Yves here. While no sane person would want to buy an apartment in Trump Tower now and be subject to inconveniences like gawkers, Secret Service cordons and the inability to have your driver drop you off and pick you up, Wolf’s piece shows that Trump Tower apartments had been languishing on the market long before Trump won.

There’s been a sudden glut in the market for super-high end units, due to a perfect storm of a rash of construction combined with a crackdown on anonymous buyers using shell companies, which has choked off a lot of money laundering and foreign buying that was pretty much the same thing. But there are other signs of ill health in the New York City real estate market generally: falling rental prices at the lower end, and a remarkable rise in retail vacancies, with many in my neighborhood (Third and Madison Avenues on the Upper Eas Side) remaining empty for more than a year. One reason for shuttered storefronts (at least in my ‘hood) is that landlords tried pushing through big rental increases, apparently thinking they were entitled to catch up after years of no or modest rises in the wake of the crisis. On Third Avenue two years ago, many landlord tried doubling the rents on leases up for renewal. Many stores folded or relocated and those owners either have not found tenants or have gotten businesses in that look too misconceived to last. One was an upscale frozen food purveyor with a large space, another was a “healthy” prepared foods vendor, but there’s now tons of competition in that niche, and the staff was snooty and the offerings looked to be fattening by virtue of visibly using tons of oil. The former vendor is still open but I never see any traffic; the latter has closed.

A colleague who is a tax expert points out that retail business that soldier on with no apparent business are likely to be money launderers. The prototype is the greasy spoon pizza joint that not only seems never to have any customers but where the staff looks a bit surprised if you look like you want to eat there. There’s a low-end jewelry store on Third where in the last five years of walking by it on a regular basis I’ve seen all of two people in the store save its staffer. That would seem to fit the bill.

So this is an excuse for our periodic question: how is your local economy doing, as reflected in the apparent health of its residential and commercial real estate markets?

By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street

The iconic mixed-use 58-story Trump Tower, on 721 Fifth Avenue, in Midtown Manhattan, with top-dollar retailers such as Tiffany’s nearby, was the ultimate in condo living when it was built in 1983. Now it’s even more iconic as President Elect Donald Trump holds court there, among enormous security measures and the daily flow of potentates, moguls, Big Oil CEOs, the occasional Silicon Valley wunderkind, billionaires, retired generals, Goldman Sachs folks, and the like.

But not all is well at this piece of glamorous real estate.

Of its 238 apartments – located on the top 38 floors, including nine duplex and triplex penthouses on the top nine floors – 11 are actively listed for sale, according to CityRealty, and another 12 are listed for rent. Asking prices and asking rents have been slashed to get the units to move, and it’s not working very well.

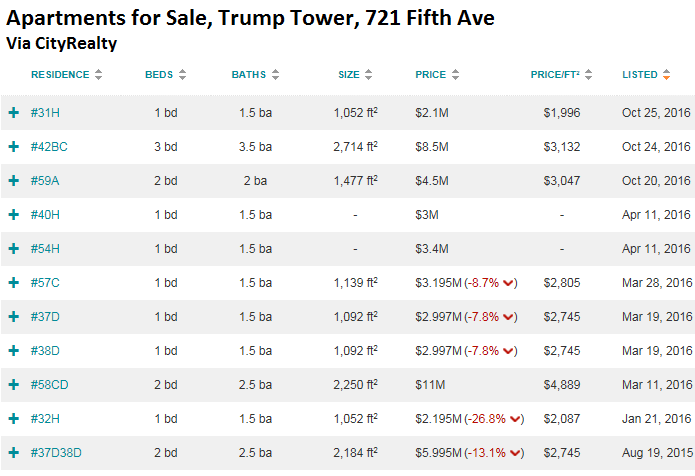

The table below shows the 11 apartment listed for sale. Three of them consist of two units that have been combined: 42BC, 58CD and 37D/38D. Five sellers have cut their asking prices, with reductions ranging from -7.8% to -26.8%. And note for how long they’ve been on the market (right column), in a market that isn’t exactly ideal:

For some units, asking prices have been cut more than once. For example, 37D/38D, with 2,184 sq ft, was originally listed over a year ago, in August 2015, for $6.9 million, according to StreetEasy. In February 2016, the asking price was cut to $6.5 million, in June 2016 to $6.2 million, and in October 2016 to $5.995 million for a total reduction of 13.1%. And still no takers.

