Served by Jesse of Le Café Américain

Some controversy was triggered over a line of questioning this morning during Ben Bernanke’s testimony before Congress, as reported on some of the top financial blog sites Zerohedge and Naked Capitalism. We read them both daily and are often envious of the depth and breadth of their expertise.

Congressman Grayson’s line of questioning implied that the Fed was providing loans to foreign companies. Others wondered if the Fed was engaged in propping up the dollar by forcing central banks to buy US dollars in these swaps.

During the current credit crisis the Fed first reacted to market conditions and requests from central banks starting in September 2008 by expanding its currency swap lines with the European Central Bank and the Swiss National Bank, and creating new swaps with the Bank of Japan, Bank of England and the Bank of Canada for $180 billion.

What Is a Currency Swap?

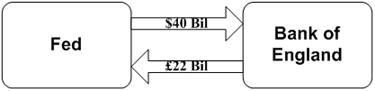

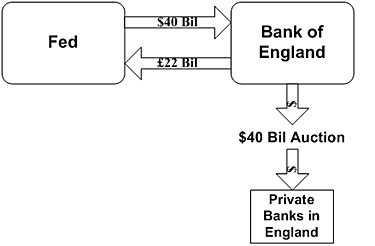

A currency swap is a transaction where two parties exchange an agreed amount of two currencies while at the same time agreeing to unwind the currency exchange at a future date.

The currency swap is executed at a given exchange rate, generally the market rate, in order to provide liquidity in a specific currency to a specific banking jurisdiction. Here is an example of a swap that was conducted with the BOE at the rate of 1.8173.

The reason for the swap is to provide the BOE with additional US dollars to meet the short term needs of its client banks, and the dollar demands of their customers.

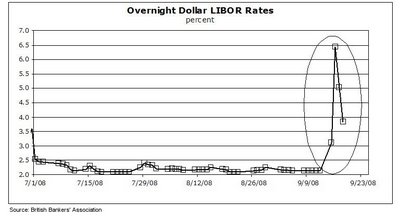

At the time in September private banks were reluctant to lend to one another or engage in private swaps because of a prevailing fear in the market of potential bank insolvencies and the counter party risk which that entails.

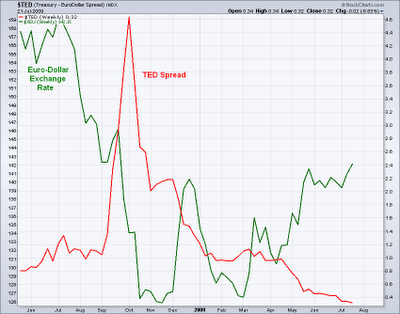

At the same time there was a ‘run’ on dollar assets in Europe as customer sought to liquidate their investments denominated in US dollars but held by foreign banks. Some of these ironically enough were collateralized debt obligations that had been sold to the foreign banks and their customer by Wall Street. TED Spread Soars to New Record – Symptom of the Eurodollar Squeeze?

Did Wall Street set up their foreign counterparts, and then squeeze them mercilessly when they needed dollar assets? Probably giving the Street too much credit for planning. It is more likely a case of simple misrepresentation, followed by fear when the misrepresentation had been discovered.

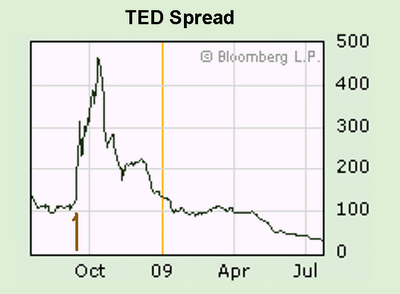

The Ted Spread is the difference between the US Dollar LIBOR and the 3 Month US T Bill. It intends to measure the difference in ‘price’ between dollars in the US and dollars overseas. Nine out of ten people might notice a sharp spike in this spread as the credit crisis hit full fury in September 2008. Demystifying the TED Spread

As one can easily see, the TED Spread began to decline after the Fed and the Central Banks began to provide dollar liquidity where it was required.

