The latest edition of Marc Faber’s latest newsletter fell off two separate trucks in my ‘hood, and I thought the most useful bits were Faber’s observations (honed from many years of seeing the world from Asia) that just because a market has gone down a ton doesn’t mean it can’t go down a great deal further.

Some choice tidbits:

The S&P 500, adjusted for inflation, is at its highest level ever, save for the 1995-2007 period. By contrast, at the market bottom in 1974, the S&P, adjusted for inflation, was lower than it was in 1906. In 1974, the market cap of all stocks was 31% of GDP versus 100% now, and the Dow yielded 6% and was at a marked discount to book value.

The 1974 rally, while powerful, ended in 1976. Stocks resumed their fall and hit their inflation adjusted low in 1982.

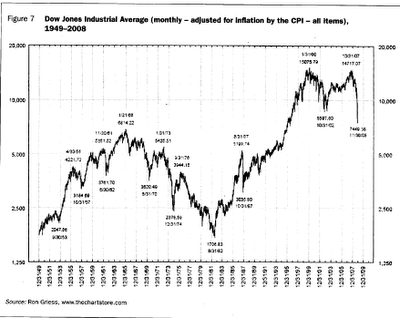

The Dow chart above makes some of the same points.

Faber concedes an equity rally is still possible, which he thinks would lead to a reversal in gold, which he argues would make for a buying opportunity. In general he prefers the risk/reward ratio in commodities to that of stocks. He also recommends selective buying of Asian equities, with the caveat that prices could fall further in 2009.

From his conclusion:

I am far from certain that US equities, which have declined by about 50% from their highs, are such a a bargain. Valuations are far from where they werea at major market lows such as in 1932, 1974, and 1982. Moreover, economic conditions may turn out to be far worse than in previous recessions, including the Great Depression at the beginning of the 1930s. Everybody seems to think that, thanks to the government’s monetary and fiscal interventions, this recession will come nowhere near the 1930s slump. However, I think it might be far worse – and precisely because of the interventions.

Faber concedes an equity rally is still possible, which he thinks would lead to a reversal in gold, which he argues would make for a buying opportunity.

Until credit creation refires and deflationary forces reverse, I can’t see any arguments in favor of any assets other than the dollar. Everyone expects massive reflation already; everyone couldn’t be more bearish on the dollar. Everyone thinks the Fed’s money printing will lead to hyperinflation, or that fiscal deficits will save the day. I believe, like Faber but maybe in a different way, that our policy actions, including money printing, are far more likely to cause everything to gum up further.

Unless currency regimes change, the dollar will strengthen. It has to, by definition. There has long been a critical need for US labor and capital to become cheaper internationally, and the market is now trying to deliver that through deflation because currency revaluation has been forcibly prevented. Relative real pricing and wages matter more than almost anything else.

The dollar’s strength and deflation will together eventually cause something to collapse under their weight. I have no idea what will give first, or what that means for the currency itself.

It looks like a giant bubble that correlates more or less with conservative fiscal policies – laissez faire/neoliberalism/free market blah blah blah.

1982 was down around the 1949 level. What are the chances then that 2009 will attempt to return to 1982?

It looks like a giant bubble that correlates more or less with conservative fiscal policies – laissez faire/neoliberalism/free market blah blah blah.

Hmmm … I must have missed the part where government spending as a percentage of GDP actually went *down* over that period.

It was more of a debt bubble produced by two decades of interventionist easy monetary policy.

A chart like this, is like correlating tapioca to jello, then adding in a third dimension of time. Faber is an idiot and this chart is babyfood in a diaper!

If one were to backtest this data, one could probably compare the weight of cocktail napkins and the cost of ink as well, and then extrapolate a time series to show the cost of a loaf of bread at noon in a deli off 5th Avenue, which would help predict the cost of the cheese on a burger — which come to think of it, could then be used to interpolate the cost of a milkshake, because diary products could be used as a dynamic variable, which might suggest that the cost of wheat (related to the bread) was influenced by the cost of gas on a farm in Kansas, which uses an average amount of watts to heat a barn in January, and stuff like that which is classified, unless you buy my secret and special race track compass kit that has photos of the dark side of the moon…

That felt better…. ahhh

ndk,

i think you are quite confused with regards to the dollar.

