Yves here. There is of course the nasty issue of greenhouse gasses..

By Gaurav Agnihotri, a mechanical engineer and an MBA -Marketing from ICFAI (Institute of Chartered Financial Accountants). Originally published at OilPrice

History has been so fascinated with oil and its price movements that it is indeed hard to imagine our future without oil. Over the last few months, we have witnessed how oil prices have fluctuated from a 6 year low level of $42.98 per barrel in March 2015 to the current levels of $60 per barrel. It is interesting to note that, in spite of the biggest oil cartel in the world deciding to stick to its high production levels, the oil prices have increased mainly due to falling US crude inventories and strong demand. However, the current upward rally might be short lived and there may yet be another drop in the international oil price when Iran eventually starts pumping its oil into the market at full capacity, potentially creating another supply glut. In these endless price rallies, it is important to take a holistic view of the global energy industry and question which way it is heading. Are the dynamics of global energy changing with current improvements in renewable energy sources and affordable new storage technologies? Can the oil age end in the near future? Will we ever stop feverishly analyzing the rise and fall of oil prices? Or, will oil remain irreplaceable in our life time?

Are Renewables Ready to Take Over?

With little or no pollution, renewables like solar, wind and biofuels are viewed by many as a means to curtail the rising greenhouse emissions and replace oil as a sustainable alternative. There is little doubt as to why China, US, Japan, UK and Germany, some of the world’s biggest energy gluttons have invested heavily in renewables.

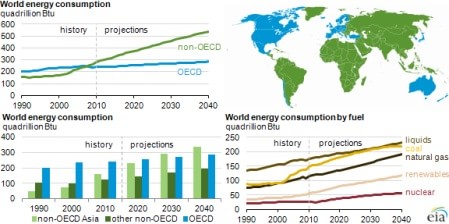

Image Source: EIA

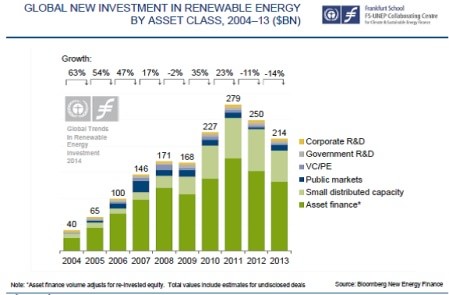

However, according to a study conducted by Frankfurt School-UNEP Collaborating Centre for Climate & Sustainable Energy Finance, the United Nations Environment Program (UNEP) and Bloomberg New Energy Finance, the total global investments in renewables fell by 14% to $214 billion in 2013. One of the major reasons of this fall was the backing out of some big oil firms such as BP, Chevron and Conoco Phillips. These companies significantly reduced their investments in renewables and decided to focus on their ‘core’ business; that is, oil and gas. As per Lysle Brinker, an oil and gas equity analyst at IHS “It’s not their (Big oil majors) strong suit to be spending a lot of money and time on renewables when they are definitely challenged in their core industry.”

However, if we take the example of the solar industry, where the cost of an average photo voltaic panel is declining at a rate of more than 10% per annum we see that, in spite of reduced global investments, renewables still hold a lot of promise. Some of the major integrated oil and gas companies such as Shell, Total and Statoil have actually been slowly and steadily increasing their renewable related investments. Shell is investing big time in biofuels, while Total, with its stake in Sunpower, is investing substantially in the solar sector while Statoil is placing its bets on wind energy. This shows that renewables are a phenomenon that many believe can give oil a run for its money.

Is Saudi Arabia Sensing anEnd of Oil Age?

“No one can set the price of oil – It is up to Allah”, this is what Saudi Arabia’s oil minister Ali Al Naimi had to say while speaking to CNBC recently. OPEC, which holds around 40 % of the world’s crude output, is showing no signs of reducing its production levels, even if Iran starts pumping more oil after sanctions are lifted should the international nuclear deal with P 5+ 1 counties prove successful. Many see this move by OPEC as a means to protect its market share and drive US shale players out of business. But is the decision of OPEC (especially Saudi Arabia) part of a much bigger game? The Saudis, who lead OPEC, would obviously be very interested in delaying ‘Peak Oil Demand’ after which global demand for oil would start declining steadily, along with Saudi oil revenues.

According to Bank of America and Merrill Lynch commodity researchers, if crude prices stay in the range of $50 – $70, peak oil demand would be pushed beyond 2030. This delay in peak oil demand would definitely hurt renewables and anyone who is investing in them. As per Alex Thursby, Chief Executive at the National Bank of Abu Dhabi, “Renewable energy technologies are far further advanced than many may believe: solar photovoltaic (PV) and on-shore wind have a track record of successful deployment, and costs have fallen dramatically in the past few years. In many parts of the world, indeed, they are now competitive with hydrocarbon energy sources. Already, more than half of the investment in new electricity generation worldwide is in renewables. Potentially, the gains to be made from focusing on energy efficiency are as great as the benefits of increasing generation. Together, these help us to reframe how we think about the prospects for energy in the region.”

