Here we are, nearly ten years after the financial crisis. The financial services industry is so heavily subsidized as to not be properly considered to be private enterprise, yet even mid-level people get pay packages that would outrage any voter if an elected official made that much.

But the inadequate new regulations imposed in the bust and the less attractive profit prospects resulting from the super-low rates have some bankers chafing. Big-name players have been going West to the greener pastures of Silicon Valley.

By Sarah Anderson, who directs the Global Economy project at the Institute for Policy Studies and is the author of the new report Off the Deep End: The Wall Street Bonus Pool and Low-Wage Workers. Originally published at Alternet

Every year, the New York Comptroller releases a big number representing the combined value of the bonuses Wall Street banks have doled out to their employees. The state government keeps track of these payouts because a really big number boosts their local tax base. And this year’s number, released March 15, is indeed gigantic: $23.9 billion.

But imagine if those huge sums were channeled instead into the pockets of low-wage workers. The economy would get a much bigger bang for the buck because the poor tend to spend nearly every dollar they earn, creating beneficial economic ripple effects. The wealthy, by contrast, can afford to squirrel away more of their earnings. And so while the Wall Street bonus season may coincide with an uptick in luxury goods sales, a minimum wage hike would give America’s economy a much greater boost.

A new Institute for Policy Studies report includes four dramatic charts that reveal how the increase in Wall Street bonuses has far outpaced the rise in the federal minimum wage — and how this in turn has contributed to race and gender inequality.

Wall Street Bonuses v. Minimum Wage Earners

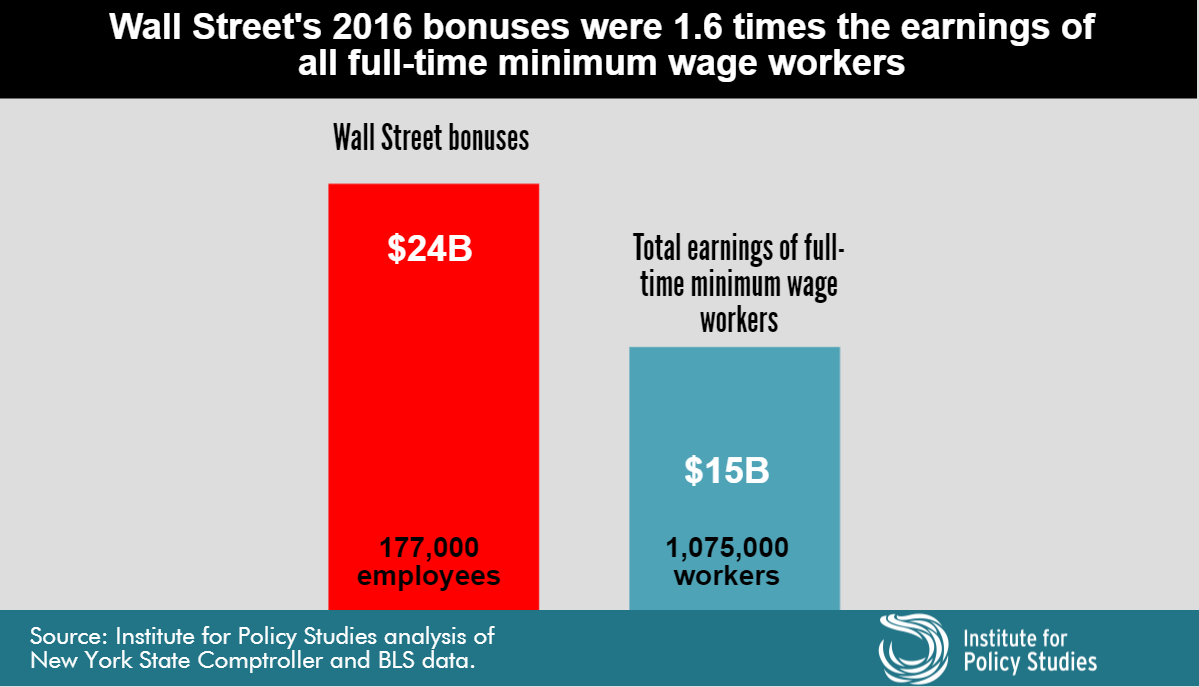

Wall Street banks doled out $23.9 billion in bonuses to their 177,000 New York-based employees, which amounts to 1.6 times the combined earnings of all 1,075,000 Americans who work full-time at the current federal minimum wage of $7.25 per hour.

