By Philip Pilkington, a writer and research assistant at Kingston University in London. You can follow him on Twitter @pilkingtonphil. Originally published at Fixing the Economists

I’ve been asking myself that question rather a lot in the past two weeks. This is because I have had two separate commissions for pieces of writing that require me jump down the rabbit hole into the land of the money cranks. One piece is for a magazine and is about gold bugs and their ilk. The other is for an encyclopedia and deals with the Real Bills Doctrine.

To be frank, the Real Bills stuff is actually in some ways worse than the gold bug stuff. Whereas the gold bug stuff is pretty straight-forward and basically in line with the quantity theory, the Real Bills stuff is all over the place. The basic “insight” is simple — that is, money-loans backed by assets that yield real income will not cause inflation — but the various and almost never-ending articulations and re-articulations become ever more murky and confused the digger you deep.

So, what then constitutes a money crank? Well, first of all let’s run through a few names and try to decide if they are money cranks. I will be doing this more so from intuition at this stage rather than by appeal to argument. I will try to build an argument around the intuitive examples I give thereafter.

Was Irving Fisher, founder of the famous Quantity Equation, a money crank? I don’t think so. Was John Maynard Keynes in his Treatise on Money a money crank? Again, I think not. Were Milton Friedman and Anna Schwarz money cranks when they wrote their A Monetary History of the United States, 1867–1960? I would answer in the negative. What about Nicholas Kaldor in The New Monetarism and Joan Robinson in The Rate of Interest and Other Essays? Again, no. The MMT economists? I think not. Finally, what about David Graeber in his book Debt: The First 5,000 Years? Nope, I really don’t think so.

As the reader can appreciate that list contains a number of people with different opinions and different backgrounds. Most are trained economists, for example, but Graeber is an anthropologist and largely an autodidact on monetary theory. It also contains some people that I strongly disagree with on monetary matters, like Friedman and Schwarz. I wanted to include all of these to show that the criteria for what constitutes a money crank should have nothing to do with (a) academic background or (b) whether I disagree with the theories or not.

Now, let’s list some people who I do consider money cranks. Murray Rothbard is, I believe, a money crank. But he is of a more softcore variety. On the left is Silvio Gesell, albeit he is of a more softcore variety. Antal Fekete is what I would consider a hardcore money crank. What about media figures like Peter Schiff and Marc Faber? I don’t believe that these two constitute money cranks. Rather I think that they draw upon the stories spun by money cranks to sell their respective products — whether that be themselves as media figures or financial positions managed by their companies. They are better seen as ‘pop money cranks’ who spread the heavily condensed Gospel to the masses in the form of soundbites.

So, what are the commonalities that go to make a person a money crank? If I must summarise I think it would be as follows: in order for someone to be a money crank they must meet one of two criteria. One such criterion is that their analysis of money must be tied up with strongly normative views of how the money system should function. Now, obviously most monetary theorists will have some normative views about how the system should operate, but I think that we can draw a distinction between, say, the view of Friedman that central banks should stick to monetary targets and, say, the views of Rothbard.

We can get a clearer idea of the divergence by quoting from both writers. The chapter headings of Rothbard’s work What Has the Government Done to Our Money? are instructive in this regard (as is the title of the work itself). These include:

Government Meddling With Money

and,

The Monetary Breakdown of the West

The content is quite in keeping with the titles too. In the subsection entitled Government and Money Rothbard writes,

Furthermore, government meddling with money has not only brought untold tyranny into the world; it has also brought chaos and not order. It has fragmented the peaceful, productive world market and shattered it into a thousand pieces, with trade and investment hobbled and hampered by myriad restrictions, controls, artificial rates, currency breakdowns, etc. It has helped bring about wars by transforming a world of peaceful intercourse into a jungle of warring currency blocs.

Now compare this to some of Friedman’s writings on the desirability of his monetary policy rules. The following is from his paper The Role of Monetary Policy,

By setting itself a steady course and keeping to it, the monetary authority could make a major contribution to promoting economic stability. By making that course one of steady but moderate growth in the quantity of money, it would make a major contribution to avoidance of either inflation or deflation of prices. Other forces would still affect the economy, require change and adjustment, and disturb the even tenor of our ways. But steady monetary growth would provide a monetary climate favorable to the effective operation of those basic forces of enterprise, ingenuity, invention, hard work, and thrift that are the true springs of economic growth. That is the most that we can ask from monetary policy at our present stage of knowledge. But that much and it is a great deal-is clearly within our reach. (p17)

Note carefully the difference in tone. Rothbard gives off an impression that this is all quite personal. Someone has, in a very real sense, done him an injustice… personally. Terms like “meddling” and “tyranny” are thrown around to show that all the ills of the world are tied up with the money system. This highlights something of interest. Whereas in, say, Marx we find a similarly agitated tone, we do not find this tied to something occurring in the money system. That is why Rothbard is a money crank and Marx is not. Marx’s ire is primarily political, Rothbard’s is primarily tied to the money system — for Rothbard politics and the money system cannot be separated.

For Friedman, however, there is no indication that the money system gets him hot and bothered. For him it is just a means to an end. He has set goals in mind for society — goals that are largely in keeping with the economic consensus — and the money system is merely a means to bring about these goals. Whereas one can imagine Rothbard foaming at the mouth and genuinely affronted by a Federal Reserve open market purchase, one cannot imagine the same to be true for Friedman.

This criterion may be outlined as such: a money crank is a person who views the money system from a position in which they have substantial emotional investment.

Rothbard, however, is tame in comparison to a writer like Fekete. In his poorly written work The Gold Standard Manifesto: “Dismal Monetary Science” he writes,

Governments and academia have utterly failed in discharging their sacred duty to provide a serene environment for the search for and dissemination of truth regarding economics in general and monetary science in particular. This failure has to do, first and foremost, with the incestuous financing of research ever since the Federal Reserve System was launched in the United States in 1913… Under the gold standard government bonds were the instrument to which widows and orphans could safely entrust their savings. Under the regime of irredeemable currency they are the instrument whereby special interest fleeces the rest of society.

Or again,

Unknown to the public, at the end of the day the shill is obliged to hand over her gains to the casino owner, alias the United States Treasury. There is nothing open about what is euphemistically called ‘open market operations’. It is a conspiratorial operation. It has come about through unlawful delegation of power without imposing countervailing responsibilities. It was never authorized by the Federal Reserve Act of 1913. It defies the principle of checks and balances. It is immoral. It is a formula to corrupt and ultimately to destroy the Republic.

Such passages are pretty off-the-wall. The money system is portrayed as a vast conspiracy set up to defraud widows and orphans. Here we see that Fekete is far more hardcore than Rothbard. Whereas both agree that the government “meddles” with money and this is undesirable and leads to some sort of personal injury, Fekete goes one step further and portrays the system as an organised conspiracy set up against the vulnerable. Let us now turn to the second criterion that a person can meet to be considered a money crank.

This criterion is often, but not always, tied to the first. It is: the idea that all of society’s ills can be solved merely by reorganising the money system. Often the proposed changes must be extremely complex and little thought is typically given as to how really existing social institutions — which arose less by design than by necessity — will integrate the proposed changes. This, I think, is why Gesell falls into the category of money crank.

I cannot quote it at length here but the interested reader should have a look at the section of his work The Natural Economic Order entitled Description of Free Money. There you can see a highly complex exposition of how the money system should be changed to liberate mankind. The problem with such expositions are twofold. First, as already mentioned, it is well-nigh impossible to redesign institutions that have arisen organically — the money system is one of such systems. Second, the idea that the Grand Plan would work out just as it did on the back of the author’s envelope is deranged. No one seriously interested in economic policy could rationally believe such a thing. Plans only work when they are highly simplified — and even then they will have enormous unforeseen consequences.

So, let’s state this criterion in no uncertain terms: a person who believe that all, or the vast majority of, social ills are caused by the current money system and thus can be solved by implementing an imaginary money system that they have designed can be safely considered a money crank.