There is concern amongst some that the Fed was engaging in these currency swaps to prop the dollar, as expressed in the US Dollar Index (Dx). There was no need to do these swaps to support the dollar, as the US dollar was already enjoying a strengthening as the ‘flight to safety’ currency. The original September tranche created by the Fed grew to 500 billion dollar swaps line as the Central Banks sought to prevent a currency crisis, an artificial dollar shortage in what amounted to a run on foreign banks for dollar holdings, as the credit crunch hit with its full fury.

The DX index is a somewhat imperfect gauge of the dollar value as it is heavily weighted to the Euro and Yen, and has a no exposure to some of the most important developing industrial powers.

More importantly, here is the Euro – Dollar Exchange Rate. Again, the ‘jitters’ over the state of the European Banking System were causing a steep decline early on and a flight to safety in the US Dollar. The Dollar Rally and the Deflationary Imbalances in the US Dollar Holdings of Overseas Banks

Finally, Ben Bernanke is no Alan Greenspan in that his deportment in front of Congress is rarely calm, but I did not find any particular ‘tells’ in his responses to Mr. Grayson beyond his usual skittishness and unease in the public spotlight.

Quite frankly, my initial take was that Ben was incredulous that the Congressman was asking such naive questions, particularly when the congressman started asking about the source of the Fed’s authority to conduct foreign exchange operations.

Personally I wondered if it was a ‘red herring’ served up by a friendly Democrat. There are much more penetrating questions to be asked of Mr. Bernanke and his Fed, and these are not among them.

The concern about the swaps seemed a bit misplaced and confused. But the obvious opacity of the Fed and its operations does underscore the political naivete in promoting the Federal Reserve as the uber regulator of the system. One wonders who is so politically tone deaf on the President’s economic staff? Or is Larry Summers really that arrogant to think that he can be the next Fed chief and chairman of the SEC all rolled into one? Considering Larry’s past performances, the answer may very well be yes.

Postscript: The emails show that there are those who observe, somewhat correctly, that if the Fed had done nothing to alleviate the eurodollar short squeeze then the dollar would have most likely appreciated in value, perhaps moreso than it had done, for a brief but happy moment for the dollar bulls.

The proponents of this solution do overlook the problem that the private markets for overnight loans had utterly seized, and to not provide central bank liquidity in this situation would have most likely have caused a cascade of significant failures, and a backlash from the rest of the world that would have been equally impressive.

There is the issue, raised rather stridently by some of the central banks, that it was the US financial institutions and ratings agencies that had caused the problem in the first place by selling large amounts of fraudulently rated assets to trusting private bankers around the world. You know, those funny foreign folks who the US, as a net debtor with debt load growing mightily, is going to continue to ask to buy its debt and financial instruments now and for the forseeable future, and continue to support the dollar as a reserve currency.

It reminds me of a story an old boss of mine told me about his philosophy of business. He said, “I’m Irish, and the way the Irish compete is to say, Let’s race, and then punch the other guy in the face, and start running. What do you think of that?”

My answer was, “I’m part Italian, and my advice is if you do that to an Italian, don’t stop running at the finish line.”

And so it goes.

Yves, I do think Congressional naivety is a huge part of the problem. It genuinely appears that none of them have any idea on how the banking system really works. Fortunately it seems that some of their staffers lurk here on occasion though.

Tanta over at CR managed to bottle her essence into her UberNerd series before time ran out. Maybe you should spoon feed them a set of UberBanker cliff notes. I can't think of many others with the knowledge, patience, clarity, and brevity needed to get the point across.

Or you could just comp each one of the dopes in Congress the rough draft of your book… If they thought it was an elusive leak they might actually read it.

Gee, and here I thought the Fed was just trying to manipulate (force) interest rates low where banks can loan at higher rates to stay afloat then pay back at the reduced rates.

We have inflation they just don't want you to notice it. The debt outstanding begs for more inflation.

Don't assume that the Congressmen want to know, or even care.

Their priorities are often straightfoward and quite mundane: collect donations, deliver favors and legislations to those who donate, weave a credible story to cover same.

Cynical does even begin to cover it. There are a few notable exceptions, but the emphasis is on 'few.'

