A fairly long discussion, by blogosphere standards, has broken out over second liens. For those comparatively new to the topic, a recap is in order.

Second liens are either second mortgages or home equity lines of credit on homes. The bone of contention is that mortgage servicers, which also happen to units within the biggest US banks, have not been playing nicely at all with stressed borrowers out of an interest in preserving the value of their parent banks’ second liens. And the reason for that is that writing down second liens to anything within hailing distance of reality, given how badly underwater a lot of borrowers in the US are, would blow a very big hole in the equity of major banks and force a revival of the TARP. That is one of the very last things Team Obama would like to see happen, hence its eagerness to promote various extend and pretend policies.

The mortgage settlement proposal includes a provision that would call for second liens to be reduced pro-rata with the firsts. That, as Gretchen Morgenson noted, and Jesse Eisinger amplified, is contrary to long-standing principles of priority of creditor payments. Felix Salmon then argued that the banks were within their rights to try to extract some value from the seconds, which led to further rebuttals by Adam Levitin and Mike Konczal. Levitin’s realpolitik argument was that given that TARP is closed for new business and Dodd Frank resolution isn’t operationally or politically attractive, the regulators are locked in forbearance strategies. Konczal points out a deranged aspect of the second mortgage market: that unlike any other type of credit, borrowers are allowed to take out second liens out without obtaining the consent of the first lienholder. This feature, BTW, dates to the Garn-St. Germain Depositary Institutions Act of 1982

Now let us remember: if an underwater house is foreclosed upon, the first mortgage comes up short and the second gets wiped out. In theory, both lienholders can try to get a deficiency judgment. In practice, no one does; if someone is so broke they will give up their homes, it’s pretty unlikely that trying to extract more from them will be a profitable exercise.

Here is Felix’s argument to the contrary:

The idea is to set rules for banks servicing first liens, remember — and the owner of the first lien has always had the freedom to leave the second lien entirely untouched if they want. In most cases, banks don’t actually want to do that. If you’re taking a hit on a secured loan, you don’t want to be bailing out someone whose debt junior to your own….

Sophisticated banks already do a delicate dance with each other in these situations: the owner of the first lien wants the owner of the second to write down that loan as much as possible, but the owner of the second has a certain amount of negotiating leverage in terms of being able to hold up the modification or even push for outright foreclosure.

Um, I wouldn’t call this a “sophisticated dance”, I’d call this baldfaced abuse by an agent with a clear conflict of interest. Banks get paid inadequately to service troubled portfolios; the pricing models result in them taking big losses. Pushing for foreclosure wipes out the second, so it’s hardly an option they want to exercise. But first mortgage investors are disenfranchised; the bondholder agreements required that 25% need to band up to sue (and even then they need to sue the trustee to get them to prod the servicer). That’s a high enough threshold to make the servicers unaccountable. Put it another way: if the first lien investors had decent access to the courts (and weren’t afraid of annoying big banks, yet another deterrent to litigation), or the second lien holders had nothing to do with servicing, I think you be hard pressed to argue that you’d see outcomes like the ones we are witnessing. The second lienholder advantage results from deliberate negligence of their duties to the investors (and if you don’t think they abuse investors in lots of other ways, I have a bridge I’d like to sell you). Therefore I have very little sympathy with the banks on this one.

A second mystery, raised both by Eisenger and Konczal, on why borrowers are defaulting on firsts and not seconds, is actually not that hard to clear up. Eisinger wonders:

The performance of second liens is among the biggest puzzles in banking today: why are they doing better than the firsts? When Wells Fargo disclosed its earnings, for instance, it classified 5.3 percent of its first mortgages as nonperforming, but put only 2.4 percent of its second liens in that category. That seems very odd because it’s much easier to lose your home if you don’t pay your mortgage than if you don’t pay your home equity line.

Konczal’s answer is partly right:

So what you see is a lot of people, almost 64%, who have stopped paying the first trying to make some sort of payment and paying the much smaller second. It’s tough to justify why a financially literate person would do this – the first is the one that is going to drag him into foreclosure.

Some of it, as he suggests, is ignorance: borrowers realize that making less than the minimum gets them nowhere, so they try to stay current on as many debts as possible. But is the fact that the payment on the first is smaller than the second really the driver? It might be, but there is good reason to think other factors are involved.