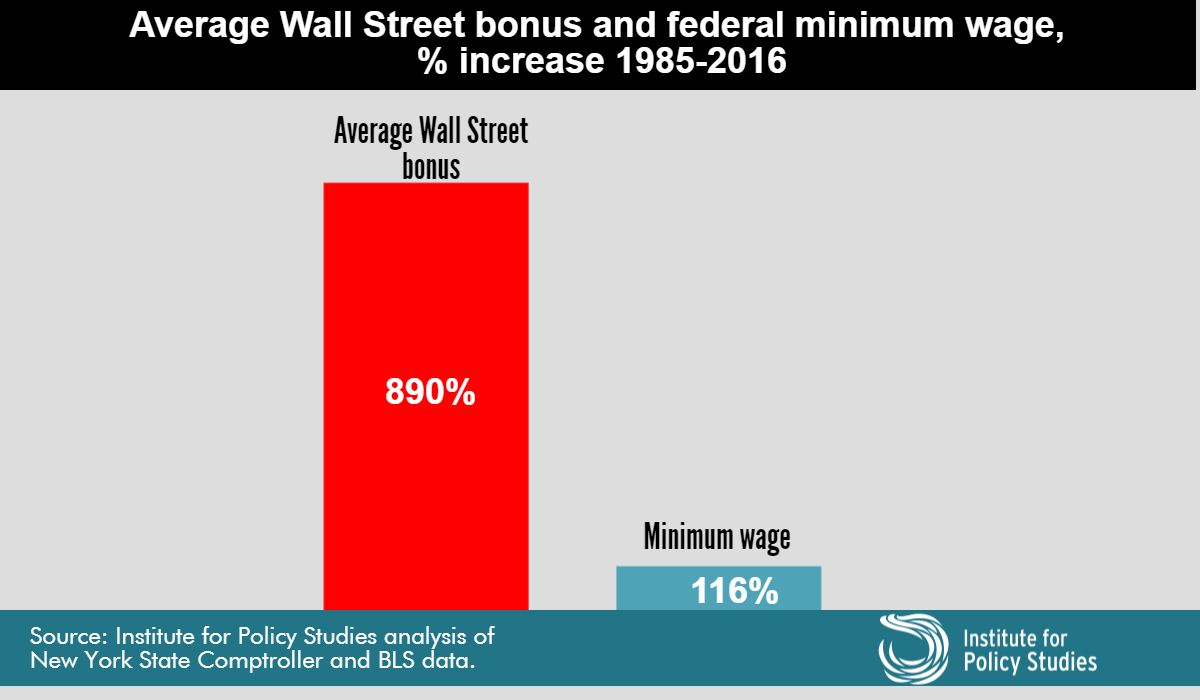

The average Wall Street bonus increased by just 1 percent last year. But the nominal value of the average bonus has grown by 890 percent since 1985, from $13,970 to $138,210. Meanwhile, the minimum wage has risen only 116 percent, from $3.35 per hour to $7.25. Adjusted for inflation, the minimum wage was nearly 3 percent lower in 2016 than in 1985, whereas the average bonus was about 343 percent higher.

