Submitted by Rolfe Winkler, publisher of OptionARMageddon

So much for de-leveraging…

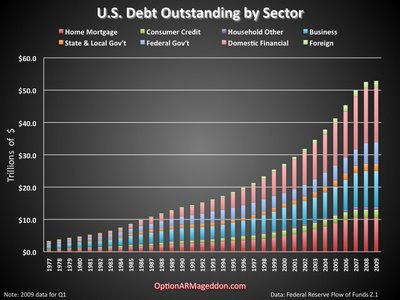

The Fed published its latest Flow of Funds report today. One key takeaway: While total debt is growing more slowly, it is still growing. Since Q3 ’08 households have cut their debt (slightly), but the federal government is borrowing so rapidly, overall debt continues to expand.

(Click chart for larger image in new window)

By the way, the Fed only includes publicly held debt when calculating total federal government borrowings, $6.7 trillion at the end of Q1. This excludes over $4 trillion owed to the Social Security “trust fund.” More importantly, it excludes $60 trillion of unfunded future liabilities for Medicare and Social Security.

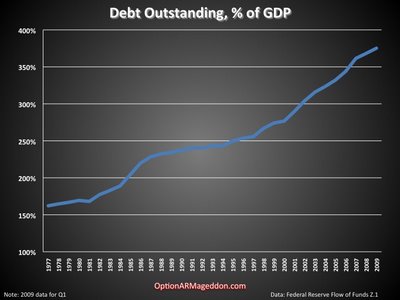

The second chart puts the data into perspective. As a percentage of GDP, debt continues to expand, from 368% at the end of Q4 to 375% at the end of Q1.

It’s been said that the income statement is the past, but the balance sheet is the future. Our balance sheet is getting worse. Those who see “green shoots” believe the crisis is abating. But they don’t understand its origin: a credit bubble that, in the aggregate, continues to inflate. The equity value of our economy is going down—think the stock market and housing equity (see below). At the same time our debt is going up. In other words, America’s leverage continues to expand.

The only way to climb out of a debt-deflationary depression is to pay down debt or to write it off. Levering up only delays the inevitable. Unfortunately Americans, and lately the Obama administration, have shown absolutely no political will to do this. Republicans decry growing deficits, but do you ever hear them enumerate cuts they would make or taxes they would raise? Clearly our plan is to keep borrowing until our lenders cut us off.

Speaking of crashing equity…

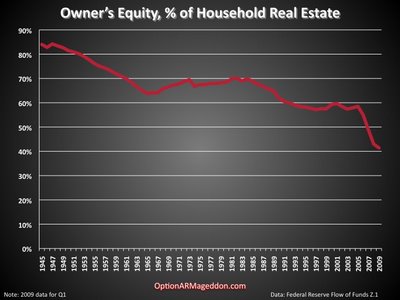

The last chart plots the amount of equity Americans have in their homes. This figure has been crashing as house prices fall while mortgage debt stays roughly constant. At the end of 2007 the figure was 49%, at the end of last year 43%. It now stands at 41.4%.

And as CR notes: “approximately 31% of households do not have a mortgage. So the 50+ million households with mortgages have far less than 41.4% equity.”

"The only way to climb out of a debt-induced depression is to pay down debt or to write it off. Levering up only delays the inevitable.Unfortunately Americans, and lately the Obama administration, have shown absolutely no political will to do this. Republicans decry growing deficits, but do you ever hear them enumerate cuts they would make? Clearly our plan is to keep borrowing until our lenders cut us off."

Of course. Between two bad choices, catastrophic deleveraging now with unforseeable consequences for US- and world economy and massive social disruptions in society or postponing this outcome into the future for the price of an increasing debt load, latter is being made. Japan's public debt to GDP ratio is almost 200%. The ratio for other countries is also higher than the one for US (about 70%?). Thus, way to go for United States.

rc

First, I haven't seen many claims that we would deleverage on aggregate, just that the private sector would… and that seems to be happening. At least public debt growth is not [yet] overwhelming private debt contraction at the rate Japan experienced (graph).

