Andrew Haldane and Richard Davies of the Bank of England have released a very useful new paper on short-termism in the investment arena. They contend that this problem real and getting worse. This may at first blush seem to be mere official confirmation of most people’s gut instinct. However, the authors take the critical step of developing some estimates of the severity of the phenomenon, since past efforts to do so are surprisingly scarce.

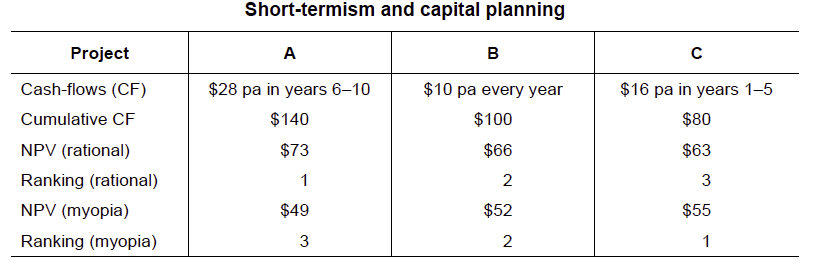

A short-term perspective is tantamount to applying an overly high discount rate to an investment project or similarly, requiring an excessively rapid payback. In corporate capital budgeting settings, the distortions are pronounced:

Most recently, in 2011 PriceWaterhouseCoopers conducted a survey of FTSE-100 and 250 executives, the majority of which chose a low return option sooner (£250,000 tomorrow) rather than a high return later (£450,000 in 3 years). This suggested annual discount rates of over 20%. Recently, Matthew Rose, CEO of Burlington Northern Santa Fe (America’s second biggest rail company), expressed frustration at the focus on quarterly earnings when locomotives lasted for 20 years and tracks for 30 to 40 years. Echoes, here, of “quarterly capitalism”.

This table illustrates in a more concrete fashion how investment myopia leads to projects with longer-term results being misrated:

Haldane and Davies argue the effect is significant:

First, there is statistically significant evidence of short-termism in the pricing of companies’ equities. This is true across all industrial sectors. Moreover, there is evidence of short-termism having increased over the recent past. Myopia is mounting.

Second, estimates of short-termism are economically as well as statistically significant.

Empirical evidence points to excess discounting of between 5% and 10% per year.

The result is that projects with long-term payback, beyond the 30 to 35 year timeframe, are treated as having no value. No wonder we don’t fund basic science, infrastructure, or climate change related projects.

The writers point out the first order bad effects: good projects don’t get funded, and those projects are often the ones with the highest potential for broad social impact (would we ever build the US highway system now?). But the knock-on effects are if anything more pernicious. The fact that most investors employ overly high discount rates produces is the same result you’d see with oligopoly pricing: overly high returns with restricted output. And this is consistent with the picture we see in most of the world. Perversely, the corporate sector has been a net saver for nearly a decade in the US, longer than that in some other economies. As we wrote with Rob Parenteau last year:

Over the past decade and a half, corporations have been saving more and investing less in their own businesses. A 2005 report from JPMorgan Research noted with concern that, since 2002, American corporations on average ran a net financial surplus of 1.7 percent of the gross domestic product — a drastic change from the previous 40 years, when they had maintained an average deficit of 1.2 percent of G.D.P. More recent studies have indicated that companies in Europe, Japan and China are also running unprecedented surpluses.

The irony is that China, with its command economy, is more willing to make long-term investments than capitalist economics which rely on the supposedly superior wisdom of having the capital markets play a dominant role in the pricing of risk funding. Now I’m of the school that China will likely have a bad stumble; there’s ample evidence that its unprecedented level of investment, which is fueled by lending, is scoring lower and lower returns. But the West’s short-sightedness increases the odds that this massive gamble might work out pretty well by moving into the type of projects that myopic capitalists are unwilling to take on.

Haldane and Davies prefer minor interventions to dirigisme:

Transparency: The lightest touch approach would be to require greater disclosures by financial and non-financial firms of their long-term intentions – for example, their

long-term performance, strategy and compensation practices. For financial firms, this might include metrics of portfolio churn. This could be accompanied by a programme of educating managers, investors and advisors of their fiduciary responsibilities.Governance: A more intensive approach would involve acting directly on

shareholder incentives through their voting rights. For example, fiduciary duties could be expanded to recognise explicitly long-term objectives. More concretely, shareholder rights could be enhanced for long-term investors, perhaps with a duration-dependent sliding scale of voting rights.Contract Design: There have been various attempts over the past few years to make compensation contracts more sensitive to long-term performance and risk. This includes employment contracts conditioned on long-term performance, or with deferral or clawback. Changes in the compensation instrument can also help – for example, remunerating in equity is better than in cash and remunerating in junior or convertible debt might be better than either.

Taxation/Subsidies: Authors have suggested a variety of ways in which government could penalise short-duration holdings of securities, or incentivise long duration holdings, using tax and / or subsidy measures. These measures differ in detail, but the underlying principle is to link them to the duration of an investor’s holdings or the length or nature of a company’s investment.

We have a peculiar desire in America to pretend that we have unfettered capitalism when, even before you consider the banking industry boondoggle, we have a remarkable amount of industrial policy by accident, via lots of special interest receiving subsidies and tax breaks. We’d do much better to try to put some of it on a more rational footing and implement broad-based programs of the sort Haldane and Davies suggest. But we may need to lose more ground to advanced economies before complacent CEOs and their various message validators are willing to consider more radical changes in how we do business.

“The result is that projects with long-term payback, beyond the 30 to 35 year timeframe, are treated as having no value”

As a civil engineer, this drives me insane.