The Race and Gender Divide

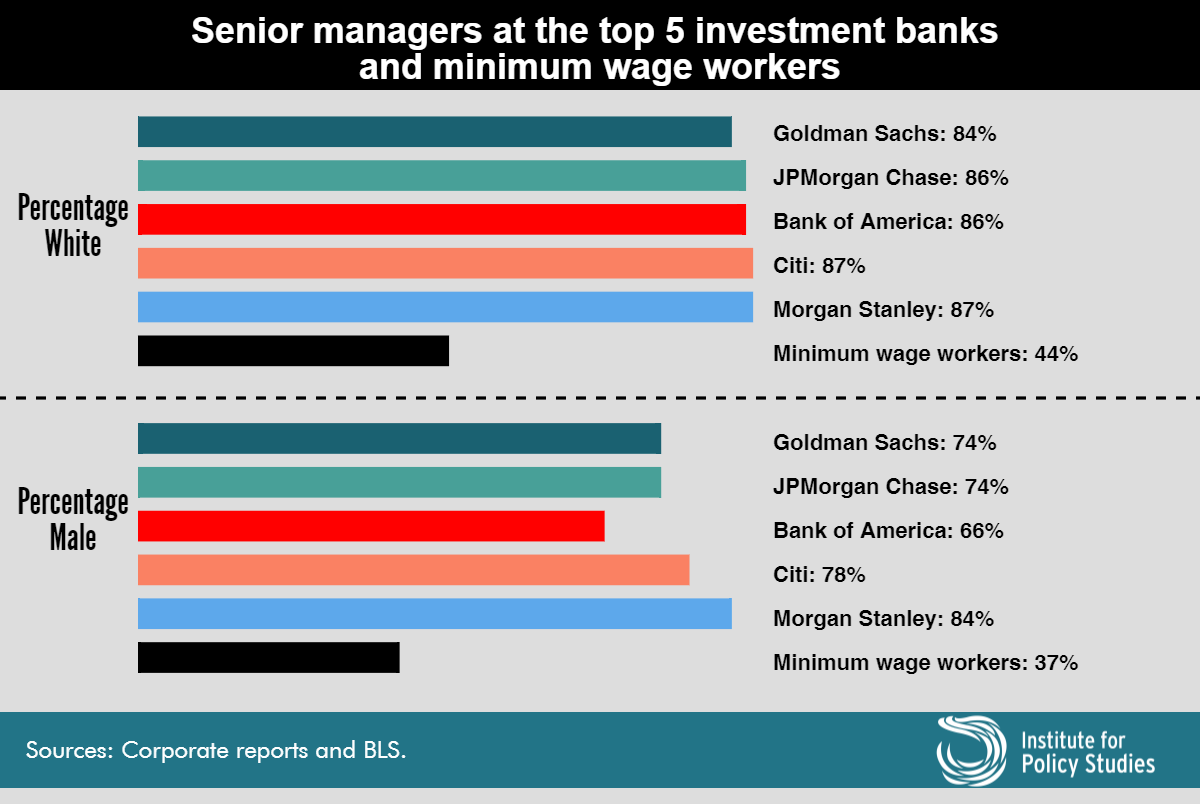

Over the past three decades, the dramatic rise in average financial industry bonuses relative to the minimum wage has contributed to racial and gender inequality. Workers at the bottom of the national wage scale are predominantly people of color and female, whereas those in Wall Street’s upper echelons are overwhelmingly white and male.

At the top five U.S. investment banks (JPMorgan Chase, Goldman Sachs, Bank of America, Merrill Lynch, Morgan Stanley, and Citigroup), the share of executives and top managers who are white ranges from 84 to 87 percent and the share who are male ranges from 66 to 84 percent, according to the firms’ own reports (see sources section). By contrast, only 44 percent of minimum wage workers are white and an even smaller share, just 37 percent, are male.

For Wall Street employees, annual bonuses come as an extra reward on top of their base salaries, which averaged $388,000 in 2015, the most recent year for which data are available. According to the New York State Comptroller, this is five times higher than the average salary for other New York City private sector employees.

On top of their cash salary and bonuses, top Wall Street executives also typically receive massive stock options and grants, most of which are deemed fully deductible “performance-based” pay and thus fully tax-deductible for the firm. According to a 2016 Institute for Policy Studies report, the top 20 U.S. banks paid out more than $2 billion in fully deductible performance pay to their top five executives between 2012 and 2015. At a 35 percent corporate tax rate, this translates into a tax break of more than $725 million, or $1.7 million per executive per year.

