Why is it Groundhog Day? Back in 2011, I wrote a seriously messy blog post about dodgy New Zealand FSPs (Financial Services Providers), their dodgy web sites and people and addresses, and the evidently nonexistent oversight of all of this by the NZ Ministry of Economic Development and the NZ Companies Office. To my surprise, this report appeared in the New Zealand Herald soon after:

Green Party co-leader Russel Norman recently questioned Power about New Zealand International Savings & Loan Ltd, which is New Zealand registered with its registered office at 9/22 Curran Street, Herne Bay, has its sole director – Rodrigo Edgardo Alvarado – located in Panama, and its shareholder listed as the Stockholm-based Eurocapital New Zealand Limited Partners SA.

Norman was alerted to the company by a Naked Capitalism blog. On its website New Zealand International Savings & Loan says it offers banking services as a registered financial services provider in New Zealand.

Naked Capitalism got its name check via Gareth Vaughan, a New Zealand journalist, who, ever since 2011, has been publishing a stream of stories, better informed and better organised than mine, about the continuing insanity of New Zealand FSPs.

Nearly four years later, the politicians, the name of the Ministry, the governing laws and the regulators have all changed, but here I am, still blogging ineptly about FSPs. The parliamentary questions continue, too:

7024 (2015). James Shaw to the Minister of Commerce and Consumer Affairs (09 Jun 2015): What action, if any, has he taken to ensure the London Capital NZ and affiliated company Asian Finance Corporation are operating in accordance with the law?

Hon Paul Goldsmith (Minister of Commerce and Consumer Affairs) replied: I am advised that London Capital NZ Limited was deregistered as a financial service provider on 7 March 2013. Asia Finance Corporation Limited is still currently registered as a financial service provider. The Financial Markets Authority is in the process of reviewing, under section 18B of the Financial Service Providers (Registration and Dispute Resolution) Act, Asia Finance Corporation Limited’s registration.

For context, the founder director and 100% shareholder of both London Capital (NZ) and Asia Finance Corporation is Bryan Leonard Cook. His Asia Finance Corporation (AFC), now subject of a parliamentary question, is easily as dodgy as New Zealand International Savings & Loan ever was, back in 2011. In fact, it’s much, much dodgier: AFC is a key component of the giant international Virgin Gold scam, which has cost offshore investors hundreds of millions of dollars, or more.

For the last few weeks, the look of AFC’s web site has been quite demoralising for its clients, who have put a fair chunk of their worldly wealth into AFC’s tender care, and can’t get at it any more, via the one access route that existed, the web site:

Nevertheless, the NZ Financial Markets Authority (FMA)’s review of Asia Finance Corporation has still produced no visible results.

Background knowledge might help FMA get off the mark more quickly in the future. Helpful as ever, let’s do what we can to drag FMA up the learning curve. We will confine ourselves, as usual, to the simplest of means: Googling, and inspection of public registries: the FSP register, the New Zealand Companies Office, OpenCorporates, Companies House in the UK.

Let’s start with Opencorporates’ take on Bryan Leonard Cook, Asia Finance Corporation’s founder and 100% shareholder. He turns out to be hooked up to three New Zealand companies, each of them a current or former FSP, registered back when Companies Office oversaw the FSP scheme. Since mid-2014, FMA has had a role in FSP registration.

First, there’s ABIL Finance Corporation LLP, which was deregistered as an FSP on 18 Jan 2013.

Then there’s London Capital NZ, deregistered as an FSP on 07 Mar 2013. London Capital NZ’s principal place of business, 124 Willis Street, is a backpacker hostel. My first tip to the FSP registrar and to FMA is this: if one of your FSPs has its place of business in a backpacker hostel, there’s probably something a bit wrong with it, and with the bloke who registered it there. Clearly my 2011 blog post about deficient FSP oversight never really hit the spot.