Yes, OPEC has sensed the end of its glory days. And it is obvious that Saudi Arabia, with 85% of its export revenues coming from petroleum exports does not want the oil age to end anytime soon.

What Can We Expect?

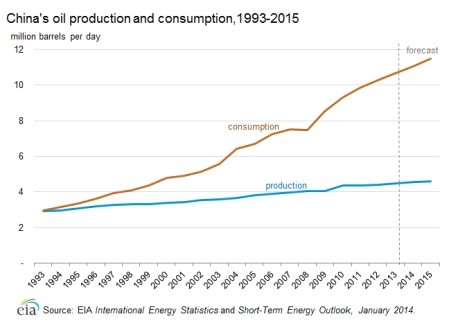

If we look at China, the second biggest global consumer of oil, we find that its oil consumption rate constitutes about one third the world’s total consumption rates and shows no signs of slowing. In fact, EIA even predicts steady growth of China’s oil production reaching 4.6 million barrels per day in 2020 and 5.6 million barrels per day in 2040.

China has also invested heavily in building its strategic petroleum reserves and plans to expand them to 500 million barrels by 2020.

Now take India, a country that is considered by many as the next solar investment hotspot. India has been investing heavily in building its own strategic petroleum reserves and its public sector undertaking, Oil and Natural Gas Corporation Limited (ONGC) is planning to invest about $62 billion on its discoveries in Krishna Godavari Basin block KG-D5.

These are two of the world’s fastest growing economies that are investing heavily in renewables but also safeguarding their oil and gas aspirations. Moreover, when we analyze past oil price trends, we find that volatility related to geopolitical equations, speculations, wars, economic sanctions and climate change have always kept the global energy markets guessing about the future. The world is still myopic when it comes to energy. Yes, it wants to embrace renewables but not at the cost of oil. Whatever happens to oil prices in the coming years, one thing is certain: that the age of oil isn’t ending anytime soon, at least not in the next 30 years.

Hopefully India decides to become the leader in developing renewable energy. It would be nice to visit my relatives in Mumbai without smog suffocating me.

The “oil age” isn’t an autonomous process insulated from its own waste products- it will self-terminate long before 2045 at this rate.

I don’t know about the time frame, but the story I get is that global warming will be a looming catastrophe well before we run out of oil and other fossil fuels.

That was to be my point. Saudis can pump all they want, China can burn pellmell, India can go heavy on oil but it will get them (and all the rest of us) to global collapse of modern civilization, plus mass (human) die-off well before oil reserves are pumped dry. It is self-limiting in a way that is VERY unfriendly to humans, their societies, and all the rest of life we’ve known our entire lives.

It is this stupidity that has brought me to the conclusion that we ARE around the last generations of humans. Climate change negotiations and treaties will NOT go far enough (the longer you put off doing the heavy lifting, the heavier the NECESSARY lifting becomes). I would be perfectly fine with this if it didn’t also mean taking out most other truly innocent bystander organisms as collateral damage.

Hence the drive towards interplanetary colonization.

LOL…yeah a drive by people with either a) no clue about physics (lift requirements to clear a gravity well, energy densities) or biology (humans evolved on and adapted to a planetary existence on THIS planet…and idiots can’t seem to grasp the implications of that…or…b) they stand to make a shitload of money and massage their already insanely overinflated egos.

Oil is essentially transportation, with industrial uses the distant second.

Peak Oil demand will therefore be a function of the technological development in this area.

Today, the alternatives are still way behind : Electric Battery powered vehicles barely achieve costs parity only with subsidies on one side, and big taxes on fossil fuels on the other (especially in Europe). As the article points out, renewable costs of energy production are starting to be competitive, and there maybe some room for improvement, but the real kicker will be from advances for mobile storage, either from batteries or a hydrogen/fuel cell complex. We may be closer to the breakthrough/breakevem than we think. When I see the state of Toyota fuel cell technology now, I don’t think it will take 20 years to mature.

Once cost parity is achieved and vehicle production switches to the chosen technology, based on vehicle fleet composition by age, my expectation is that the age of oil will end quite fast, as in one decade, with accelerating factors coming first from the will for consuming countries to free themselves from the influence of the Middle East (both from an operational standpoint and a balance of payment standpoint) and second from Global Warming concerns.

Note that I am talking about Oil here, not Fossil Fuels. Natural Gas has way to go thanks to use in power generation and hydrogen production if fuel cells become the ground transportation winning formula.