Wall Street Bonuses v. Low-Wage Service Workers

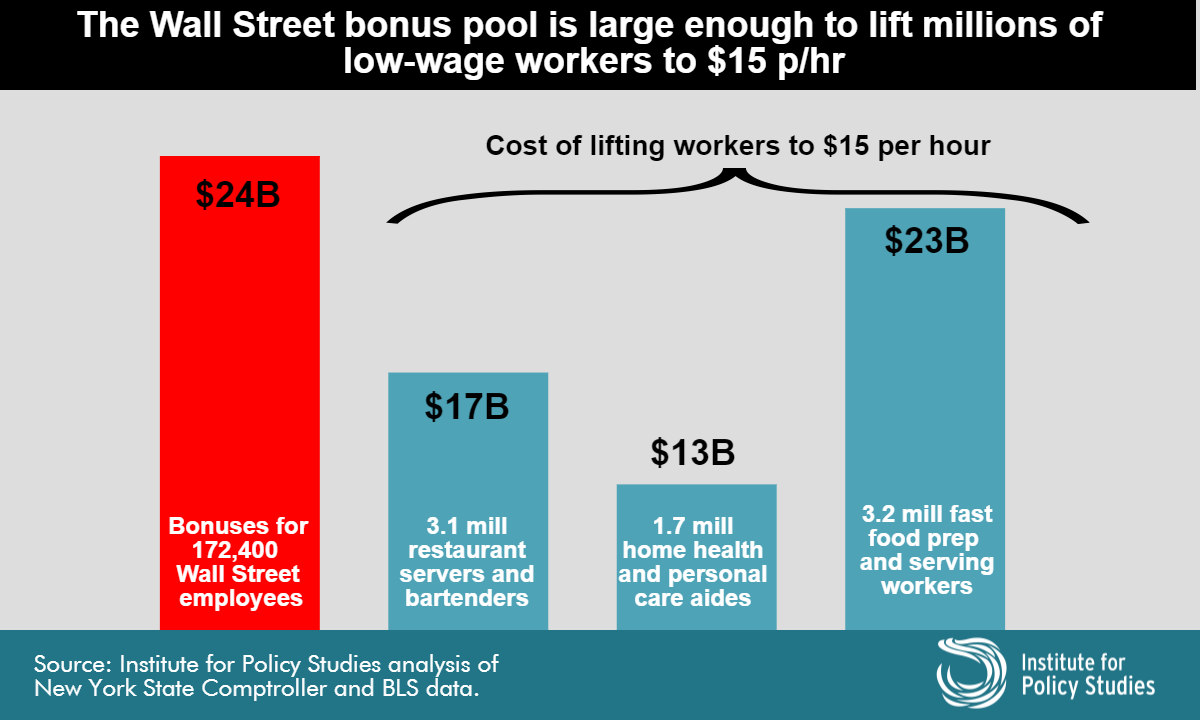

While living wage campaigns have been successful in many cities, Oxfam and the Economic Policy Institute report that 44 percent of U.S. workers still earn less than $15 per hour. This is the wage level needed to cover basic living costs in most areas of the country, according to the National Employment Law Project.

The Wall Street bonus pool was large enough in 2016 to have lifted all of America’s 3.2 million fast food prep and serving workers up to $15 per hour — and still have had $776 million left over. Or that bonus pool could have raised to $15 the hourly wage of all our nation’s 1.7 million home care aides or all of our 3.1 million restaurant servers and bartenders.

Wall Street Bonus Reform Long Overdue

Huge Wall Street bonus payouts also encourage the sorts of high-risk behaviors that led to the 2008 financial crisis. And yet financial regulators have still not implemented a Wall Street bonus reform law that has been on the books for nearly seven years. Section 956 of the 2010 Dodd-Frank financial reform legislation prohibits financial industry pay packages that encourage “inappropriate risks.” Regulators were supposed to implement this new rule within nine months of the law’s passage.

In 2011, regulators issued a proposed rule that did not go far enough to prevent the type of behavior that led to the 2008 crash. As spelled out in detail in Institute for Policy Studies comments to the SEC, the proposed rule falls short in several areas, including overly lenient bonus deferrals, weak stock-based pay restrictions, and enforcement proposals that leave too much discretion to bank managers.