Second, adding up the numbers from table "D.2 Borrowing by Sector" suggests that total borrowing contracted at an annual rate of 255 billion in Q1, even when you include government debt. Yet this doesn't reconcile with "D.3 Debt Outstanding" which it seems you used. I can't find a definition of "borrowing" per D.2 — does anyone know how it differs from the change in debt outstanding?

There is a fundamental error in this post and some of the comments to it. It is the false equivalence between the debts of households, the debts of businesses, the debt of state governments, and the debts of a United States Government. Instead, as Alexander Hamilton understood, each of these debts has a particular character based on entity owing the debt, which the market understands if not the posters since each of these debts carry a different price and has a different market, with the U.S. debt being the cheapest. Debts owed by apermanent and enduring Government are paid as long as the will exists to pay them. However, an individual or household's debts is limited (or should be) by the income he earns and the value of the assets he aquires. Even with individuals, there is a distinction between debt incurred for a purpose likely to increase income (education) or acquire long term assets and that debt incurred for short term consumption (almost always bad). But all individuals die, and a prudent lender should not lend to someone beyond their ability to pay or what he or she will leave in their estate to cover the debts. With businesses credit viabilty depends on its size, management skills, and the price setting nature of the business (unique product vs. commodity). But all these conditions are transitory and hence these are also relatively temporal institutions that credit should be based on income and a conservative value of its assets. The individual states are more enduring as credit risks, although a dysfunctional local culture (California) can make creditors worry. Which brings me back to Hamilton. As Secretary of the Treasury he took not only the debts of the United States incurred by the Continental and Confederation Congresses, but persuaded Congress to assume the Revolutionary war debts of the states. He argued that the Union, with its power to tax, was perpetual and that as such creditors could have faith that these debts would be repaid.

In the current situation what is going on here is the gradual cleaning up of individual and corporate balance sheets, and the transfer of the debts that are not discharged or paid off to the state primarily to ameliorate the human hardship caused by the drop in consumption, and probably an eventual increase in the tax take by the Government to pay off these debts, a necessary result that is being driven, as Tim Duy states in his blog "Fed Watch,",by the "invisible hand" that compels U.S. consumption to decline to the point where our current accounts become balanced.

oh and awit Rolfe, it only gets better. Wait to LBOs raise a few more funds and pile on the debt. Wait till all those double and triple long-short indexes blow up retail investors. Wait till pensions get killed on OTC swaps they got into for portable alpha…wait, wait…

cheers,

Leo

Richard wrote:

"In the current situation what is going on here is the gradual cleaning up of individual and corporate balance sheets, and the transfer of the debts that are not discharged or paid off to the state primarily to ameliorate the human hardship caused by the drop in consumption, and probably an eventual increase in the tax take by the Government to pay off these debts,…"

This is an extremely optimistic scenario according to which the US-government will be able to slowly engineer the debt bubble away by taking over a large amount of the debt onto its balance sheet. Quite possible the rational of the actions by the government is carried by the believe they can both slowly dissolve the debt bubble and prevent a depression, maybe worse than the Great Depression, and massive social disruptions and other consequences, having economic growth instead generating enough tax income to pay off the debt. Richard apparently subscribes to this scenario.

Let's talk numbers. How much debt will be moved from private and corporate balance sheets to government's balance sheet to achieve this? 20 to 30 trillion US-dollars? Or how much? And what consequences will this have for the ambitious plans of the Obama administration?

@Richard said…"what is going on here is the gradual cleaning up of individual and corporate balance sheets, and the transfer of the debts that are not discharged or paid off to the state primarily to ameliorate the human hardship caused by the drop in consumption…"

That’s right, Richard. We surely wouldn’t want any of the Masters of the Universe to have to give up their new Gulfstream G650s, their yachts, their summer homes in Aspen, much less their penthouses overlooking Central Park, would we?

And Hamilton? What more can we say? He’s from the same school of thought as Geithner and Bernanke—anything and everything for the rich, and pass the tab to ordinary working Americans.