Lastly, there’s Asia Finance Corporation Limited, incorporated on 27 Feb 2013 and registered as an FSP on 12 April 2013. That’s the occasion for my second tip to the FSP registrar and to FMA: try to remember what Companies Office did a month earlier with the last dodgy FSP from the same persistent guy; there just might be something a bit wrong with the new one, too. Otherwise, people will leap to the conclusion that the FSP registrar is, in fact, a goldfish (though that turns out to be unfair to goldfish, if not to the FSP registrar). One Mr David Mapley, who also spotted the Asia Finance scam, and brandished the same evidence at FMA, only to rebuffed by them, has leapt to some unflattering conclusions about FSP registration and FMA, too.

Even if the FSP registrar does live in a little glass bowl, FMA could work around that problem, by putting the names of people associated with dodgy FSPs on a special list, called, for extra vividness, a black list. The short term memory problem wouldn’t matter so much: the goldfish, perhaps conditioned by a few strong electric shocks, that I, for one, would be very happy to administer, could just consult the black list, before registering the FSP, or deregistering it. Naked Capitalism is willing to offer this innovative surveillance idea both to the FSP registrar and to FMA, entirely free of charge.

Let’s scout around in the back story for related companies: if New Zealand’s FSP oversight was the porous pushover I proclaimed it to be back in 2011, there will obviously be plenty more.

We’ll start by looking up Asia Finance Corporation on the FSP register. Asia Finance Corporation‘s address, Plimmer Towers, Wellington, is a Regus serviced office that has a hotel on the bottom floors. Where there’s a serviced office and an offshore FSP, there’s a rat smell, and there are usually more miscreants, too. Accordingly we seek, and find, a whole bunch of FSPs in the same building, among them a group that all have “LLP” in their name and claim to be New Zealand branches of English Limited Liability Partnerships. That’s what LLP stands for, of course.

All those FSPs have been deregistered in the post-2011 kerfuffle stoked by the local media and politicians. Are there more “LLP”s at other New Zealand serviced office addresses and mail drops? Oh dear me, yes, and they have all been deregistered, too. Good for the sometimes-dopey Companies Office and for the journalists and politicians! We can now add…

- 131 Featherstone Street, Wellington

- 23 Edwin Street, Mount Eden, Auckland

- Level 5, 22 The Terrace, Wellington

- 85-89 Customs Street West, City Centre, Auckland

…to our list of dodgy FSPs’ favourite hangouts. Click through and you will see they too are all serviced office addresses, apart from the last one, which is a hotel. My third late tip to the FSP registrar in New Zealand is therefore this: if one of your registered Financial Services Providers has its place of business in a hotel, there’s probably something a bit wrong with it.

Now let’s look at the English parents of those FSPs. Here they are in a table.

|

UK LLP |

NZ FSP |

NZ Reputation impact |

| ABIL FINANCE CORPORATION LLP | FSP193585 | |

| BESTLA FINANCE LLP | FSP231245 | |

| CAPITAL FX INVESTMENTS LLP | FSP222225 | |

| DMA CAPITAL MARKETS (NZ) LLP | FSP190264 | |

| ECNPROFX LLP | FSP182004 | Broker disappears with the money 2012, NZ thought to be its regulator |

| FINIMPORT CORPORATE FINANCE LLP | FSP131885 | |

| GOLD GOAT LLP | FSP167164 | |

| IB CAPITAL FX LLP | FSP190284 | Senen Pousa $3.4Mn scam reported in the Sydney Morning Herald: |

| MEDIAFIN FINANCIAL SERVICES LLP | FSP179444 | |

| NR FINANCE LLP | FSP154844 | |

| OFC – OMAA FINANCE CORPORATION LLP | FSP201805 | |

| PRIVATE SECURITIES BNCORPORATION LLP | FSP200465 | |

| ROKEA FINANCE LLP | FSP179764 | 2013 forum complaint by a typical panicked FX-investing type: he can’t withdraw funds. NZ connection not noticed by moderator. |

