We stumbled across a troubling anomaly in CalPERS annual financial and investment reports, its Comprehensive Annual Financial Reports, in public pension speak are called CAFRs.

One of CalPERS’ most visible outside advisors is its private equity consultant Meketa Investment Group. Reports to the board about CalPERS’ outside contracts showed payments to Meketa of over $1 million across the last two fiscal years. Yet CalPERS’ CAFRs for those two years showed payments to Meketa of only $78,000 in one year, the fiscal year ended June 2019, and none the previous year, even though Meketa received fees from CalPERS in both years.

And as we’ll soon show, CalPERS’ efforts to ‘splain itself only wound up digging its bad accounting hole deeper. Not only did CalPERS admit to vastly bigger expenditures for Meketa than it had ever disclosed before, but it said it had buried the cost by improperly classifying it as an in-house investment expense, a violation of the accounting standards it uses.

Francine McKenna, an accounting expert and adjunct professor at American University in Washington D.C., confirmed our concerns about the misclassification of the Meketa charges:

It’s either intentional manipulation of the books or a level of incompetence and sloppiness that is inexcusable for an entity of this size with so many highly paid professionals and consultants involved.

If this excuse for the inability to track the Meketa payments is accurate, it’s an admission that CalPERS has been making false accounts, which is a violation of the California Penal Code section 424. Given the magnitude of either the omission or the deliberate misclassification in combination with the fact that CalPERS is rated by Moodys, which presumably relies on the information in the CAFR, this abuse could rise to the level of a fraud.1

This reporting deficiency is troubling since it calls into question the integrity of CalPERS’ accounting and record-keeping. But perhaps this is not surprising. Most of the CAFR, including the “Other Supplementary Information” section in which outside vendor costs and CalPERS’ investment overhead fall, is unaudited. As we have pointed out, the entire investment section of CalPERS’ financials, including the valuation of its assets, is not audited either (see the auditor’s letter starting on page 17 to confirm).

CalPERS Reports Only Some Investment Consultant Expenses to the Board and the Public

CalPERS staff customarily provided the board every September with various financial reports from the fiscal year just ended (June 30). That information winds up in the draft Comprehensive Annual Financial Report which goes to the board in November, and the final is normally released later the same month.

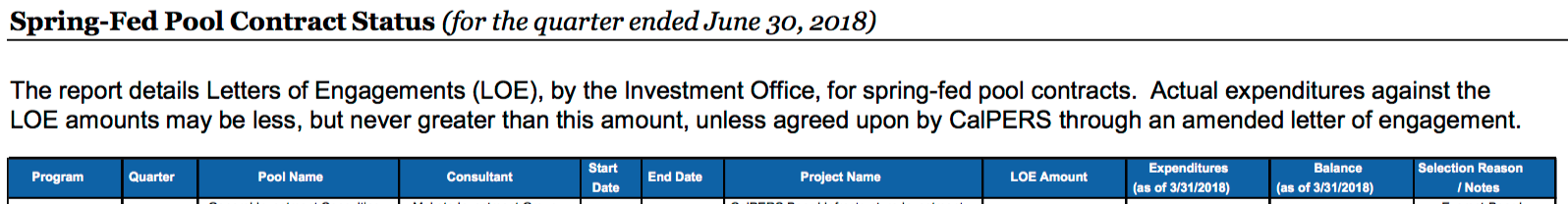

One of the September reports to the Investment Committee is the Investment Controls report, which contains the annual account on the so-called spring-fed pool contracts.2

