As foretold, Goldman tops the list. From the Financial Times (hat tip reader Dwight):

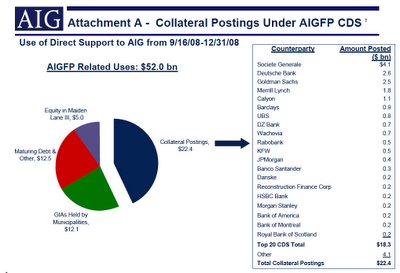

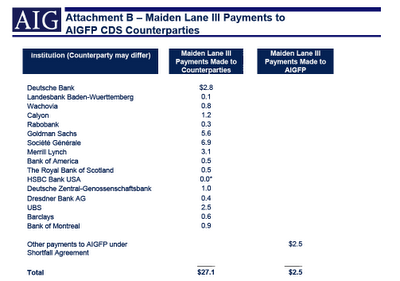

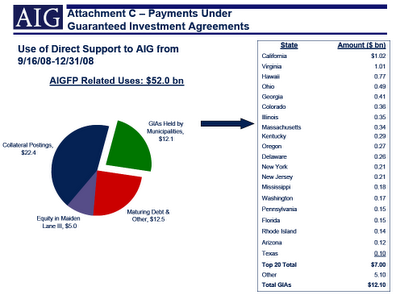

AIG paid out $22.4bn of collateral related to credit default swaps, $27.1bn to help cancel swaps and another $43.7bn to satisfy the obligations of its securities lending operation. The payments were made between September 16 and the end of last year.

Goldman Sachs, which has also accepted US government support, received payments worth $12.9bn. Three European banks – France’s Société Générale, Germany’s Deutsche Bank and the UK’s Barclays – were paid the next-largest amounts. SocGen received $11.9bn; Deutsche $11.8bn; and Barclays $7.9bn.

From its supplement (click to enlarge):

How much of the AIG CDS market was for out and out gambling and how much was necessary for counterparties to meet government and NGO requirements for capital requirements?

Are there changes to requirements that should be made to reduce the need for CDS’s for that purpose? Presumably then, allowing the collapse of the CDS market for the gambling component may hurt some individual firms but should not cause a cascading collapse of insolvent institutions.

Goldman at the top of the list?

Shocked, gambling, establishment, etc, etc.

I’m fighting the numbness, but I think I’m losing.

A bit off topic, but how many of you think the latest AIG bonus revelation hitting MSM tonite is going to put some horrendous pressure on Congress on Obama going forward?

All I could think as I was watching ABC tonite at dinnertime was how many others were knifing up their food with a little more force than usual.

IMO, TS is about to HTF if this continues. I’m thinking that D.C. has NO IDEA how pissed off middle-America is getting here.

AM

It’s time for everyone to put down their ipods and video games, get pissed off and protest the offices of this company.

The money is supposed to help this company survive and stimulate the economy, not pay for a few people’s second home, vacations, etc.

This unethical distribution of tax payer money cannot go unanswered by the public. This is all happening on our watch.

Some AIG office addresses at:

http://agilog.blogspot.com/

But Bernanke says that if we save all the banks by taking all their losses, we’ll pull out of recession this year! We have to trust these people – they’re Professionals!

Damn, I thought I could type that whole sentence without laughing, but no luck.

I just had the weirdest insight – I feel the same rush of patriotism that people used to get when buying War Bonds, every time I further short-sell the long US T-bond. Like I know I’m doing the right thing for my country in my own little way.

If we all pitch in, maybe when rates hit 5% Ben will start to rethink whether creating US dollars to bail out European banks from their own stupidity is the wisest course.

I think an important question is whether the CDSs purchased, e.g., by GS were actually to cover existing notes held by GS, or were naked bets that against all reason we’re now paying off. Yves, any idea? Rob Kane

Re, how much was gambling:

The Times, FWIW, says in its editorial today:

Eric Dinallo, the insurance superintendent for New York State, has said that some 80 percent of the estimated $62 trillion in credit default swaps outstanding in 2008 were speculative.

