This is Naked Capitalism fundraising week. 1065 donors have already invested in our efforts to combat corruption and predatory conduct, particularly in the financial realm. Please join us and participate via our donation page, which shows how to give via check, credit card, debit card, or PayPal. Read about why we’re doing this fundraiser, what we’ve accomplished in the last year, and our fifth target, more original reporting.

Yves here. This article by Carolyn Sissoko, who has long been providing savvy commentary about derivatives and complex financial products, does an impressive job in a new post, in a clear, non-technical manner, of addressing an issue that the financial press has seldom presented properly: that of the moaning among dealers and investors about the scarcity of “safe assets” meaning Treasuries and other high quality bonds. You’d think the demand came from end investors, like widows and orphans or their functional equivalents, such as foundations and endowments.

In reality, as we’ve discussed earlier, the demand in fact came from the need to secure derivative positions. As we wrote in 2012:

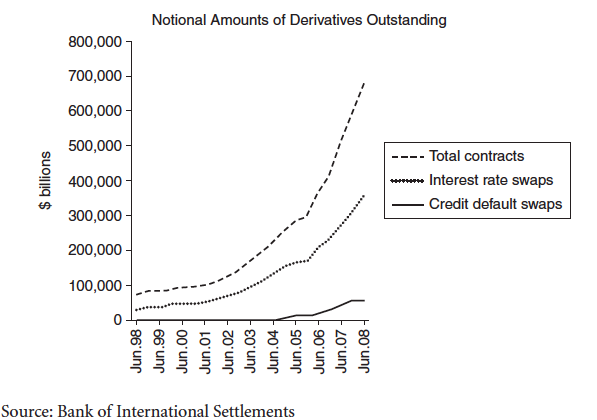

This massive fail results from the refusal to deal with the derivatives problem head on. For some peculiar reason, economists and regulators have bought the idea that financial “innovation” is always and ever good and should therefore be given free rein. Even though the crisis would seem to have proven decisively otherwise, no one seems willing to question the value to anyone other than banksters of the continuing growth of over-the-counter derivatives markets. And the ever rising “need” for more collateral is the direct result of the explosive growth of the derivatives market. This chart from ECONNED is somewhat dated but gives you an idea:

Sissoko not only gives a brief treatment of this syndrome, but more important, explains the implications for the banking system as a whole. And they are not pretty.

By Carolyn Sissoko,a fellow at the University of Southern California Center for Law and Social Science. Her research focuses on financial regulation, and the role played by financial regulation in financial stability. Originally published at Synthetic Assets

Noah Smith reviews the debate over negative real rates, and Brad DeLong remarks on “how profoundly strange and unexpected” is the current environment. While Noah covers all the most common explanations for real rates, I think that he — and most of econo-blogosphere — are missing a key factor that is probably driving this data.

First, recall that the problem of negative real rates is very much focused on the “safe” side of the market. That is, it is Treasuries (and similar assets like Bunds) that bear negative real rates. The market rates available to non-public borrowers are much higher than the rate on “safe assets.” (The distinction between these two rates is the premise behind Caballero and Farhi’s work.)

In my view the missing element of the discourse on the low yields of safe assets is the remarkable change in the structure of the financial system that started very slowly in the 1990s, accelerated at the end of that decade, and was a full-fledged financial revolution by the end of the next decade. This change is the collateralization of inter-bank lending, that previously was unsecured and funded on the basis of reputation-type mechanism.

ISDA data shows that with the growth of swaps starting in the early 1990s, collateralization of bilateral derivatives contracts become fairly common, though far from ubiquitous. Subsequent to the 1998 LTCM crisis, collateralization of derivatives contracts became much more widespread. The 2000 Commodities Futures Modernization Act pre-empted long-standing common law and state law constraints on derivatives markets, which subsequently grew dramatically — along with the use of collateral. The 2005 bankruptcy reform act dramatically changed markets for collateral, and in particular made it possible for the repos of just about any asset to trade on a par with derivatives collateral.

In addition in the early naughties, the growth of structured financial assets that made possible synthetic assets in which “investors” sold protection on bonds (instead of investing in actual bonds) and held the collateral that was used to guarantee payment on the protection contracts in “safe assets.” Finally, financial market participants have sometimes commented that the Basel rules for banks promoted collateralized interbank lending over unsecured interbank lending (though I’ve never really investigated this point).

In short, the same data the Ben Bernanke explained in terms of a “savings glut” can also be explained by the financial industry’s massive increase in demand for safe assets that serve as high quality collateral over the same time period. The financial industry’s demand is a demand for safety and cannot be met by risky assets, so it is an excellent explanation for the 21st divergence between the behavior of “safe” interest rates and risky interest rates.

Furthermore, since the 2008 crisis the financial industry’s demand for collateral has only increased. In 2008 the unsecured interbank markets, including both the Federal Funds market and the Libor market, collapsed. They have not recovered. Interbank lending has shifted almost entirely to a collateralized basis. While it is true that the demand for collateral that was created by structured finance products has largely disappeared, this is most likely offset by regulatory changes that increase the demand for collateral.