The last mission statements for the US Army which I read (a couple of years old now — so they may have changed yet again) anticipated numerous small scale wars and civil unrest occurring almost anywhere in the world. To meet this threat required the capability for rapid concurrent deployments of self-contained brigade size forces to multiple theaters anywhere in the world. I do not know what kind of threats other nations are planning for. I suspect they see similar kinds of small threats within their smaller areas of interest but again spread throughout and occurring concurrently.

Oil is transportation and transportable concentrated power — two things vital for supporting an expeditionary force. Today’s Army runs on oil. Military aircraft run on oil. I cannot foretell how future military forces might be configured or equipped but it is beyond my imagination to design a military that could run on solar or wind power. Heavy armor and military aircraft require more concentrated power than solar or wind could ever provide. Besides, the footprint and weight of solar technologies would be hard/impossible to trim down enough to make them suitable for the heavy power demands of rapid deployment and maneuver characteristic of expeditionary actions at this time.

There may be breakthroughs for civilian users but the age of oil will be with us for a long time to support military actions and “defense” — probably long after the end of the civilian age of oil. [I’m not saying this is a good thing. It is the future I see and fear.]

Well, nuclear energy is much more concentrated than oil, by a factor of a million (http://en.wikipedia.org/wiki/Energy_density), therefore the concept of nuclear submarines. An there is plenty of Uranium out there…

You are (hopefully) correct but I’d like to see some data about oil’s use in industrial and agricultural products, e.g. plastics, fertilizers, etc. It is “hopefully” because the transportation technology to get substantially off oil is available NOW. The best example is the much maligned GM Volt. To my knowledge there will not be a commercially available battery with the the energy density of gasoline for some time. But most of us most of the time don’t need more energy than can be crammed into a lithium ion traction battery right now, yesterday. The Volt’s gas powered ‘range extender’ (generator) allows it to tap that energy density if needed. If your daily commute is less than 40 miles round trip – or one way with 3 or 4 hours and a ‘Level 2’ charger at your destination – you won’t need even that, i.e. the range extender. If it is more (or more even than the 200 mile GM Bolts coming online sometime in 2017), then buy a Prius or some good hybrid.

The Volt costs more than a pure electric vehicle because of that range extender it carries around as an antidote to the range anxiety experienced by drivers used to the ability to hope in a car and drive two or three hundred miles without stopping. If that’s you, I suggest you take a look at a Volt – unless you do this on a regular basis. For a milder case of range anxiety take a look at a BMW electric with range extender.

This is NOT a troll-produced GM Volt commercial, I promise you! It was only because of my ‘moral flexibility’ I was able to forgive GM for its Hummer (and other abominations)-filled past. What the Volt (and the electric vehicle generally) IS is a threat to oil-powered automobile transportation – and perhaps to the stranglehold the oil industry and our Middle Eastern bankers have over the US political process. Petrodollars set the stage for the US Empire of Debt. Once the US power junkies realized they could get other nations to foot the bill for their military ambitions by Wall Street, its banks and Washington offering them a sink for all the money they could make selling the country the oil it needed, it was easy to extend the idea of foreign financing for US consumption to products produced for the private sector.

But the whole edifice remains anchored on Washington’s control of the world’s energy supplies. The Nobel Prize winning chemist wrote 80 years ago

Soddy, Frederick M.A., F.R.S.. Wealth, Virtual Wealth and Debt (Kindle Locations 1090-1091). Distributed Proofreaders Canada. Ronald Reagan should perhaps be remembered most for his instructions to the White House maintenance personnel to “Tear down those solar panels” (perhaps preceded by a “Yes sir!” to the country’s Wall Street mediated paymasters.)

And Obama should be remembered for the time when the kids from Unity College in Maine — where the White House solar panels had been stored — drove down with them to the White House and couldn’t even get a meeting. That was when people believed in Obama, of course, the whole “his heart is in the right place” thing; not like now.

If you only travel 40 miles round trip (I drive 30), then your current best choice is a used Leaf. The going price for a 2011 off of lease is $9,500 – 10,500 for around 30K mileage. If your utility has a night time EV rate like PG&E ($0.07/kWh), you can save money, run without gas, and have a fairly quick breakeven on your Leaf EV.

Now, all I have to do is to convince my wife to buy one. Unfortunately, that is going to be harder than stopping the Saudi’s from beheading people.

For some reason I can’t understand, very few understand the game-changing potential of the Volt concept. That is, that it takes just enough battery chemistry, something that’s not particularly environmentally friendly or neutral even, to produce, to eliminate nearly all gasoline usage. I think it balances two evils about as well as can be done at present.

I expect the article is right in that renewables won’t take the place of oil. First time I’ve seen the phrase “peak oil demand,” which he places in the future, perhaps because he knows peak oil production is in the past.

