Submitted by Leo Kolivakis, publisher of Pension Pulse.

There is a lot to cover today, so let’s begin with U.S. automakers. President Obama gave General Motors and Chrysler deadlines to “fundamentally restructure” or lose government aid that has kept them alive. The steps to force a restructuring by U.S. automakers drew a mixed reaction from members of Congress.

In rejecting the “viability plans” submitted by the struggling automakers, the U.S. government put both the companies and their stakeholders on notice that government-mandated bankruptcy is very much a possibility:

Highlights of the administration’s action include:

- Forced the resignation of longtime GM CEO Rick Wagoner. (My Note: Wagoner walks away with a $20 million retirement package while the rest of GM employees get a pension fund running on fumes.)

- Gave GM 60 days to present new cost-cutting plans and will provide funds to keep it afloat until that time. “The administration is prepared to stand by GM throughout this process to ensure that GM emerges with a fresh start and a promising future,” the White House said, The Wall Street Journal reports.

- Gave Chrysler 30 days to complete a pending transaction with Fiat, reduce debt and restructure its healthcare obligations. The government’s auto task force “doesn’t believe Chrysler is viable as a standalone company,” according to The Journal.

- The government will guarantee warranties on all new GM and Chrysler cars; the warranties will lapse back to the automakers once they reemerge from this process (assuming they do).

This may just be a negotiating ploy by the government to get all parties to make major concessions in short order, but the sharp reaction in both stock and bond markets suggests traders see this as more than just a bluff.

Curiously, one major stakeholder which hasn’t been asked to make any major concessions yet is Cerberus Capital Management, which controls 80.1% of Chrysler and 51% of GMAC. The private equity firm counts former high-ranking government officials John Snow and Dan Quayle among its board members, and had about $27 billion of capital under management as of December 2008.

Is it really curious that Cerberus Capital Management hasn’t been asked to make any major concessions? Not really; they get all upside if the restructuring goes through and taxpayers will protect their downside if things go wrong. Welcome to Capitalism II.

Reuters reports that private equity and hedge funds are concerned about the proposed rules that threaten their secretive industry:

For years, U.S. hedge fund managers have worried that their loosely regulated and secretive industry would one day face tougher regulations.

Now that day seems to be here.

“It was inevitable that this would happen,” said Brad Alford, founder of Alpha Capital Management, an advisory firm that invests in hedge funds. “From the time Congress had the industry’s top hedge fund managers testify late last year, we knew something was coming.”

But exactly what that something will be remains unclear, said managers, their lawyers and investors on Thursday hours after the Obama administration said it plans to press for broad reforms to curb risk taking on Wall Street.

“People want a road map and some clarity,” Alford said.

All agreed that putting hedge funds on a tighter leash will add new nervousness to an industry already facing poor returns, struggling with redemptions and being blamed for a financial crisis its managers say they did not cause.

Specifically, many hedge fund managers and their lawyers fear that public outrage over enormous bonuses paid to executives at nearly failed American International Group plus news of hefty paychecks at hedge fund firms could prompt lawmakers to try to impose unduly harsh rules.

“There is a concern that you will end up with ill-fitting regulations,” said Elizabeth Shea Fries, who works with hedge funds as a partner at law firm Goodwin Procter.

The private equity industry also voiced concern, saying the proposal “for the first time would impose potentially significant regulation on the private equity industry.”

“We believe that private equity investments do not create systemic risk,” Douglas Lowenstein, president of industry group the Private Equity Council, said in a statement.

“Private equity firms invest in companies, not exotic securities, and their investors are long-term investors, eliminating the ‘run on the bank’ type of risk that helped create the current financial crisis,” said Lowenstein.

He said the PEC aims to work with the government to ensure that any legislation enacted wouldn’t impose “undue burdens on private equity firms.”

Undue burden on PE firms? Give me a break! These guys schmooze with Washington’s top brass, pass laws to help them mitigate their fair tax bills and then claim that they did not contribute to systemic risk? This is laughable given all the leverage they used to rack up “profits” in their multi-billion dollar buyout funds.

