Yves here. One reason for our continued coverage of the IMF generosity to Ukraine isn’t simply to demonstrate how the institution is bending its rules to support US adventurism. It’s also to highlight the striking contrast with the treatment of Greece. While Greece has a class of oligarchs that specialize in tax-evasion, Ukraine is widely recognized as a spectacularly corrupt country, to the degree that it makes Greece look like a paragon of virtue.

By John Helmer, the longest continuously serving foreign correspondent in Russia, and the only western journalist to direct his own bureau independent of single national or commercial ties. Helmer has also been a professor of political science, and an advisor to government heads in Greece, the United States, and Asia. He is the first and only member of a US presidential administration (Jimmy Carter) to establish himself in Russia. Originally published at Dances with Bears

The International Monetary Fund (IMF) has decided to give the Ukrainian banks R&R&R – that’s rest from regulation and refinancing. Inspection of the foreign exchange book, unwinding related-party credits, recovery of non-performing loans, and obligatory recapitalization, which were all conditions of the Fund’s 2014 Ukraine loan, have been relaxed. The new loan terms announced by the IMF last week, postpone reform by the commercial banks until well into 2016. In the meantime, the IMF says it will allow about $4 billion of its loan cash to be diverted to the treasuries of the oligarch-owned banks. That is almost one dollar in four of the IMF loan to Ukraine.

The biggest beneficiary of last year’s IMF financing is likely to repeat its good fortune, according to sources close to the National Bank of Ukraine (NBU). This is PrivatBank, controlled by Igor Kolomoisky (lead image), governor of Dniepropetrovsk region and financier of several units fighting on Kiev’s side in the civil war.

Last Thursday, the IMF’s chief spokesman, Gerry Rice, claimed in a press conference that “the authorities [in Kiev] have demonstrated a strong commitment to reforms. They have implemented, as you have seen, last week a set of prior actions that in many respects breaks from the past and tackles issues that were once considered taboos.”

The taboo against admitting failure is one the IMF hasn’t broken. The new loan dossier reveals that IMF supervision of the Ukrainian banks, introduced last April and pursued through ten months, failed to staunch capital outflow from the Ukrainian banks; failed to recover value from the assets of insolvent institutions; and failed to require control shareholders to recapitalize their bank balance-sheets. These include Kolomoisky’s PrivatBank; Rinat Akhmetov’s First Ukrainian International Bank (FUIB, Cyrillic acronym PUMB); and Credit Dnepr Bank of Victor Pinchuk. The remedy, newly proposed by the IMF last week, lets the oligarchs off the hook, promising to feed their banks with public funds. That’s to say, IMF funds.

According to the latest IMF staff report, the Ukrainian banks are now in a worse condition than they were last June. This is because the cash provided by the IMF and the World Bank through the NBU and the Deposit Guarantee Fund (DGF) has disappeared from bank balance-sheets and left the country. “As of end-January 2015,” the IMF reported last week, “the banking system’s capital adequacy ratio (CAR) stood at 13.8 percent, down from 15.9 percent at end-June.”

Fund officials now reveal they were novices at Ukrainian accounting, admitting “the balance sheets of intervened banks turned out worse than the books indicated; little value has, so far, been recovered from the assets of failed banks.”

As for success in renewing bank liquidity and recapitalizing the biggest institutions – announced by the NBU Governor, Valeria Gontareva, last August, and endorsed by the IMF since then – that has now been postponed into the uncertain future. “For the nine large banks that needed a capital increase, and for which: (i) credible recapitalization plans were approved, and (ii) capital shortages were reduced by 25 percent, the recapitalization deadline has been set for end-June 2015. Banks that did not reduce the capital shortage by 25 percent will be put under regulatory constraints, including on asset growth, and will be subject to higher degree of on-site monitoring. One out of the nine large banks, accounting for about 2½ percent of the system assets, failed to submit a credible plan and was resolved.”

