Yves here. As we’ve repeatedly pointed out, bank “stress tests” are officially-orchestrated bank PR. And the reason they worked so well the first time was that exercise was accompanied by all sorts of Administration “we’re fully behind the banks” messaging, including a commitment that any banks that fell short would get a heapin’ helping of new capital. But the effort to talk bank stock prices up worked so well that many, even the weaker ones, were able to float new shares.

The Europeans have tried emulating the Americans, but with more emphasis on the optics and less on prodding the banks to take meaningful steps to shore up their capital bases. Ilargi describes how even this exercise in porcine maquillage is failing to cover up the unhealthy state of many banks.

By Raúl Ilargi Meijer, editor-in-chief of The Automatic Earth. Originally published at Automatic Earth

The EU and ECB claim they conduct their stress tests and Asset Quality Reviews to restore confidence in the banking sector. That is easier said than done. The problem with the confidence boosting game is that if the tests are perceived as not strong enough, nobody knows which banks to trust anymore. And, on the other hand, if the tests are sufficiently stringent, there’s a genuine risk not many banks are found healthy.

There’s the additional issue of quite a large group of banks having been declared ‘systemic’ by their mother nations, which is of course equal to Too Big To Fail, and, in layman’s terms, ‘untouchable’.

All in all, after the results were announced today, it’s hard not to have the feeling that Europe aims at restoring that confidence by not telling us the whole story. There are a lot of numbers, but there are even more questions. Which may well be because those answers the leaders of the political and the financial world would want to see are simply not available, other than by making the tests even less credible.

Letting the numbers sink in, would the markets really feel more confident about European banks, or would they simply continue to have faith in the ECB’s bail-out desire for as long as that lasts? When I read that the ‘Comprehensive Assessment’ issued today states that the stock of bad loans in Europe is estimated, after the tests, at €879 billion, but banks’ capital shortfall only at €25 billion, I wonder where the confidence should come from.

The data. Starting with a Bloomberg piece from last Wednesday.

Don’t Be Distracted by the Pass Rate in ECB’s Bank Exams

The largest impact may be on Italian lenders led by Banca Monte dei Paschi di Siena, Unione di Banche Italiane and Banco Popolare, according to a report last month from Mediobanca analysts. They foresee a gap of more than 3 percentage points between the capital ratios published by the companies and the results of the ECB’s asset quality review. Deutsche Bank may see its capital fall by €6.7 billion, cutting its ratio by 1.9 percentage points, the analysts said.

The biggest lenders may see their combined capital eroded by about €85 billion in the asset quality review because of extra provisioning requirements, according to Mediobanca. That’s equivalent to a reduction of 1.05 percentage points in their average common equity Tier 1 ratio, the capital measure the ECB is using to gauge the health of the banks under study, the analysts said.

The AQR evaluates lenders’ health by scrutinizing the value of their loan books, provisioning and collateral, using standardized definitions set by European regulators. To pass, a bank must have capital amounting to at least 8% of its assets, when weighted by risk. The bigger the hit to their capital, the more likely lenders will need to take steps to increase it.

Banks the ECB will supervise directly already bolstered their balance sheets by almost €203 billion since mid-2013, ECB President Mario Draghi said this month, by selling stock, holding onto earnings, disposing of assets, and issuing bonds that turn into equity when capital falls too low, among other measures.

Those €203 billion the banks managed to acquire can be interpreted as positive, since they managed to do it, but it can also be seen as negative, because they needed it in the first place. It also raises the question whether another €203 billion would be just as easy. Not very likely, the low hanging fruit always goes first. Question then is, could they perhaps need another €200 billion? Brussels clearly says not, but Brussels is a figment of the imagination of politicians. Then, the New York Times today:

25 European Banks Fail Stress Test

Banks in Europe are €25 billion, or about $31.7 billion, short of the money they would need to survive a financial or economic crisis, the European Central Bank said on Sunday. That conclusion was a result of a yearlong audit of eurozone lenders that is potentially a turning point for the region’s battered economy. The E.C.B. said that 25 banks in the eurozone showed shortfalls in their own money, or capital, through the end of 2013.

Of the 25 banks [that failed the tests], 13 have still not raised enough capital to make up the shortfall, the central bank said. By exposing a relatively small number of sick banks – of the 130 under review – the central bank aims to make it easier for the healthier ones to raise money that they can lend to customers.