Moreover, as top hedge fund earners take home billions, an astute observer notes that hedge fund inequity is going unnoticed:

Congress has been grandstanding the past weeks in its usual windy style regarding the compensation paid to AIG executives. Amazingly careless confiscatory special tax bills were designed and placed in the legislative hoppers in a matter of days.

Why will Congress not seriously and hastily deal with one of the most unfair and obviously flawed sections of the Internal Revenue Code: the ability of hedge fund managers to pretend that their compensation is really capital gain that should be taxed at 15 percent while the rest of us have our compensation or business profits taxed above 35 percent?

I can’t imagine that it would have anything to do with political contributions flowing to Washington from politically active hedge fund managers like George Soros, who made $1.1 billion in 2008, largely by betting against the US dollar. I suppose that the favorable tax rates are due to the enormous value these hedge fund managers add to our national productivity and wealth! I don’t know how our country ever grew and prospered before the birth of thousands of hedge funds in the late 1980s.

Perhaps this is why the proposed new rules worry hedge fund and private equity. For so long, they were able to borrow cheaply, leverage up to wazoo, market this as “alpha” and collect huge fees for what was essentially “beta on steroids”.

Total nonsense. One senior pension industry insider wrote me tonight, telling me the following:

“Just read an interesting statistic that 37% of all private equity capital raised over the last 30 years was raised in the last three years. A giant experiment whose results won’t be known for another 5 to 10 years.”

A scary thought indeed, and he is absolutely right, we simply do not know how all these billions of dollars into hedge funds, private equity and real estate funds will pan out over the next decade.

Turbulent financial markets have caused institutional investors to reduce hedge fund exposure temporarily, but not permanently, according to State Street Corp.’s fifth institutional investor hedge fund study:

The study, conducted late last year in conjunction with the 2008 Global Absolute Return Congress, polled representatives from public and government pensions, corporate pensions, endowments and foundations and insurance companies with an estimated $1 trillion in total investable assets.

It found a moderate decline in overall portfolio allocations to hedge funds, but revealed that nearly 90% of institutions intend to increase or maintain current hedge fund allocations over the next 12 months.

“Hedge funds have not been immune to the extremely volatile market environment,” said Gary Enos, executive vice-president and head of relationship management and client strategy for State Street’s alternative investment solutions team. “While alternative investments, including hedge funds, largely outperformed traditional investments in 2008, negative returns understandably disappointed. Although hedge fund allocations declined slightly over the past year, we anticipate growth will resume later in 2009, as institutional investors continue to focus on diversification and risk management.”

The hedge fund study shows that the proportion of institutions allocating more than 5% of their portfolio to hedge funds fell from 68% in 2007 to 51% in 2008.

But 49% of institutions said they would increase their allocation to hedge funds in the next year, and 39% will maintain their current allocation. Of the funding for new hedge fund positions, 80% is expected to come from equity allocations. The study also found increased institutional interest in private equity funds. More than half of institutions have allocated more than 5% of their portfolio to private equity funds, and half intend to increase their allocation to private equity over the next 12 months.

Among the challenges arising from the recent market volatility has been the growing difficulty in accurately valuing derivatives and other complex financial instruments. As a result, 77% of institutions reported that accurately valuing hedge fund holdings can be problematic, up from 55% last year.

The study participants expressed a need for more transparency. Of the institutions, 84% expect more disclosure of hedge fund positions and 49% anticipate more frequent reporting from hedge fund managers. Only 19% said they currently receive some level of consistent transparency across hedge fund holdings.

To gain a more meaningful assessment of risk across their portfolio, nearly two-thirds of institutional investors either intend to, or already are, aggregating alternative investment risk exposures with other portfolio exposures.

“The recent unprecedented market volatility has prompted institutions to increase their focus on risk management,” said Enos. “To address these concerns and the increasingly difficult challenges inherent in the financial markets, the hedge fund community and allied third-party providers and administrators are stepping up efforts to develop and expand risk management solutions for institutional investors.”

Expand risk management solutions? What is that some euphemism or hedgespeak for trying to pull the wool over our clients’ eyes? When are people going to wake up and finally realize that the majority of hedge funds are selling beta as alpha? (Note: Bloomberg reports that hedge funds are using emerging-market exchange-traded funds “quickly raise risk levels”. And why are they charging 2 & 20 for this “alpha”?!?)