Being a Kentuckian I feel obligated to share:

http://www.maced.org/coal/exe-summary.htm

If you don’t go to the link I will summarize. Coal is a net cost to the state of Kentucky, and for those who think it is because of big government check their research. It is simply too costly to extract and utilize as a resource. In addition, the numbers are within the paradigm of the mostly BS economic quantifying I am always ranting about on this site (i.e. no true environmental cost, etc.). So consider that coal is more plentiful (still) then oil and quickly one will realize our problem. Fossil fuels are miracle energy sources that are disrespected as such, and they are no longer “cheap”. Again, even using incomplete value models, they are becoming too expensive. The only reason oil is maintaining its economically reasonable sliding scale from $50 to $150 is because of its necessity in global trade and military operations, we’ll never let it get too high or too low until there is none left to get feasibly. It is a fully politicized commodity. I’m hoping we have enough of the stuff left to subsidize our transition to renewables, otherwise we are SOL.

Very interesting article indeed. It seems that the UE, despite popular opposition, will some day try to exploit fracking or at least the authorities look interested on it. This indicates that they foresee higher oil prices.

I’d say it is more, at least for Spain, as in “they are still reading the recycled business plans that motivated shale oil boom in the US 5-10 years ago.” With QE aka cheap money and in-laws to use as figureheads, the caste politicians in parts of Europe are trying to get their bribe. Like we all know, if you can get others (public regional banks, EU funds) fund you, and illegally extract 0.1% of the global investment plan to your accounts in Switzerland before the work even starts, no business plan is bad if it contains enough zeros at the bottom. This is the story of the Euro in the South of Europe, and I’d bet also in the East.

I’m a little sceptical about this claim for a number of reasons.

1. For oil to keep expanding, it needs massive capital investment. The recent crash in prices has wiped out billions in oil investments – I suspect that this will make the markets vary wary about funding continued exploration.

2. It is clear that oil companies are in something of a cleft stick – if the price goes up to much, it destroys demand, if it stays too low, most unconventional oil or deep off-shore is not economically viable. I’m not sure if they know how to get around this problem. We have already seen Shell focus on LNG – which seems an implicit acceptance that they need to accept a smaller role, instead focusing on profit rather than growth.

3. There is a significant possibility of breakthroughs in other forms of liquid energy that might undermine overall demand – making only cheap to extract Middle Eastern oil viable.

Obviously, there are solid reason why there is likely to be strong demand for oil for several decades, not least because of legacy infrastructure and the absence of alternatives for liquid fuels. But I do feel that if oil is seen as a high risk investment (which seems to be the case now), there could well be quite a rapid retreat from new oil fields, and a focus on maximising profits from existing fields – this may well greatly increase the political and economic need for alternatives.

The current situation is an odd historical byproduct of Peak Conventional Oil, ZIRP, and the global recession following the financial crash of 2008. Rising prices and cresting production led to the introduction of 25 year old technology to exploit tight oil plays, and the flood of cheap money that followed the crash allowed speculators to go all-in on fracking (and to a lesser extent, tar sands). Weak demand and soaring outputs of unconventional oil led to the current price collapse (although that seems to be receding rapidly, at least at the pumps around here).

For various reasons, governments and media wish to keep this history muddy. Partially, I don’t think they are thinking very clearly on these matters, and seem to react to any given condition as if it were a permanent reality (their mental time horizons are incredibly short). They themselves also want, and want their voters to believe, that what James Kunstler calls “the age of Walmart and Happy Motoring” will go on forever. The fact that 20 years from now getting from here to there is likely to be a very costly, and if the infrastructure continues to deteriorate dangerous, undertaking is not something almost anyone wants to think about. But I think the evidence is that is the way it is going to be.

There is little doubt as to why China, US, Japan, UK and Germany, some of the world’s biggest energy gluttons have invested heavily in renewables.

1 Iceland

2 Qatar

3 Trinidad and Tobago

4 Kuwait

5 Brunei

6 Luxembourg

7 United Arab Emirates

8 Canada

9 United States

10 Finland

China, Japan, UK and Germany are not on the list, as it refers to per capita consumption, and not absolute consumption.

Every person that makes a conscious decision to shrink their energy consumption, frees up oil that is consumed by the gluttons as cheaply and profligately as possible. So, the more renewable energy available, the longer the oil age lasts.

“Peak oil demand” feels like a new meme that we’ve just started seeing in the past couple weeks. Every time I hear it it’s in reference to when we will “choose” to get off of oil because we realize the consequences are unacceptable and we have had enough time to develop alternatives. The goal seems to be for commentators to convince the public (and themselves!) that we are in control of oil and not the other way around. The author assumes that demand will always be able to find more supply, but we know that many of the sources we’re counting on for supply to grow continuously as it has in the past require much higher prices than the economy can afford to pay on a sustained basis. Obviously the data on the debate between oversupply/weak demand takes years to resolve itself, and time will prove who called it correctly. James Levy above me is on the money, as far as I’m concerned.

