By Jérémie Cohen-Setton, a PhD candidate in Economics at U.C. Berkeley and a summer associate intern at Goldman Sachs Global Economic Research. Originally published at Bruegel.

What’s at stake: While Thomas Piketty’s documentation of the long-term evolution of income and wealth distributions is generally praised, the theoretical framework used to shed light on the future of inequality in the 21st century has recently been challenged by a number of authors.

The r – g Theory

Per Krusell and Anthony A. Smith writes that as the title of the book suggests, it makes predictions about the future. Piketty argues that future declines in economic growth – stemming from slowdowns in technology or drops in population growth – will likely lead to dramatic concentrations of economic and political power through the accumulation of capital (or wealth) by the very richest. Charles Jones writes that Capital in the 21st century proposes a framework for describing the underlying forces that affect inequality and wealth.

Lawrence Summers writes that Piketty makes a major contribution by putting forth a theory of natural economic evolution under capitalism. His argument is that capital or wealth grows at the rate of return to capital, a rate that normally exceeds the economic growth rate. Economies will thus tend to have ever-increasing ratios of wealth to income, barring huge disturbances like wars and depressions. This is the normal state of capitalism. The middle of the twentieth century, a period of unprecedented equality, was also marked by wrenching changes associated with the Great Depression, World War II, and the rise of government, making the period from 1914 to 1970 highly atypical.

Per Krusell and Anthony A. Smith writes that other things equal, higher values of r − g lead to thicker tails. The r − g theory argues that in models featuring multiplicative shocks to wealth accumulation, the right tail of the wealth distribution looks like a Pareto distribution with Pareto coefficient determined (in part) by r − g. The prediction of increasing inequality has its origins in falling rates of population and technology growth: were g to fall – and if r, in response, were to fall less than g – then the consequent increase in r − g would thicken the right tail of the wealth distribution. Alan J. Auerbach and Kevin Hassett write that the basic syllogism is (1) the rate of return exceeds the economic growth rate; (2) saving generated by this high rate of return causes capital and wealth to grow faster than the economy; and (3) capital income grows as a share of income because the rate of return does not fall sufficiently fast with capital deepening to offset this growing capital-output ratio.

Thomas Piketty writes that a higher gap between r and g works as an amplifier mechanism for wealth inequality for a given variance of other shocks. To put it differently: a higher gap between r and g allows an economy to sustain a level of wealth inequality that is higher and more persistent over time (that is, a higher gap r − g leads both to higher inequality and lower mobility).

The Future of r and g

Thomas Piketty writes that, from a theoretical perspective, the effect of a decline in the growth rate g on the gap r − g is ambiguous: it could go either way, depending on how a change in g affects the long-run rate of return r. Generally speaking, a lower g, due either to a slowdown of population and/or productivity growth, tends to lead to a higher steady-state capital–output ratio β = K/Y, and therefore to lower rates of return to capital r (for given technology). The key question is whether the fall in r is smaller or larger than the fall in g. There are, in my view, good reasons to believe that r might fall less than the fall in g, but this issue is a complex one.

Brad DeLong writes that Piketty points to remarkable constancy in the rate of profit at between 4% and 5% per year, but is agnostic as to whether the cause is easy capital-labor substitution, rent-seeking by the rich, or social structure that sets that as the “fair” rate of profit.

Free Exchange writes that the rate of return from capital probably declines over the long run, rather than remaining high, due to the law of diminishing marginal returns. Modern forms of capital, such as software, depreciate faster in value than equipment did in the past: a giant metal press might have a working life of decades while a new piece of database-management software will be obsolete in a few years at most. This means that although gross returns from wealth may well be rising, they may not necessarily be growing in net terms, since a large share of the gains that flow to owners of capital must be reinvested.

The Elasticity of Substitution Between Capital and Labor

Nick Bunker writes that for capital returns to be consistently higher than the overall growth of the economy—or “r > g” as framed by Piketty—an economy needs to be able to easily substitute capital such as machinery or robots for labor. In the terminology of economics this is called the elasticity of substitution between capital and labor, which needs to be greater than 1 for r to be consistently higher than g.

Lawrence Summers writes that as capital accumulates, the incremental return on an additional unit of capital declines. the rate of return from capital probably declines over the long run, rather than remaining high. With 1 percent more capital and the same amount of everything else, does the return to a unit of capital relative to a unit of labor decline by more or less than 1 percent? If, as Piketty assumes, it declines by less than 1 percent, the share of income going to capital rises. If, on the other hand, it declines by more than 1 percent, the share of capital falls.

