Yves here. As we’ve written before, the idea that US companies’ profits booked offshore means actual cash is sequestered is a complete canard. Most of the time, the funds are in the US. Yet it seems this point needs to be made repeatedly to penetrate the corporate spin otherwise.

By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street

There is a misconception about the uncanny ability of very profitable US companies, like Microsoft and Apple, to park their profits overseas in order to dodge US taxes: the money from these profits that are parked “overseas” isn’t actually overseas.

It is registered in accounts overseas, for example in Ireland, but is then invested in whatever assets the company chooses to invest it in, including in US Treasuries, US corporate bonds, US stocks, and other US-based investments. This was revealed to the public during the Senate subcommittee investigation and hearings in March 2013 that exposed where Apple’s profits that were officially parked “overseas” actually end up.

“Tim Cook emerged smelling like a rose, the triumphant CEO of America’s most iconic welfare queen,” I wrote at the time. And so the practice continues in all its glory.

These funds cannot even be “repatriated” because they’re already here — or wherever the company wanted to invest them.

According to a recent report by the Government Accountability Office (GOA), this and other practices give large corporations a big advantage over small businesses and individuals. Some key findings:

In each year from 2006 to 2012, at least two-thirds of all active corporations had no federal income tax liability.

Among large corporations (generally those with at least $10 million in assets), 42.3% paid no federal income tax in 2012.

Of those large corporations whose financial statements reported a profit, 19.5% paid no federal income tax that year.

For tax years 2008 to 2012, profitable large U.S. corporations paid, on average, U.S. federal income taxes amounting to about 14% of the pretax net income that they reported in their financial statements (for those entities included in their tax returns).

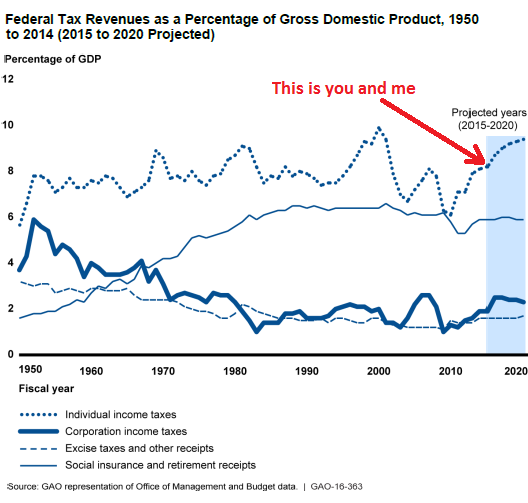

Federal Tax collections from corporate income taxes are now around 2% of GDP while those from individual income taxes are over 8% of GDP and rising. I added the red arrow and label to indicate where we stand:

The report points out the vast difference between the much bemoaned statutory corporate income tax rate of 35%, one of the highest in the world, and the Effective Tax Rate, which is zero for some of the most profitable companies.

But how much of their profits are registered overseas? The interactive chart below shows the 50 US companies with the most profits stockpiled “overseas” to avoid taxes in the US, while the actual money is wherever, including in US-based assets (hover over the blue bars to get the amounts):

OK, disclosure, I’m envious. I wish I could legally do that. As American, my worldwide income is taxed in the US (plus in other jurisdictions) even during the times I lived overseas — which makes American expats the laughing stock of much of the rest of the world. And we have no one else to blame but us; we voted these geniuses in Congress into office.

Apple shares have plunged 32% from June last year, and $282 billion in shareholder wealth has evaporated, on swooning sales and crummy data from suppliers. But still, Apple’s market capitalization is over $500 billion. And Alphabet’s is nearly $500 billion. Along with Facebook, Amazon, and LinkedIn, they constitute the Big Five in Silicon Valley, with a giant footprint on commercial real estate. And this could get very ugly! Read… Silicon Valley Commercial Property Boom Ends, Totally Exposed to Big-5: Apple, Google, Facebook, Amazon, LinkedIn

You’re right about American expats being the laughing stock. If you go to the Philippines, you will see many businesses owned and operated by foreigners from everywhere—except America. Americans don’t do it because they know Uncle Sam will be watching their foreign bank account like a hawk to pounce on any money they make. Like a big bully, the feds go after the little guy who may be trying to scratch out some retirement income renting out nipa huts on some beach, but persons like Tim Cook and Mitt Romney are considered above reproach.