there is no dollar selling because there are very few nowadays in private hands, this is what causes the technical dollar rally. since trade is shrinking, most private companies get fewer and fewer dollars, from commodity exporters to manufacturers. a bigger reason for the present dollar glut is the cds market where huge amounts are being posted to collateralize non productive trades between banks. none of the dollars that the fed has pumped into the economy so far has turned even once in the economy to create any inflationary pressure YET.

and i would say there is a deliberate policy from the US of withdrawing dollars right now from the market: it increases the purchasing power of the global reserve currency while the economic fundamentals scream the country is in deep trouble and the dollar should tank.

of course this will not continue indefinitely as the fed is trying everything to reverse this vicious cycle. once they do, the rush to the door will collapse the dollar with the trillions already pumped into banks being lent out once property prices stabilize, and the need for collateral and loan loss reserves diminish. are you expecting the fed will be quick to withdraw that money? judging by their panic reacion now, i do not have even the slightest doubt they will let the economy ‘grow’ with the just pumped dollars as fast as it could. this means inflation, inflation, inflation. and that brings what you are referring to in the 2nd paragraph: the US should become competitive once more by lowering wages.

well, I’m definitely not a gold bug (especially since it seems that the tin foil hat crowd and the gold bug community overlaps a lot), but worldwide annual gold production is ‘only’ 2500 tons….about $60b.

We’ve already seen what index fund money shifted towards commodities did in 08…..it wouldn’t take much to move gold around.

though I think whether PRC keeps its yuan peg will be a much more important story in 09. ymmv.

For more “baby food in a diaper” here is the SP500 graph inflation adjusted over a longer horizon and regressed:

http://www.ritholtz.com/blog/wp-content/uploads/2008/12/sp-composite-real-regression-to-mean-large.gif

To Doc Holiday:

People who readily call others 'idiots' are generally the idiots themselves, especially when they don't know what they are talking about.

I have been working in the stock market for over 40 years, and have been a subscriber of Marc Faber's for 15-20 years. I pay good money for the 'Doom, Boom, & Gloom' newsletter because Faber has the best understanding of relative financial markets of anyone I have ever read [& I have read just about everyone of any consequence]. Faber has made me a lot of money with his recommendations, and saved me even more by describing market risks that most don't even see. As Yves tried to point out, his current newsletter makes investors aware of largely unacknowledged market risks, and it is one of his best efforts IMO.

One of the things I have noticed about people who comment on investment blogs: some people are honestly curious, and want to make money, others just like to sound off and see themselves in print. I think we all need to have enough self-knowledge to know what category we fit into.

… this is what causes the technical dollar rally

I read your comment with interest, bb, but I don’t really have any basis on which to reply. I’m not a trader, and I don’t work at a firm. I don’t have any intimate knowledge of the markets and I can’t tell you anything about such technical factors or whether they’re overwhelmingly powerful.

That’s why I focus primarily on the underlying economic rules by which all your games are conducted. At some point, the financial system is affected by the real economy, and from where I sit in the real economy, wages and prices in the US need to drop in terms of other countries’ currencies so that American goods and services become appealing and the trade balance can even out. Since that cheapening can’t happen through currency realignment, it’s happening through deflation.

If I’m wrong and this is merely a technical move, then I’ll eat crow. But the Fed has been very aggressive in adding dollars to the financial system — domestic or overseas through repo agreements — when they’re needed. That makes it hard for me to believe that only such powerful technical aspects are at play.

“some people are honestly curious, and want to make money, others just like to sound off and see themselves in print. I think we all need to have enough self-knowledge to know what category we fit into.”

I fit into both categories. It certainly feels good to sound off.

I am uber bear.

But I don’t think that chart is honest, and I couldn’t figure out how he calculated it. If it was calculated using government inflation numbers, then it is highly suspect. I certainly dont think the market bottom is 2000 dow.

I kinda get the market was worth 30% of GDP in 74, and 100% today. (Although NBER reports the 74 number at 45% Inflation destroyed earnings, and the unfolding crisis could bring down earnings as a percentage of GDP. But even here I feel compelled to try to recreate the data because it doesn’t feel right on first inspection.