It’s also time to start shifting the conversation away from renewables “replacing” fossil fuels. They are vastly different technological suites capable of accomplishing completely different things. We should ask ourselves why we’re so busy praising Elon Musk as a visionary when he’s selling us an impossible future where everyone still drives a car, everyone’s house uses the same amount of energy, and we’re still able to extract the huge amount of resources we need to build all this flashy stuff.

Finally, re: charles 2’s comment, I’d say it’s not especially useful to separate transportation and industrial uses, given that the way the geographic dispersal of production has played out absolutely requires a robust, cheap, smooth-functioning transportation system.

Nik said:

Spot on, Nik. It’s long past time to have a clear-headed discussion of what exactly we mean when we talk about “renewables” and their ability to “replace” fossil fuels. Wind & solar collecting devices are no more than fossil-fuel extenders, as their manufacture and installation depends 100% upon a fossil-fuel powered industrial system. Bio-based fuels are a red herring, as there is no more a possibility of replacing a meaningful portion of our liquid fuels with plant-derived hydrocarbons as with unicorn farts—unless, of course, the elites succeed in commandeering the entire planet’s photosynthetic productivity to fuel their Gulfstreams and Mercedes.

Another so-called renewable source, hydroelectric dams, is a short-term non-solution with horrendous environmental and human cost. China is praised for its use of “renewable” hydroelectricity—yet much if it is generated by mega-dams on the great Asian rivers originating on the Tibetan Plateau (with many more planned) threatening the very lifeblood of hundreds of millions living along the Mekong and the Brahmaputra rivers.

Whenever I hear someone talk about renewables “replacing” fossil fuels, I know that there’s a whole lot of wishful thinking happening. Renewables boosters offer this promise of plug-and-play “renewable” sources of energy that will allow the developed world to continue its profligate use of energy, sans guilt, sans sacrifice of any kind. Tesla is indeed the poster child for this techno-fantasy.

Here’s a factory making “renewable” PV cells:

Suntech Power: How Suntech Photovoltaic Cells and Modules are Made

A dose of reality:

Some 30 years ago, I lead a revolt in engineering school because we wanted to learn about renewable energy because all the school (and Bechtel) wanted to teach was nuclear energy. They were right, solar, wind, biomass, geothermal and other renewables weren’t ready then. Today, they are ready and are getting cheaper every day. Currently, California has a 33% renewable requirement for 2020. That amount is under contract and will be in service by 2020. The Governor has proposed 50% by 2030, and that will be met (even the CAISO says it’s possible). Hawaii has just passed a 100% renewable requirement for electricity by 2035?.

Anyone who says the US, and world, can’t replace oil (and over time natural gas) has been absorbing too much Koch propaganda! Our municipal utility has over 65% renewable resources and is 100% GHG free if large hydro is counted. The rates are in the middle of what it costs for electricity in California. We are not the exception; we are the leaders. Our next purchase will be a solar generator. battery storage, or a biogas plant that would use biogas from many of the dairies and feedlots of the CA central valley. It has been estimated that if all the biogas/biomass in CA could be captured, it could supply about 16% of CA’s total energy!

Austin Energy has contracted 250MW of solar at $0.05/kWh! These prices take advantage of the ITC, but construction costs are still dropping. The average utility scale solar project is around $0.06/kWh, which is not much more than coal and natural gas. The lowest cost for electricity is no longer coal, but wind, solar, and natural gas. As coal has to pay for more externalities, it becomes even less cost effective. Trade journals are saying that coal to China is dropping because they are installing more wind, solar, and hydro. When visiting the caves north of Beijing where Chairman Mao camped, you can see the wind turbines in the distance.

EV’s, battery storage (sure Musk has a lot of propaganda on his batteries), solar, wind, biogas, and geothermal are not pipe dreams, they will displace the barbarian middle east royal families and their oil. As the next generation of EV’s comes into play with 200 mile range, they will begin to displace the IC vehicles. Initially that won’t be a problem because the electric grid has too much electricity at night and there won’t be a major disruption. Betting on Fiat/Chyrsler has almost always been a major mistake, but Sergio Marcconi seems to understand the changes taking place in the auto industry and the move to EVs.