Yay!

the money will be paid one way or the other since its purpose is not for outstanding performance, but for not saying anything to anyone. So far AIG did a decent job, why can’t they get what they were promised?

the really question is what they promised not to say. How many of these losing bets were made after officials and the industries decided AIG was the best vehicle to transfer huge amount of money?

until someone tries to ask the right question, there is nothing special. move along

One comment I see repeated, that I’m now curious about as well..

Are the bonuses incentives to stay and work, or to hush up?

The standard line is that bonuses retain talent. Do these bonuses demonstrate how out of touch AIG is (unaware of the outrage or unmotivated by shame), or are they aware of how offensive it is, but mgmt compelled to deliver them because the bonuses function as hush money?

I know I’m wading into anger-fueled speculation, but either way, I’d like to know.

If they’re just not aware, they need to be shamed — If this money is just buying the silence of people who will hurt the company or management, we need to find out.

If it is hush money, what would thye be keeping quiet about?

“A bit off topic, but how many of you think the latest AIG bonus revelation hitting MSM tonite is going to put some horrendous pressure on Congress on Obama going forward?”

Should be prime time news Monday on all the news shows and front page on whatever newspapers still exist.

Or will the BB quote that this latest bubble business be over soon

get the press?

I stilll…….. do NOT understand

1. None of those banks are making money. In fact almost all banks in that list are about to go under.

2. The money every government has injected amount to $2-300B! Where does the money go? I mean really… that’s a LOT of money. Even bunch of bogus transactions should finally ends up in some sort of hard asset right? It couldn’t possibly be all in real estate.

My basic question. if global banking system is a black box. Money goes into the box, mysterious process inside, then we have output. The total output couldn’t possibly valued at $400-600B injections!

What’s going on? I want to know where those money went? What type of real world loan did the banks created in the past 5 years or so?

The size of money these top 10-15 banks are about the size of Japanese or chinese reserve. ~$700B ish.

… I mean, the size is beyond staggering. This is like somebody misplace Japan or entire west coast on the map.

Where did the money go?

Who is AIG’s biggest customer in The USA? That is the real question! It would be funny if it was Uncle Sam.

I think the Puritan treatment of suspected witches ought be emulated here but with one alteration: To the dunking stool with Bernacke, and the earned environment, fetid horse ca-ca, not water. One will then hardly avoid seeing the justice attendant in the charge that ours is a fascist system and its leaders brownshirts.

So these were never real assets, just mark-to-market projected income and insurance gambles…

and rather than let them adjust their books to reflect their real assets… we’re pumping taxpayer dollars into these companies to make the imaginary wealth real? Because if their illusion doesn’t materialize, they’ll commence a lending strike? (either to strong-arm the govt or out of fear of each other)

Is AIG just the best vehicle to pump money into these institutions, b/c it looks like normal business and doesn’t carry the stigma of a bailout?

Can I get a quick response from an educated reader?

Sheep are for shearing.Learn to like it.

`we’re pumping taxpayer dollars into these companies to make the imaginary wealth real`

you have expressed with perfect childlike simplicity what exactly is happening – brilliant and worth repeating:

`pumping taxpayer dollars into these companies to make the imaginary wealth real`

and meanwhile the greatest theft in the history of the world is underway with no one able to stop it.

But fear not in a few weeks the politicians at the request of their Wall Street masters, will have pressured the regulators to modify the rules of mark to market that will enable the banks to make those imaginary wealth real.

So AIG had the City of New Orleans pension funds. Do they have the federal pension fund as a customer?

AIG officials, including Chief Executive Officer Robert Willumstad and lead independent director Stephen Bollenbach, “utterly failed'' to monitor operations, according to the complaint. Directors allowed AIG to market and extend subprime loans and insure subprime-related assets without considering borrowers' ability to pay and with unreasonably high risk of default, the pension fund said.

Federal Violations

Directors also allowed the company to misrepresent its business prospects and financial results, exposing AIG to liability for federal law violations, according to the complaint. AIG shares have plunged 96 percent this year on the New York Stock Exchange.

“Defendants were ill-prepared to monitor AIG's submersion into the subprime market and unduly heavy investments in credit derivatives, a business strategy that blew up in their faces,'' the complaint said.

The retirement fund is asking a judge to order the directors and senior officers sued to return to AIG all compensation paid to them, in addition to unspecified monetary damages sustained by the company.

