By Hiroshi Yoshikawa, Faculty fellow and senior research advisor, RIETI; professor at the Faculty of Economics, University of Tokyo; and member, Council on Economic and Fiscal Policy, Cabinet Office, Japan, Hideaki Aoyama, Professor at the Graduate School of Science, Kyoto University. Yoshi Fujiwara, Professor at the Graduate School of Simulation Studies, University of Hyogo, and Hiroshi Iyetomi, Professor of mathematics, Niigata University. Originally published at VoxEU.

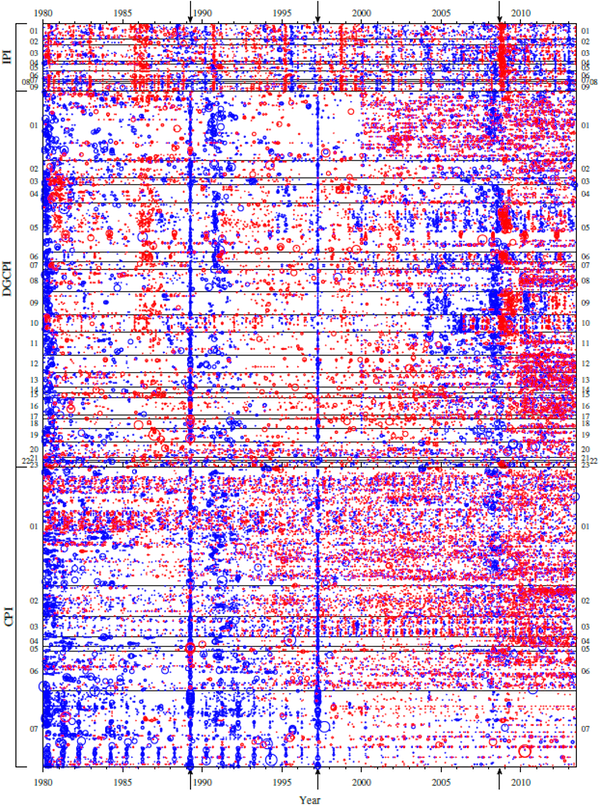

Recent empirical works on micro price dynamics hitherto have uncovered the little known dynamics of micro prices (see Klenow and Malin 2011). A new study of individual prices of goods and services for Japan from January 1980 to June 2013 (Yoshikawa et al. 2015) shows that the frequency of individual price changes and synchronisation are not constant but instead are time-varying (Figure 1), while the existing literature routinely assumes otherwise. Moreover, they change in clusters, not simultaneously in the economy as a whole. In this respect, there is a significant gap between observed facts and theory because, in standard theory, changes in money, supposedly the most important macro disturbance, more or less uniformly affect all prices (Klenow and Malin 2011). Examination of the autocorrelations of individual prices (Figure 2) reveals the importance of interdependence of individual prices with leads and lags. We analysed such lead/lag dynamics of individual prices to find out what are the major macroeconomic variables leading to systemic changes in aggregate prices.

Figure 1. Normalised monthly price changes of 75 Imported Price Index, 420 Domestic Corporate Goods Price Index and 335 Consumer Price Index.

Blue and red colors correspond to changes above certain thresholds, while smaller changes are left as blank. Two months denoted by the left two arrows on the abscissa – the distance from a point to the y-axis, measured parallel to the x-axis – show the months of introduction and the raising of the consumption tax rate (April of 1989 and 1997 respectively), and the third arrow shows the subprime mortgage crisis (September 2008).

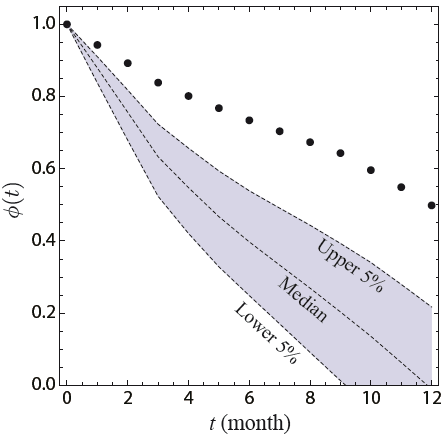

Figure 2. Demonstration of the statistical significance for interdependency of individual prices.

