Submitted by Leo Kolivakis, publisher of Pension Pulse.

Before getting into this weekend’s food for thought topic, I think you should all watch Secretary of the Treasury Tim Geithner’s interview on ABC’s This Week and the roundtable discussion where Paul Krugman expressed his concerns with the plan.

Interestingly, Krugman thinks the U.S. government is not doing enough to combat the crisis and that the plan will lead to another Japanese-style lost decade. I agree and I also agree that deficits do not matter in times of crisis because if you don’t get the economy working again, the deficits will only get worse in the future.

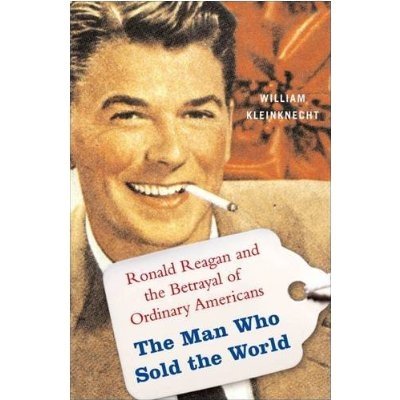

But I want to take a step back this weekend and look at the historical events that laid the foundation to this global crisis. On Friday morning, I listened to an excellent interview on CBC Radio’s The Current with Bill Kleinknecht, author of the new book, The Man Who Sold The World: Ronald Reagan and the Betrayal of Main Street America.

Ever since the global economic crisis took hold, people have been looking for a place to park the blame for it. Over-extended homeowners. Greedy bankers. Lackluster regulators. Inept elected officials.

Mr. Kleinknecht has another idea. He says the roots of this crisis go all the way back to the early 1980s and land at the feet of U.S. President Ronald Reagan. Click here to listen to the interview (scroll down to part 3).

Here is a review from Joe Conason published in BuzzFlash Reviews:

From the Nation:

The myth of Ronald Reagan’s greatness has reached epic proportions. The public rates him as one of the most popular presidents, and Republicans everywhere seek to cast themselves in his image. But award-winning journalist William Kleinknecht shows in this penetrating analysis of his presidency that the Reagan legacy has been devastating for the country—especially for the ordinary Americans he claimed to represent.

So much that has gone wrong in America—including the subprime mortgage crisis and the meltdown of the financial sector—can be traced directly to Reagan’s policies. The financial deregulation launched in the 1980s freed banks and securities firms to squander hundreds of billions of dollars and make a shambles of the economy.

Boom-and-bust cycles, obscene CEO salaries, blackouts, drug-company scandals, collapsing bridges, plummeting wages for working people, the flight of U.S. manufacturing abroad—these are all products of Reagan’s free-market zealotry and his gutting of the public sector. Reagan pioneered the use of wedge issues like race and the war on drugs to distract America while his administration empowered corporations to lay waste to our traditional ways of life.

In the spirit of Thomas Frank’s What’s the Matter with Kansas?, Kleinknecht takes us to Reagan’s hometown of Dixon, Illinois, to show that he was anything but a friend to Main Street America. Relying on detailed factual analysis rather than opinion, The Man Who Sold the World is the first major work to explode the Reagan myth.

This book is a great companion to Will Bunch’s Tear Down This Myth: How the Reagan Legacy Has Distorted Our Politics and Haunts Our Future (Hardcover)

“A seasoned crime reporter of the old school, William Kleinknecht has penetrated the showbiz curtain to expose the venality and cynicism of the Reagan era—and tells us why the crimes of that time still matter so much today.”

So should we blame this mess on the Gipper? It’s easy to blame a dead president for laying the foundations of today’s global financial crisis, but there are many other figures from both political parties that followed the Gipper and cemented this crisis.

I leave you with another Go Left radio interview with Bill Kleinknecht (two parts; click below to listen). As you listen, keep in mind that it is important to remember the historical context of this global financial mess and the ideological undertones that played a role in shaping our financial markets.

Also, think about the wedge issues that are diverting attention from today’s bigger problems, including the fundamental breakdown of our pension system.

Part 1:

Part 2:

Bullshit!

CONGRESS PASSES WIDE-RANGING BILL EASING BANK LAWS

By STEPHEN LABATON

Published: Friday, November 5, 1999

''Today Congress voted to update the rules that have governed financial services since the Great Depression and replace them with a system for the 21st century,'' Treasury Secretary Lawrence H. Summers said. ''This historic legislation will better enable American companies to compete in the new economy.''

