Yves here. One of the problems with discussing Greece negotiations that there are so many moving parts and so much backstory that any vantage winds up omitting some information, which raises the question of whether the loss was a sound streamlining of the issue down to its essentials, or may have gotten rid of a material, and potentially important element.

This post does a very fine job of summarizing the economic basis of the simmering row between the IMF and Eurozone. But that means it’s thin on the politics of the dispute, namely, that quite a few Eurocrats, most prominently the European Commission’s Jean-Claude Juncker, are mighty unhappy that a non-European institution is playing such a powerful role in European politics. The wee problem is the EC has no checkbook, and the IMF was brought in in the first place to help defray the large costs of the stealth rescues of French and German banks. Moreover, as we’ve also discussed, the IMF’s raising of the sustainability issue at this juncture makes it even harder for the other members of the Troika to paper things over and enter into a partial bailout deal to avert a Greek default. Just as Syriza’s hard left is making it well-nigh impossible for Tsipras to capitulate, one has to wonder if the IMF is trying to play a similar role here (keep in mind that the IMF at the April 24 Eurogroup meeting at Riga took a harder line that Hugh indicates via his quote from an April 22 Wall Street Journal article).

By Edward Hugh, a macro economist based in Barcelona, who specializes in growth and productivity theory, demographic processes and their impact on macro performance, and the underlying dynamics of migration flows. He is currently working on a book “Population, The Ultimate Non-renewable Resource?” His analysis can be found on his “Don’t Shoot the Messenger” blog on www.economonitor.com. He is also a regular contributor to a number of economics weblogs, including India Economy Blog, A Fistful of Euros, Global Economy Matters and Demography Matters. Cross posted from Credit Writedowns

Everything has a cost, or so the story goes, especially time. In the Greek case we now know an additional item on the mounting bill: the country is back in recession. The issue is who – apart of course from the long-suffering Greeks themselves – will pay the extra costs of the latest imbroglio.

The Cost Of Not Finding A Solution

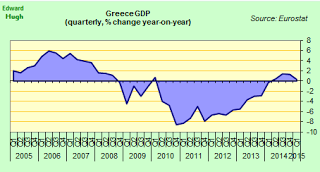

It is now clear that Greece’s economy has been going backwards over the last 6 months, and that it has once more fallen back into recession. Greek GDP fell by 0.4% in the last three month of 2014, and by a further 0.2% in the Jan – March 2015 period. As a result at the end of March Greek GDP was only 0.3% above the year-earlier level. This is a lot lower than expected in IMF forecasts, and – perhaps more importantly – well out of line with what is needed to maintain the 2022 debt sustainability targets on which continuing Fund support for Greek programmes depends.

Indeed “Greece is so far off course on its €172bn bailout programme that it faces losing vital International Monetary Fund support unless European lenders write off significant amounts of its sovereign debt”, Peter Spiegel wrote in the Financial Times on 4 May 2015. The reason for this is obvious: IMF regulations prevent the Fund continuing to make tranche payments to countries where there is a foreseeable financing shortfall during in the coming twelve months. The worsening in the Greek economic outlook and the consequent reduction in the revenue outlook effectively guarantee this shortfall.

But the sort of debt write-off the IMF is demanding of its European partners goes much deeper than that. Future IMF participation in any new Greek programme after June is also in doubt because without additional pardoning the debt will not be on a sustainable trajectory in terms of the objectives set down and agreed upon in November 2012. So you reach a point where extend and pretend hits the proverbial fan. You can, of course, do more extend and pretend till the next time it happens, but at this point the IMF seems reluctant to do so. On the other hand austerity-type spending cuts which only make the economy smaller and the growth path lower simply don’t help in this context, since what they give with one hand (debt reduction) they take away with the other (in the form of lower GDP).

The background to the current stand-off is to be found in the debt targets the Eurogroup agreed with the IMF in November 2012 and which effectively made the current programme possible. Given the latest recession these targets are clearly now not attainable. On the other hand Greece is totally bust, so the only way the negative effects of the negotiating gridlock can be paid for is by someone else “coughing up” (or rather “pardoning” debt). This someone will need to be the Euro partners (who else is there), and the longer the stand-off goes on the higher the cost. Naturally the other alternative would be allowing Grexit, but arguably the cost of Grexit would be much higher to the Euro partners, and by a large multiple.

