By Richard Alford, a former economist at the New York Fed. Since then, he has worked in the financial industry as a trading floor economist and strategist on both the sell side and the buy side.

Monetary policy is center stage as the Fed pursues highly accommodative policies in order to generate a recovery and rebuild the financial system. However, some market participants are questioning the Fed’s ability and willingness to exit the current highly accommodative stance in a timely manner. Unfortunately, the market skeptics have history on their side.

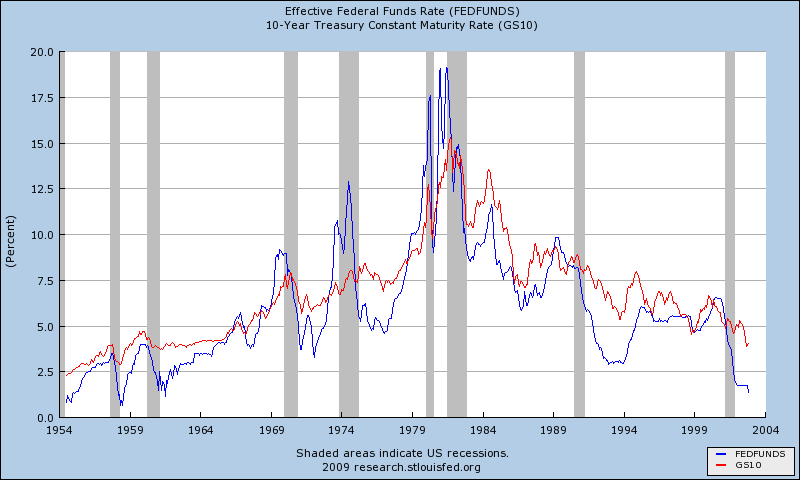

Three important points about the Fed’s ability and willingness to adjust policy in a timely fashion can be gleaned from the chart (Courtesy of the St. Louis Fed) of the Fed Funds rate and the 10 year (constant maturity) Treasury yield with recessions indicated by the vertical gray bars.

Point #1

Prior to the recession that started in 1980, the Fed was still raising the Fed funds target at or close to the cycle peaks (left side of the gray bars). Given the lags (“long and variable”) inherent in monetary policy, it appears that the Fed tightened too much and for too long.

Point #2

Prior to the trough of 1980, the Fed was still cutting rates at or past the cycle troughs (right side of vertical grey bars). Given the lags (“long and variable”) inherent in monetary policy, it appears that the Fed eased too much and for too long.

Point #3

For the period prior to 1980, the amplitude of the interest rate cycles was getting progressively larger.

Lessons Learned

Given that the Fed targeted the Fed funds rate during the period (till October 1979), it is clear that the Fed policy, centered on targeting the Fed funds rate, contributed to progressively larger swings- anti-dampened cycles- in the Fed funds rate, 10 year yields and presumably contributed to progressively larger cyclical swings in real economic activity and inflation. (This type of phenomenon -over correction due to lagged responses- is referred to as “instrument instability”). The Fed was aware of this in the early 1990s and set about trying to prevent a recurrence.

In Chapter 1 of Blinder’s 1997 “Central Banking In Theory and Practice”, he argues that in the early 1990s, the Fed decided that it had to move preemptively to dampen cycles. Blinder cites the preemptive tightening cycle that began in February 1994 and the subsequent realization of a “soft landing” as supporting the view that preemptive policy is required to dampen cycles and produce soft landings.

While Blinder did not mention it, the first step to end the pattern of “too much too long” occurred earlier.

In 1992, the Fed stopped easing before the Fed funds rate became negative in real terms. The Fed funds rate had been negative at earlier cycle lows. The Fed stopped sooner and eased less than history had led many in the market to expect. The tightening in February 1994 was earlier than virtually anyone expected. The 300 basis points that the Fed tightened starting in February was also less than the average in earlier post-war cycles.