After getting clobbered in 2008, some large pension funds are now taking a tougher stance. CalPERS is now playing hard ball with hedge funds, demanding changes:

The nation’s largest public pension fund is not happy with hedge funds, and it’s not going to take it anymore.

The California Public Employees’ Retirement System issued a stern warning to the asset class, in which it is a large and pioneering investor. The $173 billion pension said it plans to demand greater transparency and greater control of its assets invested with hedge funds.

“In recent years, institutional investors have displaced wealthy individuals as the main clients of hedge funds,” CalPERS said in a statement. “However, the hedge fund marketplace has not evolved sufficiently to accommodate what institutional investors require to maximize long-term benefits for their beneficiaries.”

Among the pension’s plans to “restructure” its hedge fund investments are more investments in managed accounts and other customized vehicles, as well as pushing hedge funds it invests with to reshape their fee system to focus more on long-term performance by spreading fees out rather than charging them annually. CalPERS also wants more clawback provisions, allowing investors to recoup some fees when performance takes a dive.

“We believe that investors and managers alike stand to benefit over the long-term when interests are better aligned, asset controls are properly instituted and transparency of risks and exposures is improved.”

CalPERS made its demands in a March 11 memo sent to 26 hedge funds and nine funds of funds it invests with, The Wall Street Journal reports. Among those counting CalPERS as a client are such luminaries as Atticus Capital, Och-Ziff Capital Management and Tremblant Capital.

The pension called the desired changes “extremely important,” and warned that it would “no longer invest in managers” that ignored them.

It’s about time CalPERS wakes up and stops being the 800-pound monkey that shoves billions into hundreds of alternative investment funds.

Tyler Durden of Zero Hedge blog wrote all about CaliPERSnication this past Saturday. I quote the following:

Two years ago it was said that you if had a direct line to the CIO of CalPERS, one of the nation’s largest public pension funds, and specifically to its Alternative Investment Management group, you had it made. None of that Goldman Sachs partners being masters of the universe garbage – this was the real deal. Say you needed $100 million for fund XYZ – you simply dialed that one number in Sacramento, and if you made it past the secretary, you were golden.

Of course, this worked best if your name started with Leon and ended with Black, but other managers were also sitting pretty. The reason for this is that unlike the public pension funds of New York State for example, where the bulk of the investments were in the public markets via an internal asset manager (who was pretty horrible at his job judging by the fund IRR), and only occasionally did NY invest in external private and public fund managers (which more often than not included a variety of kickbacks, bribes, and other illegal schemes as recently reported by NY’s own Andrew Cuomo), CalPERS has the bulk of its assets invested in 3rd parties.

While Thomson Banker gives the total amount of CalPERS public investments at $38 billion, an obscure site within the CalPERS website labyrinth presents the amount allocated and invested in various 3rd parties. And the amount is staggering: it seems that a vast number, maybe even a majority of U.S. private equity firms, owe their existence to CalPERS.

Tyler goes on to analyze some of the IRRs reported by CalPERS AIM and concludes:

We highly doubt -10.7% is anything even remotely close to where CalPERS should consider its residual equity value in Apollo VI. And by fair estimates, this is merely the tip of the iceberg. Nonetheless, presenting public data that shows that the public pensions manager is disclosing over $14 billion in profits when it is hiding potentially much more than that in losses could be interpreted as borderline illegal. The question is, is this a responsibility of Apollo (to show the true sad state of affairs), or of CalPERS (to actually check these numbers and not to pull a Fairfield Greenwich “sorry, we had no clue what was really going on until it was too late”).

Regardless, as CalPERS itself points out, the numbers were as of September 30. It is a fact, that the December 31 numbers are due any minutes and we are salivating at the prospect of feasting out eyes on these numbers, to see just how much disconnected from reality the column known as IRR as presented by CalPERS has become. And just as Apollo VI is merely the tip of the asset manager iceberg, so is CalPERS merely a blip in the Alternative Investment Management universe of all public pension managers. Combined together, and based on realistic performance, these two will result in an explosive deterioration in both fund IRRs and public pensioners’ patience and empathy, once they realize their money has been mismanaged into oblivion.