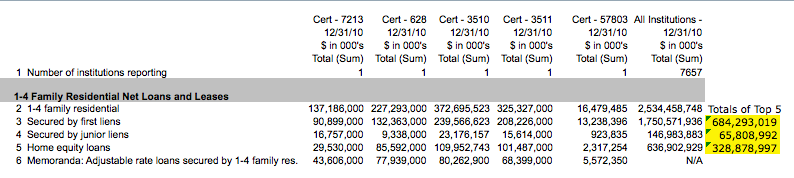

Anecdotally, it appears that banks use a very aggressive carrot and stick to keep seconds current. They threaten borrowers with aggressive debt collection on seconds. And on home equity lines, which are the overwhelming majority of second liens (see this spreadsheet courtesy Josh Rosner for details of the results from the five biggest servicers, click to enlarge), negative amortization is kosher.

For data junkies, 1 is Citi, 2 is JPM, 3 is BofA, 4 is Wells and 5 is GMAC

So what does a bank do? On day 89, before the HELOC is about to go delinquent, it tells the borrower to pay anything on it. A trivial payment is treated as keeping the HELOC current. So this explains Eisenger’s question: it’s easy for the Wells of this world to pretend that these second loans are doing fine if you will go through all sorts of hoops to make them look current, including if needed by lending them the money to make part of their interest payment. So even though a lot of commentators argue that it’s hard to argue that banks should write down their seconds if borrowers are current, what “current” really means deserves a lot more scrutiny than it has gotten.

Finally, Konczal (presumably in the interest of giving the devil his due) cited a pretty remarkable 1999 American Enterprise Institute study by Charles Calomiris and Joe Mason which argued that the second and first mortgage conflict was by design. The excerpt was not consistent with the way I’ve heard investors discuss these liens. I pinged a buy-side contact who wrote back:

Regarding investor expectations of seconds – I’d like to say that the Mason article cited by Konczal is an astonishing piece of shill work. I was active in high LTV 2nd lending going back to 1995 with a select group of lenders. The lenders, the rating agencies, the investors and the insurers all knew that making 2nd lien loans currently with negative equity, (or the potential to have negative equity), meant the loan could be crammed down.

The Supreme Court’s early 1990s decision on cramdowns specifically excluded investor properties and second liens [this is the decision that disallowed bankruptcy judges from writing down first mortgages on primary residences in Chapter 13 bankrupticies to the current market value of the collateral, which is the practice in all other types of secured liens, and treating the balance as unsecured]. We discussed these types of loans as being semi-secured – the lien provided some leverage but could be written down if challenged. Obviously, this means they were high risk loans when made (or invested in). As a result, the lender had to be very careful when making the loan. The lenders I worked with only extended these types of loans if they put the borrower in a better financial position by lowering his overall debt level and also made sure that they had a minimum of $3-4 k of unencumbered cash flow every month.

Believe or not, when lenders are concerned about the risk in their loans and careful about their exposure, they can make good loans. These high LTV second liens have performed better than first lien Alt A and subprime deals from the same era. When I checked a few months ago, most of my company’s 2004-2006 high LTV second lien deals had not been downgraded despite this housing blow up.

Mason’s argument about how awful it would be to make high LTV seconds unsecured is total BS – the risk of this happening is what made the lenders do their jobs well.

So the banks’ arguments in favor of not writing down seconds don’t stand up to much scrutiny. But given the reality that many commentators have stresses, that realistic values of the second mortgages would reveal the biggest US banks to be insolvent, we’ll continue to see both theatrics and borrower abuses continue in the interest of shoring up miscreant and incompetent lenders.

Can someone give some insight into the following?

Based on a lot of the commentary, servicers have an incentive to foreclose, rather than modify, because they don’t get paid for modification work (and don’t have the staff or expertise to do modification work, or to do it well).

On the other hand, if the servicer forecloses on a first mortgage that is underwater, the second mortgage will get wiped out. If the servicer holds the second mortgage, this gives them an incentive NOT to foreclose, to avoid recognizing a loss on the second mortgage.

So servicers may be subject to two separate conflicts of interest – one pushing them to foreclosure (instead of modification) and the other pushing them NOT to foreclose.

Can anyone provide insight on how this set of conflicting incentives is getting resolved in practice?

First, they might cherry pick and foreclose on houses that don’t have seconds.

Second, they probably also give priority to seconds where the borrower has stopped paying (if the borrower has quit paying, the regulators will make them write it down, so conflict solved).

Third, they are really dragging out foreclosures. So they collect fees but don’t pull the trigger until they have to.

That isn’t a full answer but it shows the conflicts are more complicated and can be managed a tad.

Your analysis is superficial and weak, quoting Gretchen ain’t academic. Every homeowner who is being fcked needs to use the court and start launcing lawsuits – depending on your particular situation, this includes Fannie Mae executives.

(These sons of bitchs need to be rounded up, frog marched and prosecuted.)