In short, the best explanation for why private markets are forcing interest rates to zero is that the banking system is broken. The system which functioned for centuries on the basis of unsecured, reputation-based, inter bank lending no longer exists. ZIRP is just evidence that the financial industry is turning to government as a source of the liquidity that the financial industry is no longer capable of creating on its own.

Gives new meaning to the term “demand-driven economy.” The oligarchs demand our money for nothing, and we meekly hand it over.

http://www.businessinsider.com/ben-bernanke-on-federal-reserve-hurting-savers-2015-10

“The basic complaint here from critics is that by keeping interest rates at 0%, investors and savers of all types — but most notably “regular” people who are saving for retirement — are forced “out the risk curve.”

This means that instead of buying a relatively safe asset like a government bond, these folks have to buy riskier assets like stocks to get the 5% or 6% annual return they need to meet retirement goals.

For a number of reasons, this sort of complaint is silly and fundamentally misunderstands what investing and saving really entails, which is the pursuit of certain returns balanced against that return’s inherent risks.

And as Cullen Roche outlined in a post last month, the basic thrust of the argument that savers are being hurt by Fed policy is that “savers” are sort of, in some way, entitled to a certain nominal return on their hard-earned money.

Here’s Roche:

What they really want is risk free income. And that usually comes from the US government as a function of the Fed’s policies. Ironically, these complaints usually come from “hard money” and anti government types. And in arguing for risk free income they’re essentially asking for a handout from the US government in the form of higher interest payments from Uncle Sam. In doing so they’re arguing for a higher government deficit and debt since interest income is one of the largest expenses in the budget deficit.”

=========================================================================

The above is a good example of why I read NC. We have the media of BI and related media that seem not to have a clue about derivatives. (neither do I, but I don’t make money acting like I am telling people about what is happening). We than have a former head of the FED, as well as a fairly well known economist, who from what they say either DON”T KNOW what the fundamental cause of the liquidity demand and low interest rates is, or choose NOT TO DISCUSS IT. As well as what appears to be naked contempt for the average middle class person, and a religious belief in the “market” which by the way, is completely backstopped by the government. Either way, it shows way too much empathy for banks, and none for the middle class, who just don’t understand markets, risk, and the fact that the government isn’t going to make their life more secure, but because the rich, to get even richer, need their middle class lives to be less secure.

As noted in the NC article “The financial industry’s demand is a demand for safety and cannot be met by risky assets, so it is an excellent explanation for the 21st divergence between the behavior of “safe” interest rates and risky interest rates.”

Is it “risky” assets, or is it mispriced assets? What makes an “asset” risky??? If the US financial and regulatory scheme seems to be to maintain demand by allowing, not increasing wages and income, but increased borrowing, than you damn well better make sure that none of the houses bought (i.e., assets) ever significantly decrease in price – EVEN IF their price was bid up to ridiculous levels by that ever increasing borrowing.

So we have a ratchet of ever increasing asset prices, but no base of income to support such prices (other than ever increasing borrowing)

Oh, and this, as it gets to be too tedious listening how there is no inflation

http://www.mybudget360.com/two-income-trap-high-wage-myth-median-wage-income/

Look at the components of inflation – deflation in crap, while inflation in thing you NEED

Risk free income would be nice, especially since hedgies and PE sharks are able to suck so much money out of the system without doing anything that’s remotely useful. Despite this, I’ll reluctantly forgo the income if I can just keep up with inflation. But a savings account rate of 0.1% and certificate of deposit rates from 0.5% to 1% are less than the real inflation rate. As you point out, the official inflation figures are bogus. Inflation is real, and it is happening now.

Vatch,

Excellent point. As of 23 OCT 15, you need to go out nearly 10 years in treasury or 5 years in CDs to get close to even after inflation.

Course if you’re feeling lucky (cue Dirty Harry) I see that you can get 6.5% on a 5 year note to Noble Drilling (BBB- )

For the record, real hedge funds (as in the ones that hedge through short selling) are being hurt by the low rates. Back in 2007 before these stupid rates, hedge funds used to get paid to short stocks. A prime broker would get the borrow, the hedge fund would sell the stock and the pb / hf would share in the interest in the proceeds on the stock. Now, we are all paying the pb for the borrow because this mechanism has broken down. The only folks in hedge fund land who are benefiting from low rates are the momentum and beta monkeys who don’t hedge. The fed has set it up so that funds are concentrated in the dumbest hedge funds made up of youngins or guys willing to bet that they can turn on a dime like Appaloosa (that guy isn’t stupid). The ability to deploy money responsibly is impossible and the constant ramp in markets due to hopium and the resultant surge in risk on assets makes portfolio management almost impossible.