Lawrence Summers writes that Piketty misreads the literature on the elasticity of substitution by conflating gross and net returns to capital. It is plausible that as the capital stock grows, the increment of output produced declines slowly, but there can be no question that depreciation increases proportionally. And it is the return net of depreciation that is relevant for capital accumulation. I know of no study suggesting that measuring output in net terms, the elasticity of substitution is greater than 1, and I know of quite a few suggesting the contrary.

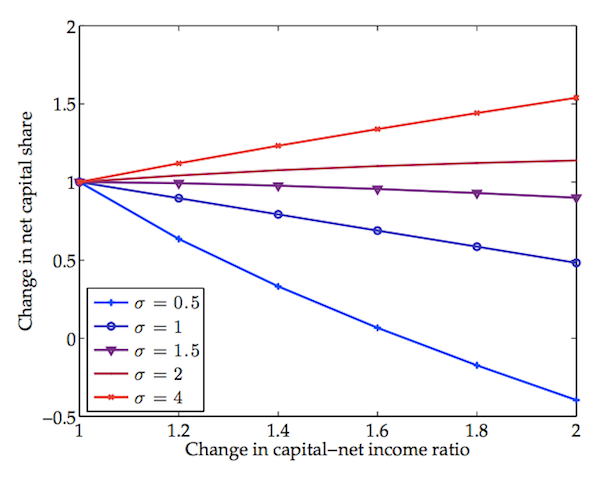

Matt Rognlie writes that Piketty does not cover the distinction between net and gross elasticities. This is problematic, because net elasticities are mechanically much lower than gross ones, and the relevant empirical literature uses gross concepts. The vast majority of estimates in this literature, in fact, imply net elasticities less than 1 – well below the levels needed by Piketty as suggested by the graph below.

Source: Matthew Rognlie

Matthew Rognlie writes that it is important to recognize that the plausibility of an elasticity of substitution greater than one depends greatly on whether a gross or net measure is used – a subtlety that is often overlooked. Suppose F(K,N) is the gross production function, with an elasticity of substitution of s. Then the elasticity of substitution for the net production function (“net elasticity”) equals the elasticity of substitution s for the gross production function (“gross elasticity”) times (A) the ratio of the net and gross returns from capital, and (B) the ratio of gross and net output. The ratio in (A) is below 1, while the ratio in (B) is above 1. Critically, the product of these ratios is always less than 1, so that the net elasticity is always below the gross elasticity.

Interesting roundup. I find the r > g notion silly since it’s determined by public policy (not some scientific law), and more generally I find that the distinction between capital and labor itself really has no meaning in our system of political economy, but it’s interesting to see the takes other people have on it.

Concentration of wealth and power happens from insufficient taxation of those with lots of currency units and overabundant oppression of those with too few. Wages, rents, dividends, capital gains, and so forth are all forms of income, whether we are talking a minimum wage cook or a billionaire CEO. That this wage/income/earning/labor inequality is allowed (or more accurately, encouraged) to accumulate over time in a few hands is an active goal of government as we presently know it.

Piketty’s point, if I’m reading him correctly, is that “r > g” is important precisely because it is a political outcome. Only politics or catastrophe (or catastrophic politics) can change it.

The “Elasticity of Substitution Problem” is a red herring in regard to Picketty’s work. It implies there has to be a connection between “capital” or “wealth” and the “real economy,” when it is absolutely possible for wealth to exist with no “real” function other than political and economic power. This is the central insight of r > g, I think. It implies that wealth creation per se (r) has no necessary connection with the increase of societal wealth (g). This freaks people out. It implies, as Karl Polanyi argued long ago, that the economy is an instituted process, not a natural phenomenon, and suggests that, at least on this point, Marx was right: Money is a relationship between people disguised as a relationship between things. It also means the dream of liberal politics: that we can help society simply by doing well for ourselves, is fundamentally flawed. Pretty radical stuff.

Capital and labor, in reality, are one, just like light being both matter and energy.

Labor should not kowtow to the notion it is excluded from capital.

“You too have greatness or great capital in your labor-ness.”

Yes, capitalists can be laborers or make into laborers too.

Don’t assume.

But labor just doesn’t pay worth a darn.

If Capital won’t come to Labor, perhaps Labor can go to Capital.

In any case, I firmly believe capitalists can make good laborers.