Note my comment at the end of that post. The bursting of the alternative investment bubble will expose the true value of many of these investments.

But hold on just a minute. A buddy of mine sent me a Bloomberg article that proposed changes to mark-to-market rules are about to go into effect:

Four days after U.S. lawmakers berated Financial Accounting Standards Board Chairman Robert Herz and threatened to take rulemaking out of his hands, FASB proposed an overhaul of fair-value accounting that may improve profits at banks such as Citigroup Inc. by more than 20 percent.

The changes proposed on March 16 to fair-value, also known as mark-to-market accounting, would allow companies to use “significant judgment” in valuing assets and reduce the amount of writedowns they must take on so-called impaired investments, including mortgage-backed securities. A final vote on the resolutions, which would apply to first-quarter financial statements, is scheduled for April 2.

FASB’s acquiescence followed lobbying efforts by the U.S. Chamber of Commerce, the American Bankers Association and companies ranging from Bank of New York Mellon Corp., the world’s largest custodian of financial assets, to community lender Brentwood Bank in Pennsylvania. Former regulators and accounting analysts say the new rules would hurt investors who need more transparency, not less, in financial statements.

Officials at Norwalk, Connecticut-based FASB were under “tremendous pressure” and “more or less eviscerated mark-to- market accounting,” said Robert Willens, a former managing director at Lehman Brothers Holdings Inc. who runs his own tax and accounting advisory firm in New York. “I’d say there was a pretty close cause and effect.”

Willens, investor-advocate groups including the CFA Institute in Charlottesville, Virginia, and former U.S. Securities and Exchange Commission Chairman Arthur Levitt oppose changes that would enable banks to put off reporting losses.

‘Outrageous Threats’

“What disturbs me most about the FASB action is they appear to be bowing to outrageous threats from members of Congress who are beholden to corporate supporters,” said Levitt, now a senior adviser at buyout firm Carlyle Group and a board member at Bloomberg LP, the parent of Bloomberg News.

FASB spokesman Neal McGarity said the proposal allowing significant judgment was “in the works prior to the Washington hearing and was merely accelerated for the first quarter, instead of the second quarter.” The plan on impaired investments “was an attempt to address an important financial reporting issue that has emerged from the financial crisis,” he said.

I guarantee you that private equity funds were lobbying hard to change mark-to-market rules, enabling them to “fudge” their numbers going forward. In the pension world, they call this “alpha”.

This brings me to my concluding thoughts. In late January, Pensions & Investments published an article, PBGC Premium Boost. I quote the following:

The agency’s huge deficit and Mr. Millard’s desire to avoid any eventual PBGC taxpayer bailout spurred the most significant contribution during his tenure: a major change in the agency’s asset allocation policy in February 2008 that permits the agency to invest up to 10% of the $55 billion it has available in private equity and real estate. Both are new asset classes for the PBGC.

Under the new asset allocation, designed to close the PBGC’s deficit over the next 10 to 20 years, 45% of assets will be in equities, 45% in fixed income and 10% in alternatives. Previously, 75% to 85% was in fixed income in a strategy designed to match assets with liabilities. The remainder was invested in stocks.

Some critics have charged the new asset allocation is too aggressive for an agency that is supposed to backstop failed private pension plans. But Mr. Millard said the new policy has a far better chance of closing the PBGC deficit than the previous policy did.

“I would urge people to recognize that it is a long-term policy, and that PBGC’s liabilities will last for decades, and we need an investment policy that focuses on the long term,” Mr. Millard said.

Today, the Boston Globe reports that the pension insurer shifted to stocks (also, read Yves’ post below):

Just months before the start of last year’s stock market collapse, the federal agency that insures the retirement funds of 44 million Americans departed from its conservative investment strategy and decided to put much of its $64 billion insurance fund into stocks.