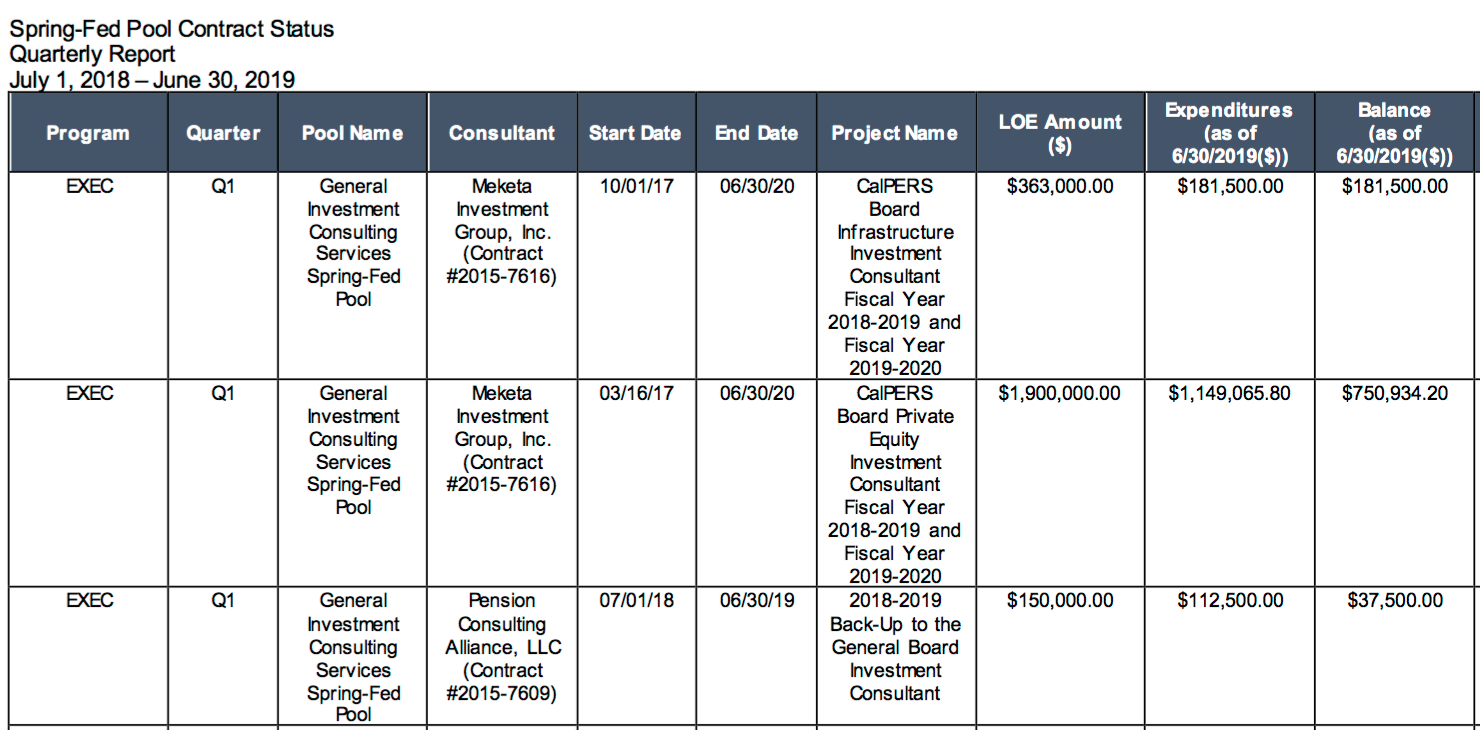

Here are the reports that contain Meketa for the fiscal years ended June 30, 2018 and 2019. Note that the latest year is not yet included in a CAFR, since that won’t come out till later this year, but you can see the latest report to the board here, starting on page 17.

We are including a Pension Consulting Alliance contract in the excerpt below because if you look at the report for fiscal year ended June 30, 2020, that contract is now reported as a Mekata contract. The merger between Meketa and Pension Consulting Alliance closed in March 2019.