The case is City of New Orleans Employees' Retirement System v. Steven J. Bensinger, CA4042, Delaware Chancery Court (Wilmington).

http://www.bloomberg.com/apps/news?pid=20601087&sid=adXJ4l5Zs33s&refer=home

Goldman receives $13 B from us taxpayers. They were claiming they could refund the $10B TARP money. Could they refund this $13 B as well?

Deutsche Bank and Societe Generale should be forced to refund the assistance from US taxpayers.

Government should declare the bankruptcy of AIG and make all its contracts void!

Wouldn’t tearing up all these CDS contracts and guaranteeing the bonds that were backed by these CDS would have been a more prudent approach. Most of these bonds are anyway AAA rated (Whatever that means…) but, atleast we wouldn’t have to put up $180 billion right now.

Can anone explain why this course of action was not taken? I mean what is this collateral for? In the cogressional hearing the powers that be that are testifying say that there are very few losses on the bonds themselves and the losses are due to mark to market accounting. Thanks

My name is not on that list. I got nothing. Not a billion. Not even a dime. Nothing.

It´s not fair. How come I got nothing?

I want a bailout too! Please Mr President, pleeease hand me a ton of cash!

likewise brilliant & worth repeating:

"But fear not in a few weeks the politicians at the request of their Wall Street masters, will have pressured the regulators to modify the rules of mark to market that will enable the banks to make those imaginary wealth real."

EXACTAMUNDO

lesson #1a on how to pull a bank heist in broad daylight — run the bank.

p.s. read the initial figures last night from a room in kowloon overlooking victoria harbor — funny how the only building on HK island with all its lights on still at 3 a.m. on a sunday night was the AIG building.

perfect metaphor methinks.

and if you do some digging, you will find that the AIG black box is titled pandora and leads down a rabbit hole far deeper than you can ever imagine.

see Knoll / Marsh & McLennan for instance.

one may eventually come to a realization that all the secrets & sheninangans over the last 8 years can be found in there…just make sure you don't fall in never to be found again.

You can not just “tear up” CDS contracts with nullifying the entire CDS exchange market. The heart of the problem is that AIG has roughly $450 billion in long risk CDS positions (sold protection). this explains why every time the market swoons and CDS marks widen, AIG is forced to post more and more collateral. It is a vicious cycle… The only recourse would be for the government to unwind thes contracts in the open market, meaning AIG and the gov’t would have to buy the balance of CDS that are not already offloaded to the US balance sheet. I estimate this to be roughly 25-50 billion in single name cds and another 50-100 billion in bespoke CDO tranches. The catch 22 is that if the government does purchase 100 billion in net notional CDS it will lead to a blow up of CDS market as spreads widen to unprecedented levels. One side effect of this would be for all other insurance companies which likes AIG have sold protection to immediately shut down as they are margin called to extinction. Thus the gov’t is unable to “save” AIG unless it backstops the entire insurance industry. And until it does that, as the market drops lower and lower, unless MTM is abolished, AIG will keep sucking more and more cash to replenish potentially infinite margin calls… that is the sad truth.

Anon. @10:58 pm :

I believe you have it exactly right. I guess I’m educated, I work in the trading business and have five years experience at one of those big banks.

The only possible error is that perhaps we’re nowhere close to making the banks whole, the CDS contracts are truly a black hole of tens or hundreds of trillions of dollars.

Amounts far more unimaginable even than those bandied about so far.

Felix Salmon is on the case as well, and ties in Gretchen Morgenson’s NYT column today.

@Tyler 11:45 pm

AIG should do what any other CORPORATION should do when it cannot pay its continuing obligations: it should go bankrupt.

Please explain why not. And not from the perspective of their counterparties, because we don’t owe those counterparties anything.

PS AIG going bankrupt would fix the problem of the excessive bonuses. The court would not allow the bonuses. It’s the right thing to do, better late than never.

Tyler,

I don’t buy it. At a minimum, if there was any political will, all CDS could be declared void (for instance, as illegal insurance or gambling products) or voided if the counterparty did not hold the underlying bond.

The ONLY reason I have read that seems convincing for not doing that is that a lot of European banks evaded statutory capital requirement with the help of AIG CDS.

