Bloomberg has a good report today explaining why the DTCC report saying the credit default swaps market is only $34 trillion in notional outstanding isn’t all that it is cracked up to be. We muttered darkly at the time that some might read more into the DTCC report, released yesterday, than it deserved. Useful is not the same as “comprehensive,” yet the DTCC has taken to making pronouncements about the swaps market that exceed the reach of its knowledge.

In particular, we complained yesterday it would be better if someone tried to take a stab at how much was missed in DTCC’s $34 trillion estimate. Obviously, given the murky nature of the market, any attempt would be rough, but one ought to be able to give a rough sense (is DTCC understating by 10% or 100%)?. Lo and behold, Bloomberg has come back a day later and attempted to fill some of the gaps we pointed out. Well done!

I am NOT suggesting that this article was in response to our post, merely that this is exactly the type of reporting we like to see. We also have some further CDS trivia after the Bloomberg excerpts.

From Bloomberg:

The most comprehensive report on unregulated credit-default swaps didn’t disclose bets in the section of the more than $47 trillion market that helped destroy American International Group Inc., once the world’s biggest insurer.

A report by the Depository Trust and Clearing Corp. doesn’t include privately negotiated credit-default swaps that insurers such as AIG, MBIA Inc. and Ambac Financial Group Inc. sold to guarantee securities known as collateralized debt obligations. It includes only a “small fraction” of contracts linked to mortgage securities, according to Andrea Cicione at BNP Paribas SA in London.

New York-based DTCC’s data, released on its Web site Nov. 4, showed a total $33.6 trillion of transactions on governments, companies and asset-backed securities worldwide, based on gross numbers. While designed to ease concerns about the amount of risk banks and investors amassed on borrowers from companies to homeowners, the report may have missed as much as 40 percent of the trades outstanding in the market, Cicione said.

The data are “likely to underestimate the amount of net CDS exposure,” Cicione, who correctly forecast in January that the cost of protecting European companies from default would rise, said in an interview. “A broadening of the coverage to the entire market is what investors really need.”

DTCC released the data as dealers and investors in the market seek to counter criticism that the market has amplified the financial crisis. The Nov. 4 report showed, for example, that $15.4 trillion of contracts linked to individual companies, governments and other borrowers were created. After canceling out contracts that offset one another, though, sellers of that protection would have to pay $1.76 trillion if all underlying borrowers defaulted and debt holders recovered nothing.

I am still not convinced that this $1.76 trillion number is as comforting as it seems. Netting merely say that if all the counterparties turn out to be good, a lot of the exposures cancel out. But some of the big non-participants in DTCC like AIG, Ambac, and MBIA, were heavily exposed on the protection writing side. Moreover, the worry is not net across all deals but the possibility of counterparty failures on one deal leading firms thinking they were hedge realzing that one side of their trade has suddenly become a naked exposure because a counterparty had failed, and that leading to bad outcomes (say a scramble for more cover, which would lead to a spike in prices and/or increased collateral requirements). Robert at Angry Bear takes a similarly dubious view in “CDS zero net supply.“

The other issue is that the swaps community is very eager to present the image that the highly lucrative swaps business really is not the walking time bomb that everyone worries that it is, and they point to the (seemingly) orderly Lehman settlement as proof, although as we pointed out yesterday, some protection writers opted out of DTCC settlement and their experience may not have been so orderly.

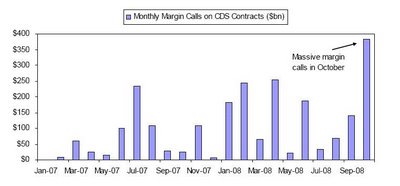

Perhaps as important, the collateral posting requirements of many (all?) DTCC members means that problems would show up not at settlement time, but when the credit event took place, positions were marked, and more collateral demanded. A chart from Bridgeford Associates courtesy an institutional investor client gives some insight:

This give a sense of where the CDS settlement stress is showing up, not in settlement failures but in margin calls, And with the Iceland CDS settlement still to come, there are more big CDS demands still to come. Back to the Bloomberg story:

Investors hedging against losses on CDOs helped push the cost of default protection to a record last week. The benchmark Markit CDX North America Investment Grade Index, linked to the bonds of 125 companies in the U.S. and Canada, reached 240 basis points on Oct. 27. The index rose 11.75 basis points today to 195.5 basis points, according to CMA Datavision.

The Markit iTraxx Europe rose to as high as 195 basis points from as low as 20 in June 2007. It closed at 141.5 basis points today, according to JPMorgan Chase & Co….

AIG first disclosed to investors in August 2007 that it held more than $440 billion of credit-swap trades linked to CDOs. The New York-based company was brought to the edge of bankruptcy in September after the value of the transactions plunged. The insurer was forced to come up with more than $10 billion in collateral to back the contracts after its debt rankings were cut. It accepted an $85 billion government loan in exchange for ceding control to the U.S.

MBIA and Ambac, previously the world’s two biggest bond insurers, lost their top AAA ratings earlier this year because of potential losses on credit swaps sold to guarantee CDOs backed by home loans. Moody’s Investors Service cut New York-based Ambac’s bond insurance rating four levels yesterday to Baa1, three steps above junk, because of potential losses on the derivatives.

A market survey this year by the New York-based International Swaps and Derivatives Association, which includes credit swaps on CDOs and other contracts that may not be captured by DTCC’s Trade Information Warehouse, estimates more than $47 trillion in gross contracts are outstanding…

“There appear to be gaps,” said Henry Hu, a law professor at the University of Texas in Austin who has pressed for the creation of a data warehouse encompassing all privately negotiated derivative trades to offer a better understanding of their risks.