The human race is plagued by idolatry of wealth and the hard-heartedness that goes along with it, all in the name of a “capitalism” that is singularly lacking the moral sentiments Adam Smith knew were a requirement for capitalism to succeed. Focusing on national income aggregates as Roglie does is especially disingenuous. The distribution that matters is at the household and individual level.

It is interesting to contrast this discussion with the discussion of years past of the forthcoming long bear market due to large numbers of retirees selling their investments as sources of income. How low can returns go? In much of Europe, interest rates on really secure bonds are now negative. However, the model has sparked much interesting discussion.

There was a blurb on ZH that a bank in Spain was now doing creative nirp by paying mortgages down every month by deducting the amount from principal owed. Maybe it was a spoof.

George Bernard Shaw writes that If all the economists were laid end to end, they’d never reach a conclusion.

Sonny Bono writes that the beat goes on. Nothing will change until the rest of us fools take to heart what Paddy Chayefsky writes (and Peter Finch says) that I’m mad as hell and I’m not going to taking this anymore. Can I have my doctorate now?

Perhaps instead of making diplomas from the skin of sheep….

This is the most wonderful Koch reference yet.

Let every sheep keep its own skin.

send me $40,000 per year and I’ll mail you one in 3 years — mounted on a professional-grade backing and with a wide selection of attractive frames from which you can choose.

No tests required!

No Phd required. Simple observation of the real world. Capital trumps all. What ever entity has more of it comes out on top. I have seen this work in the real world a thousand times. Even something that is not for sale can and will be purchased by some entity with large capital.

It is a game with a very predictable ending unless you can continually add infinite inputs, exponential population growth, and no cost waste stream disposal. Not very likely.

All this nit picking over the book does nothing to change the history as Piketty presents it. The nit picking seems to be another example of the “this time will be different” mentality. I challenge anyone to make a long term bet that history is wrong and is not repeating itself as Piketty believes. No you cannot hedge your bet, either you are a believer or not.

If software and computers are replaced more often than say a giant metal press that is not because software and computers wear out faster than heavy machinery in which case capital income might take a hit. Rather, software and computers are replaced over and over again because newer versions are so much more productive than old that it profits to replace them over and over again. I may not see the big picture but I don’t see how this can do anything but benefit capital.

Ha! The above excerpts prove that Larry Summers has been sandbagging. He can indeed string words together that make very good sense. (I was beginning to think maybe he was seriously dyslexic.) Most of the points made above had to do with productivity, right? It’s so cool, diminishing returns (low productivity) causes inequality. Because we’re fortunate enough to have an artifact of capitalism, depreciation, to help us out. Just do a little accounting and eliminate diminishing returns. And also too send all toxic industries overseas for good measure. Also never mention destruction to the environment. Ever. Because we don’t know how to account for that stuff and still manufacture profits. I mean, how exactly do we depreciate the environment?

Fortune 500 companies have done an exemplary job of depreciating the environment, just not at their expense.

I always comes back to Land Rent, economic rent and monopoly rent, who not suffer much from depreciation of capital. Remember ? Income without cost of production…

Of what order of magnitude are these income and asset accumulations ?

Well according to our old friend Michael Hudson, in 2009 ….

https://www.youtube.com/watch?v=Elg6i3NxvdE

Overlooking the depreciation of capital is a significant mistake. Notwithstanding this mistake, we should bear in mind that in the Post-GFC world there is substantial food (and until recently) energy price inflation, but an overall deflationary trend for of everything else, it can only mean that most wage incomes are stagnant or falling pretty much worldwide. An how about ZIRP ?

So relative to output, your spare parts for your industrial capital shouldn’t cost you to much. Buying a new machine shouldn’t either.

And since I don’t see this trend as something cyclical, meaning: labor has no power over its fate in this process…and excess labor is abundant to say the least….

Perhaps we will enter a period of turmoil where demographics and the laws of diminishing returns will render capital depreciation the crucial factor …. but economic rents are of an order of magnitude such that Picketty’s point (r-g) will a l w a y s remain pertinent… until the SHTF, it goes without saying…

I like some of what Nassim Taleb says about this in the Philosophical Notebook linked to his website. In particular, I like this key remark: “Piketty mistook an equality of parameters for an equality of integrals and forgot to make them both stochastic, which would skew the return on capital by adding a small probability of ruin ‘Black Swan’ style that would annihilate capital in the long run.”

Annihilation of capital is a problem, all right. Think Soviet Union.

If g goes to zero, then the economy neither grows nor diminishes, but produces constant output year after year. If r goes to zero in the long run, then capital is not maintained and worn out capital is not replaced, and the economy produces diminishing output year after year. In the case of g=0, r>g is not a problem, it’s a requirement.