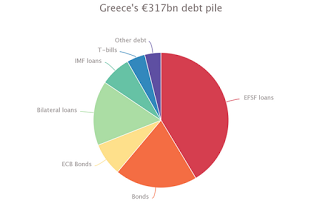

The issue of the growing IMF/Eurogroup divergence came to general public attention over the weekend when an IMF internal memo was leaked to Channel 4 News (UK). The key point in the memo, which is hardly news, is that Greece is running out of money. “There will be no possibility for the Greek authorities to repay the whole amount unless an agreement is reached with international partners,” referring to a series of June repayments to the IMF amounting to roughly 1.5 billion euros.

This impression is also confirmed by details of the letter that the Greek Prime Minister Alexis Tsipras wrote to International Monetary Fund Managing Director Christine Lagarde at the start of May (see details in this Kathimerini article) to inform her that Athens would not be able to pay the 750 million euros due to the Fund on May 12 unless the European Central Bank allowed Greece to issue more T-bills. It appears that at the time of writing the letter (which also went to EU Commission President Jean-Claude Junker and ECB President Mario Draghi) Mr Tsipras was not aware he could temporarily use the 650 million euros held on reserve at the Fund to make the payment, which he subsequently did. It’s not unreasonable to assume that it was the IMF itself who advised him on this.

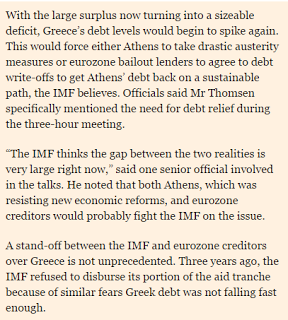

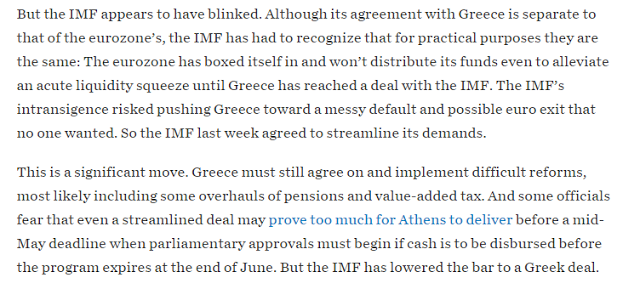

The inter-institutional tensions are evidently reaching a critical stage, although in fact the issue has now been knocking around for some weeks, as Simon Nixon reported in the WSJ on April 22.The IMF, he said, “appears to have blinked”.

The general impression being given is that the IMF is contemplating a much lower bar for agreement, and then possibly disengagement from any post June programme. The Euro partners are evidently anxious to avoid this outcome, but they are caught between a rock and a hard place.

On Or Off The Hook?

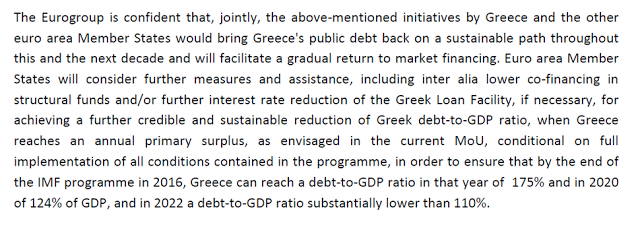

In order to understand what is going on between the Eurogroup and the IMF it is necessary to go back to a 2013 document entitled: The Third Review Under the Extended Arrangement Under the Extended Fund Facility (what a mouthful that is, henceforth the Third Review). In particular the following paragraph in that document off a key:

The macroeconomic outlook, debt service to the Fund, and peak access remain broadly unchanged and euro area member states remain committed to an official support package that will help keep debt on the programmed path as long as Greece adheres to program policies. Capacity to repay the Fund thus depends on the authorities’ ability to fully implement an ambitious program. It continues to be the case that if the program went irretrievably off-track and euro area member states did not continue to support Greece, capacity to repay the Fund would likely be insufficient.