The potential buyer can expect to pay common charges of $3,620 per month and taxes of $3,328 per month, according to StreetEasy. This would come on top of the mortgage. At current asking price, with 10% down, financed with a 30-year fixed rate mortgage at 4.2%, the monthly payment would be $26,400. So that would amount to monthly outlays of $33,348. But the views are nice.

Unit 32H was first listed for sale in January 2016 for $2.999 million. In March, the asking price was slashed to $2.5 million, and in May it was slashed to $2.195 million, in total 26.8% in reductions, and still no takers.

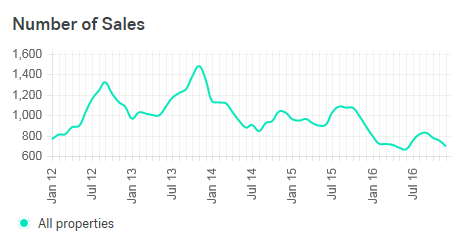

And there is a lot of competition. Zillow lists 6,330 apartments for sale in Manhattan alone. And the trend has not been the friend recently. Trulia figured that the median selling price of New York City apartments dropped 4.1% from a year ago, as sales volume has withered:

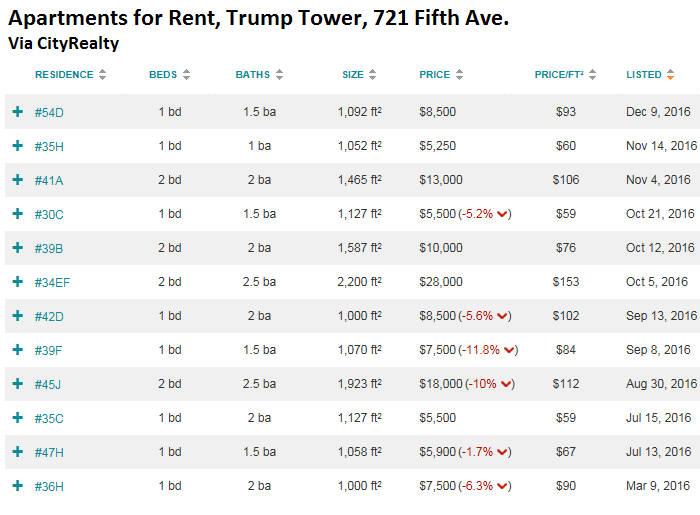

There are another 12 apartments for rent at Trump Tower, including one with two original units combined (34EF). In the table below by CityRealty, note the reductions in asking rents, ranging from -1.7% to -11.8%. These are just asking rents and do not include any concessions:

These units have a lot of company. Apartments.com lists 11,014 apartments for rent just in Manhattan. As I reported earlier this month, according to Zumper, the median asking rent for a one-bedroom in New York City dropped 7.4% from a year ago, and for a two-bedroom 7.9%.

But that’s just the asking rent. They’re kept as high as possible for appearances’ sake. To motivate potential tenants, rent concessions are piled on separately. These rent concessions just set a new record in Manhattan, according to the Elliman Report, with concessions now offered on 25.1% of all new rentals, up from 13.5% a year ago.

Is all this just a dip in New York City’s real-estate boom? Maybe not – as ominous clouds are forming. The New York Post, citing data from Attom Data Solutions, reported the foreclosures are once again surging:

More than 1,100 NYC households fell into foreclosure in October, a 32% increase from September, and a 37% increase from last year. Queens, which has been hard-hit since the foreclosure crisis began in 2007, had 400 new cases last month, nearly double the number of a year ago.

Brooklyn also took it on the chin, with 365 new cases, a 20% increase. Statewide, the number of new cases jumped 15%…..

“We’re definitely seeing a spike,” Westchester-based attorney Linda Tirelli told the New York Post.

So Trump Tower may be getting hit a little harder than other buildings in New York, given the brouhaha about the election campaign and now the even greater brouhaha around the President Elect holding court in it. But the entire Manhattan housing market, after years of booming at a blistering pace, is seeing the sudden and very unpleasant arrival of second thoughts.