RiCHter, not RiHCter or RiCTHer

How embarrassing. Fixed.

I’m wacky enough to think the law should be that if you are an American company you pay taxes on your total income, although foreign expenses could be considered deductible as long as they would be deductible if they occurred within the US and foreign taxes would be deductible. IOW, we don’t care where you make the money, stash your money, or pretend to make your money. If you don’t like it, don’t be an American company but understand not only will you not be able to do business in the US for the next fifty years, your products cannot be imported for sale by anyone else for at least twenty five years AND you will forfeit all physical property and equipment within the US or any US territory (and yes that does include real estate). Also merging with a foreign company is NOT a means to change your status as an American Company subject to all laws and taxes, the ban applies if you decide to be say Canadian (looking at Buffet…)

But that is just me. I also don’t think that tariffs are always bad.

I believe that inversion means the company is NOT an “American” company. Yes, all of their holdings may be in America, but the company is a mailbox in Ireland, Grand Cayman, Panama, and other nations, then lo and behold, most of the company’s taxable profits are in the non American companies.

Oh, I get that there is a bullshit title to avoid taxes, but I’m really talking about just calling it the tax evasion policy it is and saying there is no such thing as an ‘inversion’. You either pay your taxes on all the holdings OR you renounce your American charter, leave your property and any American sales behind and just do business in Panama.

Perhaps it isn’t kind to the business who really do do business in those tax havens, but then that is why you allow them to deduct the actual business expenses of selling widgets in Tasmania.

A corporate inversion is kinda like renouncing your U.S. citizenship while still claiming all the rights and protections of U.S. citizenship.

Short & to the point MM. I’m going to borrow that phrase.

Precisely.

Lol, yes but, if you show up at these treasury auctions and purchase US debt, wouldn’t that qualify under current immigration laws, as investing in America ? Which automatically moves you to the front of the citizenship line ?

All citizens are equal, but some are more equal than others, notably corporate citizens.

Money is an accounting illusion, directing stupid infrastructure development, pitting so dysfunctional cultures against each other, in an arbitrary rotation, surprise. Nothing new, discount to suit.

As you can plainly see, the experts have once again directed the majority down a blind alley, they have hit the wall, nature is removing the ground beneath them, and momentum of inbred followers is pushing them over the cliff. The fall in supply and demand they are measuring is just a symptom. Family Law feudalism fails the same way every time.

Religious, political or otherwise labeled, all expert systems fail, because each child is unique by design and all expert systems attempt to program them to fit into a closed system. An expert system choosing who breeds and how the children are educated is like talking to single people about marriage and expecting an intelligent conversation. The genetic feedback loop is a wave form.

Of course the politicians are going to mimic marriage and collectivize single people to commandeer your children. Without your children, they have no future. That the insecure should herd accordingly and be exploited by greed should be expected. That’s history.

Arbitrary bankruptcy law, Fed by critters chasing money because they cannot even grow their own food, is fiscal policy. Obviously, the U.S. Constitution is just the latest and greatest smoke screen, and the ponzi has once again run its course. A culture that cannot sustain itself in equilibrium with nature can only implode, and an expert global system collecting such cultures for disposal should be expected.

Parenting isn’t a leap of faith by accident.

The empire has a make work problem, not a jobless problem.

