By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street

Revenues in the current quarter – Q3 of its fiscal year – would drop 4% to 6% year-over-year, Cisco said after hours today. Shares plunged 8% to around $31 in late trading. Timing of the announcement was impeccable: Minutes after the Dow finished its 372-point plunge.

It also announced 1,100 layoffs on top of the 5,500 layoffs it revealed last August (7% of its workforce at the time), and it added $814 million in charges related to those restructuring efforts, spread over Q3 and Q4.

Cisco has a history of tripping up the markets.

In an earnings call in November 2007, then CEO John Chambers famously used “very lumpy” to describe growth in the US. The S&P 500 and the Dow had just edged down from all-time highs. The market was still blissfully ignoring the hissing from the housing bubble and the stench from the banks. Cisco’s quarter had been phenomenal, with revenues up 17%. But after some gushing, Chambers said revenue growth in the US would be “very lumpy.” The Financial Crisis was next.

So Cisco’s revenue “growth” – in quotes because it’s a decline – no longer compares to the heady days of that time. Revenue in its fiscal Q3 fell 0.5%% to $11.94 billion, with product revenue flat and service revenue down 2%. For the three quarters combined, revenues are down 2%.

But cost cutting has been effective: operating expenses fell 8%, particularly in the wrong places for a company with declining sales: In research and development, and in sales and marketing. So net income rose 7%.

But instead of continuing down this path of revenue stagnation, Cisco indicated that it would go down a path of sharper revenue declines, and expected its Q4 revenues to fall by 4% to 6% year-over-year.

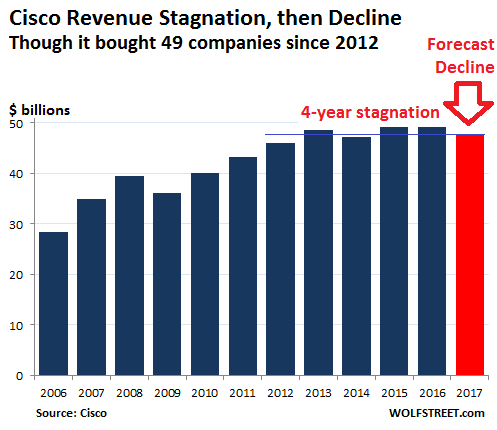

With Q4 2016 revenues at $12.6 billion, a 6% decline would bring Q4 2017 to $11.8 billion, which would bring fiscal 2017 annual revenues down to $47.7 billion, the lowest since 2014, and barely above 2012 revenues.

This chart includes estimated annual revenues for 2017 as per Cisco’s lowered Q4 forecast. In other words, after four years of stagnation comes the decline:

“I am pleased with the progress we are making on the multi-year transformation of our business,” said CEO Chuck Robbins in the statement.

In the conference call, Robbins blamed federal government spending for about a quarter of that decline (1 point of the 4% to 6% decline). The rest of that decline was just plain lumpy demand, as Chambers might have put it.

This revenue decline is occurring despite Cisco’s permanent acquisition binge. Since 2012, Cisco has acquired 49 companies, from tiny startups to not so small companies, in order to boost its revenues and technologies and stay relevant and change its future. So far this year, it has made four deals, including the $3.7 billion acquisition of AppDynamics.

Cisco has not disclosed how much it spent on 28 of those 49 companies. But for the 21 acquisitions for which it disclosed the terms, including AppDynamics, Cisco spent $18 billion! And yet, during those five years, revenues have gone nowhere!

It also blew $27 billion on buying back its own shares over those five years. Between acquisitions and share buybacks, that’s at least $45 billion out the window with nothing to show for.

Many of Cisco’s problems are company specific. For example, it’s hard for a tech company to design new and better mousetraps when it’s busy cutting in-house R&D, axing its people, and buying back its own shares.

But “lumpy” demand for a company as large as Cisco that sells primarily to corporate customers has broader implications, especially if there is a sudden and unexpected shift. Why is corporate demand suddenly drying up? Is it like November 2007, when stocks were just barely down from super-inflated all-time highs, but corporate customers were spooked by the real problems and uncertainties they saw in the economy that could no longer be brushed under the rug?

In 2007, Cisco was a key thermometer for corporate demand. Today, its revenues are 37% larger. Cisco may be on the path to irrelevance, but it cannot be ignored when it comes to corporate demand. It might be an indication that corporate investment in tech has taken as sudden and sharp turn lower, as Cisco’s customers are closing their wallets and battening down their hatches, spooked by whatever they see coming over the horizon.