Talking about a water line project with a life of 30 years. Everyone want’s to save money, so the client asks for cost cutting. The only way that happens is to make the pipe cheaper, you can’t make the trench any cheaper.

The “costs” are broken out over the 30 year expected life of the cheaper pipe. Anything beyond thirty years in valueless.

I go over and turn the water on in the sink. “That’s not worth anything?” The existing pipes were installed over 70 years ago.

Never mind that it is “worth” exactly what we are spending to “upgrade” the current system, that’s what “you” are paying for it.

Well said.

We need a new economics that measures costs accurately, at the level of resources, recycling, sustainability, etc. Currently we have The Invisible hand, that is, money measuring money via market processes that require profit–and therefore cost cutting–every step of the way, from raw material extraction to retail. This is not a recipe for quality. Nor is it sustainable. Our system is unsustainable and produces junk in the interests of profit.

One of the core problems is forced growth, foisted on us by the money system, which creates money as debt with interest owed, interest which does not exist in the money supply. This perpetual money-scarcity means economic growth is systemically necessary to stop the system from collapsing when swelling over-indebtedness leads to debt-destruction, depression and deflation. Which is what the world is flirting with now I believe.

We have very likely reached the end of growth as we have known it. Steady state growth and balanced load economics, or resource-based economics, is the way forward.

Man, I wish there was a “rec” button here. Bob the engineer reminded me of one of my pet peeves along these lines. Almost 40 years ago I fled one large city and moved to a more livable, but growing southern city that dreamed of becoming the next “Hot-lanta”. But already their main traffic artery was a by-pass candidate during rush hour. When some foresighted few recommended buying up rights-of-way to build a beltline, the gasps of horror were overwhelming. “Do you know how much it would cost to do that?” To which I nearly screamed, “Do you know how much it will cost in 20 years when you have NO CHOICE?” Needless to say, they diddled around and paid multiples of cost in the end. “Ya just can’t cure stupid>’

Toby, you’d have to get every country and company to buy into that valuation methodology for it to work. Every publicly traded company would have to provide a “Toby Index” for new projects. If it’s not mandatory, then those companies that don’t will have an advantage over those that do.

Good idea, but you do need the international community to buy in.

It’s not my idea, I just think it’s the most pragmatic. We’re talking about encouraging long-termism here, which means pretty much the same thing as sustainability. And you’re right, this can’t be forced. But this is not a choice between a red car and a blue one. This is between unsustainable, perpetual linear growth and some sustainable alternative.

Think about it. Think about what that really implies. To move to a sustainable system requires of us globally not only a willingness and ability to do so, it requires of us that we revolutionize everything we do. If we fail to do so, which is by far the likelier outcome, we will continue to head towards total collapse, which is nothing more than the logical outcome of an unsustainable system. We have a choice of course, but the difference in outcomes is stark. And it really isn’t about some Toby-Index or anything to do with me, it is about the reality of the situation.

In Palo Alto they replaced the 70 year old water pipes with plastic pull through. I only saw trenches at a few places where the plastic needed entrance and for splicing.

Back when dinosaurs roamed the earth, a friend who worked for Chevron, was complaining that the Company would only fund projects that had payback in 3 or less years. This was projects to capture the waste heat from processes that had 900, or greater, degree stack temps.

Well, they made the trench cheaper. And also reduced the inside diameter of the pipe. They are now less capable than they were before, and that process is only marginally “cheaper” up front. The pipe cost, and inspection are much more expensive, on the margin.

A problem in a few years is A LOT more expensive to fix.

If I was the United States, I would tame the Mississippi. I would do this by digging two or three humongous holes off to the side of it, and I would let those holes fill up whenever the river even thinks about swelling.

I figure the project would take about 5 China years (20 years American), and cost about $30 or $40 billion.*

I know the US can’t do it, because the US is broke, and also because the United States is prohibited, by the Constitution, from making plans, but it’s nice to dream.

* 30 or 40 billion is a lot, unless your the perpetual profit machine known as the Fed. If we’re talking Fed, we’re talking lunch money.

”

let those holes fill up whenever the river even thinks about swelling.

”

During early 30-s the suggestion of dredging Mississippi deep enough for Ocean-going-vessel-navigation was quickly squashed the the railroad rulers. Rulers argued that navigable Mississippi would thwart railroad profits.

Tell me something! When you build gigantic hub-airports, do feeder-airports quickly spring up and thrive like gangbusters? Analogously, Ocean Vessel Boom would drive growth in railroad activity, railroad activity and profits. Deeper river would obviously handle more flow thus prevent flooding. Deeper Mississippi could serve as tail-race for hydro-electric operations further upstream where navigation would be less practical.

If we don’t get dredging soon, the Mighty Mississippi will continue to wander whither thither as it floods one victim after another. Will the flooding create truly great farm land? You bet chore silt-soil, Farmer Jones. But it’s gonna knock over your tool-shed.

Er, those holes were called “wetlands”, which were what was engineered out of existence.

I guess that’s what I’m proposing; recreate the role of the wetlands — reengineer an engineering boondoggle.

As a bonus, we could use the hole on the east side of the river to fill up the big dry drinking hole down there by Atlanta, and the hole on the west side could be used to top off Lake Meade, or to refill the Ogallala aquifer. Or both.

The project would involve aqueducts, or more accurately, water pipelines. And it would be expensive; cost something like $20 or $30 billion — the kind of money, unfortunately, we don’t have.*

* Only the Fed has that kind of money. Hell, without a blink or a twitch, they can gift Goldman Sachs 50 billion in a fortnight; so rich is the Fed.

“I guess that’s what I’m proposing; recreate the role of the wetlands — reengineer an engineering boondoggle. ”

Read somewhere that that was being done in Florida. An old style river project, make the river bed straight and engineering like, was being reconfigured back to what nature thought was the best way to go. What blows my mind was this was being done in Florida a state that seems very artificial.