The decision to repeal the Glass-Steagall Act of 1933 provoked dire warnings from a handful of dissenters that the deregulation of Wall Street would someday wreak havoc on the nation's financial system. The original idea behind Glass-Steagall was that separation between bankers and brokers would reduce the potential conflicts of interest that were thought to have contributed to the speculative stock frenzy before the Depression.

Today's action followed a rich Congressional debate about the history of finance in America in this century, the causes of the banking crisis of the 1930's, the globalization of banking and the future of the nation's economy.

http://www.nytimes.com/1999/11/05/business/congress-passes-wide-ranging-bill-easing-bank-laws.html?sec=&spon=&pagewanted=1&emc=eta1

This be Clinton's mess.

Clinton was just dancing to Reagan’s tune. If you can’t blame Reagan himself for the mess we’re now in, you can most certainly blame Reaganism.

Oh, and Reagan’s the one who started racking up the budget deficits.

It’s not particularly helpful to point to one particular President’s policies. The truth is this crisis has been building since the 1960s, and at every point the succeeding administrations have taken the easy choice of punting the problem down the road.

Wow. What a slimy smear job by a bunch of dead end ankle biters.

The official dismantling of Glass Steagall was a non-event. Citi and Travellers, which owned Salomon Smith Barney, merged in 1998, with Glass Steagall still in place. UBS bought O'Connor & Associates, a derivative trading firm and 25th largest securities firm in the US, in 1993.

There had been plenty of ways to work around Glass Steagall for nearly a decade before it was officially voided.

I don’t think the myth is “epic.”

Only hard core partisans think Reagan was anything other than a very good communicator.

Reagan believed in the same free-market fundamentalist fantasy that Greenspan, Bush, Cheney, et. al. did. We see the results, and the world agrees. Check the polling. He’s in the same category as those folks, a historical blunderer.

It never spread very far in the world politically, but it spread enough to get us in the situation we’re in now.

Barry Ritholz is one of many who Reagan elevated Greenspan as a chief actor in this mess. But again, it’s the deregulatory nonsense-values at the core that’s the issue. In that sense, Reagan is an exemplar.

Reagan was a sick joke and the rest of the world knew it.

In 1986 I was in London and have a picture of a double decker bus with a Sharpe calculator ad. It had Reagan with an Einstein hairdoo and it said “Sharpe calculators can make anyone a genius”.

psychohistorian

I don’t know.

I have yet to listen to the tapes, and I will, which may change my mind, but for now I find it hard to believe that our current problems went back that far.

To propose de-regulation is one thing, for it to be an initial success is ok too. But its the absence of critical oversight and thought along the way that caused this problem.

Thinking out loud – maybe there is more to it. I have said for a long time that the “peak” of modern lifestyles and way of life (the middle class predominantly) was the late 80’s to mid 90’s after that, its been down hill all the way. Remember, one main cause of the sub-prime was that real wages had not risen in about 15 years (refer earlier post) and people began using the equity in their home as an ATM – not to live large (but that too) but often just to support basic consumption and cost of living.

Thinking out loud and not adding much. Look forward to finding some time to listen myself and read others thoughts.

I wonder how long it will take for public libraries in the south to ban this book?

Good thing it’s not a movie on CBS or we’d never even see it.

I thought Reagan had a lot of “ideas”?

I suspect I’m as constitutionally cynical as Yves Smith, so as much as some of me appreciates pointing up the obvious, another part of me says “Where’s everybody else been?”

I am not a reductionist – no ONE person or ONE policy is the cause of our predicament, but the adoration of Reagan at his death was both absurd and nauseating. It matters not to me whether he actually believed anything he said, for in either case, he was but a front man for a class interest. Reagan’s biography alleges that he studied sociology in college, but he seemed oblivious to any ideas from those whose work would surely have been in his syllabus – Veblen, Weber, Mead, Dewey and the other foundational social theorists of the late 19th and early 20th Century. His obliviousness would explain him and his pronouncement that the problem with America is “there are too many too educated young men.”

Yeah, we’re better off stoopid. Oh, and if there’s to be bloodshed, let’s get it over with …

Yeah, a real hero and man to admired.

Re: psychohistorian:

I was at uni and not very politically aware at that time (relatively speaking) but it was a joke here in Australia about who was in really in charge ie Nancy and lots of skits on how the “red button” (nuclear deployment) was almost accidentally pressed.

Reagan was admired as he was the American Dream – actor to president. You know the dream – the one you have to be asleep to believe as has been famously quoted before.