Anyway, I doubt that the above is completely comprehensive. But I think it lays down a few general observations that might help in distinguishing between monetary theorists and money cranks. Of course, as with most of these things there may be some that fall outside of the criteria here laid down who are nevertheless money cranks. In that regard, the reader can only but trust their own judgment.

Finally, I would say that we should not think that money cranks have nothing to offer. I am sure that right-wingers can find suggestive insights in Fekete’s work and I think that the left can find a few in Gesell’s work (in the General Theory Keynes certainly thought so). This is because of these writers almost monomaniacal focus on the money system. Most monetary theorists, as I have said, view the money system as a means to an end and thus they do not obsess over it any more than they need to. Money cranks do, however, and that can often lead them to generate minor insights that conventional money theorists miss. But a crank is still a crank. And that should be at the forefront of peoples’ mind when approaching the works of any money crank. Because it is far easier to fall down the rabbit hole than it is to crawl back out.

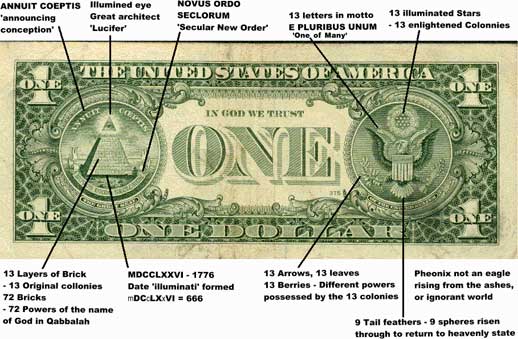

This picture is Psychohistorian bait… here you go psycho to get the ball rolling – The Trinity of Words stretched back to PIE, 72 [bricks] names of Qabbalah [aspects of divine energy] attached to the tree of life – on money – yet they all fail for the same reason, you can’t make money moral or ethical. Its an inanimate object… duh.

skippy… some believe invoking the names of Qabbalah caused the red sea to part, monotheistic mysticism.

You’re making far too much sense.

And don’t forget, if you fold a $10 bill just right, you can turn the portrait of Alexander Hamilton into a picture of the south end of a cow with pure red hair. Or something.

Criterion 1) a money crank is a person who views the money system from a position in which they have substantial emotional investment.

Criterion 2) a person who believe that all, or the vast majority of, social ills are caused by the current money system and thus can be solved by implementing an imaginary money system that they have designed can be safely considered a money crank.

In my experience most monetary cranks (the sort who will be directing ad hominem toward you in the comments today) meet both criteria, but they typically meet a third as well:

Only their personal views on monetary systems are valid. Any effort to enact a reform which does not strictly adhere to their accepted ideas is a villainous trick by servants of dark forces. Therefore it is either their monetary system or the one we currently have, and they will work mightily to throw a wrench into the works should anyone else make an attempt to improve the current system.

Does Lord Adair Turner’s proposal for Permanent Overt Money Finance of government deficits by issuing fiat money without debt fit your criteria number 2?

http://www.group30.org/images/PDF/ReportPDFs/OP%2087.pdf

Because it is indeed radical, engaging a monetary taboo.

Yet sufficiently with monetary gravitas that it gets published by Volcker’s central banker think tank – The Group of Thirty.

The thing about the evolution of money science is that it has never been claimed as something that is settled by either empirical political-economic facts nor by any long history of acceptable socio-economic outcomes.

It should suffice by Keynes’ apology that attempting to be non-inclusive of any ideas is simply intellectually dishonest.

Creating your own non-inclusive criteria serves no socially-advancing purpose.

Substitute political for money in the two criteria, and you are well on your way to a general theory of crank.

You know, that’s an excellent point.

Philip, the saying goes that “love blinds you”, and let me add that I think the same holds true for ambition. I do not understand what it is you exactly want — what your ambition is — but if you want to build a career for yourself, academic or otherwise, you may want to consider to be somewhat more respectful to authors who share a particular view on monetary affairs, albeit it is a view you disagree with. Fekete and Rothbard have shared their arguments in depth and calling them money cranks is by any standard disrespectful of their efforts, if not ignorant of the merits of their views. You may disagree with them — also I have my disagreements with these two gentlemen — but this critique can hardly be considered a serious effort of disqualifying the merits of their arguments or points of view.

Speaking of merit. Maybe you remember your guest post on FT Alphaville last year in which your expose of Treasury data was found lacking, even faulty. In fact, the graphs you used proved utterly mistaken and it collapsed the legitimacy of your projected conclusions. I hesitated to comment (in defense of you) since some of them were quite harsh on you. Let me not hesitate this time. You made mistakes in the past yourself causing your credibility to be questioned. I thought, honest mistakes happen so learn from it and go on. But then this. Oh my, oh my.

Ambition my friend, it can seriously blind you.

Oh dear, oh dear. This one has a bee in his bonnet indeed.

Well chaps,

When I fist glanced at this “header” I thought it was a discussion on crack cocaine, which in essence it would seem is what the effect of money has on our ruling elite, i.e., they cannot get enough to feed their addiction to power, which ultimately all this wealth purchases.

I’ll stick with the fags, at least I know its going to kill me – no bad thing not having a pension, nor being a home owner, so essentially doing society a favour if I listen to our neoliberal friends – not quite sure what their addiction is though. It ain’t the truth that’s for sure!

The author included in the non-crank category at least one major player (Friedman) with whom he disagrees profoundly. So your assertion that “you only called the cranks because you don’t agree with them” fails.

As Rothbard famously sang while walking across Abbey Road, “you never give me your money, you only give me your funny paper.”

Why’d you do it mu’addib ? Why ?

‘For Rothbard politics and the money system cannot be separated.’

And for Kongress as well. Within the Federal Reserve’s dual mandate of stable prices and full employment, the latter goal is clearly political.

From a summary of the Humphrey-Hawkins Act of 1978:

‘By 1983, unemployment rates should be not more than 3% for persons aged 20 or over and not more than 4% for persons aged 16 or over, and inflation rates should not be over 4%. By 1988, inflation rates should be 0%.’

Ha ha ha … now that’s some serious crankage for ye!

Rothbard is pure evil. He vigorously supported the legalization of pedophilia along with the pimping and murdering of children.

Interesting article. I think it’s useful to try and figure out the difference between an objective discussion of monetary functioning versus the political overtones as you mention with Marx.

If we take MMT as an example it tries to lay out an objective system of how the Fed and Treasury actually work and what is the true function of taxes. Functional finance or the sectoral balance approach is similar but brings in three sectors, government, private and foreign which although simple and objective and useful to discuss the impact of austerity measures quickly gets us into ‘political areas’ such as the function of the FIRE sector as part of the private sector.

We also don’t want to be too rational as then we ignore things like discrimination and the moral implications of debt.

Economic discussions also can be genuinely impassioned as when we talk about fraud. I see Bill Black leaning more in this direction.

http://neweconomicperspectives.org/2014/04/kamikaze-economics-politics-forcing-austerity-ukraine.html

The Kamikaze Economics and Politics of Forcing Austerity on the Ukraine

Posted on April 5, 2014

By William K. Black

“Sixth, instead, austerity dogma trumps – simultaneously – good economics, good domestic politics in the U.S. and the Ukraine, and U.S. national security. That’s how insanely powerful the failed dogma of austerity has become. The CEOs who run the banks that loan money to the Ukraine are more powerful than the Pentagon and our State Department.”

http://neweconomicperspectives.org/2014/04/three-passages-akerlof-romers-1993-article-prevented-crisis.html

Three Passages From Akerlof & Romer’s 1993 Article That Should Have Prevented The Crisis

Posted on April 4, 2014

By William K. Black

“My series will focus on the difference between the frenzied DOJ, political, and media reaction to Lewis’ criticism of allegedly lawful HFT practices and the “yawn” reaction of these same groups to the vastly more damaging criminal frauds runs by our elite financial leaders that caused the financial crisis is astronomical, ludicrous, and disastrous.”