Now all of this may sound – at least to the uninitiated – like a load of old bureaucratic mumbo-jumbo, but actually there are a number of key statements here which may help to put the current internal Troika tiff in some sort of broader and more intelligible perspective.

The cited paragraph talks about three issues: the macroeconomic outlook, the commitment of euro area member states to support Greece and keep the debt on the programmed path as long as Greece adheres to the programme’s requirements. It also warns of the danger that should the programme go “irretrievably off track”, and euro area member states not give the necessary support then the country’s capacity to repay the Fund would clearly be insufficient – ie the IMF would be left holding the can, and Fund employees would be faced with the complicated task of explaining to its non-European members why losses had been incurred.

Crudely put the position is this – as long as the IMF continue to write reviews stating the Greek programme is on track then the euro area member states are on the hook to cover any shortfall in Greek debt performance in order to make the 2020 and 2022 targets (see above) achievable. This is a commitment they undertook during negotiations on the second bailout agreement.

On the other hand, if the IMF were to start producing reports stating that the programme was off-track because of Greek non-compliance, rather than for example arguing that the numbers were out of whack due to faulty macroeconomic forecasts (and of course the recent economic relapse makes those forecasts even less realistic), then the euro area member states would be off the hook from additional stepping up to the plate with the result that the IMF would end-up taking a loss.

Well the present recession makes it evident that those targets are even less achievable than they were previously, and that future debt sustainability analyses will have to reflect this. Bottom line: the IMF has a clear interest in enabling Greece to sign successfully off the current programme (due to end in 2016) and they thus have more interest in giving the country a “pass” note than the Eurogroup ministers do.This is why, in Simon Nixon’s words, they are blinking, to the great discomfort of the Eurogroup partners.

Bottom Line: When You’re Bust, You’re Bust

A lot of attention is being paid at the moment to the idea that Greece is running out of money, and indeed there is a lot of chuckling about just how much grasp Yannis Varoufakis actually has of game theory. But at the end of the day it is also true that when you have lost everything (in the bankruptcy sense) you have relatively little still to lose. To some extent the idea that the Greek government might be deploying this strategy – known technically as coercive deficiency – was explored by Jacques Sapir back in February. In my humble opinion far too much energy may have been wasted on laughing at Mr Varoufakis (which might precisely have been his intention) and far too little invested in trying to think through what he might have been up to.

If delays in negotiations mean a large bill is run up on your credit card (figuratively speaking) at the end of the day you can’t pay it, so someone else will have to. This is the situation Greece is now in. If non performing loans start to rise with the new recession eventually these will have to be written off, and the bank recapitalization costs will go on someone else’s account.

The IMF memo in fact draws attention to this issue, and states that “non-performing loans are at very high levels and – going forward – the system might suffer from important stress.” Indeed they go further and point out how “staff also noted a dramatic deterioration in the payment culture in the country”. This is what you would expect to find in a country steadily, and day by day, going bankrupt.

It’s no longer clear that even if progress was made in the next two weeks towards some sort of fudged compromise deal – the so called “quick and dirty outcome” that the IMF oppose – that this would be able to get the necessary agreement from all EU parties and the IMF before the June payment. That is not necessarily an insurmountable issue, but it does highlight just how near to a potential brink (or “accident”) we are, and it also serves to draw attention to the point that the longer all this goes on the greater the cost for Eurogroup members. Reforms will bring a bit more growth, but only in the longer run. Whatever the package of structural reforms the Greeks sign on to it won’t do that much to mitigate the effects of the hit the Greek debt sustainability profile just took.

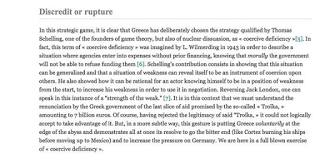

But then there is the other alternative – just allow the momentum of the present impasse to carry Greece straight out of the Euro Area. That would solve the problem of getting a deal, but the cost, when you come to think of EFSF and IMF loans plus ELA would hardly be negligible, not to mention the as yet unquantified geopolitical and contagion effects.