In its rush to blame “reaganism” and to absolve the statism of the pre-Reagan years of any taint whether for the present mess or for others I can easily remember from that era, GoLeft manages to step rather hard on one of its own testicles. Today’s problem has little to do with an inherent superiority of one ideology over another but rather with the deployment of any ideology one might choose to serve the special interests of those who have come to own government. The question is less government or private direction of the economy than it is government and private interests together versus the rest of us. Those experiencing the pathetic nosalgia for the past at GoLeft might benefit from a change of emetics. And this from someone no friend of neo-conservatism.

You know how the rich or the elite always bet on both sides?

Same with the dismal science known as economics – it always wins (by winning, I mean making life difficult for people like you and me), whether the blame goes to the left or the right. Sure, you can trace it to Reagan, but if you go further, it went back to Carter’s stagflation and malaise, then to Nixon and so on. I don’t want to take sides, but without Reagan, we would either still be in the ’70s or be an economic basket case. But of course, we have the problems of today that you can point to him. Like I said,

Today’s Progress

is

Tomorrow’s Mess.

And the eminence grise behind of all these, the one constant, whether we have inflation, depression, recession, deflation, caused by the Republicans or by the Democrats, what is the one constant? The economists – those dismal scientists. You find them there, at the scene of the crime, all the time. If you’re looking for where to place blame, try those dismal scientists.

Alas, I am old enough to remember the Reagan years (May 1984, in particular).

In the middle of May, Continental Illinois Bank was on the verge of bankruptcy, It’s stock had fallen to single digits. There was talk that a failure of Continental might even bring down Chase Manhattan.

1984 was an election. Using taxpayer funds, Ronald Regand had a major hundred million dollar extravaganza planned for June 1984 (to ostensibly commerate the 40th anniversary of D-Day).

The last thing the GOP needed was a bank failure to mar this ‘historic’ event.

Many Japanese instituions had deposits at Continental. The FDIC guarantee back then was only $5,000. So if a depositor had $100,000,00 with CINB, the depositor would might only get back as little as $5,000.

Japanese banks boycotted the May bond refunding to express their anger that they might lose money at CINB.

Long yields rose to 14%.

The brave, Christian, family man, Ronald Regan did what he always did when facing pressure — he caved in.

The FEDS seized CINB. However,the FDIC said that all depositors would get 100% of their money. All bond holders would get 100% of principal. Even preferred shareholders would get something.

Only the common stock holder and taxpayer were left holding the bag.

The June extravaganza went on without any untoward financial incident. The Japanese got their money back. The Ayatollah got his missles.

And the ‘too big to fail, Reagan Put’ was born.

Yes, yes, we know this is all the fault of Barney Frank, Chris Dodd and Jimmy Carter who forced Reagan to do this against his will.

This post by Leo fit with this story here, very well: Infinite debt:

How unlimited interest rates destroyed the economy

http://harpers.org/archive/2009/04/0082450

Of course reagan moved the needle right in the 1980’s, as FDR moved the needle left in the 30’s.

It is no more fair to blame Reagan for our current bubble than it is to blame FDR for the social breakdown in the 60’s, although each can be traced to butterflys beating their wings thirty years earlier.

Ironic. At a party last night, I said that our current predicament started when Carter was run out of DC like a syphilitic troll.

Actually, it started in 1974, but if I had to put a face to the beginning of the end it would surely be Reagan.

Hi Yves:

Gonna disagree with you a tad here. Section 20 of Glass-Steagall was slowly changed by Greenspin allowing a greater percentage of bank gross revenues to be invested on W$. When Glass-Steagall was finally repealed, that percentage was at 25% of a bank’s gross revenues. Sounds like a lot; but if Glass-Steagall was still in place would we be as deep into the rabbit hole that we are in today? I don’t know and perhaps you can add to it from that perspective.

Travelers owned both Smith Barney and Salomon Bros. It is my understanding that neither Citi or Travelers could merge “legally” until Glass-Steagall was repealed. Citi had to work around the regulations in Glass-Stegall and the Bank Holding Act to allow it to acquire Travelers and the two investment firms. While Rubin and Greenspin did the background work with the administration and Greenspin blessed the merger, the merger could not legally take place until Glass-Stegall was repealed.

April of 1998 Weill and Reed announce their merger following the Fed and Greenspin’s guidelines. May 1998, the 1999 Financial Services Moderization Act passes the House repealing Glass-Steagall and Oct it passes the Senate. “Such a deal!” and such a coincidence.

With the pasage of the 2000 Commodity Future Trade Act, all ability to regualte banks and derivatives is removed with the repeal of the 1992 version. Reagan may have wanted this; but, Greenspin enabled it with Volcker voting against the demise of Glass Steagall. Reagan was too dumb to pull this off and needed Greenspin to do it. The blame rests with Greenspan.

Great, I come to the best economic blog on the Internet to catch up on financial news, only to find another of the occasional partisan pissing fights breaking out.