And not just in New York, but now also in San Francisco, Boston, Chicago, Washington DC, and perhaps a city near you. Read…. The Great Unwind Unravels Hottest Rental Markets in the US

IIRC Mark Blyth, in one of the talks I watched around the election, mentioned that (again iirc) the BoC had very briefly put up an internal report decrying Chinese Party official-sourced capital flight (to the tune of $100B), and promising/calling for a crackdown. Does that ring a bell to anyone else, and/or might that be implicated? I could look it up, and it may be from a talk he gave a while ago already (i.e., in 2015), but it may also be that that took a while to take effect, etc., so who knows.

It wouldn’t (directly) explain the demand changes at the lower end, and in the rental market, as those officials (and SWFs/sheiks?) are mostly interested in buying, but I imagine it would affect the housing market starting at 2-3x median.

Recently on the radio (NPR?) here in Utah was a report about how the money laundering real estate boom in British Columbia had stopped cold and all that hot (Chinese) money was going to Seattle. Other reports on the internet, variously – can’t cite, have made the case that China cannot control capital flight. But Canada did crack down on absentee owners because they cause such blight. Multi-mm$ houses rotting away in Vancouver and not an owner to be found.

I’m sorry … I cannot fathom those numbers.

My rent from a 2-bedroom apartment is $800.

If that isn’t an asset bubble …

I fail to see much of a deal when an “apartment” opens at $2.9 mil and then “pluments” to a mere $2.2 mil. But then I just don’t care about poor rich people. What I really want to know is an aside: just why the HELL are shell companies even permitted AT ALL. This seems a very simple and basic thing that should be corrected. Make shell companies cease to exist. All corps must be upfront, clearly listing ALL those involved in its ownership and operation. There is simply no way to argue that shells are needed or valid when their sole purpose is to hide owners and their (illegal) activities from view of govts, law enforcement, and the People.

The fact that shells are still permitted, AT ALL, clearly demonstrates that all govts are corrupt and their officers benefit from tax evasion and money laundering.

I think it is still that the reason to be in power and have power is to give yourself and your pals and relatives extras and deals no one else can get, not to make it good for everybody. So the people in power are the step on your face and knife you in the back types, and the people who have benefited from them or do their bidding. Values for being “in power” have to change.

If you bought it at that price or levered it up at that $2.9 million price to 75% or 80% of value, you are underwater at $2.2 million after brokerage and other selling costs.

Something similar has been happening in London top end real estate for quite some time. http://treasureislands.org/top-uk-estate-agent-top-end-of-housing-market-is-in-a-slump/ There may well be a broader fall on its way soon

The NY suburban regional economy fails on the ocular test. I am an avid cyclist, generally riding throughout mid and upper Westchester and Fairfield counties (includes many high-end suburbs, such as Scarsdale, Bedford, Katonah, Greenwich, New Canaan, etc.). So when we are out we are moving at the right speed and on the right roads to take in information over a wide, representative area.

Since 2008 we observe an excess of residential for sale signs throughout. Many have been up for years. You can go through certain areas and it seems that every house is on the market. Including areas with multi million dollar estates, horse farms, etc. It is somewhat unrelenting. While brokers seem to keep saying the market is good, buy now (they always say that don’t they) everyone I know trying to sell is, or has, having a tough time. There are no buyers, even in communities like Scarsdale that is known for its schools. You hear that the tax bill, i.e., the carry, is just too high.

As to commercial space, you see “for rent” signs that have been up in some cases for multiple years. One negative that one sees in these communities is that the big banks took over a lot of space, I am guessing they temporarily drove rents up while doing so, at the expense of smaller retail. That seems to be over other than the consequences. For those not familiar with the region, it is not an area that has been decimated by Walmart. These are “true” economic results of lack of demand.

mikerw, buyers set the price.

Always.

If you list your home and it doesn’t sell, it’s the price.

Always. I’m a Real Estate Broker in an area with extremely low inventory and some place haven’t sold due to being priced too high.

There’s nothing price can’t fix.

Not so. Janet Y. sets the price, or she did until the election.