I’d rather wipe out the market, see where the dead bodies and and figure out what to do than keep pumping money at a problem with no sign of the end.

And all these armageddon stories are not very specific, and don’t strike me as any worse than what we are seeing now. The insurers are looking for bailouts as we speak, for instance.

The Hill’s pension funds are at risk, so be a good lad and bend over, its your fault you voted for us.

Grosse pointe.

I believe that a fuse has been lit.

The rage does not have a name yet but it is becoming visceral.

Even if the process of investment banking displayed before us is not criminal, as currently defined, the results are beyond war crimes.

Selective enforcement of rule of law is the chink in the armor that is causing enough cognitive dissonance that it is shattering the social fabric.

Truly interesting times.

psychohistorian

@ 11:45, not that simple but in essence (and why the US did not file it in the first place) is the virtually infinite loop in non offsetting CDS transactions. If you think about it, most CDS when created, and subsequently sold, are reset via two offsetting swap trades via the broker dealer community, implying one net issued CDS has a trail of potentially thousands cloning it in circulation, with only differentials being strike and spread and maturity roll. If you bankrupt one of the primary writers of protection (AIG or any of the other major insurance companies) you will have a leveraged domino effect which would destroy (and i do not use the term loosely) the CDS market as there will be a non offseting CDS balance in the secondary market (the proverbial card at the bottom of the card house). You could easily bankrupt AIG in the sense that all its liabilities could go to the U.S. which is the de facto state now, but the problem is you can not merely wipe out its assets (which are really contra assets now) without shutting down the credit swap market. And if you do that, it would end capital markets as we know it due to the intertwined nature of CDS as an index arb to virtually every other asset class.

Tyler,

How much would it cost to backstop the whole industry?

What would happen if they abolished MTM? What’s the main deterrent to abolition, negative economic repercussion or lack of political will?

it is not a question of cost (you can not quantify assets when there is no mechanism to represent value). it a matter of pushing the reset switch. leverage has gotten us to a point where to grow into the world’s uberleveraged balance sheet (i.e.creating even $1 of equity value) would necessitate $20-25 trillion in debt eliminated or alternatively the same amount in cash printed. both would result in a roughly 50% reduction in global asset values.

O.K. Now I’m really scared!

I think I’ll have nightmares.

Maybe some warm milk will help.

Can we all just count whatever marbles we have left, and go home, and play another day?

” You could easily bankrupt AIG in the sense that all its liabilities could go to the U.S. which is the de facto state now, but the problem is you can not merely wipe out its assets (which are really contra assets now) without shutting down the credit swap market. And if you do that, it would end capital markets as we know it due to the intertwined nature of CDS as an index arb to virtually every other asset class.”

Cool sounds like a plan. Put in guarantees for little people of 250k worth of protection for bonds, annuities, pensions, and insurance contracts, and give the FDIC authorityt to act as a DIP lender to any. Then void all CDS.

if you read my guest post below you will see why the fdic has its work cut out for it in the status quo, let alone having to provide a trillion + DIP

“if you read my guest post below you will see why the fdic has its work cut out for it in the status quo, let alone having to provide a trillion + DIP”

OK, what do you propose that will force the ultra-high net worth people to bear the brunt of the losses?

i wish i knew. at this point any “action” is just stall tactics. sure, you can tax them to hell and back, you can nationalize their property ala Eastern Block in 1945, but it won’t fix the root problem. what will? honestly, i have no idea.

“i wish i knew. at this point any “action” is just stall tactics. sure, you can tax them to hell and back, you can nationalize their property ala Eastern Block in 1945, but it won’t fix the root problem. what will? honestly, i have no idea.”

How about Buiter / Michael Lewitt’s good bank / ins co proposal or Eugene Fama / John Hussman’s forcible debt to equity conversion proposal for banks and insurance companies. Hussman thinks there is enough money in bonds to cover losses in derivative trades.

A nice little 90% windfall profit tax on all these thieves seems in order.

“A nice little 90% windfall profit tax on all these thieves seems in order.”

It needs to be retroactive for the past 6 or 7 years. That is when they made the bulk of their money. That or prosecute them for RICO, wire fraud, securities fraud, fraudulent conveyance, fraudulent transfer, conspiracy, etc. If RICO flies, it lets you basically seize all the bankers’ assets; it works with crack dealers; I don’t see why it can’t work with Goldman and co.