To BG:

The DJIA chart of Marc Faber’s that Yves reproduced is simply the Dow adjusted for CPI inflation [by the ‘Chartstore.com’]. While Faber readily admits that the CPI understates inflation, it is really the only tool we have to make that adjustment. Basically, what he is doing for the Dow is to try to adjust its ‘purchasing power,’ just as economists differentiate between nominal and real GDP using the same CPI [or other inflation indices].

ndk,

by technical i mean not supported by fundamentals. if you have in a world only $100 all goods at hand could be exchanged for no more than $100. if the reality allows for incremental exchange over time, each good could cost as much as $100 each. if goods increase faster than money (the aggregate of quantity times velocity of exchange) deflation occurs. if the opposite holds true, we get inflation.

at present goods supply increases as there is inertia of production worldwide, while the overall amount of money circulating decreases (see global trade). the central banks have pumped lots of money to support in solvency banks. that money does not make it to the economy and therefore cannot create inflation. it has no present economic use and naturally comes at a cost of 0.

but this crisis will not bring an end to mankind. once the tide turns around, all money will flow back into the economy chasing profits, leveraged by an unsuspecting fed. this will certainly unleash inflation.

the 1700s offer the perfect example of fiat money system abuse: in the colonial US the poor were robbed, in France, many heads rolled under the guillotine. you may have better idea how government insituted rip off of people’s wealth will be met in china for example.

the theory of supply and demand applies to money just as well as to goods. don’t just look at M1, always take it in context with the velocity of money circulation.

“and precisely because of the interventions.”

Yup. Yhe more they “do” the worse it will get.

It appears to me that there are a lot of threads coming together under this discussion. Before digressing I would like to explore equity values and the argument that shares are cheap compared to historic norms. There are a number of assumptions being made or not made that make equity values almost impossible to forecast.

The first assumption which many have picked up on is that company profits may fall rather more than one might expect from analysis of recent recessions. The fact that there are a broad strand of big companies which are more leveraged and cash squeezed than in previous recessions is ignored in a euphoric wave of wishful thinking. It’s a slow process where investors begin to realise that you actually need to look at company fundamentals but we will get there.

The second assumption is that recent market activity and by recent I mean the last 30 years represents any kind of norm at all. In fact there is clear evidence that the last 30 years were completely abnormal and extrapolating based on recent history may be fraught with risk.

Ambrose evans-pritchard argues that we are heading ultimately for inflation after a period of deflation while ndk appears to be arguing that currency pegs will prevent this happening. Mike shedlock also thinks we are firmly in the grip of deflation as do many US based economic commentators. It does not appear to be an unreasonable proposition bearing in mind the reduced velocity of money. Perhaps different parts of the world may have different fates yet I can not help thinking there is a flaw in the inflation will never happen argument. Assuming the dollar continues to float higher relative to unpegged currencies then export manufacturing will be hit and trade deficits will need to be ever increasingly financed. This looks like a positive feedback loop destroying US jobs until the dollar is forced to stop floating higher. I expect the currency pegs to evolve before then to a basket of currencies as Asia becomes damaged by clinging to the coat tails of the rising dollar. I think it is the Asia/China Europe currency relationship which will precipitate a quantum change to break the deflationary spiral and job destruction. Printing money just may not work with a reserve currency and even if it does it may be too slow to prevent systemic damage due to job losses. Having the reserve currency not only may be the US’s greatest asset but its greatest mill stone around its neck.

Another area of contention which seems to be brewing is the affect of savings in Asia and China and whether it can be used to finance US debt. It seems to me that there must be a tipping point where the increased savings of those in work during a recession becomes overcome by the reduced savings of those who have lost employment. Not that it makes much difference with US banks stocking up on US debt bought with TARP money funded from US debt, something else that will continue until it has done too much damage by preventing a natural correction. Anywhere that market forces are thwarted is likely to be ground zero for the worst economic fallout and China and the US appear to be top of the list at the moment.

To: Anonymous 7:50am:

"Ambrose Evans-Prichard argues that we are heading ultimately for inflation after a period of deflation, while NDK appears to be arguing that currency pegs will prevent this happening. Mike Shedlock also thinks we are firmly in grips of deflation as do many US based economic commentators."

Marc Faber's position is closest to A E Pritchard. Faber feels the overwhelming debt load [bad & otherwise]and leverage unwinding will initially force deflation upon the world economy. But because of central banks committment [lead by the US] to massively 'print money,' this will eventually lead to a general inflation, in which most fiat currencies [not just the dollar] will lose value against hard assets and gold. Or in the words of Albert Edwards, 'ice' first, and then 'fire.'