The Fed had adjusted. It moved preemptively and it moved by less than it did on average in earlier years. The changes are consistent with an effort to end the pro-cyclical aspect of monetary policy.

In “Central Banking In Theory and Practice”, Blinder also made a number of points about the challenges in designing and implementing monetary policy as well as a very brief summary of how he chose to address them when he was on the FOMC. He cited “lags” and “uncertainty” as two of the challenges in designing and implementing monetary policy.

Blinder pointed out that the lags require preemptive policy. Furthermore, he noted moving preemptively requires some faith in the forecast and the willingness to act when the future course of the economy or chosen target variables remains uncertain. Blinder characterized the alternative – responding to problems after they manifest themselves – rather derisively as a “putting out fires” strategy.

Given the uncertainties and the potential for instrument instability problems, Blinder argues that policymakers should adjust policy by less than they would if they were certain about exactly how policy worked. Over time, the policymakers could re-evaluate earlier policy decisions in light of new information. If the new information supports the original forecast, policymakers should further adjust policy in the direction initially indicated. If the new developments were unexpected, then policymakers should revise the forecast and their policy prescription. Again, they should adjust policy by less than they would have if they were certain about policy and future developments.

Lesson Forgotten?

What can be said about the current (post-1996) Fed? Again, the Fed appears locked in to a fire-fighting mode. It has not adjusted policy preemptively. It eased dramatically post the Tech bust in 2000. At the trough, Fed funds rate was negative once again. The Fed kept the Fed funds rate “too low for too long” while credit growth contributed to asset price bubbles, including the housing bubble, excessive leverage in the financial sector ultimately and the financial crisis of 2007.

However, it is difficult to argue that the Fed tightened too much for too long prior to the downturn that started in December 2007. The peak rate was in the neighborhood of the level that most version of the Taylor Rule associated with a “neutral” policy stance. While the Fed didn’t start to ease until 3 months before the cycle peak, it had ceased tightening 18 months before the peak.

Are rates too low now? Unfortunately, there isn’t a simple, straightforward answer to this simple question. Two possible paths of development must be explored in answering the question.

It is possible that short-term rates are not so low as to generate a normal recovery and maintain a pattern of anti-dampened cycles in interest rates, economic growth, etc. If that is the case, then the current Fed has solved the problem of instrument instability.

Unfortunately, it will have done so at the cost of a severe recession coupled with a crippling of monetary policy. It would also imply that at best that US will experience a Japan-like at-or-below trend recovery. In this case, while interest rates would not be “too low” in the sense that they will drive a pattern of progressively larger cycles, it is possible that they could lead to further distortions the capital markets and the re-distribution of income from savers to financial institutions, especially the TBTF institutions, which can safely lever up.

It is also possible that the current interest rate policy in conjunction with the unconventional monetary policy and the stimulative fiscal policy will contribute to a normal V-shaped recovery. Assuming that the current stance of monetary policy is appropriate and a normal recovery will take hold, the question remains will the current stimulative policy stance become too loose over time as it is pursued “too long.”

Given the current willingness to provide counter-cyclical fiscal stimulus and likely growth in the structural fiscal deficits, it seems that it would incumbent on the Fed to remove the monetary stimulus not only faster than it has in the past, but faster than it should have in the past.

However, the Fed is now committed to keeping rates low for an extended period of time. The Fed has signaled the market that it will not commence tightening until the economy has achieved a self-reinforcing recovery. The statement is aimed at reassuring the household and political sectors and may be supportive of asset prices. However, assuming a recovery and given the long and variable lags, it will have committed to remaining easy for too long-especially given the likely course of fiscal policy. It has also implicitly stated that it does not have sufficient faith in its own forecast to use it for policy purposes.

Consequently bouts of optimism about the recovery and the bias inherent in the Fed committing to keep short-term rates low are contributing to concerns that have been reflected in the fixed income, currency and commodities markets.