Whatever way you look at it, the next few weeks are certainly likely to be interesting.

Why is the IMF even involved? The IMF can be considered to be US centric and that its main purpose is to impose payback to US banks when countries get into trouble because they borrowed in a foreign currency, the USD. Then the US banks can come in and scoop up assets.

Getting triangulated in with the ECB seems to be especially problematic. It’s possible to see the US banking system being at risk if German and French banks have major problems. From the point of the ECB it is becoming clear that Greece actually borrowed in a foreign currency, the Euro, and the ECB and EC are trying to extract their pound of flesh.

It’s hard to see any part of the troika being interested in Greece except from the standpoint of being a foreign creditor demanding the payback of unsound loans which seems to be the history of the IMF.

The IMF was brought in to spread out the total bailout cost. I saw a chart I should have retained that shows the IMF provided 15% of the Greek debt outstanding now. The IMF is a lender of last resort to countries, so that made it legit for them to participate. The IMF has even more say over the current bailout, since 50% of the total €7.2 billion is to come from them. Plus the Eurogroup members (finance ministers) don’t have the time to get in the weeds of the structural reform negotiations, which they perceive to be necessary, and operationally, having 18 of them at the table (even if they or their staff did have the time and expertise) would be a nightmare).

Thanks. On some fronts (maybe not the policy front), the IMF seems to be understanding that austerity policies are not the best of structural reforms for the best interest of the countries’ populaces. Lending money for jobs programs, etc would not seem so predatory.

Here is an excellent recap on the role of the IMF, how it got involved and why it signed on a program the technical staff knew couldn’t work (with interviews and bibliography).

https://www.cigionline.org/sites/default/files/cigi_paper_no.61web.pdf

Also, here is the WSJ article reporting on the leak of the “excerpts from confidential International Monetary Fund documents, including board meeting minutes, staff briefs and board-member comments [that] reveal considerable disagreement at the May 9, 2010 meeting at which the IMF board approved Greece’s first bailout.”

http://blogs.wsj.com/economics/2013/10/07/imf-document-excerpts-disagreements-revealed/

(For more details, see above pdf report).

Thanks for the links. It seems that similar to the Fed, the main role of the IMF and ECB bailouts were to keep the banks whole.

I liked the analysis in the pdf but not sure that I agree with the conclusion. Watching the IMF act in Ukraine it seems that it could use some competition if its purpose is just to save the banking system.

I’m not sure I’m a fan of ‘the Fund’s best judgment’.

“Regional financial institutions and ad hoc arrangements among countries are on the rise, one motive being to create alternatives to the IMF or at least influential adjuncts to it. The most recent of these is the BRICS countries’ US$100 billion Contingency Reserve Arrangement (CRA), a pool of currencies intended “to forestall short-term balance of payments pressures, provide mutual support and further strengthen financial stability” (People’s Bank of China 2014). The CRA, the establishment of which was agreed in July 2014, is modelled on the Chiang Mai Initiative launched some years ago among Asian countries. Although these entitles will never supplant the IMF, it is not hard to imagine that, in a crisis, they could be used to help tilt the terms of rescue packages in directions that suited major countries’ governments, against the Fund’s best judgment. Such an approach would erode the IMF’s value as a global public goods provider, which would be to the long-term detriment of all.”

I’m not sure I’m a fan of the IMF’s “global public goods”, nor of whatever “all” they’re talking about.

The way to read this kind of reports is to ignore all that and just get a big part of the inside story on what happened and deduct the rest. That’s why I linked to it, because it explains a lot. The rest (conclusions, recommendations, calling the IMF a “global public goods provider” and so on) is just friendly noise for the VSP crowd.

VAT and pension solutions…

The VAT situation is a disaster that can easily be fixed if someone wanted to.

The actual VAT number is useless as there are very few actionable remedies currently for the rampant lack of payments…the better solution is to increase dramatically the VAT and also Decrease it effectively by having a refund mechanism in place for the citizenry. No need for swedish models as mystery shoppers.

