As we reported earlier, central banks have been providing emergency liquidity, but it has not coaxed nervous investors off the sidelines. From the Wall Street Journal’s MarketBeat:

“There is extreme lack of liquidity in the short-term markets,” Kevin Giddis of Morgan Keegan told Dow Jones Newswires, noting he has seen no commercial paper trade so far this morning. “Each moment that the government’s bill gets held up, things will remain like this. They need to calm markets.”

The interventions we’ve had to date have, by any standard, been massive, yet have failed to bring lasting relief. The idea that a $700 baillout bill is a “comprehensive solution” seems more than a tad optimistic. From Brad Setser:

In the last two weeks — if I am reading the Federal Reserves’ balance sheet data correctly — the Fed has:

Increased “other loans” to the financial system by around $230 billion (from $23.56b to $262.34b);

Increased its “other assets” by about $80b (from $98.67b to $183.89b);

Increased the securities it lends out to dealers by $60b (from $117.3b to $190.5b);

That works out to the provision of something like $370b of credit to the financial system in a two week period. That may be a bit too high: the outstanding stock of repos felll by $40b (from $126b to $ 86b), leaving a $330b net change in these line items. But that is still enormous.

The most that the IMF ever lent out to cash strapped emerging economies in a year?

$30b, in the four quarters through September 1998 (i.e. the peak of the 97-98 crisis).

The most the IMF ever lend out over two years?

$40b, in the eight quarters through June 2003 (this covered crises in Argentina, Brazil, Uruguay and Turkey)

This is a very real crisis. The Fed’s balance tells a story of extraordinary stress. I never would have expected to see the Fed lend out these kinds of sums over such a short-period.

Setser also says there is not sign of foreign creditors abandoning US assets, as custodial holdings at the Fed have increased.

FT Alphaville reports that credit default swaps spreads on the US have risen further. I couldn’t resist the lead sentence:

The US has been so hurt by the financial turmoil that markets now view its credit worthiness as akin to – or even worse than – that of McDonald’s, a shocking fact even if you believe that both are fronted by clowns.

One broker quoted McDonald’s CDS at about 26.5 basis points, compared with 30bp for the US, on Friday morning and another desk quoted both about 25bp. The picture has worsened since the news that politicians and public servants in Washington failed to seal a financial bail-out deal on Thursday night. McDonald’s closed at 28bp versus 25bp for the US on Thursday, according to Markit.

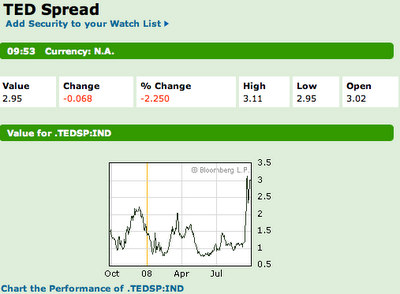

A slight bit of not-bad news: the TED spread isn’t getting worse (click to enlarge).

Update 11:00 AM The Financial Times reports banks are lending to each other only on an overnight basis:

Money market traders said that interbank lending for terms longer than a day had come to a near standstill as counterparties feared that they may be lending to a bank that could suddenly become insolvent.

Matt Dubuque

Perhaps this absolute freeze up in credit and the market behavior Yves describes here will disabuse those who believe that the Fed can simply “reflate” the economy at will.

I understand Bernanke took such a position a few years back.

He was very likely mistaken.

I have warned in this forum that the Fed is trying to engineer a HARD landing instead of a crash landing.

That may not be possible. It’s too early to tell. Because Lehman’s marks were proven to be fraudulent, we still won’t know the scope of the catastrophe until ALL the AUDITED reports come out in January.

That will be a time of reckoning.

But inflationary expectations are clearly going to be decisively wrung out of the system in a process that will be wrenching for some.

It has been claimed that my views in this forum are occasionally mistaken. It is clear that some of my views have been incorrectly interpreted in this forum. Some of my views will take time to play out. I never claim to be perfect.

But I have never fought the wrong war.

We need to focus on the dangers of a deflationary burst.

This is my view.

Matt Dubuque

I think you mean the Ted spread isn’t getting *any* worse.

“But I have never fought the wrong war.”

Have you ever fought the right one?

Yves:

Thought to post this whilst you were still asleep but took too long.

Perhaps Roubini is our modern profit.

As you may know he was a displaced Iranian Jew.

Nouriel took a little digging. But in the Kabbala (Jewish mystical teachings) Nouiel is the spirit of fire. And from the Zohar the spirit of fire performs a cleansing activity But it is the previous defilement which provides the source of fire.

And finally from KingsI: And after the earthquake a fire; but the Lord was not in the fire: and after the fire a still small voice.