This is rich and I do mean RICH, the best and brightest in the land and some from overseas, with the Bush Uberments blessing, have built the first global DOOMS DAY BOMB, even the incoming administration is hostage to it.

It is, an I.E.D of global proportions with infinite trip wires to blow us all up if we F*#K with it. In fact we can not FLAG IT as a no go zone and run away, we instead must feed it more explosive monies to delay the inevitable combustion to come some day.

We don’t need these people in control of any thing, I would not trust them to clean a public toilet and do a good job, let alone have access to the leavers of the world economy. If I may suggest we can re-educate them to the benefits of communal thinking by handing them a AR-15 and having them do guard duty, traffic stops, stretcher bearers, FO duty and the like in Iraq and Afghanistan. Then they may realize the the SH*T they carry on about in their lives, pales in comparison to the sacrifice others are experiencing for and in their name.

If I was coming back from the sand box after watching good friends and people have their life extinguished, and find out it was so pathological lairs and sociopaths could and had, permanently brought more destruction to my Country than all the terrorists Bush and Co said were out there. I would in my post traumatic depressive state, may become a loose cannon on the deck. These people better watch their backs from now on, hope it won’t happen but history says different.

Grosse Pointe…how many people have died on a wild goose chase, when the real enemy was with in.

Tyler Durden,

There's no option (regulation or nationalizing & reshuffling/renegotiating) that can stop us from falling into the CDS black hole? There's some inevitable outcome from the current path, right? What is it?

I guess, what option(s)/outcome(s) is available that lack of political will is preventing?

Simple & vague questions, but a good exercise, right?

A CDS sounds like a bet to me so I am confused. Gamblers can bet as much as they want, but when they lose, someone else gets that money.

So if there is 1,000 trillion in derivatives out there, and let’s say someone could write a check for that much, then who ends up holding all that money?

Who’s sitting there hoping this all defaults because they’ll then be owed billions to a trillion dollars.

If the CDS market is threatening to destroy the world economy what would happen if the governments just made the things illegal and unenforceable retroactively.

Tyler,

I think you’ve gone off line (thanks for the comments above) but you (as far as I can tell) didn’t address the idea of either voiding all CDS or voiding those where counterparty did not hold securities from the reference entity in similar amounts as of date certain. That would be disruptive, but less so than letting this continue. The overhang is just too great for the financial system. Someone has to cut the Gordian knot.

This is tantamount to the government backstopping the Dutch tulip mania, Isn’t enough money to make that happen, short of a Zimbabwe style printing operation.

So…

What prevent a bank to create fictive lost and charge it on government bail out?

I mean, is not like anybody can check how much of those CDS has been created. I know if I was BofA or Citi, I would make sure I report gigantillion worth of lost so I get maximum bail out. (hey, it’s free money. Print some more equity and future IOU, who cares.)

so, what stops bank to create semi fictive lost transaction to maximize bail out money?

Does a single soul amongst us not want blood?

I don’t want blood, but I’d love to see some public shaming by posting names and retention bonuses. I’m sure I’ve met a few of those folks, probably last time I was vacationing at the Grand Wailea in Maui and I’d love to ask how they feel being pariahs to 99% of the US.

I find fascinating the debate whether we should break private contracts for the good of the global economic system. Morbidly fascinating, but fascinating nonetheless.

This whole situation with AIG reminds me of a movie called Speed, where there was a bus wired to blow if the bus was stopped or even if it slowed under 50 (my memory is a little hazy on the details).

AIG has insured everything, States pension plans, union pension plans, corporate pension plans, private pension plans, you name it and that is just their pension plan insuring desk.

You don’t really want AIG to go under do you?

The money going to the counter parties via the taxpayer is what is going to cause hyper-inflation at this pace. The money is waiting to pounce on the next bubble and when it comes into circulation prices go up.

Wanna bet AIG still writes derivatives in all forms to this day?

So the smartest minds in finance have devised a system that is entirely based on the proposition that markets must always go up and if they don’t then all the intertwined indexed ponzified unregulated, untracked financial (not insurance) instruments will blow up and the world will end.