Republicans suck! No, Democrats suck! No, YOU suck. No YOU suck!

The regular commentators at Calculated Risk once requested that a block be installed to not allow the words “Democrat” or “Republican” or any specific politician’s name to make it into the comment section to keep the infantilism out, and keep things on topic. A great idea. Never done – the occasional rookie comes on and goes into a screed about Bush or Obama or R or D, but they’re just ignored – no one takes the bait. They just let the person feel ignored so they leave and go back to the political ad hominem attack forum of choice.

Yes, I think we are nearing the end of an era, but it is not the Reagan era. Reagan merely patched the system together for another twenty years by bringing the country back from the excesses of the Great Society and the 70s (the awful Johnson, Nixon Carter sequence).

But the beginning was the New Deal–Hoover and Roosevelt–who taught the public that they could vote themselves other people’s money.

“Tax tax, spend spend, elect elect” is original sin behind today’s crisis. The expense of the Great Society programs brought about the end of “tax tax” as a policy, so continued spending generated about inflation. Reagan (and Volker) stopped that for a while with tight money, tax cuts and the demise of the Soviet Union (which raised the value of every bit of property, real and otherwise, in the non-Soviet world). But he was not able to get spending cuts. Borrowing replaced taxes, and so we are where we are.

This is the dumbest thread on this blog I’ve ever seen – and this almost had me spitting diet coke on my screen:

“Anonymous said…

Clinton was just dancing to Reagan’s tune.”

Thanks for the laugh, Anon.

“Reagan pioneered the use of wedge issues like race…”: I take that as evidence that the book is dishonest.

Reagan was ‘shocked, shocked’ that anyone would find it disturbing that he would open his 1980 campaign in Philadelphia MS.

The Gipper railed against “Welfare Queens”, but when it took him all of two weeks to decided to open the U. S. Treasury to pay off banks.

Who’s to blame for Reagan? Carter.

Who’s to blame for Carter? Nixon.

And on and it goes…

until we get to the Founding Fathers…and for them we must blame Enlightenment Thinkers…and for Enlightenment Thinkers, we must blame The Catholics…and for the Catholics we must blame Christ.

Jesus Christ is to blame!

[Of course, blaming Reagan is just as heretical to many Conservatives.]

PS

Hey Leo, I absolutely love your line towards then end that reads:

“As you listen, keep in mind that it is important to remember the historical context of this global financial mess and the ideological undertones that played a role in shaping our financial markets.”

I love it….Telling us to watch out for those vexing “ideological undertones”….on a post blaming Reagan for Citi, Goldman and Bear. Classic.

I think the regulars here know how I feel about the man.

He took the teeth out of every agency designed to safe guard the people and Country from the madmen of wealth at all costs.

They poured a bucket of nitrogen straight on the tree of wealth, to green the leaves, knowing it would kill it in the long run, but by that time they would be set, and basking in their glory.

skippy…prople with no regards for longevity, should carry the load of responsibility here.

Speaking of Reagan, who can forget "RAP" Accounting? I guess all the Republicans.

RAP accounting allowed S&Ls to use mark-to-market accounting for tax reporting and then use hedge accounting for regulatory capital purposes.

The Gipper also waived rules that said owners of S&Ls could have no other business interests.

Every law firm, real estate developer, con artist started an S&L and the intentionally took on bad assets for tax write-offs and let the taxpayer pay the ultimate bill.

that was the first version of the the Giethner Plan

Well, it took a village, that is for sure. Reagan certainly over-stated his case when he said government was the problem. The most generous thing to be said in defense of that stupid blanket statement was that Reagan was going overboard trying to get people to look first to themselves for answers to their problems. (Funnily his own notes show he was much more thoughtful than most of his acolytes or many of his critics have proven to be.) And clearly his own use of the levers of government power reveal he was by no means averse to strong government.

In retrospect Mr. Reagan won the Cold War by attacking Communist government with the same kind of bravado with which he verbally attacked government in general — remember that? — but in so doing he set the stage for our society to lose the peace, step by stupid step under the banner of Ayn Rand’s followers, most especially the Maestro himself.

So, yes, the butterfly flapped its wings in the early 1980s.

I just read Will Bunch’s “Tear Down This Myth”.

Very interesting to hear about the Reagan Legacy Project steered by Grover Norquist. An interesting effort at revisionist history. I wonder if it will succeed.

