Yves here. This is a short but important debate over how much to worry about the upcoming train wreck in emerging markets when the Fed finally gets around to tightening. Pettifor sees it as a potential global crisis event; Macrobusiness sees it as a typical emerging markets bust.

The Pettifor viewpoint seems more on target. First, so-called developing economies are far more important contributors to global GDP than in the last big emerging markets crisis of 1997-1998. Second, too many people forget how close we came to a bigger meltdown. Lehman nearly failed then, Goldman was wobbly, and the LTCM crisis, as the Fed and bank counterparties recognized at the time, had the potential to become a systemic crisis. Third, unlike the 1990, where the underlying global growth trend was solid and central banks had room to break glass and lower interest rates to deal with a crisis, fundamentals are much weaker and central banks are already at super-low policy rates.

By David Llewellyn-Smith, founding publisher and former editor-in-chief of The Diplomat magazine, now the Asia Pacific’s leading geo-politics website. Originally posted at MacroBusiness

From The Guardian:

Ann Pettifor of Prime Economics, who foreshadowed the credit crunch in her 2003 book The Coming First World Debt Crisis, says: “We’re going to have another financial crisis. Brazil’s already in great trouble with the strength of the dollar; I dread to think what’s happening in South Africa; then there’s Malaysia. We’re back to where we were, and that for me is really frightening.”

…Brazil’s already in great trouble with the strength of the dollar; I dread to think what’s happening in South Africa Ann Pettifor Developing countries are using the UN to demand a change in the way sovereign defaults are dealt with…It calls for a once-and-for-all write-off, instead of the piecemeal Greek-style approach involving harsh terms and conditions that knock the economy off course and can ultimately make the debt even harder to repay.

However, when these proposals were put to the UN general assembly last September, a number of developed countries, including the UK and the US, voted against it, claiming the UN was the wrong forum to discuss the proposal, which is anathema to powerful financial institutions.

Pettifor shares some of the UK and US’s scepticism. “The problem for me is that the UN has no leverage here,” she says. “It can make these moralistic pronouncements but ultimately it’s the IMF and the governments that make the decisions.”

…Brazil’s economy is likely to be seriously tested as the greenback rises; Turkey, Malaysia and Chile have large dollar-denominated debts and sliding currencies; and a string of African countries face sharp rises in debt repayments. Ghana and Zambia have already had to turn to the IMF to ask for help. It’s as if, as Pettifor warns, “absolutely nothing has changed since the crisis”.

That’s not entirely true. There’s more debt. Especially here. And this is not so much a rerun of the GFC that began at the core as it is a traditional cycle-ending emerging markets bust at the periphery. This will kill commodities stone dead and will be the moment to buy for long term investors.

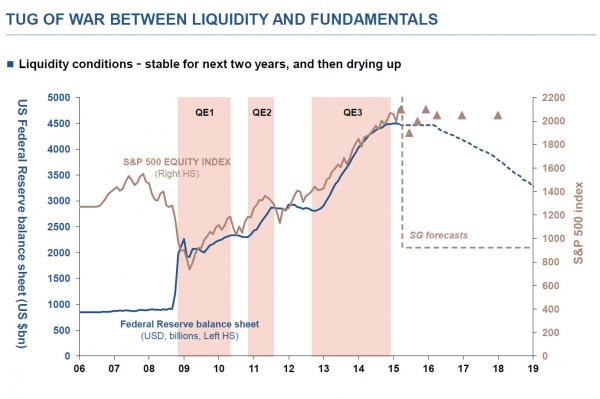

The reasoning of Jeremy Grantham remains most persuasive vis timing, with a positive 2017 via the US Presidential cycle followed by the bust. Two US rate hikes next year would set that up nicely! A chart from Soc Gen forecasting a shrinking Fed balance sheet is a useful illustration:

In the meantime Greece and China worry.

Another point of view from one Fed official (which I got from a second hand source) is the Fed hikes only once and is done. Emerging Market risks not withstanding, when I thought about one and done for awhile, it began to make eminent sense to me – at least until the rest of the global central banks decide it might be time to tighten again as well.

We have multiple bubbles, collapsing prices in certain key commodities like iron, demand is slack, China is pretending they know how to deal with their stock market run-up while their economy slows down, much of the fracking industry is insolvent without endless massive infusions of cheap money, and the Fed is creating more liquidity by pretending that municipal bonds are as liquid as Treasuries, so how does “one and done” resolve any of these problems? I’m not criticizing you, just pointing out how removed from reality the policy makers are. They now deal in shamanistic symbolic displays, not hard-headed actions intended to cope with real-world problems. The Chair of the Fed is looking more and more like a Mayan king carrying out blood rituals in order to keep the sun rising each morning. She and the rest of the Power Elite sure don’t seem to be trying very hard to prevent the sky from actually falling in the form of a predictable global depression that they may well not be able to “print” their way out of this time.