——

And the marxist oriented review of Piketty’s book

http://mltoday.com/professor-piketty-fights-orthodoxy-and-attacks-inequality

“Piketty talks to a specific audience. Perhaps he hopes enough capitalists will be far-sighted and realize that open oligarchy may stimulate mass rebellion. He thinks there are good people like himself who care about democracy and understand that it must be paired with capitalism. In U.S. terminology, he is a liberal, on its left flank. The people next to them on the political spectrum hold the same beliefs but profess socialism in one or another cloudy version. These are the social democrats.

They have had a rough time for a couple of generations. Capital, weakened by fundamental problems in its economy, became heavy-handed in a drive to raise the rate of exploitation. It dumped the old generation of social democrats whom it had coddled, the admirers of Walter Reuther, Michael Harrington and Tom Hayden. A section of progressives are excited about Capital 21 because it might help revive social democracy.

For the rest of us, Capital 21 provides solid data about the very rich. Piketty’s work is a demonstration of the adage, follow the money. Good advice. But when you need deep understanding of society, follow the labor.”

I do not get the point of this post. The author writes, “The money system is portrayed as a vast conspiracy set up to defraud widows and orphans.” We live in a kleptocracy. The monetary system is by far the most efficient means of looting the 99% for the benefit of the 1%. Fed policy for the last 35 years has targetted worker wage increases as inherently inflationary. The result has been 35 years of flat real wages. This means that all gains in productivity have gone to capital not labor. When the kleptocrats blew up the economy back in 2008, the Fed came to their, not our, rescue to the tune of something like $16 trillion. Since then while the rest of the country has languished in an unstated recession, the Fed has run ZIRP and QE programs whose main purpose has been to inflate bubbles in commodities and equities thereby allowing the rich to pump up their wealth even more.

For me what is important is how easily an economist and his or her ideas can be used to propagandize for kleptocracy. I would add to that virtually all modern economics fail to deal or even acknowledge kleptocracy, wealth inequality, and class war. So from that point of view, all modern economics is crank as far as I am concerned.

The monetary system is not the means by which the Corporate Lords loot. Corporate governance and financialization and capture of regulatory agencies are the means, and they do not depend on whether you have a central bank or fiat currency or gold.

Do you know how many depressions and financial crises happened in the U.S. while on a fixed-rate monetary system? Dozens. So they can loot with fixed-rate, they can loot with free-floating, they can loot with any system which can be implemented in the real world. That ought to be a big flashing neon sign that currencies are not the problem.

“”The monetary system is not the means by which the Corporate Lords loot.””

False.

…..rather ‘financialization’ is one means……not dependent on whether you have a central bank or fiat currency or gold.

False choice again, public versus private central bank and money being the real determinants of who wins and who loses.

Our system of money is one where we either have or do not have money in circulation based on the number of ‘debt contracts’ the banks have with borrowers.

We have a money system based on debt contracts.

THAT is the system that allows and encourages ‘financialization, because the banker-class can always create new ‘debt-contract’ structures, like futures, options, swaps and derivatives, that determine the amount of money things in the economy, and determines who gets to issue, control and benefit from those contracts.

Clue: It ain’t The Restofus.

Definitely a dangerous structure of ‘debt-contracts’

In his book ‘Extreme Money: Masters of the Universe and the Cult of Risk’ (2011) Satyajit Das talks about the ‘Liquidity Factory’.

On an inverse pyramid at the bottom little pinnacle are the central banks, 2%, then there are bank loans, 19%, then securitized debt, 38% and then derivatives 41%.

This is all considered liquidity ie the lubricant that allows the global economy to run. And 79% of it is derivatives and securitized debt which are largely unregulated and full of fraud. And the $16 trillion of US Treasuries used as collateral to back it all up is a small little fraction.

This is financialization run amok and what he calls ‘cotton candy’ which is spun sugar composed mostly of air.

I would argue that they can create the debt instruments you mention because the government lets them, not because of the monetary system we live under. Fiat currency existed for decades before CDOs or other such instruments. It was deliberate government policy that led to financialization and supported it all the way to its present monstrous state. My god, slavery and indentured servitude existed side-by-side with the gold standard in earlier centuries, as did the world of Bleak House. The money system didn’t make that a reality–people did.

We are being robbed because there are robbers afoot, not because of this or that monetary system. Europe today refuses to adopt the monetary strategies of the Fed, yet is being looted even more thoroughly without securitization. And as the author points out, the idea that a change of monetary system will cure our ills and usher in the millennium is pretty weak thinking.

Citizens United… duh.

Skippy… the government let them… shezzz.

The money system itself may not be looting, but it’s hard to argue that the management of that system always results in inflation over time. You only need to look at what a dollar would buy just 20 years ago to see this. Inflation is a slow-motion looting of workers and savers. Of course, the way the government now measures inflation, there officially isn’t any at present. However, if you need food, energy, and a place to live, you will definitely notice how expensive things have become. And those consumer goods which have remained the same price as they were a few years ago, are either lower quality or sold in a smaller amount for the same price.

The government lets them operate the money system on a debt-contract basis, that’s for sure.

But the nature of a debt-based system of money is that money creation and issuance, the “being” of national circulating media of exchange, of purchasing power, can only be done by those corporations with a banking charter that allows them to monetize their debt contracts, and to make their bank liabilities legal to tender for payment of any debt, public or private, in this country, and elsewhere.

This is the bankers’ school money system.

I’m sorry that you’re not informed that it is exactly a systemic problem, it is of their design, and these results are not the work of a few bad actors.

Read the Andrew McNally piece in yesterday’s Financial Times on the problems of debt contracts in our society today.

If you want to do something about our wealth and income disparities, how about ditching the money system where, for some reason, the One-Percent get to create and issue the nation’s money, and collect, perpetually thereon, its rent from The Restofus. Perpetually.

(Obviously qualified on both points there.)

The alternative is that indirectly proposed by Adair Turner, for money creation and issuance by the processes of government that would provide the tools needed “to maintain long run growth of the monetary and credit aggregates commensurate with the economy’s long run potential to increase production”.

It is readily within grasp, as Friedman said above, through a change to a truly sovereign and autonomous fiat money system.

http://sovereignmoney.eu/currency-and-banking-teachings

Nothing you have written here addresses the comment to which you were responding.

Perhaps it was that the monetary system IS the means by which the corporate Lords loot the masses.

And that , yes, they can loot with any money system that is based on debt contracts.

And, that with a money system that is NOT based on debt contracts, rather on public equity issuance of money, they have lost their looting system altogether.

We are back to ‘MMT is descriptive.’

No need to reform, change or abandon the current monetary system – “The monetary system is not the means by which the Corporate Lords loot.” Yes, and so, “Let me describe how this system – as good as any, because it’s not about the system – works and what fantastic things we can do with it.”

‘Money is neither moral nor immoral’

‘It’s the actions of people.’

OK. Let’s go along with that for a moment (just a brief moment, but not too long).

How about the action of some nefarious people designing a monetary system that defrauds widows and orphans? Is that resulting monetary system immoral? When you oppose that action, you oppose its monetary system. You can’t separate the two.

This is a follow-up to an earlier MMT proclamation that this is not a good time to tax the wealth.

I have no idea what argument you are making here, other than the current system personally offends you. Financial looting is possible in any monetized economy and a different monetary system won’t change that. You either do the hard work of holding people accountable or your don’t and there is is no reform that will ever change this or render grand corruption an impossibility.

The point is to focus on reforming the current system, instead of waving it away with ‘the monetary system is not the means by which the Corporate Lords loot.’

It is the means.

And that reminds us of the MMT claim that it is just ‘descriptive’ – with the implied emphasis on describing how that system works AND how to work within that system.

That also reminds us of another MMT claim from the other day that this is not the time to tax the wealthy.