Here is the year ended June 2019:

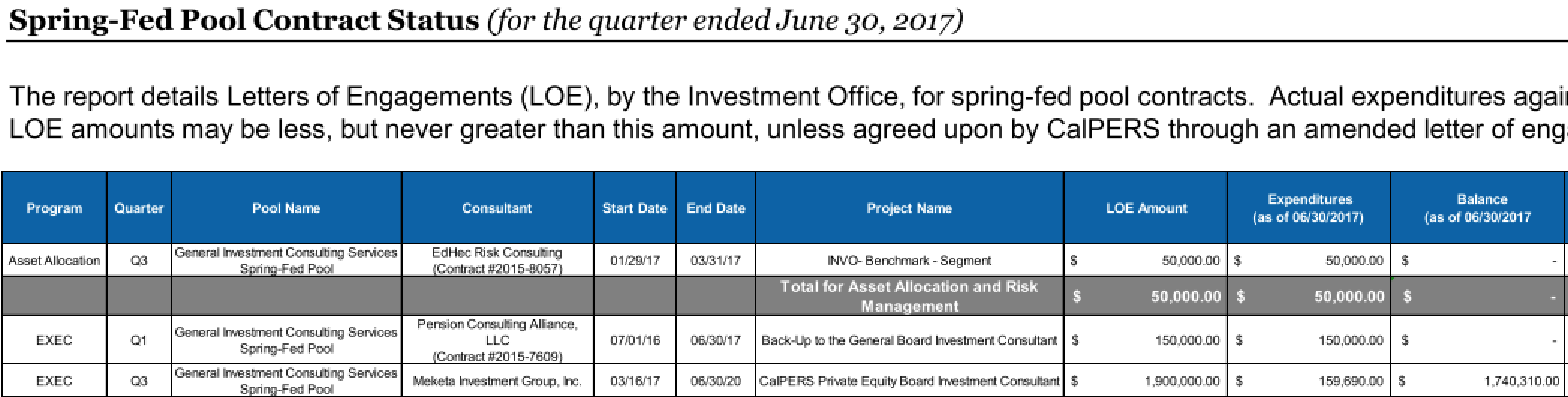

If you look at the same report for the quarter ended June 2017, you can see Meketa had billed only $159,690 from the inception of their private equity contract to the end of that fiscal year.3

So for the two fiscal years ended June 30, 2019, you have:

Meketa Infrastructure $181,500

Meketa Private Equity $989,476

Pension Consulting Alliance [later Meketa] $112,500

So depending on how you classify the third contract, the payments to Meketa for the spring-fed pool contracts for the two years were either $1,170,976 or $1,283,476.

Former board member JJ Jelincic pointed out that Meketa had also been assigned to be CalPERS real estate consultant, yet it wasn’t listed in that section of the spring-fed pool report, even though other “Real Assets Investments Consulting” firms like Bard Consulting were.

Note also that while CalPERS didn’t provide the board with a spring-fed pool report that covered the full fiscal year ended June 30, 2018, we can see from the June 30, 2018 Investment Compliance report that the third contract was already at $112,500 of spending as of March 314 and the other two had healthy levels.

