A June 6 trial court decision in Michigan, Hendricks v. US Bank, has not gotten the attention it warrants because to the extent it has been noticed, it has been depicted as invalidating an effort to effect a note (the borrower IOU) transfer via MERS. While that was one of the grounds for a ruling favorable to the borrower, the court also considered and gave a thumbs’ up to what we call the New York trust theory. That has far more significance, as readers will see shortly (hat tip to Foreclosure Fraud for this sighting).

This legal argument, which so far has been tested in a very few cases (primarily in Alabama, since it was perfected by Alabama attorney Nick Wooten) was the basis of a favorable ruling in Alabama trial court. The reason it bears watching is that if the New York trust theory continues to be validated in court, it has devastating consequences for most post 2004 vintage residential mortgage backed securities. it has been the subject of a long-running argument among legal experts, with the Congressional Oversight Panel, Adam Levitin, as well as consumer lawyers like respected bankruptcy attorney Max Gardner on one side, and securitization industry incumbents like the American Securitization Forum and SNR Denton.

The bare bones outline of the argument is that the trusts, the legal vehicle that holds the mortgage loan, in virtually all securitizations, elected New York law as the governing law for the trust. New York law is well established and very rigid. A trust can act ONLY as stipulated; any deviation is a “void act” and has no legal force.

But the problem is that the notes appeared not to have gotten to the trust. As we wrote earlier:

…. there is substantial evidence that in many cases, the notes were not conveyed to the trust as stipulated. As we have discussed, the pooling and servicing agreement, which governs who does what when in a mortgage securitization, requires the note (the borrower IOU) to be endorsed (just like a check, signed by one party over to the next), showing the full chain of title. The minimum conveyance chain in recent vintage transactions is A (originator) => B (sponsor) => C (depositor) => D (trust).

The proper conveyance of the note is crucial, since the mortgage, which is the lien, is a mere accessory to the note and can be enforced only by the proper note holder (the legalese is “real party of interest”). The investors in the mortgage securitization relied upon certifications by the trustee for the trust at and post closing that the trust did indeed have the assets that the investors were told it possessed.

The pooling and servicing agreement also provided that the transfers had to take place by a particular cutoff date, which was typically no later than 90 days after the closing of the deal. That means notes cannot be transferred in at a later date.

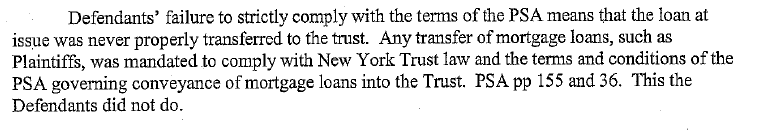

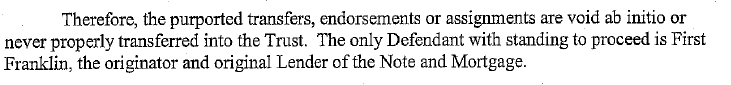

The ruling is very clear that the note never made it to the trust:

Note that the judge rules that someone can foreclose, but it’s not the trust, it’s the original lender. But that is unacceptable to the mortgage industrial complex. They cannot afford to admit they defrauded investors, which is what a foreclosure in the name of the original lender amounts to.

So when people complain about borrowers getting free houses, they act as if it’s the borrower’s fault. That’s the wrong place to assign blame. No one is saying the borrower does not owe somebody money. And the borrowers aren’t seeking a free house; they usually came to this juncture because they thought their records had overcharges in them or they thought they were a good candidate for a mod but could not get the servicer to consider their case. It’s the originators and packagers who put themselves in the situation of not being able to enforce the debt, not the borrower.

The apparent widespread abandonment of the practice of crossing the ts and dotting the is potentially devastating. If the failure to convey notes properly is as widespread as we have been told by various observers (and Abigail Field’s sample confirms), the mortgage industry has a monstrous problem on its hands. As the Michigan ruling suggests, at a minimum, notes not transferred properly are actually owned by someone earlier in the securitization chain. But no one wants to admit that; it means the investors were lied to and hold paper that does not have clear legal rights to foreclose and that originatorrs, servicers and trustees have committed massive securities fraud. And in a worse case scenario, if no notes were transferred to the trust by closing, there is a contract formation failure.

This is the sword of Damocles hanging over the bond markets. The incumbents, bizarrely, seem intent on pretending it does not exist rather than trying to do something to alleviate the damage.

I’m including the full ruling below since it’s short and readable and I know some readers enjoy court filings.

This is all legal posturing and play-acting. The banks know that the government will ultimately “correct” any defects in MERS and the overall mortgage system. For now, banks are playing “extend and pretend” so they don’t really care too much and would rather have all these foreclosures tied up in court for years.

