Proponents of mortgage modifications contend that the cost of even a deep principal reduction still puts the lender ahead of foreclosure, and experience in past real estate downturns would bear that contention out.

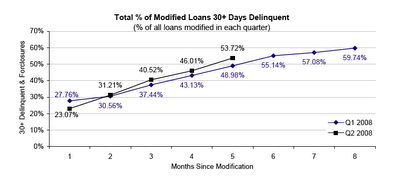

So why is this time different? Data from the Office of the Comptroller of the Currency show that 55% of mortgage mods redefault within six months. Even more discouraging, the three month re-default rate was higher for loans modified in the second quarter of 2008 than the first.

It is hard to know for certain without digging further into the data. With housing prices down nearly 30% nationwide, and foreclosure costs averaging $50,000, banks could afford significant principal reductions and still come out ahead. However, borrower advocates contend that many mods in fact reduce interest, but unless the principal is cut, the reduction in payments is insufficient to make enough difference with many borrowers. Without mining the data further, it is hard to know where the truth lies.

Click to enlarge:

The FDIC home mod plan has a NPV test – you make a valid point that unless having both principal and interest reduced (rather than having it recapitalized), recidivism will stay high. The continuing declines of LTV (with many >100%) is not a good sign.

What remains is the question of whether the US will be better off in the long run by relieving some people of their obligations while not letting others “off the hook”. I find it hard to remove moral hazard from this discussion as individuals will do what is in their best interest. If poor decision-making is rewarded, expect more of it (I see this first-hand as a college professor). I say “increase unemployment benefits and train the unemployed”, but I cannot see how anyone can justify reducing the cost of homes for some and punishing the prudent.

problem is that folks own the mortgage not the house but are stuck with ongoing maintenance cost,higher taxes and payments that far exceed their ability to be anything other then debt slaves.

As renters they can quickly move to an area with better job prospects or downsize to affordable rents.

From being in a trying to mod situation, so far the bank has only been interested in increasing monthly payments, and is unwilling to reduce interest, extend terms, or defer payments. Had any of these occurred months ago, additional financial problems would have been avoided.

“I cannot see how anyone can justify reducing the cost of homes for some and punishing the prudent.”

These are the “beggar thy neighbor” policies in the most real sense of the phrase. Most prudent people were more than happy to count on the equity that they had ‘earned’ when their neighbors house went up 200% in value.

I am part of the generation that was beginning to look at homes. I bailed, a lot of my friends didn’t, they needed a place to call home. The boomers blaming all of this on younger generations is the ultimate in hypocrisy. How is your retirement going?

Its always easier to make half of the poor think they are rich than to actually make them so. You got in the lifeboat, but there are no rescue ships on the horizon.

How exactly does reducing the principal and interest on a loan to levels which are sustainable not make sense? This is the question, too late to bring in moral hazard. That left with the ALT-a.

Anonymous said…How exactly does reducing the principal and interest on a loan to levels which are sustainable not make sense?

There is a reason that it will not make sense — simply the amount of the principal/rate reduction is less than what would be realized in a FC or legal proceeding (recourse against other assets).

the fdic loan mod program has a serious analysis deficiency with respect to holders of whole loans. please ask the fdic to explain how someone can fund for up to 40 years a portfolio of mortgages (blemished ones at that) with a weighted coupon of 3%. such a portfolio will expose an institution to undue market risk and periods of negative spread. a proper analysis would include this risk in the “net present value” analysis. yet it is missing. perhaps this is a reason why banks will not modify certain loans.

“There is a reason that it will not make sense — simply the amount of the principal/rate reduction is less than what would be realized in a FC or legal proceeding (recourse against other assets).”

Mortgages are non-recourse. Hence the term “jingle-mail”. Take the house.

Banks do not sell houses, banks loan money. Pushing them into the home selling business is not the way out of this problem.

The recovery numbers are still not accurate, and lead back to cassandra’s post on normal. Normally, the recovery rate is better. I doubt that is true any longer, and probably won’t be true for a long time.

As to the coupon on the portfolio, it also should include currency risk. Europe was using these securities as a beach head for other investment. They couldn’t find real bonds that were cheap enough for them.