But there remains a sign of our crazy times: Despite Cisco’s five years of revenue stagnation, serial layoffs, and $18-billion acquisition binge to nowhere, its shares have actually doubled!

And it’s not the only company riding up miraculous asset bubbles. But pressures are building on these bubbles – and some of them are already deflating. What the slow crash of classic car prices says about the future of other asset classes. Read… This Is How an Asset Bubble Gets Unwound these Days

Alas, it’s never enough for a firm to have ebbs and flows of profits. Cisco is profiting, but to appease the asset trackers, err share holders, they have to engineer price increases. Clearly in the short term that is working, but it remains to be seen if aqui-hiring talent and technology can improve the bottom line.

This could also just be a/the high watermark for corporate network spending on things like Cisco products if this migration to the cloud is real. I’m betting neither Amazon nor Google are building their cloud data centers with Cisco networking hardware.

very soon in-house IT departments will be extinct in smaller companies and not universal at large ones (replaced by the cloud + a skeleton crew, if any).

But keep pushing those H1-B visas.

There will also be more US job losses then. Personally I think entrusting everything to “the cloud” (ie, someone else’s computer) is kind of nuts, however convenient it may be.

There will also be more US job losses then. Personally I think entrusting everything to “the cloud” (ie, someone else’s computer) seems kind of nuts, however convenient, but what do I know…

XKCD opined, but everybody’s always already seen XKCD.

Cisco makes “premium” (relatively expensive) network hardware used in enterprise data centers and branch offices. But more and more of its customers are gutting their data centers and switching to 3rd party cloud services (from Microsoft, Google and Amazon). The networks in many of those cloud environments are built almost entirely in software, and a lot of the hardware is on generic servers that increasinly are built by the cloud providers themselves. Cisco’s premium hardware market is in the process of disappearing the way Sun’s did a decade ago. Their software and services offerings can’t close the gap because of stiff competition in those markets and a lack of human resources to pursue them.

Agreed. I work in the cloud space. Massive migration is happening. Companies, even very large ones, would rather not have their own data centers.

Facebook, Google, and Amazon all build their own servers and networking devices.

This does not bode well for Cisco, HP, Dell, and a slew of other companies.

Cisco has a history of leading market turns…so the author gives one example of that.

Wolf has only ever written bearish articles since he started blogging. I guess a broken clock will be right once a decade.

1. The headline very clearly stated that this post was by Richter. If you don’t like his work, don’t read him. This is equivalent to going to an Indian restaurant and then complaining that you don’t like spicy food.

2. Bears happen to be fundamentally oriented. We post Wolf mainly because he does a lot of very good work on what is going on within sectors, like subprime auto loans, student debt, and commercial and residential real estate. But I take it you have a problem with that.

I was a network engineer at Cisco from 96 to 99. The company was just lucky to be where they were when they were, there is nothing special about them, which revealed itself after 2000 when they had to rely on more than just being in the right place at the right time. After 2000 all they did was M&A and they ruined what they bought. (Linksys) Now they are trying g to transition to a software company and buy up those technologies? Ha!

I still have friends working at Cisco, last week one of them told me there were rumors of layoffs, he was worried and it sounded like moral was low.

There has been an increase in VM density per server (due to LXC/LXD amongst other containerization technologies like microservices, whereby you can easily host 300-600 microservices per server), and with technologies like SR-IOV, XDP, eBPF, etc., occuring within servers, the need for more ToR switches has reduced.

As much as intel has been behind the technology curve, with regards to mobile & IoT, Cisco has been behind the technology curve, with regards to SDN (some of it, is outside its control and though some within, it does not lead these market segments (read Cumulus Networks, SNABB switches, Cilium, Openstack networking)

There is also another trend of commoditization of networking from specialized ASICs to White Boxes (aka using standard intel chipsets, to drive networking), so the premiums afforded in many of these markets will get squeezed

This will affect some of the primary revenue sources of cisco

we haven’t bought much new Cisco equipment in years… Only major purchase within the past 5 years was their (very expensive) call-center/VOIP servers.

Their routers & switches are sooo cheap used, if you don’t mind running no-longer-supported versions of the internal software.