Italy had by far the largest number of banks that failed the review, with nine, of which four must raise more capital. Monte dei Paschi di Siena, whose troubles were well known, must raise €2.1 billion, the central bank said, the largest of any individual bank covered by the review.

… the review also uncovered €136 billion in troubled loans that banks had not previously reported. In addition, banks had overvalued their other holdings by €48 billion, the E.C.B. said.

That’s €184 billion in troubled loans and overvaluations. That leaves €19 billion of the €203 billion banks bolstered their balance sheets with, for all other shortcomings. Doesn’t sound like a lot. On to today’s Bloomberg summary:

ECB Finds 25 Banks Failed Stress Test

Eleven banks need more capital, including Monte Paschi with a gap of €2.1 billion. “Although this should restore some confidence and stability to the market, we are still far from a solution to the banking crisis and the challenges facing the banking sector,” Colin Brereton, economic crisis response lead partner at PwC, said. “The Comprehensive Assessment has bought time for some for Europe’s banks.”

Banks will have from six to nine months to fill the gaps and have been urged to tap financial markets first. The ECB’s stress test was conducted in tandem with the London-based European Banking Authority, which also released results today. The EBA’s sample largely overlaps the ECB’s, though it also contains banks from outside the euro area.

The ECB assessment showed Italian banks in particular are in need of more funds as they cope with bad loans and the country’s third recession since 2008. [..] “The minister is confident that the residual shortfalls will be covered through further market transactions and that the high transparency guaranteed by the Comprehensive Assessment will allow to easily complete such transactions,” Italy’s finance ministry said in a statement.

“The Comprehensive Assessment allowed us to compare banks across borders and business models,” ECB Supervisory Board Chair Daniele Nouy said in a statement. “The findings will enable us to draw insights and conclusions for supervision going forward.” The ECB said lenders will need to adjust their asset valuations by €48 billion, taking into account the reclassification of an extra €136 billion of loans as non-performing. The stock of bad loans in the euro-area banking system now stands at €879 billion, the report said.

Under the simulated recession set out in the assessment’s stress test, banks’ common equity Tier 1 capital would be depleted by €263 billion, or by 4 percentage points. The median CET1 ratio – a key measure of financial strength – would therefore fall to 8.3% from 12.4%. Nouy has said banks will be required to cover any capital shortfalls revealed by the assessment, “primarily from private sources.”

Striking to note that the ECB doesn’t rule out having to save more banks. Discomforting too. For taxpayers. But the main question mark remains the simulated recession: what were the assumptions under which is was conducted? Make them too rosy and you might as well not test or simulate anything. Unless of course window dressing is the only goal.

Bloomberg’s Mark Whitehouse writes about quite a different stress test, which quite different outcomes. Makes you think.

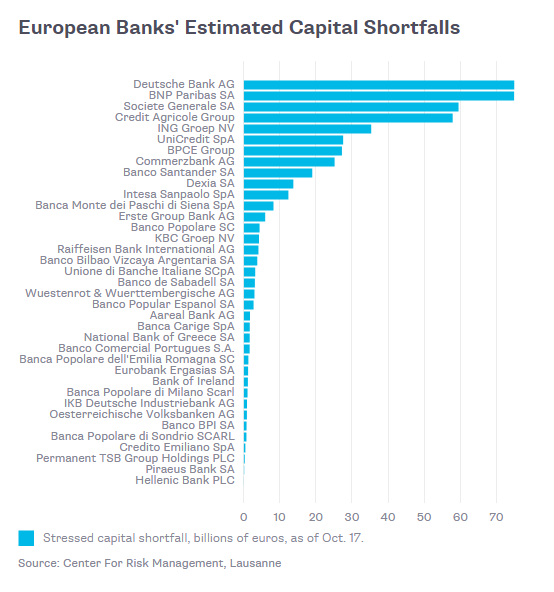

What would a really tough stress test look like? Research by economists at Switzerland’s Center for Risk Management at Lausanne offers an indication. By simulating the way the market value of banks’ equity tends to behave in times of stress, they estimate how much capital banks would need to raise in a severe crisis. The answer, as of Oct. 17, for just 37 of the roughly 130 banks included in the ECB’s exercise: €487 billion ($616 billion).Deutsche Bank, three big French banks and ING Groep NV of the Netherlands are among those with the largest estimated shortfalls. Here’s a breakdown by bank:

