Yves here. For readers who are not housing mavens, Fannie Mae has the biggest and by most accounts, the best housing research operation in the US. And while every big organization has its biases and blind spots, Fannie Mae, as an insurer has to be cognizant of downside risk, which makes it less prone to cheerleading than other putative industry forecasters.

By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street.

You’d think the housing market is in fine shape, based on the sizzling optimism of the National Association of Home Builders, which just released its Housing Market Index. It rose to 55 in August – above 50 means more builders view conditions as good than poor – the third month in a row of gains, and the highest level since January.

All three components of the HMI rose: current sales conditions to 58; future sales (that’s where hope thrives) to 65, the highest since August 2013; and traffic of prospective buyers (that’s where reality is nagging) to 42. OK, so foot traffic was crummy. But in the prior month, it was 39, even crummier.

That all three components rose three months in a row “is a positive sign that builder confidence appears to be firming following an uneven spring,” said NAHB Chief Economist David Crowe. This feat was due to “sustained job growth, historically low mortgage rates, and affordable home prices, which are helping to unleash pent-up demand.”

Yup, “affordable home prices” and “pent-up demand!” Not to mention “sustained job growth,” of jobs that pay enough to buy a home.

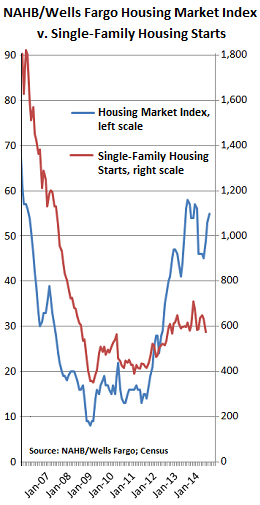

Home builders have become an optimistic bunch in 2012. As housing starts were ticking up a smidgen, builder optimism as measured by the HMI began to surge, and except for a couple of dives, including during the harsh winter this year, has continued to surge. As the chart shows, the HMI (blue line, left scale) has soared even as the puny growth in housings starts (red line, right scale) petered out in 2013. And starts remain mired down at about one-third of the level where they’d been at the peak of the last housing bubble.

Home builders have become an optimistic bunch in 2012. As housing starts were ticking up a smidgen, builder optimism as measured by the HMI began to surge, and except for a couple of dives, including during the harsh winter this year, has continued to surge. As the chart shows, the HMI (blue line, left scale) has soared even as the puny growth in housings starts (red line, right scale) petered out in 2013. And starts remain mired down at about one-third of the level where they’d been at the peak of the last housing bubble.

But the NAHB’s electronic ink wasn’t even dry, so to speak, when the ever optimistic Fannie Mae, the bailed-out government mortgage giant, came out with its August 2014 forecast, in which it took a sledgehammer to its prior forecasts.

Home sales have been plunging for months, after post-crisis optimism peaked mid last year. And Fannie Mae is belatedly adjusting to an ugly reality.

It slashed its 2014 forecast for construction starts for single-family homes to 642,000 units, down 8% from its July forecast of 696,000. But it has been slashing its forecasts all along: in January, it had still seen 768,000 single-family housing starts for the year. And in August last year, it had forecast 876,000 starts for 2014. It has now chopped 27% off that forecast.

Same thing with home sales.

Fannie Mae cut its forecast for new single-family home sales to 431,000 units, down 11% from last month, down 21% from its forecast in January. August last year, it still believed that 588,000 new single-family homes could be sold in 2014. Now it has axed that by a brutal 36%.

The current forecast is about flat with the 429,000 units actually sold last year. But this is only August. There are four more months to go, and at the current rate of slashing forecasts to bring them in line with reality, it doesn’t look good for the year.

Fannie Mae then took its sledgehammer to its forecast of existing home sales. Only 4.91 million units will change hands this year, it said, down from 4.97 million in July, down from 5.18 million in January, and down from 5.26 million in August last year. The current forecast is already 3.5% below actual sales last year.

And total home sales? Fannie cut its forecast for 2014 to 5.34 million units, from 5.45 million last month, from 5.70 million in January. The forecast is now down 9% from the 5.85 million it forecast in August 2013, and it’s 3.4% below last year’s actual sales.

Unlike the NAHB, Fannie just couldn’t quite see “the sustained job growth, historically low mortgage rates, and affordable home prices” that would “unleash pent-up demand.” Instead, Doug Duncan, Fannie’s chief economist, blamed rising mortgage rates, bad winter weather, and consumer “conservatism.”

The “disappointing housing activity” so far this year led Fannie to downgrade the outlook for housing, Duncan explained. “We currently estimate that 2014 will finish lower in total sales figures than 2013.”