To put concrete numbers on distributed energy (which will become two-way energy with utilities), at current prices of residential solar the electricity is $0.16/kWh fixed for 25 years. At current prices this is more than many places but certainly less than will be charged 25 years from now. For 800 miles a month, the average EV costs $44/month for 25 years. Using Musk’s battery prices, there will be another $0.05-0.10/kWh which effects the payback in the short term. If you think this is pie in the sky, compare an Apple II w/16K memory running Visicalc thirty years ago to the cheapest computers of today. There is NO doubt that we are at the beginning of the renewable energy curve and that doesn’t even account for the work the Koreans and Chinese are putting into making Thorium reactors a viable and safe energy source!

Don’t buy the Koch propaganda! Renewables are not wishful thinking and techno-fantasy but are beginning to replace fossil fuels!! There are many of us that can provide concrete examples of this transition, not cute quotes about reality.

“Many see this move by OPEC as a means to protect its market share and drive US shale players out of business”

I don’t see how this helps keep OPEC market share. Oil is bought by the price and transportation costs. The price is set worldwide. So OPEC pumping a lot of oil now is not going to keep “market share” in a year. It is what they are doing in a year that is going to keep their market share at that point.

As to the second part, there are investors lined up to by bankrupt shale plays for pennies on the dollar. What is their cost of production going to be?

In the past, OPEC has cut production in order to lower supply and goose up the price. This is what everyone expected to happen when prices started dropping last year. If they had cut production they would have lost market share, but by maintaining and even raising production, they ensure that they’re keeping the same portion of global consumption.

Monthly CO2 Levels Above 400ppm

Human extinction will likely occur in the 2020s.

Humans are a remarkable species, often not in a good way. We are collectively unable to confront trends which would obligate us to do things which are unpleasant or inconvenient. There is ample evidence that we are approaching multiple crises of overpopulation, resource depletion, waste disposal, and other consequences of all of the above (like climate change), and we are not able to even have a conversation about these approaching crises, much less propose and carry out some mitigation plans. The only thing one is allowed to do is to propose fairly tale, happy ending stories which permit us to carry on and do nothing. And don’t think that having a conversation on NC means anything. In places where decisions and policy are made, this conversation is not tolerated. You would think that self preservation would be a strong instinctual drive, apparently it isn’t.

It is amazing, and not in a good way. Someone recently posited to me that we proles don’t need to “bother” ourselves trying to figure out what the Plutocrats/Oligarchs/whatever are thinking about when determining the policies they follow. Perhaps, but it is rather gobsmacking that they .001% & various corporations can be so ignorant about the coming storm.

One reads about certain Oligarchs owning their own private islands with heavily fortified compounds on them and with the likelihood of giant storage of foods, water, medications, etc. I have photos of some of these places. My pea brain boggles at the notion that the super rich are so deluded as to believe it would be “great” to be the last man standing… and doing what? Employing snipers and/or drones to kill the serfs who attempt to “invade” their piece of paradise? And how long can that last anyway?

Fully nuts. My friend is right: senseless to try to “understand.” Magical thinking, really.

We need to get the CO2 out of the atmosphere. And the oceans. Where is the science on this?

Very cautiously trying to tell the truth while not getting smacked down as “alarmist” or “socialist” or some other horseshit by the FOX News’s of this world.

Most honest scientists are trained, and internalize, the ideal that you put your finding out there into the world and if your crap is found to be any good, it will be praised and rewarded. In some nooks and crannies, this may have worked in the past. When Marshak, Gell-Mann and Feynman were putting out papers on the Weak Force in the later 1950s no one in any position of wealth or power new or cared what they were doing. The work could stand on its own and be accepted or rejected as other scientists looked at the equations and the data and drew their own conclusions. This obscure example is the template for How Science is Supposed to Work.

But that kind of science is useless in a modern political economy where money “talks” [hell, it has free speech rights!] and PR and advertising are the templates. Accurate information about climate change has about as much chance of thriving as geocentric theory did in 17th century Italy. Too much power is aligned against it right now, and we don’t see a serious split in the Power Elite over what is to be done. Yes, a serious faction could develop that sees this in terms of survival (you’d think they’d be worried about their kids and their legacy, but so far no such luck). But we don’t see it yet, and time is likely running out.

Don’t forget – once research becomes proprietary (commercially or as a national asset) it ceases to be science – which relies at base on a free and frank discussion between knowledgeable parties in order to verify methods and results….

…it’s well understood.

Unfortunately, the currently available options are not attractive to ‘civilized’ populations, who value HVAC, automobiles, tech gadgets and mass media over a mote traditional lifestyle.

Google ended its RE<C Program to study the efficacy of replacing fossil fuels with renewable energy sources because they concluded it would be impossible. http://www.theregister.co.uk/2014/11/21/renewable_energy_simply_wont_work_google_renewables_engineers/ Mining materials, and building & transporting solar panels and wind generators takes massive amounts of minerals and fossil energy.