| SKYBRIDGE PARTNERS LLP | FSP204965 | |

| SWISS CAPITAL & FINANCE CORP LLP | FSP201825 | |

| SWISS FIN ASSETS LLP | FSP193605 |

The very first entry in that table is another Bryan Cook vehicle, ABIL Finance Corporation LLP; among its partners, ABIL Holdings Ltd, which turns out to have been registered in Guernsey, where the identities of the underlying company directors are not necessarily public information. The SEC comes to our rescue: ABIL Holdings Ltd is also directed by Cook . Its subsidiary, ABIL Finance Corporation LLP, has an address in Wembley, a suburb of London. The SEC connection is a whole other scam story, by the way; perhaps I’ll get to that, one day.

The second entry, Bestla Finance LLP, has a registered place of business at a company bucket-shop in London’s Baker Street, Coddan CPM. Bestla’s online incorporation details reveal that its two designated members are offshore corporations in St Vincent & The Grenadines, where the names of company directors need not be registered. In other words, Bestla Finance is a black hole, unless you have the power to put in an Exchange Of Information request, which you don’t, unless you are a tax collector or a law enforcement agency in a country that has the right treaties with St Vincent & The Grenadines. No wonder Companies Office deregistered Bestla Finance’s New Zealand subsidiary: good job.

The third entry, Capital FX Investments LLP, has a UK address at a mailbox, Suite 717 at 95 Wilton Street, as do all of the subsequent entries in that table, so that’s a strong lead. Capital FX Investments LLP’s designated partners are Hitachi Investments GmbH and Mahdia Consulting Ltd. The online incorporation documents at Companies House reveal that these entities are registered in the Seychelles under the International Business Companies Act of 1994, under which director identities are not disclosed: Capital FX Investments LLP is another black hole.

Hitachi Investments and Mahdia Consulting are designated members of a number of other UK LLPs too: ALLIANCE FX LLP, FINCOR INVESTMENTS LLP, FXCAP FUTURES LLP, FX T INVESTMENTS LLP and PFS – PACIFIC FINANCIAL SERVICES LLP. None of these black holes appear to have made it to NZ FSP status, though. That was the original intention, no doubt: all share the UK mailbox address at Suite 717, 95 Wilton Street, and one of them, FXCAP FUTURES LLP, has a branch in New Zealand at another mailbox address. That’s the same structure as the dud FSPs in our first table. The ubiquitous Mr Joaquim de Magro Almeida is director of FXCAP’s New Zealand branch, too.

Out of all of these aborted FSPs, “PFS – Pacific Financial Services LLP” is the most immediately interesting: one of its designated partners is Julie Cecilia Cook, who is Bryan Cook’s sister, and its registered address in Wembley is that same as Cook’s ABIL Finance Corporation LLP. The network is growing!

So, next, we look for more Julie Cecilia Cook corporate connections. That gives us quite a list, from which I have selected the following. This time they are limited companies, not partnerships:

|

UK Companies – via Opencorporates |

NZ FSP |

NZ Reputation impact |

| EURO FOREX SERVICES (UK) LTD | ||

| PACIFIC FINANCE SERVICES CORPORATION LIMITED (UK company) | ||

| PACIFIC FINANCE SERVICES CORPORATION LIMITED (NZ company) | ||

| PFS PACIFIC FINANCE SERVICES LIMITED (NZ company) | FSP232385, FSP267065 | None yet, but see the next paragraph. |

Consolidating our initial impression that the FSP Registrar is a goldfish, we find that the first PFS Pacific Finance Corporation was deregistered on the 15th January 2013. The second one of the same name registered on the 21st, and deregistered again on the 30th when someone with a bit more attention span spotted Julie Cook being a bit cheeky. What a pity that same person wasn’t around a couple of months later when, just after Julie Cook’s brother Bryan ‘s backpacker hostel FSP London Capital (NZ) was deregistered, he tried the same short-attention-span trick with Asia Finance Corporation, and succeeded in registering it. As it happens, spotting that subterfuge would have saved an overseas stock exchange, GXG Markets, an awful lot of management time and reputation damage. It might have averted uncounted millions in investor losses, too: but they’re uncounted, so we don’t know.