They are arguing over this now. They did dig big holes (built up secondary levee systems), they were called flood plains, and when the river gets high enough, they blow the levee up and let the water flood the plain.

They have done this at least twice this year. As usual, the people who “own” land in the flood plains cry bloody murder, and try to sue the USG.

How much silt is deposited in those plains that will BENEFIT the landowners in the next years?

There should be permanent areas devoted to flood plain use. But it’s usually a politician that goes looking for some quick cash who sells or leases this land to a private person. These “buyers” are the people who are now suing the USG.

To be clear, most of these areas were flood plains to begin with (determined by gravity, geology and god). The only reason they are able to make use of them is the levee system that was put into place.

bob, hope you don’t mind me parking this here.

To all^^^above^^^regarding the flooding and recipient issues. I ‘ll just keep it simple, the modern flood has *ZERO* resemblance to its historical brethren…full stop, it is, a toxic sludge and H2o nightmare. Full of everything man made it touches, Ag chem, industrial chem/byproducts, house hold chem, dead domestic animals, back up of septic/sewage pipes (bonus points for plants), back up of storm drains (stealth toxic storage facility’s), flood born viral and bacterial agents (some ancient {living in sub soil, some new mankind influenced]), this is the short list.

Skippy…So, where ever the flow runs…well you get the idea…just like the mouth and preceding dead zone of industrialized rivers.

PS. we still have closed public areas from our little flood here in Queensland. River and inundated areas are still a mess, not many choices though.

It’s straightforward.

Since nobody is doing long term investment, the currency issuer should become venture capitalist and start funding these projects.

An appropriate levy could be on private company’s cash hoards.

“I know the US can’t do it, because the US is broke”

The US is not broke and never can be. The only bankruptcy is in the ideas and backbone departments

“The US is not broke and never can be.”

This is true, but the US doesn’t know this, which makes the US, one of the dumbest countries that ever existed.

There are some special situations where long term planning makes sense. Planting trees is one; some types take a long time to grow.

But in general, it doesn’t make sense. Technology change, business change, change of all kinds, will thwart any long term plans you make.

In general, your reply is shortsighted. Read Bob’s post at the beginning of replies.

I question whether you even read the article. The U.S. has many examples of long-term investments that are still paying dividends. Saying that “technology changes, business changes” is a weak excuse. It takes courage and vision to invest for the long-term gain. You plan a long-term project that you can build on when technology or business changes. Or, you find a long-term investment that will weather business changes. It just takes a little more work.

“The U.S. has many examples of long-term investments that are still paying dividends.” Made me think of the San Francisco Water Project that brought water from the Sierra’s to the Bay Area. Started sometime around the WW1 era and finished sometime in 30’s or 40’s. Just now they need to do a lot of rehab and upgrading of the system. We used to ride horses in the SF watershed and were docents for the Dept of Water and Power so we got a history lesson on the project. The same engineer that brought water to the Hawaiian sugar plantations was the original engineer of the project. An Irishman I am proud to say. The California investment in higher education is another. Sad to say the system is under attack. I guess I could mention the Panama Canal as another long term project with high return on investment.

Much easier to justify the upfront costs of the construction of the water project than its maintenance. You can sell the vision of incremental growth in the Bay Area far easier than you can expensive maintenance of the status quo.

Unless you compare the cost of replacement against the cost of maintenance. If it was built with the long-term view, (capacity growth, quality planning) maintenance may be cheaper than replacement.

It almost makes you wonder whether a dumbed down executive aggrandizing finance capital business monopoly military worshipping sado porno entertainment society built on public relations and propaganda creates the best of all possible worlds. No, that can’t be it. The problem must be something else.

“…the same result you’d see with oligopoly pricing: overly high returns with restricted output. And this is consistent with the picture we see in most of the world. Perversely, the corporate sector has been a net saver for nearly a decade in the US, longer than that in some other economies. As we wrote with Rob Parenteau last year:”

I’ve been saying this for a long time, but this is the first consistent analysis I’ve read. Indeed, even the econ-liberals admit that capitalists are in control to the point that jobs won’t be created without hefty returns for them.

The problem with dirigisme is that it will have to follow the same model of corporate graft as previous deregulation has, unless a really powerful democratic restructuring takes place. Civil society is incredibly weak in the U.S., so don’t expect top-down shuffles to do anything but delay capitalist graft, if that…

Dean Sayers said:

The problem with dirigisme is that it will have to follow the same model of corporate graft as previous deregulation has, unless a really powerful democratic restructuring takes place. Civil society is incredibly weak in the U.S., so don’t expect top-down shuffles to do anything but delay capitalist graft, if that…

Yep. You nailed it.

A dictatorship of bureaucratic planners and administrators is hardly an improvement over a dictatorship of corporations. Enhanced democracy is the only way out of the trap, but since people who currently have power aren’t going to voluntarily surrender it, that’s not going to happen without a fight.

Unfortunately Americans seem to have bought into the notion that those without political power should have it bestowed upon them by elite benefactors. Either that or they buy into the defeatist distortion promoted by the social structuralists—-that we’re helpless before the engineers of consent.

The problem with investing with anything over a period of a year is the next congress or president will come in and destroy your industry. Somehow tanning salons are “health care”, and they expect the tax to actually generate revenue instead of destroy small businesses. (Compare the luxury tax that destroyed the boat and small plane industry years ago and because of the unemployment and bankruptcy was net revenue negative).