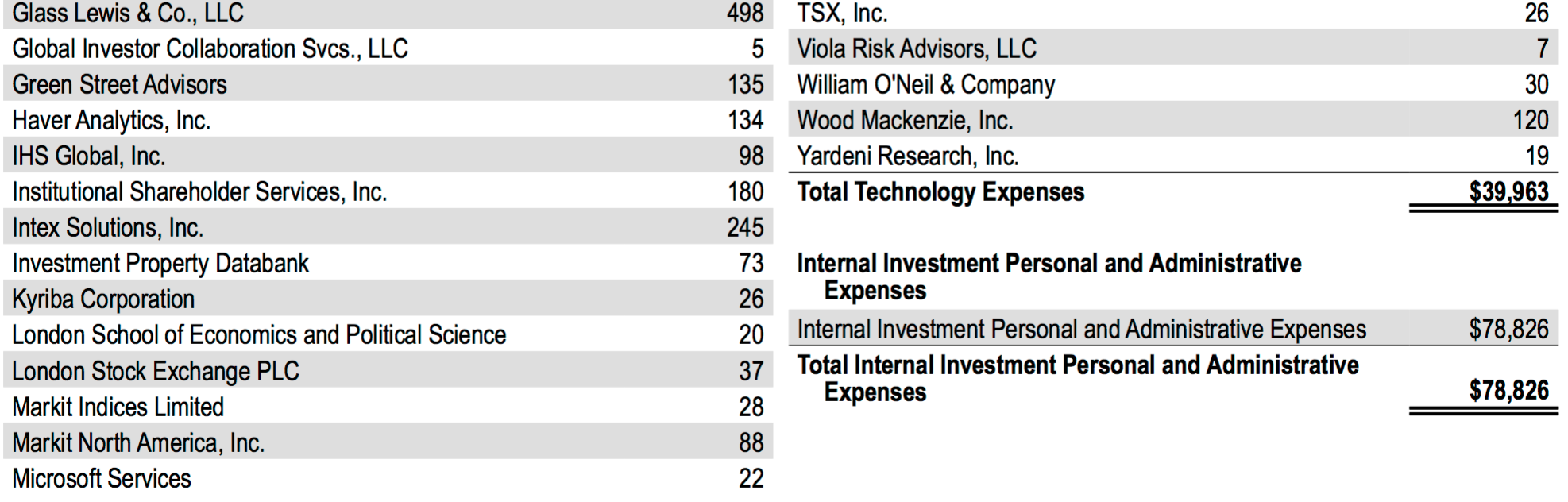

The Supplementary Information section of CAFR contains literally hundreds of names of vendors and how much CalPERS paid to each, including in the fiscal year ended June 30, 2019, a $1000 refund from Summit Financial Printing, LLC. The CAFR includes a section listing investment consultants such as Hamilton Lane, Mercer and SRI.

In the fiscal year ended June 30, 2018, Meketa was not mentioned anywhere in the CAFR. Pension Consulting Alliance was there, showing a credit (not an expense) of $24,000.

For the next fiscal year, ended June 30, 2019, Meketa was included in the Investment Consultant section with an expense of $78,000.

$78,000 over a two-year period versus a bare minimum of $1,170,976 per CalPERS own reports to its board is nearly $1.1 million of under-reporting of expenses across the two years.

Moreover, the disparity calls into question the integrity of CalPERS published reports. Showing lower expenditure totals to the board than appears in the end in the CAFR could be due to omissions or miscategorizations that were caught in the year-end review. But having expenses you clearly know about because you’ve presented them in public then omitted from the year-end accounts looks like a dangerous level of incompetence or chicanery. As McKenna put it:

It’s so brazen. This is a public entity that reports frequently to its board and the public in detail. To publish financial accounts that don’t match those reports, that’s ridiculous. CalPERS must believe no one is paying attention.

I e-mailed CalPERS Deputy Chief Executive Office describing how it appeared that CalPERS had seriously under-reported its spending on Meketa in the CAFR.

Pacheco’s explanation raised even more red flags:

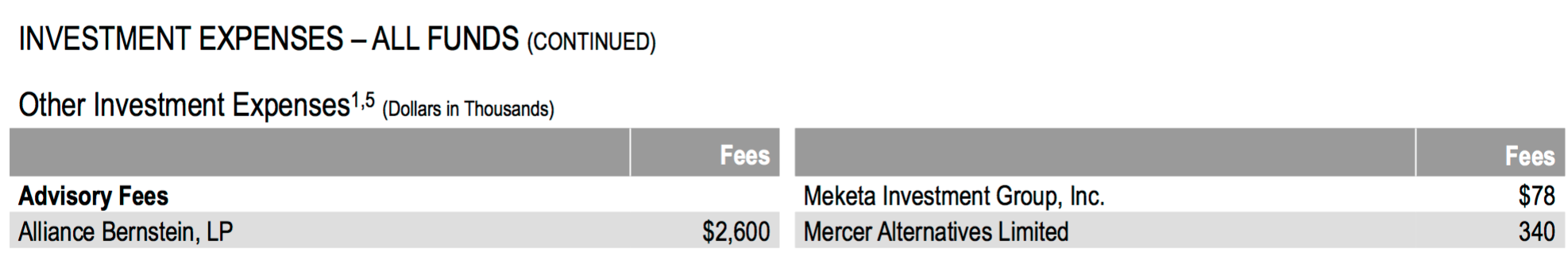

The Meketa contracts that you are referencing have been included in the Internal Investment Personal and Administrative Expenses category of the CAFR since 2015-16. At that time, it was determined that this categorization was most appropriate given the Board’s consultants unique role in providing independent investment evaluations, opinions and recommendations to the Board. While the CAFR includes the amount as part of a larger line item, the Board consultant expenses are tracked separately. Here is a summary of the Meketa contract expenses as reflected in recent CAFRs (as well as for 19-20):