Hm. Except for years now r has been quite high, and capital hasn’t been maintained or replaced. Look at all the privatized industries with long-delayed or completely blown-off maintenance. 50-60 year old pipelines so corroded they explode. Electric grids still using pcb-filled transformers, backup generators that fail at the first demand. On and on and on. No, high returns on capital aren’t required. High returns to labor are, as is a big enough government to keep the infrastructure from falling apart.

Piketty argues that future declines in economic growth – stemming from slowdowns in technology or drops in population growth

This, in itself, deserves our focus.

Drops in population growth, with or without technology advances, can lead to future declines in economic growth.

That is, economic growth is a Ponzi scheme, requiring ever more ‘investors’ being brought in or born into the scheme.

If growth slows more slowly than population declines, each person can grow financially faster in absolute terms! You can keep growing financially per person until there’s one person left and they’ll be so rich they’ll own everything. But there won’t be much liquidity if they want to sell . . . haha

Another way is to migrate illegally to Mars or any ‘unoccupied’ planet (One must be willing t o blind to, or not see, any living beings there).

Unoccupied Mars divided by one = mucho milk and honey.

All this nit picking over the book does nothing to change the history as Piketty presents it. The nit picking seems to be another example of the “this time will be different” mentality. I challenge anyone to make a long term bet that history is wrong and is not repeating itself as Piketty believes.

Diedre McCloskey could well have a bet down. Check this out. http://www.deirdremccloskey.org/docs/pdf/PikettyReviewEssay.pd

Her conclusion: “It is a brave book. But it is mistaken.”

Corrected URL:

http://www.deirdremccloskey.org/docs/pdf/PikettyReviewEssay.pdf

(the final “f” was missing)

Slavjo Zizek agrees.

Unfortunately, I cannot provide a link to his very interesting, often amusing talk in which he explained how SYRIZA is a greater threat to the West’s global capitalist paradise than Putin and ISIS combined because although the current Greek government admit they owe the money, they don’t feel at all guilty about it and this is driving the super-ego driven Germans and their like-minded allies into a frenzy of moral indignation masking mortal fear of ideological contagion.

I cannot provide this link because City Arts and Lectures, which broadcasts recordings of its live events on our local NPR station, will not stream their content for no other reason that I can divine than some sort of oddball proprietary elitism. They are like dragons that horde gold and virgins but have no use for either. I have recorded the event however, which I will transcribe eventually and post on one or another website after seeking legal advice.

She writes pretty well but she is pretty far off WRT completing her arguments. Lacking a bit too much scientific insight. Her stuff about oil is goofy. Same old rational markets nonsense. If markets do such a good job utilizing resources why do we use them up to the point of depletion? Beside ignoring how Capitalist expansion is a sequence of catastrophes she completely shades the reality of a global catastrophe for which Capitalism and all its ethereal mechanisms would have no function and its Phoenix could not rise from the ashes. Not to mention her inability to reconcile the necessity of Capitalist growth with the material constraints of the planet. Technology only saves as it displaces and the costs are embedded in its development and implementation. Thus there is no easy solution for continual growth (i.e. following her example, Indians and Chinese will get richer at further expense to the planet’s resource base until most of us are dead). The pessimism is more than warranted.

Margin Liquidity

So, with all the talk, what has changed about empire, other than changes you have made in your own life? If someone doesn’t comply with empire, another can take their place, in a buffer, with no net change. There is no relationship between work, income and asset valuation, other than that which you choose to recognize, within empire.

You always have three choices: answer the questions, get out of the way, and pay the bill; get a disposable replacement from a drug dealer; or fix it yourself. Option C is always best. Option B is always the path of the herd. Psychological insecurity in a positive feedback loop with physical control is not economical, no matter how many laws the so-manufactured majority adopts, creating the make-work drugs.

Growing income inequality is a function of expending energy to prime a dead pump. You don’t need politicians to transform energy locally, but expect their herds to get in your way, to the extent they can see you. It’s not called work by accident. Accelerating margin leverage on a portfolio of stupid doesn’t make it SMART, no matter how many fuses you install in the line.

Climate variability is a function of gravity, you don’t need a satellite to see it, and more talk, carbon trading, isn’t going to restock the planet with natural resources, or stop pay for compliance with exploitation. CO2 is a symptom, employed by the planet. The empire is choking itself, with artificial crises, as a make-work jobs program.