Amazon, of, by and for robots, the ultimate derivative of empire behavior is toast, whether Trump wins or not

ke @ 12:19 pm

None of Them Knew They Were Robots:

Mendel’s machines replicate in the night

In the black iron prison of St. Augustine’s light

He’s paying the bills and they’re doing him proud

They can float their burnt offerings on assembler clouds

With omega point in sight

The new Franklins fly their kites

And the post modern empire is ended tonight

From history

The flood of counterfeits released

The black cloud

Reductionism and the beast

Automatons gather all the pieces

So the world may be increased

In simulation jubilation

For the deceased

Spray-on clothes and diamond jaws

Wrinkles smoothed by nanoclaws

With my machines I can dispatch you

From this world without a trace

Our nostalgia ghosts are ready to take your place

Content-shifting shopping malls

Gasoline trees and walk-through walls

None of them knew

None of them knew

I feel the gray goo boiling my blood

As I watch the dead rise up out of the earth

Try to hide from the lies as they all come true

Deus absconditus

Deus nullus deus

Deus nisi deus

I feel the grey goo boiling my blood

As the fenris wolf slowly bites through his chain

Try to hide the myth as it becomes a man

None of them knew

None of them knew

Buying an X or an O

In state craft tic tac toe

Cats game for Joe Blow

Post industrial bliss

A binary hug or kiss

Can be wrung from utility mist

They stole the great arcanum

The secret fire

Moloch found his gold

For the new empire

Once again

The necrophage becomes saint

Lindy hop around the truth

Jump back wolf pack attack

Swingin’ up there in the noose

Slap back white shark attack

Phased array diffraction nets

From full-wall paint-on TV sets

Migratory home sublets

And time shared diamond fiber sets

Recombinant logos keys

Bitic Qabalistic trees

I feel the grey goo boiling my blood

As leviathan and his bugs freeze the sea

Try to save the world by immolating myself

From history

The flood of counterfeits released

The black cloud

The resurrection of the deceased

Automotons gather all the pieces

So the world may be increased

In simulation jubilation

For the builders

Of the body of the beast

–Preston L Spruance, Mr. Bungle, California

Funny, 2 + 2 is 4, the Clintons marriage is a fraud, and statecraft is about playing one off against the other, as redundancy grows and grows, assuming itself normal, and life deviant, to be expunged.

A piece of paper as individual, and humans its slaves, born to build their own prison, and serve the machine.

So, then, does it follow that this money never shows up in the foreign country’s balance of payment?

Google and Apple alone dwarf the GDP of ireland.

How does it show up in the accounting sense? Is 75% of Irish GDP tax washing? Can it really be called irish GDP then?

You are absolutely right to point out this anomaly. Yes, 75% of Irish GDP is tax washing. This means that when Irish GDP is used (e.g. in debt/GDP) the results are complete hogwash. This doesn’t stop politicians using these crap GDP figures to claim that things are going well. They have to justify the austerity policies of the Irish government and of the EU, and throw the wool over the eyes of the Irish voters.

The distortions to Irish GDP make it difficult or impossible to compare Ireland’s economic

non-performance to that of other countries in a meaningful way.well evidently all that money is being invested in America anyway. so if it was taxed and then spent, it would still be invested in America and maybe in the same investments. depending on who is in congress, of course

that’s kind of weird. how could that be? it doesn’t seem possible that something so odious and depraved as this could actually be no different than something just and righteous. That would be like in the Dead Sea Scrolls Manuscript B Testament of Amram if the Angel of Light is the same dude as the Reptilian. This is something the mystic traditions warn people against, believeing in these dualities, and the trained shaman also get instruction in seeing beyond the false illusion of the dualities.

But me. i’m not a shaman or Amram,, so I say ‘Tax their fukking assets off” Seriously.

Bernie Bernie

QED !

Bernie Bernie

QED!

I gave Bernie $200 and it was money well spent. Certainly it was better spent than all the money I lost on precious metals calls last year. That was bad.

Wait until Professor Kelton and Professor Wray get their hands on the budget and it won’t matter where the money is because it won’t even matter anymore. If that sounds like circular reasoning it’s because it’s so revolutionary it’s hard to describe in words. You just need to see it. I’m ready. I’ve had it with the flagrant deceit of Newtonian metaphors, particles, velocities, mass and acceleration, crowding out (as if this were some kind of rugby scrum). The fukking monetarists don’t have a clue about what money is, neither do the mathematicians (they have no clues about almost everything but math, it should be an embarrasement to them but they’re too self absorbed to even think about it).

What was this post about? Sorry to wander, oh, taxes! that’s right. Tax there fukking assets off and spend it on nirvana. It’s out there somewhere and we just need to find it..