So please don’t lump all hedge funds into the same bucket. We aren’t all momo beta chasing monkeys with no alpha.

It’s not that the inflation figures are bogus. It’s just that you need to know which one reflects your life situation. Normally, the CPI-W, the one used for Social Security COLA, is pretty good, but this year the big drop in petroleum product prices masked all the other price rises. That’s why I can’t have nice things next year.

Every country can claim it’s risk free.

“Thou shall not question my debt.”

After imperial Rome fell, some patrician families survived, indeed thrived, in a new religious organization and supplied its leaders for hundreds of years.

Would you rate those families as better risk than their government?

Are there some corporations today that are better rated than their host nations?

My finance textbooks mention the concept of the risk-free rate of interest (I cannot remember if this is with reference to Markowitz, Sharpe or both).

Quaint?

Actually, being a rich land-owner in late Imperial Rome and later, was pretty low-risk. Apparently most of them continued to thrive, although the economy was in a slump for about three hundred years. They converted to greater self-sufficiency because of the disruption of transportation routes and converted their tenants to slaves (serfs).

Moderate, risk free income makes a lot of sense for me and Joe the Plumber. It’s entirely reasonable for us to expect to be able to work for 45 years, set aside for retirement, and get to relax for another 15-30 in frugal decency. That absolutely requires risk free income. The State should be up to providing that income (rather than, say, locking people in cages for crossing a line in the sand to ask about a job).

Those of us who get internal rewards out of what we do might want to work ourselves to the grave, but the market will eventually prefer the product of the younger set. Kids get ideas, ya know. Give me a pension, and the opportunity to reasonably pad it with bonds pegged to my real inflation. While were at it, throw in a JG and a BIG – to safeguard me and Joe’s asses against the softening of the labor market that all these new-fangled gadgets and globalisms are pushing.

Not hard. And with the gazillions we’re spending on bullets and toxic algorithms, there’s really no substance to the “. . . yeah, if only we could afford that . . . ” apology. I like this “People’s Quantitative Easing” rhetoric, and I hope it catches on. Not quite as nifty as that “99%” stuff, and it sounds a little Mao. But it latches nicely to an actual policy of wise spending. I could see a bottomless fund for 5% retirement bonds as part of a PQE package. Here’s hoping.

“What they really want is risk free income. And that usually comes from the US government as a function of the Fed’s policies. Ironically, these complaints usually come from “hard money” and anti government types. And in arguing for risk free income they’re essentially asking for a handout from the US government in the form of higher interest payments from Uncle Sam. In doing so they’re arguing for a higher government deficit and debt since interest income is one of the largest expenses in the budget deficit.”

This paragraph from Business Insider confirms what I was thinking. Many complaints about Fed’s policies come precisely from the guys that promote austerity, wage repression etc. They don’t want to see the paradox in their claims and very few economists show the contradiction as clearly as in this paragraph.

Michael Hudson in “Killing The Host”

…”… the mathematics of compound interest leads economies inevitably into a debt crash, because the financial system expands faster than the underlying economy, overburdening it with debt so that crises grow increasingly severe. Economies are torn apart by breaks in the chain of payments…“…

You’re the one who doesn’t understand. Savers are loaning money to the banks. If we had anything resembling a market economy, the banks would need to pay a nontrivial interest.

And try negotiating down your loan rate from a banker by telling him there is no such thing as “the time value of money”!!!!! Good luck with that!

To paraphrase Jerry Lee Lewis, not a whole lotta negotiatin’ goin’ on.

…craazy, that notion starts from the apparently false premise that “it’s YOUR money.” This appears no longer to be even a pretense… The Banksters and other variants of the Vampire Squid species MIGHT let you use a little bit of what the Massa’ allots to you, to gather enough calories and self-training to make you valuable for the moment — doled out increasingly via fee-generating “cash cards,” from the Store of iValue that the Real Wealth gets notionally globerulated into — after that period, you’re just a “useless eater.”

Beyond that, I keep wondering where the stack of Washingtons about 21 inches high that represents what I have been able to globerulate under what until bail-in or default time I have foolishly considered “my account.” exists, even notionally… Deletable with a swipe of a Bankster’s SwifferDuster, hack-away-able I am sure by any anonymous tripe with a code-brain…

There’s good reasons to debate what “money” is, to try like some early phlogistologist to figure out whence comes and whither goeths the flows, and the nature of the engrams that carry them… It’s an enormous fragile beautifully refractive crystal, apparently, grown from a single narrow stalk, shooting off fanciful branches and dendrites, precipitating “value” and wealth out of thin air, getting massier and massier and more unbalanced, until *snap…* and the sounds of all that froth and seeming structure, tinkling down, melting…

The a__-pain to me is knowing that the teasers who flit about like bespoke-suited, timepiece-sporting Jack Frosts, lining out and seeding the wild untenable exuberances, will skate away on golden blades, off to their personal Fortresses of Solitude…

FTAlphaville had a whole series on this, quite some time ago (few years IIRC). It’s nothing really really new. It was an issue even in the first EUR crisis around 2012 when all of sudden Italian bonds weren’t “acceptable” collateral, leading to all sorts of problems.