Now Shell has been given approval to drill in the Artic, and Russia is also exploring and planning to extract oil there. Human civilization is on an unstoppable path to extinction. This will probably unfold within the next few decades, based on the documented and anecdotal evidence. The high standard of living many of us have enjoyed will be sustained through continued consumption and waste until resource scarcity and climate change take it away through all manner of calamity.

We use 30+ billion barrels of oil a year. At that rate, we (theoretically) have 50 years of conventional oil left that might be both energetically positive and economically profitable to extract. With fracking, we might extend that for a while, but fracked oil becomes cost prohibitive and energetically pointless rather quickly. There’s almost as much energy in natural gas, however as we replace expensive oil with relatively cheap gas, we start using that up much, much faster.

Bottom line? There’s no viable scenario where the majority of our transportation energy comes from hydrocarbons by the end of the century. If costs go up due to oil price feedback, or geopolitical problems like an extended ground war occur, this timeframe could shorten quite a bit.

It’s not the end of human civilization. It’s the end of industrial civilization at it’s current scale. There will be no more globe spanning, “just-in-time” supply chains of any note.

And many people will die. Mostly from starvation and cold. We’ll see a population bottleneck like any other species that uses all available resources. In the year 2115, expect to see less than a billion people on Earth. If someone decides to throw nukes around, it could be a tenth of that, or less, easily.

Cheers!

Well said, Mr. Man.

And many people will die. Mostly from starvation and cold. We’ll see a population bottleneck like any other species that uses all available resources. In the year 2115

I’m pretty confident I wont be seeing anyone in 2115 :o/

I submit Gail Tveberg’s last week post. It’s a true all-encompassing gem.

http://ourfiniteworld.com/2015/05/06/why-we-have-an-oversupply-of-almost-everything-oil-labor-capital-etc/

I spent several hours today reading/skimming Gail Tveberg’s posts and the long chains of comments and her responses associated with each. As to “renewables” she was very sceptical of their ability to fill in for oil. Both solar electric power and wind power — as applied in big commercial installations — rely heavily on the availability of oil and a complex network of high technology inputs. Solar cells don’t last forever and if they’re tied to the grid they come with a complex electric setup with an estimated lifetime of 9 years. Wind Turbines take a constant supply of high tech parts and repairs. Neither technology in its present forms is renewable in any meaningful sense.

In a post from last month “Overview of Our Energy Modelling Problem” she raised a lot of fitting criticisms of the models used for modelling energy based on oil and other sources. Very briefly —

The models economists build assume “If there is not enough of a resource the system will adapt.” The models work neither as explanations of what happens nor as tools for prediction.

Hubbert’s peak oil model “Didn’t adequately consider new techniques: effect of higher prices.” Hubbert doesn’t consider the impacts of factors other than the quantity of oil in a discovered reservoir and the pattern of production increase and decline characteristic of production for similar reservoirs in the past.

The “Limits to Growth” model adds more of the inputs and outputs that affect growth but contains the “same bias as peak oil analyses” assuming “no ‘above ground’ problems to interfere with extraction.”

Prof. Charles Hall’s — Energy Return on Energy Invested (EROEI) model based on ideas from ecology: the “… energy output of fish cannot be greater than energy input” but while the model works well for fish it oversimplifies leaving out factors important for modelling oil production. Industrial production processes are affected by more than a simple balance following the conservation of energy principle.

This lead to Gail Tveberg’s modelling explored in her other posts. I couldn’t quite follow her arguments which seemed to suggest a strong relationship between energy consumption and growth coupled with considerations of a spectrum of increasingly difficult and expensive to exploit oil resources developed by a market where costs. finance, profits and other limiting factors tied to the many inputs to oil resource development have an affect. I was left with an impression that she posited some kind of nonlinear Leontief model, though I’m not clear what all the inputs are nor how they couple in her model. I need to do a lot more study. I also left with an uncomfortable sense that something didn’t feel quite right about her model such as I could grasp it. The ties between energy, growth, government resources, debt, and the underlying value of money residing in energy.

Elsewhere in her posts and comment responses Gail Tveberg speculated that other limiting factors besides peak oil or climate change will trigger a systemic collapse. She feared this collapse would occur much more rapidly than anticipated by any of the models she reviewed in her modelling post. Her prediction of some other limiting factor triggering a rapid collapse possesses a very uncomfortable feeling of Truth. Too much of our industrial world depends on the interplay of huge numbers of inputs coming from sole sources scattered throughout the world and backstopped by extremely narrow inventories at their destinations — to support just-in-time production. The giant transformers in our electric grid make a good example of this risk. With a system as complex and fragile as our industrial economy has devolved to, a random monkey wrench could trigger a chain of unpredictable events … “for want of a nail ….”

So much hangs from slender threads.