While regulators responded to criticism by agreeing to issue a new proposal, this work was not completed before the end of the Obama administration. And now with Republican control of both Congress and the White House, there is a strong chance it will be postponed indefinitely. House Republican leadership introduced a bill in the last session to repeal most of the Dodd-Frank reform package, including the Wall Street pay provision. President Donald Trump has also vowed to “do a big number” on the landmark financial reform legislation.

In the meantime, the Wall Street bonus culture that contributed to the 2008 financial crisis continues to flourish.

So Capitalism for the poor, Socialism for the the rich continues apace then?

Good to know there are some things in life we can still rely on.

Guillotines is what we need. Don’t we?

We do need them. But we need to plan carefully — we also need tumbrels to get the banksters to the guillotines. We don’t want the process to be interrupted by systemic bottlenecks. An adequate supply of pitchforks could also be useful.

Short question: what are the major arguments for saying the financial services industry is so heavily subsidized as to not be properly considered to be private enterprise? I could guess a little, but I lack the knowledge to make more specific arguments.

All of the im- and explicit guarantees/backstops, low taxes, their TBTF status + the political unwillingness to prosecute individuals.

Not to mention their exclusive government franchise to create US dollars out of thin air (well, really someone has to invest a few computer keystrokes in the effort — unless it’s all done by algorithms now).

Also QE1, QE2, QE3, the Twist,and the promise of Bail-Ins, Bail-Outs and Negative Interest Rates.

This doesn’t answer your questions specifically, but the crucial place to start is money creation.

http://m.youtube.com/watch?v=2nBPN-MKefA

Don’t be put off by some of the dubious associations. It’s by no means a perfect explanation of money/debt, how it is created and by whom etc but it informs everything we see unfolding before our eyes today.

Hopefully it will help you understand that we are where we are by design, not by the hand of a harsh but fair free market or even by unhappy accident.

With regard to private banks create money – unequivocally true, this struck me: “The economy would get a much bigger bang for the buck because the poor tend to spend nearly every dollar they earn, creating beneficial economic ripple effects.”

Wait. What if the poor aren’t actually on a shopping spree as assumed? It’s a mystery. Maybe not.

Consider: “Because they have never learned to even contemplate that perhaps people can be so deep in debt that they have nothing left to spend. Instead, their knowledge base states that if people don’t spend, they must be saving. Those are the sole two options. And so if the US government reports that 863,000 underpaid new waiters have been hired, these waiters have to go out and spend all that underpayment, they must consume. And if they don’t, that becomes The American Mystery Story.”

https://www.theautomaticearth.com/2015/03/the-american-story-is-a-mystery-only-to-economists/

It is no wonder the bankers don’t want us to pay down our debts – they carry interest which feed the bankers. Considering that according to the calculations of Margrit Kennedy, 45% interest is fed to bankers with every dollar that is exchanged even when we’re just “trading” in the marketplace. https://youtu.be/QuBy3BzCXwg

So yes, I can see how these bankers collect these huge bonuses since they loan/create money as debt. We’ve allowed the entire business of sovereign currency issue to become privatized as debt issue. Add tax arbitrage to the mix, and you’ve got a fine cocktail. The duplicitous bankers will simultaneously grab what assets you may have (home) with a wallop of shaming because you don’t pay your debt, yet give you the gaze of disdain when you pay off the mortgage or pay off a credit card net 30. Because – without our debt, they aren’t fed with the caviar to which they’ve become accustomed.

Indeed.

As I stated the other day, somewhat controversially it would appear with one poster not a million miles above (who did see fit to offer me some ‘helpful’ aversion therapy by providing some links on the history of debt WTF?!?) the real ‘wealth creators’ in the current debt based system, certainly in terms of volume, are the borrowers not, as we are often led to believe, the blessed few who make money in their sleep lending at no personal risk and with impunity according to demand.

The debt created is a mortgage on the fruits of future labours of borrowers if you like and adds to the money supply.