In any case, no matter where the market goes, the banks will win. They will either get the government to approve MERS and the entire system retro-actively, or they will keep playing “extend and pretend” and bury their losses.

You may well be right. But then, in a few trillion years, the whole universe will die a thermal death. So we may as well just give up now, right? It’s going to win anyway, so why try?

WORD.

Expat,

They can’t. Dirt (real estate law) is state law. The Feds can’t make MERS legal at a state level. Even a sort of fix that might move forward, although that is not even certain, a new version of the Uniform Commercial Code, will take YEARS to draft (it’s like coming up with new Basel rules), will most decidedly NOT be retroactive, and will still have to be enacted by the legislatures of various states to come into effect. We are now on version 2 of the UCC in most states. New York and South Carolina still have not adopted it, and a separate new version of one article (IIRC Article 2) proposed something like 9 years ago has yet to be approved by ANY state.

You are right in that real estate law is state law, but Congress can preempt state law at any time.

While such a preemption would be an unprecedented violation of the principles of federalism, not to mention a shameless act of self-pimping, I do not doubt that a congressional majority would shrink from doing just that, if that is what their banker friends needed them to do.

You are right in that real estate law is state law, but Congress can preempt state law at any time.

Not true. There are limits to federal preemption. I don’t see federal law successfully preempting real estate law, and even if it were to do so in the future, it would not be retroactive.

See U.S. Constituion, 10th Amendment:

The powers not delegated to the United States by the Constitution, nor prohibited by it to the States, are reserved to the States respectively, or to the people.

As Scalia is ever so fond of pointing out, the Federal government’s powers are not unlimited. I would think any attempt to “federalize” real estate law would be trounced by conservatives and liberals alike on the the Supreme Court.

I know what the 10th Amendment says.

Even if the Amendment clearly forbade Congress from pre-empting state real property laws, I would not hold my breath waiting for a majority of the Supreme Court to start taking it seriously.

I know I am terribly pessimistic about the US political and financial system, I don’t believe that Wall Street will accept hundreds of billions in losses from defective mortgages. If the losses are passed on to the final holders of the note (in whatever form), then Wall Street may accept it. But imagine foreign banks, quasi-governmental agencies, and foreign investment funds who end up losing. What will they do?

If MERS is found legally defective, then the banks will be compensated by the government. Perhaps a new agency will be set up to buy all MERS-related instruments at par. Or Fannie and Freddie can do it.

I don’t think Wall Street will lose a dime in the deal, so you tell me how it will be sorted out with or without so-called state’s rights.

Dear expat;

The fly in the ointment here, (Help me, help meeee..) is that such a neo-bailout would really bankrupt the government. The numbers are huge. Then there is the ‘smell test.’ I posit that we’re reaching a tipping point where public perception of this debacle will shift from fatalism to anger. Politicians, despite their faults do realize that the ultimate ‘right to govern’ depends on the acquiescence of the polis. The smart ones know that if they ignore the needs of the people too long they run the risk of being swept away by the firestorm. I wonder what the stastics are on fatal crashes resulting from games of ‘Chicken?’ So, if they are ‘damned if they do,’ they are really damned if they don’t.

Sorry for hi______g this thread to Rant Central. (It’s a sign of the times when we self censor, see hi______g above, because we suspect that the data mining algorithum being used by Big Brother might target us for using “certain words.”)

I don’t think politicians are capable to making long term decisions (letting banks lose money on MERS) when those decisions would hurt them in the short term (taking money from Wall Street for campaign funds). If the government pays for MERS, it can hide the stench for another few years.

“But in another few years we’ll have a worse problem!”, you say. Yes, but it’s an SEP (somebody else’s problem).

@Yves: Perhaps the government will classify the mortgage fiasco as a national emergency and a clear and present danger to our nation and way of life. Then it would be easily covered by the Patriot Acts. The government could then do whatever the fuck it wanted to do with the mortgages, the debtors, and the houses. Stopped paying? Okay, we’ll waterboard you and rape your six year old boy until you start paying.

Sounds like a sick rant? Not so much if you ever spent time in one of the US Gulag Archipelago prisons.

@Expat

In any case, no matter where the market goes, the banks will win. They will either get the government to approve MERS and the entire system retro-actively, or they will keep playing “extend and pretend” and bury their losses.

This isn’t about MERS. This isn’t even about mortgages.

This is about mortgage backed securities that are not backed by any mortgages. The mortgages were never transferred to the trust. A whole bunch of institutional investors and wealthy individuals bought these empty boxes thinking they were filled with valuable things.