Simply, the VAT should be doubled across the board. BUT, set up a refund system (quick refund) where the citizenry would use its tax ID number to input its purchase receipts either via a smart phone application (much like is being used today with banking deposits made via photos of check instruments) and for those who do not have a smart phone, there can be technology set up via the post office or KEP offices. There would be a sliding scale of refunds, so that someone would not lose out totally if they could not take advantage of the monthly refund checks that could be made. The receipts being in the hands of the government electronically would be coordinated with a store code number which every enterprise would be required to display in LARGE BOLD PRINT in various places around the store. You log into your account, you type in store number, the date on your receipt, you type in your purchase and tax information, you review your account for pending refunds, you hit send. If you input the receipt within 72 hours you get a larger refund, one week, maybe 25% less, monthly delays, refund reduced by 35%, three months behind, 45% reduction of refund, six months behind 60% reduction of refund and within one year, 75% reduction. For those who are chronically behind schedule, then an 85% reduction would be in order for up to the second year. After two years, your right to a refund would expire if you did not begin the process of entering the data. There will be some who will never send in the information, since they don’t want the government to know they are making undeclared money. That is fine, the large increase in the VAT becomes an income tax on those undeclared funds. The key will be to make it an actual reduction by making the refunds (if done within the first week) large enough to create an effective decrease in the current VAT on the items purchased. Game set and match, and the tax revenue will not only increase by at least 30%, the enterprises which have made a habit of using the VAT money collected as “enhanced profit margin” will realize the computers will soon enough re-calibrate their revenue numbers and there will be increases from there as well. The key is to establish the refunds to be distributed back on a monthly basis so that the tax refund regime gains traction. Waiting a year for the refund would not incentivise most people who are currently struggling to get to their next “metrio” coffee.

As to the pension reform, there is an effective and financially efficient way to do what the Troy-kia wants yet still keep the pension holders with almost the same if not maybe more funds. Now, there will be problems for those who are 53 years old who are going to cry they will have to wait to at least 63 to retire. There are very few places globally that have tax payer subsidized retirements at 50, although there are many systems in the USA for an early reduced private pension at 55, so it is not that out of line, as long as it is a reduced pension. But for those who would find themselves with a lowered pension who are already out of the work system…again borrowing from the USA system…

In the USA, to save on long term costs and to create family unit preservation, the government has programs whereby a family member gets compensated in lieu of a government/taxpayer paid third party either caring for an elderly or sick member of the family, or for child care/daycare. The US has over 1.7 million nursing home beds. Greece has a total of 15 thousand. In comparison to the US, Greece would need to have over 50 thousand beds. this is due to many factors, most that Greeks put up with arguing much better than Americans, so there is not this mental anguish over not agreeing on things in life…we just disagree and get louder till we get tired (not my idea of fun). The Greek government could enact a series of Tax Refunds/Tax Credits for households where the elderly family member is taken care of at home, or the elderly person gets compensated for taking care of the younginz. Dr. Stangeluvauble would probably approve, as at least the parties getting money would be doing something other than watching reruns of “Brusco” on Antenna tv.

And speaking of Dr. Strangluvauble(along with Frau Mutti), he had proposed special business development districts in Greece to help reduce the level of direct imports made by Greece, how did this economic enhancement idea get lost, considering its probably the only thing he offered (back in 2010-2012) to help the greek economy (he had not offered to hand over the Siemens execs)…

Get on with it, you made to the summer Syriza, congratulations…I did not think you would be able to talk your way into june…well done…now it’s time to get to work…you put greece on the front pages and PM Tsipras has become the new Tito, learning to play one against the other for the benefit of the citizenry…very well done…but it is time to get to work…break out the blue ink and get on with it…sign on and fall forward…the armenians had mister five percent…maybe you will be remembered, Mr. Prime Minister, as “mister fifth ace”…

China has some prior art (bunniestudios) worth studying: prepaying estimated tax monthly and incentivizing crowdsourced enforcement of tax payment with

new draxmalottery tickets. No need for anything more high-tech than scratch cards and the ability to count.Along the line that you mention, but simpler, the proposal that has been floated is: Greece will set up a dual rate: 18% if you pay cash, and 16% if you pay with a credit card. The idea is that people will use credit cards, and thus the money will be registered for further taxing. People gets a small discount, government a record of the transaction.