It doesn’t mean it’s less of a problem now, if anything, it’s more of a problems because you have to post not only variation margin (as you generally have to under an ISDA CSA), but also initial margin to the exchanges. And on some ISDA CSAs people are starting to look for an initial margin too.

That said, I believe it’s all a cycle. Now the collateral rules go much stricter than before, but give it a decade and some bright spark will “discover” uncollateralised derivatives again (assuming there’s no disaster in between).

The real problem with collateralisation is with securitised transactions though. There’s no way an RMBS SPV can afford to post collateral on its swaps – at least no way that rating agencies would give it AAA rating at the moment, unless you shovel in so much mortgages it makes it highly uneconomical. And the sad thing about it is, that with the current regulatory rules, unless banks can securitize in some way, the overall lending to the economy will be not just a bit curtailed (that would be ok), but very severely restricted.

So, we’re getting back to the old problem – CBs run ZIRP “to stimulate the economy”, but at the same time restrict balance sheets (and funnily enough, ZIRP due to the discounting factors increases balance sheets on its own), and “improve quality” (hah!) so overall lending to the economy constricts considerably.

Thus ZIRP benefits only the largest players (actually mostly large corporate and private players) – paradoxically, ZIRP policy is bad for banks, especially with a flat curve as we have right now.

Higher rates, but state-guaranteed lending would be a much better economical stimulus, but of course that’s a fiscal, not monetary policy, and would run into much more political troubles.

OK, I know this is nuts because it is based on Milton Friedman, but just for the sake of argument, if the economy is only growing at maybe 2% per annum, why should be need lending (the creation of new money) at a rate greater than that 2%? I mean, Friedman had a point about the only need for new money being the need to keep up with the growth of the economy. If the economy isn’t growing, then what is the need for all this leverage which in turn calls for all this collateral? These activities seem, by definition, to serve no economic purpose (other, of course, than creating opportunities for the rich to skim the extra, which seems to be the only purpose of all this nonsense and goes under the bullshit heading of “the wealth effect” I guess).

It should be easy, if I’m guessing right here, for more knowledgeable people to demolish the whole edifice of current economic policy and thinking. You can even use right-wing Monetarism as the brickbat. What surprises me is how few people will take up this obvious line of argument.

Because there are frictions in the system stopping money circulating. Most notable one being ‘savings’. It’s just natural because there is a lose of ‘heat’ in any system, you can’t fight thermodynamics.

Off course when a small fraction of the population is hoarding most of that money that should be circulating it’s even worse…

Savings is kept in bank accounts. We have fractional banking. The banks can either loan (and eventually securitize the loans and get them off their books) or invest. At the current reserve requirement, that can be up to 10X what we have in savings. That’s the direction to look in for disfunctionality.

Two points: Ignacio, the amount of new money created is way more than can be accounted for by a fall-off in the velocity of money; crazyboy, loans are assets on a bank balance sheet, not liabilities (the savings accounts are liabilities as they are owed back to the depositor), so I don’t see the logic of “getting them off the books” when they are (or at least historically have been) the banks largest assets.

It’s an option. I’m sure most of our 6000 banks still like performing loan portfolios.

But in recent times some have become more like loan mills where they get upfront fees, then flip the loans to a big Wall Street securitizer, like we had with RE mortgages running up to the GFC. I think there is a similar thing going on with securitizing [subprime] car loans nowadays. Credit card debt gets securitized sometimes too. I’ve seen bond funds I can buy that have this stuff in them. No thanks.

Is not this flipping of loans just another form of complicated criminal activity to steal the value of actual human labor? It seems to me the details just describe where the actual theft occurs and at what point in time.

Banks creating loans with the knowledge that the loan will never be paid back- then moving said loans off their books is criminal activity.

By blurring the line between honest and criminal activity, our society is becoming dysfunctional for honest people. Criminality wins out every time.

It seems that the best move an honest person can make is don’t take out any loans and keep your money in a mattress.

Yes, and almost yes. There are house burglars…

Simple – how many people would be able to afford a house/car (two large ticket items) w/o a loan?

How many businesses would be able to save from their cashflows for large ticket capital items? It’s not just about growth. Flipping a house from owner A to owner B may add zilch to growth, and often does.

If you want to go to 19th or so century, when most people rented (maybe not in the US, where they were able in effect to get a free money from the state via the homesteading act), it’s possible. But it means even bigger accumulation of wealth, since then you have to have massive landlords.

Majority of the credit outstanding right now, and a vast majority of securitised credit are mortgages. Also, due to their long duration, a massive amount of “new” credit is refinancing. But if you stop securitization in its tracks, the refinancing dies (banks are now incapable of carrying all of the mortgage debts on their balance sheets, not to mention that they haven’t done so for decades now so wouldn’t even know how to), and we have a problem.