My Parents waterfront property, now empty lot (Thanks Sandy), in Fairfield was on the market since shortly after the storm. It was worth $750k and finally just a few months ago sold for less than $500k

Mike, you fail to recognize the yuuuuge investment in new real mansions in Greenwich, including North St, Dingletown Rd, Cat Rock Rd into Stamford (Ponus Ridge Rd) and then New Canaan (Oenoke Ridge Rd), etc. The amount of presumed cost is staggering. Also, the volume of new middle and high end residential construction over the past half dozen years in Stamford gentrifying the area at the south end of Atlantic Ave on the water, is staggering. I’ve often described Stamford as where the business of business gets done, as in Wall Street (in NYC) is the board room. Remember, Greenwich is the hedge fund capitol of the world. UBS and RBS, to name just 2 of the most visible concerns downtown (which both have a significantly reduced presence currently), is where the trading takes place (I won’t name several other large trading, commodities and marketing firms as I currently work these). Large numbers of middle level managers and service staff in spite of a very poor public school district.

Well, mikerw, looks like the Cycling Intelligence Agency also has a mission in suburban NYC.

Here’s Agent Slim’s report from Tucson:

During my morning bicycle commute, I counted eight “for sale” signs. Some have been up for the better part of this year. I suspect that those houses are overpriced.

I’m also noticing a glut of rental properties without tenants. In the University of Arizona area, this is VERY evident.

Why? Because of the new apartment complexes that have been built next to — or near — the campus. Nice properties with many amenities. Makes those 50-year-old SFRs look highly undesirable. So there they sit, with their “for rent” signs creaking in the breeze.

On to CRE. I work in Downtown Tucson, and let me tell you, there’s no shortage of places for rent. Again, I suspect that the pricing is above what the market will bear.

Gentrification is finance capital’s preferred strategy, as well as its endgame, because of the amount of money that can be sunk in RE (on both sides — developers and buyers). Highly recommend watching this video, called Limits to Growth, Limits to Gentrification: https://www.youtube.com/watch?v=4JQPnbN6ALo

Cycling is definitely the best way to get a feel for a local economy! Fast enough to get a ‘slice’ through urban, suburban and rural area, slow enough to notice the for sale signs, whether gardens are being maintained, houses in multiple occupancy or empty etc.

Things are fine in Kirkland, WA. (Home to Google North, next door to Microsoft) Moderate amount of infill development, nothing like the white-hot market in South Lake Union (Amazon) My rent’s going up 30% January 1st, which still puts my unit substantially below market rate.

I just recently sold two properties in Sacramento California on my way out of the country to live in a place focused on culture, community, and tranquillo. The first house was bank-owned when I bought for 107,000 cash at the end of 2010 and it sold for 240,000. I received an offer over asking on that house before it was even listed on the MLS -just a “coming soon” sign. The buyer had a VA loan and the appraiser appraised at less than the offer from the buyer. So I ended up getting only 2000 more than asking and 2000 less than the offer. ***So in that case the appraiser forced down the deal between a willing buyer and a willing seller by a measly amount.

The second house was in the highly desirable Midtown area and was brand new construction that I had bought for 409,000 in August of 2014 but construction wasn’t finished until June of 2015. I priced it at 479k and the neighbors were incredulous, “is that all?” Well easy for them to say. After about two weeks on the market I came home to see an identical property 5 houses down had been added to the market as well, priced at 499,000 but with much better views. In 2 weeks it sold for very nearly that much. But not mine. So I took a trip out to see what new construction was available similar to mine in this desirable Midtown location. Well there had been and continued to be a lot of building going on and stuff was starting to come onto the market – 18 houses at 1 development and 6 at another with them building six more as soon as those sold. With the election fast approaching, along with the glut of new homes to compete with mine, I dropped the price. I ended up selling that house for 462,000, nearly 13% over what I bought it for, but barely enough to cover the transaction costs. There was no problem with the appraisal since I had the excellent comp 5 houses down.

**Sacramento has a very hot market in the midtown area due to the new stadium just opened for the Kings basketball team and a severe shortage of affordable housing. Of course the new stuff being built isn’t affordable stuff generally, but more often gentrification. But I can’t imagine how they are going to sell all of these expensive new houses they are building, and the costs of services and parking is rapidly rising. (got to cover the public subsidy of the new stadium, of course) Finally, the rapid rise in housing costs in the midtown area is pricing out the very people that made the area desirable as a funky and happening place to live, and the escalating parking is discouraging the customers of businesses that are also facing higher service fees and wage increases of 50 cents to $1 per hour per year from the current $10/hr. I think it will be hard to keep this bubble inflating, and I am glad to be out of it.