The debate over the compatability of wealth and democracy is as old as the republic. From the start, concern that the egalitarian-seeming United States of the late eighteenth and early nineteenth centuries might develop wealth concentrations to match Europe's was a worry for many but also the guarded hope of an important few.

Alexander Hamilton, who favored both a financial class and an aristocracy, would have cherished the possibility of such an elite…

On becoming the first secretary of the treasury in 1789, Alexander Hamilton presented Congress with a bold economic program. To secure the creditworthiness of the new U.S. government, he called for redeeming at full face value not only U.S. wartime debts and certificates but the debt instruments of the various states. Many of the later had been bought up by speculators at very low prices. The second proposal was to establish in Philadelphia a national depository to be called the Bank of the United States, which would also facilitate the financial operations of the U.S. Treasury…

“Assumption and funding,” as Hamilton’s debt redemption provisions were called, provided the nation’s first cornucopia for financial speculators… From New Hampshire to South Carolina, cliques of wealthy Federalist supporters and officeholders, using traveling agents, had bought as many of the federal and state debt instruments as possible at cut-rate prices…. Lesser profit –seekers prowled through the backcountry, buying up old, unpaid certificates from veterans, widows, and storekeepers. A group of New York investors, given early information on Hamilton’s plans in mid-1789 by his deputy, William Duer, collected for as little as ten cents on the dollar some $2.7 million worth of South Carolina, North Carolina, and Virginia state Revolutionary debt. This was about one-third of the three states’ total…

James Madison failed with his compromise to redeem at less than face value paper held by specualtive (rather than original) purchasers. Still, the whole arrangement was in doubt until Hamilton made a deal with Jefferson, who later admitted not understanding what was at stake…

Of the overall $40-$60 million disbursed by the federal treasury under the debt assumption and funding program, about half is though to have gone to speculators. To emphasize its enormity, $40 million would have been almost 15 percent of the estimated U.S. gross domestic product of 1790! …

Funded debt, to Hamilton, was an engine of state and even a "national blessing." He and his allies sought to create a private class of "money-men"…

(continued)

The mechanisms put in place from 1790 to 1792–the Bank of the United States, funded long-term U.S. debt, federal assumption of state and local debt, and the forerunner of the New York Stock Exchange–became the playground of the incipient speculator class… The first American wave of securities speculation came in New York and Philadelphia in 1791, as Bank of the United States shares climb from $25 to $60, peaking at $170 in some three months. Similar speculation developed in the new U.S. bond issues, and when the bubble around Bank of the United States and other bank stocks popped, Hamilton ordered the treasury into the market in March and April of 1792 to support the price of government debt. His allies sighed with relief over what by some accounts was the first U.S. financial bailout.

These financial wranglings…helped split Washington’s original partyless government into the factions that became the Federalists and Democratic-Republicans. Jefferson, who resigned as Washington’s secretary of state in 1793, disparaged the Federalists as Tories, aristocrats, merchants who traded on British capital and “papermen” (bondholders, financiers, and investors); and his allies rose to the attack….

By 1794, “speculator” became an effective political epithet. Massachusetts voters were asked to exclude them from the new legislature. Candidates in North Carolina were told to swear that they had never been interested in the funding system. “Archimedes,” in Philadelphia’s National Gazette, mocked the would-be aristocrats: Speculators, he said, ought to be classified by wealth and awarded titles (such as the Order of the Leech, and “Their Rapacities”).

However many treasury payments wound up in prominent Federalists’ pockets, the party paid a steep price. Hamilton’s use of government banking and debt to reward a wealthy elite trespassed on the Revolutionary credo, as did the excise taxes so anathemous to farmers…

While Jefferson’s now-victorious party, the Democratic-Republicans, consisted of a more homespun and egalitarian crowd, during the new century’s first decade they overwhelmed the Federalists in part through equally partisan politics. These began with the National Debt Reduction Act of 1802 to repeal all internal taxes, take on no new debt, and reduce the existing national debt through tariff receipts. Bankers were glum, while Democratic-Republican farmers and frontiersmen cheered.