Switching from a heavy reliance on bonds, the Pension Benefit

Guaranty Corporation decided to pour billions of dollars into speculative investments such as stocks in emerging foreign markets, real estate, and private equity funds.The agency refused to say how much of the new investment strategy has been implemented or how the fund has fared during the downturn. The agency would only say that its fund was down 6.5 percent – and all of its stock-related investments were down 23 percent – as of last Sept. 30, the end of its fiscal year. But that was before most of the recent stock market decline and just before the investment switch was scheduled to begin in earnest.

No statistics on the fund’s subsequent performance were released.

Nonetheless, analysts expressed concern that large portions of the trust fund might have been lost at a time when many private pension plans are suffering major losses. The guarantee fund would be the only way to cover the plans if their companies go into bankruptcy.

“The truth is, this could be huge,” said Zvi Bodie, a Boston University finance professor who in 2002 advised the agency to rely almost entirely on bonds. “This has the potential to be another several hundred billion dollars. If the auto companies go under, they have huge unfunded liabilities” in pension plans that would be passed on to the agency.

In addition, Peter Orszag, head of the White House Office of Management and Budget, has “serious concerns” about the agency, according to an Obama administration spokesman.

Last year, as director of the Congressional Budget Office, Orszag expressed alarm that the agency was “investing a greater share of its assets in risky securities,” which he said would make it “more likely to experience a decline in the value of its portfolio during an economic downturn the point at which it is most likely to have to assume responsibility for a larger number of underfunded pension plans.”

However, Charles E.F. Millard, the former agency director who implemented the strategy until the Bush administration departed on Jan. 20, dismissed such concerns. Millard, a former managing director of Lehman Brothers, said flatly that “the new investment policy is not riskier than the old one.”

He said the previous strategy of relying mostly on bonds would never garner enough money to eliminate the agency’s deficit. “The prior policy virtually guaranteed that some day a multibillion-dollar bailout would be required from Congress,” Millard said.

He said he believed the new policy – which includes such potentially higher-growth investments as foreign stocks and private real estate – would lessen, but not eliminate, the possibility that a bailout is needed.

Asked whether the strategy was a mistake, given the subsequent declines in stocks and real estate, Millard said, “Ask me in 20 years. The question is whether policymakers will have the fortitude to stick with it.”

But Bodie, the BU professor who advised the agency, questioned why a government entity that is supposed to be insuring pension funds should be investing in stocks and real estate at all. Bodie once likened the agency’s strategy to a company that insures against hurricane damage and then invests the premiums in beachfront property.

Since he issued that warning, he said, the agency has gone even more aggressively into stocks, which he called “totally crazy.”

The agency’s action has also been questioned by the Government Accountability Office, the investigative arm of Congress, which concluded that the strategy “will likely carry more risk” than projected by the agency. “We felt they weren’t acknowledging the increased risk,” said Barbara D. Bovbjerg, the GAO’s director of Education, Workforce and Income Security Issues.

Analysts also believe the strategy would not have been approved if the government had foreseen the precipitous decline in the stock market.

Now, they warn about a “perfect storm” scenario in which the agency’s fund plummets in value just as more companies go into bankruptcy and pass their pension responsibilities onto the insurance fund. Many analysts say it is inevitable that the agency will face significantly increased liabilities in coming months.

“The worst case scenario is coming to pass,” said Mark Ruloff, a fellow at the Pension Finance Institute, an independent group that monitors pensions. He said the agency leaders “fail to realize that they are an insurer of pension plans and therefore should be investing differently than the risk their participants are taking.”

The Pension Benefit Guaranty Corporation may be little-known to most Americans, but it serves as a lifeline for the 1.3 million people who receive retirement checks from it, and the 44 million others whose plans are backed by the agency.

The agency was set up in 1974 out of concern that workers who had pensions at financially troubled or bankrupt companies would lose their retirement funds. The agency operates by assessing premiums on the private pension plans that they insure. It insures up to $54,000 annually for individuals who retire at 65.

Despite its name, the agency does not necessarily guarantee the full value of a person’s pension and is not backed by the full faith and credit of the government.

Nonetheless, agency officials say that if the pension agency fails to meet its obligation, the government would come under intense political pressure to step in. That means taxpayers – including those who don’t get pensions – could be asked to pay for a bailout.

Currently, the agency owes more in pension obligations than it has in funds, with an $11 billion shortfall as of last Sept. 30. Moreover, the agency might soon be responsible for many more pension plans.