I live pt in Sacramento. Midtown, as you indicate, is super hot and desirable but has gotten very expensive recently. There are new homes and condos going in midtown and downtown. Many of those are pretty high priced for this area. I think some of what happens is the usual: a lot of buyers are from the SF Bay area, where RE is super, mega expensive and sometimes not all that available. So they buy in places like Sacramento and rent. And/or they work from Sacramento.

What I’m hearing is that inventory is pretty low overall. Two work colleagues either bought just recently or are looking. One person who bought recently – after selling a property in Reno – couldn’t afford anything reasonably close to downtown (where we work). That person bought a place in far north Natomas. Not a bad area, but far away. Another collegue is presently looking mainly around Carmichael (not too far from downtown and a pleasant area of older homes, many of them rehabbed and quite nice). That person says they feel like the prices keep rising even from one week to the next.

In my area near Land Park (highly desireable) just south of downtown there is not a lot of inventory, and it seems to sell pretty quickly. I see prices that are starting to match what happened right before the last bubble burst. The thing with Sacramento, though, is that if you can put down a decent down payment and get a low interest mortgage, you can probably ride out the boom and bust cycle if you are assured of enough income to continue paying the mortgage. Although I don’t want to stay here long term, it’s pretty clear that Sacramento will continue to grow and be a desireable place to live.

The Trump Tower could be characterized as a “Flagship” property for various reasons. This upper echelon value deflation trend is all very interesting but, how well does it correlate with rents and structure values at the lower levels of the income range? I gather from anecdotal evidence gleaned from street level communications that rents for the “lower orders” here Down South are still rising. As a percentage of income, many of my communicants display shock and anger at the rapacity of landlords, especially large corporate owned apartment complexes. A generally expressed view is that the corporate entities proceed upon a preset plan of rent inflation despite any headwinds experienced by the client population.

On the local commercial property front, our friendly small shop keeper has encountered yet another annual rent increase, even after she informed the managers for the landlord, a regional commercial property management firm headquartered in another state, that her business was treading water at best. All I can imagine to account for such hardheartedness is that these management entities have a set rate of return per rented property that they must achieve; I.E. a system of “metrics” controls everything else. There are plenty of vacant store fronts in our town, and the experience so far is as Mz ‘Y’ attests; start ups do their thing and then quickly wither away.

On another sector of the housing front, the hobo jungle next to the older Wal Mart store has been cleared away due to the fact that the piece of property it was situated on has been cleared of underbrush and listed for sale, yet again, as Commercial Property. Sixteen acres more or less, which looks suspiciously like a small flood plain as it falls away from higher ground on all sides to a drainage canal running through the centre. Even in a moderately successful community, this qualifies as waste ground. The Salvation Army homeless shelter is now full almost every night, and that is saying something given the rules and restrictions attendant to staying there. (In by Five P.M. for the night etc.)

Just the point about money laundering, I think a lot of small retail units operate as tax dodges or just as hobbies for people. A friend of mine was looking at the idea of renting a small unit in a chic little mall – all antique shops and specialist fashion. She spent a few days talking to the owners to see what she could find out. She told me she thought only one or two made a profit. The majority were ‘hobby’ shops – retired people looking for something to do, the wives of wealthy men wanting a little project – some were just for tax purposes. One was a shop selling cute Japanese antiques and the guy who owned it just ran it so he could go to Japan and buy the Japanese stuff he loved while writing it off as a business expense against his other ‘real’ businesses. No doubt some may have been for laundering too, although I suspect those places are in lower rent areas. But it did occur to me that if that’s replicated, then its likely to push up rents for starter businesses, there is no way they can compete with that.

Although an unusual case, in Banff in Canada is right in the middle of the National Park and there are strong restrictions on building houses. Only local workers or businesses can build or buy a house in most of the town. So of course what happens is that rich ski fanatics just open up small non-profit making businesses so they can qualify to make their mega sized winter homes. The result is a town with more Gucci stores than grocery stores, or so the locals claim.

A sibling has just such a hobby shop. Loves to buy and sell antiques. Doubt much money is made. The shop is in a small town in Western PA. Used to get a lot more buyers for the types of items that the shop specializes in. Now the younger generations are coming and are not interested in that style of antique anymore. Sibling looking to sell out… but has a real honking big hoarding problem, so, er, could take a while to off-load all the stuff.