Internal Investment Personal and Administrative Expenses Meketa

17-18 $76.1 Million $1.635 Million

18-19 $78.8 Million $1.957 Million

19-20 $89.0 Million $2.062 MillionFor example, see page 94 of the most recent published CAFR: https://www.calpers.ca.gov/docs/forms-publications/cafr-2019.pdf

It’s hard to state clearly how obviously bogus from an accounting and intellectual honesty standpoint this characterization is….even assuming that all those Meketa expenses really were dumped in the “Internal Investment Personal [sic] and Administrative Expenses” bucket. Here is how it appears in a screenshot of the bottom quarter of that page 94:

There is no breakdown whatsoever of that $78.8 million total. You’d expect at a a bare minimum to see salaries and bonuses separated from other overheads.

By contrast, as we pointed out, the CAFR lists external vendor fees down to as little as $1000 of spending.

Here is a partial list of why any CalPERS beneficiary should be alarmed by Pacheco’s statements.

CalPERS is violating the accounting standards it claims to use, Global Investment Performance Standards, or GIPS. GIPS does have a category of “Administrative Fees” but that is clearly for outside charges. From the CFA Institute GIPS glossary:

All fees other than trading expenses and the investment management fee, administrative fees include custody fees, accounting fees, auditing fees, consulting fees, legal fees, performance measurement fees, and other related fees.

“Internal Investment Personal [sic] and Administrative Expenses” in the CalPERS CAFR is clearly the overhead of operating its investment office. CalPERS motive for a deliberate accounting misclassification is unclear but the treatment is at best inaccurate and obfuscatory.

It is even more egregiously inaccurate to classify a consultant to the board as if it were an internal unit reporting to the Chief Investment Officer. Or Pacheco telling us that is how it really works?

CalPERS never disclosed that it changed its accounting presentation. Changes in accounting treatment need to be presented so that readers can make adjustments from the prior treatment. Note that it decided to bury its payments to Meketa and Wilshire Associates after two years of particularly poor investment returns. For fiscal year ended June 30, 2015, CalPERS earned 2.2% and in fiscal year ended June 30, 2016, it was a mere 0.5%.

The numbers Pacheco admits to for Meketa are far higher than staff has presented to the board, when the board mistakenly believes it gets a full accounting of all significant external vendor payments. Recall that the most we could attribute to Meketa for the two fiscal years ended June 30, 2018 was $1,283,476. Pacheco says the number included in the “Internal” expense catchall bucket for those years was $3.59 million, nearly three times a much.

The expense misclassification is so egregious that it raises concerns about fraud. Accounting expert McKenna reacted strongly and negatively to the CalPERS’ claims:

The first thing I thought of is that CalPERS is hiding work done for or on behalf of someone with a conflict of interest. The second thing I thought of is that hiding on the CAFR could suggest its numbers are padded with non-work payments or even kickbacks. The third is that putting third party fees in an internal category is that CALPERS own staff are acting as a consultants to the own agency and being paid via a contract with these consultants.

Pacheco doesn’t explain the $78,000 listed for Meketa in the fiscal year ended June 30, 2019:

Meketa is part of the category “Investment Consultant Fees.” Did this $78,000 just leak out? Is it double counting? Pacheco simply can’t carry off his pretense that the Meketa fees are all tidily hidden in the investment office overheads.

CalPERS deliberate and incorrect treatment of the Meketa expenses is a misappropriation of public funds, a crime, and may also be a fraud. CalPERS may argue that its misclassification of Meketa (and Wilshire Associates) expenses is not material from an accounting standpoint. The California Penal Code Section 424 has no materiality carveout. Boldface ours:

California Penal Code 424.