The NBU and IMF aren’t identifying the non-compliant banks. Without mentioning names, but plainly targeting the oligarch groups, the IMF announced last April, when it commenced its Ukrainian bank programme, that it was setting up “a central credit register at the NBU.” The objective was “to monitor credit risk concentration and enhance the monitoring of large business groups (including those related to bank owners), and become an important tool of off-site and on-site banking supervision.” The targets of the operation were to be given plenty of time and manoeuvre room. “The existing legal framework for the credit register will be revised by end-August 2014 in consultation with the IMF and WB [World Bank] staff, with the aim to become operational no later than August 2015” (page 69).

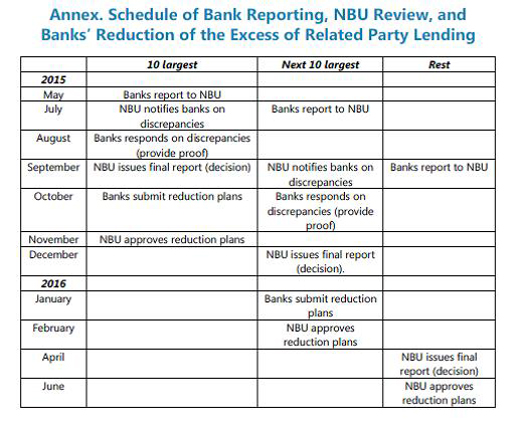

According to the new loan papers, the top-10 banks haven’t reported to the NBU yet, and won’t for at least another two months. They will then have another year to negotiate over the “discrepancies” without putting shareholder money up front. Here is the IMF loophole for the Ukrainian banks:

Source: http://www.imf.org/external/pubs/ft/scr/2015/cr1569.pdf at page 112

Altogether, the IMF team working on Ukraine numbers 25 – 24, if Olga Stankova, a press officer who fails to answer press questions, is subtracted from the count. The team has been headed by Nikolai Gueorguiev, a former Bulgarian finance ministry official with a US university degree; he reports to Poul Thomsen (below left, in Athens with bodyguard) and Thanos Arvanitis (right); they are the director and deputy director, respectively, of the European Department of the Fund.

The reason for Thomsen’s bodyguard is that Thomsen, a Dane, has become well-known among the Greeks for his work supervising the IMF and European Union loan programme for Greece. Arvanitis, a Greek, is also well-known for success of another sort: he was ordered out of Hungary when the government of Viktor Orban leaked IMF loan terms, cancelled the programme, and in 2013 made a pre-term repayment of the IMF’s loan.

The reason for Thomsen’s bodyguard is that Thomsen, a Dane, has become well-known among the Greeks for his work supervising the IMF and European Union loan programme for Greece. Arvanitis, a Greek, is also well-known for success of another sort: he was ordered out of Hungary when the government of Viktor Orban leaked IMF loan terms, cancelled the programme, and in 2013 made a pre-term repayment of the IMF’s loan.

Last April, Gueorguiev, Thomsen and Arvanitis reported to the IMF board that in return for phased payouts of loan instalments to Kiev, “we will monitor the banking system closely and send inspection teams to the field as needed. If a bank’s capital declines below the regulatory minimum, the NBU will require that the shareholders submit an action plan to recapitalize the bank, as well as impose restrictions on the bank’s activities in line with the law.” For a brief time, Gueorguiev answered the telephone at his Washington office to explain how well his scheme was going. For what he said then, click.