In response, the Fed is attempting to reassure the markets that it has the tools to drain the reserves that it has recently pumped in to the system. However, the markets’ concern has not been “does the Fed have the tools to drain the reserves”, but rather does the increasingly politicized Fed have the confidence, the will, the confidence in its forecast and the fortitude to take the politically unpopular step and begin to drain in a timely fashion. Fed officials assert that they will, but the open-ended commitment to maintain a highly accommodative stance for an extended period of time, i.e. until after the recovery is assured, strongly suggests that the Fed will again remain too loose for too long.

The current Fed has behaved much as the pre-Volcker Fed behaved and it has indicated that it intends to continue to do so. It is small wonder that many in the markets do not have confidence in this Fed?

Yves here. This is a very good summary and assessment, but it has one important omission. Alford praises the Fed’s “early and less” tightening in 1994. He also notes that the tightening was unexpected That’s an understatement. This was the first time credit derivatives were in use on a widespread basis (the bets were often embedded in bonds, so that folks like pension fund managers and insurance portfolio managers who weren’t allowed to use derivatives were nevertheless playing). And just about everyone had bet, often on a levered basis, that the Fed would continue to cut. The result was $1.5 trillion in losses, a bigger wipeout than the 1987 crash (but not a one-day event). There were also lots of hearing into derivatives, with the predictable lack of action.

That debacle led to the restoration of the old policy, plus asymmetrical responses: the Fed telegraphing well in advance any intention of raising rates, and then doing so cautiously, and being quick to ease.

Such analyses on fine-tuning monetary policy are sounding more and more absurd. Someday historians will look back on these desperate efforts at controlling complex systems with one-dimensional analysis and solution, and draw the not-unwarranted conclusion that this was an age of simpletons.

unirealist has hit the button. Read through Alford’s essay and see how many times he enters the premise …”if the fed’s forecasts prove right”…”or wrong”.

There is a pyramid of reasoning here in monetary policy that is balanced upside down on a single point. And yet people expect a central bank to achieve stability. Simpletons indeed.

Yeah like to see the Fed figure out how to stop yo yo traffic on the 405 PCH during peak. Every individual speeding up, then slowing down, speeding up, then slowing down, if only *every one* did intervals and the same speed….um equilibrium[?] the Economists fairy dust!

Barry Ritholz at Big Picture responds to Bernanke’s speech, which I have added below that I think shows that Chairman Bernanke still does not understand the operational imperatives of the market for a apparently secured investment with a respectable yield.

Steve Randy Waldman also has an excellent post on the dynamics of the bailout and the role of banks and fractional lending. Related to Ritholz’s point, he deals with the desire of all parties in the capitalist system to enjoy the benefits of investment/speculation while shifting risk to someone else. This goes back to the the birth of the modern corporation, which allowed gentleman adventurers to shift the risk of their speculation from their personal fortunes and limit it to the value of their investment, while shifting the remaining risk to the corporation’s creditors.

“When historical relationships are taken into account, it is difficult to ascribe the house price bubble either to monetary policy or to the broader macroeconomic environment.”

-Chairman Ben S. Bernanke, Federal Reserve

>

The buzz this morning seems to be all about Bernanke’s speech yesterday, defending Greenspan’s ultra-low rates, and lamenting the lack of regulation and poor supervision over mortgages:

• Lax Oversight Caused Crisis, Bernanke Says (NYT)

• Bernanke Says Regulation Came ‘Too Late’ to Curb Housing Bubble (Bloomberg)

• Fed Chief Edges Closer to Using Rates to Pop Bubbles (WSJ)

• Rate hikes not best way to burst bubbles: Bernanke (Reuters)

Unfortunately, it appears to me that the Fed Chief is defending his institution and the judgment of his immediate predecessor, rather than making an honest appraisal of what went wrong.

