By Laurence Ball, Professor, Johns Hopkins University; Research Associate, NBER; and Visiting Scholar, IMF, Daniel Leigh, Economist at the Research Department of the IMF, Prakash Loungani, Senior resource manager and advisor in the IMF’s Research Department. Originally published at VoxEU.

Will recovery be jobless? A broad array of analysts, from Vox columnists to McKinsey, are arguing that Okun’s Law is broken. This column presents new research suggesting that, in fact, Okun is alive and well. When output recovers, the jobs will come back, although employment will differ across countries. There may be good reasons for the structural reforms that many propose as a way to boost job creation, but undertaking them in the belief that Okun’s Law has broken down should not be one of them.

Unemployment rates remain high in most advanced countries. Many scholars have drawn attention to an apparent decoupling of unemployment increases from output declines during the Great Recession (e.g. IMF 2010, Cazes et al. 2011).

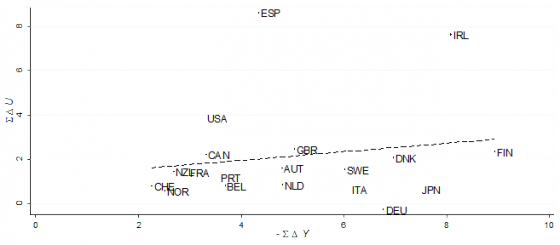

Figure 1 shows peak-to-trough declines in output for a group of OECD countries during the Great Recession against the change in unemployment over the same period. The correlation is essentially zero. In the language of economics textbooks, Figure 1 suggests a breakdown of Okun’s Law, the short-run negative relationship between output and unemployment reported by Arthur Okun in 1962.

Figure 1. The Great Recession: Peak-to-trough output and unemployment changes (simple scatter plot)

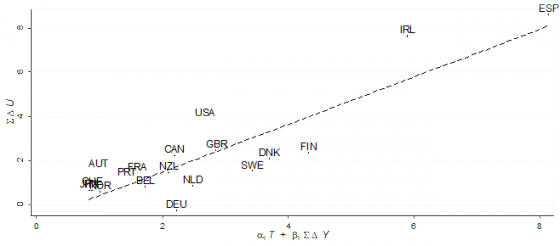

We believe the casual impression that “Okun’s broken” is misleading (Ball, Leigh and Loungani 2013). Two adjustments are needed to restore Okun’s Law (as shown in Figure 2):

- The first adjustment is to account for differences in the duration of the recessions;

For the set of recessions shown in these charts, the period from peak to trough ranges from two quarters to seven quarters. As we show in our paper, Okun’s Law implies a relationship between the changes in unemployment and output only if we control for this factor.

- The second adjustment accounts for the fact that, historically, the coefficient in Okun’s Law varies across countries.

Figure 2. The Great Recession: Peak-to-trough output and unemployment changes (with adjustments for duration of recessions and country-specific Okun coefficients)

Notes: Σ ΔU and Σ ΔY denote the cumulative peak-to-trough change in the unemployment rate and in the log of real GDP, respectively. T denotes the duration of the recession (peak to trough in quarters). αi and βi denote country-specific Okun coefficients.

With these two adjustments, the actual changes in unemployment – shown on the vertical axis of Figure 2 – line up with the fitted values predicted by Okun’s Law, as shown on the horizontal axis.

Spain’s large rise in unemployment is explained almost entirely by the fact that its Okun coefficient is unusually large, along with the length of its recession. Germany’s level of unemployment is lower than that predicted by Okun’s Law – which may be due to its extensive use of worksharing programs – but the residual is modest compared to the cross-country differences in unemployment changes.

Policy implications

McKinsey (2011) argues that Okun’s Law has broken down and that a return to full employment will require not just “healthy GDP growth [but also] major efforts in education, regulation, and even diplomacy”. A recent column Vox column argued that “we can’t just blame the recession” for the high unemployment during the Great Recession (Dobbs and Madgavkar 2012). Whether or not Okun’s Law holds matters for the interpretation of unemployment movements and for policymakers.

In contrast, our results are consistent with textbook models in which aggregate shocks cause changes in output, which in turn lead firms to hire and fire workers. In these models, when unemployment is high, it can be reduced through demand stimulus. Our results suggest that Okun’s Law is alive and well: when output recovers, the jobs will come back.