30-40 years with no currency risk?

Fat tail anyone?

The problem is the owner’s mortgages are heavily leveraged by derivatives.

Any reduction in principle (legal or not in breaking a contract) would send many exotic investments belly up. So, modifying or reducing principle is trying to be avoided.

Hell, banks are trying to avoid even repricing their RE portfolios where the losses would bankrupt them on paper.

http://mrmortgage.ml-implode.com/

has/is been all over this. Lately, ‘Markit’ is trying to start a new index for RE values. Anything industry related is fighting that tooth and nail.

55% Redefault rate? Why am I NOT surprised? Mortgage servicers have been manufacturing bogus defaults for more than 20 years now with every fercockta fee imaginable, BPO fees, phony late lates, force placed insurance,

on time payments “drawered” or thrown into suspense accounts. This crisis will continue until servicing abuse stops. Who do you think made all those defaults CDS speculators profited so mightily on? Traders knew exactly what servicers were doing. One BS head mortgage trader even sat on board of subsidiary servicer. Mortgage servicing fraud has got to be criminally prosecuted and stopped.

This might something to do with the low success rate:

“Half of November’s loan modifications increased monthly payments…”

Bloomberg: Home Mortgage Modification Programs Are Flopping

Who in the world wouldn’t just walk away with that offer? If I had a loan for 15% more than my house is worth I’d walk away in a flash.

The devil is in the details…

The last of the responsible and prudent are being pushed against a wall with all the bailout talk. We are not stupid.. We watched what are neighbors were up to… We watched the easy money buy vacations, autos, additional homes for a flip etc. etc.

We also watched hard working Americans put a large down-payment down and trusted the realtor, mortgage brokers and the marketing lines of the NAR. These people who never took out a second mortgage or never did a cash out refinance or spent their HELOC and still pay on one purchase money loan.. well.. …..I could understand throwing them a bone since they already have lost hard earned money in their down-payment.

Unfortunately nowhere in all this bailout talk do our leaders give us the confidence they know the difference. Their hearts seem to bleed for the most incompetent. We are becoming a survival of the fittest nation as a result. As much as I don’t want to I need to look out for my family. I can’t afford to look out for my neighbor anymore. I can’t count on my government to look out for me and punish the irresponsible. Therefore I will need to start gaming the system myself so I can provide for MY FAMILY and attempt to survive in this corrupt economy. No more charity from me. I will laugh in the face of the bleeding heart liberals and conservatives trying to sell me stories on someone less fortunate. I will become cold and have very little empathy left for anyone.. Don’t count on me helping the old lady cross the street anymore.. I will game and cheat this system within the government’s misallocation of bailouts.

This you can count on when I see the most dumb of dumb “gamers” winning…

So go right ahead and justify giving homes away.. The consequences will be horrifying… We will become just like Russia during the Stalin years. Everything corrupt and bought and sold in the black market… Everyone out for himself only….

There’s a sad reality here that many don’t want to face. You can refi people out of high rate ARMs into 4.5% 30 yr FRMs and cram down principal by 20-30%, and you’re STILL going to see high redefault rates. Particularly for mortgages made during 2005-7. Lots of these folks simply can’t afford ANY sort of reasonable payment. Their repayment ability was based on 1. introductory payments with a below market teaser rate and non-fully amortized principal 2. dramatically rising home prices to eliminate the rolled forward principal and 3. the ability to refi into a new mortgage with another non fully amortized teaser rate payment when the first mortgage was at the end of the introductory gimmick period. This may not be true in all cases, but it’s true in many of them.

@Anonymous 4:41pm

Agree with you. We should game the system, that’s the game here in America, other we just get gamed. It’s the American way, and we can play too.

Maybe that’s why we were born in this country at this time, so we could learn to play. Use the chance, do what you want to do!

But I think you’ll still help the old lady cross the street, because you’re still a kind person, just a more realistic one now.

Are the banks worse off, better off or about the same, if they refi someone who then re-defaults, vs. foreclosing the first time?

I would guess no worse off unless the market for REOs gets worse (there is no sign of that), they weren’t going to be selling that REO very quickly anyway.