(a) Each officer of this state, or of any county, city, town, or district of this state, and every other person charged with the receipt, safekeeping, transfer, or disbursement of public moneys, who either:

1. Without authority of law, appropriates the same, or any portion thereof, to his or her own use, or to the use of another; or,

2. Loans the same or any portion thereof; makes any profit out of, or uses the same for any purpose not authorized by law; or,

3. Knowingly keeps any false account, or makes any false entry or erasure in any account of or relating to the same; or,

4. Fraudulently alters, falsifies, conceals, destroys, or obliterates any account; or,

5. Willfully refuses or omits to pay over, on demand, any public moneys in his or her hands, upon the presentation of a draft, order, or warrant drawn upon these moneys by competent authority; or,

6. Willfully omits to transfer the same, when transfer is required by law; or,

7. Willfully omits or refuses to pay over to any officer or person authorized by law to receive the same, any money received by him or her under any duty imposed by law so to pay over the same;—

Is punishable by imprisonment in the state prison for two, three, or four years, and is disqualified from holding any office in this state.

(b) As used in this section, “public moneys” includes the proceeds derived from the sale of bonds or other evidence or indebtedness authorized by the legislative body of any city, county, district, or public agency.

(c) This section does not apply to the incidental and minimal use of public resources authorized by Section 8314 of the Government Code.

This violation becomes more serious in light of the fact that CalPERS had a rating from Moody’s for the purpose of acting as a financial guarantor after this practice started. That means its accounting chicanery has far more serious legal ramifications than just misleading beneficiaries and the legislature.

We need to stress that we did not go looking to find dodgy accounting. We’ve stumbled across three serious examples by sheer happenstance: Randle Associates, Meketa, and Wilshire Associates, whose charges CalPERS has also improperly shifted into the internal expense bucket. We have not had the opportunity yet to dig into Wilshire, but its fees are certain to be considerably higher than Meketa’s, yet they are not disclosed to the board in any periodic reviews of contacts and their costs, nor is there any disclosure in recent CAFRs. Perhaps these are all coincidences, but they are far more likely to be the tip of a very dirty iceberg.

_____

1 CalPERS is engaged in similar misleading/abusive reporting for what is certainly its biggest investment consultant, Wilshire Associates. But by virtue of the lack of any reporting of Wilshire expenses to the board, versus partial via the so-called “spring fed pool” reports for Meketa, we are less far along with them and so limited this post to Meketa. However, there are no expenses identified for Wilshire in the last two CAFRs, when Wilshire is certain to bill more to CalPERS than Meketa does.

2 The concept of the “spring-fed pool” has been bastardized over time. It was originally meant to allow CalPERS to pre-qualify service providers, including pre-authorizing certain levels of spending, who had capabilities that staff did not have and were believed to be too costly or too intermittently needed to justify building up internal skills. But now the spring-fed pool seems to be just a device for hiring outside vendors whether or not CalPERS could do the job. Note the Investment Committee sometimes gets interim quarterly updates on the investment-related spring-fed pool contracts.

3

4 Par for CalPERS, you need to look at the column header to learn that the expenses are as of March 31, 2018 even though the report is dated June 30, 2018.

I may not have the chance to write “Attorney General Basura is gonna be all over this in no time”

on many more occasions.

:)

Tom, that’s unfair. How can you possibly expect Becerra to do his job under these conditions? Responding to Trump tweets is the main focus of california’s AG. It requires all of Becerra’s massive mental capacity. He’s too tired by 5pm to attend to any silly possible fraud involving retirement funds for 1.6 million members of CalPERS.