~

–Kevin Phillips, Wealth and Democracy

Richard

While what you say makes sense as an option these despotic "leaders" have and seem to be implementing, it is an absolute disaster. Transferring private debt to gov't, to be paid later via taxes applied to all citizens, is a pathetic, immoral act.

The core problem is, and was, the structure of the monetary system. A fiat money, fractional reserve system (highly leveraged) is a tool of interventionists and despots. These systems, combined with large gov'ts financed by taxation systems that are complex and confiscatory, are designed to impoverish the middle/working class. Like all interventions, in the end, this will blow up and cause the desitution of the majority of the population.

Regardless of what happens in the next month or two, look for the bond market to start spanking the Fed really hard no later than the fall..imagine what the upcoming major bond market bear will do to the masses of debt slaves out there..then, let the real de-leveraging begin..the best/fastest, but ugliest way, to overcome this crisis is to reduce debt in a major way – and what better way is there than a major drop in most bond prices – inflation or deflation (more likely in next 6 mts)?

JO

This excludes over $4 trillion owed to the Social Security "trust fund." More importantly, it excludes $60 trillion of unfunded future liabilities for Medicare and Social Security.

Trust Fund Assets, 2007 & 2008

Size of unfunded liabilities derive from assumptions made about, well, future conditions – dropping the assumed [75 yr or 'infinite'] future into the present while not relating the amount to an also assumed GDP for the same period(s) is a MSM scare tactic.

Saying that, yes, no doubt the U.S. healthcare system requires drastic improvement, something unlikely to occur so long as private insurers have their hands in the pot.

Another gem from Naked Capitalism …

Yep, we are mired in debt but unlike the 30's we aren't the worlds biggest oil producer, industrial power and creditor in the world.

And unlike the 30's the demographics are getting worse with huge entitlement spending looming on the near horizon …

We are insolvent on an aggregate basis and worse, we owe trillions in debt to foreign investors … Somethings got to give …

Good post by Rolfe.

The moral flaw in Richard's comment is encapsulated here: "..transfer of the debts that are not discharged or paid off to the state..".

The people who obtain this relief are those who borrowed too much, became bankrupt, lived beyond their means, also imprudent lenders to these imprudent people, and further the financial intermediaries who profited hugely from securitization of aforesaid imprudent loans.

The people who PAY this relief are all those who were prudent, saved, and managed their affairs properly.

This transfer of debt from private to state hands is nothing short of the "Crime of the Century" (hat-tip Supertramp!).

This rewarding of financial imprudence harms the social fabric of the country for decades to come.

I don't know why I bother but Richard is right. Some of the debt statistics are incomplete or out of context. Richard is advocating a mainstream economic position — namely, during a recession, apply fiscal and monetary stimulus.

Anyway, the debt graph is obviously in nominal rather than constant dollars. At the very least, it should be plotted on a log scale.

As far as personal debt, this is the ratio of personal debt to disposable income. It has edged up 1% for renters and 3% for homeowners since 1980. http://www.federalreserve.gov/releases/housedebt/default.htm

People can disagree with my characterization of the figures, but I don't see anything dramatic. I was surprised that the ratios hadn't increased significantly, given the expansion of credit availability.

Here is a nice graph from Brad Setser http://www.calculatedriskblog.com/2009/06/setser-who-bought-all-recently-issued.html

http://www.calculatedriskblog.com/2009/06/setser-who-bought-all-recently-issued.html

"… the Fed’s flow of funds data leaves little doubt that — at least during the first quarter — the rise in public borrowing was fully offset by a fall in private borrowing."

http://blogs.cfr.org/geographics/2009/06/12/offsetting-borrowing/

"Overall borrowing has not changed significantly"

I do agree with the last comment in the post — namely that personal balance sheets were crushed by the housing meltdown.

The rise in the overall debt ratio increase is largely due to a fall in the denominator. Grow the denominator and you improve the ratio.

Personally, I am quite happy with offsetting government and personal borrowing. Without it, we would have surely ended up with a deflationary spiral. In which case the ratio would be much, much higher.

Thank you!

And I just found an interesting post, http://pie-ing.blogspot.com/