We need to go after their houses. This is retarded!! The alternative is what? Living in the street, having a nervous breakdown? Why are we even listening to what mobster driven corrupt TBTF banks say?!?!

Did you bother reading this post? It looks like you skimmed it and went off the deep end.

All you did was engage in an ad hominem attack on Morgenson and me. So much for complains about intellectual rigor. Did you cite an “academic”? I did quote Levitin, who is broadly supportive of the argument. And BTW, “academics” don’t settle these matters. Courts do.

Thanks, Yves. This is a question I’ve had for a while. I’ve been surprised that banks were ready to foreclose if it meant writing down seconds. I suppose not all foreclosures are alike.

Ahh… I see. Banks oppose mods because to qualify for a mod, you have to be a good credit risk, but be in a small pinch. If you are a good credit risk but in a small pinch, you probably already have a second or HELOC that you’re current on. That, on top of the servicer losing money doing the mod homework.

So the people deserving of a mod are exactly the ones whose seconds, if written down, would collapse the TBTFs.

Are the banks insured against losses on seconds and helocs? Surely someone created a way for the banks to profit from someone failing to pay on a second?

On the ground I can confirm, on an anecdotal basis at least, the agonizingly slow pace of judicial foreclosures and the cherry picking of loans without seconds. I’m following many borrowers with seconds who are 1-2 yrs in default and still no foreclosure case filed.

I can confirm my own general experience here in Florida regarding second liens—setting aside HOA’s, tax liens, and workman’s liens:

1. They almost never bother foreclosing, and in only a handful of instances do they ever sue on the loan itself.

2. Junior liens are willing to take a very close haircut in exchange for cash, now. I’ve seen them go for pennies on the dollar. 10% is common.

“Now let us remember: if an underwater house is foreclosed upon, the first mortgage comes up short and the second gets wiped out. In theory, both lienholders can try to get a deficiency judgment. In practice, no one does; if someone is so broke they will give up their homes, it’s pretty unlikely that trying to extract more from them will be a profitable exercise.”

But I believe this is changing and will change even more. Particularly in the cases where borrowers are giving up their homes not because of an inability to pay, but as a business decision based on their current mortgage(s) and expected future value of the property.

From everything I can tell (and I have a decent network), strategic default is an urban legend. The bank and academic work on this is complete garbage (both study parameters and surveys are embarrassingly badly designed). To the extent it is taking place, it’s on second homes.

…and third, and fourth homes, I think. Lots of investors–or more properly, marks who thought they were investors. Your point stands though.

“From everything I can tell (and I have a decent network), strategic default is an urban legend.”

An urban legend that has avid followers. No less than Calculated Risk himself cited a study by Atlanta Fed economists Chris Foote, Kris Gerardi and Paul Willen.

Note the title of the study: The seductive but flawed logic of principal reduction.

The money quote:

This is the same BS logic as in the strategic default myth. It assumes that people are rational, emotion-free machines that compute their finance in real time and take strictly business decisions based on algorithmic conclusions.

In a word, a theory about human behavior that is an Everest-sized steaming pile of enzyme-free bovine digestive remains, an undignified residue of pidgin-derivative of the Efficient Market Hypothesis. How’s that for flawed logic?

Moreover, it should go without saying that such a phenomenon would be met by a rather forceful reaction of officialdom and the lending industry. They’d be more than justified to do so. A borrower would have to prove that financial hardship is real and not an accounting fiction. Furthermore, penalties for pushing said accounting fiction could easily be crafted. (Don’t they own the government anyway?)

But something so obvious completely eluded the distinguished professors at the Atlanta Fed and CR himself, not to mention a notable majority of commentators to his blog.

That’s precisely the sort of junk study I meant. I had wanted to debunk that paper but it was already out. It’s even written in a dishonest manner and tries to give the impression that only “wonks” favor principal reduction, not borrowers AND investors!

Economists are dreadful at primary research, embarrassingly so. Wassily Leontief (Nobel Prize Winner and former head of the AEA) quit doing economics research and writing altogether out of his disgust with the lack of interest in primary research in the discipline.

The Fed has put it name on more than a few disingenuous studies. I don’t have the time or energy to shred them (and I often don’t see them when they are first out, which is the best time to go after them).

Agreed about the second homes.

I think people will eventually figure out that the majority of homes sold during the bubble were investment homes, mislabeled as seconds or even primaries by borrowers and brokers for lower rates.

“Put it another way: if the first lien investors had decent access to the courts (and weren’t afraid of annoying big banks, yet another deterrent to litigation), or the second lien holders had nothing to do with servicing, I think you be hard pressed to argue that you’d see outcomes like the ones we are witnessing.”

