial crime continues, on a larger scale, even.

Douchebag, indeed.

Agreed. The S&L thing was a little wind compared the the hurricane of the GFC.

Leaving the criminals untouched and rewarded as the solution to the GFC seems counterproductive. The banksters will do it over and over until finally someone brings a noose and hanging platform and sets it up on Wall Street.

It is not a crime if the watchdog in charge refuses to prosecute, dontcha know? The lesson of the S&L was learned by the criminals: capture the political parties and get them to deregulate the industry. Get them to put you in charge of the watchdogs, or else a trusted flunky. Get douchebags to do your PR on the intertubez and in the MSM. Voila, the world is yours for the taking.

So how are you going to fix it?

Step 1: election reform

The Citizens United Supreme Court decision is a travesty, allowing the wealthiest to purchase politicians like they were a commodity.

Step 2 : put Bill Black in charge of prosecuting the banksters. Make the fuckers spend all their loot on lawyers defending themselves.

Step 3: let non violent prisoners out to make room for the incoming banksters. There are enough prisons already. No new ones need to be built.

That would be a start.

Public campaign financing, strict limits on lobbying, re-regulation, strong watchdogs with no revolving door, no lifetime judicial appointments, etc. Either that or the guillotine. Your choice.

Dream on. That ain’t going to happen until the 5% get really pissed off at the .5%. It’s going to be their little battle. You and I have no say. Just hope it happens before our democracy really falls.

Meanwhile, save your money.

Good doG, did you even read what you wrote before you hit the ‘post’ button?

have a nice weekend, dude. Get out of that cellar and talk to girls. It’ll be a start. ciao!

What’s wrong with saying ‘Good doG’? Did you recognize yourself or sumpthin?

banks aren’t lending, the fundamentals aren’t there, and when they are, it still makes more sense to put it into financial vehicles. If lending is so important, and it is, maybe it needs to be done on a basis that promotes growth–how about a public banking system?

Then you put a gun to their head, as Bob Cringely suggested a few years back while taking a detour from his usual IT industry beat. “Banks lend money. If you’re not a bank, you’re a counterfeiter. Now, what are you again?”

Fines don’t work. Withdrawing cooperation and privileges *does*.

There’s a difference between needing a financial system and needing this financial system. They could’ve closed markets for weeks if need be to figure out where they wanted to go. And other measures of similar seriousness. To suggest that was impossible is simply not the case. The people involved in creating that mess and managing its implosion all belong in jail.

We’ve been a trickle-down economy for such a long time, long before the Great Depression and the Second World War. It was pretty naive of all the big private banksters to think that operating a strictly supply-side (if secret) economy would prevent inflation. (Or “bubbles” as we now call it.) And therefore they seriously planned to “protect” a strong dollar. We stuck with the plan long enough to make the whole world a bubble. Because it would have failed immediately if we had not bailed out the idea for many decades. The problem we now face is social and political because money has worn itself out because the whole idea of a “strong dollar” is just mercantile nonsense.

Japan has been doing some serious research in this for the last 20 something years. The results have not been spectacular. It cracks me up that after all this time, after all evidence, after many examples no “serious people” are advocating stimulating at the household level, preferably poor and middle income people, who need to spend money and reduce debt. Seriously, do you think they would just sit on it? Or maybe do stock buy-backs?

I think a great many people would have paid off debt, and thus actually given the banks the money in the end anyway. They would have been “stimulated” on all those non-paying loans, and our drowning-in-debt society would have had a little more fungible income to spend. Yes, people do very stupid things with money, but I think many are out of desperation. But, for some reason, we find it better to give corporations, investment banks, anyone who threw in on the political campaign bail-outs, grants, interest free loans of the people’s money, instead of helping the people who actually need it.

Oh right – they caused the crisis and we do not want to reward their immorality, or something. To this day, no one has any idea of the true cost of propping up the economy and bailing out the banks. But, if one just takes the expansion of the deficit, and Fed balance sheet, it is well over $12 trillion dollars (which is probably VERY modest) and growing. I think more good could have been done with that money, and I think the failure to use it wisely on the one chance we had to do it, will come back to bite us in ways we cannot even imagine.

Janet Yellen’s comment is so perplexingly out of touch, a true “Let them eat cake” moment. When you have a consumer ecomony, and you’ve killed the consumer (assets owned, family income, family debt, decreasing returns on anything besides the stock market, quality of jobs, benefits, etc., etc., etc.) there is no such thing as escape velocity. Reminds me of the line at the end of this scene in Top Secret…

http://www.youtube.com/watch?v=GGWwiqbBZzM

Slick, I agree with you. The guy above who thinks new cars are cheap doesn’t understand that too many people don’t have the down payment or a job that pays enough to qualify for an affordable loan. If us “little people” had more money we’d not only pay off debt but we could buy more than just the necessities. I can’t save much because my bills are too high and everything just keeps going up (especially my school and property taxes). I need a handicapped ramp, a new roof, a new car, and a propane tank and lines to make it through the winter. I have enough money for one of those things, so my choice is to either go into debt or let the house leak until Spring. I doubt Yellen, the Fed, or my lousy Congresscritters have a clue as to what the average person deals with.