RE: equities

According to Investech, the longest recession since 1930 has been 16 months. The current recession is already in month 13. I have no idea when a recovery will come about, but given that the market leads the economy by 6 to 9 months, we can maybe assume the market has already priced in a 20-24 month recession…which would be the worst since the GD.

So yes, things are awful, but another 6 to 9 months of awfulness in the market would be pricing in an almost 2011 recovery. I don’t have exact numbers or target for where the market is going, but the point is, while, yes, we are far from an economic bottom, the market is further ahead than what the news and nobody should expect concurrent recoveries.

I think Faber is on the money both with his preference for gold and commodities and with his assessment that the market could go down a lot more. Time will tell…………

Gee, I thought they re-weight the DOW at will. How can you draw any logical conclusion from the graph except that that they re-weight the DOW at will.

Injecting funds into the system, interferes with a meltdown prolonging a recovery or no funds for backstopping and we crash worse than the Great Depression.

Pick your poison.

I’ll believe in deflation when my taxes start to go down.

ndk is way off the mark.

There are many reasons the dollar will depreciate:

1) Inflation is the most painless way politically to diminish the burden of US debt.

2) The dollar currenly is far overbid because of a temporary spell of fear and Treasury security buying.

3) The largest buyers of US debt, like are becoming satiated (see Setser).

4) China must at some point release its peg, and was well along the path of yuan revaluation until the US brought down the world economy to its knees.

But the most important reason the dollar will devalue is rather simple: the supply of dollars is the one of the very few elements about the current crisis the govt. can control. If it could net derivative contracts out, it would. If it could renegotiate mortgages nationwide, it would. If it could rewrite financial regulations effectively overnight, rebuild and recapitalize the financial infrastructure, it would.

But it can’t do any of these things. However, it can create money, lots of it, in an attempt to fill the vacuum the private credit markets have left.

And when people can’t eat because jobs are disappearing, and if all you can do is either print money so people and companies can borrow again, or let them starve, you’re going to print money.

I personally think it’s an absolutely terrible option, but also the best one we’ve got. I do think the US is going to have a serious standard of living crash, and dollar depreciation will play a role in that. I also cringe to think that these people (who didn’t see the current crisis, the financial sector crisis, or the housing crisis coming) are just improvising this, and God knows what the ramifications will be.

One silver lining is that the money is so cheap (10 yr today at 2.3%), that’ll take some of the sting out if it long term for us taxpayers. So there is a decent argument there for the govt to borrow all they can today at these rates as long as they spend it on something that pays off tomorrow, like infrastructure, education, alternative energy, etc.

Everybody seems to think that,thanks to the government’s monetary and fiscal interventions, this recession will come nowhere near the 1930s slump. However, I think it might be far worse – and precisely because of the interventions.

that comment holds true and I think Faber has made those same feelings known. I’m a big Faber fan, right to the point and the

beauty of fundamentals.

Being no expert here one would think with a new prez and short term stimulus, a counter rally above 10,000 is very possible, followed by a bigger leg down.

Deflation has a ways to go…businesses need to consolidate, real estate has to find a bottom, p/e ratios need to

get lower, trade needs rebalancing,

services need to retract, autos need to streamline, etc, etc.

We over built, produced, and expanded beyond comprehension. More change is in the wind…can’t expect this type of collapse to right itself in a year or two.

Yves,

I can't believe that in the above 21 comments no one noted the obvious: Faber is treating the S&P as if it were a commodity. In other words, he is arguing that if we strip out inflation, the S&P is a mean-reverting variable. THIS IS FALSE!! The S&P is not mean reverting because its long term performance is a combination of two things: inflation and real GDP growth. In other words, if we strip out inflation, the S&P still deserves to go up like 2-3% a year, if we assume the environment is one of inflationary democracy, like modern western countries. Furthermore, Faber didn't take into account that the S&P will dividend out some cash, and that its component companies will sometimes buy back shares.

Faber’s makes two substantive points. First the stock market valuations are not cheap. Secondly, that commods on a risk/reward basis are more attractive than equities. I subscribe to the latter premise on balance.

