Dear readers, as much as the fact set in the headline sounds bad, we need to parse things a bit to calibrate properly. IMHO, the fact that the Fed used an attorney that also served Goldman is symptomatic of how concentrated the high end of finance has become and how incestuous all the relationships are rather than evidence of a misdeed (mind you, I DO consider the failure to disclose to be not kosher, but more on that below).

First, to the underlying issue. From Little Sis:

….here is an incredible conflict of interest at the heart of the AIG-New York Fed dealings: the very same New York Fed lawyers who pushed AIG to withhold the names of counterparties also advised Goldman Sachs on large deals in 2008.

Goldman Sachs was one of AIG’s largest counterparties, and received a controversial 100% payout on its swap contracts with the firm.

The attorneys worked for the firm Davis, Polk, & Wardwell, which represents the New York Fed. Davis Polk attorney Peter Bazos pushed AIG to withhold agreements that contained the names of key counterparties (including Goldman Sachs). From the Wall Street Journal:

In a Nov. 25 email, Peter Bazos, an attorney at law firm Davis Polk & Wardwell, which represents the New York Fed, wrote that certain agreements “do not need to be filed.” One agreement contained the names of banks that received payouts from AIG. A Davis Polk spokesman declined to comment.

Bazos had advised on a Goldman Sachs deal the previous month, in October 2008 – a $12 billion stock offering from GE.

Davis Polk lawyer Ethan T James, who had advised on another Goldman deal that closed in May 2008, asked AIG to delete information on routine disclosure statements about the $10 billion in swaps. From the New York Times:

The Fed’s lawyer, Ethan T. James, of Davis Polk & Wardwell, deleted all references to the $10 billion in swaps that could not be torn up. He wrote in the margin: “There should be no discussion or suggestion that A.I.G. and the N.Y. Fed are working to structure anything else at this point.”

Davis Polk isn’t exactly Goldman’s favorite law firm — many more deals show up on the firm’s site for Citigroup, JP Morgan, Morgan Stanley, and other banks (using unscientific google searches) — so it’s somewhat surprising that two Davis Polk attorneys so recently and closely linked to Goldman deals would show up in these email exchanges.

Yves here. Yes, it is true that Sullivan & Cromwell is Goldman’s preferred firm (the two are almost joined at the hip), and Davis Polk is more strongly associated with the Morgan houses, but as much as this looks bad, correlation does not imply causation.

Let’s consider some facts. There is substantial bias in New York, and I stress bias, towards using the big name fancy firms. The fact is that the securities regs are only 1/4 to 1/5 the length of FDA regs, and are very well settled. In the stone ages, when I was at Sumitomo, I used Covington & Burling, a Washington, DC firm, rather than one in New York because I knew I’d get more attention from experienced partners than at any of the big name NY players. Third world investment bankers don’t command the legal fees to get access to the top team (yes, the vast majority of legal work at big firms is done by two to seven year associates, but on deals, you DO want seasoned partners involved in the negotiations).

So the Fed is probably very much a believer in the law firm status game, gotta have big players, rather than a horses-for-courses stand. And there are good firms (but not high status by New York standards) that do not represent the big banks. This may no longer be true, but as of a couple of years ago, Venable, a DC firm, stayed away from banking clients (it preferred to represent people suing them) and still had a good SEC practice (any big corp will need some securities law advice from time to time, and you also have to be pretty good to man a decent litigation practice in a regulated area).

So if the conflict issue was perceived to be a problem, there were solutions. But the course of least resistance was no doubt perceived to be to disclose the conflict (as if it needs to be disclosed, the Fed no doubt is well aware of the fact that the big NY law firms have the Street as their main meal tickets) and get a waiver.

The second issue is that good lawyers aren’t passive about the law. They try to find a way through the thickets of the law to do what their client wants done. So the Fed doesn’t want the payout disclosed (or the Davis Polk lawyers point out this could be embarrassing and the Fed agrees?) Wellie, we seem to have an easy rationale, which the NY Times parroted:

Others disagreed, saying that bank and insurance regulators normally keep their discussions with struggling financial institutions private, to keep from inciting runs. There has always been tension, one securities lawyer said, between banking regulators, who want to resolve problems behind closed doors, and the federal securities laws, which compel disclosure.

Yves here. Ahem. You can see how specious this argument is. AIG was ALREADY backstopped, as was every bloody bank feeding at the 100% payout trough (even though some of the Eurobanks like Deutsche Bank have not gotten equity injections, they have benefitted from super low interest rates and the other fancy bank welfare programs devised by the Fed and other central banks). And the usual context is that the financial firm is in serious negotiations with its regulator or has been moved to a risk designation that says it is deteriorating. This was not the case with any of these firms; this was not a matter of current and prospective credit quality, but of how money flowed from the Fed through AIG to the banks. This failure to disclose most assuredly had NOTHING to do with the precedents invoked.