Now you’re being dishonest. MMT hasn’t “claimed” anything regarding whether or when taxes should be raised, nor would it as it’s just a tool-set for analysis. It can’t have political views.

Here is a simple question.

Should we tax the wealthy…NOW?

Thank you, Hugh.

Exactamente.

Well said. The fervor with which some people want to avoid addressing reality is almost comical.

How can a piece this inflammatory not even mention financial fraud and bankster bailouts?

Because it isn’t about fraud. It isn’t about the proper way to cook a tortilla either, so I guess we should condemn it for that too.

I guess the point is that it isn’t about anything. Hence Hugh’s quip that it’s all crank.

Theoretically time stops at the speed of light. So if money is digital we only need one dollar for the entire world. Then there would be no money to steal and problem solved. Because that money, that one brave astronaut-dollar, would have an eternal speed limit. We could take that dollar and digitize it, turn it into an electron, put it on an accelarator to maintain a constant speed as it sailed around and around the world creating enough grease for the global economy and there would be no debt, no future money, no poverty and no theft. Because time would be standing still monetarily. Can somebody please build this accelerator?

Has anybody read Leading Indicators by Zachary Karabell. A book review would be nice. It sounded interesting on CSPAN. To the effect that we don’t know what we are quantifying. So… why bother?

Not sure how Philip is defining crank. Most, if not all of us are cranks. Keynes, GB Shaw and Beveridge were all adherents of back-of-a-fag-packet eugenics. So tough to disestablish “organic institutions”? I doubt it. I’m off for a walk with the dog. I’ve appraised him of the argument and will let him think it through. Curses! I’ve just revealed myself as a crank.

Money is crankery, much as technology is ideology (Habermas). It’s a control fraud much as water-engineers did in the past with the then vital to life liquid, pretending to be in touch with water-gods. Money is much safer for its priests as they can print more of it, rather than have to rely on such fickle matters as rain.

I find the criterion spurious somewhat, although I get the sense of what you mean… methinks you want to draw a line based on some sense of normality of organic institutions…

However, taking the lead from Graeber, this is a time in history when there is not the NORMAL (in historic terms) human opprobrium of interest / chrematistics… If money is debt, and it grows and grows, then as Mark Blythe reports it, it is a commitment to emetic economics (boom bust, and you just have to ride out the collapse)… and most NORMAL economics does not even have a theory of crisis, nor a commitment to Spencerian survival of the fittest.

Not including Friedman, for instance, as a crank is truly worrying! ‘Assumptions do not matter as long as the hypothesis meets the reality test’ as a Friedman scientific proposition… means forgetting that if you can assume anything then you can prove anything… if one makes a distinction between domain and non-domain assumptions as Steve Keen does, then Friedman is complete CRANK. Even Samuelson gets this, he called Friedman’s causation the F-Twist!

Whatever happened to a critique of Equilibrium, the counterpart to the laws of attraction in physics, as the organizing principle??…. except for super competitive markets, it is junk. Others who dispense with eqm set upon a muddy path of embracing a complex reality… Paul Davidson has repeatedly criticized the ergodic axiom, which Samuelson said was necessary to make economics a science… ‘past is prelude’…

Basically, I think there are far more monetary cranks than your criteria allow…

Why?

Rather than having an open discussion about what the money system is and what it should be, we get a page full of categorizing the ‘ideas’ of some major players as ‘out of touch’; these are the people that Phillip thinks are ‘the cranks’.

Sorry, this is really small-minded stuff.

While the smallest contribution might come from whomever asks for an article on monetary cranks(who is that?), by posting Phillip’s hit list here, ‘smallness’ on money science becomes a new NC standard.

That, or whether, money system failures have, in turn, caused all of the major failures of the national economy, should be on top of the discussion list, and whether every new money idea, such as advanced recently by the former Chair of the UK’s Financial Services Authority, Lord Adair Turner, should be scoffed at because they embrace a new money paradigm.

http://www.group30.org/images/PDF/ReportPDFs/OP%2087.pdf

Turner’s recent work is based on both Fisher and Friedman, who Phillip has classified as non-crank rationalists, but Turner’s proposal bridges the taboo of non-debt-contract fiat money creation by government.

Sorry that Phillip fell for the call to the intellectual barricade. ‘Let’s not talk about the money system. Let’s just shoot our basket of money messengers.’

Nice work.

Turner is advocating using existing institutions in a novel way. I see nothing “crankish” about that.

Nothing “crankish” about preserving failed institutions? Failed from the perspective of a ninety-niner.

“All censorships exist to prevent any one from challenging current conceptions and existing institutions. All progress is initiated by challenging current conceptions, and executed by supplanting existing institutions. Consequently the first condition of progress is the removal of censorships”.-George Bernard Shaw (1856 – 1950).

Labels and Categories are clever forms of censorship…”He’s a crank-don’t listen to him/ He’s not a crank-listen to him”

Based on this conclusion I think this analysis by Turner misses the mark

“But, second, in the upswing of the cycle, we should have been massively more worried than we were precrisis about the excessive creation of private debt and private money, and we should be wary of relying on a resurgence of private debt and leverage as our means of escape from the mess into which excessive debt creation landed us.”

The problem wasn’t private money creation as much as it was fraud.

http://neweconomicperspectives.org/2014/04/three-passages-akerlof-romers-1993-article-prevented-crisis.html

“This is the perfect “signal” of accounting control fraud because no honest lender would ever inflate an appraisal.

Similarly, no honest lender would make “liar’s” loans.

Because there is no fraud exorcist these frauds propagated throughout the secondary markets. Like toxic heavy metals, the concentration of these fraudulent loans tended to increase as one went up the financial food chain producing CDOs that were so toxic that they took down the global economy.”

There is nothing organic about the expansion of the actual monetary system worldwide. Anthropologists have documented how economies that were not dependent on currencies were drawn into European monetary systems. That is the history of European imperialism. Washington took over after WWII. This article is confused. Philip wants to make emotion a characteristic of a crank. I want to know what kind of a person would not be outraged once they understood the violence behind the expansion of capitalism in the modern world. And that violence continues everyday, most obviously in the precipitous expansion of the pauper class worldwide. Money is the central institution of capitalism, which requires a dependence on the market for one’s survival.

A cool head is better than a hot temper. Outraged humans do little thinking.

Wrong. Jesus Christ. Karl Marx. E P Thompson. Mahandes Ghandi. Joan Robinson. Nelson Mandela. Patrice Lumumba. Michael Hudson. Vandana Shiva. David Graeber. There’s no end to this list. Outrage is the starting point of good critical thinking. What are you suggesting? It’s not the endpoint. Even Pilkington acknowledges this in the posting that starting this discussion. The notion that Marx was incapable of outrage and cool analysis at the same time is simply wrong.

Good point, Paul.

For some, outrage leads to critical thinking.

Without that discipline to transform it, outrage is simply too dangerous to have…and to be avoided.

Your comment neatly illustrates my point.

Thanks

My comment addressed Pilkington’s false claim that the actual monetary system is organic. It is not, but has been imposed worldwide through a number of strategies, designed to destroy alternative systems identified by many economic anthropologists. Graeber calls a certain number of these systems “human economies.” There was nothing organic about the violence that destroyed them and forced people into dependence on pounds, francs, and dollars. You avoid that substantive correction to dismiss anybody who responds to that violence with outrage. My further argument is that outrage does not exclude analysis. Are you suggesting that Michael Hudson’s The Bubble and Beyond is not analytically strong because Hudson is outraged? Is Capital poorly argued? How about Graeber’s Debt: The First 5,000 Years?

Do they give money agency? Is money vengeful? Or is it pure, corrupted by man?

If ‘money’ can be ‘corrupted’, someone gave it agency. I think most monetary cranks give it agency.

“Furthermore, government meddling with money has not only brought untold tyranny into the world;”

Great, you’ve made the money angry, resulting in its wrath — tyranny.