In practice, the 24 IMF officials let the Ukrainian banks work out with the NBU what books to open and close; what plans to file or delay; and how much money to receive. NBU records reveal that IMF cash was poured into PrivatBank. World Bank money, too. On August 15, Gontareva (right) announced at the NBU that “the fifteen biggest Ukrainian banks have already gone through a review and have not revealed any substantial problems…”

In practice, the 24 IMF officials let the Ukrainian banks work out with the NBU what books to open and close; what plans to file or delay; and how much money to receive. NBU records reveal that IMF cash was poured into PrivatBank. World Bank money, too. On August 15, Gontareva (right) announced at the NBU that “the fifteen biggest Ukrainian banks have already gone through a review and have not revealed any substantial problems…”

Last week Gueorguiev and his 23 colleagues acknowledged these problems were yet to be addressed. The new loan conditions, they are now claiming, make a “comprehensive strategy to strengthen banks’ financial health, through bank recapitalization, reduction of related party lending, and resolution of impaired assets, which are critical to regain public confidence and support economic recovery.”

The IMF team now says they weren’t in charge, as they had claimed to be last year. The fault that the Ukrainian banking system has deteriorated, they claim, is the NBU’s, not the Fund’s. “Preliminary [sic] information suggests that several institutions intervened by the Deposit Guarantee Fund (DGF) had breached credit limits to insiders. Opaque ownership structures and lending schemes have made it difficult for the NBU to limit effectively banks’ exposures to insiders. This highlights the need to strengthen the supervisory framework to better address related lending. International experience shows that excessive lending to insiders raises the banks’ likelihood of failure and reduces expected recovery in cases where banks turn insolvent and need to be resolved.”

For the record of how the IMF encouraged Ukrainian officials at the NBU and Finance Ministry – officials with records of past ties to Kolomoisky – to make PrivatBank the biggest recipient of emergency liquidity, read this. One of those officials, Stepan Kubiv, lost the governorship of the NBU to Gontareva when President Petro Poroshenko appointed her last June. Six months later, in mid-January, Kubiv (below, first left) was returned to office as the government’s lobbyist at the Verkhovna Rada.

The IMF remedy for the banks is as generous as Kubiv had been at NBU. Poulsen, Arvanitis and Gueorguiev have recommended to Lagarde and the IMF board what they call “forbearance”. “In view of the large shocks buffeting the economy, [IMF] staff and the authorities agreed that some forbearance on capital indicators was appropriate. To this end, an agreement was reached to allow banks that were solvent to meet a minimum capital adequacy ratio of 5 percent as of end-January 2016 and gradually reach 10 percent no later than end-December 2018.”

The IMF remedy for the banks is as generous as Kubiv had been at NBU. Poulsen, Arvanitis and Gueorguiev have recommended to Lagarde and the IMF board what they call “forbearance”. “In view of the large shocks buffeting the economy, [IMF] staff and the authorities agreed that some forbearance on capital indicators was appropriate. To this end, an agreement was reached to allow banks that were solvent to meet a minimum capital adequacy ratio of 5 percent as of end-January 2016 and gradually reach 10 percent no later than end-December 2018.”

Last April, according to the first loan papers, the IMF’s capital adequacy target for the largest Ukrainian banks was supposed to be 7% “within an overall capital requirement of 10 percent… under the baseline scenario” (at page 66).

The oligarch bank owners are not only to be let off that hook; the IMF has decided that its cash should be theirs for the asking. “Overall, staff believes that capital injections by the private owners remain the best option for bank recapitalization and restructuring. However, given the uncertainties and risks associated with this strategy, the program contains a buffer of nearly 4 percent of GDP in public funds that could be used for bank recapitalization and restructuring.”

On last week’s IMF projections of this year’s Ukrainian GDP, that percentage means about $4 billion in cash. If the $17.5 billion now agreed for the new IMF loan to Ukraine is fully disbursed, the oligarch-owned banks should collect almost one dollar in four. “This is mainly explained,” the Fund reports, “by the incorporation of potential additional losses associated with the conflict in the East and the higher than expected exchange rate depreciation.” A Geneva banker with an office close to Kolomoisky’s residence in the city comments: “Not even the Swiss have thought of war financing like this – funding civil war, then taking international loans for compensation, then banking the profit margin in Geneva.”