I did not say new cars are cheap. I said that they are easy to get, due to easy money. Just like homes were in ’05, when anybody with a pulse could get a half million dollar mortgage with no money down for a tract house in the Inland Empire. So, in essence, houses were much more affordable back then. Cheaper, you could say.

New cars are a very good value these days, though. I bought a Subaru last year that was the same sticker price as the same model I bought in ’02, but, it’s a much better car. I see deflation in auto costs.

Evermore Chinese made parts in new cars these days.

. . . it’s a much better car till it craps out.

I’m old enough to remember the cars of the 60s, when it was quite an achievement to make it to 100,000, and even then you were looking at a few expensive repairs before that. Today? My 2001 Subaru is still very alive at 210,000, humming along, with minimal costs. It’s ridiculous to imply that modern cars, because they have “Chinese” parts, are crap.

I have seen lots of Chinese made stuff fall apart after just a few uses.

I have seen Chinese tooling that worked when they sent the video of it running, and once it was put in a molding machine here, wouldn’t make ten parts without overheating. The cooling lines were missing, among other things.

When slaves make your stuff, crapification isn’t far behind.

GM used to have a transmission plant in Windsor, which has closed. Those transmissions are now made in China, along with entire engine assemblies, and the average customer has no clue as to where those components are made. I would be very surprised if those engines and transmissions last as long as the ones in your Subie.

What world do you live in? How old are you? Do you remember the Cimarron? The Vega? The K car? Good lord.

Are you making the Whig mistake of assuming that our political-economic trajectory is ordained by Progress and shall never deviate?

I think there were some tech improvements in industry in the last fifty years.

I think Wolf is a fox. He tosses this stuff out like chum to see who has figured stuff out.

There are “serious people” advocating stimulating at the household level.

http://ellenbrown.com/2014/09/01/even-the-council-on-foreign-relations-is-saying-it-time-to-rain-money-on-main-street/

Even the Council on Foreign Relations Is Saying It: Time to Rain Money on Main Street

Posted on September 1, 2014 by Ellen Brown

“”The September/October issue of Foreign Affairs features an article by Mark Blyth and Eric Lonergan titled “Print Less But Transfer More: Why Central Banks Should Give Money Directly To The People.” (CFR)

It’s the sort of thing normally heard only from money reformers and Social Credit enthusiasts far from the mainstream. What’s going on?

The Fed, it seems, has finally run out of other ammo.

There is another reason for handing the job to the Fed. Congress has been eviscerated by a political system that keeps legislators in open battle, deadlocked in inaction. The Fed, however, is “independent.” At least, it is independent of government. It marches to the drum of Wall Street, but it does not need to ask permission from voters or legislators before it acts. It is basically a dictatorship. The Fed did not ask permission before it advanced $85 billion to buy an 80% equity stake in an insurance company (AIG), or issued over $24 trillion in very-low-interest credit to bail out the banks, or issued trillions of dollars in those glorified “open market operations” called quantitative easing. As noted in an opinion piece in the Atlantic titled “How Dare the Fed Buy AIG” (Atlantic):

– It’s probable that they don’t actually have the legal right to do anything like this. Their authority is this: who’s going to stop them? No one wants to take on responsibility for this mess themselves. – “”

Wallstreet is not mainstreet! Is one of the saying’s I really like , it’s true without being offensive and it is says so much with few words! for example : It means that some people gamble for a living and some work for it! Or , The have’s are looked after better than the have not’s, as the IMF has conceded that a mainstreet bailout would work to end the depression but was considered last! I am confident that my point has some validity! Most would see why I like this saying! It throws light on the growing chasm of dishar-money! The dissemination of information by controlled sources artfully taylored for either side of the street! There is so much in this one saying It probable has the answer of how to fix the country but I think i only need to just look deeper at these four little words!

correction! not, ( IMF ) rather CFR conceded

We are in stage II of trickle down economics. Carter/Regan gave the first dose of deregulation/lower taxes now we are just directly injecting liquidity into financial markets bloating equities even more and allowing elites to buy even more useful things like land and means of production. That is the important part. The money is ultimately irrelevant, it is everything useful the money can buy that facilitates power and control even more, and it is all a “legitimate” and “legal” process. I wish we didn’t think it is all just bad decision making. These things are done purposely by a fairly large group of people with similar interests and ambitions. There doesn’t need to be a smoke filled room for there to be a conspiracy.

The rate of growth is not the core problem: it’s the distribution of wealth; perverse misalignment of incentives (neoliberalism on steroids); capture of legal, regulatory, policy-making and political leadership; deliberate de-education of the population; an elite engrossed in global accumulation and extraction; others too numerous to list. If the US wanted faster growth, it could commit decisively to peace and the titanic project to get off fossil fuels that must occur if ‘growth’ is to be a meaningful concept even a decade from now.

The Fed may be able to control markets in some circumstances, but not all – there will be a fiasco alright, and I think both Wall Street and Washington completely underestimate just how much of the public’s positive emotional capital they’ve burned through.