Just to highlight the author’s point. The FTAlphaville series vlade is referring to goes by the title “Death of Banks”.

Just checked out comparable 10yr yields. US compared to Germany at 0.50%, Japan at 0.29%.

Very interesting points on the interbank markets.

is this literary criticism or social science?

it makes some good points though.

Narry a word about our Super Heroes at the Fed, however. The author must not have read “The Courage To Act” by Batshit Ben (published by Marvel Comics). Janet’s “Super Girl” comic book is on the way too!

I thought Lawrence Olivier wrote that. it’s hard to keep up these days.

I think it behooves us to think about the counterfactual central bankers. If we didn’t have Yellen et al what would be happening? I believe things could be much much worse. Core problem is the dysfunctionality and corruption in congress, who are incapable of doing the right things.

Well, first off, the Fed did a major fail in their regulatory responsibilities and we got the Great Financial Crisis. They then poured money on the crooks, merged them together and we got even bigger TBTF banks. They’ve cost savers upwards of half a trillion with ZIRP so far, and still counting. Low rates have been financing stock buybacks and M&A , which is always followed by layoffs. Then Congress does nothing because it’s become fashionable, and easy, to believe the Fed is “fixing the economy”.

I guess things could be worse. We could become a third would country that starts WW3. But I used to think I’d be golfing in my retirement years.

Third World, twirled and whirrled:

CD term deposits at Laxmi Bank in Kathmandu are 4-4.5% for 1 year term (in Rupees/USD is at 1.25-2%); capitalization requirements for banks are pretty strict too.

Before GFC they were 6%!

http://laxmi.laxmibank.com/Individual/Rates/Interest%20Rates.aspx?m=7lB0lzf8qeg=

“In short, the best explanation for why private markets are forcing interest rates to zero is that the banking system is broken.”

Um, the Fed dumping $4 trillion of QE on “private markets” should have something to do with zero interest rates.

I’m hoping (assuming?) that’s what the author means by that. But it is written a little awkwardly, isn’t it?

What is going on is not being driven by private markets. It is being driven by public policy.

Yup. “Lack of agency” problem again. Or mis-assigned agency.

there’s plenty of agencies in Washington, that can’t be the problem.

+10, LOL

Oh yeah. My mistake then.

Actually the Fed isn’t entirely a public entity. It’s one of the original public-private partnerships.

That’s why I like the phrase public policy. The fascists love all those public-private partnerships. But at the end of the day, the activities still only happen because of political action, due to things like the Federal Reserve Act, Financial Services Modernization Act, Commodity Futures Modernization Act, and Emergency Economic Stabilization Act.

…and one wonders at what point enough ordinary people will have had it with the theft of “legitimacy” by the boughtandpaidfor legislatures and “executives” and judges that (yes, “political legitimacy of the hierarchy” is something humans very much need, had it to the point that it’s time to tell the Fokkers we ain’t abiding by their self-serving “Acts” any more, and come and get it if you can — and if you have enough mercenaries lined up and paid well enough to shoot down their fellow starving humans, and your Panopticonal Penetration of Everything is both complete enough and intelligent enough to cut out the troublemakers from the herds….

If somebody dumped $4 trillion on the banking system, is it surprising that it broke? I don’t know how much that weighs but it must be several tons, at least. The problem is finding just where it broke. It could be anywhere.

I think that’s why they’re putting RFID chips in money. Someday we’ll be able to figure it out!

I think the econommist Ed Bucks formerly of M.I.T. and now living in a tree in New Hampshire waatching deer through binoculars was working on some partial differential equations that map money flows before he flipped out. RFID chips might have saved him or just delayed the inevitable. It’s hard to say for sure. Economics is like that.

This post makes some good points though. But I still think it’s literary criticism and not social science. Also, It’s nice when they’re short like this. I wouldn’t have minded a few equations just for decoration, though, as long as it’s not stochastic calculus. But they can use e^it as long as they keep it simple.

I read someone who did it years ago using Irving Fisher’s formula for quantity of money and velocity of transactions and merged it together with the money multiplier formula which shows how much “banking money” is created for a given reserve ratio in a fractional banking system.

Dat would be da gizmo der.

The paths it all goes thru in TBTF, post Glass Steagall, banks will still need the RFID chips.

Do you suggest that it was the Fed what broke the financial system?

(I am not the same Ignacio that you replied above)

It didn’t help..

“[Former Federal Reserve chairman] Alan Greenspan hated Glass-Steagall and he subjected it to 10,000 cuts in terms of regulatory waivers and loopholes and such,” Black said. “By the time it was effectively repealed in 1999 under Bill Clinton, there wasn’t a whole lot left of Glass-Steagall.”

http://knowledge.wharton.upenn.edu/article/can-the-bank-of-englands-new-ring-fencing-rules-work/

ZIRP is just evidence that the financial industry is turning to government as a source of the liquidity that the financial industry is no longer capable of creating on its own

Chomsky:

The banking system “broken”? Perhaps. Or perhaps it is simply corrupt.