All those Pacific Finance Services companies appear to be part of the same wheeze. But who are Euro Forex? There does turn out to be a Euro Forex on the New Zealand FSP Register: Euro Forex Investment Limited. It claims to be a subsidiary of a British company and its address is the serviced offices at 23 Edwin Street, Auckland. This is beginning to sound very familiar. Another visit to Opencorporates yields yet another little list:

|

Companies |

NZ FSP |

NZ Reputation impact |

| EURO FOREX INVESTMENT LIMITED (UK company; note the address change in the history of filings, to try hide its connection to the FSA warning), EURO FOREX INVESTMENT LIMITED (NZ company) | FSP233725 | FSA Warning. Forum complaint. |

| EFIL – EURO FOREX INVESTMENT LIMITED (UK company), EFIL – EURO FOREX INVESTMENT LIMITED (NZ company) | FSP259205 | |

| ABFX FINANCIAL SERVICES LIMITED (a UK company that is a director of Euro Forex Investment Limited), ABFX FINANCIAL SERVICES LIMITED (an NZ company) | Forum complaint, Sept 2012 |

We have yet another goldfish sighting there. Euro Forex Investment, deregistered as an FSP on the 10th November 2012, when its UK parent’s director was Joaquim Magro De Almeida, is swiftly replaced by the very similarly named “EFIL – Euro Forex Investment Limited”, which registered as an FSP on the 3rd December. EFIL’s UK parent was formerly directed by Joaquim Magro De Almeida.

Thus, shell games, played with two pairs of similarly named companies in NZ and the UK are more than enough to baffle Companies Office. It’s like a rerun of “The Comedy of Errors”, except with dire consequences, that are yet to emerge.

Let’s pause for breath. Our incomplete tour of the back story has quickly led us to a whole bunch of dodgy FSPs, all thankfully deregistered and mostly struck off, and to around 30 profoundly nasty-looking mass-produced British, Guernsey and New Zealand companies. There are dozens more just a click or two away, here and here, just for instance. Connected with those 30 companies, we have four disappearing brokers who waltzed off with their clients’ money, just one regulator warning, and adverse coverage in the Australian press.

Somewhere offstage, there will also be bemused scam victims who will have had official brush-offs from the various New Zealand regulators, who, by the madness of current FSP law, don’t actually regulate registered FSPs, if the FSPs operate only offshore. NZ-branded regulators are therefore compelled to affirm that they don’t give two hoots about foreign investors cleaned out by NZ-branded scams. This is not great diplomacy.

Last of all, remind yourself that there were once hundreds of similar vehicles, operated by various overseas crooks. For all I know, there still are; these thirty are merely a sample.

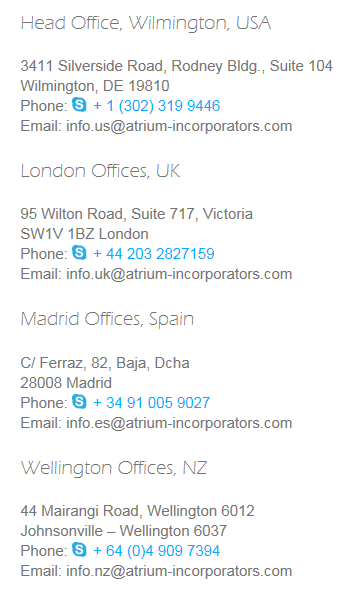

The dirty thirty companies are connected, directly or at one remove, to various Auckland and Wellington addresses, to Bryan and Julie Cook, siblings, and to mailboxes in London: Suite 717 and Suite 718 at 95 Wilton Street, which is now the focus of our interest.