Cross-country variation in the Okun coefficient

What is true is that the extent to which the jobs come back will differ across countries. While a stable Okun’s Law fits the data for most countries, the coefficient in the relationship – the effect of a 1% change in output on the unemployment rate – varies across countries.

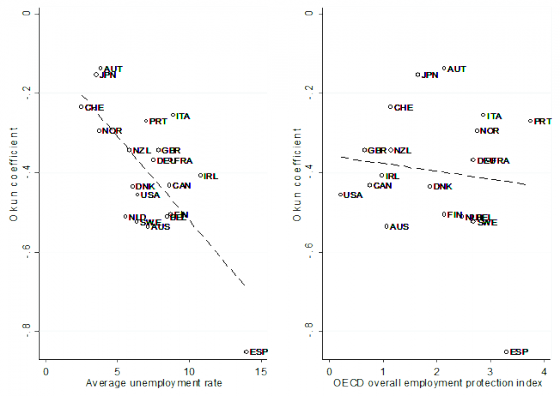

In our paper we report estimates of Okun’s Law for 20 OECD countries using annual data from 1980-2011. The fit is good for most countries except Austria and Italy. The estimated coefficients do vary across countries but most are spread between –0.25 and –0.55. Countries with higher average unemployment rates have higher Okun coefficients in absolute value (see left panel of Figure 3), suggesting there are common factors that drive both variables.

We have had limited success in finding factors that can explain the cross-country pattern of coefficients. A notable failure is the OECD’s well-known index of employment protection legislation. In theory, greater employment protection should dampen the effects of output movements on employment and therefore reduce the Okun coefficient. But, as shown in the right panel of Figure 3, which plots the OECD’s overall employment protection legislation index (averaged over 1985-2008), the relationship has the wrong sign, and it is statistically insignificant. We also find no relationship between the Okun coefficient and the various components of the employment protection legislation index.

Figure 3. Cross-country variation in Okun coefficients (Okun coefficient vs. candidate variables)

Notes: Average unemployment rate denotes 1980-2011 mean. OECD overall employment protection index denotes 1985-2011 mean based on available data.

It appears that the labour markets of many countries have idiosyncratic features that influence the coefficient. These features – not one or two variables that we can measure for all countries – probably account for most of the variation in the coefficients. At one extreme, Spain has an Okun coefficient of –0.85, which is much higher in absolute value than any other country’s. The natural explanation is the unusually high incidence of temporary employment contracts, which makes it easier for firms to adjust employment when output changes, raising the Okun coefficient. At the other extreme, Japan’s small Okun coefficient, –0.16, probably reflects Japan’s tradition of ‘lifetime employment’, which makes firms reluctant to make workers redundant. A possible explanation for Switzerland’s low coefficient, –0.24, is the frequent use of foreign workers in Switzerland. When employment rises or falls, migrant workers move in and out of the country. Changes in employment are accommodated by changes in the labour force, and unemployment is stable.

Austria’s data are puzzling. Its Okun coefficient, –0.14, is the smallest for our 20 countries, and we have not found an explanation for this result.

Conclusions

Our evidence suggests that jobs and growth remain coupled in most countries. There may be good reasons for the structural reforms that many propose as a way to boost job creation, but undertaking them in the belief that Okun’s Law has broken down should not be one of them.

References

Ball, Laurence, Daniel Leigh and Prakash Loungani (2013), “Okun’s Law: Fit at 50?” NBER Working Paper 18668, also IMF Working Paper 13/10.

Cazes, Sandrine, Sher Verick, and Fares Al-Hussami (2011), “Diverging Trends in Unemployment in the US and Europe: Evidence from Okun’s law and the Global Financial Crisis”, Employment Working Paper No. 106, International Labour Organisation.

Dobbs, Richard and Anu Madgavkar (2012), “Why the jobs problem is not going away”, VoxEU.org, 19 September.

IMF (2010), “Unemployment Dynamics During Recessions and Recoveries: Okun’s Law and Beyond”, World Economic Outlook, Chapter 3, April.