We now have a slow civil war in Washington DC, so at best some employer destroying policy might be delayed, but there cannot be a guarantee. We ask for R&D and funding the search for resources, then ask for a Windfall Profits Tax when it works. BP might be evil, but if there were a good citizen oil company, it would still be crushed by the regulations I expect. In Iowa I saw more attempts to kill clean coal than to promote either wind or ethanol (which might be net environmentally worse).

Since I expect any cash in the corporate coffers to have a very high chance of being looted in the next year or two, the implicit interest rates are correct. (Not that this would be improper, corp(se)orations are frankenstate monsters; and they have been subsidized by things like rules allowing them to cheat their pension funds, but I don’t think the looting will go to fix this.)

Put another way, I’m all for regulating the TBTF financial utilities probably more strictly than Yves might (I’m also for allowing completely free market alternatives, but it means no subsidies, bailouts, or even much regulation beyond common law and criminal fraud statutes). But assume we all get our way and the bankster’s get justice. What happens to the stock price of GS, BOA, C, and the rest? Anyone rational would pump the stock this quarter, and suck every last dime out and crash the stock, like Sunbeam or the other “take private with debt, declare a big dividend, then let it go bankrupt”. The only thing interrupting the process is the taxpayer infusions and the Fed buying the toxic trash, so the cycle repeats until the government too becomes obviously bankrupt.

Because you can cheat – Black’s “control frauds” for a few quarters, and can make a lot of cash, and you can let frauds go (overstock.com naked shorting) no one can have confidence in anything going for even a few years.

Railroads? Wait for the next accident and demands that trains only go 5MPH, or be eliminated, or who knows what. The locomotive might last 20 years and the tracks 40, but the laws change every year.

If you want people to invest over a longer time horizon, you have to guarantee that what is invested in will be left alone for that time horizon (Maybe after restoring a level playing field – neither subsidized, regulation-as-harassment, legal immunities, ignoring or overenforcing pollution laws, or the rest).

It would be better to have a high but fixed overregulated socialistic economy, and a weak but stable currency over the next 20 years than the current battle where it swings wildly every few years. You should also prefer a freer but stable (intrinsically, not designed to crash) situation over the next 20 years to the chaos.

Friends;

Bob above has it exactly right. As one of the “skilled trades” that put the pipes in the ground when he tells us too, I am here to testify that the short time, profit monstersizing forces have taken construction over. One of the unexpected consequences of this mind set is what I like to call the “degradation factor.” Cheaper pipe is easier to accidentally break. Repairing such breaks costs money, usually not budegeted up front. I have personally been up to my knees in mud wrestling with broken water pipe that should have been Schedule 80, (thick and durable,) and turned out to be Schedule 3036, (much thinner and more fragile.) A parking lot crew had put a hole in it driving a wooden stake to construct a batter board, (from which lines are run to measure the form that holds the cement,) So, not only was the pipe understrength, but the trench was too shallow! All for a short term profit. You see this kind of thinking everywhere today.

Now, you might see this as an opportunity to start up small businesses devoted to repairing the results of this short timerism. Not so fast friends! First, I have personally been caught in the battle between general and sub contractors over who pays for these “minor setbacks.” One case took three years to unwind, and I do not have deep pockets. Second is the “bearer of bad tidings” curse. Remember what happened to the poor Roman soldier who had to tell the Senate about the big military defeat? Seems to be an universal mind set. I once worked for a mid sized plumbing contractor. I spent most of my time fixing broken stuff on projects. A round of wage raises came around. Everyone got a rise, except me. When I confronted the manager about this and asked for an explanation his reply was that when the other crews finished their phases of the jobs, he could send the builders a bill, and get a check in return. “When we send you out to a job we can’t send anyone a bill. You’re not making the company any money, you don’t deserve a raise. Be thankful you even have a job.” That man has never understood why I put in my two weeks notice the next Friday. See what I mean by degradation?

On another front, one of the authors suggestions, (penalise short duration holding of securities,) looks to be a straightforward endorsement of raising the Capital Gaines tax, or even making it a multi year sliding scale. Let us say, for arguements sake: 50% tax for under one year retention; 45% for under two; and so on down to whatever level works best for long term investments, say one half the profit yield for twenty years or so.

As for transparency, well anyone reading this probably came to that conclusion about when they reached puberty.

ambrit’s story reminds me of Orangeburg Pipe, a ‘fibre’ pipe made of cellolose and coal tar pitch. It was used in large quantities in suburban construction in the 1950s and 1960s, serving as sewer laterals.

But it had a dark side, as the City of Tempe, Arizona explains:

http://www.tempe.gov/bsafety/Orangeburg/Orangeburg.htm

Orangeburg Pipe closed in 1972, but homeowners nationwide are still spending thousands to clean up the mess left by leaking and blocked sewer laterals.

Completing the irony, the site of the demolished pipe factory is now a Lowes store, selling the PVC pipe (a late 1960s innovation) that put Orangeburg Pipe out of business.

That stuff sucks, period.

Another “cheaper” alternative for pressure pipe at the time was AC (asbestos concrete). Most subdivisions built in the 50’s and 60’s are full of it.

It’s more fragile than grandma’s tea set. Dig anywhere near it and it breaks. Putting in a new gas line? Double the price for it upfront if the neighborhood has AC water pipe. You are going to be chasing water leaks for the entire project.

The other, less well seen problem is old tile pipe or clay. The pipe was used, as was orangeburg, for sewers.

As with orangeburg, it leaks. Only tile pipes were much shorter, and they never had any sort of union between the pipes.

Those leaks go both ways, in and out. When they were first building cities, water leaking into the sewers was a good thing, it helped bring the water table down. This was before people realized that sewage should be treated.

Now you have tile pipe taking perfectly clean groundwater to the treatment plant. This is even before taking into account storm sewers that dump into sanitary sewer systems, or what is know know as CSO (combined sewer overflow).