Whereas the responsible borrower, who is not even underwater, they have no incentive to help. He will probably get those payments made on time in full, and if not and they take the house, it has real value and they can resell it or hold it as a “gem” in their REO portfolio.

The truth is this: millions of underwater, over their head mortgagees are also deeply in credit card debt. Banks know that the real number for effective modification is 40% off principle and a very low (3%) 40 year rate. Do the math! Add in food, clothing, taxes, car insurance and gas to get to work and compare to the average income of those still working.

Banks simply can’t take the write-down.

Cheers @anon 3:24pm and others who point out the largely uncooperative lenders, evil fees, etc, making for deals that are not deals. As a borrower, you take an offer if you think it’ll keep you in the house, but it looks ok. But if in the meantime, you lose your job, go to 4 day workweeks, etc a previously worked out deal becomes untenable again and you’re back at failure, even tho there was no bad faith involved. I am very concerned that these stats are put up in order to justify more overtly draconian measures by the lenders.

Catherine Austin Fitts (solari.com) has asserted that the reason for the roundabout bailout is that there is a large amount of money tied into truly fraudulent mortgages, i.e. no real borrower or no real property. Of course, when stuff like that comes out, someone does a perp-walk.

Having once been in insurance underwriting and seeing what snr marketing and mgmt would do “for the numbers” I imagine that scenarion 10x in mortgages. I pray to the great god Internet to cough up some incriminating emails from crooked CFOs and mgrs in this process and let’s get this cleaned out.

If over half of all loan modifications are doomed to fail, and if the real estate market is continuing to deteriorate, why does it make any sense for the holder of the mortgage to defer or delay taking title to the property? It would be more sensible to encourage the defaulting borrower to move on, take possession of the property and sell it for whatever it’s currently worth, deriving some small comfort from the fact that by moving quickly you will minimize your loss.

I can understand why the government would want to discourage this approach. And I can imagine that a fair number of mortgage owners can’t afford to take the hit currently.

Unfortunately, it’s what Guido the loan shark would do. And, whatever his CRA deficiencies, Guido could teach us all about managing risk exposures.

ANON @ 4:41…BINGO…MORAL HAZARD..I’M SORRY TO SAY I HAVE TO AGREE..WHAT A SAD PRECEDENT..AND SOON WE’LL BE BRIBING A COP TO GET OUT OF A B.S. “TRAFFIC TICKET” LIKE IN MEXICO

To have a stable system, the collateral of mortgages or any secured loan for that matter, should be marked-to-market regularly and interest payments should be proportional to the current value of the collateral. Had we had this convention in place, we would not have this nasty crisis and risk total melt-down of our currencies.

The current system is not stable. It inflates into bubbles and it bursts destroying lifes. In a sense, it is a pyramid scheme in the same class as Madoff’s.

Here is Mr. Mortgage take on the Fannie and Freddie MOD proposal’s:

Home owners! Accepting this ’solution’ means you:

acknowledge the full debt regardless of the value of the home;

waive all rights to fraudulent or predatory lending claims in the future;

turn your loan into a full recourse loan that could follow you for life even if you choose foreclosure down the road;

remain underwater, full-leveraged, renter for the rest of your life (in most cases);

will save no money at 38% housing debt-to-income ratio plus all other debts;

may not discharge any of this mortgage debt through any bankruptcy even after foreclosure;

If widely accepted by home owners, this will ruin the American consumer and make housing a dead asset class for decades. If you are in a serious negative equity position when signing these forms, as most are, remember that you will:

never be able to sell your home

never be able to buy a new home

never be able to rent your home due to owner occupant provisions

be responsible for the full loan amount even if the value of your home keeps dropping for the next 10-years.

The 38% debt-to-income ratio on top of all of your other debt means you will save no money and live hand to mouth to keep this underwater roof over your head.

For those of you who do not care about being underwater in your home but only wanted a lower payment, this is your green light to default. Your new terms are outlined below.

In my opinion, many of those who qualify for this plan would be better to walk away, which is precisely the reason they rolled this out. Please, please consult your financial adviser before doing anything of this sort.

http://mrmortgage.ml-implode.com/2008/12/17/fanniefreddie-come-get-your-loan-mod-pay-for-life/

Yves,

Thanks for your blog. I found you a few months ago and visit daily!