At IMF headquarters in Washington, the Bulgarian, Dane and Greek don’t appear to be speaking the same language. On the one hand, they recommend that what hasn’t worked for a year should be attempted all over again; if IMF supervision doesn’t work for the second time, the banks should be left to their own devices. “Revise the existing related party lending framework. The authorities will analyze the current legal and regulatory framework on related parties and identify loopholes that need to be fixed in the near future with IMF and WB technical support. Allow bank self-assessment. The aim would be to identify exposures that are above limits according to the revised regulatory framework.”

There’s a contradiction between proposing a regulatory scheme, and if it fails, allowing the banks to regulate themselves. This is the nub of the IMF’s problem in Kiev, say Russian bankers, and everyone else’s too. They say that Gontareva at the NBU and Jaresko at the Finance Ministry have no power to regulate their domains; if they had, they wouldn’t have been appointed. So it’s the bank owners who dictate to them, not the other way round. In the Ukrainian Letter of Intent and Memorandum which Gontareva and Jaresko have signed, along with Poroshenko and Prime Minister Arseny Yatseniuk, the IMF has been assured they have set up “a specialized unit to follow up on credit exposures with the banking industry of economically related groups and individuals (financial and non-financial groups).” Kolomoisky’s Privat group is the most powerful of them, and sources in Kiev expect it to dispose of the “specialized unit”, and the IMF’s new targets for the banking sector as it did last year’s.

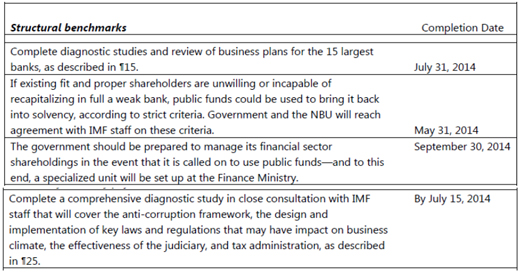

For comparison, here are excerpts from the IMF staff report’s table, “Prior Actions and Structural Benchmarks”.

LAST YEAR’S IMF TARGETS FOR THE UKRAINIAN BANKS

Source: http://www.imf.org/external/pubs/ft/scr/2014/cr14106.pdf at page 78.

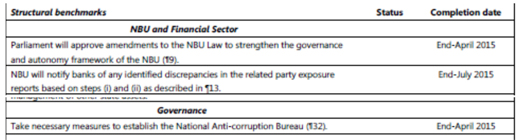

THIS YEAR’S IMF TARGETS FOR THE UKRAINIAN BANKS

Source: http://www.imf.org/external/pubs/ft/scr/2015/cr1569.pdf at page 109.

In the year elapsing between the two “actions” and “benchmarks”, the IMF confirms that nothing concrete has been done. Gontareva and Jaresko now say they will need another nine months, plus outside help, to find out what Kolomoisky, Akhmetov and Pinchuk could tell them directly, if they were asked and obliged to say. “With technical assistance from the IMF and the World Bank, by end-September 2015 we plan to have this unit [credit register] fully operational and with an action plan for the following 12 months, which would include the mapping of the largest 10 industrial and financial groups by end-December 2015” (page 86).

Even former US White House officials are conceding this week that if the Ukrainian Government lacks the clout to “map” the oligarch groups, it cannot govern, and cannot reform. “Ukraine survives today,” according to this Clinton Treasury official, “largely on the good will of several oligarchs. More robbers than barons, these bosses control key provinces, fund private armies and finance divisive factions in Parliament.”

Kolomoisky has been assured by the IMF that he is one of the few Ukrainian taxpayers to be safe from an increase in income tax. According to the memorandum of government intentions, “we will continue with measures, begun in 2015, to broaden the base and further increase progressivity of taxation. This will include steps to better detect and tax the income and wealth of high net worth individuals, drawing on technical support from the IMF.” Since Kolomoisky has publicly declared himself to be a tax resident of Geneva, and the Swiss authorities renewed his permit late last year, taxing him is a non-starter.