The “government” can’t do anything retroactively to extinguish the contractual rights of those investors, nor can the “government” bless the fraud, which appears to be criminal. And let’s not forget that the court that ruled here is part of a government.

”

backed securities that are not backed

”

~~Tao Jonesing~

You bet!

The Un-Backed Insecure Insecurity Curiosities

Are Fed Governors a governmental agency? No! They are a de facto independent thorn. Did they already buy up all the Flaky Curiosities? They bought up mine! On the side of the un-backed-flake-holders, all is peaceful within the valley of the Joli Green-back. On the other end of the chain of legal disconnections, what is happening to the mortgage victims who live inside flaky-ownership-homes? Do banks care? No!. Banks have no anxiety whatever. If squatters get to keep their homes, banks could care less. Will lucky squatters cause profit loss for banks? *If* remains irrelevant so long as banks can supplement income with taxpayer’s generously offering up the bailout cash. Do tax payers have any left? No, but banks will lend to taxpayers at low interest rates which will quickly become oppressive as disinflation then deflation set in for the duration.

Court stands adjourned.

All rise

!

I don’t doubt that the banksters sit easy in part because they know that in the worst cast of a Big Plunge over the sheer worthlessness of all the MSBs they falsified, they can count on a grossly extra-legal TARP like palanqin to be voted and toted by the dollar slaves in Congress. In that event, liability will be forgiven and all losses dumped on the public. The real problem for the banksters is what they have now, something well _short_ of a Big Plunge where the typical mechanics of the industry are all gummed up and no business as usual is proceeding.

The Fed Regs don’t want a thing to do with Fraudclosure, and keep trying to pull the curtain back closed on the mugging of the mortgaged masses. But the courts are slowly, slowly grinding the banksters down. So what, then, is the best scenario for the Banksters? That’s right, kick someone over the edge into Big Plunge II so that Congres can vote through TARP Too in the usual 23 hours. Stay tuned, Grand Theft Autowriter coming to a screen near you.

By not following there own legal rules set down in the PSA the banks are on dubious ground and it places the establishment in a difficult situation. Does the establishment side with the banks or other parts of the finacial community. Lets not forget that to some extent AIG and the monoline’s got into trouble insuring the losses on these securitized mortgages. If the transfer of those mortgages into the trust were invalid then possibly so were the losses. On one side you have the servicers and banks on the other you have pensions, hedge funds, foreign banks, China and other saving institutions. At the end of the day without the investors on their side banks and ultimately the US economy will have to pay more for upsetting the investors.

The problem as Yves has talked about before is that the law is set up in such a way that those investors either need to be very big players like CALPERS, Fannie and Freddie who are already begining to take advantage of this or investors need to group together and take action. Investors know that they are on a bit of a gravy train and know that the establishment could make things much more difficult through increased regulation if they upset the apple cart. What most probably will happen especially for foreign investors is that they will slowly reposition themselves away from US bank handled debt so as not to alert the establishment and chip away at the foundations of the US investment industry.Again there will be losers namely the US taxpayer whether its through backdoor bailouts, pensions being reduced, rises in pension contributions, litigation costs, high mortgage and loan costs, higher taxes. Its all about saving reputations of banks and politicians which does have some value, rather than telling the truth and taking the medicine.

Yes, a lot of big players slugging it out in court. Seems the best we can hope for is enough light to shine on the fraud so that it can’t be ignored. A lot of the losses are baked into the cake but would still be helpful to see some handcuffs and get some better referees in the game. The tickerguy does a good job of calling a lot of this out such as this case of Amback suing EMC/Bear Stearns/JP Morgan..

http://market-ticker.org/akcs-www?post=181055

Our Biggest Financial Firms Don’t Scam

“”JP Morgan adopted a strategy to deliberately and systematically deny the financial guarantors’ legitimate repurchase demands to avoid JPMorgan Chase & Co. from bringing onto its financial statements the massive off-balance sheet exposure and, in doing so, effectively engaged in accounting fraud.

91% of the Chocolates in the box are really used dog food, but nobody has gone to jail for selling adulterated boxes of Chocolate.””

There is a law over here about selling cars that have been written off, instate or interstate, says nothing about ex-fill in the —blank— country’s thou.

Skippy…snicker…

No one is saying the borrower does not owe somebody money. Yves Smith

Actually that case can be made. Banks steal purchasing power from the entire population and lend it out for interest. So who is the debt owed to, morally speaking? To the banks or to the entire population?

But let the banks be paid – by bailing out the entire population equally, including savers, with new, debt-free fiat. That would both fix the banks and restore the stolen purchasing power to the population.