The sum of all of the autocorrelations of individual prices (dots) is compared with the colored region of the null hypothesis, obtained by randomly rotating them independently in the time direction such that any interdependency is destroyed.

Signals and ‘Core Consumer Price Index’

In looking at any data, economic or otherwise, it is fairly important to identify what is at their core. Take ‘air’ – noises or ‘random’ fluctuations come from thermal individual motions of molecules, while sounds are collective motions of interacting molecules. If we are to find meaningful signals in the motion of air, we need to identify the latter.

‘Core Consumer Price Index’ pushed forward by central banks aims for this, but only with heuristic arguments. A scientific way to identify signals, called the Complex Hilbert Principal Component Analysis and the Rotational Random Simulations were invented — the latter by us — and applied successfully to physics, meteorology, economics (Vodenska et al. 2014) and other areas. Applied to prices, we find that only 26 modes of collective motion among 830 modes are significant signals, which should constitute the new ‘true core Consumer Price Index’.

Macroeconomy and the ‘True Core Consumer Price Index’

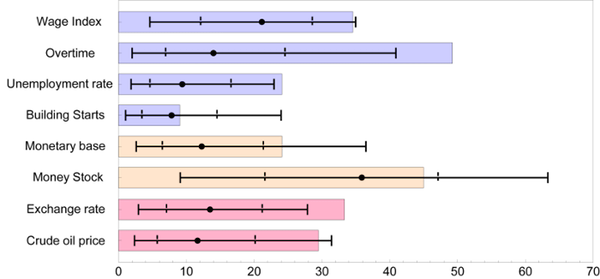

Systemic co-movements of micro prices are conditioned strongly by the state of the macroeconomy. Then, which aspects of the macroeconomy are crucial for the price changes? Figure 3 shows the relevant result for the first (most important) comovement mode, showing that only “Overtime” and “Exchange rate (yen/US$)” have a significant correlation with prices, followed by “Wage Index,” “Unemployment rate,” and “Crude oil price,” but never with “Monetary base” or “Money Stock”.

Figure 3. The absolute values of the correlation coefficients (colored bars) between the first eigenmode and macro variables, compared with their RRS ranges (dots for average and black dashed vertical lines for the 1-sigma ranges and the solid lines for the 2-sigma range). The latter is obtained by randomly and independently rotating data in time-direction.

The second important factor (eigenmode) generating the systemic fluctuations of individual prices is significantly correlated with the exchange rate and crude oil price. In an open economy such as that of Japan, changes in the exchange rate and oil price affect the import prices without lags, and, in turn, modify the costs of energy and materials used in the production of a wide range of goods and services. With lags, many prices follow suit. The case study of the post-Plaza Accord period when the yen sharply appreciated from 240 per US dollar to 120 amply demonstrates the presence of this mechanism.

The results for all of the other 24 statistically significant modes are similar: changes in the aggregate price index, namely, deflation or inflation, consistent with systemic fluctuations of micro prices, are not directly linked to changes in money supply such as M2 and base money.

The reason is that, except for when it is at the irregular zero interest rate bound, monetary policy is interest rate policy ubiquitously that makes the money supply endogenous, or even passive as Black (1986, p. 539) observes.

The result is consistent with the old Phillips curve, which states that in booms, both quantities and prices change upward while the converse holds true in recessions. Note that the Phillips curve is not a mere correlation between price and quantity. It is not the case that quantities change because prices do not change. Rather, prices change responding positively to changes in quantities. Causality runs from the level of real output to changes in prices. The Phillips curve, a macro equation, emerges from aggregation of heterogeneous markets (Lipsey 1960, Tobin 1972, Okun 1981). The bottom line is that the aggregate price index rises when the average level of real economic activity as represented by overtime hours worked or the unemployment rate goes up.