I agree. Too many people reify money to the extent that one system of money or another is moral or immoral, rather than seeing the actions of people as moral or immoral. I still want to know how these purveyors of “sound” money intend to get us out of a crash (ah, but for them, crashes “can’t” happen if only we had “sound money”!) without some way of reflating the economy short of the Yukon gold rush.

If we had clear, proper rules around the use and abuse of money, and enforced them, then almost any monetary system from shells and beads to gold and fiat currency could work. What we lack are clear rules and vigorous enforcement, not some “perfect” monetary system.

“capital is fleeing the country”…the capital didn’t like the food?

No, people are sending money out of the country. It’s just another way to cover for their treachery. “the money is making me do it!”

Power corrupts.

Yes, some people can not be bought.

A lot of people are not so strong.

If it’s not ‘money corrupts,’ perhaps we have to wary that ‘money can corrupt.’

“”I still want to know how these purveyors of “sound” money intend to get us out of a crash (ah, but for them, crashes “can’t” happen if only we had “sound money”!) without some way of reflating the economy short of the Yukon gold rush.””

Sounds like that Boom and Crash, Bubble and Bust pro-cyclical debt-based money system is at the center of your thinking.

Some truth to that ‘prevention’ has its merits.

And the answer to your question is reflating the economy with equity-based rather than debt-based monies. Pretty straight-forward.

But if you really want to see HOW the alternative works, Please have a read of:

“”Workings of A Public Money System of Open Macroeconomies – Modeling the American Monetary Act Completed – (A Revised Version)

Dr. Kaoru Yamaguchi

∗Doshisha University

Kyoto 602-8580, Japan

E-mail: kaoyamag@mail.doshisha.ac.jp

http://monetary.org/wp-content/uploads/2011/11/DesignOpenMacro.pdf

Steve Keen called Dr. Yamaguchi’s modeling the most sophisticated he had ever seen.

Thanks for the references! There are hundreds of alternatives.

Of course there is also the work of Stephen Zarlenga who argues that sound money should not be debt. It is possible to have greenbacks, as in the anti-colonial war establishing the US. He has a disagreement with Ellen Brown on what is to be done.

And anything can be money, as long as someone else is willing to accept it. Banks use and abuse their deposit creating abilities (seeking reserves AFTER), and mainstream economics ONLY focuses on public finance.

Alternatives abound, but the issue is how to get from here to there – as even Andy Haldane is finding out… there is something very perverse about chrematistics politically… what makes things difficult is the global homogenisation of the US T-bill standard without a Jubilee (except for BigFinance).

BigFinance is known to deindustrialise a country, as the US is finding out…

Then Keen was not on his game. I’m four pages in and have already seen three egregious mistakes in this “sophisticated” work. Yamaguchi’s model depends entirely on defining central banks as private institutions, allowing him to label all monies issued from them as debt. Get rid of private ownership and suddenly money isn’t debt any more. That’s how “sophisticated” his argument is.

There’s not one instance of the term “liability” in that paper, his understanding of the difference between stocks and flows is questionable and his overarching premise requires an exceedingly narrow definition of a very broad term.

It boils down to “we’ll call it this instead of that” and then our problems will go away.

Some sixty years ago Martin Gardner wrote Fads and Fallacies in th Name of Science. In the first chapter (which can be read online for free at Amazon, Google books, etc.), he lays out some criteria for identifying a scientific crank. You might find a compare and contrast with your requirements for a money crank to be useful.

What Hugh says rings true for me. Some people will say “so what, things have to be this way and the sky will fall if you fools tinker with anything”. Any analysis of money is probably crank, other than in thought experiment, if money or capital is considered neutral. There is a difference between slogans like ‘all truth lies in the main destruction’ said as though we can rely on some natural, lovely human nature, and genuine analysis of how humans have, do and might behave. Philip has to be challenged on the assumptions in this:

‘First, as already mentioned, it is well-nigh impossible to redesign institutions that have arisen organically — the money system is one of such systems. Second, the idea that the Grand Plan would work out just as it did on the back of the author’s envelope is deranged. No one seriously interested in economic policy could rationally believe such a thing. Plans only work when they are highly simplified — and even then they will have enormous unforeseen consequences.’

1. Clearly the term ‘organically’ is doubtful. Money is not an organic system. We do such stuff as husbandry and genetic engineering on real instances. No doubt another meaning is intended. So what is organic in this sense? Organic versus mechanistic, as in solidarity? One can pick up the shorthand, but as Philip says ‘envelope stuff is dangerous’.

2. If we establish what organic means as a figure of speech, would money qualify as purely organic even in this sense, or would we find mechanistic components? Is it true such organic systems are so difficult to practically deconstruct and reconstruct? The argument here is mixed. And what are we trying to change? Sexism and racism have more or less had it in the West even if residual traces remain. What components have we changed?

3. Plans have to be very simple to succeed? This sounds like someone who has done little planning and been suckered by management-speak like KISS (keep it simple stupid). Of course, one accepts the cautionary tale ‘of mice and men’.

In operations research we had a rule of thumb that solutions that didn’t look like bringing a 50% improvement weren’t worth much effort because most change tends to need big retraining efforts and other costs. Otherwise, continual improvement or fine-tuning was the order of the day. One can plan for the 50% improvement and it will fail if you don’t.

Philip’s piece doesn’t work for me, but nor would Hugh, taken as ‘let’s kick over the kleptocracy’. Neither, of course, is a crude as space allows. I would intend my criticisms as benign. We can’t be exulted to rebel with no idea of the strengths of the enemy or how to organise to prevent default afterwards.

Money probably has some very real organic roots – their are exchange systems in biology. One can imagine ‘no money systems’ and even ‘no human work systems’. One reason we should be exploring such is to define money now. I would not work if I had enough money not to. Lottery winners soon stop. If money is something we work for and we don’t like work, how does this fit with what money is? For those who ‘lurve wirk’, pop round and mow my lawn and clean my toilets. I like pleasing people. We need deeper definitions of what we are looking at,

If you want to understand the so-called ‘organic’, but in reality ‘ecology’, of money, then please have a read of Dr. Frederick Soddy’s lectures in Cartesian Economics,

http://habitat.aq.upm.es/boletin/n37/afsod.en.html

or of his book on The Role of Money.

https://archive.org/details/roleofmoney032861mbp

There really is a LOST Science of Money.

Thanks.

Always worth posting links to Fred JuneTown. Of course, no economist is going to believe him as he proposed “honesty is the best policy” in monetary affairs. I’ve long believed his ‘couple of honest adding machines’ being worth more to us than all the financiers.

Not sure how his work helps on the organic issue. Any ideas on this welcome.

We do experiments in biology that can only be repeated on humans in thought experiment. If we remove (i.e. kill) nurse bees from the hive population, some of the foragers will revert to nurse status (and vice versa) Lots of genetic switching is involved (perhaps like running Microsoft programs on Linux). This is an organic process. There are hundreds of examples. Imagine we removed the world’s 92000 richest families and all the financiers overnight. What would happen? Imagine how we could bring this about. I set thought experiments like this as class debates. They are in the form of ‘there’s no such thing as a free lunch’ with its implicit ‘and derive all economics’.

It would take a book to outline this argument, which probably starts with ‘god’ hurling an asteroid at the dinosaurs. Think, perhaps, of our revolting financier-political class as dinosaurs – the thought being removal has very significant effects in eco-systems, Much of biology defaults to ‘no change’ – remove a leader and the group provides another, sometimes involving such as sex change and massive growth rate in the new leader.

“Organic” is clearly a metaphor (even in science if we go deconstructive). My experiments generate a lot of reaction against me. First is the crank thing – I become ‘mad Einstein’. Then comes the ‘what’s this got to do with the price of fish’ – students worry I’m wasting their time asking them to think, rather than dictating stuff for them to regurgitate in exams. The idea is to get people both thinking and believing I’m prepared to mark their thinking, not regurgitation of set texts. This is much easier with mature students.