I’ve noticed a distinct lack of interest in antiques amongst the younger generation. Its an interesting generational shift.

They’re into cold, emotionless, heartless, ultra-modern.

Sterile, boring, unchallenging.

Like them.

Clean, cool, simple elegant.

All a matter of perspective.

I am a tenant with a hoarder. In the literal “pile” in the garage I actually found an old Western Electric dial telephone (pre-Chinese).

Yeah, that shift has happened everywhere I think – it was very noticeable when I lived in the UK in the 1990’s that antique shops were closing down everywhere, despite the English love of antiques. Partly its just cultural. I remember years back reading an article by a prominent writer about how he and his wife in their 20’s saved up to buy a big Victorian dining table for their house – they felt that this was a sign that they’d ‘made it’. When they told that story to their grown up children, they just laughed and thought it was crazy.

I think the inevitable Ikea has a big impact too. When I was growing up my parents had some antique furniture around the house – it wasn’t because they liked antiques (they didn’t) but because going to antique auctions was a cheap way to buy reasonable quality furniture. Now its just not worth the hassle and cost when you can buy something well made and stylish in a flatpack.

Some antiques are tiny. I have one that likes mixing and has a couple of larger chairs and I have done what would be a horror to antiquers…painted a chair and covered it with modern fabric. I have two more I am going to paint and put linen on. It may be some don’t care for the dark finishes but have interesting shapes and history. I’ve told them to feel free to do what they want with a piece and keep it in the family and make new history rather than worry about ‘value’.

They have neither room nor a permanent abode.

Shades of 4th Avenue in Tucson! However, recent rent increases are forcing the dippy-hippy shops to move elsewhere. Or shut down.

And then there’s that shoe store on Congress Street in Downtown Tucson. It’s owned by a University of Arizona basketball star who’s now in the NBA. I have never, ever, EVER seen a shopper in that place, and it’s in its second Downtown location.

The LA area I live in has seen enormous rent increases.

This past weekend, I noticed three move outs in my building. I’ve lived in the building a number of years and never saw 3 in one weekend.

I only got the chance to speak with one of the movers and, sure enough, it was due to rent increases.

Even these numbers represent a denial of reality by the sellers. The problem is that these owners, both of the condos/co-ops and the buildings, aren’t just owning for a pretty view in a luxury apartment with a posh address. They built and bought with capital appreciation in mind. And not just a modest gain 20-40 years down the line, big money gains. These were investments, first and foremost. So the condo/co-op owners are refusing to admit their cash cow is ill, while the building owners won’t reduce the common charges, as less luxuries will make their buildings look a little too plebeian for prospective buyers (and fewer people milling about creates the illusion of exclusivity, so that’s even less motivation to fill vacancies). Alas, though, it turns out Saudi oil barons, Russian oligarchs, and Chinese nouveau riche are a limited resource. So expect these owners to keep their heads in the sand, while their neighborhoods become ghost towns.

I’m wondering why it is that real estate developers are the last to know. It must pay not to know and just go ahead and build up a mind-boggling surplus of lux apartments because they can all be written off and at some point demolished. Seems kinda wasteful, no? What would the economy look like without this nonsense? Why can’t there be a moratorium on real estate? Where is Michael Hudson when we need him?

Why can’t they just build smaller houses that more people can afford?

Well, susan the other, here’s the reason:

Real estate developers aren’t known for being deep thinkers. Matter of fact, there’s more deep thinking on this thread than there is in the minds of most of them.

I don’t know what they’re thinking when they start a project, but my understanding is, once a project is underway, how the project proceeds at that point is dictated by whomever financed it. At least that was the explanation I heard during the last recession why new over-priced apartments would offer signing and move-in bonuses, but would never, ever lower the rent. The bank would have shit a brick.

