Submitted by Leo Kolivakis, publisher of Pension Pulse.

The FT reports that U.K. pension deficits hit £250bn:

The aggregate deficit of corporate UK pension funds soared past £250bn ($373bn) in March, setting a record for a shortfall due in large part to the drop in gilt yields as the Bank of England’s quantitative easing commenced.

According to the Pension Protection Fund, the insurance scheme for the underfunded pension plans of insolvent employers, the aggregate gap between the value of scheme assets and the value of liabilities it guarantees rose to £253.1bn.

That reflects the aggregate shortfall of schemes in deficit, which is 90 per cent of all plans. Overall, the shortfall is £242bn, but that number has little meaning because the surplus of one scheme cannot be used to cover the deficit on another.

The PPF calculates its 7800 Index – named for the number of schemes it insures – based on average asset mix and interest rates prevailing on long-term conventional and index-linked gilts. In March, rising equities markets increased the value of assets by 2.8 per cent from their levels in February. However, this was too little to cancel out the effect of falling gilt yields as the Bank undertook its purchases of about £25bn in gilts, which it hopes will encourage banks to lend more to the wider economy.

Although yields on some bonds have risen since the end of March, they remain lower than at the start of this year.

The widening gap in the level of pension funding may trigger a larger debate about the merits of investing heavily in equities by pension schemes whose members are mostly at, or near, retirement age. While schemes had vowed to reduce their investments in risk assets in 2003 as yields and stock markets fell, those intentions appear to have been cast aside as equities recorded strong gains. Now those gains are being reversed and the shortfall is greater than in 2003.

Critics of the Bank’s efforts have cited the detrimental effect it is likely to have on calculations of scheme liabilities and raised fears it may force companies to inject more cash into their retirement plans.

However, Mervyn King, Bank of England governor, in recent testimony before the Commons Treasury Select Committee noted that schemes that matched their liabilities with assets that move in line, such as bonds of appropriate duration, are unlikely to be affected by quantitative easing.

The shortfall shown by the PPF is smaller than the aggregate shortfall across all defined benefit schemes generally. That is because the PPF only insures 90 per cent of promised benefits and limits total pay-outs.

I have already discussed about how quantitative easing may bring pensions to the brink. And Mervyn King is right, schemes that matched assets to liabilities by buying more bonds of appropriate duration are unlikely to be affected by quantitative easing (they might even benefit from it). But most other schemes that did not match assets to liabilities will surely be affected by quantitative easing as their deficits soar to record levels.

Another FT article that caught my attention was YRC plans for a pension shake-up:

YRC Worldwide, the biggest trucking company in the US, is negotiating with its unions to allow it to suspend cash payments to its defined-benefit pension plan and to pledge real estate as collateral instead.

It would be the first major US company to use its real estate to help meet its pension obligations.

The talks are also a strong sign that corporate payments to defined-benefit plans, usually considered sacrosanct, could be reduced or suspended as a result of the economic downturn.

The largest corporate pension plans, which provide employees with a defined benefit on retirement, have lost more than $330bn since January 2008, leaving companies under pressure to make up the shortfall, according to Milliman, a consulting firm.

Companies are struggling to make payments while their profits are plummeting. YRC said it had to pay $34m-$45m a month to its plan, while its freight volumes had fallen by 29 per cent in the latest quarter compared with a year ago.

It said it was finalising talks with the International Brotherhood of Teamsters “to provide certain of the company’s real estate as collateral to its . . . defined benefit plans in lieu of making payments for certain to-be-agreed-upon months”. The Teamsters declined to comment.

More than a third of US companies have cut back or eliminated matching payments to employees’ defined-contribution pension plans since January 2008, according to Spectrem Group, a research firm.

Defined contribution plans, called 401(k)s after the section of the tax act that governs them, require employees to pay into their own plans, with their company typically matching contributions up to a certain level.

Saks, General Motors, clothing company J.Crew, Coca-Cola Bottling, FedEx, Motorola and Sprint Nextel are among the companies that have suspended such contributions in recent months.