McKinsey Global Institute (2011), “An Economy That Works: Job Creation and America’s Future”.

Okun, Arthur M (1962), “Potential GNP: Its Measurement and Significance”, reprinted as Cowles Foundation Paper 190.

I believe that those differences in the coefficient explained by “idiosyncratic factors” have a lot to do with the productive structure of each country. Spain’s economy relies heavily on pro-ciclic sectors like housing and tourism and associated services. Manufacturing is not as important as in other countries. That migth explain why so many jobs in Spain are temporary and firms adjust by ending contracts and jobs associated with these contracts.

I do enjoy it when middle earth inhabitants rise to the surface at the end of Q4. It’s at these times such at these when we discover that Okun was the favourite topic of the hobbits last quarter.

This came across my desk last October. (http://research.stlouisfed.org/publications/review/12/09/399-418Owyang_rev.pdf). By Tatevik Sekhposyan, Senior analyst, International Economic Analysis Department, Bank of Canada

I love the explicit assumption that of course growth will come back. And the implicit assumption that growth is desireable. But I suppose the mind of the economist is too chained down in its shallow rigidity that it cannot tear itself away from customary modes of thought, even as the world around it that it used to base its assumptions on breaks apart.

They read the entrails of dead goats for the generals. They are sufficiently rewarded to support their families and their habits. They wear feathers in their hats, and they are proud of their station.

Depends what is meant by “growth”.

If it means increased usage of new material resources we may be at or near a number of peaks.

If it means “increase in work that needs doing” there is certainly plenty of that. We have to rebuild our entire infrastructure to have a hope of true sustainability.

Did someone say…. _ _ _ _’_ LAW?

Seemingly not unlike the polies on the tele tonight… absolving themselves of said laws incantations… WRT the flood tomorrow and the day after. If the scientists are correct (modeling input – can’t tell till the rain hits the ground) we should only have half the flood we had in 2010.

Skippy… best part about it all… this currant liberal state PM and mayor…. used the last flood to blemish the last Labor Government PM and mayor… snicker…

PS. psychohistorian… Sure, but… as we used to say around here… Stormy one moment and beautiful the next… to be rephrased… Rapture followed by Paradise… marry – go – round.

What a piece of garbage. Even after fudging the numbers to make them fit the “law” the correlation coefficient is low, and if you throw out Spain and Ireland the data has no correlation at all. And then they have the balls to say that the unemployment in Spain was “caused by” its Okun coefficient. And even if it was true, the growth ain’t coming back.

I could never bring myself to care too much about this sort of economic analysis (which is just about all of it, nowadays). There are so many unstated and, to my mind, faulty assumptions wrapped up in word like “growth” that the conclusions reached are totally un-compelling to me.

This growth the author speaks of, does it include growth in financial instruments? How about a growth in the prison industry? Why should we care about “growth,” so broadly defined and why should we assume it to be a good thing?

And that’s not even getting into the data over-fitting issues. It seems like a lot of what practicing economists do is figure out ways to manipulate their data so that it bears at least some passing resemblance to what the theory says it should look like. This is always justified through more or less convoluted reasoning and the conclusions reached are ever the same. Despite what it looks like, the “economic law” in question is found to be upheld (the Phillip’s Curve is good example of this). This makes the economist feel good, since his theory is justified, but doesn’t help a lick in making predictions about the future behavior of the economy.

Very briefly, it is fantasy to believe that industrial employment is going to increase when a) automation replaces many industrial jobs in the near term, and b) real energy costs are skyrocketing eating into the ability of the ‘less employed’ to support industries by purchasing goods and services w/ credit (there is no more credit).

At the end of the day any jobs at all will be non-industrial jobs that require manual labor and a high level of artisanal skill such as shoe making, cabinet making or ‘horticultural’ (non-industrial) farming … if such a thing is possible in a post-industrial climate regime.

If it isn’t there are bigger problems than no jobs.

Along with cheap gas and the luxuries that flow from it, the luxury jobs are dinosaurs waddling off to the graveyard … anyone waiting for them to return will have a very long wait indeed.

Horticultural garden-farming might adjust to wild weather swings and climate decay better than largescale agrifarming might. A hortigardener can fix mistakes or correct for swift changes better than a locked-in multi-hundred acre farmer committed to his crop in the ground.