I live in a rural county in Virginia. It’s a college town VMI, W&L. This has kept the bottom from dropping out. There was only 1 excess subdivision built in the past building boom. The county used to have many factories. It was a place where the factories from the Union north stopped on their way to Mexico. Air conditioning made it possible for the northern execs to live in the south. In the year before NAFTA was passed, the profitable Blue Bird factory was bought from the family that had owned it for ages. A friend who worked there said, “the pays ok but they expect you to work hard for it.” In the early 90’s, in rural VA, $15/an hour was ok. Less than a year after NAFTA passed, it moved to Mexico. Bonded Fibers was sold to China – the machinery moved to China and the plant closed. This process started in the 80s when factories that were in the flood zone closed after a major flood. The town where the factory workers lived used to be solid Democratic – this year it went solidly Trump. Real estate has gone from where in the 60s one could buy a logged over 1/2 a mountain for several thousand dollars. Back to the land hippies moved here in the 70s driving up land prices. Then retirees from New Jersey selling their homes for $250,000- 4000,000 and buying old small farms for $100,000. Now unbuildable steep mountainside is assessed over $2000 an acre. I bought in the mid 80s a fixer uppable at the bottom of the market. One has to drive across a creek to get to house – a bridge would cost $40,000 Rents are now comparable to Knoxville, Tennessee where my daughter lived a while ago. $650- 800 for a single bedroom. For quite a while there was a good business in selling farms for gentile horse farms and farmettes for rich people. Now properties over $250000 are not moving. The rest are selling like they did in the 90s but there are many more real estate agents. Where I live is an excellent place to raise children. The schools are decent. The countryside beautiful and except for a couple of places unpolluted. The colleges add cultural activities. Good jobs are hard to find. Not so good for people 15 to 30. Wal Mart has driven places like the downtown hardware store out of business.

The Trump towers might become a novelty and a buyer could make a premium if “The Donald ” doesn’t sell to the government to make it into a new headquarters for the Secret Service, Douup! In that case the Gov would probably buy you out ! A win win situation! As for the rest of the realestate in the area, it’s just the regime change and new money will move in as the old party monied move on!

The Trump towers might become a novelty and a buyer could make a premium if “The Donald ” doesn’t sell to the government to make it into a new headquarters for the Secret Service, Douup! In that case the Gov would probably buy you out ! A win win situation! As for the rest of the realestate in the area, it’s just the regime change and new money will move in as the old party monied move on!

During the real estate engineered “boom” in NYC real estate starting in the 1980’s, natives scrambled for housing, doubling up, fighting in housing court at 111 Centre St., and taking over squats to evade “homelessness.”

The wealth of some necessarily entails the impoverishment of others.

I walked one evening through the upper west side and midtown with a friend gazing at all the empty units and speculated that one day prices would collapse and actual people would inherit the vacancies.

I’m taking plenty of vitamins hoping I’ll live to see it.

For those who haven’t seen it yet, the late Robert Fitch uncovers the plot in The Assassination of New York. Nothing natural or free market about it.

The Seattle housing market is red-hot, with 14% increases in homes in the last year. The median price is $611,500. The average rent for 1-bedroom apartments in Seattle is $1,924 a month; for 2-bedroms it’s $2,705. We have a massive housing crisis, with more than 4,000 people living on the streets. Now that Vancouver, B.C. has a 15% surcharge on foreign purchasers of real estate who don’t live in the homes, Chinese and other foreign money is pouring into Seattle. Amazon and other high-tech companies are destroying the city I’ve lived in for 40 years.

Aren’t the forclosures just HELOC’s coming home to roost?

http://blog.credit.com/2015/10/the-new-foreclosure-threat-troubled-helocs-second-mortgages-127436/

In 2012 Trump Corp took out a $100 million dollar mortgage on Trump Tower. Open call for Federal Judges to dismiss with prejudice the eminent foreclosure and breach of contract complaint in exchange for a seat on the Supreme Court. Huge opportunity. Great deal.

Well, NPR just ran a dazzled piece about all the luxury that sought to undermine any suggestion that it’s not so great for the rest of us (they’re being built where rich people already live, dontchaknow). So the market must be poised to collapse. But then, a lot of things may be collapsing over the next ten years. Where to place our focus?

Doesn’t every broker in New York list their inventory at an inflated asking price?

Part of the point of this article I don’t get. 6,000 appartments for sale in a city of 1.6 Million, one of the most world-connected and dynamic, moreover, doesn’t seem like anything out of the ordinary. It’s probably about or below 1% of the housing stock, so it really doesn’t seem special. Same for rentals. Is there a typo?

Otherwise, as a European having lived in some of the most cramped parts (London, Paris, Netherlands) I can’t fathom a 1,000 sqt (i.e. nearly 100 m2) 1-bedroom flat! What on Earth do they do in the bedroom, play indoor golf?