How many miles of sewers are under a city? Every 4 feet there is a gap. Chances are very good that at that gap water leaks into the pipe which then has to be treated at the bottom of the system.

Sewage treatment plants are HUGE energy users. Giant chemical plants.

“You’re not making the company any money, you don’t deserve a raise. Be thankful you even have a job.”

So, this manager just wouldn’t even acknowledge that you were saving the company a lot of money by doing repairs, that, if neglected, could cost much more to fix?

Logic-challenged much, he was. This guy redefines the concept of asshatery.

Shocking, but not surprising.

Dear friends;

I’m sure there are lots of people out there with worse experiences to relate. The basic problem is in the mind set. One of the best Quality Control men I ever encountered, (you get them occasionally,) once told me only half jokingly, “I can’t be seen palling around with anyone on the job. Half of my real job is to be seen as the Ultimate A__hole In Chief on this project. That way, people think twice before trying to push the envelope.” He had to work quite hard to establish a reputation for diligence and incorruptability. Otherwise, the general contractors boys on the job would take him for granted and pull all sorts of ‘funny stuff.” Like using less rebar in the footers and slabs then the plans called for. Or ‘cheaper’ bolts and fastners on the steel frame connections, (I’ve seen both.)

As CE Bob will probably attest, the urge to make more money by cutting corners is well nigh universal. It is a constant battle to detect and forestall such peculations.

As to slick lining water mains. Everything has a life expectancy. Then they start to break down. Your choices are two. Replace the system entirely, difficult and expensive to do in built up urban areas. Repair the breaking pieces as they come up, also expensive, but often cheaper when factored over the life of the system. Slick lining is in that grey area. The people putting it in know in the back of their minds that it is inferior to a full replacement, but the cost factor blinds them to a more rational view of the long term solution. It’s always good to remember that there is no “Magic Bullet” to solve our technical problems. It is always better to “Bite the Bullet,” or sooner or later you get bitten in a very tender place. I have the tooth marks to prove it.

Thanks for taking the problem seriously!

Here’s an orgasm:

“The irony is that China, with its command economy, is more willing to make long-term investments than capitalist economics which rely on the supposedly superior wisdom of having the capital markets play a dominant role in the pricing of risk funding”

China is toxicity in the food, air, water, an occassional state sanctioned assasination of some rogue bizness man who used drums of cutting agents in baby formula, massive hydro projects that could care less about the environment, huge German cars running down peasants, (literally and figuratively) even more tyrannical control of information, days of wine, roses, drugs and full bore investment orgies in Bejing, a burgeoning military industrial complex that’s playing temporary catch up to the West, etc,etc,etc,etc,etc,etc.

Dirigisme should not be dismissed: the historical record is quite clear that dirigistic economic policies at the national level result in the fastest and most widely shared growth of economic wealth and potential to create wealth. The Hamiltonian policies of the American System, as it was known in the 1800s; List’s Zollverien of Germany; the application of the American System to Japan by E. Peshine Smith in the late 1800s. More recently, the dirigistic economic policies of South Korea, where per capita GDP in the 1960s was at the same level as Ghana. Malyasia and Indonesia are other examples.

The simple fact is that economic development and growth are best achieved by a “partnership” between the public and private sectors, in which the government of a nation state identifies and implements an industrial policy and public infrastructure projects that will best promote the general welfare. This in turn creates an economic climate in which private businesses and entrepreneurs flourish. Look at how the U.S. interstate highway system transformed the country. Or how the railroads in the 1800s, supported by massive grants of public lands as well as direct support by U.S. Army engineers, transformed the American economy in the period after the Civil War. The conservative war on the idea of “general welfare” may well be one of the most pernicious and dangerous attacks on the economic survival of the United States as a self-governing democratic republic.

By contrast, where faith in market outcomes has reached the point of theological canon, as in the U.S. and Britain, we have seen leading industrial economies be de-industrialized, with widening gaps in income and wealth that will, in the not too distant future, have unsettling, if not violent, consequences for social stability.

Tony,

It seems to me yes and no: a dirigisme structure will be captured eventually by an elite as Korea’s was by the military who overplayed their hand torturing a student; popular revolt evolved politics into a real democratic form and wholesale change of elites renewed the system.

Our nominally democratic government is supposed to prevent the entrenchment of elites and the electoral schedule is supposed to institute change on a quadrennial cycle. Capture by a plutocratic elite that finances both political parties here has prevented structured change from functioning since Buckely v Valeo confused money and speech 35 years ago.

Both economic systems and the political systems they integrate need to change when the benefits of a particular arrangement exhaust themselves through success, but when both poles of “politics economy” are captured by the same elite, that elite will strangle everyone else subject to the system until they organize to overthrow the elite. It is time for an American Spring.

The New Deal was dirigisme it seems to me and played itself out under Nixon when an elite that no longer understood the details of the system overextended it with “Great Society” programs, some good, some a waste of money and more importantly war spending in VietNam.

At the same time, the balance of payments permanently turned on the US as foreign growth converted the dollar into a global reserve currency that essentially forced the US to run deficits to fund global development. To avoid the trap of mercantilism that would have shipped our gold abroad and bankrupted the country Nixon took us off gold.

While our trading partners continued their mercantilist policies and purchased bonds to support their own exports (extending an accidental Marshal Plan to all of our trading partners still in effect today), our domestic economic agents used the chaos that ensued to dismantle the dirigisme aspects of government policy without eliminating its financial effects that favored energy, agriculture and military production.

With a healthy section of the sluice of money creation that fiat money allowed channeled to those elites that drove the dismantling of government agency in the economy, those elites through a pliant Supreme Court have taken over the economy and created a perfect stability for themselves that even the disruptions of the 2008 financial crisis did not perturb.