Conclusion

Deflation and inflation are macroeconomic phenomena. However, we cannot fully understand them by only exploring macro data because the behavior of aggregate prices such as the Consumer Price Index depends crucially on the interactions of micro prices. On the other hand, all in all, the results we obtained have confirmed that aggregate prices significantly change, either upward or downward, as the level of real output changes. The correlation between aggregate prices and money, on the other hand, is not significant. The major factors affecting aggregate prices other than the level of real economic activity are the exchange rate and the prices of raw materials represented by the price of oil. Japan suffered from deflation for more than a decade beginning at the end of the last century. More recently, Europe faces a threat of deflation. Our analysis suggests that it is difficult to combat deflation only by expanding the money supply.

References

Black, F (1986), “Noise”, The Journal of Finance 41 (3), 529-543.

Klenow, P J and Malin, B A (2011), “Microeconomic Evidence on Price-Setting” in Friedman, B H and Woodford, M (eds.) Handbook of Monetary Economics vol 3A, chapter 6, North-Holland.

Lipsey, R G, (1960), “The Relation between Unemployment and the Rate of Change of Money Wage Rates in the United Kingdom, 1862-1957: A Further Analysis”, Economica: 1-31.

Okun, A M, (1981), Prices and Quantities: A Macroeconomic Analysis, Brookings Institution Press, Phillips, Peter CB and Pierre.

Tobin, J (1972), “Inflation and Unemployment”, American Economic Review 62 (1): 1-18.

Yoshikawa, H, H Aoyama, H Iyetomi, and Y Fujiwara (2015), “Deflation/Inflation Dynamics: Analysis based on micro prices”, RIETI Discussion Paper 15-E-026, available at SSRN http://ssrn.com/abstract=2565599.

Vodenska, I, H Aoyama, Y Fujiwara, H Iyetomi, Y Arai and H E Stanley (2014), “Interdependencies and Causalities in Coupled Financial Networks”, available at http://ssrn.com/abstract=2477242.

“…there is a significant gap between observed facts and theory because, in standard theory, changes in money, supposedly the most important macro disturbance, more or less uniformly affect all prices…”

Seriously, this is what ‘the standard theory’ posits? And serious people believe this silliness? Despite the fact that wholesale counterexamples pervade the global economy? Consider the past 7 years, in which the world’s central banks have tried to counteract the contractionary effects of the GFC via an unprecedented flood – or because the authors of the present piece are Japanese, perhaps ‘tsunami’ is more apt – of liquidity, funneled predominantly to the TBTF banks. Have ‘all prices’ responded similarly to the flood of money? Not even close. Because there is still a large overhang of private debt remaining from the massive credit bubble which culminated in the 2008 GFC, consumers are (on the whole) unwilling to once again leverage up with abandon, especially because the job market has never recovered, bogus rosy government unemployment stats notwithstanding. So most of the money has been turned to speculative ends, bidding up the prices of risk assets and reigniting multiple sectorial bubbles – in equities (largely via cheap-money-fueled corporate stock buybacks), junk bonds, dotcom bubble 2.0, housing bubble II, subprime car and student loan bubbles, and the now-busting EM bubbles. At the same time, wages have remained stagnant, in fact for the bottom 90% they have dropped. So the whole ‘rising tide lifts all boats’ theory is patently absurd, but this is somehow ‘non-obvious’ to the econ. PhDs.

LOL, “Complex Hilbert Principal Component Analysis and the Rotational Random Simulations” — that sounds like someone is trying *really* hard to make their flummery sound like actual science. Well, ya know what? I know actual science. Actual science is a friend of mine. And you, sirs, are not practicing actual science. And the late David Hilbert would be spinning in his grave if he knew what kind of pseudoscientific claptrap you lot were slapping his name on in a desperate attempt to make it sound rigorous.

Lastly, regarding deflation —

I’m still waiting for one of these macro wonks to provide a coherent rationale for the ‘deflation bogeyman’ myopia, in which all the focus is on the deflation which necessarily accompanies the bust phase of the boom/bust bubbles the central bankers so love to stoke, while strenuously denying the existence of said bubbles during the manic inflationary stage, and in unison crying ‘who could have foreseen it?’ when the inevitable bust arrives.

If deflationary busts are so evil, perhaps y’all should stop blowing the bloody bubbles that culminate in them, no?