Most of the nation’s private pension plans suffered major losses in 2008 and, all together, are underfunded by as much as $500 billion, according to Bodie and other analysts. A wave of bankruptcies could mean that the agency would be left to cover more pensions than it could afford.

In the early years of the George W. Bush presidency, the agency took a conservative investment approach under director Bradley N. Belt, who favored putting only between 15 and 25 percent of the fund into stocks.

Belt said in an interview that he operated under “a more prudent risk management” style and said he “would have maintained the investment strategy we had in place.” Belt left in 2006 and Millard arrived in 2007.

Under Millard’s strategy, the pension agency was directed to invest 55 percent of its funds in stocks and real estate. That included 20 percent in US stocks, 19 percent in foreign stocks, 6 percent in what the agency’s records term “emerging market” stocks, 5 percent in private real estate and 5 percent in private equity firms.

Millard said he thought he had little choice but to seek a higher investment return in part because Congress had limited the agency’s ability to charge higher premiums based on each plan’s likelihood of drawing on the agency’s funds.

The agency’s board – which consists of the secretaries of Treasury, Labor, and Commerce – approved the new investment strategy in a meeting in February 2008. But the board members have had only a limited role in the agency’s operation, meeting only 20 times over the 28 years before 2008.

The board is also too small to meet basic standards of corporate governance, according to an analysis by the Government Accountability Office.

“The whole model of having three sitting Cabinet secretaries with day jobs overseeing a $60 billion investment portfolio and occasionally owning significant percentages of large American companies is fundamentally flawed,” said Belt, the former agency director.

The Government Accountability Office is preparing a new review of the investment policy, but in the meantime it continues to place the agency on its list of federal programs at “high risk.”

And the article above brings me to another excellent post by Ian Williams that appeared on the Barricade blog over the weekend, Who Killed U.S. Public Pension System?

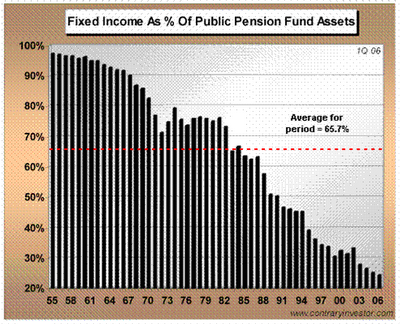

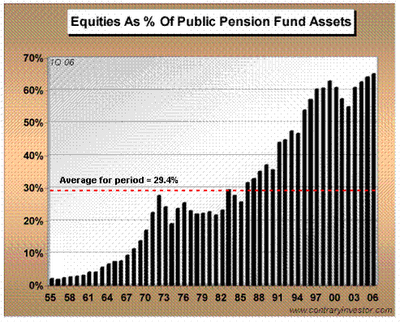

Ian was kind enough to email me and share his insights with me. The charts above are from his post and I quote the following:

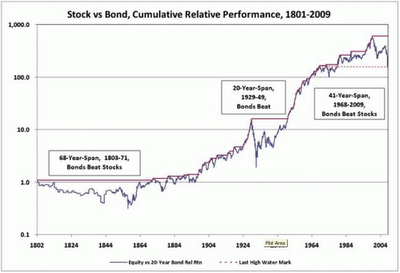

Professor and Nobel Laureate Paul Samuelson in late 1998 was quoted as saying, a bit sadly, “I have students of mine – PhDs – going around the country telling people it’s a sure thing to be 100% invested in equities, if only you will sit out the temporary declines. It makes me cringe.”

When someone tells you that stocks always beat bonds, or that stocks go up in the long run, they have not done their homework. At best, they are parroting bad research that makes their case, or they are simply trying to sell you something.

Which leads nicely into our 2nd bullet point – politically connected pension systems promising benefits and COLA’s assuming and I am likely being conservative a 7.5% investment return assumption on their portfolio which is now skewed heavily into stocks over bonds. Their investment return assumptions are PIE IN THE SKY or RAINBOW PONIES WITH WINGS depending which fantasy reference you prefer. I think it is time for pension systems to allocate 200% into equities with leverage provided by the US Govt as the retirement and pension systems are woefully underfunded.