All remains well inside the bubble and that is exactly how our elite is behaving.

I still don’t understand why it took us so long to get off gold. It was a problem already in 1960. So it took more than a decade.

@ Susan —

At the time, moving off gold was an immensely radical step. It took the Vietnam war’s cost to make other nations uneasily consider the long-term viability of their dollar holdings. Till France asked the U.S. to recoup its dollars in gold, and Nixon did the deed and made the dollar a fiat currency.

It turned out to be an unprecedented success in terms of U.S. hegemony. Economist Michael Hudson’s ‘Super Imperialism: The Economic Strategy of American Empire’ is worth reading on this score.

Have you considered, Susan, that gold was just the messenger, not the cause?

After Nixon took the US dollar off gold, we got a teeth-rattling oil shock two years later, followed by a nasty inflationary recession. No coincidence, and hardly gold’s fault.

Yesterday our washing machine was broke, and I took a load of wash to a laundromat. Last time I was in a laundromat, it took two quarters to operate a washing machine. This time the cost was … $3.25! In quarters, mind you!

I had to laugh — Rip Van Winkle stumbles out from under his log, lost in a world he no longer recognizes. If you don’t consider endless, runaway inflation a problem, then fine. My wife hates it; rants about it. Gold woulda stopped all that.

Gold woulda stopped all that. Jim Haygood

If gold is such an ideal money then it should have no problem surviving in the free market without government recognition of it as money. And if it does require government recognition then it is just expensive (and fascist) fiat.

We need liberty in private money creation, not expensive fiat.

tz has it exactly right. The discount rate reflects the risk entailed in the investment. That is a given. If the discount rate is skewed like it is on longer term investments, it indicates that there is greater inherent risk in them.

As a small manufacturer, I can testify to the risk entailed in ANY investment with more than 1 year payback, and refuse to commit to them anymore. I have been burned way too many times.

tz has several examples, but his list could go on for book lengths. In Illinois, code compliance alone renders any building more than 20 years old near worthless. It is less expensive to tear it down and build new. I could go on and on……..

You have to be crazy in this legislative and business environment to invest beyond a year.

Example – 3 years ago, customer wanted me to add capacity. I did. Job went to Malaysia 12 months later – oh – we’re sorry! But you can sell the capacity (WHERE), and besides, you entered it with an agreement, which our $500/hr lawyers would be happy to argue in court.

Wolf,

I had a very similar experience in 2007: client insisted I double the size of my office to take on a much larger project: I spent a couple 100K to fit out, staff and start project: project was funded by Lehman (oops). About the time my upfront capital outlay was spent, finance for the project vanished. It really looks to me like we have an economy optimized to strip wealth from small holders.

Good new, neutral-sounding word: Dirigisme. But unless we can use strong national law to protect our own businesses and industries, all the dirigisme in the world will not help.

Read the underlying piece. The discount rates used are too high. This is documented consistently in financial econ because the equity premium is similarly too high relative to the rights of equity v. debtholders.

The individual human life span is the measure of all things short term. To think that business plans, political plans, personal goals, must happen to coincide with when you are most able to personally enjoy the benefits, is not all unreasonable for most reasonable undertakings. Most undertakings on a practical level should happen when I can see the full results of my labors. The aggregate result of everyone at all times working to get immediate results regardless of the counterproductive short term, self defeating elements of not structuring some projects for their inherent long term needs is evident all around us.

But so is the value of building for the ages. In Philadelphia, among many industrial edifices, is the former US Navy Shipyard, in South Philadelphia. It is being redeveloped with some great adaptive reuses. The example that I would like to point out are several dry dock facilities abandoned there. Today, what I term a Global Asset, the dry docks are being used by a foreign shipbuilder to manufacture with a state of the art technology transfer to the USA, supertanker cargo ships. This facility has single handed returned the COMMERCIAL ship building industry back to our nation. At great cost to the tax payer, but with a solid benefit in returns, over a thousand skilled jobs have returned to the city. And of course, it would never have happened if the total cost would have included the billions necessary to create the gargantuan concrete infrastructure and port facilities, made almost a century ago.

“It’s straightforward.

Since nobody is doing long term investment, the currency issuer should become venture capitalist and start funding these projects.

An appropriate levy could be on private company’s cash hoards.”

Since at some stage the currency issuer is going to have to reflux through taxation to prevent inflation and rich selfish Neo-Liberals hate paying tax how is this workable?

It is a kleptocracy. This is the central economic reality of our times and we cannot escape it in any discussion of economics.

Why loot tomorrow what you can loot today? Or to be more precise, why commit assets for projects whose profits won’t be realized until after you’re gone? Especially if volatility in markets (an effect of kleptocracy) could erase those profits or even turn them into losses. Make the surer short term bet. You’ll be richer and also if you don’t, markets will punish you, your investors will dump you, and then you’ll have no profits, short term or long term.

As I said above, volatility is a characteristic of late-stage kleptocracy. Basically, things begin to fall apart. The economy becomes increasingly unstable. Large public interventions are needed. These are used not to fix anything but to keep things going so the looting can continue. So we enter a cycle of interventions and temporary upswings followed by renewed looting and downswings. But this pattern itself degrades over time. The interventions become less effective because the unaddressed economic fundamentals continue to deteriorate.

However, volatility is just an excuse not to make the long term bet. Kleptocrats would have made the short term bet anyway. Like the scorpion, it is their nature.

I should note too that we already have economic dirigisme. The problem is it is a dirigisme by and for the rich, and the corps they control, and often own.

The Trucking Industry is another classic example of a short-termism view. The business model is to deliver freight without damage from point A to point B on a timely and reasonably cost-effect basis. Simple model, can’t screw this up right?