“Hopefully, regulators are getting more information,” he said.

Because the DTCC registry captures only commonly traded contracts that can be confirmed over electronic systems, not every swap trade is in the company’s report, spokeswoman Judy Inosanto said. Among those not included are credit-default swaps on CDOs, she said.

MBIA, the Armonk, New York-based insurer crippled by ratings downgrades earlier this year following losses from such contracts, has said it sold $126.3 billion in guarantees on slices of CDOs backed by corporate bonds, mortgages and other debt. Ambac sold $60.7 billion in guarantees on these so-called tranches, mostly through credit swaps, the company said.

Insurers including AIG, MBIA and Ambac typically sold protection on the highest ranking slices of such deals, meaning they’d be required to make good on payments only after a substantial part of the underlying debt defaults.

The failures of Lehman Brothers Holdings Inc., Washington Mutual Inc. and three Icelandic banks that were widely held in CDOs linked to corporate debt caused no losses on tranches MBIA guaranteed, Mitchell Sonkin, the company’s head of insured portfolio management, said in a conference call yesterday.

New York-based Lehman and WaMu, based in Seattle, filed for bankruptcy. Iceland’s government took over its three biggest lenders last month after they were unable to raise short-term funding, triggering pay-outs on credit-default swaps.

Some investors holding the riskier slices of CDOs that weren’t guaranteed lost more than 90 percent because of the bank failures.

“The worry is that these bespoke tranches are being eaten away, and who knows if and when these losses will get realized,” Tim Backshall, chief strategist at Credit Derivatives Research LLC in Walnut Creek, California, wrote in a note to clients yesterday.

Truth hurts; keep it up Yves.

I’m shocked that there’s gambling going on in this casino!

To be fair, the fact that the world hasn’t blown up indicates the behind-the-scene Lehman settlement was probably fairly orderly. Lehman was a big company with a lot of speculation on it so if the market managed then the most apocalyptic scenarios where the interlocking CDS result in the market not having a stable outcome are probably not going to happen in the next year or two.

I think the problem now may be the big insurer’s exposure, just as you say. I can’t help but wonder how much of the extra AIG bailout was Lehman related. And the monolines are now getting some (ridiculously inadequate) downgrades. Hmmm.

I just keep wondering when a lot of these swaps will start coming due. I imagine a lot of the securitized mortgages must have been hedged with such swaps. What happens when interest can’t be paid on any number of bonds? As well as the fact that any number of mortgages still have yet to reset.

Excellent post. I was asking around about the same issue.

keep up the good work, Yves. great post!

November 7, 2008

Suggested first Obama legislative bill:

1. All “off balance sheet items” forbidden by law.

2. All cards (derivatives etc.), and the card holders hands, on the table as of date of enactment.

3. All non-certificate holder CDS’s, etc. null and void.

4. Trading in any kind of non-certificate derivatives punishable by law.

Earl L. Crockett

Santa Cruz, CA.

Quotes from the Bloomburg story:

“A market survey this year by the New York-based International Swaps and Derivatives Association, which includes credit swaps on CDOs and other contracts that may not be captured by DTCC’s Trade Information Warehouse, estimates more than $47 trillion in gross contracts are outstanding…

“’There appear to be gaps…’”

“Because the DTCC registry captures only commonly traded contracts that can be confirmed over electronic systems, not every swap trade is in the company’s report, spokeswoman Judy Inosanto said. Among those not included are credit-default swaps on CDOs, she said.”

So there are at least $47 trillion in gross contracts outstanding, of the most virulently derivative kind of instrument (CDS on a CDO)? So the theory is that these will kind of net out to zero somehow unless – but what could possibly go wrong?

Could someone provide a link to an explanation of how this zeroing-out is supposed to work, or why anyone thinks it should all come out even – a wash – and not something a lot more untidy?

The “zeroing out” concept merely indicates that in aggregate no money is made or lost in CDS. Money is transferred from one party to another.

Think of having a $100,000 insurance policy on your house. If the house burns to the ground, you collect $100k on your policy and the insurance company pays $100k. In total (between you and the insurance company), the gain is zero.

Regarding the question “I just keep wondering when a lot of these swaps will start coming due.” They don’t really come due. They are insurance contracts that pay out if there is a default and ultimately expire worthless if there is not.

Regarding what is in DTCC’s Trade Information Warehouse, it does only include the more liquid, commonly traded CDS. As reported it does not include the illiquid, more customized CDS like AIG entered into. There are more investor’s interested in buying/selling protection on General Motors or the State of Italy than a particular mortgage back securities.

Most trading in the CDS market is in the form on index trading (e.g. Markit’s CDX in North America and iTraxx in Europe). Markit launched a mortgage backed CDS index in 2006; however, by that time most investors were highly suspect of the mortgage mortgage. Therefore, few wanted to sell protection and the volumes for that particular index were never significant.

There will be more transparency for the more customized CDS contracts like those which AIG sold. However, those expecting to find a massive amount of volume here will likely be disappointed.

It is interesting to me that as the CDS market provides more and more transparency the pundits keep claiming that the problem must be in some area not yet revealed.

To be fair, it seems to me that the CDS market is in part paying for the sins of the past. In an effort to appear to be an important real market, the CDS market hyped the notional value (what this article called gross) knowing that it was nowhere near the actual value. Now the media has picked up that figure, relayed it as the actual value and people are frightened.

The actual value of the CDS market is a very, very small fraction of the notional value.