So much for Ken Lewis’ cheery prediction that Bank of America would be profitable in 2009, although Bank of America could always be the exception.

McKinsey is generally considered to have the best financial services practice among the major consulting firms, and being overly gloomy does not endear one to clients.

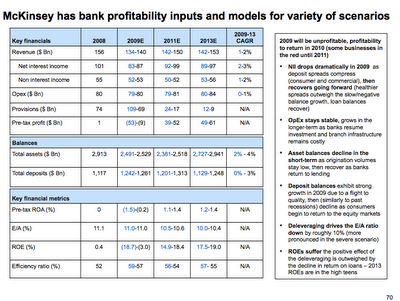

The profit forecast is in the first chart, from a March 2 presentation “Financial Crisis Discussion Document” (click to enlarge) and the second is just a particularly cool bit of analysis. Thank reader Doug.

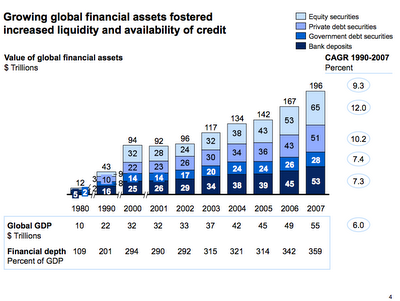

Nice to see such a major firm unafraid to do real analysis and posit financial depth as a synonym for debt to GDP. So much importance has been placed on excess indebtedness that it’s blocking a really important and gruesome separate spectacle.

The longer-dated projections are necessarily a bit sketchy, and I don’t see some of the same trends they anticipate, because rising real interest rates and negative equilibrium real interest rates are very persistent and powerful effects. I don’t see NII recovering persistently any time soon on a risk-adjusted basis, for example. But the rest is well-reasoned.

Is there a link to the full report, Yves, or do we need to be institutional and/or cool for that honor?

I would love to understand why McKinsey thinks that this will be a U or V downturn and not a L.

Aren’t we just starting to expereince the multiplier effect of the layoffs?

Don’t we still have 18 months to go of mortgage defaults?

Don’t we still have a credit card bubble to deal with?

Has anyone figured out what to do with the unregulated derivative insurance scam hovering up trillions?

What about the fact that we will have deflation in some sectors and inflation in others with those dollar printing presses running the background?

Companies that want to stay in business and make their customers happy spout the rose colored future, no structural problems, nothing to worry about here, kick the can down the road and hope it becomes someone elses problem, whooocoudanode irresponsible bull shit.

Why are we still letting the bozos drive the bus?

Pull the cord for me will you, I want off at the next stop….

psychohistorian

This is precious in light of the profit/revenue spin from the CEO’s from Citi, BAC and JPM this week.

Thanks Doug and thanks Yves.

And goodnight, just dropping by before going off to bed.

psychohistorian,

The McKinsey doc has four scenarios, and works off the two grimmest, although the worst may not be dire enough for some tastes (mine, for instance, but it isn’t wildly off). However, in the gritty detail, they say several times, loudly, that the losses could exceed their estimates.

The reason banks recover early is that deflations feature high real interest rates. Owning high quality bonds, and originating high quality loans (and banks are being very picky right now) are the best places to be in deflation. So if banks weren’t sitting on all the dreck they created over the last few years, they could do well.

ndk,

Sadly, no I was e-mailed the report. Guess you need the secret handshake, or have to be the friend of someone who knows it.

here is what I don’t understand about banking profit return.

1. does anybody expect housing price climb to return to 2004-2006 meth day? Interest rate was going down from about 5 to 2 and money was very easy. Even if everything else return to the way it was. interest rate difference and easy money won’t exist anymore. so.. housing price will at best grow at population/income rate.

2. baby boomer will start entering retirement age en masse. Let’s just say, they aren’t social climber changing houses as they get richer. Their priority now is enjoying life. demographically, house buyer will start to shrink.

3. regulation change on CDS, CDO, or all those derivative gambling game. THis was the most profitable money machine ever. even more so than stock market. Any government sane enough to let derivative running lose again?

4. smaller lucrative countries like iceland, eastern europe will now adopt Asian lesson. They will stop consuming and piling up on reserve. No more debt. (there goes another easy money source)

5 and finally, Asia seems to recover first, and money movement will be different. The weakening banks will have to compete against asian banks on high growth economy…

so, … somebody explain to me how those banks will enjoy the 2005/6 crack cocaine days? Expecting US economy to grow 8% using unicorn and rainbow power?

Actually, that looks pretty bullish to me. One more year of losses, then back to break even, then back to “normal” by 2011? I’m in banking and that looks nuts.

Although what that chart doesn’t show is that the majority of banks – by charter, as opposed to by aggregate industry assets – will be profitable this year. Although not nearly as profitable as in past years.

These aggregated numbers really just show what’s happening at the largest banks, as 20 banks (out of 8,300 total) account for over 60% of industry assets (and profitability). Which is a big part of the problem…

…although Bank of America could always be the exception.