There’s your mistake, first sentence: Listening to the CBC, especially the Current. Ignorant socialists all

Just look at the historical chart of U.S. total debt to GDP. From the mid-1950’s to 1980 it’s basically flat at 150% of GDP, and for every $! of additional debt $! of additional GDP. When Reagan takes office, the slope of the graph immediately shifts upward, so that by the late 1980’s for every $1 of additional debt $.60 of additional GDP, until, during the last administration, for every $1 of additional debt $.20 of additional GDP. Yes, it was the Reagan/Thatcher laissez-faire/neo-liberal ideology of de-industrialization and over-financialization, de-regulating and privatizing everything and neglecting the commonweal in favor of the private self-interest of “individuals” that is at the root of the current crisis. Of course, all that was preceded by the demise of Bretton Woods and the stagflation of the 1970’s, so, more impersonally, one might attribute the roots of the crisis to the former crisis in profitability that was conveniently blamed on the wages of workers and the ameliorations of government programs and expenditures. But anyone who was alive at the time will remember the corporate-sponsored publicity campaigns and the rising punitive fury that was manipulated into Reagan’s “popularity”, the infra-structure and results of which we’re stuck with nowadays.

“In retrospect Mr. Reagan won the Cold War by attacking Communist government with the same kind of bravado with which he verbally attacked government in general.”

Perhaps the author of this cliche should take a broader view of actual history than that afforded by examining the hairs in his anus. He “won” the Cold War how? By dangerously adding to excrescent build-ups of nuclear armaments and launching illegal wars on bare-foot armies poised to invade Texas? Maybe the former U.S.S.R. just imploded from within, due to its own long-simmering “contradictions” and the collapse of oil prices. And maybe a more sober assessment of what had happened might have led to a more tempered response in the aftermath than the horrors of ideologically inspired, IMF imposed “shock therapy” on the former U.S.S.R.

Reagan and Thatcher did increase debt. I am very upset how “conservative” governments, including Mulroney in Canada and Bush II in the States, did likewise.

But, they did set in motion the processes to get out of debt – reduce expenses or raise taxes. Bush II is always a disappointment to conservatives on this score; he wasn’t really a conservative.

But, the liberal/left/socialists have always spewed money out much faster – like drunken sailors as we say. See The One or Dalton McGuinty in Ontario.

“It never spread very far in the world politically, but it spread enough to get us in the situation we’re in now”

I think a certain South American continent would disagree with that.

I have no idea why brutal dicators do what they do when it is so easily outsource to the IMF.

I’m still trying to decide if “greed is good”, was a clumsy startement or a brilliant statement affirming the beliefs of that SOB, Milton Friedman.

Trickle down economics, indeed. I would say it is mutually exclusive with greed.

I don’t think that was rain trickling on our heads.

RW – is sad when people spout things they only hear and do not know.

GDP increases more under Democratic rule than Republican. It’s a statistic.

Also, if the New Deal was so bad, how come the standard of living soared in the decades after the war?

The standard of living soared in the decades after the war because the U.S. was one of the few places in the world with an intact infrastructure.

Of course Reagan is to blame because he destroyed the possibility that the bourgeois state would be destroyed through inflation. It should be evident by now that only communist party terrorism (Stalinism) can truly liberate man

Also, if the New Deal was so bad, how come the standard of living soared in the decades after the war?

Because the prices of fuels (oil, coal, natural gas) and electric energy were falling throughout the 1930s to late 1950s. Increases in production, real incomes and GDP are strongly and negatively correlated with energy prices.

In the industrial age your principle workforce is the horsepower of engines and motors, not the muscle power of people and animals. This ought to be generally obvious to people who see this devices hourly and more often, but isn’t.

The energy cost factor altered, radically, starting in 1973. It’s no coincidence the Banana Republicization of US Gov’t statistics started then also.

Simple minds easily confuse coincidence with cause and effect. Such as the coincidence of FDR appearing at the start of this period of rapid advance. Or the appearance of Reagan at the start of a lull in the relative decline.

To Yves Smith,

I’d like to propose discontinuing Leo Kolivakis as a Naked Capitalism guest blogger. He’s definitely a two-trick pony at best.

Trick One is the pension funds are actuarially broke. This is very widely known and discussed by the US Comptroller and legions of federal and state bureaucrats and legislators. It’s just not being widely acted on.

Trick Two is the tedious and mendacious partisanship Canadians invariably bring to discussions of US political history. This might be because several decades ago their own plantation regime criminalized public discussion of its true nature under so-called “Hate Speech” laws.

I know this next opinion will not be popular with Canadians. But in my view Canadian slaveys, peons and lickspittles have no business exercising 1st Amendment Free Speech on US affairs when they’re too gutless to reclaim it for their own domestic affairs.