I read through the report and found a further depressing factoid..these figures account for 60% of the mortgage market. SO, what is going in the other 40%??

I spent a great deal of time in and around Salt Lake City, Utah during the housing bubble. I’m no MIT grad, but common sense says you can’t afford a $500,000 home on $50,000 average salary regardless of the terms. Thus, how could anyone be surprised by the re-deault rates?!?

Then on to the next dilemma: moral hazard. How can one possibly quantify??

@Irene 6:50pm

The default risk is already taken into account in the mortgage rate! That is why people in the mortgage market watch the OAS (Option Adjusted Spread) that captures the rate premia due to refinancing and default for other reasons, in the presence of market-implied interest rate volatility. It was priced into the bets they made.

They didn’t price it correctly perhaps, or priced it based on receiving that year’s bonus. Oh well, if you want to take all the risk out of the system, good luck. I’m afraid you would be opening a can of worms for appraisal fraud; as a homeowner I would pay well for a low appraisal.

It stands to reason that if you fell into arrears in the first place, there’s a highly probable chance that you’ll do it again. Regardless of the asset value, if you can’t make the repayments you’re in trouble (unless your a bank or IAG then you get help).

as a homeowner I would pay well for a low appraisal.

But if your appraisal was considered an offer to sell, then wouldn’t it be in your interests to discern the fair market value? (Ditto if the bank does the appraising, and their appraisals were considered to be offers to buy.)

lineup32,

mr.mortgage wants to bring back serfdom?

Anonymous said…”Mortgages are non-recourse. Hence the term “jingle-mail”. Take the house.”

please note that all mortgages are not non-recourse. in all cases, all refinancings, junior liens (HELs, HELOCs, etc.), and non-primary residential debt (purchase money, seconds, etc.) are all recourse. also, in some states purchase money mortgages for primary residences do have recourse. so everyone cannot walk away with immunity.

In the cannabis pot.

The bankers/lenders/politicians/morlocks, by design or by decades, maybe even hundreds of years or could it be thousands of years, chained us to their will. How many here have knowledge of mankind’s rise from hunter gather to this moment. Mankind’s descent came when hunter gathers attached them selves to warlord like groups on the sales pitch (you supply us with commodity’s and labor and we will protect you). Protection is the driving force in human action/thinking. We always gravitate to offers, ideology’s, belief systems which we think can provide us some form of protection from the forces we fear hunger, mortality, reduction in status etc.

Putting this to a mathematical/ graphic equation is a lot of fun and has some surprising out comes. I use 8 SSD drives in mirror/racked with two large CPUs and the best GPUs in SLI 4 stack or dual SLI, i can actually see the the out comes in 3D with over laps, superimposed visual representations. Its a hell of a thing to see mankind’s actions in real time for 4 thousand years. Yes i am always tweaking the values

as better more precise information becomes available, but the broad projection remains stable.

Back to my point, it is not in the details of this economic problem that we should be worried about. It is about how we set are selves up for manipulation, as individuals and as groups. The longer we fear what we cannot control, the deeper we will fall. There is no group think or authoritarian solution to this to this problem, it rests in the individual and what he or she does to a cumulative effect. What does this society have to offer, white picket fence dreams, the thousand screams of the suburbs, the prison of metropolis, were man cannot see the outcomes of his actions to the environment.

Decide for your self and live it. Just remember your actions as an individual do have a ripple effect that you may not realize and can have far away consequences. Your future offspring/generations may come to hate and charge you with villainy for your short comings. 50 years is all we have, what will you do with your time. Worry about status, greasing the machine, saving face before your peers. We as a collective group of individuals globally are changing the way this biosphere operates, its time for a new book/ideas on how to operate with regards to our activity’s and there real time outcomes.