Last Friday, the same day as the IMF confirmed payment to the NBU of the loan first tranche of $4.6 billion, the NBU issued this release, confirming it was sending UAH$1.215 billion, equivalent to $61 million, to the account of PrivatBank. The NBU claims the money was “to ensure timely implementation of… PrivatBank’s obligations to depositors…[and] to support its liquidity.”

The justification for the PrivatBank payout, Gontareva’s press office claimed on Friday, is that Kolomoisky (below, right) has “concentrated 26% of the deposits of individuals in the banking system and 15% of the assets of the banking system, and…is the largest bank in Ukraine.”

For collateral, Gontareva has accepted a shareholding in the bank, plus an undisclosed number of airplanes owned by Kolomoisky, or by airlines associated with the Privat group. These airlines include Dniproavia (above, right) , Aerosvit, Cimber Sterling, Skyways Express, and City Airline. They are all bankrupt, and so the asset value is uncertain and the subject of creditor claims pending in several countries. For that story, read this.

For collateral, Gontareva has accepted a shareholding in the bank, plus an undisclosed number of airplanes owned by Kolomoisky, or by airlines associated with the Privat group. These airlines include Dniproavia (above, right) , Aerosvit, Cimber Sterling, Skyways Express, and City Airline. They are all bankrupt, and so the asset value is uncertain and the subject of creditor claims pending in several countries. For that story, read this.

The latest PrivatBank financial statement, dated September 15, 2014, reveals the asset value of the bank attributable to shareholders was 22.8 billion hryvnia; that’s about $1.1 billion. Asset value has declined since then, and the bottom-line profit, which was negligible in September, hasn’t improved. About $1 billion was recorded in the September report as impairment for loan losses.

Kolomoisky admits to owning only 37% of the bank’s equity himself. Indirectly, through cutout companies in Cyprus and the British Virgin Islands, he owns at least another 8%. How the NBU determined what value to put on Kolomoisky’s collateral, and how to capture it in case PrivatBank defaults, the NBU refuses to say. Instead, it reports that it consulted “one of the leading international accounting firms which meet the criteria established by regulations of the National Bank of Ukraine.”

Asked to say which accounting firm was employed, and what check Gontareva ordered for a conflict of interest which the accountant might have in relation to Kolomoisky’s businesses, the NBU refuses to say.

While Greece has a class of oligarchs that specialize in tax-evasion

Does not every country have these? I highly doubt that they are bigger or different in Greece than in other countries. Greece does not have that many billionaires and multi millionaires as people seem to think.

Greece look like a paragon of virtue.

And which country is a paragon of virtue? I’d say it has done a lot less than some other countries. At least it doesn’t kill other peoples populations by murderous economic or war policies.

“Does not every country have these?” Well, didn’t John Kerry park his boat in Rhode Island to avoid paying taxes on it in his home state of Massachusetts? And now he’s running the State Dept.? That’s one good example.

Right you are. He avoided the onerous excise tax in Massachusetts by harboring his boat in Newport, RI. I suspect if you go the Newport Yacht Club, you would find several other multi-millionaire and billionare owners parking their egos there to avoid a few tax dollars.

In 2009, the governor of the People’s Bank of China, Zhou Xiaochuan, proposed increasing the use of SDRs at the IMF which would be similar to Keynes bancor.

http://www.bis.org/review/r090402c.pdf

SDRs are currently in limited use and tied to 4 currencies, the USD, Japanese yen, Euro and British pound. He proposed enlarging this to all the major currencies. There are certainly important markets not represented here. Hence the AIIB.

Seeing how the IMF is dealing with the Ukraine, it seems that a combination of the IMF/AIIB or an IMF with a better basket of currencies bringing China and Russia to the table could very well bring a more balanced and nuanced approach to dealing with countries such as Ukraine and Greece.