In this world it’s crank to believe we can even organise a vote for substantial change in finance and even that such a vote would work in producing the change given what happens to leaders once in power. On crank we should be doing more than repeating the pseudo-science debate (Velikovsky and such) and do some thinking on whether our socially approved epistemic authority is crank itself, or at least discover our rationalities are not as rational as we hold them.

Soddy has not helped me in the past on the organic metaphor. He was a chemist. I’m open to see how he could. There are many alternative to the organic metaphor including the difference between espoused theory and actual theories-in-use, formal and informal systems, autopoesis, onticology, anamnesis – http://www.re-press.org/book-files/OA_Version_Speculative_Turn_9780980668346.pdf (free book) and even Foucault’s somewhat simple engineering notion that if we know something is man made we can unmake it.

If human systems were genuinely “organic” I’d have spent my life in the lab inventing ways to put altruism effects into our water supply. The metaphor doesn’t work well here, though I got Durkheim.

“So, let’s state this criterion in no uncertain terms: a person who believe that all, or the vast majority of, social ills are caused by the current money system and thus can be solved by implementing an imaginary money system that they have designed can be safely considered a money crank.”

Can this statement apply to MMT?

P.S., I mean that as a serious question. It feels a bit like watching a sibling rivalry. Both “gold bugs and their ilk” and MMTers have the same basic view of the monetary system, namely, that the sovereign government has unlimited printing powers in nominal terms – and that is a bad thing.

What I find interesting is the underlying assumption that a buffer stock is necessary and can actually anchor prices, whether that’s gold or JG or something else.

Nah. I said MMT isn’t included. They view the money system as a means to end. So, they’re way out of crank territory.

Very exceptional.

MMT does say that a sovereign government has unlimited printing powers, but not that that is a bad thing. MMT doesn’t say that a buffer stock is necessary or desirable. It just observes that it is practically inevitable that something will act as a buffer stock, as a price anchor to some degree. There will either be unemployed people or not. If there are unemployed people, this “reserve army” will discipline wages and prices to some degree. It will be the buffer stock, a price anchor.

If there is no unemployment, then you’ll either have high inflation or something like a JG. The “something like a JG” is what acts as a buffer stock. Incessant high inflation defeats the whole benefit of money and credit – a tool to organize the division of labor, production and trade. So while there is always a bit of inflation, it hardly ever gets very high for long periods. People usually realize eventually that having old style Latin American chronic inflation of say 100% a year is at best just pointless – all it does is make accounting and organization harder.

It is easy to see that a JG anchors prices. Basically it makes a dollar equivalent to a certain quantity of “unskilled” labor time. A JG is a “labor standard”. Since human labor gets ever more productive, ever more valuable, a sane, not obscenely immoral monetary economy – that is one with a JG – will have the hardest money of all time. The dollar would be tied to an appreciating asset. And there are plenty of examples – especially during the postwar era. Countries with JGish policies, low unemployment – Japan, Australia, Scandinavia etc had low inflation too. Inflation was no higher worldwide during the Keynesian era than it was during the “Great Moderation” (=Great Stagnation).

“”MMT does say that a sovereign government has unlimited printing powers, but not that that is a bad thing.””

I would say that IF the sovereign government HAD unlimited creation and issuance(printing) powers over the money system, THEN that would definitely not be a bad thing.

But the reality is that today the government has no creation and issuance powers(c.e.).

So, why again, is MMT not crank-like?

The federal reserve act gave all of the money issuance powers to the private banks, and gives to the government the need to borrow money from those banks in order to fund its deficits.

What is true, and being mis-construed is that the nature of sovereignty is to have the money power, but, once had, the sovereign nation can empower private interests by abdication of that public power, and that is exactly what has been done.

Why MMT would rather CLAIM that the government is the monopoly issuer of the currency rather than support the government BEING the monopoly issuer of the currency, is a mystery, still.

The federal reserve act gave all of the money issuance powers to the private banks, and gives to the government the need to borrow money from those banks in order to fund its deficits.The US Constitution gave the power to create money to the US Congress. The US Congress does not have the power to overturn the US Constitution by a mere act.

If you consolidate the Fed & the Treasury, then I don’t see how anyone can deny that the Fed/Treas issues money. The point of MMT is that in addition to the legal (and conceptual) arguments, it analyzes the self-imposed restrictions on the interactions of the Fed & Treasury. Conceivably they could restrict a government in practice – like a gold standard. But MMT analyzes the actual constraints and shows that in fact there are no constraint at all, just a pretense. Just smoke and mirrors. The Treasury can spend just as before 1913.

And basically everyone knows this. If Congress decided to spend money, the money would be spent. Denying the government’s actual monetary sovereignty is denying an obvious truth. Because of the stupid rigmarole with the Fed and the Treas etc, people delude themselves into thinking that the fact that most of the money Congress/the Treasury prints is in the form of Bonds means that the government is constrained somehow. (The only constraint is hyperinflation – if the dollar became so worthless people refused to accept them.)

anybody else here thinking of Beardo right about now? bowhaahahahah. dude, you’re the best, don’t ever change.

at least a crank can do useful work it it’s connected to a gearbox. but if you connect an economist to a gearbox nothing happens because it’s probly in a state of equilibrium and all the economist does is talk anyway.

Beardo wanted to give everyone 4 acres and let gawd sort it out, that would strip the gearbox and more out.

skippy… Whey To Much Brotein… eh.

http://www.youtube.com/watch?v=7kbSfFFEvxw&list=UUduKuJToxWPizJ7I2E6n1kA

Beard wants to have government fiat separate from private money, like stocks and other assets. I could never see how that would work unless private property were no longer taxable and etc. But Beard has interesting insight. I think the question of the century came from you Craazy – yesterday – when you said, If all money is future money, where the hell is now money? Or stg. like that.

Just shining a flashlight into the holes and cracks of naked capitalism. that’s what we’re here for in the peanut gallery.

Money is like gravity.

Concentration of mass bends light (and truth) by its gravity.

.

Similarly, concentration of money bends reason, compassion, love, etc.

That is why the No 1 priority is to address wealth inequality, not the economy, not inflation, not money printing.

spot on

I disagree beef. Money has next to zero gravity and its mass is miniscule.

Money is a concept which is bent ideologically by its human tool user, it has zero agency of its own, one has to be injected into it by the user, tho the use[rs themselves are subject to the same influenced cognitive bending too.

Here’s a nice little example of that effect.

A public debate on macroeconomic theory and policy with leading thinkers from Modern Monetary Theory (MMT) and the Austrian School. Warren Mosler represents MMT, Robert Murphy, Ph.D, represents the Austrian School, and John Carney moderates.

http://www.youtube.com/watch?v=cUTLCDBONok

That was more of a love fest than a debate.

What, pray tell, could anyone have learned from it?

Heh? Why don’t you quantify both arguments and then critique it, yourself, you know put some skin in the game.

skippy… emotive reply w/ no granularity wrt to the subject matter might be a sign of crankdom.

well skippy,

I have observed your comments on this website for some time now. I’m never sure why you post.You never say anything seemingly based on anything. It is all snark and quip.

So, Why do you pick on the one comment from junetown, that wasn’t packed full of “skin in the game”?

What have you ever “put up”?

skippy,

First, everyone SHOULD watch the video of the S/C debate.

Debate?

What debate?

What was the issue they were debating?

Was there a “Given” proposition with two opposing views?

No.

Carney shouldn’t moderate anything.

Without any ‘issue’ to debate, they both made wandering observations of their views of the money-world, in response to which they mostly agreed with each other.

I watch a lot of debates.

I was hoping for a debate, even wrote to Murphy on some MMT points, hoping for a little fur flying.

This was the biggest non-debate in monetary history.

But, everyone SHOULD watch the video of Mosler and Murphy’s views.

Forget what I said.

Let each person decide..