Skippy

@artichoke from 7:21pm “I’m afraid you would be opening a can of worms for appraisal fraud;”

Ah, but haven’t we already–in the other direction? Over-appraisals layered one on top of another like some beastly exponential brought all of the “agreed upon” values thru the roof. One guy in Florida was appraising houses for 700K+ in an area that should’ve been around 77K. He was busted (eventually) only because he was so far out there. Once banks were no longer conducting mortgages as a local activity, some person in Skokie is deciding on a place in La Jolla. If, by agreement or laziness, said approver trusted whatever was shoved under their noses for approval, they wouldn’t know the difference until years later.

“Unfortunately nowhere in all this bailout talk do our leaders give us the confidence they know the difference. Their hearts seem to bleed for the most incompetent. We are becoming a survival of the fittest nation as a result.”

I will let this inane piece of wisdom speak for itself. Tell the truth, you worked for the white house press office?

Yves,

Astounding graph, no attribution though

ON “Gaming the System,”

Folks, that is largely what has been going on in America since the creation of the Fed in 1913

"It is hard to know for certain without digging further into the data."

You don't have to dig into the data. You merely need to re-read your own blog.

People purchased homes & could afford only the interest payments (they did so with the expectation of being able to resell or refinance in a few years). Banks are refusing to reduce principals because it would make them basically insolvent, and as the Countrywide class action suit shows, they often don't have the authority to reduce the principal. Homeowners are facing no or negative equity as foreclosures continue to destroy home values, so they cannot refinance, and they have no economic incentive to do so. Shareholders of MBSs do not like or want loan mods & would prefer foreclosures.

No principle reduction + negative/no equity + no desire to keep the homeowner in the home + homeowner's inability to afford amortizing payments = loan modifications guaranteed to fail.

Personally, I'm amazed at the 45% success rate.

@Anonymous 7:36 pm

“But if your appraisal was considered an offer to sell, then wouldn’t it be in your interests to discern the fair market value? (Ditto if the bank does the appraising, and their appraisals were considered to be offers to buy.)”

Clever, and actually you don’t need appraisals then, just bids and offers.

But is this not the same as the game that can occur now? Disregard for a moment the abuse and stubbornness of servicers just trying to rack up fees and pretend the borrower is in touch with the lender. The lender will want to take the house back if it has value, but to “work with” the borrower if he is way underwater. It would produce the same result as what happens now, in those cases where the servicer is put to one side by determined action of the borrower.

@Mara 11:09pm

Yes you’re right, we’already tasted the overappraisals, then we could taste the underappraisals. Maybe they would balance out and everything would be hunky dory, especially if you get it happening both ways on the same house!

Or, two cans of worms don’t make a right? Sigh …

Bleeding hearts for the most incompetent leading to survival of the fittest. Even in the most rabid free market capitalist circles there is no one looking out for the little guy. They can’t afford a lobby. So, Que Bono?

Please stop looking down your nose and start looking over. They are your equals in this system. The only ones who have any one looking out for them are the ones who can pay for it. Beside this stunning example of what doesn’t work, what other money has been spent?

If you say the banks, you are correct. They were the ones with financial acuity, or so we were told as they were rolling back the leverage limits. Mr. Paulson.

So, this is the score-

GS/JPM/C/Senate 700 billion

GM/Chrysler 15 billion

Homeowers- Nothing

I expect you are getting exactly what every other home owner is getting, nothing.

Any moral hazard aguments must start with the banks.

They should end with the people who work for them who still won’t put an accurate price on things that they themselves created.

There will always be people who need or want to borrow money. There are not always people who want to loan money. The problem now is that no one is lending the money, even after they took a 700 billion dollar down payment to do it.

Once again, stop trying to put everyone underneath you. The much more objective view is that they are right next to you, and everyone on TV who talks about moral hazard is being paid by the people looking down at you.

This whole line of argument is completely rooted in flawed application of capitalistic ideas. The people who espouse the virtue of the free market are the first to ask for help. They take what ever they can, and then leave nothing but bitter divides and logical falsies that just serve to divide and obscure the true root of the problem.

Moral Hazard applied in this situation and in this manner should also punish anyone who sold a house in the past 5 years. I don’t see anyone proposing that.

You need to understand the proper stages of dealing with this crisis.

1. Denial

2. Anger

3. Bargaining

4. More anger

5. More aggressive bargaining

6. Murderous rage

7. Start killing people

Once you get into my frame of mind you’ll understand how this all works.