The misleading numbers posted by retirement fund administrators help mask this reality: Public pensions in the U.S. had total liabilities of $2.9 trillion as of Dec. 16, according to the Center for Retirement Research at Boston College. Their total assets are about 30 percent less than that, at $2 trillion. With stock market losses this year, public pensions in the U.S. are now underfunded by more than $1 trillion.

I urge to read Ian’s entire post and to start taking a closer look at how your pension funds are being managed or mismanaged.

The solution to the pension crisis won’t be easy. But we have to start by admitting that the crisis exists and that pension funds have not taken adequate steps to address their underfunded status. Only then will we be in a better position to confront the challenges that lie ahead.

“Underfunded” is such an ugly word.

How about: “Challenged, but only in terms of future liabilities”.

Followed by, “…and as Americans, we can meet any challenge. So, obviously, I see no liability whatsoever.”

Ah, symmetry.

“There is a concern that you will end up with ill-fitting regulations,” said Elizabeth Shea Fries, who works with hedge funds as a partner at law firm Goodwin Procter.”

Money shot. Can you believe the balls on these people?

So Cerberus Capital Management escapes as the good old boys club protect their members at the expense of the general population. The veneer of pretence that government represents the people rather than the good old boys club begins to wear a little thin.

What rather surprises me about the hedge funds is that they have not taken the initiative and put forward their own ideas about what regulation should be in place. Its probably important to remember that not all hedge funds were gambling casinos and there are a few which did perform a useful role, having said that I can see no reason why they don’t pay tax the same as everybody else. Yet another case where inviting the good old boys club to the gravy train has paid dividends.There is a very good reason why the US does not come top of the world tables for controlling corruption.

As for the pension funds who have not properly exercised their financial duties then I would not be surprised to see unions taking legal action against them. I guess they are just run by members of the good old boys club, so we would have to wait a long time to see either exercise their authority or rights.

Next up is the FASB being pressured by the good old boys club and the PBGC investing in all the worst assets. Not that they had much choice since Congress had limited the agency’s ability to charge higher premiums. Undoubtedly this was politically expedient to the goods old boys club and what do they care if the taxpayer has to bail it out.

The good old boys club has done a good job of getting the taxpayer to pay for their mistakes and to top it off they have stolen the taxpayers savings through their pensions. Whatever way you look at it somebody is laughing all the way into the sunset as you are loaded down with debt which ever way you turn. Its like stealing candy from a baby, easy as pie.

The game that is being played here is a little more complicated and cynical than just “hedge funds against the public.” It’s more like “big hedge funds against the public and the smaller hedge funds.” The big hedge funds are perfectly willing to agree to major paperwork burdens on the hedge fund industry. Indeed, they are actively lobbying for more paperwork. The reason is twofold:

(1) They hope to minimize any substantive changes in their compensation or ways of doing business, by persuading the Feds to substitute meaningless paperwork requirements instead.

(2) They know that smaller funds will not be able to afford the paperwork burden. In particular, they know that their own employees will be less able to leave and start their own funds. This has two benefits for the big funds. First, it reduces competition for investors’ dollars and for investment opportunities. Second, it reduces their compensation expense, leaving more money for the people at the top.

This comment above on how the new rules benefit the big hedge funds is excellent and worth looking at by regulators.

If the new rules benefit the bigger hedge funds at the expense of smaller ones who are typically hungrier and align themselves with the interests of their investors, then it will undermine the hedge fund industry.

Bear in mind, that big hedge funds and big private equity funds tend to become “big asset gatherers” who are typically content on collecting that 2% management fee while they ignore the 20% performance fee.

Bottom line: New rules should not undermine the alignment of interests by penalizing many smaller and typically hungrier hedge funds.

Regards,

Leo

Great Post. It has seemed to this humble commentor that the bailouts of the last year are only bailouts of businesses at the PR spin level. The reality is that the entities being bailed out are PE empires and hedge funds.