Close to a third of companies plan to suspend 401(k) contributions in the next 12 months, said Spectrem.

George Halper, president of Spectrem, said: “This . . . raises questions about the ability of the current generation of working Americans to adequately fund their retirements.”

The trend has in recent weeks spread to the UK, where Aon, the British arm of one of the world’s biggest insurance brokers, became the first large UK company to cut payments to its workers’ defined contribution plan.

I wonder how many other pension funds are looking at selling real estate as collateral to their defined-benefit plan. As for not matching contributions, this is all part of corporate cost-cutting measures, squeezing employees now that they are vulnerable to the economic downturn.

The Pittsburg Tribune reports that there is only one solution to the pension crisis:

Court rulings prevent changing benefits for existing participants in public pension plans. But the Pennsylvania General Assembly can ensure that future taxpayers won’t face the problems inherent in today’s plans.

The Commonwealth Foundation and the Allegheny Institute for Public Policy, among others, note Pennsylvania’s unwieldy total of more than 3,000 state, city and municipal pension plans — too many of them underfunded — and the “defined-benefit” nature of more than 2,200 plans.

Defined-benefit plans promise guaranteed payouts and are vanishing from the private sector, replaced by “defined-contribution” plans that don’t guarantee payouts and usually involve 401(k) accounts for employees.

Both types invest similarly. But underfunded defined-benefit plans in the public sector leave taxpayers on the hook. That would end if Senate Bill 566, which would change public-sector pensions to defined-contribution plans and establish a unified statewide retirement system for public employees, becomes law.

The bill is before the Senate Finance Committee, chaired by its principal sponsor, Republican Sen. Patrick M. Browne, who represents parts of Lehigh, Monroe and Northampton counties.

Public employees and their unions are sure to resist even a change that would affect only future participants. But their influence can be countered, and the public won’t keep bearing the financial burden of the public sector’s antiquated defined-benefit plans if enough taxpayers insist on enactment of SB 566.

If they think shutting down DB plans for DC plans is a solution, then I got news for them. This will only ensure poverty for most workers looking to retire in dignity and security. For the most part, DC plans are a case of pot luck. I propose they sit down with the public employees and their unions and try to salvage their DB plans.

Finally, a creepy story out of Serbia where a dead father was kept for pension:

Serbian police have arrested a man who kept his dead father in his home in order to continue collecting his retirement pension, Belgrade newspapers said on Tuesday.

The 70-year-old man died up to 18 months ago, the reports said. The son meanwhile collected pension cheques, filing a missing person report only recently, when bank officials finally demanded to see the old man.

Police in the mining town of Bor, 200km east of Belgrade, became suspicious when it became apparent that nobody had seen the father for more than a year and a half.

When police broke into the two men’s apartment, it found a decomposed corpse on a bed, under an open window which nevertheless failed to vent the stench, reports said.

An autopsy is to reveal whether the old man died of natural causes or was murdered.

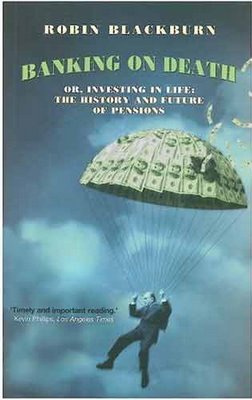

Let’s hope we don’t hear of any other stories of keeping corpses around to collect pensions. Of course, the way things are going, when it comes to pensions, more and more people are banking on death.

We know this is a problem that has been bounced around site for over a month now. What tenable solutions can you present us that would be logical? Should companies reduce current wages, stop the flow of profit to shareholders, reduce investment in future projects or bet the book on speculative instruments? What options do they really have in a zero percent FF rate environment?

What type of solution can you offer? It would be interesting to hear your opinion because, frankly, it seems the entire pension system has been exposed as a fraud. On a massive scale it depends on overly optimistic growth projections by companies’ pension systems and asset managers. How can the trillions in pension funds can expect to find the alpha necessary to meet its obligations? Like its big brother, Social Security, it promises far too much and is dependent on those who actively working paying into it.