The North Koreans certainly prefer unsupported versions. :-)

Demand was “lumpy” back in 2013 too. http://www.zerohedge.com/contributed/2013-08-16/cisco-ceo-chamber%E2%80%99s-warning-record-sales-and-%E2%80%9Clumpy%E2%80%9D-demand-just-november-200

The only condition for the markets (real and whatnot) to turn south is for David Stockman to throw in the towel.

Anything else is just noise.

We have Cisco as a customer as well as a technology provider. At one point we had a handshake agreement with them to install their incredibly expensive telepresence technology at each of our branch offices, but when our new CFO came in and saw how much it was going to cost he was apoplectic and shut the whole project down. I think we have them in about half of the offices now, and for the most part they just gather dust. It’s easier for most employees to just use Skype / Google Hangouts / Slack from their desk for free.

Does this support the Conservative’s mantra that by allowing corporations to keep more of their money they will create jobs! jobs! jobs!? What is their net on jobs for this corporation’s spending of excess funds, roughly $9 billion per year?

Current Market Cap: ~$160B

All time Stock Buybacks: ~$100B

Net Cash w/ generous 0% repatriation cost: $33B

Revenues: Unchanged over last 5 years.

Shares Outstanding: Static due to dilutive M&A and Exec compensation.

Layoffs: Annual

A repatriation tax window is unlikely to have any effect on net jobs. There will be some pay down of higher cost debt, and some big ticket local M&A based on latest fads. There will be no new value creation or innovation.

Were Cisco’s sales additionally impacted by the leaks about how Cisco routers were one of the built-in vulnerabilities to hacking?

While this exploit was no surprise to me, some in the industry may have lost their trust in Cisco.

I wonder why Richter didn’t mention this–maybe it’s too recent for its impact to be measured?

Cisco not only has the typical corporate illness…share buybacks instead of R&D, etc…it has a particularly nasty technical problem. Computing power has now caught up to the specialized hardware in switches and routers. You can make a typical, speedy computer into a virtual switch, router, firewall, etc. with software instructions. In fact managing such virtual hardware is an up-and-coming technology, and it’s looking like the specialized chips that Cisco, Juniper, etc. are relying on will be obsolete if they aren’t already. Meanwhile the bandwidth demands of billions of smart phones means the market in networking is actually expanding explosively.

Finally, I’d suggest the security holes in Cisco and other American hardware manufacturers’ goods have at least put a damper on overseas markets. China’s going to buy from Hauwei, not Cisco. Apparently that little security peccadillo cost U.S. tech billions.

The diagnosis of Cisco’s current predicament is correct but the symptom is not the wider corporate economy it is Cisco’s failure to adapt to changing trends in Enterprise IT. Cloud & SaaS have been over-hyped for years but each year incrementally more enterprises shift their spend in this direction. Combine that with the fact that NO new technology-savvy company purchases Cisco products and you will have significant challenges maintaining revenues no matter how many acquisitions you make.

The same symptom is impacting Oracle, IBM, HPE, Dell/EMC and a litany of other “classic” Enterprise IT firms.

Things that used to be complex and expensive are now simply and easily-automated and this spells trouble for legacy corporate IT vendors.

It’s not sudden and is not unique to Cisco. Corporate IT departments just don’t spend as much in this area (along with devices) as they used to. Instead itIT budgets at large enterprises are more focused on anti-virus/intrusion, software, cloud, outsourcing, and probably a half dozen other areas I’m forgetting. As a result, Cisco has become the new IBM, furiously trying to acquire top line growth and buy back shares to show EPS growth. Meanwhile, as Wolf accurately (and importantly) notes, they’re also cutting R&D to boost profits, thereby sealing their fate as a dying company.

It’s far more secular than cyclical.

“But there remains a sign of our crazy times: Despite Cisco’s five years of revenue stagnation, serial layoffs, and $18-billion acquisition binge to nowhere, its shares have actually doubled!”

That’s #CasinoCapital for ya!

Cisco also abandoned their fledgling cloud efforts. Some of the money not being spent with Cisco is ending up elsewhere (AWS, Azure, Google) so I’ll take Wolf’s words with a pinch of salt. There are far more ominous harbingers of economic doom IMO.

Since everything seems to be going to the cloud where does this leave us with our personal information like say legal records or medical records backed up on the cloud? This has always been the thing that drives me crazy. I pay someone to help me and then they steal my information and give it amazon or something.