So the government gives unlimited money to the big banks at like 0 percent interest. This of course drives down interest rates for regular folks to near zero as well (one wonders when the big banks will stop accepting deposits altogether – why should they when they can get as much money as they want from the general public treasury at zero cost and with much less book-keeping hassle?). But the big banks can still charge much higher interest rates when they loan the money out or on their other ‘investments’. Nice work if you can get it.

I would propose that the low interest rates that private savers are getting is yet another form of theft. We are basically being taxed something like 5% annually on our savings as yet another subsidy to big finance.

I recently met someone from Australia who said that personal savings rate in that country was like 5%. The following article is a little dated but still possibly of interest. There are some pretty broad spreads between countries, and it’s not all explained by differences in inflation.

https://www.quora.com/Why-is-the-interest-rate-in-Australia-so-high-June-2011

The banking system isn’t broken. It’s fixed.

touché!

‘The Federal Funds market and the Libor market collapsed. They have not recovered. Interbank lending has shifted almost entirely to a collateralized basis.’

This does not sound correct. According to the New York Fed,

Libor is defined similarly:

In other words, Fed Funds and Libor, by definition, are uncollateralized.

The NY Fed article goes to note that while the Fed Funds market shrank by about two thirds after 2008, the Federal Home Loan Banks constituted about 75% of the lending in 2012 when the article was written.

Jim Haygood

It is a well-established stylized fact that interbank lending has shifted from an unsecured to a collateralized basis.

The point in the post is therefore not that unsecured markets no longer exist, but that they no longer play an important part in interbank lending. The article you link to supports this conclusion: the federal funds market collapsed from $200 bn to $60 bn and now what little lending takes place on the market today is largely done by the GSEs (e.g. FHLBs), not the commercial banks that traditionally have dominated the market.

For more on this see: http://blogs.wsj.com/economics/2015/02/03/grand-central-new-york-fed-tries-to-address-plumbing-problems-in-fed-funds-market/

On Libor see:

http://www.newyorkfed.org/newsevents/speeches/2014/dud141002.html

Hope this clarifies things for you.

I went to the bank today to deposit my paycheck. Imagine my surprise when the teller pulled a mask over her face, jumped over the counter brandishing a semi-automatic and handed me a note demanding all my cash or cash equivalents. I immediately handed the check and pulled out my pockets, where a few stray coins appeared. I said “this is robbery”. She responded “no this is NIRP”. It turned out it was actually a DHS drill practicing the next step, CIRP, or confiscatory interest rate program, and I got a free photo of the holdup. I got a CD with -5% interest and was walking on air when I left the place.

Broken Financial System indeed. Given the regulatory allowances to derivatives speculation that have been made by the Fed and Obama Treasury/OCC, I applaud the FDIC’s approach to addressing the rampant derivatives speculations being engineered by the senior managers of bank holding companies and placed onto the books of the FDIC-insured bank subsidiaries in an effort to force taxpayers, depositors and the public to again pick up the tab in the event of a systemic default event such as occurred with AIG.

I seems to me that the outcome of this policy action contributing to negative real interest rates can be swiftly rectified by requiring the bank holding companies book their derivatives elsewhere than in FDIC-insured banks. Better yet, restore the Glass-Steagall Act.

Related article is behind a pay wall, but the headline and first sentence are the tell:

http://www.wsj.com/articles/u-s-banking-regulators-poised-to-cut-banks-costs-in-swaps-margin-rules-1445522400

Negative Interest rates are another symptom, true, but not a of broken financial system, but of political philosophy. Negative interest rates, deflation, are a consequence of the demand gap, in turn cause by wage suppression driven by free trade policies with the current dogma elevating profits to the only one God..

The Neoliberial agenda which has dominated since 1980, and grown in breadth and depth is the driving meme of out time.

It includes the view that Government is the problem, especially Government spending on the poor, with the contrary pressure that growth is forever and must continue. This coupled with the trickle down emphasis of neoliberalism is the drive meme behind negative interest rates,

Holding two opposing concepts in mind at the same time, growth for ever and, tickle down works, are at opposite extremes.

If discretionary spending is increasing only at the top 10%, spending will cease (not enough to buy) and gambling will increase – Thus both a demand gap and increasing instability.

That the financial system adapts to the current political system is to be expected, it it is but a symptom, not the disease.

Where is a vow of poverty these days? The disease is greed.

Now we know why empires raise and fall.

” It’s the deflationary liquidity-debt-trap, stupid”

whereby no matter how much QE or NIRP aggregate debts just can’t get paid (bail-ins, confiscation, eminent domain BS) initial motions of which can already be seen all around us while Michael Hudson keeps shouting from his roof-top “Debts that can’t be paid, won’t be” including the many (known and hidden) un-funded liabilities.