That’s right. I already had a jaundiced view of economics before I read Debunking Economics. And after the entire field seemed like nothing some much as a random mish-mash of disproved fallacies that academic elites used to credentialize whatever inhumane policies made rich people richer. Yes, Steve Keen has his own ideas about making economics empirical, and he has mentioned in interviews I’ve seen of him that he is perfectly aware of the resource and ecological predicament we’re in–but I still think he is somewhat optimistic about his belief in the salvagibility of economics.

Anyway on to my idea about economics: I’m now utterly convinced that money should be completely and irrevocably disassociated with the provision of basic living needs. A fiat should be issued henceforth that every local community is responsible for sustaining the life of the local residents, with local resources, using, at most, a local currency regime. National and international currencies should be strictly the domain of luxury goods and tribute. I’m not suggesting that because it’s “practical” but because such a regime is a sure-fire way to avoid wiping ourselves out.

I am intrigued by your ideas about local economies but they raise serious questions. I can’t see how you could pull it off without invoking a variant of the Elizabethan Poor Laws that tied everyone to their parish. I also am not sure how you could provide for everyone’s needs from local resources without instituting some form of command economy (and I include in my definition of a command economy regimes like feudal manorialism and southern plantations). Depending on population density and local resource availability, standards of living may prove grossly uneven and in many places coercion mandatory to meet the needs of subsistence in every given area. This would tend to create a flight to the best regions from the worst, which would cause the same sorts of problems on a national/regional basis we see in the European immigration crisis right now. Not a pretty picture. So the devil in all localization schemes is in the details. I don’t know if you could make it work without killing off a lot of people and abandoning civil and political rights people have espoused and fought for since the Enlightenment.

And the current Freedom(tm) and Trade via money and Finance (sic) are really working so very well, right?

Seems to me kind of like the likely drift toward Ragnarok and anomie, actually more of a plunge.

Humans love disaster stories with Promethian and Heraclean survivors and nick-in-time deus ex machina bits. Not the slow, mostly boring, construction of geodesic meta-stability based on only populating areas where that other boring stuff like gardening and conservation, rather than indulgence-serving looting. And dealing with socio- and psychopathologies like the ineffable urge to hierarchy and violence and accumulation and ornamentation and stuff. “Eat it up, wear it out, make it do, do without” does not appeal as a motto to Dimon or Schauble or Geithner or even Netanyahu, certainly not the handicap gaggle of Presidential Hopefuls except maybe Bernie or to the rest of us Consumers(tm)…

One could try to plan out and effectuate behaviors and incentives that looked to life rather than death, whether it’s dealing with global default or climate demolition derby. But hey, the outcomes “we” produce, that only stuff the already stuffed ever further, people who like malignant tumors have immunized themselves against correction and consequence and are happy to die in impunity along with the host, tell “us” what’s most likely. The horror for the few with consciousness and conscience is seeing the apparent inevitability despite the best they can do to slow, let alone stop, the collapse.

We are hundreds of years away from finding a sustainable economic solution.

The model needed is more complex than the brain and we are still in the early innings when it comes to understanding the brain.

In the western world we have gotten this far because of power and an abundance of resources. It’s the overabundance of resources that have permitted a semblance of fairness. An overabundance such that it masked all our gross inefficiencies.

Take away this abundance and our social constructs will dearly suffer. And dealing with 300M opinions will surely make it lively.

So its nice to value science in order to make it progress but anyone who thinks science will get us out of this system mess on a global scale is deluded.

We are flying by the seat of our pants and the squeaky wheel will get the grease.

We will be able to fix some systems but to the detriment of others because there is no way we can see the big picture. The law of unintended consequences will prevail.

That’s why we must be more supportive of those around us. We are now bathing in a world where the right choices have never been so opaque, yet many of us still think we are in control and should blame eachother for our failures.

Looking on the bright side, we’re about 10-20 years from making serious moves towards a sustainable economy. Though admittedly that’s because we’re getting towards the end of exploiting non-renewable resources and those who don’t make the switch to a sustainable model will enjoy a swift die-off.