@Rob… you have years of comments to view, yes there are positions taken on a great number of issues and when needed granularity. Your comment bemoans what – it – is.

@JuneTown… whats this high lighted “should” business when I said nice, projection much? Seems your more concerned about the debate not suiting your personal tastes [cage match] with no broken bloody body to loom over at the end, signifying complete and devastating victory over the vanquished.

Seems you sore about Murphy not utilizing your suggestions. You might consider that the school [PR firm – Marketing agency] has been so discredited that he was in damage mitigation control mode.

skippy… I wonder what the practitioners will do when they realize their masters no longer need them or that they have out lived their utility to them, as they have become a blunt tool.

Yves, At the risk of invoking your bot moderator, I think there is one thing Tyler Durden over at ZH has going you should maybe consider borrowing – those cute little agree/disagree buttons. You see, I don’t merely agree with MLTPB here, I see it as divine wisdom, a truth we might build a whole arena of discourse around. It is not, however, new.

“For the love of money is a root of all kinds of evil. Some people, eager for money, have wandered from the faith and pierced themselves with many griefs.”

1 Timothy 6:10

Perhaps the word “themselves” should be replaced with “all of us” but it is clearly one of the most obvious truths in that book.

The reason I’m not a fan of them is the experience of many sites is that they are used to game comments, and the net effect is detrimental. Too easy for trolls to vote down a comment via voting multiple times (via using different browsers, getting a new IP address, etc).

The thing is steelhead23, if you take money away it can be replaced by some other object, fetish, or belief e.g. money is not the problem.

I would summit the actual problem is the – perception of reality – its self.

skippy… antiquity is one massive millstone imo.

We are a society of money cranks. Money and the monetary system are not the problems, our collective understanding of money and the monetary system is the problem.

“For the love of money is a root of all kinds of evils.” Think about it. (I am not a Judeo-Christian of any sort, but hey, I don’t discriminate against wisdom, wherever it comes from.)

If we as a society had a proper, healthy understanding of money, the lovers of money would not be tolerated and would be ostracized. Instead we celebrate them and consider them our betters and tolerate their sociopathy because our society is sick, very very sick. If we had a proper understanding, we could move on to solve the real problems we face. But we are enamored of money and use it to measure everything while ignoring real measurements, like nutritional content of our food; sea level rise; climate weirdness; soil air and water contamination; plummeting biodiversity; amount of energy used and wasted; rise in cancers, auto-immune diseases, metabolic diseases; etc. As an example, you have probably heard of the state of North Carolina’s policy of ignoring scientific predictions of sea-level rise. Why? Certain lovers of money (real-estate “developers”) want it that way. Our healthcare system is measured in dollars spent, not health. Look at any of our real problems, how are they ultimately measured? How sick is that?

The money loons (those that think money is a store of value and should maintain that value indefinitely) are just another form of money lover and deserve to be ridiculed and ostracized. However, we are all, collectively, money cranks and until that changes, we are travelling on the path to ruin.

I think the love of money is why MMT gets so much resistance. People cannot tolerate having their

perversityattachments challenged.I feel you Hugh, but until we collectively wrap our heads around money and the monetary system, nothing will change. Until we stop using it as the ultimate measure, our problems will only intensify.

+100

MMT will only get you deeper into that love of money attachment.

How so? I don’t love money and I am writing to you from the 80-85th percentile (there’s that money measurement again! It is everywhere. ;) ) Money is simply the grease that lubes the wheels of public and private economic activity. That’s all it really is, and all it should be. I think that many of the MMT scholars do tend to overemphasize the need for more economic activity while not looking too closely at the possible repercussions and the real restrictions on such activity (Bill Mitchell being a notable exception), but their understanding of money seems right on to me. The main value of MMT is in drawing a line between money and the real and then using money to facilitate real public purpose, BECAUSE WE CAN. (Yes, right now there are big barriers, like corruption,institutional bias and ignorance, in the way, but if we, collectively, understood what money really is then I daresay we would start demanding it be used for public purposes and not to line the pockets of the parasitic sociopaths – unless we are predominately sociopaths, which I don’t think is true.) The conflation of money with the real fosters the love of money, IMO. A common, non-covetous understanding of money and the monetary system allows us to have serious discussions about the real without the “How are we going to pay for it?” or “It’s bad for business.” crap obfuscating or ending the conversation.

For instance, do you think that anyone who makes contributions to society should have to worry about how they are going to feed, clothe, and shelter themselves? Or get that tooth pulled or see a doctor when ill? I mean, we do it for incarcerated criminals and money doesn’t seem to be an issue (a profit is made on it in a lot of places!), so why not the working poor or long-term unemployed? The money needed to facilitate it need never enter the decision-making process. Do we have the physical ability to supply people with food, clothing, shelter and basic healthcare? Because that is all that matters when you get down to it. Unless one is a sociopath that thinks money concerns come first or that they don’t deserve it because they don’t contribute enough.

That’s the value of MMT, IMO. It puts money aside (but not completely out of view) so we can focus on the ethical and the real, because that is what matters most to any kind of decent society.

As I said, as long as we as a society use money as the ultimate measure, our problems will only intensify.

MMT is about printing more money so those robbed of the fruits of their labor can be enticed to go back on the hamster’s wheel to get more money.

It is not about returning the loot to the victims via a wealth tax.

That’s what the MMTers say – now is not a good time to tax the wealthy.

It’s not a good time to tax because each time you make it the tip of your political spear you waste an election cycle.

So we just give up, because of the perceived obstacle?

The point is that MMT accepts the notion of moeny being “accepted” and that high powered money is that which discharges taxes. It is not surprising that in an interest based money system there is a need either for an emetic response (boom bust) or an outside jolt of more liquidity used to feed the ‘natural’ rate of interest (which is somehow related to risk). It is not a grand theory as such, it is conditioned upon modern constraints.

Money risk was standardised in the cost of money (interest). Alternate systems that do not allow interest, like the Judeo Christian religions, Buddhism, Hinduism, push toward sharing of risk i.e. no assumptions on natural rate of return… simply sharing of returns.

In short, one has a typical bell distribution in the latter, whereas one has a skewed one in the former to the one percent.

Even Skidelsky gets that one must look at Marx for diagnosis, and perhaps the secular world needs to look at some of the religious prohibitions too. This is especially so when microcredit can solve the poors problems, or Wonga and payday lending being perceived as a market with 1000s of % interest.

Insittutional diversity, private and public money, are important… to keep things in balance and check. Zarlenga on this is simply brilliant!

Who is this “we”? I don’t follow this blame-the-victim tactic.

“The money loons (those that think money is a store of value and should maintain that value indefinitely) are just another form of money lover and deserve to be ridiculed and ostracized. ”

Um, doesn’t MMT worry about price stability?

It’s not enough to understand the monetary system. We need to understand the entire economy: the whole system of economic production, ownership, organization, labor, governance, exchange and distribution.

Is the insurance system the monetary system? It it integrated with the monetary system, but would still exist in some form or other if we had a different system. Are the systems of private credit and private finance the monetary system? Likewise, they would exist as well under different monetary systems. Is the system of concentrated private ownership of land and real capital, and the system that determines wage levels the monetary system? Issues in these areas have arisen under many different monetary systems.

The problem isn’t proposals for monetary reform. These proposals come in all kinds of flavors. Some are very interesting and worth taking seriously. Some are irrelevant distractions at best or completely dotty at worst. The problem is the tendency of many people to fixate on the monetary layer of the economy alone, and to ignore the entire “real” economy underneath it, or to assume that all of the problems of economic abuse, oppression, injustice and cruelty depend on the nature of the monetary system, or on the monetary manipulations of a few Wall Street bankers.