Citibank? PE creation

AIG? Insurance? hah — PE empire

Chrysler? Cerberus

The reality is that PE empires have put the nameplates of real companies on their front doors allowing the government to sell these bailouts as bailout of the traditional companies implied by the names, when in fact what is being propped up is the game of buying and selling little strips of white paper, and using the ‘profits’ to raid the coffers of succesful businesses.

There is no question that what is really going on in the bailouts is allowing short term manipulations to suck wealth out of long term investments in productive and profitable enterprises. In other words the same game that got us into this mess.

There is no way a bailout of PE firms of the scale we have seen could have been sold to the public honestly. It is only by obfuscating the facts that it can go forth.

I have a nasty feeling that everything we have seen so far was just the amuse gueule, and that an entire banquet of financial mess is now simmering on a giant stove in a kitchen of horrors. And the bill will be paid by the common people, as always.

I suggest that you visit Guy Fawkes’ blog and scroll down to his post about the Bank of England Pension Fund. Sharp cookies!

http://www.order-order.com/

And with GM/Chrysler given 60 days/30 days to reorganize their debt structure, I think we’re going to see the PBGC receive any more liabilities.

Cerberus’s Equity in Chrysler’s Auto Company to Be Eliminated

http://blogs.wsj.com/autoshow/2009/03/30/718/

As an average chump (a.k.a. taxpayer), may I kindly ask Wall Street swindlers that when the last U.S. dollar was stolen from the U.S. Treasury, would one of them please turn off the lights? Thank you.

Vinny Goldberg

This comment above on how the new rules benefit the big hedge funds is excellent and worth looking at by regulators.

The US Government IS a big hedge fund.

Leo, I posted this at ZeroHedge but since you cited it on Yves site I thought I would post it here as well.

Tyler,

I am not nitpicking here but choosing Fund VI and making it indicative of the rest of the Apollo investments is a bit of cherry picking the data to make your point. Funds III, IV and V have IRRs of 10.5, 8.5 and 42.4% So it would be quite reasonable for the alternative investment manager to continue on with Apollo’s next offering (these funds are numbered this way in that each fund is offered after the subsequent one. It gives institutional funds an insight into how many successful funds a company has.) While I agree in principle that Apollo VI is doing pretty horrible you have to look at a number of other factors, especially when you are involving IRRs. This is because an IRR does not tell you the length of the investment. I can have a 100% IRR but only held an asset for 6 months then the multiple on the investment is only 1.7 times the money put in. On the other hand I can have an IRR of 100% and a period of 3 years and I have 8 times my investment

In this case you have taken a very immature PE investment only in its third year out of a normal 10+ year investment horizon and castigated it.

Also another mitigating factor is that in the early years when the fund is buying portfolio companies and not selling them the only cash flows are the management fees, which are outflows. Thus, a phenomena known as the j-curve is shown, where cash flows eventually become positive as the portfolio companies are sold off or recapitalized and the fund receives returns higher than the management fees. So it is obvious and a natural fact that the returns should be negative for PE funds from years 1-5.

Here is CALPERS website showing you the explanation of the J-Curve

http://www.calpers.ca.gov/index.jsp?bc=/investments/assets/equities/aim/private-equity-review/understanding.xml

Let me reiterate, the portfolio companies this fund holds do look to be in terrible shape but the 10.7% return showing is a matter of CALPERS requiring quarterly performance reports when no positive cash flows are being generated. The managers of CALPERS are comfortable with this because they know of the J-Curve.

You may be correct that in the future though this fund may not achieve its objective IRR or even return the Limited Partner’s monies, but it has very little to do with the numbers you cite in your post.

Harry,

You are absolutely right:

“You may be correct that in the future though this fund may not achieve its objective IRR or even return the Limited Partner’s monies, but it has very little to do with the numbers you cite in your post.”

This is why most large pension funds here in Canada only post results for private equity and real estate once a year.

However, I know for a fact that many pension funds did not take proper vintage year diversification in their PE portfolios, leaving them very exposed to a bad vintage year.

Tyler was making a point, but your observations are valid.The only thing is that in a bad vintage year, you can get burned big time in PE and never recoup your losses from a particular fund.

One final thing people forget. PE lags the stock market. If the stock market does not recover, you can forget about a healthy PE recovery.

cheers,

Leo