Swiss Zoo Has One Too Many Hippos, So Little Farasi May Have to Go Wall Street Journal. The zoo in Birmingham, Alabama lost one of its two hippos last year. Maybe it has room. although their remaining hippo could be a male.

Researchers find ways to sniff keystrokes from thin air ITWorld

Bank of America’s Desoer Says ‘Thank Goodness’ for Countrywide Bloomberg

Entrenched Managements: Yet One More Reason Why TARP = CRAP Roger Ehrenberg

Retail Sales Report Spencer, Angry Bear

Read the big four to know capital’s fate Paul Kennedy, Financial Times

A think-nugget from Arnold Kling inspires a very long riff… Steve Waldman

Congresswoman, Tied to Bank, Helped Seek Funds New York Times. This looks like a particularly ham-handed effort.

RIAs angry over SEC move to contact clients directly Investment News

Gordon Brown broke Lloyds, and it should break him Telegraph, hat tip reader mr. ugly)

Antidote du jour:

Here’s a nice bit of antidoting.

http://www.dailymail.co.uk/news/worldnews/article-1161393/Who-dares-swims-Man-takes-dip-giant-lioness.html

Sorry, I meant animal-doting.

“The clients are going to be nervous that something is wrong, and then I have to spend time convincing people that I’m not stealing from them,”

Apparrently, the worst kept secret on wall street was that Madoff was stealing and no self respecting wall streeter would give him a dime. But here’s the good part, they all kept their mouths shut. Self regulation, yea.

If your “time is money” investment advisor doesn’t want due diligence, dump him immediately.

I can’t stand morning TV shows, and that BofA piece gave me the same feeling: perma-smiles everywhere.

“I’m smiling, I’m smiling, I swear to god I’m smiling…my teeth are grinding incredibly hard, but I’m smiling”

Antidote du jour:

http://www.telegraph.co.uk/telegraph/multimedia/archive/01364/kevinRichardson_li_1364837c.jpg

http://www.telegraph.co.uk/news/newstopics/howaboutthat/4977904/Zoologist-swims-with-lioness-to-escape-heat-of-South-Africa.html

Jim Cramer – on The Daily Show –

(there is justice)

Cramer on Daily Show Part 1

Cramer on Daily Show Part 2

YS:

I read the RIA piece. It shows how incompetant the SEC is. CPAs have been required to get outside receivable confirmations since 1939. Is the SEC aware of that? Of course, I wonder what did PWC do during its Satyam audit.

Chris Whalen at Institutional Risk Analyst has a very good new piece that sums up where things are on the bank bailout scene. It is clear and concise and gets to the heart of the issues:

http://us1.institutionalriskanalytics.com/pub/IRAMain.asp

So much for China financing the US deficit….

Historic Trade Deficits Loom

By CSC staff, Shanghai

Published: March 12,2009

China’s trade surplus has dropped to $4.85 billion after steep decreases for four straight months. If it continues to decline in the following months, historic deficits loom.

http://www.chinastakes.com/Article.aspx?id=1062

D

The next act:

RMB devaluation.

If the “hidden” capital outflow is counted, China is actually depleting its Forex reserves at a pretty good rate.

D

I was at a sales presentation yesterday touting alternative investments for RIAs that service "retail" investors. One of the guys was from a firm that does due diligence of hedge funds, etc.

At the end he wondered why nobody had asked about Madoff. (I kind of felt like he had insulted our intelligence – the issues have been well documented in the press & elsewhere.)

Then he enlightened us by saying they had passed on Madoff because of the custodian issue, among other things. I thought the same thing as Anon at 7:40 a.m. – why didn't they let someone know?

Then again – people had told the SEC and it didn't go anywhere. I'm convinced the grunts at the SEC likely pointed the problems out, but as the findings went up the SEC hierarchy the concerns were removed from the reports.

I have to stop thinking about it now because it just gets me so angry.

I think if we replaced everyone in US jails caught for smoking pot with everyone on wall street that thinks derivatives are peachy we would improve society as a whole.

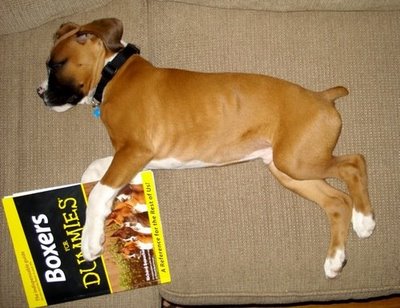

Boxers for dummies, that is a riot!

CFR 3/6/2009 presentation with:

Speaker: William C. Dudley, President and Chief Executive Officer, Federal Reserve Bank of New York

Fast forward 21 minutes into audio and you find this jewel:

“The point of the stress assessment is not to pick winners and losers, but instead to insure that the banking system and all the major banks have sufficient capital to withstand a very adverse environment. Following the conclusion of the stress assessment process, the government is committed to supplying whatever amount of capital is needed to ensure that all the major banks remain viable.”

William Dudley places special emphasis on the last portion of this quote…So the “stress test” is really a “needs assessment test.”

Click “brushes9” above for the link and listen for yourself.

Here is the transcript of the CFR presentation that I mentioned above:

http://www.cfr.org/publication/18743/conversation_with_william_c_dudley.html

Nearly half-way through the speech, discussion on the banks and the “stress test” occur.

Banks do not want to seek capital, today, before the economic environment worsens, because it will dilute their share holders equity;

“..many bank holding companies don’t have an incentive to raise sufficient capital to ensure that they can handle a very bad outcome. That is because such capital-raising would severely dilute existing shareholders.

This implies that, left to their own devices, banks might end up being undercapitalized in a stress environment. The risk of this outcome makes these banks, and their counterparties, very cautious in terms of their behavior. This cautiousness, (in turn ?), which is rational for each bank and counterparty individually, is bad for the system,..”

Click “brushes9” for link to entire transcript.

New York’s transit authority, MTA, is going to hike rates AGAIN!

Excerpt:

“The situation is dire,” the authority’s chairman, H. Dale Hemmerdinger, said at a meeting of the authority’s board. He described “25 to 35 percent increases in the cost of getting to work” and “serious and painful cuts in service.”

Is that blogger Tyler Durden weighing in on comment #6:

“So does this mean they’ll halt work on the 2nd Ave line or the extension of the 7 train? If their financial state is so poor, why did they take on these massive projects in the first place? The reality: they are a corrupt monopoly that millions of people rely on every day. They know they can put NY’ers in whatever position they want and just keep taking out money.”

— tyler durden

Sounds like blogging about banks has left Tyler in tip-top, fight-club, form!

http://cityroom.blogs.nytimes.com/2009/03/13/mta-warns-of-dire-fiscal-picture/