Just sayin’

foolonthehill

OT Yves is there anywhere apicture of you? Make you less of a electron-ic being :)

“Markets now view [US] credit worthiness as akin to – or even worse than – that of McDonald’s, a shocking fact even if you believe that both are fronted by clowns.”

ah ha ha ha

AH HA HA HA

The only difference being, USGOV don’t serve Happy Meals. Instead, it smacks us in the face with a reeking pile of Shinola.

— Juan Falcone

“I never claim to be perfect.”

“But I have never fought the wrong war.”

YES OF COURSE! This is all about you.

An Informal Poll:

Who’s more insane—Paulson or this Matt character who leads off these comments?

That is one tough call.

I gotta go with Matt, though. Yes, clearly Paulson’s has an insane ego, but he’s at least been on the public scene for many years. Matt, on the other hand, is convinced that he is some kind of public figure and that we are all talking about is prescience.

I know it will take years, but someday my plea and prayer to shut down SIFMA and rewire FASB will be a part of the solution to this mess. IMHO, short term liquid cash is being linked and backed and connected to derivatives that act as a sort of drano plug filler, i.e, every time money is injected into this corrupt and fraud-filled sewer, derivatives act as sponge-like depends pads that absorb liquidity. Has anyone seen my walker and dementia pills?

What is the role of FASB you ask, as you agree that SIFMA is a corrupt lobby group?

The Mission of the Financial Accounting Standards Board

http://www.fasb.org/facts/index.shtml#mission

The mission of the FASB is to establish and improve standards of financial accounting and reporting for the guidance and education of the public, including issuers, auditors, and users of financial information.

Accounting standards are essential to the efficient functioning of the economy because decisions about the allocation of resources rely heavily on credible, concise, transparent, and understandable financial information. Financial information about the operations and financial position of individual entities also is used by the public in making various other kinds of decisions.

>> Does anyone out there think they have helped make corporate accounting on wall street efficient? Have they thus contributed to the mess we are in, and then have they worked with SIFMA to delay accounting reform, e.g, things like:

>>> Saying that the “risks of too much haste are high,” SIFMA and the ASF suggested that a quick implementation of any proposed changes could further impair bruised balance sheets and drive up capital constraints at a time when very few firms in the financial sector could handle such a burden.

Both organizations said that the changes would impact more than $10 trillion in MBS, ABS and commercial paper facilities and that any change to accounting standards would affect “large markets that provide substantial funding for U.S. business and consumers.”

The trade organizations’ cause was joined on July 22 by House Committee of Financial Services ranking member Spencer Bachus (R-AL), who sent a letter to FASB chairman Robert Herz and Securities and Exchange Commission chairman Christopher Cox echoing similar concern over “serious unintended consequences.”

FASB appears to at least have considered the requests, saying late last week that it would “reconsider the effective date and transition provisions” around its proposed changes to FAS 140 and FIN 46R.

>>>> Corruption, that is what will destroy America and like Japan, it could take decades for reality to gain fractional acceptance.

It looks like Kathy Fuld (wife of Lehman CEO) is seeking liquidity also.

http://www.bailoutville.com/forums/f5/let-them-eat-cake-64.html

I would not read too much into the increase in Fed custody holdings. As I explain on my blog ( http://reservedplace.blogspot.com/2008/09/beware-rising-custody-holdings.html ), I think that an increase in custody holdings would be expected because of the collateral taken by the central banks lending under the reciprocal swap lines arrangement.

I am reposting this question from an older thread (I was late in posting) since it is related to the posting. The context is the Treasury Supplemental Financing Program and how it is represented in the H.4.1.

anon said in another thread:

“From a monetary and inflation perspective, the key to the transaction is the liability side of the Feds balance sheet. The transaction doesn’t create new reserves or new money supply – it creates locked in government funding for the Fed and shifts existing money supply around. That’s a lot different because the monetary base doesn’t change.”

My comment:

This is the part that I am struggling with … if no new reserves are created (which I agree with since this was new treasury debt that was sold and not treasuries held on the Fed balance sheet), then why the substantial increase in “Reserve Bank credit” in the H.4.1? The “Total factors supplying reserve funds” (asset side) must increase because the “Total factors, other than reserve balances, absorbing reserve funds” also increased due to the the Treasury deposit of proceeds in the “U.S. Treasury, supplementary financing account” line on the H.4.1 (the proceeds from the Treasury debt auction under the Supplemental Financing Program).

In other words, it seems that Treasury credit was increased here, not Fed credit. But the H.4.1 represents it as an increase in Fed credit.

Thanks for your input.

Brian

If someone has a short position, it would be easy to loan the target money, with a note saying “please go bankrupt”.

Long bond / Short stock was a reasonable hedging strategy until they banned shortselling.

If the bank might go bankrupt overnight and there is no way of hedging, no one in their right mind would loan them money.

(Somewhere there is a paper or thesis calculating short position hedge on equity depressing stock values equal to interest rate borrowing costs).