A quick Google, and lo, we have identified Suite 717 as the UK contact address of Atrium Incorporators (archive):

Cementing the link, Opencorporates confirms that our Joaquim Magro De Almeida is a former director of Atrium Incorporators Worldwide Limited and a current director of Atrium Investments (Holdings) Limited. De Almeida‘s worldwide footprint, with companies in Panama, Cyprus, New Zealand and the UK, looks exactly a money launderer’s, to me, but that, of course, is just my impression.

Atrium is still marketing New Zealand FSPs (archive). It has kept track of the latest New Zealand law changes, and thinks it can meet the new stricter requirement for a local presence in New Zealand, with a new service offering. The new laws were specifically designed to counter the abuse of Financial Services Providers. Here’s the simple workaround from serial abuser Atrium:

New Zealand Financial Services Provider Registration Package

Corporation Registered in New Zealand Registration as a New Zealand Financial Services Provider

New Zealand Dispute Resolution Service Membership

Establishment of a Physical Office in New Zealand with all Regulator’s required services, provided on a monthly basis, inclusive available for company’s physical meetings with clients Appointment of Company’s Office Manager in New Zealand to direct and personally take care of all diligence and compliant matters with Regulators

Assisting opening Corporate Bank Account

That’s mildly alarming, but it gets worse. Here’s Atrium’s very special executive team (Archive). First, Group Managing Director Philip Simon:

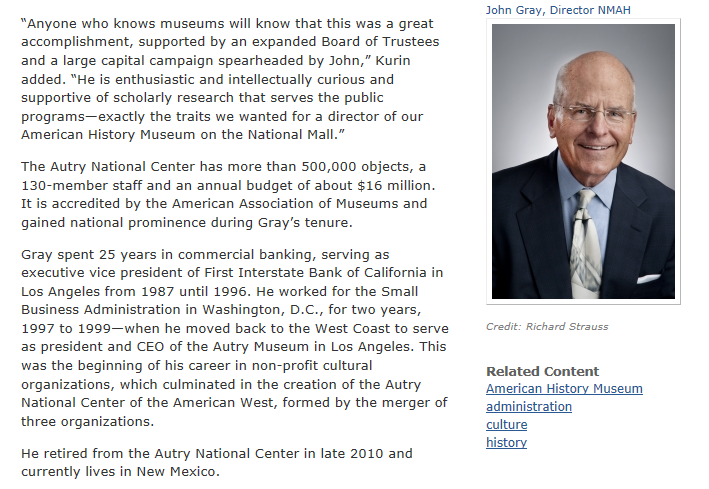

I think John Gray, Director of the National Museum of American History might have something to say about that. Here he is:

The look of Atrium’s Group Executive Director Bernard Johnson…

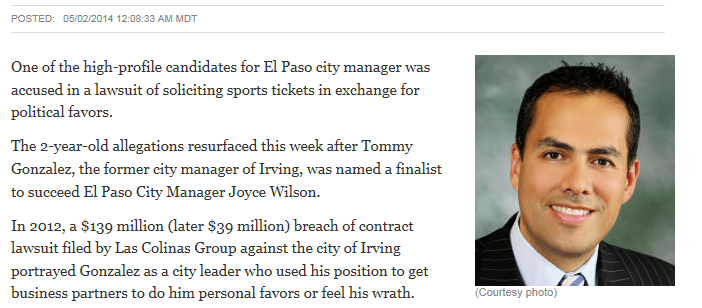

…is going to be a bit of a shock to the El Paso Times, who believe that person, or at any rate, a lighter-skinned, more Anglo-Saxon version of him, whose hair sticks out in exactly the same places, is Tommy Gonzalez, controversial El Paso City Manager candidate.