A Wise Old Indian once said: ” When the last salmon is gone from the last river, then the White Man will learn he can’t eat money.” Not even if its all the money in the world. Not even if its all the MMT money that the mind of government can issue and emit. Once the last salmon is gone.

it kinda makes you wonder whether money farms and fish farms have a symmetry. there’s natural stream born salmon and there’s fish farm salmon. we all know about that, or if not, it’s worth knowing.

I wonder if there’s natural organic money and government money-farm money. that’s a strange idea, since you can’t have the former without some of the latter. So it’s a ratio not an either/or. At any rate, fish farm salmon are almost a different phenomenon than wild salmon. Wild money and government money? Are they antipodes on a continuum of money? And if so, what does that imply about the phenomenon of money? And even if not, what does that imply? These are deep thoughts for the fisherman of phenomenological energetic structures. It’s like Thoreau said in WALDEN “I fish in the sky whose bottom is pebbly with stars”. It’s a little overwrought, but not as bad as Camus, that’s for sure.

Born through the corporate prism of Family Law feudalism, into bankruptcy law, debt as money, enforced by public healthcare, education and safety as a positive feedback loop, to liquidate natural resources and create artificial scarcity, the majority, which cannot sustain reproduction in equilibrium, defines fair as taking your children, paying a compliant to take them, and assigning you the bill, so…If you choose to let the empire see you work, creating abundance, you must be able to stand up to the empire of competing peer pressure groups alone, and the physical task, as difficult as it may be, is far easier than the intellectual and spiritual stress, because labor will not turn back to assist you, which is the point.

Laundering money requires birth into scarcity, which is chasing RE inflation on massive excess capacity. North America still has so much natural resource capacity, the critters can’t destroy it fast enough, even with those practicing birth control printing money for the ignorant ponzi it is breeding below, as supply, demand and scapegoat, and the automation isn’t quite working out as planned, because it’s easier to replace a doctor than a nurse, which is easier to replace than an electrician, which is easier to replace than a good laborer. Imagine that.

Going after the guys that stole wealth as a means of redistribution is chasing nonrecurring for recurring, perpetuating the problem. CEOs produce nothing; they are highly paid scapegoats, inducing participation in a ponzi aspiration keep up with the Jones economy. Don’t waste your time on FANG and it disappears. LinkedIn advertises jobs that don’t exist net, merely reshuffling the deck to no end at cost. Look at the data.

I have read a number of your comments. I am just not intelligent enough to understand the vast majority of them. How about speaking in a language that some of us dummies can understand?

The war is in AI programming. It’s one thing to participate in the false assumptions containing a culture and another to program them. Silicon Valley, like the other globalists, is employing H1B1s as a means of extortion, to program the self destruction of America. Like most, most of the programmers are simply following along, because questioning the underlying assumptions is quite painful, like driving north in the southbound lane.

Most accept the imprinting of their culture at birth, so those false assumptions become hard wired in the neural circuitry. Intelligence has nothing to do with it. It’s artificial. Whether you are tolerant and want to learn is what matters. To the extent a culture paves over photosynthesis, it is strangling itself.

What we are talking about specifically, without going into details, is programming an energy system for photosynthetic building materials.

The fields are unified across fulcrum, exploding on one side and imploding on the other. Life is a multiplex tuner of quantumly isolated biological clocks. Plants diffuse energy with oxidation reduction into a food battery. We are destroying our own life support to prove the false assumption of scarcity required by debt as money.

The problem the theorists are having is they don’t want to begin from the as is abutment to build their bridge. They really do believe that labor can be replaced.

There are clocks that do travel in other directions, but our eyes, the primary processing path for most, only accept a tiny fraction of energy information.

Okay, thanks.

The law should require that a company’s corporate headquarters be located where it registers or incorporates for tax purposes.

As an expat working overseas, I used to have to fill out form IRS form 2555 every year. I believe the exemption was 90K – meaning that if you made less than 90,000 US, you are exempt from paying taxes. Of course, you are still paying local taxes.

90,000/year is an astonishing amount of money. I have zero sympathy for anyone who is that wealthy griping about paying taxes.