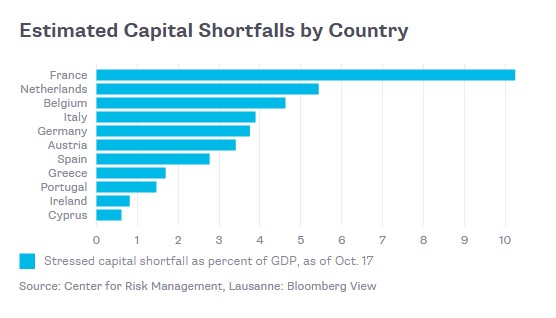

And here’s a breakdown by country, as a percentage of gross domestic product:

The economists’ approach, based on a model developed at New York University, isn’t perfect. It could, for example, overestimate capital needs if the quality of banks’ management and assets has improved in ways that the market has yet to recognize.

And, because crises are rare, the modelers had scant historical data with which to build estimates of how banks might fare in future disasters. That said, this relatively simple model has some important advantages over the ECB’s much more labor-intensive stress tests. The Swiss group’s approach is free of the political considerations that constrain the ECB, which can’t be too harsh for fear of reigniting the European financial crisis. In addition, the model implicitly includes crucial contagion effects, such as forced asset sales and credit freezes, that the ECB’s exercise ignores.

A bit of back-testing suggests that the economists’ approach works relatively well. The NYU model’s projection for the largest U.S. banks’ stressed capital needs before the 2008 crisis, for example, comes pretty close to the roughly $400 billion that the banks actually had to raise. If the ECB’s number is a lot smaller than the figure the model comes up with, that won’t be a good sign.

The ECB’s Comprehensive Assessment says $203 billion was raised since 2013, leaving ‘only’ €25 billion yet to be gathered. The Swiss report says €487 billion is needed just for 37 of the 130 banks the ECB stress-tested. Of the banks the Swiss identify as having the greatest capital shortfalls, most passed the EU tests. Judging from the graph, the 7 banks in need of most capital have an aggregate shortfall of some €300 billion alone.

Among them the 3 main, and TBTF, French banks, who all passed with flying colors and got complimented for it by French central bank governor Christian Noyer today, but according to the Center for Risk Management are about €200 billion short between them. Which means France as a nation has a stressed capital shortfall of over 10% of its GDP, more than twice as much as the next patient.

Wouldn’t it better to let an independent bureau do these tests, instead of the ECB which obviously has huge political skin in the game? Or are we all too afraid of what might come out?

Will the markets actually feel more confident, or are they going to fake that too? Was this really a yearlong audit, or did it only take that long because the spin doctors needed to make sure the lipstick was applied correctly on the pig?

We all deserve better than a yearlong exercise in futile tepid air. But Europe’s taxpayers deserve it most of all.

“Wouldn’t it better to let an independent bureau do these tests, instead of the ECB which obviously has huge political skin in the game? Or are we all too afraid of what might come out?”

But such is the epitome of the present-day world of finance and politics. This isn’t a “bug”, it’s a “feature”.

“Will the markets actually feel more confident, or are they going to fake that too? ”

NASDAQ: I fake my orgasms.

DJIA : I know.

NASDAQ: You knew?

DJIA: Of course. I fake mine, too.

NASDAQ: I knew that.

DJIA: You did?

NASDAQ: Yep.

DJIA : Whadda we do now?

In unison: Keep faking it.

Why would they bother doing anything? Everytime Draghi mentions “stimulus” the market rallies.

But the effort to talk bank stock prices up worked so well that many, even the weaker ones, were able to float new shares. Yves Smith

Ironically, if the banks ONLY used their common stock to buy new assets or to lend (interest-free but over-collateralized) without issuing any other liabilities then they would always be 100% capitalized. Bank runs would be impossible, no deposit insurance would be required, nor a central bank, nor borrowing by the monetary sovereign nor bailouts.

But then we’d have an economy based on equity and sharing and democracy (at least per share) rather than a Rube Goldberg contraption based on usury for legally stolen purchasing power which has caused untold misery for tens if not hundreds of millions.