I call bull shit! Unmitigated self serving bull shit!!!

psychohistorian

Gee imagine that; GS stacked government officials dolling out cash to end up in GS accounts. How much did they know about which counter parties would receive the cash? That came as a real surprise.

Worth pointing out that KfW and Landesbank Baden-Wuertemberg are German state owned banks so in the end the US government sponsored the Germany…

Anonymous at March 15, 2009 9:44 PM said: A bit off topic, but how many of you think the latest AIG bonus revelation hitting MSM tonight is going to put some horrendous pressure on Congress on Obama going forward?

VERY worried! See story here:

========================

March 16, 2009

News Analysis

Bracing for a Bailout Backlash

By ADAM NAGOURNEY

WASHINGTON — The Obama administration is increasingly concerned about a populist backlash against banks and Wall Street, worried that anger at financial institutions could also end up being directed at Congress and the White House and could complicate President Obama’s agenda.

The administration’s sharp rebuke of the American International Group on Sunday for handing out $165 million in executive bonuses — Lawrence H. Summers, director of the president’s National Economic Council, described it as “outrageous” on “This Week” on ABC — marks the latest effort by the White House to distance itself from abuses that could feed potentially disruptive public anger.

“We’ve got enormous problems that need to be addressed,” David Axelrod, Mr. Obama’s senior adviser, said in an interview. “And it’s hard to address because there’s a lot of anger about the irresponsibility that led us to this point.”

“This has been welling up for a long time,” he said.

…

LINK TO FULL STORY

========================

What a mess.

Regarding the credit default swaps — the transactions between AIG and the counter parties between September 16 and now represents the amount paid for multi sector CDO's. These ended up in Maiden Lane III and are currently valued in the high $20 billion range. That is the so called market value when the credit default swaps were terminated. I think it misses the amounts booked by AIG prior to September 16th on these.

The net gain for the banks on these will equal the total cash they received minus the total cash thrown off by the CDO's as they amortize. This is a "bad bank" situation where the toxic assets are now sitting in an entity and will simply amortize. No one will know the final amounts until Maiden Lane III is done. The cash payments are the maximum cost assuming Maiden Lane III assets generate no cash.

These were real CDO's that the banks sold to AIG to extinguish the CDS.

There is still a relatively smaller chunk of CDO's where the banks don't hold the underlying that haven't been settled ($10 billion range).

I would like to see a complete reconciliation, on a CDO/bank level of detail. First a cash reconciliation by quarter and payment type. Then an accrual reconciliation showing the amounts booked by quarter. This should be continued until the final dollar is collected on the CDO's.

After the cash reconciliation, an accrual based reconciliation showing what was booked each quarter on the CDO's.

As long as this is a wish list, I would also like a series of quarterly estimates of future CDO cash flows used in AIG's financial statements compared with the actual cash flows.

Just showing the cash transactions Since September 16th is misleading and overstates the gain by the banks during this time frame. It also leaves out cash payments to the banks prior to September 16th. Finally it leaves out all cash thrown off by the CDO's.

Once they start breaking out the data, they need to go all the way.

As far as what the government will have to eat, once again, it depends on how much they get back on their loans and preferred stock, as well as the final results of the Maiden Lane entities.

They are also going to need to break out the P&L's of all their businesses. 90% of these problems were in the capital markets and securities lending areas.

Unfortunately, the taxpayers own AIG. The entire enterprise needs to be managed to minimize taxpayer losses. Secondarily, viable businesses need to be sold off as soon as possible, even if it hurts overall recovery, simply because the government can't run a business in a politically acceptable manner. This will result in windfalls for vulture buyers, but they got over profits made by vultures buying from the RTC.

People that are hot to have Citi nationalized need to take a close look at AIG. The only gain is wiping out the residue of value in the common and a big chunk of the debt. After that one time gain, the taxpayers will own something that will make them very unhappy.

If AIG is essentially nationalized, can’t we make it official and force the renegotiation of CDS contracts? Couldn’t the “nationalization” be structured so that govt only steps in tinker with the CDS contracts, then steps aside so that AIG can continue operating w/o customers fearing the govt stepping in later and tinkering with new contracts?

WHat would be so awful about that?