“…….Personally, I’m amazed at the 45% success rate.”

It’s only been 6 months, give it time and they all re-default.

The GSEs are not forgiving the original loan amounts. The difference in the then and now appraisal is being attached to the re-fi as a secondary loan to be paid as a balloon payment at the sale or payoff of the loan.

Don’t walk but run away from these types of re-fis.

@ anon 12:01

I like the cut of your jib.

skippy

Apologies. The chart also came from the OCC paper linked to in the post.

And I for one would like to know the parameters of these mods before reaching any conclusion. On the one hand, we do have borrowers who logically could be expected to have difficulty, even with reduced payments, However, we also have an industry which has been made to do mods against its will, and has every reason (by design of the mods, who they decide to offer them to, whether they are really “mods” or payment catch-up programs) to make the effort look like a failure.

The US is probably one of the few places in the world where mortgages are non recourse and even in some states this is not the case. In the UK for example if your house does not pay off the mortgage you are still liable for the rest of the mortgage (you end up with no house and a mortgage). You can declare yourself bankrupt to write off the mortgage, but you have to convince a judge you cannot pay. Once you are bankrupt though you cannot have any credit for a significant term. There is no point handing the keys back.

The whole idea of non recourse mortgages has moral hazard written all over it as does writing off principle. There are a lot of people who could have had a million dollar houses who will be very upset at those that did and will have a large part of the bill paid for by the state.

The latest ideas to relax mark to market valuations of housing are ripe for abuse and quite simply make it impossible to properly assess mortgage risk. While this may help an individual it completely undermines confidence in the wider market. The original problem was that mortgage risks were not properly priced into mortgages because banks shifted them on wrapped in insurance. How does obfuscating risks return the market to stable conditions? The world has changed and decision makers seem to be stuck in the past.

Anon @ 5:05

If, in the weeks and months leading up to the Selection of the person who would be fronting for the executive branch, you had pointed out that something was seriously wrong with all these bailouts and other emergency measures, conservatives would have looked at you pityingly, as if you were a small child or a deranged conspiracy theorist, saying, “You sure are good at criticizing but do you have any solutions?”

Anything other than an _ab initio_ step by step manual on how to resolve the crisis would have been dismissed with a few handy catchphrases. It’s very difficult to make it out of a discussion with a Follower because part of the Follower’s programming gives them a list of catch phrases and desired Pavlovian responses.

I have been through this with a handful of Republicans I tried to argue with. The dumb Followers interpret your silence as meaning they won the argument. The smarter ones interpret your silence as meaning they silenced you, which is the goal of the Leaders.

You will now experience exactly the same condescending treatment from the Krugmanites. “Don’t you realize that there are complex math formulas we can use to calculate the precise amount of stimulus required to get us through this economic bump on the road? Even a child can come up with the necessary eigenvectors. Please, do not darken our doorway again until you are prepared to discuss solutions like a civilized Nobel Laureate in economics.”

artichoke @ 11:55 PM

> Clever, and actually you don't need appraisals then, just bids and offers.

This is clever indeed, isn't it?

Model free mark-to-market! Not my idea though, this is a truly ancient one …

> But is this not the same as the game that can occur now?

It could in principle, as an emergency measure, although the system is really not setup this way.

This could be done best if the monetary system was equity based as opposed to debt based. So money creation would occur through equity shares issued by the monetary authority that require regular mark-to-market as opposed to occuring through debt. This way the monetary authority would regularly provide a risk cushion at the system level and risk manage systemic risks by controlling money aggregates.

The key point is that this should be done on an ongoing basis also in the good times to prevent bubbles from forming in the first place.

I spoke about some of the same things on my blog today. Also got into some of the other remedies before a foreclosure. Keep up the good work.

Mike Haltman

The Political and Financial Markets Commentator

http://politicsandfinance.blogspot.com

This (epic) failure rate doesn’t even need to have anything to do with the specifics of the loan mod. Just think about how the job market has done over the last six months. You could be modded down to a 90% LTV (based on a real appraisal) and still have a snowball’s chance of making the payments if you end up on unemployment.