The Power Elite only needs to go through the motions, recite the chants, let the cantors sing the holy texts. They are personally exempt, in their inner bubbles, from the effects and consequences. One could scarcely believe that Yellen or Paulson or Schauble or any of the rest have anything but “IBG-YBG” in their sociopathic little brains. Impunity Forever! Their personal fans are well protected from any contact with flying sh_t…

That’s hardly fair. After ripping out the sacrificial victims’ hearts, they have to roll them down the stairs of the temple. If you think that’s easy, you try it.

“The Chair of the Fed is looking more and more like a Mayan king carrying out blood rituals in order to keep the sun rising each morning.”

+1. You are onto something here.

The central bank words have been important to many for quite a long time. We all remember the words of Volcker, Greenspan, Bernanke… Their actions and words they would use were “systemically important”. Are they to-day?

Do we really care about central bankers’ action and words in 2015?

Love the metaphor!

John,

I’ve been in the “one and done” camp for some time. Conventional wisdom is the end of the world when the Fed moves the rates up — I suspect nothing happens. The Fed “proves” it has the “courage” to “make the tough decisions”. And then the SP 500 REALLY takes off.

James,

First I want to thank you for your insightful comments. When I see your name, I always slow down to read thoroughly. I agree 100% with your economic summary and with the perception of the Fed. Having said that, I believe that, given the tools at hand and the political constraints faced, Ben Bernanke was satisfactory as the Fed chair during the GFC. Monetary policy is a blunt and slow tool — the GFC cried out for bold fiscal action. That fiscal action was insufficient (at the time) and is now being reversed (with the exception of the MIC). We have money to blow people up in Yemen, but not to pay for Grandma’s walker.

“I’ve been in the “one and done” camp for some time. Conventional wisdom is the end of the world when the Fed moves the rates up — I suspect nothing happens. The Fed “proves” it has the “courage” to “make the tough decisions”

I wish it is that simple! Fed has never been Pro-active but always REACTIVE, too late and too little! Talking ‘courage’ with regard Fed is NOT supported by it’s actions or the record after Volker left. They created 2 bubbles with the 3rd one brewing, thanks to Fed, again!

There is 9 trillion US$ carry trade out side America. Gobal debt has increased by 57 trillions since 2008. Virtually there is significant leverage, where is Debt driven the pseudo growth and asset bubble. Leverage in European Banks is at least 26:1 (Lehman 30:1 in 2008). Even a 4% loss will wipe out all their capital.

Even 0.1% increase will start a mini earth quake, displaying all the ‘faults’ all over in global Bond World! Bond market is bigger than Equity market. Slightest sign of instability, demand for US$ goes up, further stressing the carry trades etc. You cannot STOP falling dominoes once fear goes pandemic! Every one to the exit.

So one time is NOT that easy. Otherwise Fed would have done it long time ago. Why did we need Q2 & Q3 when Q1 failed to achieve the goals?

Agree. Reflecting back on the Brazilian government’s opposition to hot money carry trade inflows and the consistent stance of the central bank of India and others, the probability s/b entertained that the policy implications of QE were and are anticipated, and that this is part of a calculated, intentional effort at economic and political engineering.

So what will the catalyst be that will precipitate the next Minsky moment? And what is the vision for its aftermath by its engineers? Expected features are fairly self evident.

This whole “Whocouldanode?”, “sheer incompetence”, “The Fed has painted itself into a corner” schtick lacks credibility at this point IMO.

Sunny,

There hasn’t been a pro-active FED since (maybe) Tall Paul or Wm. McChesney Martin (Chairman 1951 – 1970 and who said (paraphrased): The FED is in the position of the chaperone who has ordered the punch bowl removed just when the party was really warming up).

My point is simply this: there is an EOTWAWKI expectation if the Fed raises rates 1/4 point. I think they’ll do it, the world will NOT end, they’ll declare victory (“make the tough decisions” “show courage”). And that will be the end of rate increases.

There are numerous financial issues which Yves and Lambert point out regularly — but one MONETARY one is that all of the $$$ flooded into the economy in QE1 – QE3 is sitting in a stagnant pool. It’s dead money.

It’s looking more and more like it it the season for one giant shrug of a Jubilee.

There are good reasons why the notion exists and persists. “Hurry up please, it’s time…”

Unpayable debt cannot be sustained forever. Jubilee is merely the wise precaution to peacefully cleanse the economy by deliberate design which otherwise markets will eventually cleanse violently.