Is there any document that attempts to identify who owns the MBS? It seems that there has to be some rather large losses out there. The latest dynamic provides further confirmation that MBS is dead without govi guarantees.

Years into this mess, the govi green lights dividends while avoiding mark to market. I presume that only the little peoples are holding the crap once the grand scheme fails. You can fool most of the people most of the time when it comes to finance and banking.

“But given the reality that many commentators have stresses, that realistic values of the second mortgages would reveal the biggest US banks to be insolvent.”

Is there any real evidence of this? The only “study” I’ve seen that suggested that seconds were this big a problem was

the one Mike Konczal did, and that was a completely flawed analysis — Konczal looked at a small subset of all mortgages without seeming to realize that’s what he was doing) and assumed they described the mortgage market as a whole. Are there any numbers at all that point to the actual size of second-lien losses?

“In theory, both lienholders can try to get a deficiency judgment. In practice, no one does; if someone is so broke they will give up their homes, it’s pretty unlikely that trying to extract more from them will be a profitable exercise”

But this is clearly not true in the case of strategic default. If someone is walking away from the home because they’re so far underwater that they have no chance of making it a profitable investment, then it actually makes sense to sue them. This is another reason it makes sense for borrowers to stay current on their seconds even if they’re not paying their first.

This is the view of people who follow banks closely and talk to regulators, such as Josh Rosner and Chris Whalen.

If you look at the recent CoreLogic study, nearly 30% of US homes are in negative equity territory or near negative equity. The seconds would be 100% wipeouts in those cases. There is reason to think that seconds are more heavily represented in homes in near or negative equity profiles.

No. The ‘lower payment’ modification payments are actually being funneled to the 2nd loan (the servicer loan), rather than the 1st loan (idiot investor loans). Most homeowners dont have a say in where (1st or 2nd) payments go.

What?

Quid?

http://www.bloomberg.com/news/2011-03-21/fed-must-release-bank-loan-data-as-high-court-rejects-appeal.html

Naturally in our Orwellian culture, “The Clearing House Association LLC” was trying to prevent the release of these documents.

Hi, Since there seems to be no place to send an email to the author I will just have to air this complaint here. I love this blog and I greatly admire your intelligence and your experience. It is incredibly refreshing to read someone who knows what they are talking about and is willing to share it. How ever the editing of these articles is terrible. I cringe at every dropped word, misplaced comma and grammatical error. I have even thought of volunteering myself to do your editing. Only I work for a living and just don’t have the time. Because the articles are edited so poorly they have a tendency to negate the arguments you are making. I am sure you can get some students or the like to freely spend their time to edit these posting. They badly need it. Again keep up the great work, it wonderful stuff.

“You do something, and then somebody else comes along and does it pretty.”

-Pablo Picasso

An editor would have a field day with your post, sir.

The banks do not wish to lose money.

Therefore the banks will not foreclose.

As long as the banks do not foreclose, the markets will not recover.

It seems clear to me that the banks are waiting for a Government bailout of all of their problem loans.

This is the usual game, where the banks can expect to be bailed out, sooner or later.

Resolving the mess will not occur until the banks can make a steady profit performing the resolution.

Another way to resolve the mess would be for the regulators to warn the banksters:

“Hey Look! An eagle!”

http://www.youtube.com/watch?v=CVS1UfCfxlU

:-)

Stop the abuses, start filing bankruptcy, Phuck ’em. If you can take down some evil attorneys with you, all the better.

Viola!

“There is reason to think that seconds are more heavily represented in homes in near or negative equity profiles.”

What’s the reason to think this? I’m not saying it’s not true — I’m just wondering what the evidence is that it is true. I also wonder what percentage of homeowners with negative equity can be expected to default, particularly if — as you argue — strategic default is not of any significance.

One thing to consider for seconds in near or negative equity is that in many of the places where prices were out of whack (Florida, Nevada, Arizona, California) it was not uncommon to see primary mortgages written with a simultaneous (or “piggy-back”) second mortgage (often in the form of a HELOC) that was drawn on at closing to provide a larger down payment on the first, avoid PMI on the first, or both. Many mortgages came out of that process “appearing” as 80% LTV on the primary with the combined LTV at 100% (or more).

As for strategic defaults they aren’t as prevalent as one might think nor are they likely because of the negative consequences. For anyone significantly underwater the deficiency judgment is near certain to put the borrower into bankruptcy court with up to five years of paying against that judgment. Also, the IRS will hit the borrower with taxes against that judgment as imputed income. This would more often than not be the case in states where full recourse mortgages are written. Even in states like California where non-recourse mortgages are written for purchase the borrower has likely blown that opportunity by re-financing as a mortgage with a purpose of re-finance becomes full recourse.