"I'd like to propose discontinuing Leo Kolivakis as a Naked Capitalism guest blogger. He's definitely a two-trick pony at best.

Trick One is the pension funds are actuarially broke. This is very widely known and discussed by the US Comptroller and legions of federal and state bureaucrats and legislators. It's just not being widely acted on.

Trick Two is the tedious and mendacious partisanship Canadians invariably bring to discussions of US political history. This might be because several decades ago their own plantation regime criminalized public discussion of its true nature under so-called "Hate Speech" laws.

I know this next opinion will not be popular with Canadians. But in my view Canadian slaveys, peons and lickspittles have no business exercising 1st Amendment Free Speech on US affairs when they're too gutless to reclaim it for their own domestic affairs."

>>>My response:

Don't you love people who insult others without having the guts to publish their real names? Talk about gutless.

Moreover, please provide links to substantiate your claims and add credibiltity to your points.

My post was just food for thought, not my ideological points of view. As a Canadian, I happen to think that both the Democrats and Republicans pander to Wall Street.

All this pandering to kleptocrats has led to disastrous results.

Finally, please refrain from calling people names. It's easy to insult behind a computer but much harder to add constructive criticism.

cheers,

Leo

How typically leftist to blame the current crisis on Reagan's 'deregulation.' While most libertarians and true conservatives have trouble with Reagan's move towards big government they will point out that the biggest myth is one in which the US comes off as a country in which regulations are low. The simple fact is that the country has far more government and far more regulation now than it did during Carter or Reagan's terms. The increase happened under both Democratic and Republican rule and is still going on today.

First, Reagan did not start the deficit problem. The simple fact is that if we use proper accounting, which means not hiding the SS, Medicare and other program liabilities, we find that the US debt has been rising steadily for more than 50 years. While that may not be a problem in any one year, it will be a problem eventually.

Second, the banking system was operating under fairly strict, risk-based capital requirement rules. These rules were put into place because of the S&L crisis in the 1980s and it was these rules, that permitted the creation of structured products that were backed by subprime mortgages.

Third, it wasn't Reagan who changed the regulations to force banks to lend to poor credit risks; that was the work of Congress as well as Clinton/Bush.

Forth, the biggest drivers of the crisis were the money creation of the Fed and the balance sheet expansion by the GSEs. Those GSEs were created by FDR, not Reagan. And the ability of the GSEs to borrow at lower rates because of their implicit backing by the government as well as the willingness of management to pursue political goals helped fuel the housing bubble.

The bottom line is that the left is looking at the wrong person to blame. In fact, as much as I would like to put the blame on Hoover/FDR, who deserve most of the credit for the move towards big government, it is obvious that the problem is structural. As long as the Fed and Treasury have the power to meddle in the economy by robbing savers of purchasing power by their printing press based inflationary actions the economy can never be sufficiently stable to avoid major systemic errors.

From what I see, Obama has chosen to follow the steps of Hoover/FDR and devalue the currency in order to jump start the economy. I suspect that the results will be similar and that real economic activity in the US will collapse over the next few years. Sadly, the collapse is very likely to take place along a major collapse in purchasing power that sees the price of many goods and services explode.

Perhaps after a time the public will finally figure out that the Democrats are no different than the Republican and the statist activities that both sides have pushed will be discredited sufficiently to be rejected by the voters. Sadly, that is the optimistic scenario. The pessimistic one has the rise of a strongman type who promises to take action to solve the nation's problems and takes it even further towards serfdom.

You might be able to prove conclusively that regulations have increased since Reagan’s term, but anti-statists will never be able to prove that the increase was overall negative to the economy or even that it increased systemic risk over an anarcho-capitalist alternative. The meme that reduction in regulations is a salve for all ills is totally and completely without factual basis and is no less blind faith than belief in the resurrection.

VangeIV,

Alas, facts to exist.

Prior, to St. Ronald of Reagan, deficits in peacetime were considered bad for the economy. St. Ronald believed that “deficits don’t matter” and quadrupled the national debt.

St. Ronald was also a firm believer in socializing losses and privatizing profits. His administration authored the infamous ‘Rap Accounting Standards’ — which were but literally a license to steal from the taxpayer. That RAP Accounting cost the taxpayer a trillion dollars need not be mentioned because St. Ronald spoke against budget deficits.

Again, in our haste to blame Negros and Democrats for all social ills, we are not allowed to mention the “Reagan Put” started with St. Ronalds bailout of Continental Illinois National Bank.

Also, GOOPER dittoheads have never been able to explain how lending to Negros caused the current credit crisis. Were they selling CDS without collateral? Even if banks were forced at gunpoint by Barney Frank to lend to Negros, why would anyone buy MBS structured with such loans? Was Chris Dodd forcing investors to buy these assets? Perhaps we need to listen to Rush, Glen and Drudge to get his flow correct.