Whether Fred, Joe or Hillary becomes president makes not an iota of difference. Like every other herd, most old-timers will hold what they have managed to acquire until they die, alternating between damsel-in-distress and tyrant. Walk on by.

Without your children, trained by you, the empire can only choke itself. Iran is welcome to Iraq and Russia is welcome to Greece, none of which can solve their own problem, feudalism, a problemsolution. The economics of feudalism can only lead to war, which is always a make-work sh-show.

Buffet & Gates wealth has been refloated, not grown, with numbers in a computer, notwithstanding more bull from Bernie Sanders, getting his own kickbacks. The only free markets are the ones you make, locally.

That stupid SMART train isn’t bringing any rain. Other than one small, but important, application, the dc computer will go down as the dumbest invention in human history yet. You do realize that electronic error, the dc computer, has been placed in a positive feedback loop with operator error, the pilot, to expediently grow Boeing and all the others at your expense?

Feudalism is a brake. GDP simply measures the brake, RE inflation, which is implemented with increasing make-work complexity. The critters cannot measure economic growth, because they are not involved in the process. They can only see what you show them, which, of course, they want you to stand in line to do, for income, money created by moneychangers. If you want growth, turn off Family Law for a period, instead of switching back and forth, to mimic ac economic growth. PWM is great at control, controlling increasing pressure on decreasing volume. Whether the talking head is male, female, black, white or pink changes nothing.

*groan*

Seems they are still hell bent on seeing the world as two intersecting lines…

Truly. Who was it once described the field of economics as having retreated into the thickets of algebra? An economist, no doubt. I can understand the necessity of numerical accounting but when it gets too thick I retreat into the soft, warm and fuzzy realms of moral philosophy.

Heilbroner: “Mathematics has given economics rigor, alas, but also mortis.”

I have a question for NC. Having read Piketty’s book and gained a bit of an understanding of what is truly capital. Having a rough understanding of many of the recent “exotic” financial forms, CDOs, CDS etc. Has anyone ever totaled the amount of real capital in the world available to financial firms as well as their countries capital assets and compared it to the obligations out there? I am beginning to believe that there is more BS exotic financial obligations out there than there is actual money or capital to cover the bets by an unsustainable exponent. Has anyone an idea of the total amount of promise to pay instruments put out by the financial outfits compared to the total capital they can all rely on to make their bets good? Such information would be interesting to have. Especially if the taxpayer of the country is guaranteeing these too big to fail operations.It would be even more enlightening to put it into layman’s terms. The average person gets into some questionable territory according to banks criteria for lending when they are leveraged more than 3-4 times their income. Just how much are the people running the financial investment houses, hedge funds, banks etc., actually leveraged if all the exotic investment vehicles invented in the last 20 years are taken into account? Has a scholarly work giving this information been published that shows how much real capital exists after the smoke and mirrors are taken away?

Define “capital.”

Eh, more Piketty and all of his book’s packaged controversies. The discipline of economics needs to take it easy on the maths, most of it is hand waving. Besides economies are pure political and social constructs anyway. Despite all of the factors influencing economic activity including: resource depletion, pollution, foreign policy, warfare, cultural values, illness, consumption, on-and-on, models are still based on measures of capital? CERN physicists and programmers develop more thorough models for two particle collisions. or at least they account for as many variables as are presented in the experiment (see http://home.web.cern.ch/about/computing). The less complete the experiment the farther from the validation of the scientific process. I still refer to Capital Volume I to understand all I need to know about Capitalism and its inevitable outcomes. It is a wonderfully rational, philosophical analysis (with a pleasant peppering of literature) without the need for endless quantitative validation.

Economic predictions are absurd. Impacts of runaway climate change which has recently accelerated beyond critical tipping points, will throw economies into chaos. Superstorms caused by the meandering Jet Stream and other anomalies, storm surges due to rising sea levels, protracted droughts, depleted soils and vast destruction of forests, ocean acidification and pollution from radioactive emissions, and methane eruptions from the Arctic sea beds, will cause unimaginable death and destruction. All bets are off.

Summers is being disingenuous on two fronts. First, he pretends that at the upper end of the income scale (which is the portion being examined), wealth is acquired for economic reasons, when it is actually acquired for political reasons. Return is irrelevant; wealth acquisition is required to get and keep a seat at the directors’ table. Second, since that wealth is measured in capital (whatever physical form it may take), the acquired power will be wielded to protect the value of capital by whatever means and at whatever cost to any other asset, including labor and environment.