As I have argued in this space for nearly 2 years, one cannot fix what’s broken until there is a full understanding of what went wrong and how. In the case of systemic failure, a proper diagnosis requires a full understanding of more than what a healthy system should look like. It also requires recognition of all of the causative factors — what is significant, what is incidental, the elements that enabled other factors, the “but fors” that the crisis could not have occurred without.

What Bernanake seems to be overlooking in his exoneration of ultra-low rates was the impact they had on the world’s Bond managers — especially pension funds, large trusts and foundations. Subsequently, there was an enormous cascading effect of 1% Fed Funds rate on the demand for higher yielding instruments, like securitized mortgages (Yes, I laid all this out in the book).

An honest assessment of the crisis’ causation (and timeline) would look something like the following:

1. Ultra low interest rates led to a scramble for yield by fund managers;

2. Not coincidentally, there was a massive push into subprime lending by unregulated NONBANKS who existed solely to sell these mortgages to securitizers;

3. Since they were writing mortgages for sale (and had them only briefly) these nonbank lenders collapsed their lending standards in order to write more mortgages;

4. These poorly underwritten loans — essentially junk paper — was sold to Wall Street for securitization in huge numbers.

5. Massive ratings fraud of these securities by Fitch, Moody’s and S&P led to a rating of this junk as TripleAAA.

6. That investment grade rating of junk paper allowed those scrambling bond managers (see #1) to purchase higher yield paper that they would not otherwise have been able to.

7. Increased leverage of investment houses allowed a huge securitization manufacturng process; Some iBanks also purchased this paper in enormous numbers;

8. More leverage took place in the shadow derivatives market. That allowed firms like AIG to write $3 trillion in derivative exposure, much of it in mortgage and credit related areas.

9. Compensation packages in the financial sector were asymmetrical, where employees had huge upside but shareholders (and eventually taxpayers) had huge downside. This (logically) led to increasingly aggressive and risky activity.

10. Once home prices began to fall, all of the above fell apart.

If the Fed Chief wants to prevent this from occurring again, he should get a better graps on what actually happened . . .

sherparick1,

But you left off Ritholtz’ punch line, which I felt was the most important part (and also a point made by other commenters on this thread):

If the Fed Chief wants to avoid seeing this occur again, he needs to recognize that this was not a single factor event; rather, this was a complex event set off by numerous factors.

I think the world is approaching one of those sea change moments like the late 15th-early 16th centuries. That is when the West transitioned from Christian dogma to the Age of Reason. One of the things the Age of Reason gave us was Classical and Neoclassical economic theory.

Classical and Neoclassical economic theory are based upon incredibly simplistic, reductionist assumptions. And for someone like Bernanke, thoroughly indoctrinated in classical and neoclassical doctrines (think of him as being like the Pope), is there any surprise that he should be so simpleminded?

It was an instrument—the telescope—that dealt the final blow to two of Christianity’s two most cherished tenets: geocentricism and the flat Earth. It is worthwhile to note that, almost 100 years before Galileo’s introduction of the telescope to astronomy, philosophers and others pointed out the fallacies in Christian dogma. But the road to the present was hard and long. Irregularities were explained away with Ptolemy’s epicycles. It was unconscionable to question the dwelling place of angels and other spirits in the service of God the Creator, the unmoved mover living at the farthest boundary. Following a papal trial in which he was found vehemently suspect of heresy, Galileo was placed under house arrest and his movements restricted by the Pope.

It is my hope that the crafting of new instruments—such as that which allows us to peer into the inner workings of the human brain and measure fMRI in real time—will ring the death knell for classical and neoclassical economic theory. But this too will have been a hard and long road. Nietzsche, in the late 19th century, began challenging the gospels of biology and social science, the mystical nostalgia of classical economists. In mid-20th century Herbert Simon was the David who dared try slay the classical-neoclassical giant. There’s a growing chorus now—Etzioni, Mandelbrot, Taleb, Haidt, Sloan-Wilson, Turchin, Gintis, and many more—inveighing against the simplistic notions that underpin orthodox economic theory.