Meanwhile, Atrium’s Group Director Christopher Ducanes…

…leads a double life as Leipzig hotel manager Armin Hies:

Boringly, the image of Atrium’s hot little Accounts Development Manager, Beatrice Duvois, is a crop of a stock image, “young-business-woman”, viewable here. Presumably, she is real too: she just isn’t “Beatrice Dubois”.

One wonders exactly what sort of corporate bank accounts these identity thieves, Atrium, will be opening.

Readers may at least feel by now that Atrium, its companies, and the people who use them, are less than 100% reliable. I hope that FMA and Companies Office agree, because I have a suggestion. Why not find out who is operating in Atrium’s Wellington offices? Intriguingly, the shifty Atrium web site now gives that Wellington address as 24B Moorefield Road, Office 2942, which is just a mailbox. When I took the screen dump shown earlier, it was 44 Mairangi Road, Wellington. That’s the one you should look at. It’s the address of four live NZ companies that were once incorporated by Atrium or run by de Almeida. They’re not FSPs (yet?), but, given their pedigree, I do wonder what they are up to. Just possibly, Janet Mary McMenamin and Alex Bob Cijffers of ABC Accounting Services may be able to help you. Is one or both of them acting as Atrium’s stooge director, agent or office manager, perchance? According to their hugely unreliable web site, Atrium do have a local presence in New Zealand. Have we found Atrium’s latest company factory, in Wellington?

It could be a very important question. There appear to be still more, nasty Cook-related FSP goings-on, also based in Wellington, and the bill for those could run to billions. That’s in addition to the final Virgin Gold/Power8 reckoning, which is likely to be hundreds of millions of dollars, and is quite possibly billions already, all by itself.

Since further huge FSP scams dating from 2010-2015 are still to surface, further reputation damage to New Zealand is already pre-programmed. Scammers and victims just do what scammers and victims always do: the venue seldom matters. In the case of New Zealand, though, the potential for deception and fraud has been greatly enhanced by the idiosyncratic and benighted FSP system itself, and, until the handover to FMA, by Companies Office’s chronically, nonchalantly inattentive attitude to FSP registration, too.

There’s not very much FMA can do to mitigate the legacy horrors still to emerge. Mind you, FMA might want to dream up something more intelligent to say to the shoals of bilked offshore investors yet to wash up in New Zealand regulators’ incoming mail: not, for instance “NZ doesn’t regulate those: take a hike” or whatever the current official response amounts to.

We will be following up on all of that in due course. In the mean time, back to Cook: this has just turned up in my Inbox:

From: StA Stuttgart (Pressestelle) [mailto:Pressestelle@stastuttgart.justiz.bwl.de]

Sent: 26 June 2015 09:50

To: Richard Smith

Subject: AW: Anklagen gegen Bryan Leonard Cook

Sehr geehrter Herr Smith,

vor Kurzem ist das Urteil gesprochen worden. Der Angeklagte ist wegen vorsätzlicher Marktmanipulation zu einer Freiheitsstrafe von 1 Jahr 9 Monaten zur Bewährung verurteilt worden.

Viele Grüße

C. Krauth

Claudia Krauth

Erste Staatsanwältin

This means Bryan Cook of AFC is now officially a crook: he’s got a suspended jail sentence of a year and nine months, for deliberate market manipulation. We know that this one German stock fraud is far less than the tip of Cook’s mighty iceberg of scams.

Perhaps the new information from Germany will accelerate FMA’s review of AFC. The Financial Service Providers (Registration and Dispute Resolution) Amendment Act 2014 very carefully and deliberately grants to FMA completely discretionary powers in respect of FSP registration (section 15) and deregistration (section 18). This 2014 tweak is a wise legislative move. If it smells a rat, FMA can withhold or withdraw any FSP registration it likes. Which is great, as long as FMA can smell rats.