I believe that Greece has been trying to force the Troika to commit to debt restructuring (including write-downs) as part of a deal. But the Troika wanted Greece to submit a payment plan first. Now the IMF calls for debt reduction but they are doing so rather late in the game with Greece facing default in two weeks (June 5).

This either helps Greece to accomplish their goal -OR- it is a siren song inducement for Greece to accept a deal that doesn’t include debt restructuring. Yves has previously written of the bureaucratic headwinds in the way of changing the two-step formulation (payments THEN restructuring).

It’s hard to trust the Troika because the payment agreement they seek is a Catch-22: if Greece presents a plan that shows how it will pay the debt, then the Troika can argue that no restructuring needed (or, more likely, that adjustments be minor).

Hugh shows that the IMF had concerns in the past. Thus, the concerns may be real, but those concerns have not previously changed much. The IMF seems to have a backseat.

=

=

=

H O P

Why seek to solve the small problems first and the big problems later? Restructure Greek debt first and this gives everyone financial and political breathing room to solve for structural reforms ( EU and Greek). The current climate is hyperized by the entrenched polity around this debt block. Take away the elephant in the room and watch reason and common sense ( on all sides ) return. To ensure Greece continues to deal…you tie access to commercial debt markets to the reforms.

Varoufakis originally submitted a well thought out plan to the EC. They called him an “amateur” and he called them “idiots.” And then an impasse followed. But there was always mutual respect among and between them. Schaeuble himself praised Varoufakis as a smart and competent person, etc. Merkel primly avoided the issue. As did Hollande. When Varoufakis made his introductory speech re the Troika, afterward he shook hands with Djesselbloem and Djesselbloem said “You just killed the Troika” and V. said “I hope so.” And they looked like colleagues. Intriguing. Now it looks like they colluded to stiff the IMF. As things deteriorated, Varoufakis came to Washington. Obama had already encouraged the EC to do reforms; then Obama backtracked. Now we know why. The EU is fighting it out with the IMF (that’s us) and Greece is caught in the middle. And it is becoming clearer what Schaeuble meant originally by “Grexident.” That’s when an accident is made inevitable by insane contracts which ensure that all parties will self destruct.

I see it differently.

Washington and European elites are neoliberal pals. Obama urging Troika to compromise was Kabuki (and getting in front of the parade) that made it seem that Troika was under pressure. Europe offered minor concessions (as planned) that enticed Syriza to present a payment plan that made real restructuring unnecessary (the Catch-22). When Syriza made it clear that they would not continue the farce – they wanted more than to get their political ticket punched (welcome to the club!) Obama reversed himself and urged Greece to accept the Troika’s offer.

The Unified Field Equation (misnomer) & Compensation

Begin with 0 = 0. Add components on each side. You have a stack and a dynamic heap. For the dynamic heap, turn the equal sign vertical, to see the double-sided mirror, acting as a dimensional multiplexer.

What is time? What is the difference between AC and DC? What is opposite and what is complimentary? If the square root of 4 is 2 AND -2, what is the square root of -4? Are imaginary numbers imaginary? What are prime numbers? How do you make Maglev work, for you?

If you do not know where/when the center of the universe is, how can you measure time, or anything else?

If a bunch of homosexual cardinals assemble a bible, to bankrupt marriage for the sake of State feudalism, does that make it useless? If a popular president anoints Supreme Court Justices for life, with the blessing of Senators, and the acquiescence of Representatives, does that make the US Constitution useless, or just the interpretation? Which way is backward and which is forward?

What is the current economic traction slip ratio at your position? Why would you exchange natural resources, and your time to move them, for empire money, and expect anything other than a supply-side real estate prison?