As to the former point, I can elaborate a bit further. I am not at all happy, or shall I say comfortable, with the stock market valuations as we enter the Q 4 2008 earnings season. With the recent downward revisions, analysts now only expect the SP500 to earn $48 for 2008. This increases the near downside risks to the SP500 markedly on a valuation basis. Assuming $48 is going to be approximately accurate, then to maintain a P/E of 15, roughly the SP500’s historical average P/E, it would have to be repriced to 720-ish, which would take out the November 21, 2008 year lows at 739.

Priced at 864-900, the SP500 would have a P/E of 18 if it earned $48 for all of 2008. For much of the past decade, an 18 P/E has not been all that high. However, what was relevant for the past 10-15 years is not what is relevant in the new paradigm of a severe and prolonged recession coupled with deflationary forces that keeps business from wanting to invest a dime in anything. So, we as market participants should proceed with due caution.

Looking back to the prior bear market and recession, market participants should be aware that earnings troughed at $44 in 2001 and then began growing to $47 initially in 2002. Earnings peaked at $87 in 2007. When the SP500 peaked at 1586 in October 2007, the peak earnings multiple was roughly 18—based on 2007 year-end ttm earnings.

To a degree, earnings have come full circle oscillating a full 360 degrees from $44 to $87 and back to $48. For that reason, it merits pointing out that the stock market troughed in price at 939 in 2001 and 767-788 in 2002. In 2001, the P/E compressed to 21, and in 2002 that multiple compressed to a tad over 16. What we wish to take some pains to point out is that the Stock market has gradually been undergoing a multiple compression since the peak, fantasy valuations set during 1998-2002. To hold a P/E above 18-20 is to participate somewhat in fantasy valuations again. After all, that was roughly the peak valuation of the stock market in October 2008. A P/E of 20 in the SP500 based on $48 earnings projects the SP500 to 960-ish, just above the 2009 year high to date at 943. For money managers to get excited in 2009, they must be deluded in thinking the stock market’s earnings will trough around year-end 2008 or early in 2009. If they should think that earnings could bounce back 10% or more to $52 roughly, they could justify a P/E of 20 for short while. This would allow the SP500 to rally back to 1040-ish, just shy of its October 2008 high at 1067.

Unfortunately, analysts have been revising down their earnings estimates for 2009 and are projecting another 12% earnings contraction from roughly $48 to $42. Another year of declining earnings is apt to accelerate the earnings multiple compression, a compression which should drive valuations back into its long term historical range of being overvalued when above 20 and undervalued only when under 10. But there is no reason to begin worrying of a multiple of 10 being accorded to the SP500 in 2009 unless there is crisis of as yet untold proportions. Obama, the Fed, and every possible gov’t agency will be pulling out all the stops to prevent this spiraling further out of control.

The only way they fail is probably from the other actors in the game. Namely, the other countries may at some point take their ball and bat and go home. If they do not continue to buy the debt they are creating, we are going to be in some hot water again. So, what the other players in the game do bears close watching. At some point, they may pull the plug even if it is against their short-term interest to do otherwise

Now, where does that leave the SP500 at present? It leaves them pointed lower as they enter the earnings season. This coming week, they have to be able to absorb bearish hits from all sorts of economic reports in the form of Retail Sales, Industrial Production, Philly Fed, PPI and CPI. Thursday’s PPI deflation report will not be welcome to businesses, but the deflationary CPI report on Friday may be mildly welcome. And the week to follow will be chockful of financials. (I have a twisted theory: financials may report much better than expected because after the banks dumped their mbs’ onto the Fed for which they received treasuries, treasury prices all along the curve were manipulated sharply higher in Q4 08. Kind of a crazy idea, but one that bears watching for its potentiality.)

A final consideration for equity market participants to consider at the moment is the inverse correlation of the stock market to the US Dollar. A strong dollar is not good for the US stock market, or even the world stock markets. Yes, a strong dollar means consumers have greater purchasing power which in previous years would have increased exports from developing countries, but this go around, a stronger dollar is not apt to lead to greater consumer spending. Additionally, multi-nationals earnings will be hurt by the weaker foreign currency translations. Either way it is bad for the multi-nationals, and only a modest bump to consumers in the shape of cheaper goods that they can barely finance. And if they can’t finance the cheaper goods, then what will China and other countries do with the excess production and capacity? No matter where you try to roll this, you end up getting stuck on the mat. It reminds me of the days on the high school wrestling team. If you had a weaker opponent, no matter where to or how hard he squirmed, you just keep sticking him on his back over and over again. Now, I don’t know what to make of a stronger dollar quite yet. But the higher it goes, more than likely the worse the deflationary crisis will become. Somehow, it does not feel like a path we wish to go down too much longer.