Being as woke as Becerra is a full time job. Sometimes that means massive, systemic fraud at the country’s largest public pension fund has to take a back seat to getting a good night’s sleep.

in another language..”Bechara”..also meaningfully appropriate somehow……

https://translate.google.com/#view=home&op=share&sl=hi&tl=en&text=Bechara

The late author Robert Heinlein once pointed out that numbers are sharp things and that when you attempt to juggle them, you cut yourself. What is happening here has gone beyond that point. I mean you can’t exactly defend it in a court of law as it is all in black and white. Or should I say that the problem is the absence of some of that black on that white. I am willing to bet that after the past few weeks with the Meng fracas, that a lot of the big boys and girls in the financial world are taking a closer look at CalPERS’s books if they have any exposure to them. Maybe Moodys as well (that would be ominous). It would be the prudent thing to do. Certainly the great State of California should be.

CalPERS’s Comprehensive Annual Financial Reports, in public pension speak are called CAFRs. Is that an inside joke as in “coffers”? It is a pity that CalPERS finds itself in the position of having to go to companies like Meketa Investment Group for their expertise. If they had sacked two-thirds of their PR staff and had spent the savings on building up an in-house expertise instead, it may have saved them a lot of hassle. But CalPERS is not that sort of organization, is it? It deliberately chases away talented people instead. In any case, sooner or later there is going to be forensic accounting done on CalPERS’s book and I suspect that it is going to get nasty. And it won’t be an excuse to say that ‘a computer ate my accounting’ as that won’t fly. The best thing that CalPERS can hope for is that one of those forest fires breaks out at 400 Q Street in Sacramento.

I don’t see how anyone with any heft would have any exposure. They almost certainly have some of calpers money, but they aren’t going to be liable for calpers malfeasance.

I suggest you bone up on the California False Claims Act. The California Constitution Art. XVI sec. 17 appears to give the members and beneficiaries of public pensions a constitutional right to sound fiduciaries. California also has a qui tam False Claims Act which can be used to go after excessive and fraudulent fees. I am aware of active exploration with competent counsel of other legal arguments that could result in very large judgements since the theories in question would generate treble damages.

Potential liability for individual board members has been a consistent theme of Yves’ posts on CalPERS. Board members of CalPERS have liability analogous to partners – it’s joint and several. Plaintiffs need only go after whomever has deep pockets. She has also taken pains to point out to readers and the board that much of that liability is not insurable or insured.

The best course for board members would be to discover and do the right thing. If they don’t, pleading ignorance and that they tried their best are likely to achieve nothing. Shuffling their assets may not get them much more. In the end, though, the harm will end up on the shoulders of pensioners. While that’s sorted out, they will undoubtedly complain loudly to their elected officials and at the voting booth.

> Maybe Moodys as well (that would be ominous).

Mad-Eye Moody and the Department of Magical Law Enforcement may have once struck fear into the financial world’s heart, but the 2008 subprime mortgage crisis showed that those Aurors weren’t as incorruptible as had previously been thought.

Ahh… we’re now getting into money.

What gets me is that it’s easier to sue for defrauding few hundred k than mismanaging billions. But then, Al C. was got for tax evasion, not all those murders. So I’ll settle for what’s possible.

Butt in jail or flexian upgrade / retirement plan – ????

Bye Bye Marcie

The real question though is will any of the CALPERS staff turn over ?

The thought occurs that NC has inaugurated a new field of endeavor, or is a pre-eminent example of an underappreciated one — “citizen accounting/auditing”.

Thanks for your ongoing work on this, Yves. I’m guessing that there is a not-insignificant number of undeclared lurkers from CALPERS and the government of CA who scan NC daily, with growing anxiety, for the latest things you have uncovered.

Who sits on the risk audit committe?

Did any of them know of these discrepancies? This hen house needs some watching.

I’m imagining a remake of the 1968 movie The Producers, this time called At CalPERS , starring Marcie as Max Bialystock.

https://www.youtube.com/watch?v=xGdY4jfhKRM

Thanks for your continued reporting on CalPERS, PE, and pensions.