Funny, only manufactured majorities need money to get up in the morning, to play make-believe, blindly assuming that humanity, and themselves by extension, is the center of the universe.

It’s about time someone considered the possibility that Varoufakis is neither an idiot nor an incompetent.

And in case no one has noticed… It is May 21st, and Greece has not capitulated to the Troika. Still may happen, but it is looking increasingly like a write-down (the original goal), may in fact be part of the eventual outcome. May take several months to reach that point. But it is increasingly obvious that it is inevitable. Only the terms remain to be settled.

This is, and always has been, primarily a political struggle.

Given the comments about catch-22s made by Jackrabbit, this entire situation makes much more sense to me. I always suspected Varoufakis had a strategy but couldn’t figure it out until the aforementioned catch-22 scenario. Greece/Syriza CANNOT put forward a plan as it destroys their ability to get a debt write-off by making the fraudulent Troika program appear sustainable, thereby relieving the ECB/Eurozone of responsibility for an unsustainable program. The only thing they can do is nothing and dare the Euro elite to cause a Grexit or Grexident. Either way, (partial debt write-off or Grexident) the Euro elite carry the bag. While the consequences of a Grexit/Grexident are high for Greece, they are even higher for the ECB and the Euro elite and keeping in mind the bad blood the Euros have engendered in the Greeks, the schadenfreude of Grexit/Grexident makes even those negative consequences seem much more palatable. Given all the possible outcomes and the IMF’s late-in-the-game change of heart about program sustainability, holding out for a debt write-off is the best strategy Greece could possibly hope for.

I personally believe the Euro-elite is dumb enough to opt for Grexit/Grexident because the Eurozone is a pseudo-economic zone based upon and driven by political forces, not the other way around. The guiding forces behind the block are political and as such are hostage to base political calculations not economic fundamentals or necessities. Much like the former Soviet Union. Politicians, afraid of telling their public that they must write-off some Greek debt, are more than willing to make a foolish short-term political decision to exact a pound of flesh through Grexit/Grexident and protect themselves (for a few days) from backlash than to do the greater thing that might actually save the system. But it would only last a few days as the consequences of Grexit/Grexident become larger and clearer.

Yes! I think the Catch-22 and resulting game of chicken is key to understanding what is really going on.

I was critical of Syriza until this occurred to me (a few weeks ago). I’ve been mentioning it at NC from time to time ever since.

I think there are many others that can’t fathom why Syriza/Varoufakis are acting the way they are. The thinking is: Greece is a supplicant – they need the money – so why are they angering their creditors (the ones with a financial lifeline) instead of negotiating? One has to understand the trap (the Catch-22) to see why this is wrongheaded.

=

HOP back for previous comments about Greece and other things.

=

=

H O P

Well sir, I think it was a brilliant observation. So simple it is brilliant. It makes every action taken by Greece make sense. In fact, if I remember correctly, Varoufakis has at times stated as much that as conditions worsened and the negotiations continued that the creditors would ‘see the light’. Now those comments look prescient instead of hopelessly naive. By giving no “real” plan (since really there’s no such thing possible in this case), they’ve increased their riskiness to the IMF such that it isn’t possible for their continued participation in this fake bailout of Greece. The Day of Reckoning has finally been moved forward to the present, except primarily for the Euro elite. The Greeks have stealthily ended Extend and Pretend. The IMF changing its tune on debt sustainability is the first sign of this strategy working. As you and the article rightly point out, the IMF cannot let itself be put on the hook for the bailout and finally realized that was exactly what the ECB/Euro-elite would accomplish if it went along with any more fake deals. Now, the Euros are in a box. They cannot fake another extend and pretend because now a large creditor will not abide this game any longer. They cannot risk a Grexident/Grexit in this weak, very weak global economy. They either have to give substantial debt relief or own the Financial Crisis-on-steroids that they will unleash with a willful Grexit/Grexident.

The Euro group do neither have a common economic poicy nor a comparble taxation system but have been working with the political will to eventualy have one and Greece becoming the first casualty of the experiment. The political lead ership in the European union should have the courage to break up the common currency of Euro for the member states.

Rex Minor