When and if the classical-neoclassical religion finally comes tumbling down, I wonder if we will look back upon it as we do with geocentricism and the flat earth, and wonder how so many fell for such nonsense for so long. Etzioni gives a great description of the basic building blocks upon which the entire classical-neoclassical edifice is built:

The Age of Reason advanced the image of a rational person, who chooses means on the basis of evidence and logic, free of the bondage of the superstition, prejudices, and biases that dominated early ages. Homo-economicus, rationalistic, isolated, and preoccupied with self-interest, is but one offspring of the Man of Reason; the offspring has a neo-classical psychological sibling. The sibling, too, is largely reactive, driven by inputs, is without personality, hedonistic and egotistic, a-social, devoid of affect (or emotions). Moreover, the sibling’s value judgments are locked away into a forgotten compartment.

–Amitai Etzioni, The Moral Dimension

I don’t believe Bernanke has a one dimensional view that oversimplifies reality or is overlooking the knock on effect the low rate policy had. He’s merely distracting his audience from the other poor policy decisions made by the Fed that contributed to the crisis .

His tactical focus at the moment is getting reappointed and expanding the powers of the Fed. He can’t speak to the other factors without jeapordizing it, so he accepts the risk of being labeled as a narrowly focused apologist to get the reappointment.

His argument that low rates didn’t cause the crisis is debatable but has some merit as its so difficult to refute. It also deflects attention from other Fed policy errors that contributed to the knock on effects from the low rate environment. It’s a persuasive point for the person whose main responsibility is overseeing monetary policy. It’s especially intimidating when used to convince (confuse)a bunch of senators who are looking for an oversimplified fix.

It’s pathetic though that he’d use the ‘it’s everyone elses fault the markets imploded’ defense. It indicates he’d use the same defense the next time even if the Fed was provided with additional powers. He’s not the right man for this job.

“instrument instability”

Imaginary instruments,

They’re so fucking hard to read,

It makes setting the policy,

So difficult indeed,

Ease it or squeeze it,

Everybody watch the fed,

Read their scam instruments,

As the world slowly drops dead,

Turn on the pumps,

Drain the reserves,

Call the fucking plumber,

Its all getting on my nerves,

Too low for too long,

Too much for too long,

Too loose for too long,

Its the voodoo magic song,

First you say you will,

And then you say you won’t,

And then you say you do,

And then you say don’t,

Strip away the voodoo,

And what do you really see,

Rich folks fucking poor folks,

Its as obvious as can be,

Too many people and not enough shit,

The wealthy elite control the money pit,

And while in your voodoo haze you dozed,

They snookered you again and the money pits been closed …

Deception is the strongest political force on the planet.

pretty good!

I bet the old Pink Floyd could put a tune to that.

At the Institute for Contemporary Analysis we have conducted numerous statistical regressions of instability among a wide variety of analytical methodologies — mostly after a few glasses of Cote du Rhone — and we found conclusively, with an r-squared of 1, that the single most “unstable instrument” of all is the one three inches behind the spectacles concocting the methodology in question.

We also found that PhD = “Probably has Dandruff”; MBA = “Mostly Beers and Alcohol” and CFA = “Can’t Fucking Analyze”. Ecce Homo, said Fred.

Speaking of Pink Floyd, let me remind you that no physicist has yet to come up with the math to describe what it’s like to pass through a black hole. But IMO, Pink Floyd has come up with the music to describe what this is like. Here’s Pink Floyd performing the first two parts of “Echoes” at Pompeii 37 years ago:

http://www.youtube.com/watch?v=J2hFZ8KnsSo

http://www.youtube.com/watch?v=5sein6WnbY0

Which leads me to say that Nima Arkani-Hamed is inarguably one of the brightest stars in the field of quantum gravity, including black hole physics:

http://en.wikipedia.org/wiki/Nima_Arkani-Hamed

So I’d like to think, though it’s only a dream of mine, that the next great Einstein will be of Persian descent. And considering the enormous amount of grief that Israel has recently given to Iran, it would tickle me pink for a Persian to have the honor of stepping into Einstein’s shoes, thus triggering an end to Israel’s hegemony over the Middle East and especially its apartheid against Palestinians. I don’t think that the people of Iran will regain the top spot in theoretical physics anytime soon, but I do think that their overwhelming hunger for enlightenment will enable them to come pretty darn close to it!