Perhaps people should reduce consumption over the short term and save for their future expenditures(not invest). Maybe this is the kick in the ass our society needs.

Just couldn’t resist.

Keep writing Yves, the world needs you.

This proves QE in its current form probably does more damage than goodp. Each time the pension deficit rises, either companies or individuals need to make up some of the difference. Sure they can bury their heads in the sand and leave problems for further down the road, but I bet there is a proportion who tackle the problem. The end result of this is either the consumer has less money to spend right now as he pumps more money into the fund, the business has less investment money to spend now as it pumps money into the fund, or the government gets to bail out the fund later on. Either way this looks like affecting demand, which will mean more QE will be needed. Quite simply this is a way to raid pensions to prop up banks, with the result that the real economy gets trashed.

@Brick

Do not forget that a large part of pensions hold bank debt as a source of investment. Perhaps that is why the bondholders have been treated so unequally throughout this entire charade.

The problem is not QE, the problem is that the concept of a pension based upon compound interest and grossly appreciating asset values is a sham.

RPB wrote:

“We know this is a problem that has been bounced around site for over a month now. What tenable solutions can you present us that would be logical? Should companies reduce current wages, stop the flow of profit to shareholders, reduce investment in future projects or bet the book on speculative instruments? What options do they really have in a zero percent FF rate environment?”

If I were President Obama, the first thing I would do is set up a commission to look into the pension crisis, like they did in the U.K. with the Myners commission.

I would look into bolstering the governance of the major public pension funds, reviewing the risks they take in all asset classes, including alternative investments and derivatives.

Another proposal I would seriously give thought to is doing away with all private DB and DC plans, shifting them over into public DB plans run by professional money managers who are properly compensated and whose interests are aligned with those of the pensioners and stakeholders.

I would not create a single mammoth fund, but several large funds capped at a certain amount. I would make sure they get their asset allocation right, focusing on protecting against downside risk.

I would introduce the concept of risk budgeting to each fund where you properly budget for each risk taken in every asset class.

Finally, I would ensure that these funds are fully transparent and that the incentives for senior execs are aligned with their stakeholders, not their own pockets.

The pension crisis is not going to go away. It is a structural issue that will deplete public coffers for years to come.

We need to start thinking about how we are going to deal with it once and for all.

cheers,

Leo

Leo,

I like this idea. A lot. Wouldn’t it be lovely if we could do it with Basic Health Care as well?

Tim in Sugar Hill

Leo & Harlem Dad,

Worthy thoughts and ideas. But… we should consider carefully how they are vulnerable to those who would game the system. Where that much money is around, the incentive is too great to resist. Of course the current system is being "gamed" big time anyway.

Also, it seems to me that the same people who are anxious to "privatize" Social Security could very effectively propagandize about "poor performance" of pension funds invested conservatively, citing the much greater returns from equities (conveniently ignoring the lessons that have just been taught by our bubble-driven economy). The willfully ignorant are easily swayed and this would be a huge target.

Finally, let's be realistic about our politicians/leaders. There is only so much political capital to spend, and there are lots of issues to address. This is just one of many serious issues. I don't pretend to know which is most serious but there is always a practical limit to what they can take on. Perhaps we could list the order of what we think should be our priorities.

The bottom line is, there are plenty of good ideas about what we ought to do. There are a lot fewer effective implementation plans. And fewer still are those who have the energy and resources to do the hard work needed to execute those plans.

-guilty as charged

«Let’s hope we don’t hear of any other stories of keeping corpses around to collect pensions.»

Not reporting deaths is a very common ruse to continue getting pensions and health care.

In some countries this is so common that there is even a “certification of being alive”, required to collect a pension, and rules that say that pensions must be collected in person and not via a relative at least every N months.

Of course all these measures just increase the number of people to bribe so they turn a blind eye, but this can be expensive enough to dent a bit the phenomenon.