The only ‘way out’ is induced hyper-inflation were the many trillions “assets” now parked at the Fed are loaned into forceful Main Street existance (so-called ‘helicopter money’) and become circulating über-velocity currency (or legal tender) but not “money” in the technical sense of the term because it’d have almost zero store of value.

The idea is to destroy (on purpose) the US dollar as the world’s reserve currency… while the many additional trillions of dollars stashed abroad (by central banks, businesses and regular people) come rushing home to roost to be promptly dumped on the Fed’s front lawn…

Ladies and gents, commentariat at large:

Talk all you want about it, but at the end of the day it’s your (timely) CYA that’ll matter.

.

Did anyone else hear the report on the BBC last nite about the BOE or some fiscal authority setting up a public pension investment fund, for the benefit of the people of the UK and to be run by a non-profit manager so that every citizen in the UK can “share the wealth” – they quoted a high interest rate so that the long term returns would be enough to enhance both the wealth and retirement for everyone. This coming out of the City of London? And is this even possible in a time of depression?

And is this even possible in a time of depression?

Nop!

Yes, not only possible but necessary. Increases demand and gives more secure footing to pensions.

Maybe, but sounds alot like a test run for privatizing S.S.

According to different clue below looks like you are right. I was thinking more along the lines of personal QE and/or developing the equivalent of personal accounts at the central banks. I definitely don’t think it’s a good idea for public retirement funds to get into private investments such as privatizing social security.

Yes, I still remember back at the height of the “crisis suggesting that the guv write a $3000 check to every S.S. number regardless of credit issues, all that money, or a large portion would have gone into the banks but the population would get something too, but Very Serious people told me that would never work although I’m not sure still why not. That would be an example of peoples QE don’t you think? My reply to you last night had been much longer in which I said I understood your meaning but that I had a more cynical perspective. After 3 McEwans, however, cautious reflection caused me to excise it down to the important point.

Still think it would have been great, think of all the 7 year olds with investment accounts it would have created. On the other hand the 8 year olds would get the husk so I can see it would be problematic as any one time input distorts things, but thats what they did for the banks, just more than one time….

:) Yes indeed.

So we get into questions such as where does the supply of money actually come from and how is it distributed. Production of money is the result of a power struggle between the major contending groups and interests in society. (Ingham)

If the country was sovereign in the creation of money then it would be possible. The reality is a sovereign nation can fund whatever it likes. They don’t just have to take on debt for wars or to bail out banksters, they can take on debt to fund the olds retirements too.

+1 see Greece as an excellent example, or Iceland…

I heard this report but understood it differently then you-all are understanding it. I understood it to be a forced prior-decuction “savings” program from every paycheck in Britain in order to turn that money over to private managers to manage it. (And charge as much/many fees as possible to do so, I suppose). It is designed to prevent people from using that money to invest in personal up-skilling, building personal fortresses-of-subsistence however partial, etc.

Money forcibly save-extorted from the earner into a forced-privately-managed “fund” is money not available to buy meat grinders, canning equipment, garden tools, personal solar panels, etc. That is how I understood the report. Was I wrong?

Also, I heard it described as setting an example to use against Americans eventually. I was thinking that my only defense would be to figure out the very least amount of “money” I would need to live on . . . and then figure out how to make that very least possible amount of money, and not one cent more. After all, the less money one makes, the less money one has to be stolen from, or deprived of.

Our current political economy makes one appreciate the need to protect oneself from the vice of hubris. The financial high priests are using every trick invented by their order to insure that every living human being on the planet is compelled to continue playing their game.

When you come to realize that crooks and liars run the country and make all the decisions concerning policy, what is the sane and rational thing to do?

Turning hard earned resources over to a private money manager should be last on the list.

The lesson learned in WWII was expanded by the cold war until the point that the entire system is dependent on the state to advance hegemony.

Skippy… seems the only change is the philosophical preference from defeating Communalism to advancing Corporatism… maybe the rapture comes when there is only 7 corporations on the planet after M&A runs is inevitable course…. beardo – ?????

Timely and important work.

Sissoko

“the lender of last resort role of the central bank should be limited, and, in particular, should not extend to the support of asset markets and “shadow banking.” Work in progress re-evaluates the reasoning behind the passage of the Glass-Steagall Act and argues that the Act was designed to prevent commercial banks from intermediating markets in what we would now call repurchase agreements, because of the prominent role such lending can play in fostering asset price bubbles.”

Yes, it is getting tiresome out here on the outside, waiting and waiting for the people on the inside to learn that the point about Glass-Steagall was not that it had become antiquated, but that its purpose at the outset was to keep the fox out of the hen house. It is that separation of the fox from the hens that must be reintroduced. Unfortunately, courage is in short supply with our leaders, these days, and greed is still as popular as ever, so we may have to live through a bubble economy for a while now. Just remember, one of the ways out of the bubble economy is to create a stable financial environment for the middle class, which means that their banks are really dull and boring. Yes, getting the foxes out makes for boring banks and a middle class that has sane places to put their money.