Particularly appreciated your third paragraph, Nobody. Wealth, both of nations and individuals, is measured in money. A couple of alternatives to GDP have been developed that do not use money as the measurement, but human beings: The Happiness Index and the Inequality Adjusted Human Development Index. Interesting that both measurements were initially developed elsewhere than in the U.S. – the first by a monarch of a Buddhist nation (Bhutan); the second by an Indian, although both have subsequently been refined.

Jacob Needleman’s book published in the mid-1990’s was also enlightening to me.

Would the Nobel prize winning chemist Frederick Soddy be considered an economic crank? His book Wealth, Virtual Wealth, and Debt is certainly heterodox. I haven’t read anything that he wrote, but I’ve seen short descriptions of his economic work, and he appears to have had some interesting insights.

Certainly! And that is how he was seen in his day:

“In four books written from 1921 to 1934, Soddy carried on a quixotic campaign for a radical restructuring of global monetary relationships. He was roundly dismissed as a crank.”

http://www.nytimes.com/2009/04/12/opinion/12zencey.html?_r=2&ref=opinion&

And I’m sure there were some interesting insights in his work. I doubt that he was a boob. But as I said: a crank is a crank is a crank is a crank. And if they must be read they should be read in that light.

Is GDP sharing more like a cranky or wacky idea?

GDP sharing? Like redistribution of income? That’s totally un-cranky… that’s the essence of politics! Most politics is about income distribution and what way it should flow.

It’s not redistribution when every weekly, monthly or quarterly GDP is immediately shared equitably upon harvest.

There is no need to do distribution (actually more correctly termed, sharing when done the first time) again a second time.

It can be thought of as an economic system, brought about by politics, just like other economic systems.

As all net financial assets flow from government, all must be distributed. Which you very well know.

But it doesn’t have to flow from the government.

And the real question is how they are distributed or shared.

That’s the reason we have the needy begging and entreating, why little people are outraged and indignant.

Go to China or Russia and have a good time with that project.

From Vatch’s link;

In his 1926 book Wealth, Virtual Wealth and Debt: The Solution of the Economic Paradox (a book that presaged the market crash of 1929) Soddy pointed out the fundamental difference between real wealth – buildings, machinery, oil, pigs – and virtual wealth, in the form of money and debt. Soddy wrote that real wealth was subject to the inescapable entropy law of thermodynamics and would rot, rust, or wear out with age, while money and debt – as accounting devices invented by humans – were subject only to the laws of mathematics. Rather than decaying, virtual wealth, in the form of debt, compounding at the rate of interest, actually grows without bounds. Soddy used concrete examples to demonstrate what he considered this flaw in money economics in his book.

“Debts are subject to the laws of mathematics rather than physics. Unlike wealth, which is subject to the laws of thermodynamics, debts do not rot with old age and are not consumed in the process of living. On the contrary, they grow at so much per cent per annum, by the well-known mathematical laws of simple and compound interest … It is this underlying confusion between wealth and debt which has made such a tragedy of the scientific era.”

Can you be more specific as to what’s “crankish” about any of this, other than “a crank is a crank is a crank is a crank”?

Is it possible to be “crankish” without BEING a crank?

@Alej & June

I have long thought Soddy right. He also thought our education system largely counter-productive. I have long thought good sense comes from crankish folk and have spotted some examples about. One would be pretty cranky suggesting there is no need to mutilate male private parts after sex in a society where this is common owing to ‘menstrual magic’ (bits of PNG). Think of the idiot practice of female castration now. What is “organic” in the idiot resistance to these foul practices? What might we understand from the failure of good sense, law and enforcement in such areas?

Hudson often cites the Sumerians as knowing business and agricultural cycles not matching debt cycles. I’d struggle to find a scientist who doesn’t think we should base economics on global resources and sensible environmental processes. We tend to see the problem as mad leadership, stupidity among the learned (‘r’ factors, ‘groupthink’) and lack of sensible alternatives to militarism. And we know we are corruptible (‘Silent Spring’) despite being overwhelmingly left-leaning – and this despite almost no formal political education. Geoff Davis is in print with a book called ‘Sack the Economists’ – largely influenced by Steve Keen.

I found learning economics and management like doing religious studies, or like learning chemistry from phlogiston theory. Like — I want world peace, so the way to get there is reading books on how we avoid it.

The problem with learned bureaucracies is they protect themselves from analytic critique from the outside. I doubt I’d have welcomed Philip into my old lab to help me with cell research – yet he might have helped with my metaphorical thinking – a point Dawkins makes a lot. Current thinking on co-evolution. epigenetics and a kind of arms’ race, plus the radical changes in equipment has made my learning 35 years ago redundant. The economics has changed too. PhD candidates can do work I’d have spent two years getting funding for.

I find economists utterly smug. But they have been taught to subsume thinking to textbook erudition – a kind of organic sublimation from religious scholasticism. They adopt glib metaphors, rarely understanding the origins in their complexity. I once saw an economist arguing against the organism as a good metaphor for human systems. It was a very sound argument, except she had no clue about how biological organisms function and how what the individual is in biology moves through at least 20 definitions.

Though democracy is wasting away, we have made real changes in our collective constitution on slavery, women, disability (no doubt the list is longer). Instead of whining the obvious – that social change is tough – why no focus on how we achieve anything significant? I still don’t intend to wander towards the alien invaders with MMT Bible held high.

Philip is right if he is pointing out Utopian problems. He is also, by immanent critique, a crank, relying on definitions that do not match reality. But then I get drunk, have mad friends and take on disabled PhD students other non-cranky staff have dismissed as suitable for basket-weaving. Seeing oneself as a crank might just be the first step in recognising incompetence. It’s surely long past time economics listed the questions it is incompetent to answer and for economists to stop scurrying around as functionaries of our bent captors.

Today, Phil Pilkington says Dr. Frederick Soddy was and is a crank..

Everyone, please read that article.

Zencey is a big fan of Soddy and the gist of his writing is that Soddy’s ideas have carried the test of time…..that four of his five revolutionary ideas are now accepted wisdom and the only one that has not been achieved is public money.

The article begins, thus:

“”INNOVATIVE and opaque instruments of debt; greedy bankers; lenders’ eagerness to take on risky loans; a lack of regulation; a shortage of bank liquidity: all have been nominated as the underlying cause of the largest economic downturn since the Great Depression. But a more perceptive, and more troubling, diagnosis is suggested by the work of a little-regarded British chemist-turned-economist who wrote before and during the Great Depression.

Frederick Soddy, born in 1877, was an individualist who bowed to few conventions,””

For Pilkington to pick that honest quote of what Soddy went through for his truly heterogenic ideas is illustrative of a shallow grasp of how the monetary science has evolved.

Soddy was the foundational thinker to Simons and Fisher, who was foundational to Friedman’s early work, ALL of from which Turner today finds a workable solution.

For Pilkington to ‘accept’ Turner and not be aware of the chain-of-command of the ideas upon which his construct is built, is rather embarrassing on these pages.

Sorry, Phil, you are out of your league here.

Soddy is still largely right, crank or otherwise. His texts read like third-person polemic. But Beard quotes from the Bible, managing the find the decent bits in that crankery. Or did until our lack of fellowship drove him away, Fabians (left-leaning egalitarians) like GB Shaw, Beatrice Webb and even Keynes were into eugenics. Soddy had some links to anti-Semitism and rather thought the Germans had the better form of government, if concerned by ‘excesses’.

Philip’s definition of crank is cranky and not much more than a warning about simpleism, relying itself on – er – simpleism. We might ask who dismissed Soddy as a crank – the every – er – “sensible people” who had us fight disastrous wars and come out on the other side with all the money?

The guy or gal looking down a microscope who tells us he or she is looking for a route to the stars sounds like a crank to most. Levels of science are so poor in economics classes I have to explain the link to relativity via work on the size of molecules.

All of economics is crank. What would happen to finance if we took away the US military umbrella overnight? Or the now technologically irrelevant petro-dollar? Which are thought experiment questions on what is really going on in economics now – are there people who are already doing money stuff to support and erode this stuff? So what is economics, really?