“You might be able to prove conclusively that regulations have increased since Reagan’s term, but anti-statists will never be able to prove that the increase was overall negative to the economy or even that it increased systemic risk over an anarcho-capitalist alternative.”

I did not wish to get into a long argument about the merit of free markets. I only pointed out that the deregulation argument given by the leftists cannot be supported by the facts. We are quite capable of looking at the reality around us and see that we live in a highly regulated environment for business.

This means that the argument that what we saw was a failure of regulation is not supportable by the facts.

“The meme that reduction in regulations is a salve for all ills is totally and completely without factual basis and is no less blind faith than belief in the resurrection.”

Perhaps but at least I have reality as a guide. History shows that societies in which governments stick to protecting people from the initiation of force or from fraud and do not meddle in the economy tend to do much better than ones that engage in the form of central planning that is advocated by the Keynesians on the left or the crony capitalism favoured by many statists on the right.

“Prior, to St. Ronald of Reagan, deficits in peacetime were considered bad for the economy. St. Ronald believed that “deficits don’t matter” and quadrupled the national debt.”

I agree. Reagan talked a good game but his actions were those of a statist.

“St. Ronald was also a firm believer in socializing losses and privatizing profits. His administration authored the infamous ‘Rap Accounting Standards’ — which were but literally a license to steal from the taxpayer. That RAP Accounting cost the taxpayer a trillion dollars need not be mentioned because St. Ronald spoke against budget deficits.”

When it comes to socializing losses and protecting big business Reagan is no different than his leftist counterparts. For evidence look at the actions of Obama. Of course, given the amount of money that Obama got from Wall Street it is no surprise that he is socializing losses and preventing the insolvent large banks and brokers from being liquidated. If you look at the facts you will find that both of the main parties are bought and paid for by special interests and that there is little difference between them.

Sadly, that also seems to be true with Obama even on the military issue. Although he ran on the platform of bringing back the troops he is doing the same as Bush.

“Again, in our haste to blame Negros and Democrats for all social ills, we are not allowed to mention the “Reagan Put” started with St. Ronalds bailout of Continental Illinois National Bank.”

I blamed the ‘Negros and Democrats?’ Where exactly did I do that?

And, bailouts began long before Reagan. Once Nixon took the US off the gold standard financial crises and bailouts became much more frequent and were embraced by politicians on the left and the right.

Let me repeat once again in case you missed it previously; Reagan is not with us any longer and from what I can tell Obama is doing exactly the same thing.

“Also, GOOPER dittoheads have never been able to explain how lending to Negros caused the current credit crisis.”

It isn’t race but the inability to pay that matters. It takes no special insight to figure out that if you force banks to lend money to people who are unlikely to pay it back you are asking for a banking crisis.

“Were they selling CDS without collateral? Even if banks were forced at gunpoint by Barney Frank to lend to Negros, why would anyone buy MBS structured with such loans?”

Because the rating agencies, which are highly regulated and protected from competition by Congress came up with all kinds of reasons to say that there was nothing wrong with the paper. Of course, in the early stages of a housing bubble they were totally correct in their assessment because as long as housing prices kept going up the securities were sound. The problem for the buyers of those securities was the assumption that prices would keep going up.

“Was Chris Dodd forcing investors to buy these assets?”

No. The Fed was doing that by cutting interest rates to such low levels that desperate pension fund managers were willing to look for more yield. In a world where central planners get to set rates it is no surprise that malinvestments take place. In fact, history tells us that that malinvenstments are inevitable when central banks set rates and add liquidity to the system in order to soften the effects of recessions.

“Perhaps we need to listen to Rush, Glen and Drudge to get his flow correct.”

You might be better off by reading Mises and Rothbard. They explained what would happen and why. Or you might try Ron Paul. He used his understanding of Austrian Economics to predict what would have to happen and has been proven right.

By the way, it was Ron Paul who wanted to cut off the GSE’s credit line from the treasury and to prevent them from inflating their balance sheets in order to mitigate the damage caused by the bursting of the IT bubble. He is also trying to give Congress the power to audit the Fed and is getting opposition from Obama, the Republican leadership and Wall Street.

What money exactly has Obama given Wall Street?

All the TARP money showered on banks and investment banks so far has been courtesy of Hank Paulson and George W. Bush.

Can you cite a single instance of bank being seized and depositors receiving far in excess of the statutory limit and prefererd shareholders getting some cash back prior to St. Ronald bailing out CINB?