Lewis’ claim brings up a number of questions: How about if they had to properly and alone reserve for loan losses? Meaning without TARP and other forms of aid from the Fed (that alphabet soup of programs) and federal government. What are big banks like BAC actually doing with the money they get? How do they formally account for it?

Any company can operate properly if it shrinks costs enough and has its (asset) losses covered.

Interesting.

Total FDIC insured bank deposits are more like $7 trillion, so I’m not getting what McKinsey is referring to here.

BAC has about 11% of the total.

Agree with cap vandal.

E.g. the numbers for industry assets are way, way off.

Not sure what they represent, but it certainly isn’t the US banking industry.

Yes, this doesn’t seem to be a picture of the total US private banking system, probably some kind of subset. Yves sleeps late but when she rises maybe she will be kind enough to have another look at the report. Inquiring minds are curious.

Citcorp assets alone are around $ 2 trillion; top four $ 7 trillion; total industry better part of $ 20 trillion.

The industry makes ballpark $ 300 billion operating pre-tax (and pre security write-downs obviously). These are the sorts of numbers to be looked at for pre-tax internal recapitalization. Citi alone has $ 40 billion in tax loss carryforwards as future tax shelter.

I disagree with the assessment that net interest income is going to decline in 2009. Thanks to the breakdown in the securitization markets, banks are once again in the drivers seat. A look at recent loans will give you a good idea of where interest income is headed.

Eg. The loan provided to Pfizer for the acquisition of Wyeth as also terms of the Verizon/Alltel loan all show spreads of well north of 400 bp for short term loans. It is also important to recognize that the financing costs for banks has not gone up. The spread between the average CD rate and average prime rate is very robust. Also, remember that most bank loan portfolios probably have a duration of 4-5 years. So, between the time they started tightening standards and end of 2009, a full third of their portfolio would be sporting healthier spreads.

Yves – We should revisit this chart a year from now just to see how accurate Mckinsey’s projections are.

Now, provisions for losses – that is a different story :)

Just to echo what others have already said — there’s no way this is a report on the U.S. banking industry. The total assets in the system, according to this chart, are $2.9 trillion. BoA and Citi alone have around $4 trillion. So what, actually, is this report an analysis of?

Mckinsey is part of the problem. A parasite that feeds off of spreading the same virus to multiple hosts.

Let’s see their Fin Svc practice papers from 2006 and 2007 warning of the oncoming collapse.

Yves said: “So if banks weren’t sitting on all the dreck they created over the last few years, they could do well.”

Wow! So could I if I hadn’t bought that $720,000 house two years ago that’s now worth only $500,000 and I still owe $650,000.

But unlike me, the big banks have friends in high places, and if their drive to get the government to place its full faith and credit behind their balance sheets and do away with mark-to-market proves successful, they undoubtedly can be “profitable.”

But what’s good for the big banks may not be good for me. Obama seems hell bent on saving the big banks, even if it means murdering the economy for everybody else for many years to come.

I suspect that it has always been the case that if you ignore writeoffs the banks are profitable.

I think Lewis could have made his comment any time in the last 2 years.

If the government puts enough common equity, which has no obligations on dividends or interest payments, this point might become relevant.

The banks will recover…..the taxpayers won’t.

I’m sure the chart was created with official available numbers…..the exact reason the Federal Reserve doesn’t report what is really going on.

Would like to see the projection for stock prices of the recent penny banks.

I wouldn’t give two cents for a McKinsey report.

I’ve seen their work close up in risk management, and based on proportionate effort, they’re every bit as responsible for the credit crisis as the rating agencies.

Put me down as another anon who sees this report as bullish for the banks. In a few months the market might start looking to 2010 and beyond. The shadow banking system is NEVER coming back as strong or as promiment as it was. This leaves the commercial banks in the drivers seat for some time to come.

Mckinsey is part of the problem. A parasite that feeds off of spreading the same virus to multiple hosts.

Let’s see their Fin Svc practice papers from 2006 and 2007 warning of the oncoming collapse.

Couldn’t agree more.

Anybody professing to do analysis in this field who did not predict the trainwreck is wasting our time and breathing too much of our air.

Look at BAC when they say they will be profitable it is slight ofg hand. LEwis will take a Billion plus gain in Q1 on the CIC sale. all trickery and slight of hand. it was like dimon saying that he couldnt understand the taking gains when their spread worsed. He wasnt too concerned the past few quarters when he baked it into his numbers however. These guys are filth.

Good to see McKinsey’s complicity being brought to light. A very under-reported story, in particular, is the work McKinsey did for Merrill Lynch in the 2001-2005 timeframe (i.e., change in firm’s direction toward a more levered, securitization driven profit focus). A friend in a place to know this at Merrill, referred to Merrill being “McKinseyfied.” By way of disclosure, I’ve never owned MER or BAC stock or have had any affiliations with either firm.

Yves,

Can you please email me a copy of the report at papapancho@gmail.com?

Thanks!!