During the second half of 2014, payments to Ukraine under its original IMF program were put on hold. It seemed that higher-level geopolitics were in play. In particular, Congress failed to authorize an increase in US IMF quotas. It appeared that the IMF was holding Ukraine hostage until the US ponied up more funding.

Now that’s all solved, but who knows how? In the post-constitutional era, it’s none of our business as lowly

citizensconsumers. And our rubber-stamp Congress probably hasn’t a clue either. It’s classified.What we can be sure of is that some dirty deal has been done, to keep alive the prospect of recruiting a new, provocative NATO satellite on Russia’s border. As John Helmer points out, it has been done lawlessly, in violation of a clear prohibition on the IMF financing wars.

“Gontareva and Jaresko now say they will need another nine months, plus outside help, to find out what Kolomoisky, Akhmetov and Pinchuk could tell them directly, if they were asked and obliged to.

“For collateral…. they are all bankrupt”

There are so many amusing statements like these in this piece – thanks

So the bottom line is – as long as Kolomoisky continues to fund the Fascist Asov Battalion – he is a “good” Banker especially when it comes to increasing insider loans

The fact that IMF monies are going to prop up oligarchs is odious enough, but what is truly offensive is the fact that the same oligarchs use that money to enable self-described Nazis to terrorize the population.

The Kiev regime isn’t going to last much longer, so I imagine a main purpose of these loans is to make sure that the country is in the worst possible shape when it swings back toward Russia. Better to give them a festering corpse than a critical patient.

I think the Western purpose of these loans is to protect US & European counter-parties. If Russia captures large parts of Eastern Ukraine, they’re probably not going to assume Western Ukraine’s debt. Ukraine’s collapse could weaken or even bankrupt some western banks.

The Russian purpose of these loans is to

(a) Receive payments from Ukraine on bonds and Gazprom debts.

(b) Weaken Ukraine financially. (each loan, long term, means it will take longer for Ukraine to escape the debt.)

Remember that Russia could have stopped the IMF loans just by allowing the fighting to continue. These loans are happening because Russia wants them to happen.

Yes, precisely.

Playing a long game, and at the same time being seen to be desirous to uphold the Rule of Law. In notable contrast to the US.

And as a sidelight to this, some information on Pinchuk, and his connections with the Clintons and their Foundation.

http://www.voltairenet.org/article182303.html

Eastern Ukraine is an economic albatross. Russia does not want it. It merely wants NATO not to be on its borders.

I would be surprised if Eurozone or American banks have a heavy enough exposure to Ukraine to be threatened by it’s demise. But perhaps you have read some other sources?

IIRC, the US kicks in about 18% of IMF funding. I’m sure “we” see this as leveraging our Freedum Bucks by around 500%. But doesn’t anybody anywhere get to vote on this stuff???

LOL I liked yesterday’s comment that for the first time anyone could remember a nation at war was agreeing to finance a a defeated enemy to renew the conflict (Russia committing to help fund the next IMF bailout of Kiev). If that doesn’t tell you everything you need to know about banking and war I don’t know what will.

There is no secret for anyone in the world that Ukraine cannot survive without the IMF credits now. But neither guesses why the IMF leadership has decided on new tranches for such bankrupting country as current Ukraine.

Now the high quality of Ukrainian land resources remains the only export capacity for this country. So obviously their selling out to various foreign companies, including its main American supporters based, of course, might become just the precondition of receiving next IMF tranches! Disbelieve?! Look here (www.informationclearinghouse.info/article39618.htm)! Just in September 2014 American analyst, Michael Hudson, wrote, “Ukraine’s main problem is that its debt is denominated in dollars and euros. There seems only one way for Ukraine to raise the foreign exchange to repay the IMF: by selling its natural resources, headed by agricultural land…” Moreover, there is talk that the highest interest in it are taken by the corporations, specialized in the manufacture of genetically modified food…