Neither Nixon nor Ford nor Carter ‘bailed out’ any banks. Lockheed and Chrysler received guarantees on their loans which carried market premiums. I know it is hard for GOOPERs to stomach, but the same man who gave missiles to the Ayatollah also began the bailouts.

I should mention that Chase and Citi were also technically insolvent during the Great One’s administration. But “Mr. Private Markets’, allowed them to remain in business.

So what if ratings agencies rated bonds on loans to ‘poor people’ (the GOOPER term used to be ‘welfare queen’) AAA or Greenspan made the Fed Funds rate 0, why would rational investors still buy bonds backed by such collateral? Were the buyers unaware of the nefarious Carter/Clinton/Dodd/Frank program to force banks to lend money to ‘poor people’?

“What money exactly has Obama given Wall Street?”

I take it that you have not paid attention to the activities by Geitner? Or that you did not read Obama’s remarks in February to the joint session of Congress. The Obama administration seems to have given Wall Street a blank cheque.

And before you blame Bush/Paulson, please note that Obama campaigned in favour of the Wall Street bailout last fall.

“All the TARP money showered on banks and investment banks so far has been courtesy of Hank Paulson and George W. Bush.”

You are correct except that you forget that Obama campaigned in favour of the bailout. The only presidential candidate that seemed to oppose such a bailout was Ron Paul.

“Can you cite a single instance of bank being seized and depositors receiving far in excess of the statutory limit and prefererd shareholders getting some cash back prior to St. Ronald bailing out CINB?”

What does Reagan and the Tip O’Neill Congress have to do with the fact that Obama/Bush and the current Congress are bailing out Wall Street? I have already stated that both parties are statists and act in a Keynesian manner.

“Neither Nixon nor Ford nor Carter ‘bailed out’ any banks. Lockheed and Chrysler received guarantees on their loans which carried market premiums.”

Actually, Chrysler was bailed out by Carter and Miller. It certainly would have failed if the federal government did not step in and bail out the company. Of course, had the market been allowed to work properly the bailout would have caused the industry to restructure and become much more competitive and we would not have the problems that we face today in the automotive sector.

“I know it is hard for GOOPERs to stomach, but the same man who gave missiles to the Ayatollah also began the bailouts.”

I am as big a critic of RR but I am not under any illusion that Reagan began the practice.

There are examples that disprove your contention. One is the 1971 bailout of Penn Central and its lenders. The government stepped in and provided around $700 billion in loan guarantees. (If we adjust for inflation we get around $3.5 billion, which is tiny compared to what Geitner wants to give to Wall Street.) When Penn Central could not get its act together the federal government forced it to consolidate with other railway companies to form Consolidated Rail. If memory serves me right, the federal government spent around $20 billion and received about $3 billion when Conrail was sold. While the taxpayers were losers the big winners were the banks that got their money and were shown that the taxpayer would always be there to bail them out. Chase and Continental Illinois were two of the banks that benefited.

Other bailouts in the 1970s included Lockheed and New York City. That should be sufficient to show that Reagan did not invent bailouts. But keep in mind that the President cannot do anything on his own because Congress is needed to pull off a bailout. For the record, neither has the power granted by to Constitutions but statists do not seem to care much about the Constitution.

“I should mention that Chase and Citi were also technically insolvent during the Great One’s administration. But “Mr. Private Markets’, allowed them to remain in business.”

I agree. The banks should have been allowed to fail but neither Reagan, nor the Democrats in Congress would allow that to happen. Of course, had Nixon not bailed out Penn Central, Chase and the other banks never would have taken all of the reckless risks that they did.

“So what if ratings agencies rated bonds on loans to ‘poor people’ (the GOOPER term used to be ‘welfare queen’) AAA or Greenspan made the Fed Funds rate 0, why would rational investors still buy bonds backed by such collateral?”

Because investors are not exactly rational and because managers had the excuse that they were purchasing AAA rated paper. Had pension managers not reached for yield and stuck with T-bills they would have been fired for being incompetent. Like I said, without the artificially low rates from the central planners at the Fed there would have been no housing bubble and mortgage security market. But somehow you seem to ignore the Fed’s complicity in all this because the Fed does what you believe in, plan the economy.

“Were the buyers unaware of the nefarious Carter/Clinton/Dodd/Frank program to force banks to lend money to ‘poor people’?”

Like I said, it made no difference because many managers were forced to purchase the highest yielding AAA securities that they could find or risk being fired. When the financial media, the rating agencies, the analysts, the bankers, the GSEs, and the regulators were all saying that mortgage backed securities were safe why would any manager take the risk and go against the flow?