An equilibrium point of global economy with current technologies is global brazil or perhaps global china. The way out is through technology, perhaps. Depends how optimistic one is about technology in the world of seven billion people. The question is where would this innovation come from in the world of global brazil? At some point, a society which is too oligarchic and unequal sinks into malaise and permanently simmering violence, rather than industry and innovation. This is the real question facing developed countries, and indeed the world.

Since I live in the U.S., I feel uncomfortable talking about somebody else’s oligarchy and inequality. Planks and motes, you know.

It is not about another country. It is about your country, assuming you are a US person. With present technologies, the equilibrium point for global economy is global china. The US is using 25% of world oil output wuth 5% of the population. Do the math. The question is what economic arrangement can grow technological capabilities to get the world out of this bind, rather than stuck in it.

apologies. You just said you live in the US. Scratch assuming.

Oligarchy in China is just as much a plank as oligarchy in America. Maybe oligarchy in Brazil is getting marginally less so? Not a mote in a plankload.

And oligarchs anywhere will support oligarchy everywhere else so all the other oligarchies will circle back to support and strengthen oligarchy anywhere. So its an important question: what is our future in the Brazilo-Chinamerica future?

That is an important point to raise, the one about technology. The pessimist mindset seems to presuppose that it a) always causes more problems b) just transforms problems into different ones or c) causes more enviromental damage. I would definitely like to hear more thoughts on those and why they are supposedly true or false, preferrably withOUT the perennial wanking over limited historical datasets to prove ones point. That crap has truly gotten out of hand, the more difficult and dangerous the times get, the more people stuff their heads into their historical asses for solace of comforting Absolute Truth that tells them that history is perfectly cyclical.

Technologically advanced civilisations have fallen before to ecological disasters, thus ours MUST do so as well. And since these are doomsday wankers we’re talking about, the entire dinner of course comes with a heavy side dish of immediacy and moral condemnation for this or that wrong. Right along with the assumption that if USA crashes through the floor, the rest of the planet will of course follow. Because we’re all just itching to join that particular race to the bottom to follow our dear World Leader Of The Free World Of Greatness And Glory.

Steady state economy + green energy + nanotechnology is also a possibility. Just saying. We still have options left. Less and less every day that our leadership has its heads up its collective asses, licking the colon cancer of Eternal Growth. But to assume this state will hold, I would not bet on it.

You’ll have to hope gray goo turns into green goo then…

I was having trouble with one of my own laws:

2 + 2 = 22

People were giving me a hard time over it, but then I realized if I introduced a so-called Bogu constant β, the result was trivial. With a Bogu’s constant of β = 18

2 + 2 + β = 22

Not only this, but the same Bogu’s constant works for any function:

2 + n + β = 2n, where n = 0, 1, 2, … 9.

So as you can see, my law, despite its benighted detractors, still works perfectly.

In a mathematically less rigorous fashion and as others have noted, there are numerous unstated assumptions.

What is growth? Not all growth is good or sustainable.

What is a recovery? If all its gains go to the high end of the wealth distribution.

Peak to trough: assumes that the peak is actually the peak, but in the US in the Bush years between the 2001 and the December 2007 recession job creation was poor to mediocre. Indeed during this period, the terminology of the “jobless recovery” became commonplace among economists. Where was Okun’s law then?

Peak to trough doesn’t take into account increases in jobs needed to keep up with population growth. The longer a recession and recovery, the bigger the unemployed overhang becomes.

Not all recessions are the same: A deflationary recession is the same as an inflationary sparked one.

Nor are all jobs created the same: The current distribution of new jobs is heavily weighted to McJobs.

Nor are all economies the same: It is pointless to compare the current kleptocracy in the US with all of its looting and criminality with previous downturns. And while the world’s other economies are also kleptocracies, as I have said many, many times, kleptocracies play out differently depending upon the nation or nations involved. Kleptocracy in the US is different from kleptocracy in Europe which is different from kleptocracy in China, but all these and the other economies of the world are characterized by systemic looting by elites on their own behalf and on the behalf of the rich whom they work for and aspire to be.

Should read: A deflationary recession is not the same as an inflationary sparked one.