Let’s see, business X devotes personell, time, and money to manufacture and market its product to the customer. What happens? A poorly (if at all) trained, minimum-wage, swing shift worker, driving a 10,000 plus pound fork lift truck at some god forsaken truck terminal demolishes the shipment. In a few seconds the hard work of hundreds of people in the supply chain has simply evaporated.

Does the terminal manager care? Of course not, just get the rined product on the next outbound truck so it becomes the next individual’s problem.

Does corporate care? Not a bit. After a decade of industry consolidation, they know the shipper has few choices. Lot easier and more profitable to monopolize the industry than to provide good service. Why commit resources to higher wages and better trained workers when corporate management implement cost-cutting measures to squeeze out a few more pennies on EPS.

This scenario is played out again and again in nearly every large corporation. They often fail to provide the contracted service, but are protected from any real competition by favorable regulation and tax laws, subsidies, monopolies, etc. Management is promoted and lavishly rewarded for what most people would consider abysmal failure.

Perhaps my perspective and memory betray me, but it seems there was once a time when the reward for bad executive decisions was to be shown the door, exiting with relatively minimal severance perks. The degeneration of corporate leadership and future vision is truly a national disgrace.

Yves, the AIM of China going forward from here is to MINIMIZE returns. What this means is maximizing wages cost. Henry Liu went over last week to start implementing the policy of doubling China’s wage rates, I think in the Wuhan area for starters.

From a rate-of-return perspective, this is considered a disaster. But China’s planners — especially the incoming generation two or three years from now — are not that interested in providing rate-of-return benefits to external investors. They’re looking at the labor base, raising living standards.

Productivity may or may not keep pace. And of course, if higher wages are spent on automobiles this will be a problem. The real planning problem will be how to get rising wages to be spent in the most socially productive way. But that is another story (as Kipling would say).

MH

John:

Your comments of 9:58A.M. and 10:18 captures nicely our present political/economic stalemate.

Does such an elite capture mean liberalism is potentially over?

If it can be renewed how would this happen?

One of the fascinating things about the commentary on this blog is that there is often great certainity about how the present liberal structure of power has been corrupted but great uncertainty as to whether we (as human beings) are capable of formulating and implementing a way out.

Does such a loss of confidence in the capacity of human nature to attain its desires indicate even deeper issues are involved than simply finding an alternative political and economic structure?

“Does such a loss of confidence in the capacity of human nature to attain its desires [sustainably] indicate even deeper issues are involved than simply finding an alternative political and economic structure?”

IMHO this is a key question (apologies for the edit!). What I’ve thus far found to be the most fruitful and wise manner of addressing it, including the beginnings of a new socioeconomic framework, can be found in Charles Eisenstein’s “The Ascent of Humanity”. The whole thing can be read online for free, but at close to 600 hundred (large) pages that’s quite a lot of time in front of the eye-burning monitor. Here’s the website:

http://www.ascentofhumanity.com/

You can order a copy of the book there too. I highly recommend it.

Jim,

I’m pretty sure humanity as a group will do just fine and find better solutions eventually. Unfortunately as a species we have a history of waiting for calamity to get our ducks in a row.

I just finished reading Ian Morris’ “Why the West Rules for Now” which I highly recommend. His argument, boiled down in my pan to this: humanity adapts, organizes and learns; these efforts cause those groups that do to succeed and displace though warfare or cultural displacement those groups that do not; each such successful group is eventually undermined by its own success as the conditions of success undermine the knowledge and organization that led to it and eliminate the earlier conditions that made the order successful. Morris’ 600 plus pages are a pleasure to read, so don’t trust me on that.

On top of this he introduced to me the notion of “energy capture”, a notion that explains why curves for the rates of technological change, resource consumption, crop yields and population all turned parabolic between 1750 and 1800. He makes a convincing argument that we are at a hard ceiling where new knowledge and social organization will be required just to sustain what we have, let alone prevent collapse.

So if it comes to calamity as it generally must, in my estimation the pure demographic heft the species at present will make it a uniquely nasty mess.

Thus I’m quite interested in the potential of information technology in ameliorating large crises and blogs like this evolving into something even better though I have no idea how or what. I think IT offers the possibility for the vast majority of people who do not form opinions about the infrastructural issues of politics and economics but depend on “leaders” to look after their interests, when in crisis they become interested in what has gone wrong, to quickly learn about models of change that can be mapped over facts that crisis makes incontestable. The last time everyone agreed on a fact was when Paulson was on bended knee in front of Pelosi.

A thin hope maybe, but if you have a better idea I’m all ears!

You are correct. The bad news is society will restructure the hard way. The good news is IT will make it make it a short negative stint.

Sorry if my interjection is not quite centred, but I wonder if IT mightn’t be a destablizing force. Online debate, fun and often informative as it is, isn’t the same as direct contact. We all know the Telephone Paradox. Trying to resolve difficult issues over an indirect means of communication is very easily thwarted. A break in communication, internally or externally supplied is usually enough to halt progress. Second, a great deal of human communication is non verbal; body language, gesture, even personal grooming come into play. None of this is capable over electronic lines. There is an excellent reason for human groupings being called associations. So, cut out necessary human interactions and you promote disassociative forces. We all go our merry way until the spaces between each and every one of us cause a general collapse. Wells “When the Machine Stops” comes to mind.

“All Politics is Local.” I haven’t seen IT redefine local yet. Anyone who knows more about this, please enlighten us. A serious request.