These kinds of problems tend to solve themselves, with or without human cooperation. Though acknowledging reality and engaging in a bit of thoughtful preplanning could mitigating the most horrific impacts. Not that many people are interested in that yet.

Looking on the grim side, climate change, with the associated effects of environmental degradation, rising sea levels, rising temperatures, resource wars, etc is going to make any long-term economic planning totally irrelevant. https://youtu.be/cuiTPRyrzVI

All valid points. It will be incredibly difficult to implement my suggestion. But eventually it’s going to come down to a choice between surviving locally, or participating in the mass die-off. When the crisis hits most people will admittedly go crazy–but the few who are interested in surviving and propagating will be discarding old models en masse anyway and haphazardly adopting new ones. It’s good to get a few ideas out there widespread before that happens.

That’s a good idea, but it’s really difficult. Even the radical early soviet union decided they needed money as a means of exchange.

The Shamens are a bit slow on the uptake. hahahahaha.

But on deflation the author has advanced science far beyond Greenspan/Bernanke dogma, “We can’t have deflation in this country – we have a printing press!”

The world’s biggest test program, Japan, now concludes this, after 25 years of testing…

” More recently, Europe faces a threat of deflation. Our analysis suggests that it is difficult to combat deflation only by expanding the money supply.

”

Ah! Whocouldaknowed. Mssrs “Pushing On A String” Marriner Eccles ???

I’m still disappointed that monetary theory treats all sectors, industries and players equal and assumes the money supply increase/decrease gets spread around equally amongst all in an equitable manner – resulting in price boosts flowing down to workers or price restraint as required.

Maybe we’ll discover next century that the money supply heads straight for whomever has pricing power.

The problem is not so much where to money comes from, but where it goes once it has shown up.

Frankly, to get things going again it has the reach the man on the street on a sustained basis. This in turn will allow him to rid himself on whatever debt he is struggling with, and thus allow him to spend on goods and services once more.

But thats not happening. The money invariably makes its way into the financial sector where it sloshes around for a bit before going fallow in some long term “asset” or other.

Unless the world turned into brokers over night, no amount of money in finance will bootstrap the production economy once more.

People have to spend on goods, that makes companies hire more to produce, that in turn provides more people with wages they can spend on goods.

That is the basic cycle of any economy, as long as one leave out the influence of debt.

You’ve got to fully fund those pensions , with high risk free returns on top of it… That’s the current rut.

No one over 55 wants their retirement funds invested in startups that will fail. And most still do not want government investing in startups that will fail either.

So everyone is playing the game of repackaging existing assets finding ways to increase multiples and hide volatility or risk.

The funding of the pensions is one big bottleneck. So the problem is not only the 1%. It’s also the pension system of the top 10-20%.

There are other ways pensions can invest their funds in direct benefit to their members. However, that does not benefit the rentiers because it effectively cuts them out as a middle man.

The problem is “also the pension system of the top 10-20%”. All pensioners are rentiers, whose pensions are funded by income-tax-free buildup of dividends and interest on stock and bond investments, and by income-tax-free gains on sales of stock in corporations that don’t distribute dividends. And everyone with a pension plan aspires to become a rentier, wanting to live to collect that kind of unearned income in retirement–unearned by them.

Always interesting in wonky wonk economics, is the aversion to analyze the effects of debt. Even the use of the word, seems taboo. Couldn’t find the word once in this paper and its references nor the recent paper on “bubbles” and its references-not once.

Pricing power?! I guess we know that’s not the oil industry.

Supports role of Keynesian uncertainty in booms/busts.

“there is a significant gap between observed facts and theory”

Imagine that.

“”Figure 3 shows the relevant result for the first (most important) comovement mode, showing that only “Overtime” and “Exchange rate (yen/US$)” have a significant correlation with prices, followed by “Wage Index,” “Unemployment rate,” and “Crude oil price,” but never with “Monetary base” or “Money Stock”.””

I think this is an important concept as it supports the notion that many mainstream ideas such as supply and demand and marginal utility are incorrect and that rather than supply of money affecting prices, prices may affect the supply of money.