So yes it stinks, but the Davis Polk team acted in a predictable manner. It’s pretty likely just about any big New York securities firm would have taken the same posture, recent dealings with Goldman or not. So this situation illustrates a general problem, that of the regulators relying on advisors who are strongly aligned with the industry, rather than broader social interests. But the Fed has consistently acted as a backer and enabler of the perps; why should this particular incident be any surprise?

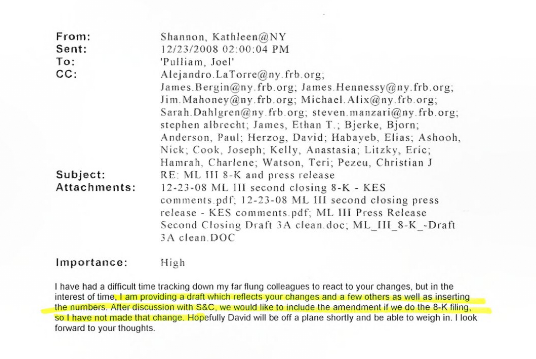

Update: Alert reader and occasional guest blogger Richard Smith points out that Sullivan & Cromwell did have a hand in the AIG press release….as counsel to AIG (see p. 9 at this URL for the other e-mails):

So corruption is predictable. The Law is something that needs to be overcome, cheated, finagled and ignored, and that is to be expected? That is the norm? If that is the norm for TPTB, then it is the norm for me. Is Law is meaningless if I hire the right law firm? Then so be it, I no longer have faith in the Law because it does not apply to me.

What if they weren’t worried about stigma to AIG but about stigma to the downstream recipients of the 100% payouts (SocGen, Deutsche, GS, …).

In other words, maybe they worried that people would say “the only way they would authorize 100% payouts is if the recipients needed the payouts to survive”? If they kept the list private it avoids runs on or doubts about SocGen et al.

That is probably what they would argue, but this debate took place in December 2008, when the acute phase of the crisis was past and the various central banks had deployed massive support facilities. It was clear then that government had made a policy decision not to let a major bank fail. At that point, Citi was the only bank still under discussion as being wobbly, and it was not a big beneficiary of this operation.

And the Fed has no business re worrying about disclosures re Eurobanks, and I am highly confident they did not have any communications with or requests from foreign bank regulators not to disclose.

But at this point, with no real effort underway for systemic financial reforms or fixing the TBTF banks, the whole need to limit the amount of damaging information to “protect” all of us little people from the size of the collapse starts to look more like nothing but a cover-up of the bailout.

Completely unrelated but amusing finance link: http://theplaylist.blogspot.com/2010/01/shia-labeouf-goes-method-for-wall.html

The conflict of interest issue gets taken care of by disclosure and waiver. The choice of lawyers is a matter of who can be brought up to speed quickly enough and who does the client trust to get the deal done properly. The likelihood that that kind of lawyer would not have been involved in other deals with other companies is small.

Bernanke, Paulson and Geithner were consistent in trying to prevent disclosure of the counterparties that got paid in full by AIG. (SIGTARP criticized them for their lack of transparency.) So it makes sense that the Fed’s lawyers would delete that information from the disclosure, if they could do so without violating any laws. The question is why were BP & G so reluctant to make full disclosure. The least likely answer is that they were trying to hide the amount of support to GS or Citi. The amount of support from the counterparty payments was negligible compared to all of the other types of support given (e.g. cheap guaranties, zero interest rates etc.)

Rita,

You argue “least likely” and fail to make the case that other reasons were more likely. The only defensible reason, that this was to protect the institutions involved, is clearly rubbish. Please advise as to what other reasons might be operative. I don’t see any.

And you are missing the significance. First, those other salvage operations of the Fed are either part of their traditional operations or were well disclosed, and available to all market participants. The taking out of counterparties at 100% favored some over other, particularly foreign banks.

Moreover, this was a FAR more potent support of support (in that these positions had been written down, a payout at par would be shown as profit and act as an equity injection. The taxpayer at least got interest and something of an equity participation in TARP equity injections. Why no restrictions (the TARP did have some limp-wristed ones), no interest, no upside?

Moreover, one can argue that the recipient banks’ financials were misleading without the disclosure that they were recipients of transfers from the Fed that they got to count as profit.

I think “least likely” because all major financial institutions at the time were in distress – some less so than others. The government LOC to AIG was made so that AIG could meet its obligations, many of which involved these major financial institutions. The disclosure would have only confirmed what was apparent – that the government was taking extraordinary actions to support the global financial system.

I am not sure why you say that the taking out of the counterparties favored some over others. SIGTARP found that those counterparty payments were not preferential i.e. financial institutions received what they were legally entitled to. SIGTARP found that perhaps the Fed could have negotiated a haircut. Even with that haircut, GS would have done ok especially with all of the other governmental subsidies. Perhaps all major financial institutions’ disclosures for 2008 and 2009 should contain a bolded footnote to the extent that without government support, the financials would look horrible.