Tiresome indeed. But the real question now is how do you get rid of the Fox? For those of us who know the Fox for what he is- a destroyer of hens- some level of protection is available. We don’t walk willingly into the hen house!

The fox in the hen house is a good story. The problem is that most people don’t get the moral of the story. If they did, we wouldn’t live in a world like today. How do you get rid of the Fox? As a start, you have to see and identify him as a PREDATOR. Words like predator, thief, crook, need to be applied to the more “respectable” members of society where appropriate. Taking the language back is step one. The equation would be language+ideas=actions. Our current system operates with: Mess up the language + obfuscate the ideas = inaction or at best-for the predator- self destructive action. What sublime feelings the elite must have when they contemplate the fact we finance our own enslavement.

There are good people in every profession, working every conceivable job in our society. When the middle class is finally destroyed in this country, maybe then we can truthfully and openly discuss the notion of class and class warfare. The people in charge know exactly what they are doing. They don’t need to learn anything. We need to learn that they are predators. They spy on everyone. They drop bombs on hospitals. They shoot down passenger planes. They stock prisons for profit. They torture people who break rules.

Bringing back the middle class- what does that even mean these days? Once your past a certain point there is no going back.

Maybe when more of us have direct experience living in poverty we can regain a better sense of our humanity.

I don’t know if it will ever happen, but the post office bank sounds like a pretty cool idea.

Hi Armchair, Financial Matters, and Norb,

I (and many other NC readers) agree with you about Glass Steagall and a Post Office Bank. If you haven’t already contacted your elected representatives about one or both of these issues, please do so. Here’s the contact information:

Senators: http://www.senate.gov/senators/contact/

Representatives: http://www.house.gov/representatives/

If you aren’t sure who your Representative is, and that often happens, because of weirdly shaped districts, you can use this web site. Enter your 5 digit zip code, and if that isn’t enough, you’ll be prompted for your address (or your Zip+4 code):

http://www.house.gov/representatives/find/

Also, consider writing a letter to the editor of your local newspaper about these issues.

Thanks for this article.

It seems that the problems you mention in the collateralization of inter-bank lending are even worse in the tri-party repo activities of the shadow banking system.

The regulation in the shadow banking system is even worse so this problem may not yet be fully ‘realized’.

It seems though that it could be realized quickly causing a money market run. This would seem like a difficult run for even the Fed to deal with.

In other words the banks are broke and can only exist in a government welfare state. But they’re only broke because of their own corruption and should have been buried years ago. And politicians rail against food stamps and some poor person getting a meal – all the while taking those savings and giving it to the banksters who then line the politicians pockets, and round and round it goes until it all blows up or disappears like a self-licking ice cream cone. Nice job on cutting COLA this year too. Paid to be clueless so the ponzi can continue….

You can’t taper a ponzi scheme, it can only get worse for anyone not a part of the scheme.

ZIRP and NIRP are ‘tells’ that the Fed has painted itself into a corner.

1) The need to normalize interest rates so that interest rates are above the rate of currency debasement is acute.

2) Yet the core of our modern banking system is now teetering over a fulcrum of only four New York City banks, for they have simply insane derivatives leverage.

3) Put simply: the ‘system’ can’t survive a rise in interest rates. These mega players are on the other side of EVERY ‘interest rate ‘insurance product’ as broadly construed.

(1) and (3) make for decision paralysis.

The dilemma is bigger than orthodox doctrine, theory or imagination.

4) The President is obdurate, and will not accept any counter-policies from Congress.

5) Need I say it: the President is enumerate. His grandmother was a numbers maven.

Having lived in her condominium in 1983 — and seen the interaction of Grandmother and Grandson — no more than three-feet away — I can assure you our President HATES numbers — and HATES it when anyone tells him that this or that calculation says he can’t do something. Hence his administration functions without budgets,… amazing, really.

[ He’s on record, telling his daughter that “long division is hard.” I believe him.]

This dynamic springs from his youth, the formative time for all of us, and not easily shed.

His youth — world of hyper-dominant women — largely explains why so many key advisors are women at this time.

Oft photographed, the President’s visage in many snaps — with his distaff staffers — is identical to that of 22-year old Barry Obama. ( His Grandmother ALWAYS addressed him as Barry, BTW. )

I’ve always found it curious that the Press has not fully explored the most important person in his life: his Grandmother.

“His youth — world of hyper-dominant women — largely explains why so many key advisors are women at this time.”

Yeah that’s evident in his key economic advisers, whom were either long time architects to the problems you perceive or acolytes of them.

Skippy…. btw whats the point of numeracy if you can’t get your facts straight at onset, you know the main problem economics has had for decades….