Now, the London Capital/AFC deregistration/registration subterfuge in 2013 illustrates how determinedly devious Cook is. In any sane world, that would be enough evidence on its own to support a summary deregistration. You’d think AFC’s owner’s investment fraud conviction would now swing it, but who knows? So far, despite all the evidence against AFC, and the new legal tools available to FMA, the regulator has insisted on going through its apparently labour-intensive and certainly protracted “natural justice” process with AFC’s registration. A natural justice approach would be absolutely appropriate, if offshore FSPs were regulated entities, but the whole crazy point about offshore FSPs, is that they aren’t.

In short, it’s not really obvious yet that FMA 2014-2015 is any less inept with FSPs than Companies Office, 2009-2014. Yes indeed, it does feel like Groundhog Day.

FMA’s perverse-looking ruminations have plenty of interested spectators now: not only this irrelevant overseas blog, but also the hugely outspoken and energetic David Mapley of international fraud investigators Intel Suisse, who spotted AFC’s scam stock APGMI and raised hell; journalist Gareth Vaughan; the New Zealand Green Party; New Zealand Minister of Commerce and Consumer Affairs, Paul Goldsmith. Then there are the numerous, so far invisible, loss-nursing offshore investors in various Far Eastern countries with which New Zealand tries to cultivate good relations.

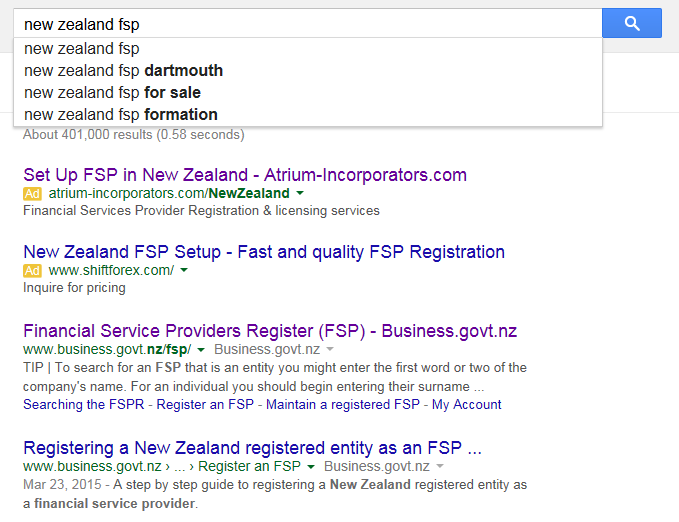

FMA still have time to get the philosophy right, and they’d better do that. Dodgy offshore company factory owners are also looking on, keen to see whether FSPs’ new regulators, FMA, are any more organised and thoughtful than the last lot, Companies Office. For instance, here’s a shot of what you see when you put “new zealand fsp” into Google. Check out who occupies the very topmost paid-for slot in the results, well ahead of the responsible New Zealand Ministry:

So, the Germans convict Cook of fraud. I don’t know, even this bemused spectator would assume that being branded a felon automatically made one ‘persona non grata’ in the world of finance. (Oh, there’s Milliken. Excuse me a moment, I have to ask a question about how his George Washington University medical department subsidiary is doing on the prostate cancer front.)

Wow. Just… Wow.

Perhaps the NZ FMA is distracted by Prime Minister John Key’s fetish for stroking female pony-tails?

The things I wish I’d known in my *first* 70 years!

Dear Richard,

We are victims of EuroFX (Euro Forex Investment Ltd), you have mentioned this in your blog. We have been following your blogs and we are so glad to see someone has unmasked this ruthless criminal group.

According to the company, there are more than 50,000 investors from more than 100 countries. We built a website ( eurofxvictim.weebly.com ) to collect evidences and gather victims. So far, the confirmed victims have exceeded 3,000 people with near 1 billion USD been defrauded. These victims come from different countries including UK, US, Singapore, Australia, Canada, Japan and China. In China, there are 100 cities being affected including Hong Kong, Macau and Taiwan.

We have put up together a report on the case, we wonder if you would like to know more details about it to complete the puzzle.

We look forward to your response.

Best regards