@Jesse: Nice analysis, although you may be too objective :-)

The question is Ben Bernanke is now the Jesus Christ of Finance. He can raise financial entities from dead like Jesus Christ did to Lazarus But as a mathematician and a discipline central banker, he must also kill some defunct financial institutions in the near future, when the time comes (let say after January 2010)

The question is will he be able to act as Shiva of Finance ?

Or the Jews will kill him ?

That's why his mind must be made of steel.

It reminds me of a story an old boss of mine told me about his philosophy of business. He said, "I'm Irish, and the way the Irish compete is to say, Let's race, and then punch the other guy in the face, and start running. What do you think of that?"

My answer was, "I'm part Italian, and my advice is if you do that to an Italian, don't stop running at the finish line."

And so it goes.

I'm a Vietnamese, and in my known previous life, the way the American do business is to kill civilians of other countries like Germany, Japan, and Vietnam. Let's rolls.

It didn't change that much lately. Sadly, they don't read their book so I have to do that for them.

that was just a wonderful primer on the TED and currency swaps. I have been reading economics blogs for years and I had never really understood how to look at LIBOR.

Very well done

Of all the things that were done last fall the CB swaps is the least onerous. These swap lines have been in place for years. They were used when they were needed. There was a liquidity panic in the E$ market. The CB's used the swaps exactly as they were intended to be used.

There were no currency conversions as a result of this by CB's. I say it had no significant currency impact. It did not change the supply demand equation.

The bulk has of this has been unwound at this time. The buck is still strong on a relative basis.

-Mr. Krastings

Just because swap lines have been in place for years doesn't make a bit of difference. If I rob a bank once a year for 20 years straight, am I justified because I haven't been caught? Swap lines are in place to circumvent currency controls to prevent currency runs, but they do so by withholding information. So, if the market cannot discpline countries to maintain credit worthy policies, who or what can?

Secondarily, do you ever think they could use those swap lines to monetize the other parties debt?

I'm not sure how you came to the conclusion that CB's used the swap lines as intended. How would you even know how they were used?

Your statements are troubling at best.

Jesse:

The true problem here is what collateral the Fed was taking to support the swaps. It has to support its balance sheet to minimize risk. The size was so large that it exposed the Fed to great risk. We are in time a systematic crises, so who is to say a Central Bank of another country may not be able to live up to its obligations.

Anonymous,

I don't think a failure of the Central Bank of Europe or Switzerland, or any of the others named, represents a significant counter party risk in this transaction. Not at all at this time.

J

Earlier Anonymous,

Certainly the Fed was trying to keep short term rates from spiking…in Europe.

That is what the TED spread is all about.

They are performing other more obvious programs to manage rates.

J

Anon. I stick with my view. These were emergency steps taking at extraordinary times. That is what the swap lines were intended for. Slow down a panic. The last time the swap line were opened was after 911.

Jesse is on point. If during that time the CB of France Germany UK and Japan went under it would not have mattered. Under those conditions there would have been nothing left anyway. Therefore an easy choice.

As has been reported these temporary steps have largely been reduced. I love to find fault with all of this. In this case I can't.

Quite frankly, my initial take was that Ben was incredulous that the Congressman was asking such naive questions, particularly when the congressman started asking about the source of the Fed's authority to conduct foreign exchange operations.

————————————-

Why is that a naive question? Swaplines are not exactly mentioned in the Federal Reserve Act of 1913, nor are such things as TALF, Maiden Lane, etc.

The quo warranto (by what right) question is thus a valid one to ask.

IMHO, there is no authorization in the FRA for this.

http://zeropointfield.wordpress.com/2009/07/17/the-legality-of-the-federal-reserve-system/

-Mr. Krastings

I find it comforting that you never addressed my points. The emergency steps at extraordinary times didn't seem to apply to other currency crises (Asia, Russia, Argentina), but I guess they weren't high enough on your list to matter.

You can stick by your statements all day because I wasn't trying to convince you in my earlier post. The FED doesn't have any approval to extend unauthorized sovereign credit to CB's and then justify it by saying they are "calming markets". Why have an interbank market if they can trade outside of it? Congress should audit the FED immediately. They might find some other criminalities hiding behind "Independence".

Who needs the Fed, when there's Goldman Sachs? Maybe GS should be contracted out as the Financial Regulator.;-)