My take in brief. Everything you say is true, but you haven’t said everything (of course, that’s impossible on a blog!). I’m writing from Germany, where I live and work, sharing ideas with you and others I could not have done mere years ago. The Internet and IT have changed my life dramatically, and both are changing the world dramatically, even though everything you say is true. Local is vital, but so is global. IT and modern communications, which are always, though stammeringly, improving, help with the global. The local is up to us, and how to federate/nucleate globally.

Culturally, for all sorts of reasons including IT and other media, we change achingly slowly. What we might do technically we cannot allow ourselves culturally. We are still deeply embedded in multiple, many-layered and largely unquestioned myths, including the myth of the Free Market, The Invisible Hand, and Money as Wealth and Measure of Value. That we can technically do things very differently, including local politics, is largely irrelevant until we wake from and penetrate the multiple myths that are holding us back and threatening our long term survival.

Even though we are running out of time, these things take time. The next few years are going to be one hell of a ride.

Ambrit,

Excellent point, but I refer you back to “Why the West Rules, For Now” where another essential concept, redacted from my dessicated synopsis, is that technology alters the meaning of geography: gunpowder eliminated the threat of steppe horse and bow warfare from both China and Europe after a millennium of affliction ending invasive migration as a destabilizing force on those societies: early renaissance sail technology transformed the atlantic from hard perimeter to open highway: the internal combustion engine transformed urban hinterlands from plow to industry to suburb, changing the meaning of distance from constraint to opportunity.

So while all action does occur at the interface of the world and our bodies, the kinds of actions we can take are transformed by technology leading to transformative affects. When the affects of technological change are in their early phase, as IT now is, where the transformation leads is quite opaque and I think up for grabs. The global financial crisis is where our baser impulses take society with depredation through IT: because of this we’re in a jam now that is not abating: what can be done? That will only get figured out by a bunch of people trying stuff until something works: Egypt comes to mind.

My one real quibble with Ian Morris (“Why the West…” etc) is his recurring use of the trope that people are “greedy, lazy and fearful”. While it is true as far as it goes, we are also loving, creative and empathetic. These latter characteristics in my estimation are the only reasons that the brutal masses of humanity aggregated over the last 15,000 years by the centripetal forces of language, religion and war have managed to hang together and prosper. It seems to me that to avoid a massive accidental cull of the population, those should be our focus.

“The irony is that China, with its command economy, is more willing to make long-term investments than capitalist economics which rely on the supposedly superior wisdom of having the capital markets play a dominant role in the pricing of risk funding.”

Maybe we have different definitions of irony. China isn’t constrained by the same ‘market’ factors that drive NPV decisions in the U.S. They have a virtually unlimited supply of near zero-cost labor and raw materials extracted by government owned/controlled enterprises. If China needs to justify government expenditures the cost/benefit analysis can always be made to work. Though I suspect they don’t even waste the time faking analyses and just pull the trigger. Moreover, they likely have more “long-term” investments that result in short-term failures thus making the observed ‘irony’ suspect.

Saw an interesting video on the internet about a mall in a remote region of China, one of the largest malls in the world if I remember correctly. The mall had spaces for hundreds of retail shops, housing for retail employees and a self-contained transportation system but no actual customers and zero prospect of ever being a successful venture. Is this type of ‘long term investment’ waste included in that irony?

FYI, Daniel Kahneman won the Bank of Sweden Prize in Economic Sciences in Memory of Alfred Nobel in 2002 for his work in the development of Prospect Theory (and subsequently Cumulative Prospect Theory) which has been used by a number of economists (most notably Richard Thaler) to explain risk framing and subjectivity in economic decision making. The important take away is that Kahneman’s and Amos Tversky’s (not awarded a dime) work suggested that people might not be swayed so simply by theories of expected utility, fundamental to NPV, but rather, individuals may place significantly greater weight on the potential for loss than on the likely gain. In other words, short-termism as observed by Haldane and Davies may not be evidence of any sort of failures in the investment of capital thus making policies to encourage more capital flows into longer-term projects potentially bad policy.

That said, it is clearly the role of government to bear the risk of uncertain benefits by footing the bill for longer-term projects. Though I still don’t see how the capitalist/market wisdom and the government investing in uncertain future benefits leads to irony when compared to China.

And, for those who don’t know, Kahneman and Tversky were psychologists.

Isn’t short term-ism inevitable though, when the people doing the investing have no interest in the things they’re investing in beyond the rate of return? And company managements in turn reflect this? The result is that airplane companies are owned and run by people who don’t care about airplanes, computer companies by people who don’t understand computers, and on and on. Short term-ism is just a symptom. The real problem is the dominance of the economy by an absentee investor class, and managements that cater to it.

“The real problem is the dominance of the economy by an absentee investor class, and managements that cater to it.”

Back in the day I was told,”If you don’t have time to do it right how will you find time to do it over?”

Responsibility has been replaced by limited liability.

Yves,

You have to make a choice.

Either real interest rates are too low, as you complained in the following post : http://www.nakedcapitalism.com/2010/09/bank-of-england-tells-old-people-to-eat-their-seed-corn-um-principal.html

or they are too high, as you complain in this post.

they can’t be both at the same time.

Personally, I side with the BoE on this : we need long term thinking. And low long term real interest rates are a prerequisite for that.

The problem is that it is not something that the Central Bank can manage only by itself. The Central Bank can indeed set-up short term rates, and indeed the whole nominal yield curve if it wants to. But, it cannot affect expectations of long term real interest rates. If the latter are systematically elevated, you either get :

– depression (because holders of capital will prefer to hoard it because “risk is not remunerated”, or even worse “eat the seed corn” because the future is not worth enough for them) or,

– bubbles (because low financing rates associated with high expectation naturally feeds leverage).

Now, you should understand why they released that paper : they want people to adjust their expectations down, which is ultimately the universal (and only) remedy for financial crisis.