Later this summer I will have finished translating a video of a French engineer’s exposé to a governmental panel on climate change and sustainability. Truth be told he barely addresses climate change at all, though he certainly considers it a priority. I currently have 20 min of video editing done of a total length of roughly 1h40min. It is very tedious work, but when I’m done, you will understand. You will only notice perhaps one difference of opinion, between Jancovici and Tveberg (on the issue of price); but on the whole…adding the engineering\physics aspect of our energy predicament will probably give you the best of understanding…

I expect to finish sometime in July…and I promise not to waste anyone’s time…

“Will renewable be ready.”

This is actually the wrong question to be asking. It comes from the old way of thinking where we assume we are in total command of the situation. We want to start with are current situation and just jump over to renewable without making any changes, like swapping old batteries for new in your I-pad.

It’s not just the scale but the nature of the dependents on hydrocarbons that needs to be looked at here.

From a certain point of view it’s a given that renewable will not be up to the task, or ever be up to the task of meeting the demands of the old energy system. Even from an ideal transition.

First, renewable systems comes with a degree of uncertainty markets are not use too. When they want power, they want it on demand and made to order, 24/7/360, right here, and right now. For wind farms for example, you have high wind days and low wind days. With high wind, you have plenty of power for all of your needs. On these days you can role up your sleeves and get to work, get that assembly line running at a 100 percent. On low wind days you need to start conserving, or even rationing with more extreme conditions. Instead of working, you take it easy, go fishing or spend more time with the family.

But also we need to face facts that we simply do not have enough deployed or under development. At some point the question changes from “will it be ready” to “this is what we have to work with.”

Some areas will have prepared better than others. Those who decided to double down will likely be faced with worse case scenarios – a true economic collapse, and not a fiscal collapse that we have been dealing with lately.

The great depression and recession are fiscal collapses. However and economic collapse involves an acute shortage of resources. When you run out of water – you have an economic collapse. This is no longer about losing one’s retirement savings – this becomes a mater of dying of thirst.

For all of human history, the population was set by the amount of resources that could be processed through human labor. Economic activities at the end of the day required calories, and human activity can only harvest and process so many calories in a year. Growth can only take place if you can harvest more calories than you consume, and contraction needs to take place in the event of the reverse.

The oil miracle allowed us to replace human labor with machines, exponentially expanding our consumption envelope. Activity and population could grow exponentially, seemingly without limit. Once oil ends however, we go right back to the old physics. And this means a massive human die-off will be the result of this economic collapse.

Through war or starvation, the human population will contract rapidly, until the population shrinks far enough to fit back in the old manual labor pyridine, or until you reach the new calorie envelope provided by the renewable systems you manage to have in place.

The question is not if its going to be ready – but rather how big the cram down will be when the moment comes.

In one more of a series of skewed information from a site devoted to the price of oil we learn, not that solar and other green energies are not ready to take over so much as oil is not ready to give up drilling, expanding economies are not ready to stop stock piling reserves, and try to not notice with each electric vehicle and increase in efficiency, oil demand is being permanently destroyed. It is not only the future that no longer belongs to oil, but more importantly the present.

The entire exercise in Saudi price manipulation is directly tied to putting the day that peak demand for oil occurs far into the future. The price for arctic oil is $150/brl, the price to frack is at least$65/brl, offshore oil?? a lot more than $60. The floor price to make any hard to get, tight oil, is well above where the volatile prices of today reside. The Saudis seek a price too cheap for a galloping solar competition to make even a small dent in their sales while not supporting tight oil flooding the market. Oil needs to be priced low enough for mass market consumption, which the Saudis have more than enough to supply, to be affordable to maintain steady demand growth. Too high a price brings out the risk takers who flood the market. This is an incidental consequence. It is not the competition that brings on too much supply that hurts the Saudis, it is the consequence of too high of a price that makes alternatives much more affordable, to more and more of the mass market.

And once the oil demand is displaced by electricity, oil will never get those customers back. Oil lost to electricity when it came to lighting, and it will finally be wiped off the face of the earth destined to reside underground where it belongs.

The Saudis don’t fear the Bakken or Permian Basin, they fear Tesla and 1366 solar panels. 1366 watts of solar energy reaches each square meter of the earth’s surface each day. It’s there for the taking.

Either I’m missing something, or this is ridiculously wrong. The chart shows China consumption around 11-12 million barrels per day. World production is around 85-90 mbpd. What gives?

Hey Yves

I think the author here is wrong, he pays lip service to the rapid disruption happening in energy markets.

The cost of renewable solar is now for leading edge projects 5.8 cents/KWH, that is a death sentence to

fossil electricity.

Electric vehicles are only about 5 years away from becoming the preferred product.

3rd world countries are now investing into renewables.

The saudi’s recognize this and are trying to wipe out higher cost producers and generate as much cash as they can now.