And 2015? Hope still reigned, but less so. The year would be “stronger than 2013 and 2014,” but it would not be the “the breakout year some are expecting.”

Construction is a large, labor-intensive contributor to GDP. That’s why construction bubbles goose jobs and GDP. And when they burst, they wreak havoc on the real economy, unlike financial bubbles. Existing home sales contribute less to the real economy, but are still important. And Fannie just shot down any remaining notion of housing being able to pull its own weight. Despite the optimism of the home builders, housing is reverting to its status as being a drag.

But without booming housing construction, the US economy would have to perform a miracle to reach “escape velocity.” And miracles are rare in our modern world. But then, there’s always “next year.”

There’s a fundamental reason behind the housing drag: Homeownership hit the skids when homes became a highly leveraged asset class, flipped and laddered by speculators, rather than lived in by normal folks. Read….. Here’s the Chart that Shows Why the Housing Market Is Sick

That comment from NAHB’s Crowe almost made me fall out of my chair. I’d like to know where all those “affordable” homes are sitting, because in my market the choices of appealing, affordable homes are slim and none.

Fannie Mae called it correctly, although I would point out that rising mortgage rates are NOT the problem; High home prices are. I’ve started compiling some new data and charts to highlight the issue, because it seems that rising mortgage rates story is going to be bilked for all it’s worth. The simple fact of the matter is that homes have become too expensive for a large percentage of the population. It’s an income and wage thing. Sadly, very few in my industry want to discuss the problem because rising asset prices are always cheered, until they revert to the mean of course.

Taking a look at the raw unadjusted permits and starts data, and you see that the rise in activity is heavily weighted toward multifamily construction. Starts on 5-unit structures up over 50% YOY! Those headlines about a pronounced rise in construction activity are a load of rubbish. The builders know that their products have become too expensive, so they are sacrificing sales to maintain profit margins. If they need more revenue, multifamily is the ticket because there are only so many families who can afford a $500,000 home.

http://aaronlayman.com/2014/08/homebuilder-disconnect-continues-confidence-index-rises-55-august/

Interesting post and I agree with it completely. I see that you’re covering the Texas market, but in New England and particularly outside of Boston, I’ve seen listings that are unrealistic and housing supply that is either very high in price, or overpriced and in need of serious work.

“overpriced and in need of serious work” describes a great deal of the resale inventory available, and if you want new construction you’d better get your checkbook out.

Why is that Aaron? Current asking prices of resale housing are 2× construction cost (lot labor materials and profit)

I live it what his generally been, as major cities and metropolitan areas go, considered a relatively affordable place to live. It certainly was affordable until sometime in 2012 when the current housing bubble came onto the radar screen, for lack of a better term.

The lack of affordability didn’t happen gradually over a number of years, rather it came out of nowhere, almost as if someone flipped a light-switch on and housing started getting ridiculously expensive for no logical reason—the number of homes going for $400,000+ is out of whack with the number of people than can afford them.

Affordable housing, unfortunately, seems to be one of those “third-rail” issues that you can’t talk about without being vilified. Nonetheless, it is a real issue that is only going to get worse over time. The corruption of housing prices is one that is tough to fix: i.e. how to bring housing prices in line with what would be homeowners can afford? I don’t have a good or easy answer here.

‘Rising asset prices are always cheered, until they revert to the mean of course.’

Just like on Wall Street. S&P 2K sounds wonderful, till you realize that it means near-zero returns from here for buyers who are overpaying.

Local govs are doing their part to make housing unaffordable by endlessly ratcheting up minimum lot sizes, utility connection fees, and building code requirements. Then they mandate a certain percentage of ‘affordable housing’ in new developments, to offload the cost of their policies onto those paying full freight. Message: we care!

Every time the words “affordable housing” are mentioned, the NIMBY (Not in My Back Yard) crowd crawls out of the woodwork, screaming at the top of their lungs, about how they don’t want “those people” living near them. It’s safe to assume that minimum lot sizes are drive, at least on part, by demands of these people to avoid living near what they consider to be the undesirables.

That said, zoning alone isn’t solely responsible for the current mess we’re–even if there were minimal (or no) zoning requirements, we’d probably still have a affordability problem.

Upstate NY is full of cheap homes as long as you aren’t in downtown Albany, Syracuse, Rochester, or Buffalo. Binghamton is cheap and decent sized and has over a years worth of supply in nearly every price bracket but has been on economic life support (provided by universities) for years. You’d be amazed what you can buy a house and tons of land for up in the Adirondacks or along the I-90. Most of the non-city center Northeast (excluding Massachusetts and Connecticut) isn’t too bad. So many people have moved away because they couldn’t deal with the winters and most of the people left don’t have enough money to buy or don’t feel stable enough in their job and therefore rent. This band of depression runs westward through the old industrial areas of Ohio, Pennsylvania, and Indiana before blending into the cheapness of the corn belt and the northern plains states.