All this seems pretty blatant, so, why isn’t anyone in power who could make a difference doing anything about it? Why does Yves have to do all the heavy lifting, but get results like Cassandra on the morning the big wooden horse showed up? Wasn’t it Mencken who wrote, approximately “Democracy is the system whereby the voters get the government they deserve, and they get it good and hard” and, except for the ex officio members, isn’t the CalPERS board elected by the beneficiaries? I am grateful for many things in my life, and one of them is that I have no financial stake in this.

Those of us who do have a financial stake in CalPERS are filled both with anger and dismay. I am a retired employee of the State and receive a pension from CalPERS. Over the years, I have noticed more and more mistakes on my account there and a growing inability of the staff to correct errors or input changes accurately. The rot is all the way down to the public help desk on the first floor of their rather nice building here in Sacramento.

You are quite right that we, the retired, do vote for some of the board members. That is to say, we fill out a ballot that is then mailed someplace and someone unknown opens or tosses said ballot and finally a result is announced. I believe Yves already posted a lengthy analysis on the issues regarding the ballots, the (transparent) paper they are printed on and so forth.

Yves, thank you for continuing to pursue them. I have no doubt that it will be shown to have gone off a cliff some time ago at the higher levels and that the financial underpinnings of the fund have been grifted into smoke and mirrors. I have no idea what those of us who are too old to start over will do when that knowledge becomes impossible to ignore, and the laws are changed so that pension payments can be reduced to useless levels.

As an aside, I would like to share a reminder of the good old days. Those of us who are truly elderly have a pension plan via PERS that can be inherited by marriage for the lifetime of the spouse. The spouse qualifies for the inherited plan on the day of marriage, no waiting period. That is to say, if I were to marry someone, and then die the next day, that person would inherit my pension for the rest of his/her life.

Of course the plan is no longer available as an option for new employees and has not for many decades. However there are some of us dinosaurs out there still living who have that ancient plan. Those spouse protecting old plans were not exceptional back in the day and were fairly common in many for profit companies as well.

Ana in Sacramento

Pacheco’s explanation raised even more red flags:

The Meketa contracts that you are referencing have been included in the Internal Investment Personal and Administrative Expenses category of the CAFR since 2015-16. At that time, it was determined that this categorization was most appropriate given the Board’s consultants unique role in providing independent investment evaluations, opinions and recommendations to the Board.

Translation

Per CalPERS Ministry of Truth staff, who see the State in 1984 as an ideal government, try their best to turn Orwell’s imagined world into reality at CalPERS with their specialty — love is hate, war is peace, an external firm is internal staff, the cost paying an external firm is an internal cost.

Pacheco knows that classifying and reporting an expense as the opposite of what it is, is wrong, that there is no gray area, no ambiguity. He knows he is defending the indefensible as the “most appropriate” when he and everyone else know that CalPERS was deceptively burying the cost as a larger internal category to avoid needing to separately report the cost. CalPERS got caught, so their Ministry of Truth needs to conjure some defense, however ridiculous

What other payments to external parties has CalPERS not reported?

And does the cost of contracts include givebacks ?

Thanks for the deep dive into the questionable financials!

But I have a simpler question: CalPERS reported a 4.7% return on investments for fiscal year 2019-2020.

https://www.calpers.ca.gov/page/newsroom/calpers-news/2020/calpers-preliminary-investment-return-2019-20

Since this 4.7% return is substantially below their expected 7% return (the discount rate), one would expect to see a corresponding worsening of their financial position, as reflected in the funded ratio. But the funded ratio is reportedly essentially stable at 70.8%, compared to 71% the previous year.

With a reported fund balance of 372.6B at the beginning of the year, achieving the expected 7% return would have earned about 26B, compared with an actual 4.7% return earning 17.5B, a shortfall of 8.5B.

The fund reportedly ended the year with a balance of 389B. Dividing that by the funded ratio of 70.8% gives an actuarial liability of 549B. Since the 8.5B shortfall is about 1.5% of the 549B liability, one would expect the shortfall to cause the funded ratio to drop by 1.5 percentage points, from 71% to 69.5%.

Presumably the investment shortfall could have been offset by an 8.5B reduction in actuarial liabilities, but that seems unlikely since no such reduction has been reported.