Central bank systems are as good as ‘privatised’ as you say. A magic money tree in which its owners, close associates and myriad of self-serving cronies have realised, particularly post 2008, they can effectively now run for maximum profit at minimal cost, in no small part thanks to ‘benign’ monetary policy, and without the genuine downtrodden, fearful ‘wealth creators’ barely raising a finger of dissent.

Additionally it also helps that there are plenty of trusting and naive souls out there who actually still buy into the lie that it might have been their relatively infinitesimal excesses which bought us to where we are, and it is they who are the architects of their own misery, but unsurprisingly this fallacious narrative clearly suits some.

Thanks for all the info!

So Wall St. bonuses shot up 890% during the same period that gave us the S&L crisis, Black Monday, the web 1.0 bubble burst, and then the Great Recession. Retaining the most competent employees, my tukhus.

this is an unpopular opinion and gonna get me flamed—you can’t have $15/hr statutory min. wage + non-enforcement of immigration laws on employers/at the border. pick one or the other.

the incentive for employers to cheat is too great. just saying. i understand if i get flamed.

seems pretty sensible to me, and also to canada and mexico who both control their immigration, I can’t go work in either place…and then there’s the robots….

They control their documented immigration, just as the US does. Big and small employers love undocumented immigrants in all three countries. Don’t blame other countries for your country’s failure to hold big employer scammers particularly to heel. It’s not a bug in your country; it’s a feature.

Totally agree. On this, I’d even say I agree with Trump that we need to reign in illegal immigration, but by going after the companies who hire them, not by building some dumb wall.

And trade agreements that decimates another countries agriculture! NAFTA not only farked up things in manufacturing in the US, but for Mexican farmers as well!

IMHO, if we took immigration enforcement on employers more seriously there would be less need for border enforcement. Latino agricultural workers (since that’s what the popular imagination conjures in response to the term “immigrants,” not Indian engineers on H1-Bs working for Facebook) aren’t going to show up to work for starvation wages if even the starvation wages aren’t available.

A while ago I saw a liberal “defense” of immigration, basically along the lines of, “Without underpaid ag workers food will cost a bunch more, so we need immigrants!” My response was “WTF, are you seriously defending what practically amounts to slave plantation owners right now?” It really shows how far the technocrats in the MSM & Dem establishment have taken us from any left ideology: their “defense of immigrants” is actually a defense of exploitative labor practices.

Yes, Will.

Here in Queensland, most of the banana, avocado, strawberry, mango, pineapples etc – are picked by young travellers on a working visa.

They get the legal rate of about $20.

Why aren’t me and other underemployed people doing this work?

It is hot and hard labor, where you drink and sweat 5 kg of water. And $20 is not enough. So yes exploitative is the word

As a former Wall Street investment banker, I would cheerfully pull the lever on each and every bank and banker. They provide few necessary services and represent a gigantic drain on the productive economy. Investment banks exist only to siphon off or outright steal money from the productive part of the economy. The few useful services they provide could be done for peanuts by a handful of banks.

A common contention is that there are few bad apples on Wall Street. My experience indicates that each and every employee is complicit in the basically fraudulent business they run. Secretaries and drivers all know the score even if they don’t know the details.

As Lloyd Blankfein said, they are doing God’s work, but only if it’s the God of the Old Testament and the bankers are the Jews. Everyone else gets raped, pillaged and smited. My long-standing solution was, is and shall be a neutron bomb strike on Manhattan and Stamford.

The actionable place to start is the Derivatives ‘market.’ ( It’s a con game. )

The biggest sub-market is the purchase of interest rate protection… in all its guises.

You have four hyper-dominant players writing 99% of all such contracts. (!!!)

When the Fed held down interest rates for years on end, it made writing such protection the closest thing to printing money.

The con is that the players writing the protection are largely in control of interest rates — via their influence at the Fed and Treasury.

This ‘game’ is the true source of Wall Street’s astounding money skim.

A big rise in interest rates will, of course, blow all four institutions up. Suddenly, they’d be paying out gazzillions.

This racket must be terminated.