So, real estate in the middle of nowhere is affordable?

Note that I live in the midst of nowhere myself, but this shouldn’t be considered a sign of affordability.

And pay for it how, with what income? And therein lies the problem, without income or access to work that pays a decent wage, even cheap housing is unaffordable.

Honestly you can say that about nearly anywhere in the country right now. There’s a huge difference though between paying $375,000 for a rundown 2/2 and paying $20,000-$40,000. At low end wages one of those is permanently unaffordable while with the other mortgage will be cheaper than rent. Also, plenty of great buys for those who work from home. Most of those areas I listed were once thriving and so have a great deal of leftover culture “on the cheap”.

@Cocomaan: no, not everywhere rural is cheap. I made a point to mention CT and MA as expensive but I’d add large portions of VT and NH to that as well, especially the areas that border MA. I also said nothing about affordability of life. Many rural places are expensive to live due to transportation costs, yours (dependent on lifestyle) and producers of manufactured goods (generally, more food is local in these areas and “can/might” be cheaper).

I live near Scranton/Wilkes-Barre, PA. Some friends were considering buying a bank-owned one-family house, with a store front on the ground floor, for $20,000. The mortgage would have been $189 a month! But the place stood vacant for a year and needed lots of work. You’ll find that banks are sitting on tons of cheap foreclosures and don’t even want a down payment. But the poor, when they tote up all the extras (like utilities, water & sewer, trash pickup), can’t earn enough to pay all those bills.

Yes. I can confirm your info on NY state. I’ve been looking at Binghamton, and Ithaca. Ithaca is gorges, right? Been looking into retirement places with cold winters as I’m (we are) a polar bear who would rather hibernate in a deep dark hole in the summer and only surface when the air is crisp and cold. Upstate NY is soooo cheap it’s amazing. Save a house for us please. Now, if we could only sell the one we are in.

Binghamton is my hometown but I can only recommend it so much. It’s also the hometown of Rod Serling, Twilight Zone creator. That should tell you a lot right there. It’s dark and gloomy – a lot. It often “beat” Seattle in the fewest sunny days rankings but that seems to be part of what you want. I often joked with my parents that it was turning into a giant retirement community and then, right before the mass shooting, it was ranked as the best place in the country to retire to due to cost of living, scenery, and culture. The area was built large by Endicott-Johnson shoes and IBM followed by a number of defense contractors (a few of whom are left, Lockheed just got a new contract) but is now mostly supported by SUNY Binghamton and, to a smaller extent, BCC. My parents house is still on the market there if you’re interested. ;-)

Ithaca is really nice, lots of culture, has the Finger Lakes (is one one) nearby, scenery is amazing, near all the wineries, Cornell and Ithaca College, and is a zealous liberal (I’d almost say too far) outpost in heavily conservative territory.

IIRC, I think I remember you posting something once about also being a gun toting liberal. Then you definitely want VT not NY. Most of VT is not very cheap (avoid anywhere near resorts and MA border) but the Northeast Kingdom is and would also fit your dark and cold requests very, very well. VT has some of the loosest gun laws (no pistol permit or carry permit needed unless under 16 – yes we “apparently/technically” allow children to carry with their parent’s permission) in the nation whereas NY is on the restrictive side. We are also headed (if it isn’t derailed) for a single payer system in 2017. Fracking is also illegal in VT while NY is still fighting about it, especially in the Binghamton and Ithaca areas. Hope any of this helps your search.

Thanks for the overview of the NorthEast. I hope the Northeast Kingdom remains affordable. I really enjoyed living in Vermont the one year I lived in a little place outside Burlington.

My sister lives in the Oneonta area which I also like. I was especially well impressed by the people around there. I visited my sister last month. I was out on a drive with my sister when my car broke down 20 miles outside Oneonta. I hobbled back to the town hall at a small town called Unadilla. The people there were so nice to me and my sister I was amazed after living in New Jersey for the last 20 years. Neither of us had a working cell phone and the heat was starting to affect my sister. The town hall was setting up for the evening traffic court. The people let me and my sister come inside even though it was past closing time for the town hall. My sister really needed the air conditioning. I borrowed a woman’s cellphone and used it for almost an hour trying to get a tow for my car following the procedure my towing insurance mandated. A friend of the same woman in the city hall who let me borrow her phone gave me and my sister a ride back to Oneonta, more than an hour round trip, and my car was towed to shop at a nearby town. The work on my car was done the next day, reasonably priced and done right.

Upstate NY is a miserable hole to escape from. It’s not a destination.

“Escape velocity”.