While we are not aware of any government strings that went along with the counterparty payouts, we can certainly look back and think that the strings that were attached to the other more obvious government subsidies were rather puny.

In times of financial distress, the Fed and other financial regulatory agencies make assessments of which institutions are goners and which institutions are survivors. That they take actions to bolster the survivors and take no action to bolster the losers is not a surprize.

I don’t know why the government was so adamant about non-disclosure. I just don’t think it was done solely to protect GS or Citi for some nefarious reason.

Yves, while I appreciate your effort to consider the broader (sociological, if you will) context of all this, it doesn’t change the facts — which stink to high heaven.

Here’s what I posted on the NYT Dealbook site:

First Goldman loads AIG up with toxic mortgage default swaps that Goldman was betting would fail and that AIG would be forced to pony up collateral for as the housing market tanked. When AIG couldn’t pony up, Hanky and Bernanke took U.S. taxpayer money and bailed out AIG, which used to pay off Goldman and other counter parties.

Then the NY Fed, headed by Timmy The Tax Cheat, tells the bankrupt AIG to shut up about the payoff at 100 cents on the dollar to the counter parties — under advice of counsel, none other than the same Davis Polk lawyers who advised “we so God’s work” Goldman Sachs.

Does it get any more corrupt (in the legal as well as ethical sense) than this?!! Crony capitalism rules. If Obama doesn’t dump Timmy The Tax Cheat, the stench from this is going to cling to his administration.

Justica,

I have ranted about this AIG transfers elsewhere. This post is also the antithesis of a sympathetic treatment. Demonstrating some knowledge of the terrain is not the same as an endorsement. The post goes about in a systematic way to dismiss the likely retorts of Davis Polk and the Fed. It also chides the NYT for running, without any critical commentary, the first line defense (“oh regulators sometimes keep details hush hush to protect the guilty but about to fail”) as a ridiculous argument.

Getting upset about secondary issues, IMHO, makes it easier to lose sight of the big matters. And being angry about everything destroys cred. It’s then easy to dismiss the source as a hysteric who uses howitzers on anthills.

Surely, if a bank was worried about a run, it would be beneficial for the public to become aware that the Fed/Treasury were backstopping the payouts to the counterparties, lest those counterparties go under in a run. Runs stop once the government steps in —

that’s the whole point of stepping in. So it cannot be

for FEAR OF A RUN that it was kept hidden.

If anything, the lack of transparency increased

the odds of further panic since no one knew who was

solvent. For all we know, those who did know TRADED

on that private knowledge that certain firms were already

being bailed out.

I think the concern was that there would’ve been a

political backlash if this information was public. And

as proof, I offer the backlash that’s resulting from it,

now that it’s leaking out.

Why do they need lawyers? They are operating so far out of the bounds of anything legal that they can do what ever they want. Ask Ben.

Why do they have to bring outside council in on this matter at all? Was inside council not cooperating? I can’t believe that the NY fed doesn’t have a few lawyers running around, or were they even embarrassed with putting their name on this mess.

The only reason to not disclose is found in the motivation to hide. Thus, I conclude that the Fed knew full well that its support of AIG was probably illegal and in fact contrary to over 200 years of established contract law.

In summary, it is very apparent that AIG was assisted in order to preserve the solvency of the counterparties to its derivatives contracts. The imbeded rationale for that support is that the counterparties were designated ‘primary dealer’ banks whose existance was, and is, deemed necessary to support the Treasury Department’s financing of government operations.

The list of ‘primary dealer’ banks was once greater that forty. Today, it numbers fewer than 20. This concentration of authorized preferential trading position is what holds the regulatory authorities captive. It is difficult to bring to heal the very group that you must rely upon to absorb the debt that must be placed. Bear in mind that this is no small matter in that you are concetrating the ability of the banking oligopoly to create credit money. Enlarging the list of ‘primary dealer’ institutions is not an out of the box idea. The reduced number of ‘primary dealer’ banks serves no economic purpose and carries with it all of the negative aspects of oligopoly.

Ignore the lawyers, they are a side show of limited importance. The issue is: What was done; Why; and, What would have been the alternative. What should have occurred is that AIG should have failed and then the dominoes should have fallen as well. That would have led to a very severe collapse of the credit markets and the breakup of a number of very large institutions that were and are, in fact, of such size as being beyond reasonable internal control.

That is a very interesting analysis. O, I can’t keep track of all the blogs I read, (?Jess’s Cafe Americain – Tim Duy’s Fed Watch – link from Zero Hedge???) but someone did some math and certainly provided grist for the idea that shenanigans are going on in the selling of Treasuries by the Fed, and part of this is the scheme of who is involved in the scam… uh, er, I mean, transaction.

I think this idea of the “primary dealer banks” as the rationale for some of the actions of the Feds seems pretty plausible to me.