Again, with all this shit, it’s impossible to decipher what is NOT happening b/c it would be a bad course, and what is NOT happening because there is no political will.

Mr. Liddy emphasized that AIG’s disclosure of the counterparties does not change AIG’s commitment to maintaining the confidentiality of its business transactions. “Our decision to disclose these transactions was made following conversations with the counterparties and the recognition of the extraordinary nature of these transactions,” Mr. Liddy said.

I think here we need to know more about the nature of this entanglement which created systemic risk. Two questions: a) what kind of contracts and obligations were exactly honored with these payments to counterparties ? b) were counterparties managing risky positions or simply betting (that is gambling)?

re: AIG & CDSs

If your gambling debts are big enough, the taxpayer will pay them off. Too bad none of us are that big or we could have a great time in Vegas–though it would take some incredible stupidity at the blackjack table to lose as big as AIG did in London.

While on AIG … see this

http://www.reuters.com/article/ousiv/idUSN1548789520090316

These bailout bandits including Larry Summers are singing a song “We are legally bound”.

The dumb suckers (tax-payers) may be should sing a new tune “File bankruptcy and untie the knot, No more alms, No more alms for slimy bailout bandits”

Can’t we just nationalize long enough to look around and see which CDS were real hedges for assets, and which were just gambling exercises? Nix the gambling contracts and move from there?

Worse than we think, possibly? Hedge funds, too?

“Two Hedge Funds Among Recipients Of AIG’s Bailout Bucks”

http://www.finalternatives.com/node/7249

Cap Vandal: “People that are hot to have Citi nationalized need to take a close look at AIG. The only gain is wiping out the residue of value in the common and a big chunk of the debt. After that one time gain, the taxpayers will own something that will make them very unhappy.”

The corporate veil shields shareholders from such an event and would apply to the government as well. Liability is limited to the loss of the equity’s value. The taxpayer could lose it’s investment in AIG, but would not be on the hook for the remaining trillions in potential libilities. So the notion that nationalization means the gov’t taking on all of the potential liabilities of AIG is mistaken.

The hedge funds were huge purchasers/sellers of protection from/to AIG. Would not be surprised to see some big ‘troubled’ ones on the bailout list.

This information is released in the hope that you will all be indignant whilst AIG tries to sneak through the fact that it is paying its executives big bonuses. CDS are of course used to hedge the risk and the payments might just reflect who wrote the tightest CDS agreements. Of course considering the size of the counter party risks these payments actually seem low and remember posting collateral may not really count as a payment.

I am not sure what to make of the fact that attachments D and E are missed out which detail US Security loans payments and details which US States got paid as well. The reason why AIG was bailed out was not just that it would take down all the other banks but that it would take down the finances of every state and county as well.

No mention of course that AIG is in the process of suing the US government or the UK government is to sue AIG for bond insurance fraud. We could of course be upset that banks wrote these counterparty risks without proper study and we could be upset that US money ended up in European banks. I feel sure though that a large proportion of European bank bailout money ended up in the US.

meanwhile the media is spending all of time on the bonus issue instead of the billions paid to Goldman and friends

Do not underestimate Obama’s power over the media

Anon @ 11:21 said: “My understanding is that the CDS contracts were largely written for 4 or 5 years. I remember reading that AIG stopped writing CDS contracts in 2006. As long as there is no default event the CDS’s value is Zero and AIG pockets the premium. Would think the banks that recieved the collateral would have to return the money.

All the government has to do is keep the companies with the largest CDS’s written against them from going into bankruptcy until the bulk of the CDS’s expire. Think that is why BB is saying 2010.”

Yves, can you comment on this? I’ve yet to see this mentioned or its outcome illustrated.

yep, we can’t let another lehman fail or it will pose too high a risk to the system. well, all the lehman CDS and derivatives were settled in the maket. ITS ALL A LIE TO STEAL PUBLIC MONEY AND STICK ALL AMERICANS WITH THE BILL! this system is so corrupt! THE BANKS CONTROL THE WHOLE SYSTEM.every american should stick the banks and not pay their debts! AIG could have gone chapter 11 and stuck all the counterparties with their losses. this company should have its doors closed as it is a bigger fraud then enron. and, no who is going to jail at AIG??