Right. We’ve been waiting since 2009, right? So far as I can tell, the insatiable black hole of plutocracy is ever devouring more mass, as more little people sink through its event horizon.

The housing market is somewhat analogous to the job market. As many of us know, fewer and fewer organizations are willing to train new employees—they want someone who’s ready to hit the ground running. The first firm to do this confers the advantage of saving money on training costs and more (and least in theory) productive employees. However, when everyone else catches on to this strategy the job market effectively freezes up; there is a finite number of employees ready to go without training.

Although an imperfect analogy, the same holds true of the current housing market. Although I can speak for every part of the country, the growth in many areas has been largely in luxury or high-end housing. This makes sense on an individual level as, all things being equal, high-end housing has a potential for higher-profit margins than affordable housing. However, once everyone else catches on, you can easily end up with a glut of high-end housing but no one wants to be the first one to drop their prices. Subsequently, this has led to a situation—in some parts of the country—where high-end housing sits empty while affordable housing remains in short supply.

Housing is a problem waiting for a solution. The problem is that our present housing technology – build em cheap and fast – doesn’t do much for housing sustainability or environmental sustainability, so there’s one drawback. The other obvious hallucination on housing is that the population will rise forever. But no. It won’t. So, in the USA, any problem waiting for a solution is by definition SOL. It’s verboten for government to create a market with effective guidelines in order to solve a “market” problem. I think it is a fiscal mess, not a financial one. It’s a stinking bog of politics, right up to your ass.

Housing has a strong political dimension—no question the NIMBY crowd pushes for restrictions to prevent [insert boogeyman] from living near them. Owning a home is a lot more socially acceptable than renting; there is a contingent of people who think renters are scumbags, undeserving of any protections or rights.

I agree that environmental sustainability is an issue but I’m not clear on what that has to do with current problem of inflated home prices investors crowding out traditional homebuyers–the latter often can’t compete on price or against buyers offering all-cash. If anything, it seems that better constructed homes would be more expensive—I’m not advocating homes be of inferior quality to keep prices down, but I just don’t see where construction or sustainability fits in with the current problem.

Sustainability fits into the housing market because it is immediately perceived by any buyer that a house is a long term investment and if you make it you might want your house to be in good enough shape to be inherited by your kids. If you have any. And nobody wants a ramshackle building needing constant repair work just to be minimally comfortable in winter or summer. So what’s a careful consumer to do? If capitalism has become consumerism we are in serious trouble with housing because it is not a consumer product – it is a producer product designed to make a quick getaway.

…and that’s the reason for building codes. Minimum levels of building safety (fire) and quality (earthquakes).

“The other obvious hallucination on housing is that the population will rise forever. But no. It won’t.”

Forever is a long time – but I don’t see any reason to think US population won’t keep rising for the forseeable future. What is your reason?

http://www.pewhispanic.org/2008/02/11/us-population-projections-2005-2050/

susan the other wrote: If capitalism has become consumerism we are in serious trouble with housing because it is not a consumer product – it is a producer product designed to make a quick getaway.

Housing has unfortunately gone from being something an individual or family invests in because they like the community to another investment shell game, whereby everyone is trying to buy in and cash-out before the music stops. In other words, you’re right: we are in trouble.

In the interim housing prices get inflated. Investors are probably what’s propping up the housing market and giving a facade of recovery, whereas if it was limited to people who actually wanted to live somewhere, the supposed housing recovery would look a lot bleaker than it does. Nonetheless, something eventually has to give, as there are only so many investors and high-income homeowners to go around; not every locality has the economic base to sustain price increases the way say San Fransico or Manhattan have.

The current housing house of cards is bound to fall sooner or later and probably won’t be pretty when it does. However, will the collapse will bring saner home prices to traditional homeowners: i.e. those who actually want to live in the community? That remains to be seen.

Do wonder what Manhattan real estate would look like without the trillions, yes son trillions(use Fog Horn Leghorn voice) of bank giveaways?..

Certainly not affordable in my L.A. beach suburb. Two recent sales:

1. Up the block – 25 x 100 lot, 2,000 sq ft house built in the 70’s but nicely updated. Listed for $972K. Sold for $1,020,000.

2. Next street over, one block farther east – New 2,300 sq ft house on same sized lot. Sold for $1,019,000.

Just so you know, “beach community” in this case means a mile from the beach, no view, virtually no yard. (But good school district.) We have some larger houses (2,600-3,500 sq ft) on larger lots 3 miles inland that also go for over $1 mil.

(In case you’re wondering about my house: 1,400 sq ft, bought in 1978 for…$82,500. Current value? Prolly $700K.)

Where is the money tree that everyone is tapping to buy these homes with? How do they do it?