As I see it, the following parties could be sued by the investors in the trusts:

(1) The investment banks that securitized the mortgages and set up the trusts.

(2) The law firms that did the due diligence.

(3) The CPA firms that audited the trusts. The firms could be sued for failure to verify that the trusts held the required legal title to the loans.

Regarding federal law changes, I don’t think the can retroactively fix the problem.

DavidE;

Too right, someone can challenge under the ex post facto provision in English Common Law. If it gets to needing ‘bipartisan’ Congressional support, then the sheep will be separated from the goats, and we can all have a nice Greek Barbecue!

English Common Law? Hmmm. Might be a better approach, since the Constitution is considered a quaint irrelevance nowadays. It might be fun to bring up the prohibition against making “ex post facto” laws just for a little humor in the case.

“… the following parties could be sued by the investors in the trusts:…”

True!!!

So why have they been flying under the radar?

Who will give granny a wake up pill?

The banksters have been goosing the stock markets which is acting as a sleeping pill for more than granny.

jal

Another thought here! Suppose a bankrupt company such as New Century is ruled to be the owner of the mortgages if title was never conveyed to the trust. Does the trust have the superior claim or can a general creditor also have a claim to the proceeds from the mortgage? In other words, these guys may have really screwed up. By not conveying the actual mortgage, then the trust could be just another unsecured creditor of a bankrupt company.

Look, rules are rules. A petition may be perfectly valid in every other regard but if it is filed one day late, it’s not valid. If the law required them to have the mortgage coveyed to the trust within 90 days, then what was the big deal about complying with that rule? It’s just a complete disregard for rules and the law.

This is not a case of judicial activism. It’s a case of bankers completely disregarding what the law says because it was inconvenient for them.

The Trust might have an equitable claim to any mortgage-related proceeds paid but parties seeking equitable relief must come to the court with “clean hands.” If the Trustee was reckless in disregarding obligations imposed under the PSA there could be a wee problem.

Scribd’s motto is “saving trees” –by destroying eyeballs?

The case file loads as a doubled blurry mess with two different fonts overlapping using a Mac/Firefox

Download it. I never read these things in the ScribD viewing page.

Truly, this is one of the most interesting aspects of the financial crisis. I really hate MERS because it essentially privatizes public record keeping without public knowledge or approval and then conducts it so sloppily as to destroy clear title for all of us (even if have no mortgage; spz you want to purchase a property later?). It should be exploded. It will cause another financial crisis maybe, but this should be turned back. Else we are not a democracy.

There are certain macro factors not mentioned in this thread or I should say rarely mentioned anywhere…

One of the main factors to be considered is the hugely disproportionate financial capacity versus the organic capacity for GNP. The institutions representing the financial industry must serve an organic utility to the economy anything bejond that is self destructive… In other words, the banks bear the seeds of their own destruction…

Alrighty then…. QE and Fed stimulus simultaniously ending…. Let’s let the markets tell us what they think…. Ben, the ball is in your side of the court…

I continue to wonder where the civil cases are. It seems the MBS holder has a case to recover par. One could buy up a number of these defective MBS and file.

This decision carries with both good and bad news.

Page 7, last paragraph, 3rd sentence:

“The Court grants Defendants’ Motion for a judgment of foreclosure, in favor of First Franklin…”

Hendricks made some good arguments, the court ruled appropriately on the NY Trust argument, and Hendricks lost his property to a prior holder of the debt.

Bondholders always win. It’s one of the reasons I stopped actively investing in stocks and moved to bonds. (I still invest in stocks, but only in index funds.)

Sure, the trusts might not have the collateral, but the bondholders will sue the banks, investment banks, anyone to get their principal back. Haircuts happen when everyone else is bankrupt.

I seem to remember one other time when the feds attempted to run roughshod over states rights….if my memory serves….one side wore blue and the other wore grey and it didn’t turn out very well.

Yves, an observation: in the PSA of my trust it says — and I paraphrase — ‘the note is to proceed from the originator to the sponsor to the depositor to the trust EXCEPT if this is a MERS transaction.’ You have argued elsewhere that the PSA trumps the UCC; well then it would seem that MERS, so referenced within the PSA, would trump the UCC. Moreover, one could hardly rely on NY trust law to vitiate the way the banksters have proceeded because they can assert that they have strictly followed the provisions of the trust’s PSA, thus at once giving cover to MERS and being given cover by MERS, arguably allowing it to do what it has done in my case (and no doubt thousands of others besides) viz., have one assignment only purporting to transfer the note from the originator to the trust. c I value your opinion and have greatly benefited from your blog. Thanks