Cynthia … the vacuum in passing through a black hole would be so intense that your ears won’t function — no molecules to transmit the sound. The silence would be as intense as the silence of the wealthy ruling elite to the plight of the Palestinians … you know … the wealthy ruling elite who set up decoy, perpetual conflict lab, exploitation and oppression r@d weapons lab, etc., etc., nation of Israel, in the first place.

The next great Einstein is multiethnic and already here … he exists in the minds of all of us … in order to tap into him you have to pick up the hammer of perception and break down the intentionally created and co-opted decoy walls of; nationalism, ethnicity, religion, government, rule of law, convenience stores, private property, designer wall paper, capitalism, perpetual conflict, free markets, beanie babies, and voodoo economics … especially voodoo economics … smash the shit out of voodoo economics …

Love the Floyd man though …

Deception is the strongest political force on the planet.

I understand that black holes are too primitive in nature for complex creatures like ourselves to ever experience what it’s like to fall into a black hole. But this still shouldn’t stop us from exploring black holes within the context of the human experience. Leonard Susskind does just that in this talk of his entitled “The Black Hole Wars”:

http://pirsa.org/05020004/

The first several comments hit the nail on the head. Alford’s essay assumes the Fed can fine tune everything if only they get the interest rates right, both the timing and level.

This is a one dimensional view that oversimplifies economic reality, and is not a meaninful addition to economic analysis.

Contrary to economic theory, and Milton Friedman, monetary lags are not “long and variable”. The lags for monetary flows, our means-of-payment money, times its

rate-of-turnover (MVt), i.e. the proxies for (1) real-growth, and (2) inflation, are historically, always, fixed in length. However the FED’s target, nominal gdp, varies widely.

There’s no excuse. Economic forecasts are infallable. Blind people, by definition, can’t see.

“unirealist” – have some faith.

Oh my goshes, Mr. Fed economist.

Whither the policy alternative?

Loosen?

Tighten?

How Much?

Too soon?

Too late?

To tell.

Pro-cyclical tendencies of fractional-reserve banking.

Counter-cyclical aspirations of fractional-reserve bankers.

It’s hard work.

Ummmmmm….. for what, again?

To set interest rates?

To control the demand for money?

To determine the proper amount of money?

And of new money?

To be counter-cyclical?

The Chicago Plan for Monetary Reform.

Guess what?

There’s a number.

Within a range.

Set it and make it happen.

In real time.

A Fiscal and Monetary Framework for Economic Stability.

Economic Stability IS Counter-cyclical.

Our system absolutely does not need a lot more regulations piled on top of the ones already in place. It does need leaders and policy-makers who are willing to do the right thing and honestly and rigidly enforce the existing regulations. I believe it’s too late for this…et tu Ben?

http://truthingold.blogspot.com/2010/01/bernanke-is-either-complete-idiot-or.html

All bank debits clear thru demand deposits. This includes all housing speculation. Aggregate monetary demand is a known quantity.

I.e., the equation of exchange is an algebraic way of stating a truism; that the product of the unit prices, and quantities of goods and services exchanged, is equal (for the same time period), to the product of the volume, and velocity of money –- to sell 100 bushels of wheat (T) at $4 a bushel (P) requires the exchange of $400 (M) once (V), or $200 twice, etc

The (Vt) figure (bank debits), encompasses the total effect of all these money flows. Bernanke LIED