Hey now, what about interest rates? The dollar and equity markets are sideshows in comparison to interest rates and determinants of GDP, mainly consumer spending.

I thought the Big Show is the absolute need to keep interest rates down so the US consumer can continue to spend; problem is it isn’t working; big riddle is when does it snap back and send interest rates to 25%?

The urge to manipulate interest rates is at the core of most of this disater. It will continue to play out, very sadly indeed.

Hard to argue with Faber,

Go read Tomorrow’s Gold- nailed every call almost perfectly. I do think DE-flation is still a much bigger near-term risk though as the parade of surplus capacity in every sector will further cut employment, wages, confidence, credit creation and growth. Perverse notions of “Savings gluts” and long periods of lower risk premia effectively enfranchised marginal producers and whole industries (can someone say SHARPER IMAGE) that are/will be crushed. The “compassionate” capitalism of the Gov’t and Federal Reserve that seeks to override the business cycle reveals our insecurity, and follows form with the rest of the world’s view that we are incapable of dealing with sustained periods of suffering. The lessons of Vietnam (and perhaps Iraq) stand for the economy as well- At first signs of heat, americans will run from the fire. They can’t take the pain. The psychology of saving is elemental in human DNA, yet somehow this country and its citizens put itself/themselves deeper into debt than ANY country in history.. How does this happen? the hollowing of a middle class? The rise of income inequality and a privileged class? A post-vietnam internalization that parents would not let their children live w/o having the opportunities to HAVE everything that was not given to those who lost their lives on the battlefield? Sorry for the ramble, but this breakdown is so massive, and so deep, and so hard to forgive..It’s very very sad

As to the Faber chart not pictured or the Dow chart shown: Who would ever mistake the price of something for the value of something? Where are earnings? Where are sales? Where is cash flow? etc. To simply put price as the denominator and CPI as the numerator says nothing. Now if one wants to chart “real earnings”, “real sales” or “real cash flow” then I’m game. Otherwise this chart tells me nothing.

I believe that chart is too limited in scope but I’d agree that the bubble hasn’t been burst enough to make stocks attractive (other than short term profiteering). Which commodities to invest in is another question?

A more comprehensive chart of the curve of a century’s worth of data shows that a consistent growth in stocks across the decades would put their value in general at about 5 to 6 thousand Dow Jones value on the steady upward curve. We just had a huge unnatural bubble without any fundamentals (other than overworked, underpaid workers supporting an elite spendthrift class of ‘investors’). So we’ve got a ways to go. I prefer to mimic the Great Depression in the present situation in that a steady fall of about 3 years is necessary before a real rally comes back. I hope that the “helicopter spreading’ of ‘fertilizer’ and stimuli will shorten the pain into a “Mini-Depression” but the underlying causes (as JK Galbraith’s Great Crash itemized ) seem identical: Income inequality, Leverage, Hubris, and add a modern term: “Financialization”.

I say hope for a shorter Depression due to better management at the Federal level..and I’ll lift my cup: “Salud!” 2010 could be a ‘new day’.

However, savvy investors are making a killing on these short term false rallies I am sure. Some other savvy advice is to invest for either 3 years ahead or more or only in the present 30 day cycle…but not for in between those benchmarks.

And most Americans know how to save…but they just weren’t getting paid enough money to have any to save. Let’s stop blaming the ‘victims’. Look at our health care “insurance” costs, regressive payroll taxes, hyper inflated ‘communication’ costs (Verizon! et al) and the ridiculously inflated real estate market and no wonder most Americans are in debt and desperate. Citbank et al bet on Americans going into a financial hole deeper and deeper w/o income appreciation for that extra effort…and we all lost that bet.

The market will sold off for its parts and split into Mini-Stockmarkets. These Mini-Stockmarkets will compete against one another creating a more stable trade and employment market do to increased capital competition. Renewable energy will replace the treasury as the true risk-free rate secured by the sun.

If any of you think that there is not a significant downside to come. Please see the video posted here for an accurate technical chart view. Worth the read.

http://blog.rebeltraders.net/2009/02/14/market-wrap-up-we-have-a-cliffhanger/