It can be more useful to view the money system as relations of power. Hence we get into things like exchange rates, oil and wages.

So we get into questions such as where does the supply of money actually come from and how is it distributed. Production of money is the result of a power struggle between the major contending groups and interests in society. (Ingham)

Doesn’t this imply that the only way to launch an actual recovery is through a government employment or works program that guarantees immediate income for the unemployed?

That would definitely be one way. Other ways government could spend money into the economy would be a minimal BIG, single payer health care (no need for the private insurance rip-off), national pension plan (no need for various pension plan rip-offs), state sponsored education (realizing its value). Major projects to get us off fossil fuels.

I think it’s important for money to be spent wisely to maintain its value and foreign exchange but I think this is done by creating a strong, equal society.

Inflation vs Deflation

=

Growth vs No growth

If you have growth you can have inflation. Inflation can not make growth.

If you have no growth you WILL have deflation. You can make no growth happen if you artificially create deflation by increasing rates and/or stop lending.

So what is happening right now?

Um, no, some of the most vigorous growth in the US came during periods when prices were deflating, see below. Hey I have an idea, maybe we should separate money and credit, that way serial banking crises are not also automatically monetary crises too.

https://mises.org/library/deflating-deflation-myth

Sorry MPS has done enough damage over the decades…

Skippy…. or are you still confused how we got in this mess in the first place… parxeology… sigh…

Tough to convince me that John Maynard Phlogiston has the answers, that somehow deflation is the worst possible outcome

Tough to discuss anything with those that think if your not a MPS fan boy… your a Keynesian commie.

Thanks for this thought-provoking post. The observation by the authors concerning the analogy of their studies to finding the causes of meaningful signals in the motion of air reminds of: “If a tree falls in a forest and no one is around to hear it, does it make a sound?” So, where have those in the economics profession been spending their time and energies, and why?

Results of this study run to the core of the rationale used to justify the many trillions of dollars of QE-ZIRP injections of money into national economies, and the resultant massive debt-levered, carry trade-enabled asset price bubbles that have been blown and are ultimately so damaging when they collapse. These are not your Mom’s Beanie Baby(™) bubbles, and they are policy-driven.

As an aside, it appears to me that the BoJ’s QE-ZIRP policy continues to be run unabated. Why?

According to Tim Duy, they haven’t done it long enough yet.

“Why?”

I think it’s useful to have a plan in place when changing gears.

Neoliberalism has stripped bare many social safety nets.

People in China, the US and Japan depend on stock market prices for some measure of future security. Especially the elite but others are also tied up in this in various ways.

“Writing off debts would increase bankruptcies and unemployment as banks foreclosed on companies”

“Any action on the scale deemed to be necessary could effectively destroy the existing social and political structure of the economy. It is very unusual for entrenched ruling elites intentionally to undermine their own positions.”

“Re-equilbrating the Japanese balance sheet by bad-debt write-offs and large-scale bankruptcies would destroy the power bases of the closely interconnected corporate and political elite.” (quotes from Ingham ‘The Nature of Money’)

How many people here know what an Eigenmode is?

Raise your hands! Maybe Andrew Dittmer but he’s looooonggggg gonnnnne.

Where is he? I need an instructor in Stochastic Calculus and I’m willing to pay good money. he doesn’t have to hang out around Zucotti Park muscling people around as a security guard. I can pay him.

Wow. you could take those blue and red dots and put a frame on it and call it “Wall Art”.

Things vibrate and they jump around for all sorts of reasons. What’s the frequency Kenneth? Anybody remember that one? I don’t know why that’s in my head now. Maybe because frequency of data observation (i.e. Periodicity) is a latent variable definition that’s not real clear here. That could be it.

Well, this one is pretty good. But it’s not necessarily a slam dunk. Your Eigenmodes could relate to a implied frequency of data observations that’s not necessarily the frequency by which money printing works. I think it could be like people waving their hands up and down riding a ferris wheel. Their hand vibrations might not relate to their vector coordinates along the wheel, but that doesn’t mean there’s not a larger pattern.

Minor penalty points for use of the word “abscissa”. You’re already confusing people, why pile on? hahahaha